Farm Bookkeeping: 7 Essential Steps for Financial Success

Meta Description: Farm bookkeeping enhances financial planning, expense tracking, and profitability. Discover these 7 essential steps for efficient farm financial management and success.

Published by Farmonaut – Revolutionizing modern agriculture with satellite-powered data, AI, and precision farm management tools.

Table of Contents

- Understanding Farm Bookkeeping

- The Importance of Farm Bookkeeping for Financial Success

- 7 Essential Steps for Farm Bookkeeping

- Comparison Table: Manual vs. Software Farm Bookkeeping

- Leveraging Agricultural Accounting Software and Technology

- How Farmonaut Boosts Farm Bookkeeping and Financial Management

- Professional Assistance and Strategic Planning

- Frequently Asked Questions

- Conclusion

Understanding Farm Bookkeeping

Farm bookkeeping is the systematic recording, organizing, and analyzing of all financial transactions related to agricultural operations. This essential practice provides us, as farmers and agribusinesses, with the financial clarity and control needed to assess and improve our performance, optimize our resources, and ensure our farm’s sustainability and profitability.

Accurate and up-to-date farm records serve as the foundation for every aspect of farm financial management—from daily expense tracking and income monitoring to compliance, tax filing, risk assessment, budgeting, and long-term planning. As agriculture becomes increasingly data-driven and competitive, efficient farm bookkeeping equips us to make informed, strategic decisions and achieve successful outcomes across all types of farming enterprises.

What Does Farm Bookkeeping Involve?

- Recording every financial transaction: all income (crop and livestock sales, government subsidies, etc.) and expenses (inputs, labor, maintenance, etc.)

- Organizing and categorizing documents: keep receipts, invoices, bank statements, and loan papers properly filed

- Maintaining accurate inventory management for farms: tracking goods in storage, livestock, equipment, and harvested crops

- Reconciling financial records with bank statements to ensure accuracy

- Analyzing data for insights, planning, budgeting, and reporting

Why Focus on Farm Bookkeeping?

With increased pressures from volatile markets, rising input costs, and tighter regulatory and environmental requirements, it’s essential for us to gain better control over farm finances. Quality bookkeeping not only helps improve profitability but also makes our business more resilient and competitive. Innovations such as agricultural accounting software are now available to automate and optimize these processes—empowering even small to medium-sized farms to implement advanced financial record keeping practices.

The Importance of Farm Bookkeeping for Financial Success

From financial planning for agriculture to accessing loans and maintaining tax compliance for farmers, robust farm bookkeeping is crucial for the modern agricultural enterprise. Let’s explore the strategic benefits:

- Financial Planning and Budgeting: Our ability to create accurate financial budgets, identify cost trends, and allocate resources effectively hinges on having systematic farm accounts. Studies show that farms with organized records increase revenue by up to 15% through better control and transparency (source).

- Informed Decision-Making & Analytics: Detailed and organized transactions enable us to analyze profitability for different crops or livestock, monitor cost per activity, and adopt productive strategies. Data-driven farms report a 12% improvement in yield and efficiency when using analytics (source).

- Legal and Tax Compliance: Keeping accurate records ensures we can confidently file taxes, avoid penalties, and meet reporting requirements. Disorganization can mean fines or even legal enforcement for inaccurate statements. Farms using proper bookkeeping minimize audit risks and penalties.

- Access to Financial Assistance & Loans: Reliable statements and reports increase our credibility with lenders and government agencies. This is essential for grant qualification and simplifies the process for bank or government-backed loans.

- Risk Management: Regular financial analysis reveals vulnerabilities, such as high input costs or unprofitable activities, letting us implement changes proactively. Practice in inventory control, input tracking, and cost monitoring reduces risk by up to 18% (source).

- Business Growth & Sustainability: Farm bookkeeping gives us insights to pursue business expansion, attract partnerships, or transition to more sustainable farming methods by understanding cost structures, revenue streams, and return on investment.

