Farm Equipment Credit: 7 Best Financing Options

Introduction: The Pivotal Role of Farm Equipment Credit

As modern agriculture continues to evolve, farm equipment credit plays a pivotal role in enabling farmers and ranchers to access the machinery and equipment necessary for efficient, productive operations. With the high costs involved in acquiring new machinery, reliable financing options for farmers become not just a convenience, but an essential driver of sustainable growth and innovation across the agricultural sector.

Today, our goal is to provide you with a comprehensive and practical guide that explores the top financing options, eligibility criteria, interest rates, and proven tips—empowering agricultural professionals to make informed, business-savvy decisions about their equipment needs. Whether you’re planning to purchase, lease, or upgrade agricultural machinery, understanding your options and the requirements involved will help you chart a path to operational success.

Understanding Farm Equipment Financing

Let’s begin by demystifying what farm equipment financing really is. In essence, this term encompasses the various methods and financial products that allow us—farmers, ranchers, and agribusinesses—to obtain the funds required for purchasing, leasing, or upgrading the essential equipment and machinery our operations depend on.

The landscape of equipment loans and credit solutions is rich and diverse: ranging from traditional bank loans, specialized agricultural loan programs, captive financing, modern online lenders, to flexible leasing options and more. The choice between purchasing and leasing depends on several factors, including:

- Available cash flow

- Frequency and type of equipment usage

- Long-term business goals

- Maintenance and upgrade requirements

- Repayment capacity and risk tolerance

With agricultural equipment financing as a backbone of operational expansion, it is crucial for us to understand and compare the avenues available—so we can make well-informed decisions that align with our business needs and strategies.

Types of Financing Options for Farmers

In our quest to select the best financing model for farm equipment, it’s essential to recognize and differentiate the primary categories and methods available. Each comes with its unique benefits, eligibility criteria, flexibility, and considerations.

1. Traditional Bank Loans

Traditional bank loans remain a trusted method for acquiring agricultural equipment. Here’s how they typically work:

- We apply for a lump-sum loan to cover the cost of our desired equipment.

- A set repayment schedule, usually with fixed—or sometimes variable—interest rates and terms up to 7 years or more.

- Once the loan is fully repaid, we own the equipment outright, giving us full equity.

- Often requires collateral (the equipment purchased or other assets), and thorough documentation of our business financials.

- Lower interest rates if we have a strong credit profile and established operation length.

Best for: Those planning to use equipment for an extended period and wanting to eventually own their assets.

2. Leasing: Flexible Farm Equipment Leasing Options

Leasing equipment introduces maximum flexibility for modern farmers:

- Low or zero upfront costs—simply a fixed monthly lease payment.

- Lease periods typically range from 2 to 7 years.

- At lease end, we may choose to purchase, upgrade, renew, or return the machinery.

- Minimal impact on short-term cash flow, allows for easy upgrades.

- Ideal for equipment with rapidly advancing technology, or shorter useful lifespan.

Best for: Farmers seeking lower upfront costs, flexibility to upgrade, and minimal commitment to long-term ownership.

3. Captive Financing

Major equipment manufacturers often provide their own in-house captive lending programs. For instance, if we’re purchasing John Deere machinery, John Deere Financial will offer packages tailored to their products.

- May offer promotional rates, incentives, or rebates on new models.

- Faster approval processes for loyal customers or bulk purchases.

- Flexible structures such as season-aligned payments.

Tip: Always compare their rates, terms, and requirements with independent lenders to ensure you’re getting the best deal, as incentives may not always equal better overall costs.

4. Specialized Agricultural Equipment Loans and Programs

A range of government-sponsored schemes, cooperative banks, and industry-specific lenders design solutions for farmers, ranchers, and agribusinesses through targeted loan and subsidy programs.

- Often lower interest rates and loan guarantees that favor rural development and food security.

- Eligibility may include minimum acreage, income levels, or participation in certain government schemes.

- Supports startups, women, and young farmers with more relaxed credit requirements.

- Examples include USDA/FSA Direct Farm Ownership Loans and various state banking products.

Best for: New entrants, startups, and those lacking extensive business credit history.

5. Online and Alternative Lenders

With digital transformation, online lenders like AgDirect offer accessible solutions for farm equipment loans:

- Streamlined application processes (24–72 hours for fund disbursal).

- More lenient credit and documentation requirements.

- Slightly higher interest rates compared to banks, but great for urgent needs or when traditional credit standards are hard to meet.

- Flexible for purchasing both new and used equipment.

Best for: Time-sensitive purchases and farmers with newer operations or inconsistent cash flows.

6. Dealer and Vendor Financing

Often, we can secure direct financing from local dealers at the point of sale. This option is:

- Highly convenient and quick.

- Generally tied to specific brands or dealership inventory.

- May include introductory offers or dealer promotions.

