Financial Inclusion: 7 Powerful Ways to Build Resilience Globally

“Over 1.7 billion adults globally remain unbanked, limiting their access to essential financial services and resilience tools.”

Table of Contents

- Introduction: The Urgent Need for Global Financial Inclusion

- The Foundations of Financial Inclusion in Building Resilience

- Comparative Impact: How Financial Inclusion Mechanisms Drive Resilience

- 7 Powerful Ways Financial Inclusion Builds Global Resilience

- 1. Digital Payments and Resilience

- 2. Access to Credit in Rural Areas

- 3. Savings and Economic Empowerment

- 4. Insurance for Rural Households and Climate Resilience

- 5. Innovative Inclusive Financial Services and Technologies

- 6. Remittances, Mobile Money, and Crisis Recovery

- 7. Small Business Financial Empowerment for SDGs

- Inclusive Products, Services and the Role of Precision Agriculture

- Comparative Impact Table: Financial Inclusion and Resilience

- Precision AgTech: Farmonaut’s Contribution to Global Resilience

- Filling Knowledge Gaps: A Call for Evidence and Collaboration

- Linking Financial Inclusion to SDGs: Pathways to Sustainability

- Frequently Asked Questions

- Conclusion: Towards a Resilient Future for All

Introduction: The Urgent Need for Global Financial Inclusion

The global risk landscape is evolving like never before. In the past decade, we have observed the intertwining of extreme weather, macroeconomic shocks, conflict, and persistent poverty. Each of these risks doesn’t just threaten individual prosperity—they collectively jeopardize the progress needed to achieve the Sustainable Development Goals (SDGs). For the most vulnerable populations—those living in poverty, rural households, women, and small businesses—these crises amplify their challenges, weakening resilience and threatening social and economic stability.

Our response must be both comprehensive and targeted. At the heart of any effective solution is financial inclusion: the process of ensuring that individuals and businesses, no matter how remote or disadvantaged, have access to useful and affordable financial products and services that meet their needs – including payments, savings, credit, and insurance. As we explore in this detailed guide, empowering communities through inclusive finance isn’t just a development nicety—it’s essential to building resilience for vulnerable populations everywhere.

This article draws on leading evidence, including new insights from initiatives like the CGAP Financial Inclusion 2.0 and the Impact Pathfinder, to provide a truly global perspective. We explore how digital payments, insurance for rural households, access to credit in rural areas, savings and economic empowerment, and advanced solutions from innovators such as Farmonaut are shaping resilient futures, supporting SDGs, and creating sustainable outcomes for all.

The Foundations of Financial Inclusion in Building Resilience

To grasp how financial services increase resilience, we must consider how they help households, small businesses, and communities not just survive—but recover and flourish after shocks. Such shocks may be climatic (like floods or drought), economic (price spikes, job loss), or social (conflict, illness).

- Insurance enables farmers and vulnerable populations to absorb and bounce back from climate shocks. Timely payouts make the crucial difference between recovery and ruin.

- Digital payments boost liquidity, enabling faster access to cash, remittances, and social support with reduced risk of theft or losses.

- Savings help populations save for emergencies, invest in preventative healthcare, and build reserves for the unexpected.

- Credit (especially microcredit and group lending) provides working capital for both households and small businesses, making them less susceptible to shocks.

As we will discuss, the effectiveness of each tool depends on context—rural versus urban, women vs. households, individual vs. small business—and on the specific design of the product or service. No “one-size-fits-all” model exists for building resilience globally.

Comparative Impact: How Financial Inclusion Mechanisms Drive Resilience

| Financial Inclusion Mechanism | Estimated Global Reach (% vulnerable population) | Key Resilience Benefit | Contribution to SDGs | Example Implementation Regions |

|---|---|---|---|---|

| Digital Payments (incl. Mobile Money) | 45% | Reduces income volatility, speeds up remittances, increases access to savings | SDG 1, 5, 8, 9 | Sub-Saharan Africa, South Asia |

| Micro-Insurance | 18% | Smooths consumption after shocks, enables farm/family investment | SDG 1, 2, 13 | Ghana, Kenya, Bangladesh |

| Micro-Credit & Group Lending | 30% | Enables productive investment, stabilizes income during crises | SDG 5, 8, 10 | South Asia, East Africa, Latin America |

| Mobile Banking | 33% | Increases secure access to savings, empowers women’s economic resilience | SDG 1, 5, 9 | Nigeria, India, Indonesia |

This table illustrates that different mechanisms deliver distinct but interlinked resilience benefits. The combined adoption of these financial inclusion strategies can powerfully support global progress on the SDGs.

