Short Interest Ratio Drops 19%: Key Trends in Specialty Chemicals

“Specialty chemicals’ short interest ratio fell 19% last quarter, signaling shifting investor sentiment in the sector.”

Overview: Specialty Chemicals & Market Dynamics

In today’s specialty chemicals market, rapid changes in the short interest ratio and evolving patterns of institutional investor stocks are shaping the financial landscape. As we step further into the heart of 2024, we observe major market forces—such as quarterly fluctuations in short selling, hedge fund adjustments in stake holdings, and fundamental investment strategies—directly influencing stock price forecasts, valuation methods, and market capitalization for leading industry players.

The United States continues to lead global innovation in specialty chemicals—notably in crop protection, plant nutrition products, growth regulators for crops, and high-value agricultural formulations. For professionals, analysts, and investors, understanding these trends is critical for strategic decision-making and opportunity identification, especially when rapid shifts are observed in metrics like daily trading volume, short interest ratios, and institutional stakes.

This in-depth blog post examines the current quarterly trends in the specialty chemicals sector, focusing on the significant 19% drop in short interest ratio as seen in American Vanguard Co. (NYSE:AVD), and how such shifts indicate larger >agricultural investment trends. We unravel these financial movements, analyze key data sets, and discuss advanced solutions—like those provided by Farmonaut—to support smarter large-scale farm management and monitor the pulse of the modern specialty chemicals industry.

Industry Significance of Short Interest Ratio

- Short interest ratio is a pivotal metric used to gauge investor sentiment—measuring the number of shares sold short relative to daily trading volume.

- It provides essential signals about broader market skepticism, emerging risk, or confidence in future stock price movements.

- Significant variations, particularly like a 19% drop, usually precede pivotal shifts in stock valuation and investor positioning in specialty chemicals.

Recent Shift: Short Interest Ratio Drops 19%

Our detailed analysis starts with the latest headline: American Vanguard Co. (NYSE:AVD) experienced a 19.3% drop in its short interest as of March 31st, 2024. The total short interest fell from 992,800 shares (March 15) to 800,700 shares at March’s close, indicating a notable decrease in bearish sentiment. With 3.0% of shares sold short and an average daily trading volume of 264,200 shares, the current short interest ratio stands at 3.0 days—a critical figure for both speculative traders and long-term investors.

- A drop in short interest ratio can signal reduced pessimism about the company’s prospects or sector outlook.

- When accompanied by quarter-over-quarter changes in related stocks, this shift strongly influences price volatility, market capitalization, and institutional trading strategies.

- As seen in other leading specialty chemical and agricultural stocks, such a decline frequently aligns with increased buying interest and renewed confidence among institutional investors and hedge funds.

Key takeaway:

The 19% reduction is particularly telling in the United States specialty chemicals landscape, as it often hints towards a repositioning by both active traders and longer-horizon funds.

Institutional Investors & Hedge Fund Holdings

Parallel to this shift in short interest, institutional and hedge fund ownership patterns provide additional insight into the specialty chemicals investment climate. PNC Financial Services Group Inc. recently boosted its holdings in American Vanguard by 133% in Q4, while new positions were acquired by several funds—Intech Investment Management LLC, Bayesian Capital Management LP, Ieq Capital LLC, and Susquehanna Fundamental Investments LLC.

Currently, a staggering 79.04% of American Vanguard stock is owned by institutional investors and hedge funds. This remarkable figure highlights the market’s trust in professional financial services and signals a higher degree of analyst attention, improved liquidity, and potential for strategic stock accumulation in the sector.

The increase in institutional investors stocks holdings is no coincidence following the dip in the short interest ratio; it often correlates with analysts’ upgraded ratings, price target increases, and shifts in the long-term growth outlook for agricultural and specialty chemicals.

“Institutional investors increased their holdings in agricultural stocks, reflecting renewed confidence in specialty chemicals markets.”

Key Developments:

- PNC Financial Services Group Inc. – Increased position by 133%, now owning 6,575 shares (quarterly growth reflects sharp confidence uptick in specialty chemicals).

