GIS for Insurance: 7 Shocking Gains in KY & NC Farming

GIS for Insurance

GIS in agriculture, especially in regions like Kentucky (KY) and North Carolina (NC), has redefined the agricultural insurance landscape. From risk assessment to precision crop monitoring, integrating satellite imagery and spatial data analytics is enabling insurers and farmers to make informed decisions, optimize resources, and enhance efficiency across insurance and farming sectors.

“GIS tech reduced insurance claim processing time by up to 40% in Kentucky and North Carolina farms.”

Table of Contents

- Understanding GIS in Agricultural and Forestry Insurance

- Seven Shocking Gains GIS Has Brought to Insurance in KY & NC Farming

- Comparative Impact of GIS on Insurance Processes in KY & NC Farming

- Farmonaut: Revolutionizing GIS in Agriculture and Insurance

- Challenges and Considerations in Adopting GIS for Insurance

- Future Prospects: The Path Ahead for GIS in Agricultural Insurance

- FAQs: GIS for Insurance and Farming in KY & NC

- Conclusion

Combining the power of Geographic Information Systems (GIS), remote sensing, and spatial data analytics for insurers, Kentucky and North Carolina have witnessed a technological revolution in agricultural and forestry insurance. The adoption of satellite imagery for crop monitoring and precision agriculture technologies is driving a new era of informed risk assessment, accurate crop insurance claims management, and more efficient farming resource allocation.

In this detailed blog, we explore seven shocking gains from integrating GIS with insurance in agriculture, enriched by real-world insights into how this transformation is reshaping the landscapes of KY and NC farming. As pioneers like Farmonaut make precision agriculture affordable and accessible, our understanding and management of risk, claims, losses, and productivity continue to evolve.