7 Powerful Ways Financial Inclusion Builds Global Resilience

Let’s delve deeper into the seven most impactful approaches that inclusive finance offers in creating resilient societies and driving sustainable development outcomes:

1. Digital Payments and Resilience

The rise of digital payments—including mobile money platforms—has been transformative for vulnerable communities. Not only do digital payments enable faster, safer, and more transparent transactions; they also foster resilience in several key ways:

- Liquidity in Crises: Digital wallets provide households with immediate access to cash in the face of climate or social shocks, mitigating the need for risky alternatives.

- Remittances and Social Transfers: Digital payments facilitate remittances across long distances. Studies in Mozambique show that after disasters, families with access to mobile money were 33% more likely to receive life-saving remittances than those without.

- Building a Savings Habit: Digital platforms encourage users to save, offering small, regular savings that add up to meaningful emergency reserves (as seen in studies from Burkina Faso).

- Security and Privacy: Unlike cash, digital transactions reduce the risks of theft and loss, while also enabling better tracking for both individuals and policymakers.

For governments and NGOs, leveraging digital payments allows for rapid deployment of social safety nets, minimizing bureaucratic delays during macroeconomic shocks. This has proven critical during COVID-19, severe weather events, and conflict-driven displacement.

2. Access to Credit in Rural Areas

Access to credit in rural areas is a fundamental catalyst for economic empowerment and resilience. Credit fills cash flow gaps, funds essential investments, and enables farmers and small business owners to recover quickly after adverse events.

- Bridge for Necessities: Microcredit and tailored lending enable households to avoid distress sales of livestock, land, or produce when crisis strikes.

- Investing in the Future: Affordable, timely credit lets rural families invest in higher-yield seeds, farming inputs, or even small-scale irrigation systems, building resilience to climatic and market risks.

- Empowering Women Entrepreneurs: Gender-sensitive credit mechanisms, such as group lending or microloans, have demonstrated strong positive effects on women’s ability to grow enterprises and invest in their children’s health and education.

Smart lending, supported by data and technology, further reduces lending risks and can help lower the cost of funds for rural populations—making credit a true lever for development.

3. Savings and Economic Empowerment

The ability to save for the future marks a critical step toward resilience. Savings and economic empowerment aren’t just about accumulating funds—they are about building security, agency, and choice for individuals and households.

- Women’s Economic Empowerment: In Kenya, group-based savings models such as VSLAs led women to invest much more in preventative health (e.g., clean water, bed nets), reducing vulnerability to both health and economic shocks.

- Preparedness for Emergencies: Regular savings, whether through digital apps, group models, or local cooperatives, serve as a buffer against sudden income loss, medical emergencies, and natural disasters.

- Community Solidarity: Rotating savings and credit groups not only help members save but also foster collective risk-sharing and support—critical in times of compounding crises.

- Pathways to Investment: Those with even small reserves are better positioned to pursue opportunities, adopt new technology, and recover after setbacks.

However, the design matters: in contexts where shocks are frequent, group-based withdrawals or defaults can undermine group resilience. Flexible, well-adapted savings products are essential.

4. Insurance for Rural Households and Climate Resilience

Of all financial inclusion tools, insurance for rural households, especially weather index insurance and crop insurance, directly address “climate shocks and financial resilience.” Insurance supports households, especially farmers, in absorbing and recovering from devastating events.

- Payouts for Recovery: Insurance provides timely payouts that help families smooth consumption, avoid negative coping strategies (like reducing meals), and re-invest in their farms.

- Reduction in Missed Meals: As evidenced in Ghana, insured households saw missed meal rates drop significantly after climate disasters.

- Maintaining Productivity: Payments empower farmers to replant, buy inputs, or expand land, helping communities avoid falling further into poverty.

- Gender Gaps Remain: While insurance benefits entire households, more research is needed to understand its specific impacts on advancing women’s resilience and economic empowerment.

The challenge lies in designing insurance products that are both affordable and pay out quickly enough to make a difference. Technology, remote sensing, and mobile verification are revolutionizing this—increasing accuracy and lowering administrative costs.