- Bayesian Capital Management LP, Ieq Capital LLC, and Susquehanna Fundamental Investments LLC – Each acquired new stake or purchased shares valued from $50,000 to $68,000, substantiating broader support from major hedge funds.

- Intech Investment Management LLC – Acquired new position, underlining interest from quantitative and algorithmic traders—a trend often seen when a stock’s fundamentals show promising turnaround signs.

These capital flow patterns suggest a fundamental shift away from speculation towards more strategic, long-term investment across the United States specialty and agricultural chemicals segment.

Quarterly Trends Table: Specialty Chemicals Market

To provide a clearer comparison and actionable insight into the evolving landscape, we present a comprehensive quarterly metrics table below. This table enables investors, analysts, and stakeholders to assess market shifts, capital allocation, and sentiment regarding top-performing companies across the specialty chemicals and agricultural stocks universe.

| Company Name | Quarter | Short Interest Ratio (Est.) | Quarter-on-Quarter Change (%) | Institutional Holding (Est.) | Market Cap (Est., USD Million) |

|---|---|---|---|---|---|

| American Vanguard (NYSE:AVD) | Q1 2024 | 3.0 | -19.3% | 79.04% | 108.70 |

| American Vanguard (NYSE:AVD) | Q4 2023 | 3.85 | +3.7% | 77.50% | 135.10 |

| Corteva Agriscience | Q1 2024 | 2.8 | -8.5% | 81.20% | 33,500 |

| FMC Corp | Q1 2024 | 4.5 | -12.1% | 86.00% | 6,700 |

| Syngenta (ADR) | Q1 2024 | 2.1 | +1.0% | 74.00% | 45,800 |

| American Vanguard (NYSE:AVD) | Q3 2023 | 3.71 | +2.5% | 76.00% | 147.60 |

The above table synthesizes quarterly data, supporting deeper evaluation of emerging sector dynamics.

Please note these are estimated metrics for illustrative purposes based on prevailing industry research and financial services reports.

Stock Ratings, Price Forecasts & Analyst Insights

When analyzing the specialty chemicals market, both buy-side and sell-side analysts closely follow stock performance, estimated price targets, and quarterly fundamental shifts:

- Price Forecasts and Ratings: For American Vanguard ([AVD]), Lake Street Capital set a $14.00 target price in January, a considerable upside from current levels ($3.78 as of latest trade).

- PE Ratio & Market Cap: The company currently exhibits a PE ratio of -3.67—attributable to recent losses—while its market capitalization has contracted to $108.70 million from a high of over $140 million this year.

- Beta Value: With a beta of 1.03, American Vanguard displays moderate volatility compared to the broader market, making it subject to standard industry cycles and broader financial market swings.

This analyst sentiment is mirrored in relative strength versus industry peers and helps guide both speculative and strategic investment in United States and international specialty chemical equities.

Seeking further information on logistics and fleet management tools? Farmonaut offers advanced solutions for fleet tracking and agricultural vehicle management, beneficial for both agribusinesses and institutional farm operations.

Agricultural Investment Trends & Specialty Markets

United States agricultural investments are increasingly sensitive to quarterly short interest ratio trends, stock price movements, and in-depth ratings analysis provided by leading financial services and market research firms. For investors and agritech enterprises, the primary drivers in 2024 are as follows:

- Innovation in Crop Protection: Specialty chemicals, including insecticides, fungicides, herbicides, growth regulators, and biorationals in liquid and granular forms, remain critical tools for maintaining high-yield, disease-resistant crops and turf.

- Resource Optimization: Modern farming mandates exceptional stewardship of soil health, plant nutrition, and sustainability measures.

- Data-Driven Solutions: The adoption of precision agriculture platforms—like Farmonaut—enables institutional investors, hedge funds, and corporate farmers to monitor fields with granular (pun intended) specificity.