The 7 Essential Steps for Effective Farm Bookkeeping

Let’s break down farm financial management into seven core steps—each one critical for building robust systems, staying compliant, and boosting profitability:

1. Establish a Bookkeeping System

- Choose a system based on farm size and complexity—manual ledgers for small plots, spreadsheets for midsize holdings, or agricultural accounting software for larger businesses.

-

Specialized software can automate repetitive tasks, reduce errors, and offer real-time financial insights.

Discover more about bookkeeping systems for farms. - Systems such as QuickBooks, AgSquared, or Farmonaut’s API streamline process for precise, timely recording and reporting.

2. Organize All Financial Documents

- Categorize and store every invoice, receipt, bank statement, loan and insurance documents, purchase records, and contracts.

- Digital storage ensures we never lose critical data—and makes tax season stress-free.

3. Regularly Track Income and Expenses

- Document all income (crop and livestock sales, subsidies, custom work, etc.).

- Track every expense—from seeds and animal feed to repairs, fuel, labor, and loan repayments.

- Accurate daily/weekly updating prevents forgotten transactions, helps identify waste, and supports budgeting and planning.

4. Maintain Accurate Inventory Records

- Develop an inventory management for farms framework that tracks harvested crops, livestock, stored supplies, and equipment.

- Use tags, spreadsheets, or inventory software to monitor: date acquired/sold, quantities, condition, and location.

- These records aid in resource allocation, ordering, insurance claims, and loss/theft prevention.

5. Reconcile Bank Statements Regularly

- Each month, align bank statements with internal transaction records to ensure accuracy, prove compliance, and detect any fraudulent activities or mistakes.

- This process is faster and more reliable with software, but even manual reconciliation prevents costly errors and tax issues.

6. Analyze Financial Data and Generate Reports

- Review income statements, expense breakdowns, balance sheets, and cash flow reports.

- Analyze cost centers, profitability by crop/livestock, debt-to-asset ratios, and other key performance metrics.

- Use this analysis to monitor financial performance, plan investments, and justify funding/loans.

7. Budgeting and Financial Planning for the Future

- With a clear understanding of past finances through bookkeeping, craft realistic, data-driven budgets for each farm season.

- Set targets (yield, costs, revenue), and monitor throughout the cycle for improved financial control.

Each of these steps can be time-consuming without the right approach—precisely why digitization and agricultural accounting software adoption is transforming modern farm bookkeeping.

Comparison Table: Manual Bookkeeping vs. Agricultural Accounting Software

To highlight the practical benefits of adopting modern farm bookkeeping systems, let’s compare the 7 essential steps using both manual tracking and software solutions:

| Bookkeeping Step | Manual Tracking Est. Time (hrs/month) |

Software Solution Est. Time (hrs/month) |

Accuracy (Manual vs. Software) |

Potential Financial Impact (Yearly USD Savings) |

|---|---|---|---|---|

| System Setup | 10-15 hrs initial, 3-4 ongoing | 5 hrs initial, 1-2 ongoing | 80% manual / 98% software | $300-500 (reduced labor, errors) |

| Organizing Documents | 6-8 | 2 | 85% / 99% | $250 (less misfiling, time savings) |

| Tracking Income/Expenses | 20-24 | 4-6 | 75% / 98% | $1,000+ (missed income & overpayments prevented) |

| Inventory Management | 10-15 | 2-3 | 70% / 96% | $500 (resource optimization, loss reduction) |

| Bank Reconciliation | 6-10 | 1-2 | 80% / 99% | $250 (error and fraud reduction) |

| Financial Analysis & Reporting | 8-16 | 2-4 | 60% / 98% | $1,000+ (decision/margin improvements) |

| Budgeting & Planning | 10-15 | 3 | 70% / 98% | $1,500+ (cost control, missed opportunities prevented) |

Summary: Proper agricultural accounting software drastically reduces manual workload, improves accuracy, and can save your farm several thousand dollars per year—while putting actionable financial insights at your fingertips.

