Farm Equipment Crediting: Top 7 Financing Strategies

Meta Description: Explore the top 7 farm equipment financing strategies, eligibility criteria, and tax implications for informed agricultural operational decisions and sustained growth.

“Over 60% of Indian farmers rely on credit to purchase new farm equipment, optimizing operational efficiency.”

Table of Contents

- Overview and Introduction

- Understanding Farm Equipment Financing

- Top 7 Farm Equipment Financing Strategies

- Comparative Financing Strategies Table

- Core Eligibility Criteria for Farm Equipment Financing

- Tax Implications of Equipment Financing

- Best Practices for Farm Equipment Financing

- Farmonaut Technologies Enhancing Equipment Investments

- Frequently Asked Questions

- Conclusion

- Farmonaut Subscriptions & Apps

Overview and Introduction

As the backbone of agricultural productivity, farm equipment financing stands out as a critical component in enabling farmers and foresters to acquire the necessary machinery and technology for efficient, productive work. In today’s highly competitive and rapidly changing agricultural landscape, access to advanced equipment is essential for remaining efficient, optimizing yields, and meeting operational goals.

Yet, purchasing new tractors, combines, irrigation systems, or AI-integrated farming tools can represent a significant financial outlay. That’s where understanding the landscape of agricultural equipment loans, eligibility standards, and related tax implications becomes not just helpful, but essential. Equipping ourselves with this knowledge empowers us to make informed, growth-oriented, and sustainable decisions.

In this comprehensive guide, we delve into the top 7 financing strategies that enable farmers to succeed—from traditional bank loans to government programs and innovative microfinance options. Along the way, we highlight eligibility criteria, discuss the benefits and implications of each option, and reveal actionable best practices to optimize every farm equipment purchase.

Understanding Farm Equipment Financing

Farm equipment financing refers to the suite of financial products, services, and programs designed to help agricultural businesses acquire machinery, implements, and associated technology. This includes everything from tractors, harvesters, irrigation pumps, and processing equipment to advanced AI-based fleet management solutions.

The agricultural equipment market is broad and rapidly evolving. As technology and sustainability become focal points, having the right financing structure is not just about procurement—it’s about ensuring long-term operational efficiency, resilience, and cost optimization.

Why Financing is Critical for Modern Agriculture

- Enabling Technology Adoption: Equipment financing allows us to leverage the latest in agri-technology, which boosts yield, optimizes resource use, and supports sustainability.

- Cash Flow Management: Spreading costs across manageable loan tenures helps stabilize our budgets and keeps capital available for day-to-day operational needs.

- Tax Advantages: Strategic use of depreciation, deductions, and interest write-offs transforms equipment investments into powerful financial planning tools.

- Solving Access Barriers: Financing breaks down high upfront-cost barriers, empowering us to scale operations, adopt precision farming, and remain competitive.

As we explore these avenues, our ability to choose the best equipment financing options for farmers hinges not just on loan terms, but also on a firm grasp of the eligibility criteria and implications.

Top 7 Farm Equipment Financing Strategies

Let’s dive deep into the seven most impactful approaches to financing agricultural equipment. For each strategy, we’ll discuss how it works, typical qualifications, timeline, pros and cons, tax implications, and how it aligns with specific operational goals.

- Traditional Bank Loans

- Cooperative Credit

- Government Subsidies & Programs

- Dealer or Manufacturer Financing (Captive Lenders)

- Leasing Options

- Equipment Rental

- Microfinance and Alternative Lenders

1. Traditional Bank Loans

Banks remain a primary source for agricultural equipment loans. They offer structured loan products tailored for agricultural businesses, often featuring competitive interest rates and flexible tenures.

- Key features: Fixed or floating rates, installment-based repayment, collateral requirements.

- Eligibility: Generally includes a minimum credit score (typically 620+), business history (at least 1–2 years), and a proven revenue stream.

- Best suited for: Established farms and agricultural businesses with stable financial records and credit profiles.

- Tax Benefits: Interest payments are often tax-deductible (learn more), and depreciation applies per tax law.

2. Cooperative Credit

Agricultural cooperatives, particularly in rural areas, pool resources to provide low-interest loans and credit facilities to their members. These organizations leverage community trust and shared risk, often offering lenient terms.

- Key features: Community-driven, often lower interest rates, minimal bureaucracy.

- Eligibility: Usually requires cooperative membership and participation in group-level initiatives.

- Best suited for: Small-scale farmers and groups seeking lower cost borrowing and collaborative support.