Tip: Review all associated costs, potential markup, or insurance add-ons bundled into dealer financing packages.

7. Equipment Rental and Hire-Purchase

If outright ownership or long-term leasing are not optimal, rural cooperatives and agri-service companies offer hire-purchase agreements or short-term rental options. These methods:

- Allow us to gradually “own” equipment by paying instalments over time.

- Offer immediate, short-term access for harvest or planting seasons.

- May be more expensive per-use, but minimize large capital outlay.

This flexibility is especially attractive to smallholder farms and those with highly seasonal operations.

Comparative Table: 7 Best Farm Equipment Financing Options

| Financing Option Name | Eligibility Criteria | Estimated Interest Rate Range (%) | Maximum Loan Amount (USD) | Repayment Tenure (years) | Estimated Processing Time | Key Features/Benefits |

|---|---|---|---|---|---|---|

| Traditional Bank Loan | Credit score 650+ 2+ years in business Min. $50,000 revenue Collateral required |

4% – 9% | Up to $1,000,000 | 3 – 7 | 7–21 days | Lower rates; equity on payoff; rigorous documentation |

| Equipment Leasing | Credit score 620+ 1+ year in business |

5% – 12% | Up to $500,000 (varies by lessor) |

2 – 7 | 2–5 days | Low upfront cost; flexibility; easy upgrades |

| Captive Manufacturer Financing | Brand loyalty Stable revenue 680+ score preferred |

4.5% – 10% | Up to $2,000,000 (some brands) | 1 – 7 | 2–7 days | Promotional rates; fast approval; brand-focused |

| Govt/Cooperative Agri Loan | Meeting rural/sector criteria May require crop plans Specialized eligibility |

4% – 8% | Up to $750,000 | 5 – 12 | 7–30 days | Subsidized rates; startup-friendly; relaxed credit checks |

| Online/Alternative Lender | Flexible credit score (600+) 1+ year in business |

7% – 14% | Up to $500,000 | 2 – 6 | 1–5 days | Fast processing; relaxed documentation; good for used equipment |

| Dealer/Vendor Financing | Equipment purchase at dealership | 5% – 11% | Up to $350,000 | 1 – 5 | 1–3 days | In-store convenience; bundled offers; limited to dealership inventory |

| Hire Purchase/Rental | Minimal income/credit checks (varies) | 8% – 16% | Up to $50,000 (per cycle) | 0.5 – 3 | 0–3 days | Short-term access; pay-for-use; no collateral or heavy paperwork |

Farm Equipment Financing Eligibility & Documentation

Success with any equipment loan or financing program relies on meeting specific requirements and submitting the correct documentation. Below are the standard criteria and paperwork needed, whether you’re applying for traditional loans, leasing, or specialized agricultural credit:

Key Eligibility Criteria

- Credit Score: Most lenders require a minimum score of 620, with 680+ improving your chances and equipment loan interest rates.

- Business Age: Minimum 1–2 years in operation preferred; new startups may access specialized government/NGO programs.

- Annual Revenue: Standard minimum is around $50,000, but this varies among lenders.

- Down Payment: 10–20% of equipment cost—lower for leases, higher for ownership loans.

- Collateral: Often, the equipment itself is used; additional farm assets may also serve as backup.

- Business Plan: Detailed cash flow statements and future projections are often required for new players.

- Specialized Criteria: Programs for young, beginning, or women farmers typically have more lenient requirements.

Required Documentation for Application

- Government-issued personal identification

- Last 2 years’ tax returns (personal and/or business)

- Past 3–6 months of bank statements

- Business incorporation certificates/licensing (if registered)

- Detailed farm business plan (for startups or government programs)

- Formal quote or invoice from equipment dealer/seller

Properly gathering and clearly presenting this information will streamline your application and improve your chances of approval, regardless of lender or financing method chosen.

Interest Rates, Repayment Terms, and Other Considerations

When securing farm business financing solutions, it’s important for us to look beyond the interest rate and examine the full set of loan terms, costs, and practicalities. Below are vital considerations that impact your overall deal:

Interest Rate Types & Benchmarks

- Fixed Rates: These stay the same throughout the loan term, simplifying budget calculations.

- Variable Rates: Can fluctuate annually, depending on market benchmarks. This may offer savings when rates are low but carries risk.

- Typical Ranges: 4% to 12% based on credit score, repayment length, lender type, and equipment age.

Repayment Schedules and Structures

- Monthly Installments: The norm for most loans and leases.

- Seasonal Repayments: Some programs accommodate our cash flows—especially useful in crop cycles and livestock farming.

- Balloon Payments: A larger principal lump sum is due at the term’s end (can reduce monthly expenses but increases risk).

Prepayment Penalties

- Certain lenders may charge a penalty if we pay off the loan early.

- Always clarify any prepayment terms before signing your agreement.