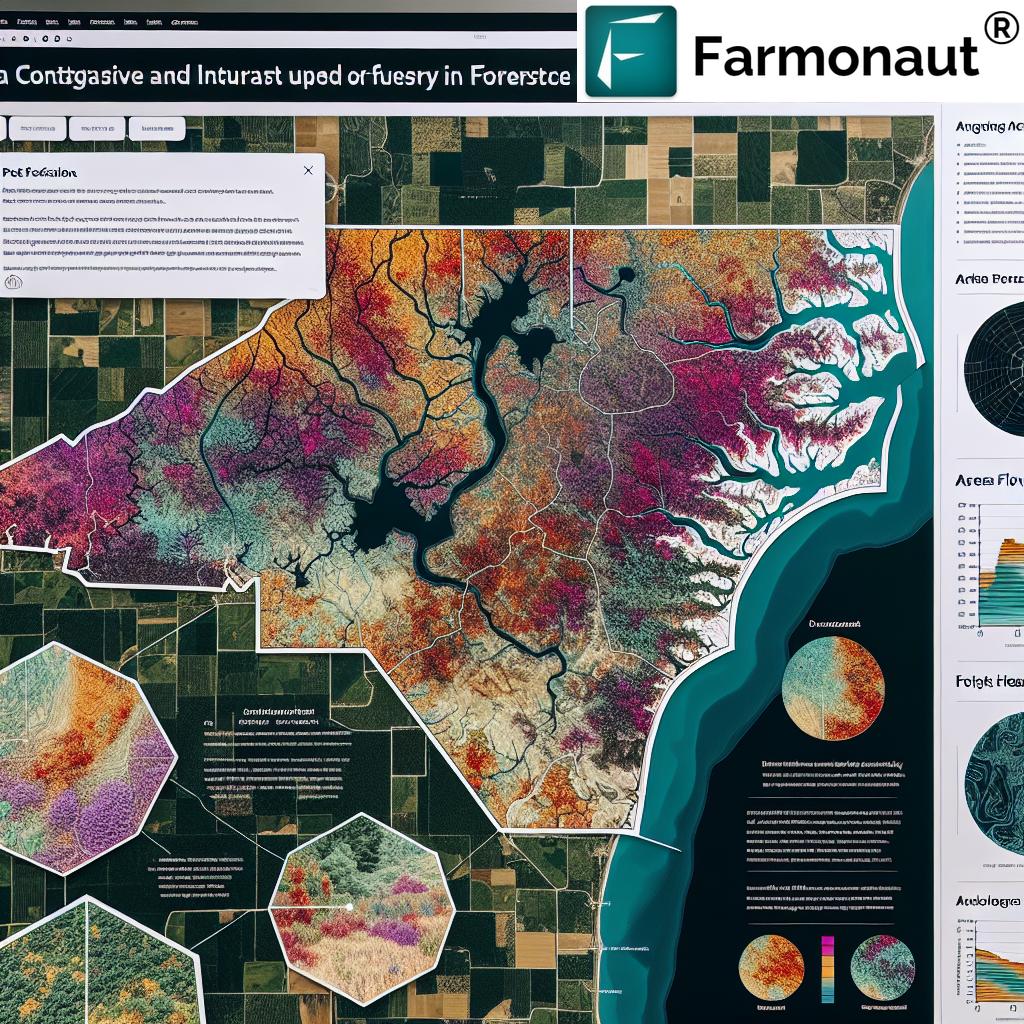

Understanding GIS in Agricultural and Forestry Insurance

Geographic Information Systems (GIS) have become the central nervous system of modern agricultural and forestry insurance processes. By integrating spatial data collection, analysis, and visualization, GIS empowers insurers and farmers to map, interpret, and understand complex phenomena affecting yields, forest health, and environmental risks.

But what does GIS actually mean for these sectors? At its core, GIS leverages location-based data—from satellite imagery, remote sensing, aerial surveys, and on-the-ground monitoring—to create detailed spatial maps. Each map overlays factors influencing crop or forest health, such as:

- Soil types

- Weather patterns (historical and real-time)

- Topography

- Water bodies and moisture levels

- Land use patterns

This data-driven, visual approach is transforming decision-making across risk assessment, claims management, and even forest advisory and plantation management.

In states like Kentucky and North Carolina, characterized by diverse landscapes, evolving weather trends, and a wide range of agricultural activities, leveraging GIS isn’t just a technological upgrade—it’s an essential survival tool for all stakeholders in the agricultural insurance ecosystem.

Seven Shocking Gains GIS Has Brought to Insurance in KY & NC Farming

When we examine the real-world deployment of GIS in agriculture for insurance risk assessment and crop monitoring, certain extraordinary benefits emerge—especially in the contexts of Kentucky and North Carolina farming.

“Over 85% of crop risk assessments in KY & NC now use satellite imagery for precise, data-driven decisions.”

-

1. Dramatic Improvement in Risk Assessment and Mapping

Risk assessment and mapping are the starting points for effective insurance coverage, premium calculations, and overall risk management in agriculture and forestry. In Kentucky and North Carolina, GIS enables us to:

- Leverage historical weather, soil, and topography data

- Map areas prone to drought, floods, or pest infestations with pinpoint accuracy

- Layer and analyze data to understand farming practices and risks across entire regions

The USDA’s Risk Management Agency (RMA) has set a gold standard by using GIS-driven maps to identify risks on both macro and micro scales. The result? Enhanced, data-driven premium setting and coverage definition, reducing unexpected insurance losses and improving overall sector resilience.

-

2. Real-Time Monitoring and Data Collection—From Satellites to Soil

Continuous monitoring with GIS facilitates early detection of crop issues and timely interventions. Here’s what this looks like in KY & NC:

- Satellites and aerial surveys document field-level changes and crop conditions throughout the growing season

- Remote sensing in farming delivers high-resolution, near-real-time updates on soil moisture, crop health, and potential stressors

- Integration of machine learning algorithms helps automate anomaly and outlier detection for claims analytics

For insurers, stakeholders, and farmers, this means improved collection and analysis of environmental data, resulting in more proactive risk management and reduced basis risk.

If you need scalable solutions for seamless monitoring and instant insights, check out the Farmonaut Large Scale Farm Management Platform. This solution offers automated satellite-based field tracking, resource management, and reporting for large farms and agri-businesses.

-

3. Revolutionizing Crop Insurance Claims Management and Verification

One of the most significant pain points in agricultural insurance is the verification and management of claims. GIS bypasses manual bottlenecks by:

- Using spatial evidence from satellite images to support or dispute claims remotely

- Reducing the need for labor-intensive, on-site inspections that can take days or even weeks

- Enabling quicker, more accurate compensation for genuine losses and reducing fraudulent claims

According to the ESRI USDA case studies, the integration of GIS and high-resolution imagery has empowered investigators in Kentucky and North Carolina to resolve insurance claims more rapidly while maintaining rigorous compliance and accuracy.

For businesses seeking to further minimize claims fraud and streamline loan approvals, Farmonaut’s Crop Loan and Insurance solution offers reliable satellite-based verification, helping both insurers and financial institutions.