- Tax Implications: Similar to bank loans; cooperative profits may have unique handling based on local regulations.

3. Government Subsidies & Programs

Many governments, such as India’s NABARD or the US Department of Agriculture (USDA), offer low-interest government farm equipment loan programs. These are often the most accessible forms of credit for marginalized or first-time farmers.

- Key features: Subsidized interest rates, guaranteed loan backing, targeted toward priority groups (small/marginal farmers, women, etc.).

- Eligibility: Varies widely, but usually includes proof of agricultural operation, land ownership or lease, and registration with government departments.

- Best suited for: New, small, or under-resourced farmers needing accessible capital.

- Tax Implications: Varies by program; some grants/subsidies might not be taxable, while loans are treated like commercial bank loans.

Pro Tip: Government programs often link to insurance benefits and digitally-driven application processes. For advanced satellite verification during loan application, explore the Farmonaut Crop Loan and Insurance Service – designed to help lenders and farmers streamline verification and eligibility assessment.

4. Dealer or Manufacturer Financing (Captive Lenders)

Major equipment manufacturers like John Deere, Case IH, and New Holland offer in-house captive financing options, which may include promotional rates, zero-interest periods, or bundled service offers to encourage loyalty.

- Key features: Quick approvals, discounted rates, integrated after-sales service, potential loyalty incentives.

- Eligibility: Similar to bank loans—credit evaluation, business verification, and down payment usually required.

- Best suited for: Farmers committed to a particular equipment brand or seeking the fastest, most seamless purchasing experience.

- Tax Implications: Same as for loans; interest portions deductible.

5. Leasing Options

Leasing empowers us to use top-tier agricultural machinery without full ownership. The leasing company (lessor) maintains ownership, and we pay periodic fees for use, often with options for upgrades or eventual purchase.

- Key features: Lower upfront costs, off-balance sheet flexibility, frequent technology upgrades, “lease-to-own” options available.

- Eligibility: Less stringent; focuses on cash flow and serviceability rather than asset ownership.

- Best suited for: Farms seeking the latest equipment with minimal upfront investment or businesses with fluctuating equipment needs.

- Tax Implications: Lease payments can be deductible as business expenses; depreciation benefits remain with lessor.

6. Equipment Rental

For seasonal or project-specific requirements, renting becomes a nimble, cost-effective solution. Reputable rental agencies offer short- and medium-term access to expensive equipment—ideal when equipment utilization is low.

- Key features: No upfront cost, includes maintenance, flexible terms, no residual asset risk.

- Eligibility: Proof of operational intention, security deposit or basic financial check may be required.

- Best suited for: Short-term, project-oriented, or start-up operations looking to minimize capital outlay.

- Tax Implications: Rental expenses generally fully deductible as operational costs.

7. Microfinance and Alternative Lenders

With the rise of fintech and digital lending, alternative lenders for farm equipment have made rapid, accessible financing an option for those unable to meet stringent bank requirements. Microfinance institutions specifically serve small and marginalized farmers.

- Key features: Fast online applications, lower documentation barriers, creative loan structures, smaller ticket-size focus.

- Eligibility: Often more flexible; approval can be based on local references, group guarantees, or app-based credit scoring.

- Best suited for: Smallholders, marginal farmers, or those with thin credit histories needing fast access to capital.

- Tax Implications: Loan-based treatments; interest may be deductible.

“Section 80EEB offers up to ₹1.5 lakh tax deduction on interest paid for farm equipment loans in India.”

Comparative Financing Strategies Table

To aid in informed decision-making for farm equipment financing, the following table summarizes key financing strategies against critical parameters—facilitating a clear, side-by-side comparison that supports your operational and financial planning.

| Strategy Type | Estimated Interest Rate Range | Eligibility Criteria | Estimated Approval Time | Estimated Down Payment (%) | Loan Tenure Range | Tax Benefits/Implications |

|---|---|---|---|---|---|---|

| Traditional Bank Loans | 9–13% (India) 4–8% (US/EU) |

Credit score 620+, 1–2 years’ business, min ₹5 lakh/$7K turnover, proof of land/title/collateral |