Leveraging Agricultural Accounting Software and Technology for Farm Bookkeeping

Technology is shaping the future of farm bookkeeping, bringing us advanced tools that automate complex tasks, reduce manual errors, and provide instant access to actionable data. Here’s why and how agricultural accounting software is changing the game:

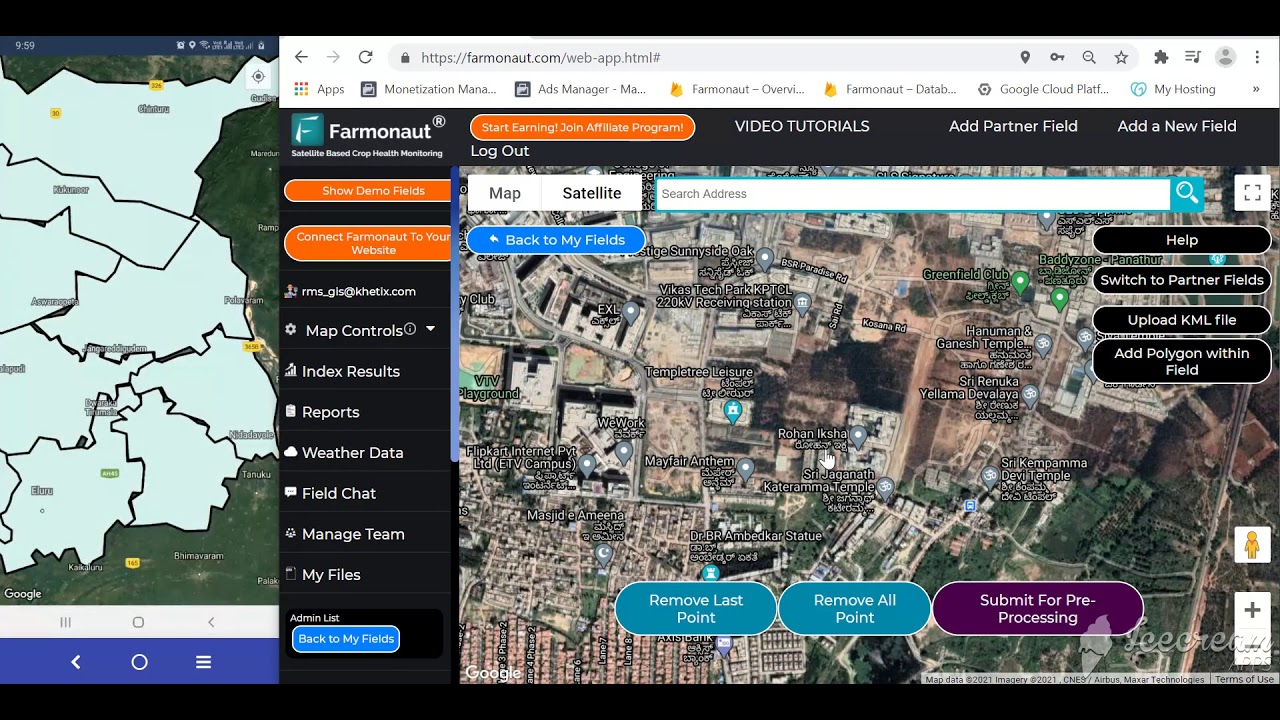

- Automate bookkeeping tasks: Software like QuickBooks, AgSquared, and Farmonaut’s API and platform streamline data entry, categorize transactions, track invoices, and reconcile accounts automatically.

- Centralize record-keeping: All your income, expense, inventory, and compliance records are in one secure, cloud-based system—accessible from any device.