-

4. Precision Agriculture Technologies: Unlocking Peak Efficiency

Precision agriculture, powered by GIS, gives farmers granular control over their resources, supporting not only insurance decisions but also productivity and sustainability:

- Optimizes planting, irrigation, and input usage using spatial analysis

- Detects pest infestations and water stress early, reducing unnecessary expenditure

- Tracks agricultural health metrics like NDVI (Normalized Difference Vegetation Index)—a core feature in Farmonaut’s satellite-based plantation and forest advisory

This data-centric approach enhances yields, reduces waste, and ultimately results in more robust insurance policies and lower premiums because risk is better understood.

For example, leveraging blockchain-based traceability solutions like Farmonaut’s Product Traceability System ensures transparency from field to fork, reducing fraud and enhancing value for all stakeholders.

-

5. Reducing Basis Risk in Index-Based Insurance Agriculture

Index-based insurance agriculture is gaining ground in regions where traditional loss verification is cumbersome. However, it is subject to basis risk—the potential mismatch between index performance (e.g., rainfall) and actual losses.

- GIS integrates high-resolution datasets—like localized rainfall, temperature, and vegetation indices—into index models

- This alignment reduces the gap between payout triggers and real on-field losses, especially in diverse terrains of KY & NC

Studies confirm that advanced integration of GIS with satellite-based data is evolving the effectiveness and popularity of index-based products, further stabilizing insurance markets.

-

6. Enhanced Fraud Detection Capabilities: Safeguarding Trust

As insurance schemes scale, fraud risk increases. Modern GIS tools, alongside machine learning algorithms, empower agencies (such as the USDA) to:

- Track anomalies and detect fraudulent patterns using multi-season satellite and weather data

- Authenticate claims by matching remote-sensed changes to reported damages (e.g., storm vs. gradual decline)

- Utilize blockchain for immutable recordkeeping and traceability of insurance and farm transactions

Such USDA GIS fraud detection measures are protecting both insurers and authentic policyholders, improving the reputation and sustainability of crop insurance.

-

7. Scalable, Accessible Solutions for Diverse Stakeholders

The GIS revolution is not limited to large farms or elite enterprises. With API integrations and mobile access, even smallholder farmers and cooperatives across Kentucky and North Carolina can:

- Participate in affordable precision farming and insurance

- Share, access, and utilize spatial and satellite datasets for their own decision-making

- Link directly to platforms like Farmonaut via API or user-friendly apps

If you are a developer or agritech business, you can also seamlessly integrate high-quality spatial and weather data into your own systems using the Farmonaut Satellite Weather API Developer Docs.

Comparative Impact of GIS on Insurance Processes in KY & NC Farming

To highlight the remarkable transformation, here’s a data-backed table showing the shift from traditional to GIS-enabled insurance processes in Kentucky and North Carolina. This comparative analysis uses estimated values based on industry benchmarks for time, accuracy, and processing efficiency.

| Process Area | Traditional Approach (KY/NC) | With GIS (KY/NC) | % Improvement (Estimated) |

|---|---|---|---|

| Risk Assessment | Manual field surveys, up to 20 days per region Accuracy ~60% |

Automated mapping, 3-5 days Accuracy ~85-90% |

70% faster, +30% accuracy |

| Claims Processing | Physical inspections, average 15 days to resolution | Remote verification via satellite, average 6-9 days | ~40% reduction in time |

| Premium Pricing | Broad regional averages, high uncertainty | Risk-adjusted by field-level data, lower basis risk | 30-40% more precise |

| Crop Monitoring Accuracy | Visual spot-checks, subject to error Accuracy ~65% |

85%+ through multispectral imagery and AI | +20% accuracy gain |

| Loss Detection Speed | Events reported days/weeks after occurring | Near real-time anomaly alerts | Up to 90% faster detection |