5. Innovative Inclusive Financial Services and Technologies

Modern inclusive financial services are grounded in advanced, data-driven tools. Innovations like satellite-based farm monitoring, AI-enabled crop advisory systems, and blockchain traceability offer several unique benefits to resilience-building:

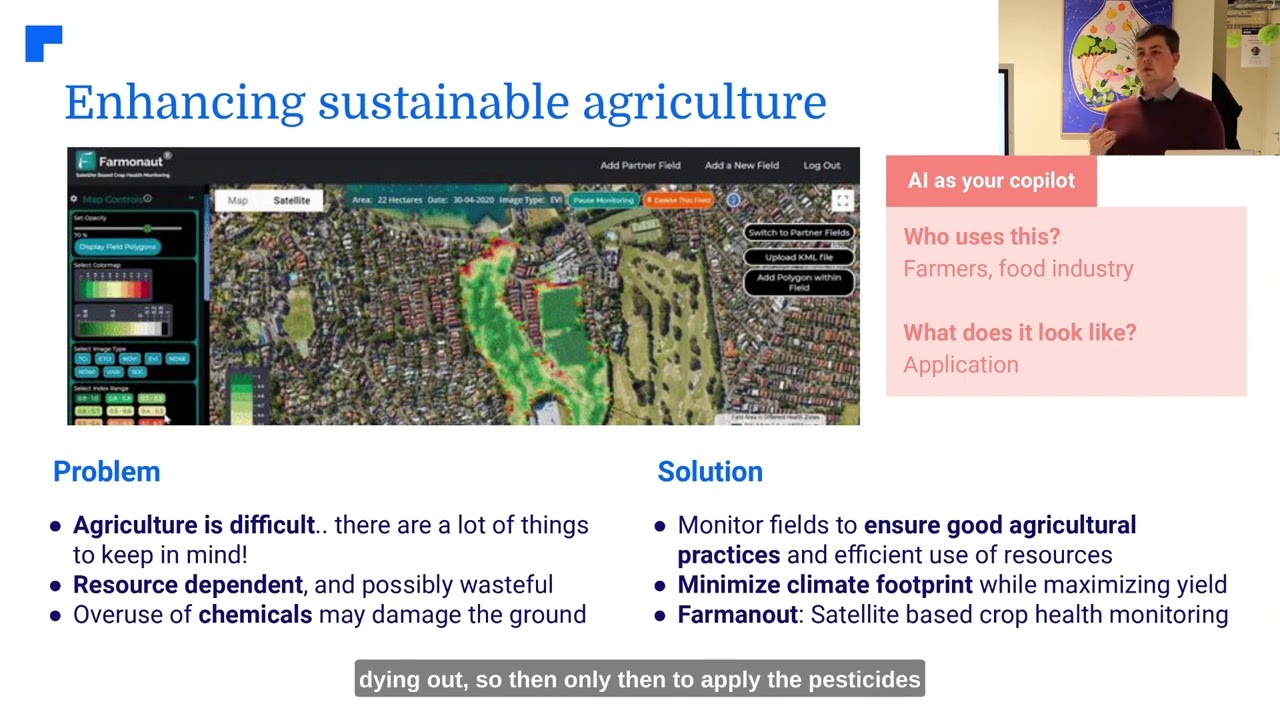

- Real-Time Risk Detection: Technologies such as Farmonaut’s satellite imagery equip rural populations, companies, and governments with timely alerts on crop health, enabling preventative decisions before risks become crises.

- Personalized Advisory: AI-driven systems like Farmonaut’s Jeevn AI provide tailored guidance, supporting efficient input use, higher yields, and more sustainable practices.

- Decentralized Validation: Blockchain traceability fosters transparency in supply chains, building trust and opening market opportunities even for smaller farmers and businesses.

- Sustainability: Environmental impact tracking (carbon footprinting) encourages sustainable, climate-smart reforms, further aligning financial inclusion with SDGs.

6. Remittances, Mobile Money, and Crisis Recovery

When disaster or conflict strikes, remittances and mobile money services provide a crucial safety net for vulnerable populations worldwide. Their contributions to resilience are multi-faceted:

- Rapid Recovery: Families can instantly receive funds from relatives working in cities or abroad, often the difference between recovery and prolonged hardship.

- Persistent Support: Mobile money platforms bridge distances during mobility restrictions, natural disasters, or social unrest.

- Formalization and Security: The formal, trackable nature of remittances on digital platforms enables not just security, but the ability to unlock other financial services, including savings and credit.

Evidence from Sub-Saharan Africa and South Asia confirms mobile money’s strong impact on household resilience and a knock-on effect of reducing local poverty.

“Digital payments could reduce global poverty by up to 14%, accelerating progress toward multiple Sustainable Development Goals.”

7. Small Business Financial Empowerment for SDGs

Small businesses—including family farms and microenterprises—are lifelines for communities, generating jobs, food security, and local economic growth. Small business financial empowerment builds social resilience and unlocks achievement of the SDGs by:

- Productive Investment: Affordable credit, insurance, and digital payments enable small enterprises to expand, diversify, and withstand adverse events.