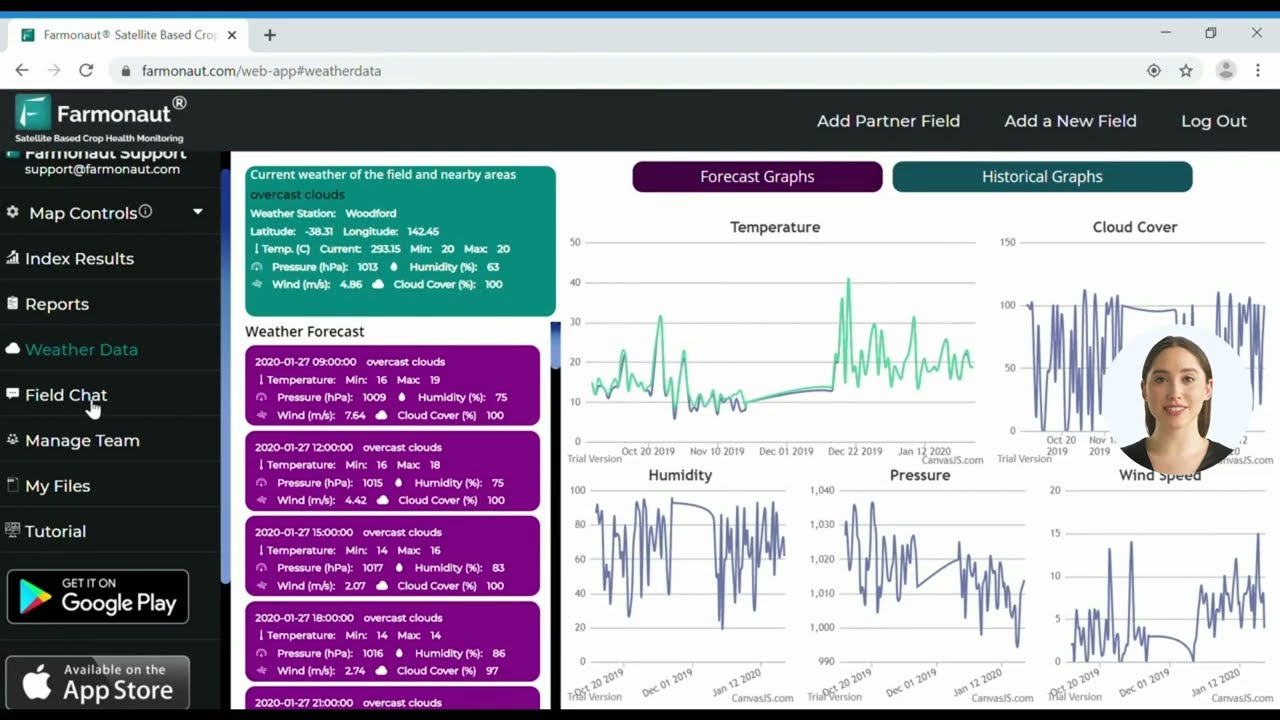

- Real-time reporting & analysis: Instantly generate farm income statements, cash flow reports, and more, so you can monitor farm performance and analyze trends as they happen.

- Integration & scalability: Modern ag software integrates with ordering, marketplace, and even remote crop monitoring solutions for enhanced control.

- Tax readiness & compliance: Most Ag software platforms help automate tax compliance for farmers, ensuring rules are met and reducing audit risk.

- Secure data & backups: Digital storage protects records from loss due to theft, disaster, or human error.

Adopting technology isn’t just about saving time. It’s about positioning your farm for long-term financial health and competitiveness.

Explore the Farmonaut Agro Admin App for Large-scale Farm Management

Farmonaut’s app provides real-time satellite monitoring, resource management, and automated report generation, making it easier to manage financial performance and reduce operational inefficiencies at scale.

How Farmonaut Empowers Farm Bookkeeping and Financial Record Keeping

Integrating a precision agriculture platform, such as Farmonaut, into your farm financial management not only boosts productivity but also delivers invaluable insights and operational control for all bookkeeping and reporting needs:

Farmonaut’s Core Features for Bookkeeping and Management

- Satellite-Based Crop Health Monitoring: Use NDVI and advanced analytics to track crop vigor and health, guiding smarter input, irrigation, and harvest decisions for optimal output and cost-saving strategies. This data also supports inventory management for farms.

- AI-Powered Farm Advisory (Jeevn AI): Receive real-time weather, crop, and financial advisories powered by artificial intelligence—directly impacting yield, efficiency, and financial planning for agriculture.

- Blockchain Traceability: Certified, auditable records of crop origin and movement are crucial for compliance and building trust in supply chains. Learn more about Farmonaut’s blockchain-based traceability for compliance and fraud reduction.

- Fleet and Resource Management Tools: Track and optimize machinery, vehicles, or farm equipment, reducing expenses and supporting sustainability. Read about Fleet Management.