1–3 weeks | 10–25% | 2–7 years | Interest, depreciation, Section 179/80EEB deduction |

| Cooperative Credit | 7–11% | Cooperative member, group guarantee, simple financials | 5–21 days | 5–15% | 1–5 years | Interest & lease deduction, possible profit share tax benefits |

| Government Subsidies | 4–7% (subsidized) | Proof of farming, priority group, documentation per program | 2–8 weeks | Varies, sometimes NIL | Upto 7 years | Interest deduction, some grants not taxable |

| Dealer/Manufacturer Financing | 0% (promo)–12% | Brand preference, equipment-based collateral, credit check | 24–72 hours | 5–20% | 1–6 years | Interest deductible, depreciation eligible |

| Leasing Options | 10–16% | Serviceability, basic credit check | 1–10 days | 5–10% | 1–5 years | Lease payments deductible, no depreciation |

| Equipment Rental | 13–20% (equivalent usage cost) | Security deposit, KYC, intent proof | 24–48 hours | Usually NIL | Days to months | Rental cost fully deductible, no depreciation |

| Microfinance/Alternative Lenders | 16–24% | Group guarantee, flexible documents, sometimes app-based scoring | 1–7 days | 0–5% | 1–3 years | Interest deductible, standard loan treatment |

*Values are indicative and may vary regionally and by lender. Always consult local financial advisors before making decisions.

Core Eligibility Criteria for Farm Equipment Financing

Meeting farm loan eligibility criteria is fundamental to successfully securing agricultural equipment loans. Regardless of the strategy chosen, lenders evaluate risk and eligibility based on several standardized parameters:

- Credit Score: Minimum of 620, with scores above 700 preferred for better interest rates and terms.

- Business Age: At least 1–2 years of documented farming operations, although some government programs and microfinance options allow for exceptions.

- Revenue: Documented annual revenue, often starting at ₹5 lakh (India) or $50,000 (US), depending on lender/applicant status.

- Down Payment: 10%–20% of the equipment cost is standard, though some programs offer NIL down payment for priority beneficiaries.

- Collateral: The equipment financed commonly serves as the primary collateral, but additional security may be required for larger loans or riskier applicants.

- Documentation: Proof of land ownership, operational records, KYC, income proof, and tax returns typically constitute the documentation set.

