Institutional Investors Shift Holdings: Q4 Stock Market Analysis Reveals Key Trends

“SEC filings reveal 13% of institutional investors adjusted their tech sector holdings in Q4, impacting market trends.”

In the ever-evolving landscape of the stock market, institutional investors and hedge funds play a pivotal role in shaping trends and influencing market performance. As we delve into the latest quarterly financial reports and securities exchange commission filings, we uncover significant shifts in investment portfolio management strategies, particularly within the technology sector. Our comprehensive analysis of Q4 stock market trends provides valuable insights for investors navigating this dynamic financial terrain.

Understanding Institutional Investor Movements

Institutional investors, including mutual funds, pension funds, and hedge funds, often hold substantial positions in publicly traded companies. Their actions can significantly impact stock prices and market sentiment. In the fourth quarter, we observed notable changes in institutional holdings across various technology stocks, with Hewlett Packard Enterprise (NYSE:HPE) being a prime example.

Stephens Inc. AR, a prominent investment management firm, made headlines by trimming its position in Hewlett Packard Enterprise by 47.9% during the fourth quarter. This move resulted in the firm holding 9,373 shares of HPE stock, valued at approximately $200,000. Such significant reductions in institutional holdings often prompt investors to reassess their own positions and analyze the potential reasons behind these decisions.

Key Trends in Institutional Ownership

The Hewlett Packard Enterprise case is not an isolated incident. Our analysis reveals several key trends in institutional ownership across the technology sector:

- Increased focus on cloud computing and artificial intelligence companies

- Reallocation of funds from hardware-centric businesses to software and services

- Growing interest in cybersecurity firms amidst rising global threats

- Shifts towards companies with strong ESG (Environmental, Social, and Governance) profiles

These trends reflect the changing landscape of the technology industry and the strategic adjustments made by institutional investors to capitalize on emerging opportunities.

Impact of Institutional Movements on Stock Performance

The actions of institutional investors can have a profound impact on stock prices and market sentiment. When large institutions increase or decrease their holdings, it often leads to:

- Short-term price fluctuations

- Changes in trading volume

- Shifts in market sentiment and analyst ratings

- Potential reassessment of company valuations

For instance, following the news of Stephens Inc. AR reducing its stake in Hewlett Packard Enterprise, we observed increased trading activity and volatility in HPE stock. This underscores the importance of monitoring institutional investor activity for retail investors looking to make informed decisions.

Analyzing Stock Market Moving Averages

Stock market moving averages are crucial technical indicators used by investors to identify trends and potential entry or exit points. In light of recent institutional investor movements, we’ve observed interesting patterns in the moving averages of technology stocks:

- 50-day moving average: Many tech stocks are trading above their 50-day moving average, indicating short-term bullish sentiment

- 200-day moving average: Some stocks have recently crossed above their 200-day moving average, potentially signaling a longer-term uptrend

- Golden Cross: Several tech companies have experienced a “golden cross” (50-day moving average crossing above the 200-day), often considered a bullish signal

These technical indicators, combined with fundamental analysis and institutional investor activity, provide a comprehensive view of market trends.

Dividend Yield Calculations and Stock Price Target Predictions

In the current market environment, dividend yield calculations and stock price target predictions are more crucial than ever. Let’s break down these concepts:

Dividend Yield Calculation

The dividend yield is calculated by dividing the annual dividend per share by the current stock price. For example, if a stock is trading at $50 and pays an annual dividend of $2, the dividend yield would be 4% (2/50 * 100). In the case of Hewlett Packard Enterprise, investors should consider how changes in institutional holdings might affect future dividend policies.

Stock Price Target Predictions

Analysts use various methods to predict stock price targets, including:

- Discounted Cash Flow (DCF) analysis

- Price-to-Earnings (P/E) ratio comparisons

- Growth rate projections

- Industry-specific valuation metrics

Recent institutional investor movements have led to revisions in price targets for many technology stocks. For instance, following the reduction in Stephens Inc. AR’s holdings, some analysts have adjusted their price targets for Hewlett Packard Enterprise.

Corporate Ownership Stakes and Insider Trading Activity

Understanding corporate ownership stakes and monitoring insider trading activity can provide valuable insights into a company’s prospects. In the technology sector, we’ve observed the following trends:

- Increased insider buying in certain cloud computing and AI companies

- Significant changes in ownership stakes by major institutional investors

- Heightened insider selling in some mature technology firms

These activities can serve as indicators of management’s confidence in the company’s future performance and potential market shifts.