- Carbon Footprinting: Monitor your farm or agribusiness’s environmental impact for regulatory compliance and sustainability. See how carbon footprinting works in agriculture.

- API Integration: Seamlessly connect Farmonaut data with your own accounting software, dashboards, or custom solutions through the Farmonaut API (Developer Docs here).

Farmonaut’s approach eliminates guesswork, enabling us to maintain more accurate expense and income records, optimize resource allocation, and stay ahead of compliance requirements.

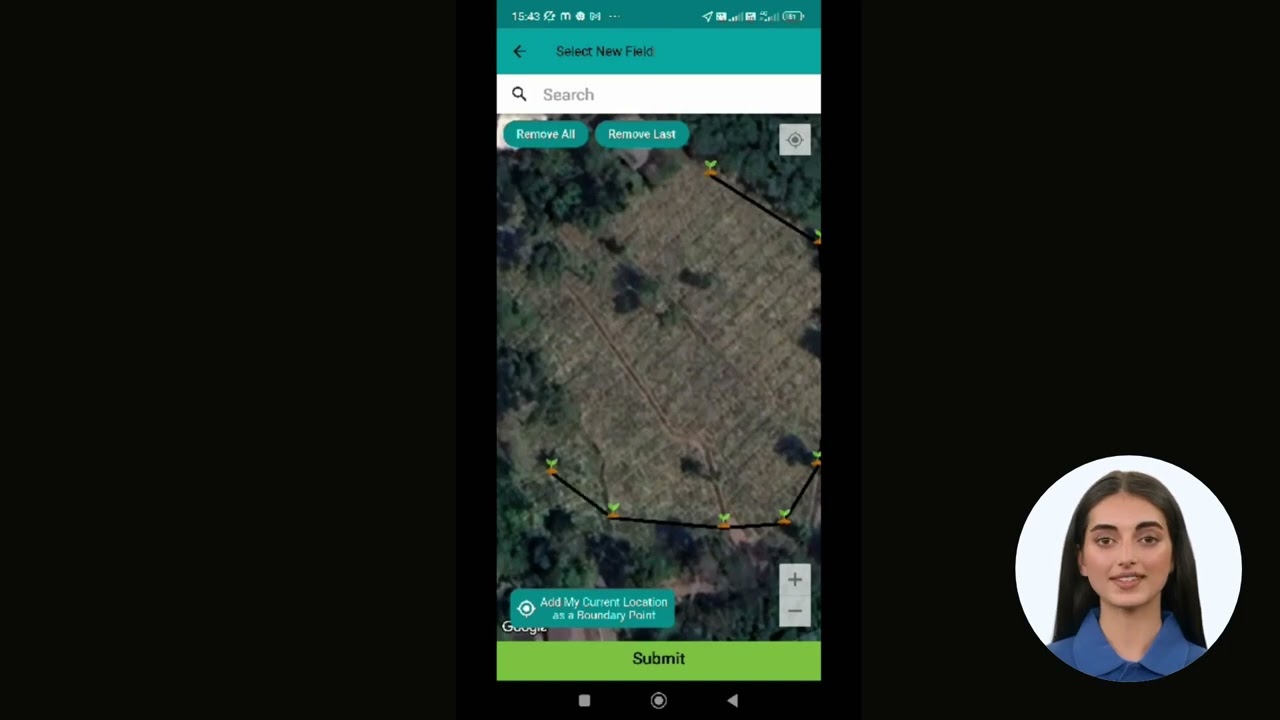

Download Farmonaut’s Mobile App for seamless on-the-go crop monitoring, operational reporting, and financial record management, wherever you are.

Farmonaut’s Business Model: Flexible for All

- Subscription-Based Access: Choose from packages that fit small farms, cooperatives, large enterprises, and government projects.

- Scalable Monitoring: Pay for exactly the number of hectares and update frequency that meets your business requirements.

- Full Suite for Multiple Roles: Individual farmers, agribusinesses, corporate supply chains, financial institutions, NGOs, and government agencies can all stretch budgetary efficiency with Farmonaut’s modular, scalable systems.