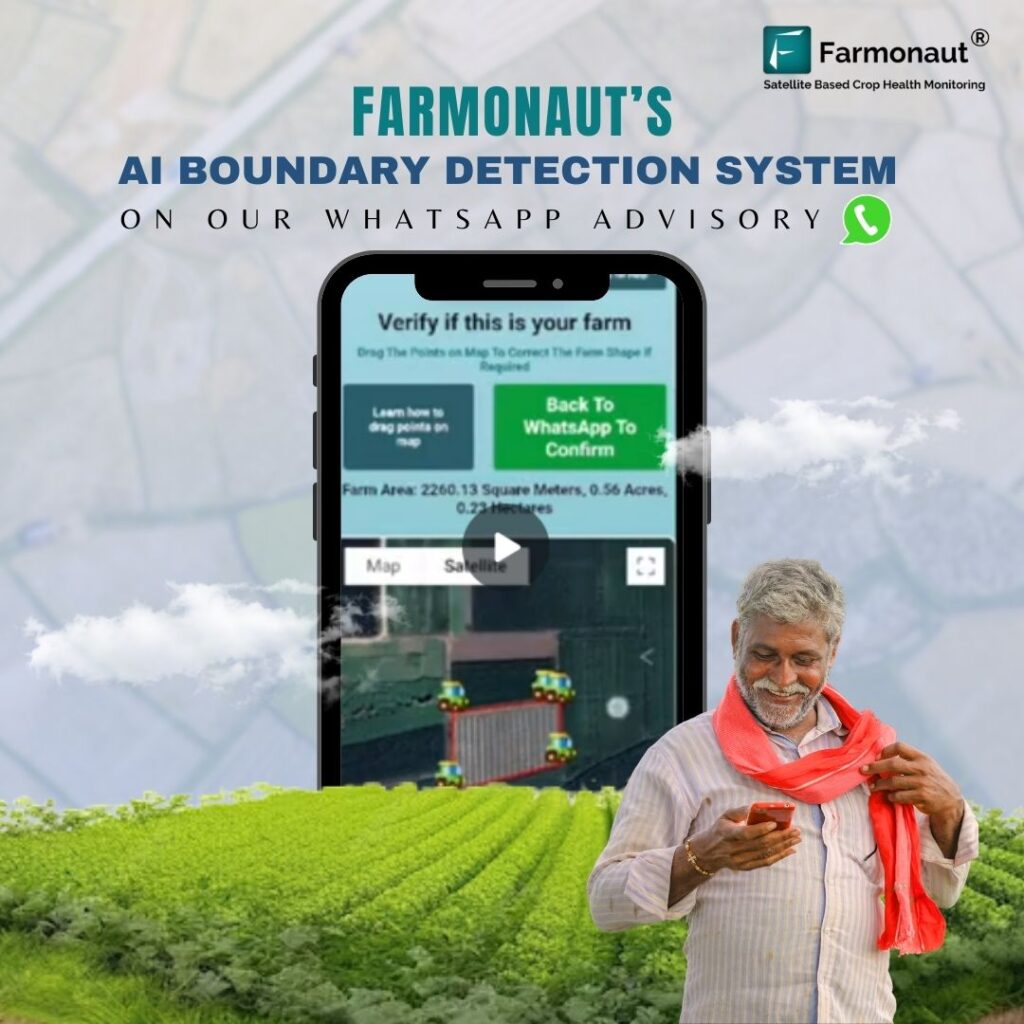

For rapid, reliable verification—particularly with government farm equipment loan programs or insurance—we recommend leveraging satellite-based verification via Farmonaut’s verification platform, which drastically reduces fraud and minimizes paperwork for lender and applicant alike.

Tax Implications of Equipment Financing

Key Tax Benefits and Obligations

The tax implications of equipment financing are crucial when planning capital investments. They can significantly reduce the effective cost of your machine procurement. Here are the major considerations:

- Depreciation: Under the Modified Accelerated Cost Recovery System (MACRS) in the US and similar rules globally, agricultural equipment is typically classified as “seven-year property.” In India, Section 32 details similar depreciation allowance.

- Section 179 (US) / Section 80EEB (India) Deduction: Allows deduction of the full purchase price of qualifying farm equipment in the year of acquisition, subject to annual limits. This deduction supercharges the business cash flow in the year of purchase.

- Special Depreciation Allowance (US): 60% bonus depreciation for property placed in service in 2024, tapering afterward. For India—accelerated depreciation may apply under certain schemes.

- Interest Deductions: Most interest paid on agricultural equipment loans is deductible against farm income, further reducing tax liability.

- Leases vs. Loans: With leasing, full lease payments are generally deductible, but ownership-based depreciation moves to the lessor.

- Rental Payments: Equipment rental fees are treated as business expenses and can be fully deducted for tax purposes.

Always consult a professional tax advisor regarding the latest agricultural equipment depreciation rules and local tax laws applicable to your region to optimize the financial impact of every equipment purchase.

For reliable traceability, inventory control, and supply-chain tax compliance, discover Farmonaut’s Blockchain-Based Product Traceability Platform. It enhances transparency and ensures your equipment and produce handling are fully documented, providing a robust system for audits and regulatory requirements.

Best Practices for Farm Equipment Financing

When navigating the world of equipment financing options for farmers, incorporating proven best practices for farm equipment financing can yield substantial, sustainable benefits.

- Assess Operational Needs

- Analyze your farm’s true equipment requirements by leveraging data-driven insights—crop cycles, area, projected yield, and labor costs.

- Combine traditional knowledge with precision tools (like Farmonaut’s Large Scale Farm Management Suite) to identify equipment that aligns with long-term productivity and sustainability goals.

- Compare Financing Options

- Obtain formal quotes from multiple lenders (banks, manufacturers, alternative and government programs).

- Evaluate “all-in” cost: interest, fees, maintenance plan, insurance, and total repayment obligations.

- Understand Loan Terms

- Carefully review detailed loan agreements. “Teaser” promotional interest rates are often time-limited—scrutinize how rates adjust.

- Map repayment schedules with your seasonal cash flows to avoid liquidity crunches.

- Maintain Robust Financial Records

- Keep all invoices, tax returns, and operational income/expense records meticulously organized. This accelerates loan processing and may improve your eligibility score.

- Utilize digital resource management tools—like Farmonaut’s Fleet & Resource Management—to automate record-keeping, manage machinery, and optimize usage.

- Factor in Long-Term Maintenance Costs

- Consider not just the purchase cost, but recurring maintenance, spare part availability, and fuel/energy requirements.

- Ensure your financing plan leaves room for these operational necessities, avoiding surprises later on.

- Engage with Professional Advisors

- Consult with agri-finance experts or digital advisory platforms to model different funding strategies and choose the one best suited for your operational profile, scale, and local policy incentives.

- Evaluate Environmental Impact

- Incorporate sustainability into your procurement plan. Newer, energy-efficient machinery may lower your operational carbon footprint—and qualify for additional grants or tax benefits. Farmonaut’s Carbon Footprinting Service can help monitor and optimize your environmental impact, supporting ESG compliance and brand reputation.

