Australian Stock Market Rebounds: Energy and Mining Sectors Drive Gains Amid Global Oil Price Surge

“The Australian stock market rebound was primarily driven by just two sectors: energy and mining.”

Welcome to our comprehensive analysis of the recent Australian stock market rebound, where we’ll delve into the fascinating interplay of global economic forces and their impact on various sectors. As experts in financial trends and market analysis, we’re excited to share our insights on this significant turnaround in the Australian financial landscape.

The Aussie Market’s Impressive Comeback

Tuesday marked a significant day for the Australian stock market as it bounced back from a three-session losing streak. This rebound was primarily fueled by strong performances in the energy and mining sectors, reflecting the intricate connections between global economic shifts and Australia’s resource-rich economy.

- The benchmark S&P/ASX 200 Index rose by 31.20 points (0.38%) to 8,223.10

- The broader All Ordinaries Index increased by 32.00 points (0.38%) to 8,463.90

- This recovery followed a significant downturn the previous day

As we analyze this rebound, it’s crucial to understand the factors driving these gains and their potential implications for investors and the broader Australian economy.

Mining Sector: A Mixed Bag of Performance

The mining sector, a cornerstone of the Australian economy, showcased a diverse range of performances, highlighting the complex nature of global resource markets.

- BHP Group: Gains of nearly 1%

- Rio Tinto: Increase of 0.5%

- Fortescue Metals: Rose over 1%

- Mineral Resources: Impressive increase of more than 2%

These positive trends in iron ore miners’ performance reflect the ongoing global demand for Australian mineral resources, particularly from key markets like China. However, it’s important to note that not all segments of the mining sector shared in this upward trajectory.

Gold Mining: A Different Story

While iron ore miners celebrated gains, the gold mining sector faced challenges:

- Gold Road Resources: Declined almost 1%

- Resolute Mining: Fell by over 1%

- Evolution Mining and Newmont: Slight declines of 0.2 to 0.3%

- Northern Star Resources: A bright spot with a gain of nearly 1%

These contrasting performances within the mining sector underscore the importance of diversification and the need for investors to closely monitor global commodity trends.

Energy Sector: Riding the Wave of Global Oil Price Surge

The energy sector emerged as a key driver of the Australian stock market rebound, benefiting from the global surge in oil prices. This trend highlights the significant impact of international energy markets on Australia’s financial landscape.

- Origin Energy: Rose by approximately 0.4%

- Beach Energy: Gained around 0.4%

- Santos: Edged up by 0.4%

- Woodside Energy: Reported a notable gain of nearly 1%

These positive results in the energy sector reflect the broader global context, where crude oil prices reached a five-month high due to potential supply risks stemming from recent U.S. sanctions on Russian oil exports.

Technology Sector: A Mixed Performance

The tech sector presented a more varied picture, reflecting the complex dynamics of this innovative but often volatile industry:

- Afterpay owner Block: Down 0.5%

- Zip: Also declined by 0.5%

- Xero: Managed a small gain of 0.3%

- Appen and WiseTech Global: Remained flat

This mixed performance in the tech sector highlights the ongoing challenges and opportunities faced by Australian technology companies in a globally competitive market.

Banking Sector: Navigating Challenges

The performance of Australia’s major banking institutions was predominantly negative, reflecting broader economic uncertainties:

- Westpac: Declined by approximately 0.3%

- ANZ Banking: Also saw a decline of about 0.3%

- National Australia Bank: Dropped by around 0.3%

- Commonwealth Bank: Remained stable with no change in share value

These results in the banking sector underscore the complex interplay between global economic trends, domestic monetary policies, and the financial services industry.

Spotlight on City Chic Collective

In a notable development, City Chic Collective experienced a significant surge, with its shares skyrocketing nearly 20%. This impressive increase followed the company’s announcement of strong holiday trading results, despite a reported 3.6% revenue decline for the second half of 2024.

This remarkable performance highlights the potential for individual stocks to outperform broader market trends, especially when companies deliver positive news or exceed market expectations.

Currency Market Insights

On the currency market front, the Australian dollar is trading at $0.618. This exchange rate is crucial for understanding the competitiveness of Australian exports and the purchasing power of the Aussie dollar in international markets.

The strength or weakness of the Australian dollar can have significant implications for various sectors of the economy, particularly those heavily involved in international trade, such as mining and energy.