Insurance Requirements

- Policies for theft, damage, or total loss—required by almost all lenders.

- Ensure sufficient coverage against a range of risks (weather, fire, vandalism, transport etc.).

Hidden Fees & Additional Charges

- Origination Fees: Applied by some lenders for processing.

- Late Payment Penalties: Important for those with variable income cycles.

- Servicing/Maintenance (Leases): Who pays for wear-and-tear repairs?

By closely reviewing these factors and requesting a clear amortization schedule, we can ensure that our equipment loan is truly cost-effective and manageable for our business’s cash flow goals.

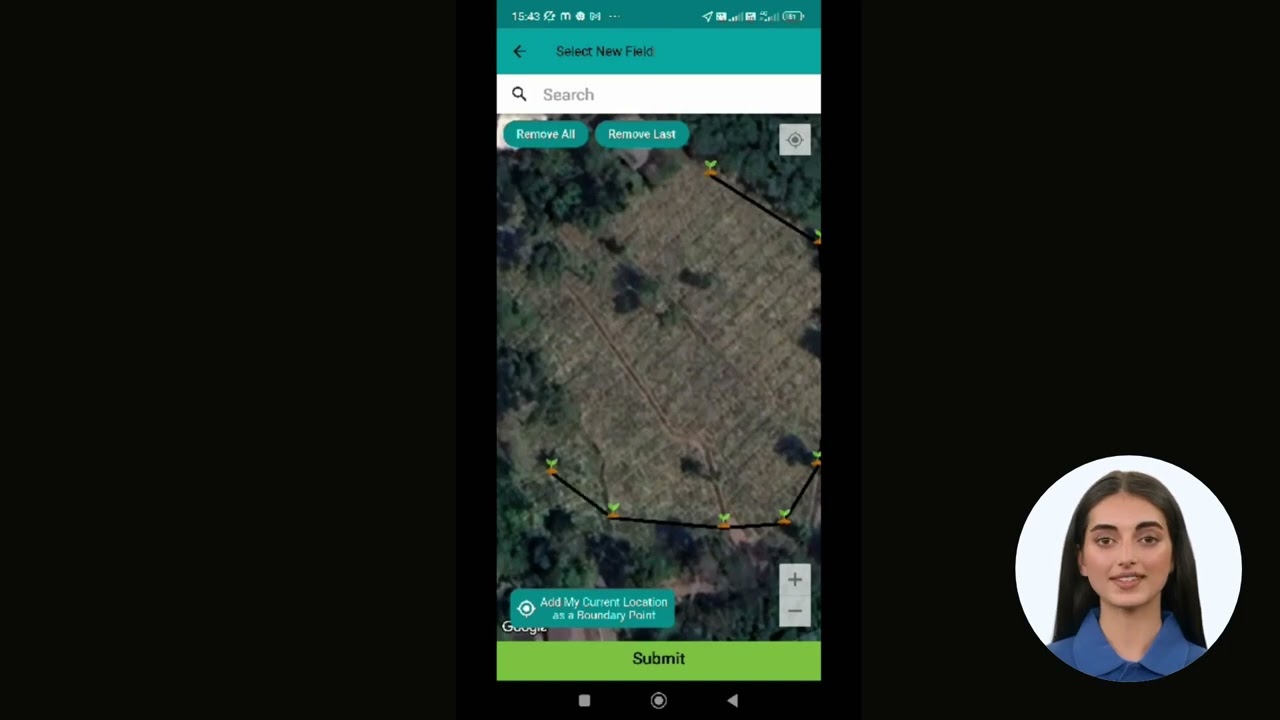

Farmonaut: Enabling Smart Equipment Financing for Your Farm

Satellites, data, and artificial intelligence have revolutionized agriculture—just as modern financing options for farmers have made advanced machinery accessible to all. As a pioneering AgTech company, Farmonaut leads the way in delivering affordable, technology-backed solutions for farm management.

Our platform provides real-time crop health, resource, and fleet monitoring via easy-to-use mobile and web apps. These services empower us to make better financial and operational decisions—including when and how to finance equipment upgrades or new machinery investments.

- Satellite-Based Crop Monitoring: We access NDVI, soil moisture, and vegetation indices to plan resource allocation and machinery needs with precision. Farmonaut’s crop loan and insurance platform also integrates satellite-based verification for improved loan approval and reduced fraud—helping both farmers and lenders.

- AI Advisory: Personalized strategies from Jeevn AI help us optimize crop cycles, guiding the timing of equipment purchases, leasing, or upgrades.

- Blockchain Product Traceability: Our supply chain partners use Farmonaut’s blockchain-based traceability tools to verify crop origin and journey, increasing trust and transparency in agricultural commerce.

- Fleet & Resource Management: With Farmonaut’s fleet management solutions, large-scale agribusinesses can efficiently schedule equipment maintenance, monitor vehicle use, and control operating costs, supporting both owned and leased assets.