- Access to Markets: Digital platforms (e.g., remote management or traceability solutions) connect small producers to new buyers, enhancing opportunity and stability.

- Operational Efficiency: Tools for resource and fleet management, such as those offered by Farmonaut, mean even small businesses can operate at scale and respond to shocks rapidly.

- Supporting Women and Youth: Tailored financial products promote the inclusion and empowerment of segments most at risk of exclusion and poverty.

Inclusive Products, Services and the Role of Precision Agriculture

The path to building resilience for vulnerable populations is paved with inclusive, context-adapted products and services. Technology-driven platforms—like Farmonaut—are expanding access dramatically:

- Real-time Crop Health: Farmers can now monitor crop health, soil moisture, and weather impacts remotely, using satellite-driven platforms.

This not only advances resilience during crop shocks but also increases efficiency in water and resource use, furthering sustainable development. - AI-Based Advisory: Personalized AI-based insights support households and small businesses in adopting climate-smart practices—from drought-adapted seeds to optimal fertilizer timing. Learn about Farmonaut’s Crop Plantation, Forest, and Advisory Service—a solution that empowers large-scale and individual users alike.

- Traceability and Data-Driven Financing: Blockchain and data tools strengthen trust for buyers, lenders, and insurers, bridging the gap between rural populations and the global economy.

These services not only reduce risks for vulnerable groups but also attract the financial sector, making inclusive finance a commercially sustainable endeavor.

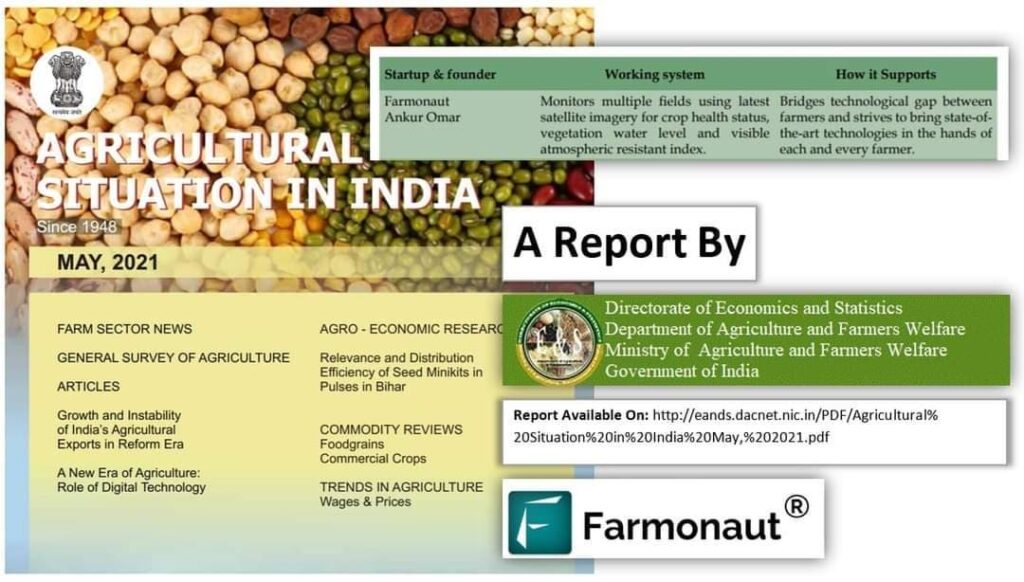

Precision AgTech: Farmonaut’s Contribution to Global Resilience

As agriculture faces mounting risks—from erratic weather to market volatility—tools like Farmonaut are essential to sustainable resilience strategies for both smallholders and large agribusinesses. Here’s how our platform transforms precision agriculture into a resilience-building engine:

- Satellite-Based Monitoring: Farmonaut provides real-time NDVI, soil moisture, and crop condition analytics. This aids farmers in rapidly detecting, adapting to, and recovering from weather and pest-related shocks.

- AI and Resource Optimization: Farmonaut’s Jeevn AI helps users harness climate, crop, and weather data to make smart, resilient decisions, boosting farm productivity in the face of adversity.

- Blockchain for Trust: Our blockchain traceability promotes transparent, trusted supply chains—attractive for institutional buyers and beneficial for small and medium farmers’ incomes.

- Carbon Footprinting: Track, manage, and minimize environmental impacts via Farmonaut’s Carbon Footprinting—contributing directly to global climate resilience objectives.

- Access to Financial Services: Satellite-based verification through Farmonaut’s API opens new doors for crop insurance and loans, especially for remote or previously excluded rural households.