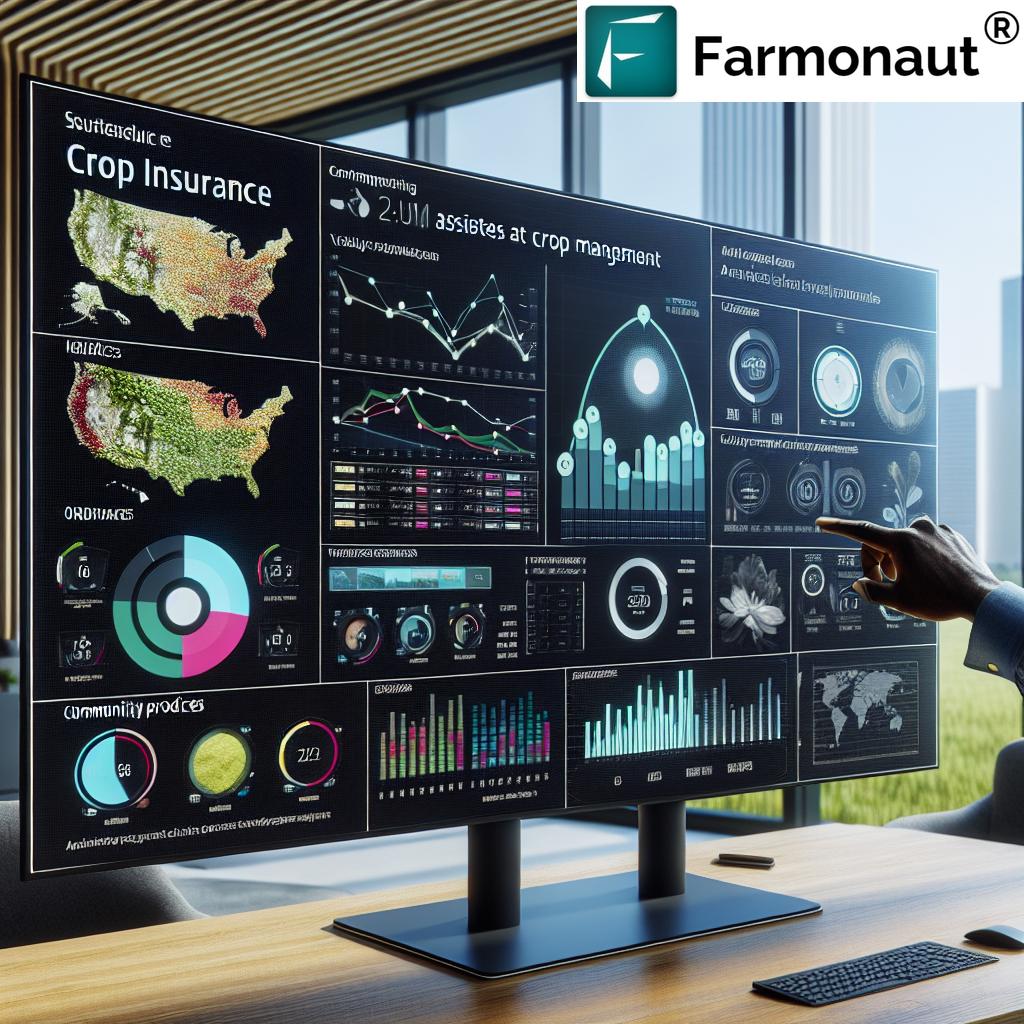

Farmonaut: Revolutionizing GIS in Agriculture and Insurance

At the heart of precision agriculture and insurance transformation is cutting-edge technology—Farmonaut brings this directly to farmers, insurers, and agri-businesses in Kentucky, North Carolina, and worldwide. Let’s break down Farmonaut’s contributions:

-

Satellite-Based Crop Health Monitoring:

Farmonaut delivers detailed, real-time insights into crop health using multispectral satellite imagery. Farmers and insurers can track NDVI, soil moisture, and pest outbreaks instantly, fueling timely decisions and reducing input costs. -

AI & Machine Learning:

The Jeevn AI Advisory System harnesses field, environmental, and weather data to generate personalized advice, forecasts, and risk warnings—improving crop productivity and reducing claim triggers. -

Blockchain Traceability:

Farmonaut integrates blockchain to deliver product traceability and insurance fraud prevention solutions, ensuring every crop’s supply chain journey is transparent and irreproachable. This fortifies both internal insurance checks and buyer trust. -

Fleet and Resource Management:

Agribusinesses cut operational costs, optimize logistics, and safeguard assets with Farmonaut’s fleet management solutions, which leverage spatial data to track vehicles and machinery. -

Carbon Footprinting:

With environmental compliance and risk growing in importance, Farmonaut provides carbon footprinting tools for farmers and insurers to quantify and reduce greenhouse gas emissions—vital for sustainable insurance offerings and premium reductions. -

Flexible Business Model:

Farmonaut’s subscription-based services scale from individual farmers to large enterprises, with flexible app, API, and platform access.

To see the current plans, explore the dynamic pricing table below:

-

Access For All:

Whether you are a smallholder farmer in rural Kentucky, a claims assessor in metropolitan NC, or a developer seeking to enhance agri-data platforms, Farmonaut delivers GIS-integrated, data-driven solutions that scale with your needs.