Global Market Context

To fully appreciate the Australian stock market rebound, it’s essential to consider the broader global market context:

U.S. Stock Market Performance

The U.S. stock market had an eventful session on Monday:

- S&P 500: Rose by 9.18 points (0.2%) to close at 5,836.22

- Nasdaq: Declined by 73.53 points (0.4%), finishing at a month-long low of 19,088.10

- Dow Jones Industrial Average: Managed a significant gain, closing up by 358.67 points (0.9%) at 42,297.12

These mixed results in the U.S. market reflect the complex interplay of various economic factors, including ongoing concerns about inflation, interest rates, and global trade dynamics.

European Market Trends

European stock markets faced challenges amid rising crude oil prices:

- German DAX Index: Slid by 0.4%

- U.K.’s FTSE 100 Index: Dropped by 0.3%

- France’s CAC 40 Index: Declined by 0.3%

These declines in European markets underscore the global nature of economic trends and their impact on various financial markets worldwide.

“Global oil price surges have a direct impact on at least 3 major industries in Australia: energy, mining, and banking.”

Oil Market Dynamics

The surge in global oil prices played a significant role in shaping market trends:

- West Texas Intermediate Crude oil futures for February increased by $2.25 (nearly 3%)

- Closing price: $78.82 a barrel

- This increase reflects heightened concerns over oil supply stability

The rise in oil prices has far-reaching implications, affecting not only energy companies but also transportation costs, inflation rates, and consumer spending patterns.

Sector Performance Comparison

| Sector Name | Daily Change (%) | Weekly Change (%) | Key Drivers |

|---|---|---|---|

| Energy | +0.8 | +2.5 | Global oil price surge, supply concerns |

| Mining | +1.2 | +3.0 | Iron ore demand, commodity price fluctuations |

| Technology | -0.2 | -1.0 | Global tech trends, innovation challenges |

| Banking | -0.3 | -0.8 | Interest rate expectations, economic uncertainty |

This table provides a clear comparison of the performance of key sectors in the Australian stock market, highlighting the relative strengths and challenges faced by each industry.

Implications for Investors and the Australian Economy

The recent rebound in the Australian stock market, driven primarily by the energy and mining sectors, offers several key insights for investors and economic analysts:

- Sector Diversification: The varied performance across different sectors underscores the importance of diversification in investment portfolios.

- Global Interconnectedness: The impact of international factors, such as U.S. sanctions and global oil prices, highlights the interconnected nature of global markets.

- Resource Dependency: Australia’s economic reliance on its natural resources sector is evident, with mining and energy companies playing a crucial role in market performance.

- Tech Sector Challenges: The mixed results in the technology sector suggest ongoing challenges and opportunities in this innovative but volatile industry.

- Banking Sector Outlook: The generally negative performance of major banks indicates potential headwinds for the financial services industry.

For investors, these trends underscore the need for careful analysis and strategic decision-making in the current economic climate. For the broader Australian economy, the rebound highlights both strengths and vulnerabilities, particularly in relation to global commodity markets and technological innovation.