Filling Knowledge Gaps: A Call for Evidence and Collaboration

While the evidence for financial inclusion and building resilience for vulnerable populations is mounting, important knowledge gaps remain:

- How do specific financial tools perform over the long term in different contexts (rural/urban, male/female, region)?

- What are the most effective combinations of digital payments, insurance, savings, and credit at the household level?

- How can we tailor insurance for rural households and other products to encourage women’s inclusion and economic empowerment?

- In what ways can technology and real-time data further reduce costs and risks for excluded populations?

We must continue to invest in pilots, impact measurement, and open-access knowledge resources—like CGAP’s Impact Pathfinder—to scale proven solutions and adapt strategies for local realities.

Linking Financial Inclusion to SDGs: Pathways to Sustainability

Financial inclusion is not just a development goal in itself. It’s a vital, accelerating force that cuts across dozens of SDG targets—especially those concerning poverty reduction, gender equality, sustainable cities, climate action, and economic growth.

- SDG 1 (No Poverty): Inclusive finance tools directly address poverty by raising incomes, smoothing consumption, and reducing the likelihood of catastrophic loss after shocks.

- SDG 2 (Zero Hunger): Crop insurance, credit, and savings empower farmers to invest in productivity, adapt to climate shocks, and ensure year-round food supply.

- SDG 5 (Gender Equality): Gender-sensitive financial inclusion increases women’s voice, agency, and economic empowerment—especially when adapted for women’s needs and realities.

- SDG 13 (Climate Action): Weather-index insurance, climate-smart credit, and platforms like Farmonaut’s carbon tracking align rural livelihoods with global sustainability and resilience goals.

By leveraging inclusive finance—with the support of policy, technology, and evidence—we march closer to a resilient, sustainable world, aligned with the ambitions of the 2030 Agenda.

Frequently Asked Questions: Financial Inclusion & Resilience

What is financial inclusion, and why does it matter for building resilience?

Financial inclusion means ensuring everyone—especially vulnerable and rural populations—can access affordable financial services (payments, savings, credit, insurance) that meet their needs. It is key to helping households, farmers, and small businesses survive, adapt, and recover from shocks, supporting long-term prosperity and the SDGs.

How do digital payments boost resilience during crises?

Digital payments help people receive remittances, government transfers, or emergency aid instantly and safely, even when travel or cash exchange is disrupted. This quick access to cash is vital for emergency needs, enabling faster recovery and improved economic stability.

Why is access to credit particularly important in rural areas?

In rural regions, livelihoods depend heavily on weather and market conditions. Access to credit lets farmers and small businesses bridge gaps, make investments, and rebound from setbacks like crop failure or medical emergencies—reducing their vulnerability to poverty.

What role does insurance play for rural households?

Insurance (like crop or livestock insurance) provides payouts after climate or disaster shocks. This enables rural families to maintain food and income without depleting assets, supporting both immediate needs and recovery investments.

Can precision agriculture and technology platforms like Farmonaut help?

Absolutely. By providing real-time risk insights, supporting data-driven decisions, and enabling transparent verification for loans/insurance, tech platforms like Farmonaut help reduce risks, lower costs, and support resilience for farmers and the broader agricultural community.

How does building financial resilience contribute to SDGs?

Financial resilience enables vulnerable populations to avoid traps (like debt or hunger) after shocks and invest in their future. This accelerates progress in SDG 1 (poverty reduction), SDG 2 (zero hunger), SDG 5 (gender equality), SDG 8 (decent work and growth), SDG 13 (climate action), and more.

How can smallholders and agribusinesses adopt such resilience tools?

They can access technology-driven services (like Farmonaut’s platform), join group savings or credit models, and utilize mobile or digital financial services solutions. It’s important to choose products adapted to local risks and realities, and to leverage available digital or satellite support for better risk management.

Conclusion: Towards a Resilient Future for All

The evolving global risk landscape—marked by climate, macroeconomic, and social challenges—demands practical, scalable strategies that reinforce our resilience. Financial inclusion—through thoughtfully designed savings, insurance, digital payments, and credit—is one of the most powerful ways to achieve this.

We have seen that inclusive financial services are essential for building resilience for vulnerable populations, especially when combined with technology, strong evidence, and local adaptation. Pioneers like Farmonaut are transforming what’s possible, lowering barriers, and making advanced tools accessible even to the smallest farmer in the most remote area.

Let us all—financial service providers, policymakers, funders, technologists, and agricultural communities—work together to embed financial resilience in our social, economic, and environmental strategies. This is how we will return to the path of achieving the SDGs, ensure no one is left behind, and build a sustainable, resilient world for generations to come.