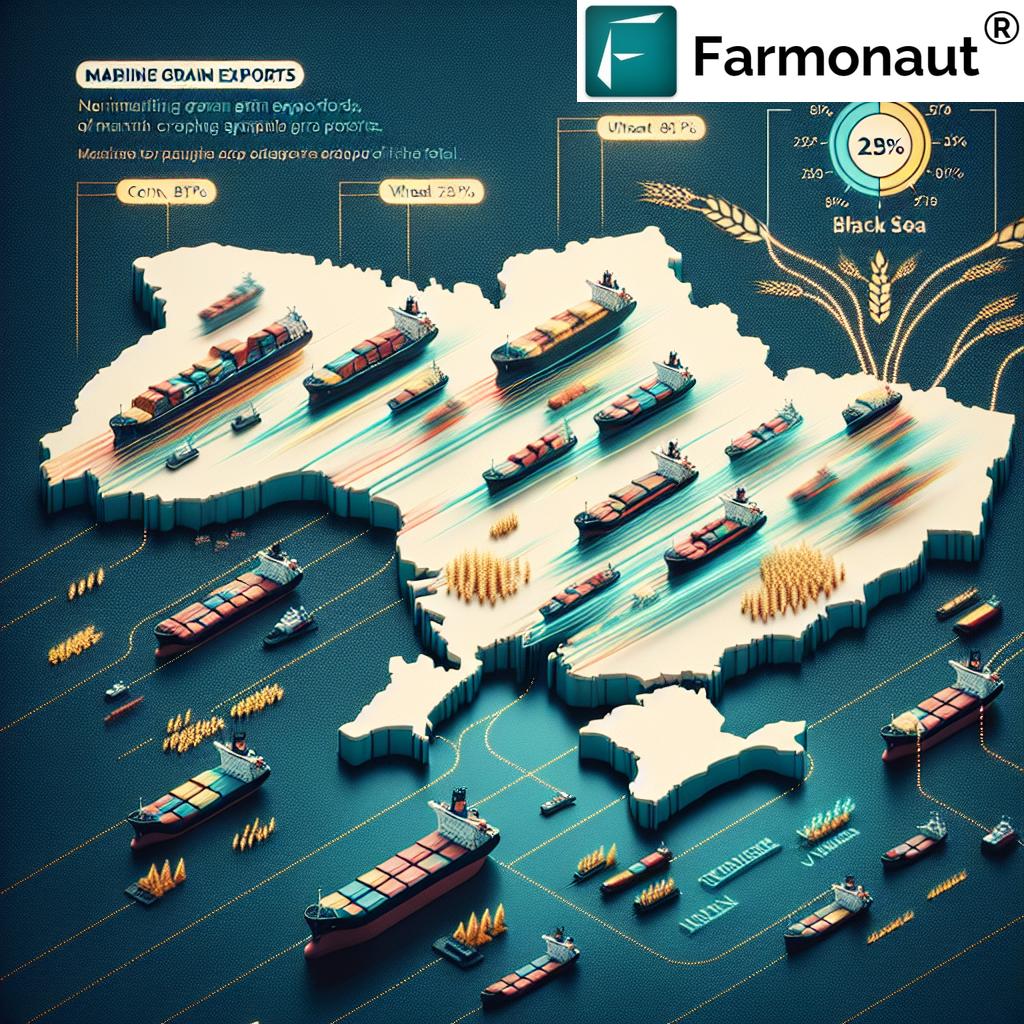

Top trending investment destinations within the specialty chemicals market currently include stocks with growing institutional and hedge fund holdings, robust product pipelines in plant nutrition, and transparent supply chains. For those interested in product traceability, Farmonaut’s Blockchain-Based Traceability Solutions provide end-to-end transparency around sourcing, supply chain management, and product authentication.

For investments centered on sustainability, Farmonaut’s carbon footprinting platform delivers real-time monitoring of greenhouse gas emissions and conformance to regulatory standards, supporting professional investors seeking green and ESG-compatible returns.

Farmonaut: Advanced Monitoring for Agricultural Investment

Modern agricultural investments demand real-time data, precise analytics, and scalable technology. Farmonaut stands out as a pioneering agricultural technology company—offering advanced, satellite-based farm management solutions accessible via Android, iOS, web applications, and a robust API.

Farmonaut Technology Stack:

- Satellite-Based Crop Health Monitoring: Delivers NDVI, soil moisture, temperature, and vegetation health data at field level.

- Jeevn AI Advisory System: Provides actionable crop management strategies and weather forecasts, enabling optimal planting, pest control, and resource allocation.