Challenges and Considerations in Adopting GIS for Insurance

While the integration of GIS for insurance in Kentucky and North Carolina offers undeniable benefits, we need to be vigilant about ongoing challenges in technology deployment:

-

Data Quality and Availability:

The effectiveness of GIS depends heavily on the quality, frequency, and resolution of spatial data. Outdated, incomplete, or low-resolution datasets can lead to faulty assessments. -

Integration with Existing Systems:

Merging GIS tools and analytics into legacy insurance platforms, government databases, and on-the-ground assessment systems can be complex. Training and technical upskilling are often required. -

Cost Implications:

While platforms like Farmonaut are making precision agriculture more affordable, there are still costs for hardware, software, training, and ongoing dataset subscription—especially for smaller organizations. -

Ethical and Privacy Considerations:

Spatial data can be sensitive, and careful management of privacy rights and ethical data use is mandatory, especially in insurance and government use.

Future Prospects: The Path Ahead for GIS in Agricultural Insurance

The next decade holds even more promise for GIS in agriculture and forestry insurance solutions:

-

Deeper AI and Machine Learning Integration:

Future insurance models will capitalize on real-time analytics, complex pattern recognition, and hyper-local risk modeling. -

Open-Source Expansion:

Increased availability and usage of open-source GIS tools and public satellite datasets will democratize access for smallholder and remote farmers in Kentucky, North Carolina, and beyond. -

Automated Claims:

Automatic detection, notification, and partial compensation for verifiable losses will speed up payouts and reduce human error or manipulation. -

Enhanced Sustainability and Resilience:

Carbon tracking will become standard metric input for insurance programs. GIS will underpin both risk assessment and continuous improvement of farming systems towards climate resilience. Learn more about Farmonaut’s carbon footprinting features here. -

Scaling and Customization:

GIS tools will become more adaptable for various scales—from family farms to corporate agribusiness—with plug-and-play APIs and modular analytics dashboards, as exemplified by Farmonaut’s satellite API.

FAQs: GIS for Insurance and Farming in KY & NC

What is GIS, and why is it important for agricultural insurance?

GIS, or Geographic Information Systems, allows us to collect, analyze, and visualize spatial data crucial for mapping risks, assessing environmental conditions, and optimizing resource allocation in agriculture and forestry insurance. With precise GIS in agriculture, insurers and farmers can achieve better risk evaluation and accurate claims management.

How does GIS help in detecting fraud in crop insurance?

Using satellite imagery, remote sensing, and spatial analytics, GIS provides objective data that supports the verification of claims and reveals discrepancies or fraudulent activity. Machine learning models can flag patterns of inconsistency, empowering agencies and insurers with accurate detection and rapid response.

Are GIS tools useful for smallholder farmers and individual landowners?

Absolutely! Modern solutions like Farmonaut’s web, mobile, and API platforms ensure even small farms in areas like Kentucky and North Carolina can monitor crop health, integrate with insurance tools, and participate in data-driven farming and risk mitigation.

What kind of data does GIS use for insurance in farming?

GIS leverages multiple layers of data: satellite images, weather records, soil maps, crop growth models, and field survey data. Combining these sources ensures a comprehensive picture of risk, health, and environmental trends.

Where can I get started with GIS data-driven insurance and crop monitoring?

You can start by visiting Farmonaut’s platform or download the mobile apps for both Android and iOS (see links above). For businesses and developers, tap into advanced capabilities using their Satellite Weather API.

Conclusion

The integration of GIS in agricultural insurance brings a new era of precision, speed, and transparency to Kentucky and North Carolina, benefiting both insurers and farmers in ways we couldn’t have imagined a decade ago. Through advanced spatial data analytics, remote sensing, and real-time monitoring, we now possess the insight to:

- Assess risk accurately (agricultural insurance risk assessment)

- Manage claims swiftly (crop insurance claims management)

- Boost crop monitoring and forest management

- Minimize losses and optimize premium computation

- Reduce fraud and improve supply chain traceability via blockchain

- Enable sustainable and resilient farming practices for all stakeholders

Farmonaut stands at the forefront of this revolution, making precision agriculture accessible, affordable, and scalable for everyone—individual farmers, corporate entities, and government bodies alike. As GIS, AI, and satellite technologies continue to advance, the gains we’re witnessing today are merely the tip of the iceberg in reshaping the insurance and agricultural sector for a smarter, more secure future.

Experience GIS-enhanced insurance risk assessment, crop monitoring, and resource management.

Try Farmonaut now—your gateway to smarter, more resilient farming in Kentucky, North Carolina, and beyond.