Every step we take to digitize and optimize our farm operation can increase our eligibility and attractiveness to lenders—making it easier to unlock affordable financing and sustainably grow our agricultural business.

Are you building custom agri tools? Experience the future of farm management with Farmonaut’s satellite and weather data API (developer docs here).

Tips for Making Informed Farm Equipment Financing Decisions

By following these expert tips, we can maximize the advantages of agricultural equipment loans and minimize long-term risks:

- 1. Assess Usage and Upgrade Frequency: For rapidly advancing technology or seasonal needs, choose leases/rentals. For core machinery with long-term use, ownership loans build equity.

- 2. Compare Offers from Multiple Lenders: Don’t limit yourself; use quotes from banks, captive lenders, government schemes, and alternative platforms to find the best overall deal.

- 3. Plan for Down Payment and Collateral: Secure your contribution (usually 10–20%) in advance and clarify which assets are put up as collateral.

- 4. Examine Repayment Terms and Schedules: Try to match payments with your cash flow—ask for grace periods or seasonal schedules if your income varies by crop/livestock cycles.

- 5. Avoid Over-Borrowing: Use financing for essential machinery. Unused or over-specified equipment drains cash flow and hinders future lending capacity.

- 6. Negotiate Insurance Bundles: Discuss insurance premium bundling with your lender to ensure both cost-efficiency and adequate coverage.

- 7. Read the Fine Print: Understand all loan fees, prepayment penalties, servicing obligations for leases, and terms for upgrades or early termination.

- 8. Maintain Strong Business Records: Regularly update your business plan and financial statements; this not only helps with loan applications but also demonstrates professionalism to lenders.

- 9. Use Technology to Support Eligibility: Leverage tools like Farmonaut’s large-scale farm management suite to optimize operations and strengthen your credentials with potential financiers.

- 10. Align Financing with Sustainability: Consider future compliance and eco-regulations by using Farmonaut’s carbon footprinting tools when financing equipment—demonstrating environmental responsibility may increase your access to green or subsidized credit lines.

Frequently Asked Questions (FAQ) on Farm Equipment Credit

What is the difference between a farm equipment loan and a lease?

A loan gives us ownership and builds equity in the equipment once fully repaid, while a lease provides use of machinery for a term, greater upgrade flexibility, and usually lower upfront costs—but we do not own the asset unless we exercise a purchase option at lease end.

What credit score is required to qualify for farm equipment financing?

Most lenders require a minimum credit score of 620; 680+ is preferred for better interest rates and terms. Special programs may relax requirements for new or young farmers.

How do seasonal repayment schedules work?

Some agricultural lenders structure repayments to align with our cash flows, allowing larger payments after harvest or peak income months and smaller (or deferred) payments during off-seasons.

Are used equipment purchases eligible for financing?

Yes, many lenders—including online and dealer options—will finance the purchase of used agricultural equipment, although rates may be slightly higher and terms may be shorter than for new equipment.

Are there penalties for paying off my loan early?

Some agreements include prepayment penalties. It’s essential to clarify this before accepting a loan—to avoid unexpected costs if you wish to settle the debt ahead of schedule.

How does Farmonaut support access to farm equipment loans?

Farmonaut’s technology enhances our operational transparency and management, which can support credit applications by providing satellite-based verification. Our tools streamline due diligence for lenders and insurers, improving access to financing.

Can I finance additional accessories or attachments with the equipment?

Most lenders allow the total financed amount to cover standard attachments, accessories, or technology add-ons as long as they’re included on the equipment quote/invoice and align with eligibility rules.

Conclusion: Empowering Modern Agricultural Operations

Navigating the landscape of farm equipment financing is crucial for future-proofing our agricultural business. By understanding the main options, their unique features, eligibility, interest rates, and practical considerations, we can make informed, confident decisions about our next machinery investment.

Leveraging technology like Farmonaut’s platform further supports smarter equipment planning by providing data-driven insights, maximizing operational efficiency, and even simplifying credit access. Remember:

- Compare multiple financing offers and read all terms carefully.

- Align your equipment finance strategy with both your cash flow and long-term business goals.

- Use modern farm management tools to enhance eligibility, reduce risk, and optimize returns on investment.

- Always seek professional advice if uncertain about loan products or financial commitments.

The era of technology-enabled, accessible farm business financing solutions is here—unlocking unprecedented productivity and sustainability for farmers, ranchers, and agribusinesses everywhere. When armed with expert knowledge and modern digital tools, we are empowered to transform our farms and shape the future of agriculture.

Ready to make smarter financing decisions?

Explore Farmonaut’s next-gen crop management & operational tools.

#FarmEquipmentFinancing #AgriLoans #ModernAgriculture #Farmonaut