Farmonaut Technologies Enhancing Equipment Investments

Superior equipment investments demand precise, credible field data. Farmonaut is at the forefront of satellite-driven, AI-enabled solutions that maximize the value of every machinery purchase.

- Satellite-Based Crop Health Monitoring: Daily NDVI analysis, soil moisture, and pest alerts enable us to match equipment use to genuine farm needs, ensuring our capital is efficiently deployed.

- Jeevn AI Advisory System: Receives real-time crop management tips and weather forecasts that inform when and how frequently equipment should be operated—improving service-life and ROI.

- Blockchain-Based Product Traceability: End-to-end transparency enhances operational trust—key for grant applications, insurance processes, and supply chain certifications.

- Fleet & Resource Management: Track usage, optimize machinery deployment, schedule preventive maintenance, and gain strategic insight into overall operational costs—all within one dashboard.

- API Access: For enterprise or agri-tech businesses, Farmonaut’s API and developer documentation enable seamless integration of weather and satellite data into proprietary loan processing, insurance, and farm management systems.

With Farmonaut, we are empowered to make smarter acquisition, deployment, and monitoring decisions—maximizing the financial, operational, and sustainability outcomes of every equipment investment.

Crop Loan & Insurance

Fleet Management

Product Traceability

Carbon Footprinting

Crop Plantation & Forest Advisory

Frequently Asked Questions (FAQ)

Q1: What is the minimum credit score required for farm equipment financing?

Most lenders require a minimum credit score of 620. However, higher credit scores (above 700) help secure better interest rates on agricultural equipment loans and more flexible terms. Microfinance and government schemes may offer leniency.

Q2: Can new or start-up farms apply for equipment financing?

Yes, though options like traditional bank loans require at least 1–2 years of operational records, specialized government programs and alternative lenders are available for start-ups and recently established businesses.

Q3: Are equipment loan interest payments tax-deductible?

Yes, interest paid on equipment loans typically qualifies for deduction against farm income, reducing your overall tax burden. Always consult your regional tax expert for specific application.

Q4: What documentation is needed for a farm equipment loan application?

Standard requirements include business registration, revenue statements, tax returns, land or lease records, credit reports, and identity verification. New digital platforms may streamline or partially automate these processes.

Q5: Should we buy, lease, or rent equipment?

This depends on your capital, utilization rate, tax plans, and operational profile. Buying is optimal for long-term, intensive use. Leasing suits those needing frequent upgrades. Renting is ideal for short-term or fluctuating seasonal needs.

Q6: How does Farmonaut support financing eligibility and equipment purchase processes?

Farmonaut provides satellite-based field verification for streamlined loan application processes, fleet/resource management for tracking capital assets, and crop advisory to maximize equipment efficiency and ROI. Start with the Farmonaut app for comprehensive support.

Q7: Are leasing and rental expenses also tax-deductible?

Yes, lease payments and rental expenses for business use are typically fully deductible as operational costs. However, only owned equipment may be depreciated.

Q8: What is Section 80EEB and how does it benefit Indian farmers?

Section 80EEB of the Indian Income Tax Act allows a deduction of up to ₹1.5 lakh for interest paid on farm equipment loans in a financial year, reducing effective borrowing costs.

Conclusion

Farm equipment financing has evolved into a powerful enabler of agricultural progress, making top-tier machinery and technology accessible to farmers, foresters, and agri-entrepreneurs worldwide. By exploring each type of equipment financing avenue, carefully reviewing eligibility criteria, and strategically planning around tax implications, we can make truly informed decisions that propel our farms toward higher productivity and sustainable profitability.

Leveraging advanced digital tools—for monitoring, verification, and operational analytics—further optimizes each investment, ensuring capital works as hard as we do. Remember to engage with trusted financial advisors, stay current on local programs and incentives, and always center decisions around real, data-driven farm needs.

With platforms like Farmonaut, every step of the process—from equipment acquisition to ongoing management and compliance—can be seamlessly integrated, transparent, and optimized for the challenges of modern agriculture.

Make every rupee, dollar, or euro count—invest smart, farm smart.

Farmonaut Subscriptions

Ready to elevate your agricultural operations with cutting-edge field data, resource tracking, and AI-powered advisory? Farmonaut subscriptions deliver affordable, world-class technology for farms, cooperatives, and enterprises of all sizes. Choose the plan that fits your needs and get started in minutes!

For custom API integration, visit Farmonaut API or view our developer documentation.