For the latest subscription options and to explore pricing, view below:

Crop Loan and Insurance:

With Farmonaut’s satellite-based verification, increase your eligibility and credibility for agricultural loans and insurance, ensuring transparency for financial institutions and reducing the risk of fraud in the application process.

Professional Assistance and Strategic Farm Financial Planning

As our agricultural operations grow, financial management complexity increases—which is why many successful farmers rely on accountants or advisors with agricultural expertise. Here’s how professional assistance adds value:

- Expert Advice: Navigate challenging tax regulations, plan for succession, diversify revenue streams, or optimize debt and investment strategies with confidence.

- Compliance Assurance: CPA professionals ensure all reporting is in compliance with local laws and filing requirements, minimizing risks of penalties or audits.

- Integrated Technology Support: Accountants can help customize your accounting software workflow, automate repetitive tasks, and maximize time savings.

- Benchmarking and Trend Analysis: By comparing your performance to industry benchmarks and leveraging data insights, advisors deliver strategies to boost profit and efficiency.

Remember: Bookkeeping and financial planning for agriculture are not just about compliance—they are about empowering us to make better business decisions, protect our enterprise, and position our farms for ongoing success.

Frequently Asked Questions: Farm Bookkeeping & Accounting

-

Why can’t I just keep all my records in a notebook?

Notebooks are prone to loss, damage, and errors. Manual methods make it hard to produce accurate statements, reconcile accounts, or conduct meaningful analysis for effective financial management. Software ensures data security, accuracy, and quick access for reporting and compliance. -

When should I migrate to agricultural accounting software?

If you manage more than a few hectares, sell multiple products (crops, livestock), or access multiple income streams—including grants or loans—software dramatically increases efficiency and helps ensure tax compliance and timely, accurate record-keeping. -

Is digital bookkeeping secure?

Yes, reputable platforms use encrypted cloud storage, regular backups, and two-factor authentication. Always choose software with robust security credentials. -

How does Farmonaut integrate with bookkeeping?

Farmonaut’s platform and API can connect with your chosen software, supplying accurate crop, resource, and financial data for enhanced record keeping, inventory management, and operational reporting. -

Can I generate tax-compliant reports directly from my software?

Yes. Most modern ag accounting platforms assist with tax filing, generating customizable income statements, balance sheets, and compliance reports—often tailored to local regulations. -

How do I get started with professional financial assistance?

Look for local agricultural accountants, or contact your farm management software provider for recommendations and integrations with accounting experts who understand your region’s regulatory requirements.

Conclusion: Achieving Farm Financial Success with Systematic Bookkeeping

In today’s fast-evolving world of agriculture, farm bookkeeping isn’t a luxury—it’s an absolute necessity for sustainable farm financial management, expense control, and long-term profitability. By following these 7 essential steps, leveraging the right agricultural accounting software, and integrating next-generation tools like Farmonaut, we unlock the insights, operational efficiency, and legal compliance needed to help our business thrive.

- Keep all transactions recorded and categorized for clear budgets and planning

- Use modern software to automate, analyze, and optimize every aspect of your farm finances

- Adopt management tools such as Farmonaut to enhance data-driven decisions and resource allocation

- Consult with financial professionals to tailor systems for your unique agricultural operations and market

Let’s empower our farm businesses—large and small alike—with the clarity, transparency, and control that only precise, well-organized bookkeeping delivers. Your path to greater revenue, fewer costs, and long-term sustainability starts here.

Quick Links & Getting Started

- Explore Farmonaut’s Apps and Solutions for real-time crop health, AI-based advice, and detailed farm management

- Farmonaut API (custom integration for your business)

- Farmonaut API Developer Docs

- Farmonaut Carbon Footprinting – monitor and reduce your environmental impact

- Farmonaut Traceability Solutions for compliance and transparent supply chains

- Farmonaut Crop Loan & Insurance Verification – secure easier, faster access to agricultural loans

- Farmonaut Fleet Management – maximize efficiency and reduce machinery costs

Ready to unlock your farm’s full financial potential? Start your journey today with smart, systematic farm bookkeeping!