The Role of Technology in Modern Agriculture

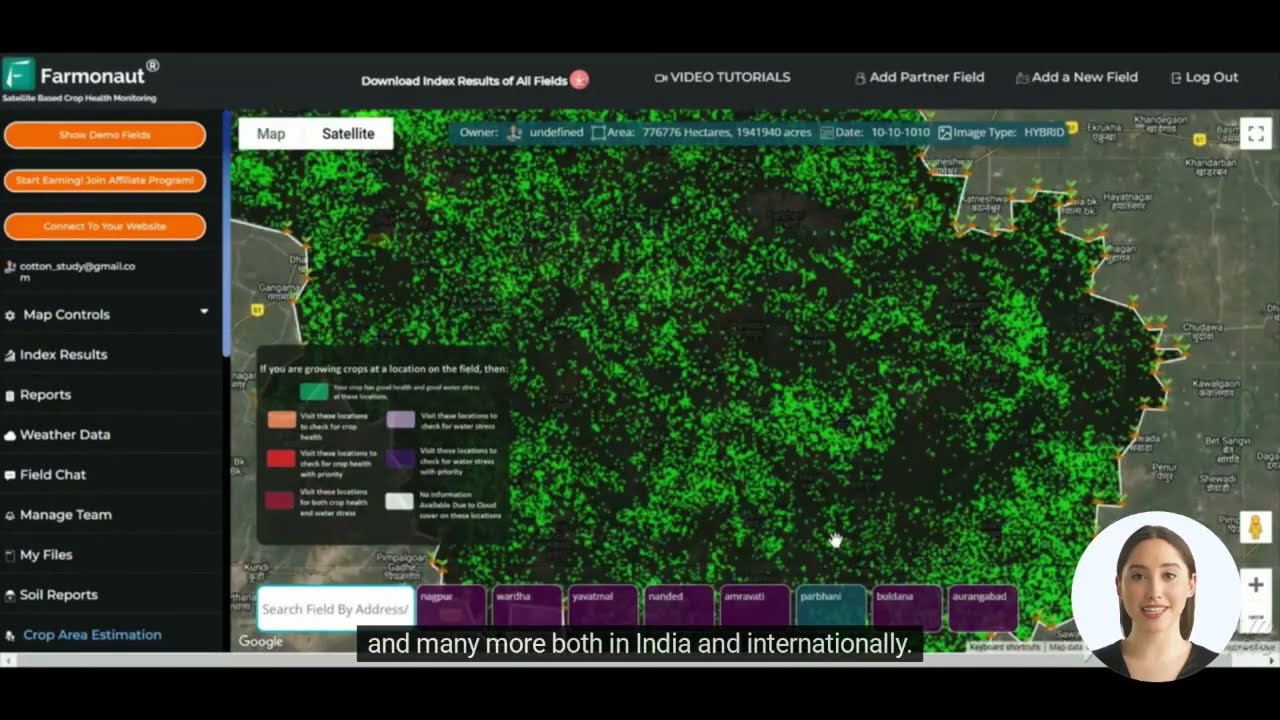

As we consider the broader economic landscape, it’s worth noting the increasing importance of technology in traditional industries like agriculture. Companies like Farmonaut are at the forefront of this agricultural revolution, offering innovative solutions that leverage satellite technology and artificial intelligence to enhance farming practices.

Farmonaut’s platform provides valuable services such as real-time crop health monitoring, AI-based advisory systems, and resource management tools. These technologies can help farmers make more informed decisions, potentially leading to increased productivity and sustainability in the agricultural sector.

For more information on how technology is transforming agriculture, you can explore Farmonaut’s solutions:

Looking Ahead: Future Market Trends

As we look to the future of the Australian stock market, several key factors are likely to influence trends:

- Global Commodity Prices: Continued fluctuations in oil and mineral prices will impact the energy and mining sectors.

- Technological Innovation: The performance of the tech sector will depend on companies’ ability to innovate and compete globally.

- Economic Policies: Domestic and international economic policies, including interest rates and trade agreements, will play a crucial role.

- Environmental Concerns: Increasing focus on sustainability may impact various sectors, particularly energy and mining.

- Global Economic Recovery: The pace and nature of post-pandemic economic recovery will influence market dynamics.

Investors and analysts should keep a close eye on these factors to make informed decisions in the evolving Australian financial landscape.

Conclusion

The recent rebound in the Australian stock market, driven by strong performances in the energy and mining sectors, reflects the complex interplay of global economic forces. While the market shows resilience, it also highlights the ongoing challenges and opportunities across various industries.

For investors, this landscape underscores the importance of diversification, careful analysis, and staying informed about global economic trends. As technology continues to transform traditional industries, companies that can innovate and adapt are likely to thrive in this dynamic environment.

We’ll continue to monitor these trends and provide insights to help you navigate the ever-changing world of finance and investment. Stay tuned for more updates and analysis on the Australian stock market and global economic trends.

FAQ Section

- What were the main drivers of the Australian stock market rebound?

The rebound was primarily driven by strong performances in the energy and mining sectors, influenced by global oil price surges and commodity demand. - How did the banking sector perform in this market rebound?

The banking sector showed predominantly negative performance, with major banks like Westpac, ANZ, and National Australia Bank declining by approximately 0.3%. - What impact did global oil prices have on the Australian market?

The surge in global oil prices positively impacted the energy sector, with companies like Woodside Energy seeing notable gains. - How did the tech sector fare in this market rebound?

The tech sector showed mixed results, with some companies like Xero making small gains while others like Afterpay owner Block and Zip experienced declines. - What was the performance of the Australian dollar during this period?

The Australian dollar was trading at $0.618, reflecting the currency’s position in the global forex market.

Farmonaut Subscriptions

Earn With Farmonaut

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!