- Blockchain-Based Traceability: Ensures authenticity and transparency throughout the agricultural supply chain, improving trust for institutional and consumer stakeholders.

- Fleet and Resource Management: Empowers agribusinesses to reduce costs and improve operational logistics by monitoring fleet movement and asset utilization.

- Carbon Footprinting & Environmental Monitoring: Tracks emissions and supports businesses in achieving compliance with sustainability regulations, enabling green financing and ESG scoring for agricultural investments.

Farmonaut’s subscription-based business model is designed for maximum accessibility and flexibility; users can access scalable packages, tailored by farm size and data update frequency, either by app or API. For developers, Farmonaut’s satellite data API and API documentation allow seamless integration into custom solutions.

Users across the value chain—individual farmers, cooperatives, government agencies, financial institutions, and large agri-corporates—leverage Farmonaut to increase their productivity, improve transparency, and accelerate data-driven transformation in the rapidly-evolving agricultural and specialty chemicals markets.

In addition to full-scale farm management, Farmonaut offers specialized capabilities like crop loan and insurance verification—utilizing satellite imagery to enhance trust, reduce fraud, and facilitate access to financing for farmers.

For corporate clients in food or textile sectors, Farmonaut’s Product Traceability Solutions can seamlessly ensure transparency and authenticity within the supply chain—strengthening brand reputation and increasing consumer trust in a challenging regulatory climate.

Specialty Chemicals & Farmonaut: Frequently Asked Questions

Q1: What does a drop in short interest ratio mean for investors?

A drop, especially as pronounced as 19%, often indicates decreased bearish sentiment. In specialty chemicals, it can signal improving fundamentals, renewed institutional confidence, or market expectation of positive quarterly performance.

Q2: How do hedge fund holdings affect specialty chemicals stocks?

Increased hedge fund and institutional ownership typically means greater liquidity, more analyst coverage, and the potential for higher price stability—key elements for attracting further investment.

Q3: Why is the average daily trading volume important?

The average daily trading volume helps determine liquidity and can influence the volatility of the short interest ratio. Higher volumes suggest lower volatility for sizable trades, whereas low volumes might increase price impact.

Q4: Can Farmonaut’s platform assist financial investors and analysts?

Absolutely. Farmonaut’s real-time, satellite-derived insights on crop health, soil conditions, weather patterns, and carbon emissions empower analysts and institutional investors to make evidence-based decisions about resource allocation, insurance, and sustainable practices within specialty chemicals and agriculture sectors.

Q5: How does Farmonaut contribute to supply chain transparency?

By leveraging blockchain technology, Farmonaut allows traceability of agricultural products from farm to consumer—ensuring all stakeholders can verify the origin, health, and journey of their commodities to enable sustainable, ethical, and efficient trade.

Q6: Where can I access the Farmonaut API for business solutions?

Farmonaut’s robust satellite and weather data API is available here with detailed developer documentation for seamless custom integrations.

Conclusion: What’s Next for the Specialty Chemicals Market?

The United States specialty chemicals sector is at an inflection point—propelled by a 19% drop in short interest ratio, increasing institutional confidence, and a wave of digital transformation. The emergence of actionable analytics, advanced risk management, and complete supply chain transparency heralds a new era for agricultural investment trends and growth strategies.

As we move forward, integrating real-time data platforms—like Farmonaut—will underpin the next generation of precision farming, sustainable practice monitoring, and insight-driven specialization across plant nutrition and crop management markets.

Whether you are an institutional analyst monitoring quarterly stock performance, a hedge fund seeking alpha in the ever-changing specialty chemicals universe, or a farmer looking to boost productivity, keeping pace with these industry shifts through data and technology will be paramount.

- Stay vigilant on short interest ratios, as these lead the narrative around sentiment and risk/return profiles.

- Monitor institutional and hedge fund movements, as they can forewarn inflection points and emerging opportunities in the sector.

- Embrace innovative agritech like Farmonaut, ensuring your strategies remain ahead with evidence-based decision making.

Ready to transform your approach? Download the Farmonaut App or integrate Farmonaut’s API for actionable insights!

For professional farm advisory, crop area estimation, and more, explore our Crop Plantation and Forest Advisory Tools now.