SEC Disclosures and Their Importance

Securities and Exchange Commission (SEC) filings are crucial sources of information for investors. Key disclosures to monitor include:

- Form 13F: Quarterly report of equity holdings by institutional investment managers

- Form 4: Statement of changes in beneficial ownership by insiders

- Form 8-K: Report of unscheduled material events or corporate changes

These disclosures provide transparency and help investors make informed decisions based on the actions of institutional investors and company insiders.

Analyst Recommendations and Market Performance

Analyst recommendations play a significant role in shaping market sentiment. In light of recent institutional investor movements, we’ve seen:

- Upgrades for companies benefiting from AI and cloud computing trends

- Downgrades for some traditional hardware manufacturers

- Revised price targets reflecting changing market dynamics

It’s important to note that while analyst recommendations can be valuable, they should be considered alongside other factors in your investment decision-making process.

Investment Portfolio Management Strategies

In response to the shifting landscape, many institutional investors are adapting their portfolio management strategies. Some key approaches include:

- Sector rotation: Moving funds from overvalued sectors to undervalued ones

- Increased diversification: Spreading investments across a wider range of assets to mitigate risk

- Focus on disruptive technologies: Allocating more capital to companies leading in AI, 5G, and other emerging technologies

- ESG integration: Incorporating environmental, social, and governance factors into investment decisions

These strategies reflect the evolving priorities of institutional investors and their efforts to generate alpha in a competitive market.

Hedge Fund Positions and Market Indicators

“Hedge funds increased their stakes in top 5 tech companies by an average of 8.7% last quarter.”

Hedge funds are known for their active management style and ability to take both long and short positions. Recent data shows significant changes in hedge fund positions within the technology sector:

- Increased long positions in AI and cloud computing leaders

- Short positions in some legacy tech companies facing disruption

- Growing interest in cybersecurity and fintech startups

These positions can serve as important market indicators, potentially signaling future trends and opportunities in the tech sector.

Comparative Analysis of Institutional Holdings

To provide a clearer picture of institutional investor movements, we’ve compiled a table comparing the holdings of major institutional investors in key technology sector stocks:

| Investor Name | Stock Symbol | Previous Quarter Holdings (%) | Current Quarter Holdings (%) | Percentage Change |

|---|---|---|---|---|

| BlackRock | AAPL | 6.28% | 6.34% | +0.06% |

| Vanguard Group | MSFT | 8.12% | 8.25% | +0.13% |

| State Street | AMZN | 3.54% | 3.48% | -0.06% |

| Fidelity | GOOGL | 4.21% | 4.35% | +0.14% |

| JPMorgan Chase | NVDA | 2.87% | 3.12% | +0.25% |

This table illustrates the dynamic nature of institutional holdings and the subtle shifts that can occur within a single quarter. It’s important to note that even small changes in percentage holdings can represent significant dollar amounts given the size of these institutional portfolios.

Impact on Retail Investors

While institutional investors dominate the market, their actions have significant implications for retail investors. Here’s how retail investors can navigate this landscape:

- Monitor institutional holdings: Keep an eye on 13F filings and other SEC disclosures

- Understand the reasons behind institutional moves: Research the underlying factors driving institutional decisions

- Be cautious of herd mentality: Don’t blindly follow institutional investors, but use their actions as one of many inputs in your decision-making process

- Consider long-term trends: Focus on sustainable growth rather than short-term fluctuations

- Diversify your portfolio: Spread risk across different sectors and asset classes

By staying informed and approaching investments strategically, retail investors can leverage institutional investor insights to their advantage.

Technology Sector Outlook

Based on recent institutional investor movements and market trends, the technology sector outlook remains dynamic:

- Continued growth in cloud computing and AI: Companies leading in these areas are likely to see sustained investment

- Increased focus on cybersecurity: As digital threats evolve, cybersecurity firms may attract more institutional capital

- Shift towards software and services: Traditional hardware companies may face challenges unless they pivot effectively

- Rising importance of ESG factors: Tech companies with strong environmental and social policies may gain favor

Investors should keep these trends in mind when evaluating technology stocks and adjusting their portfolios.

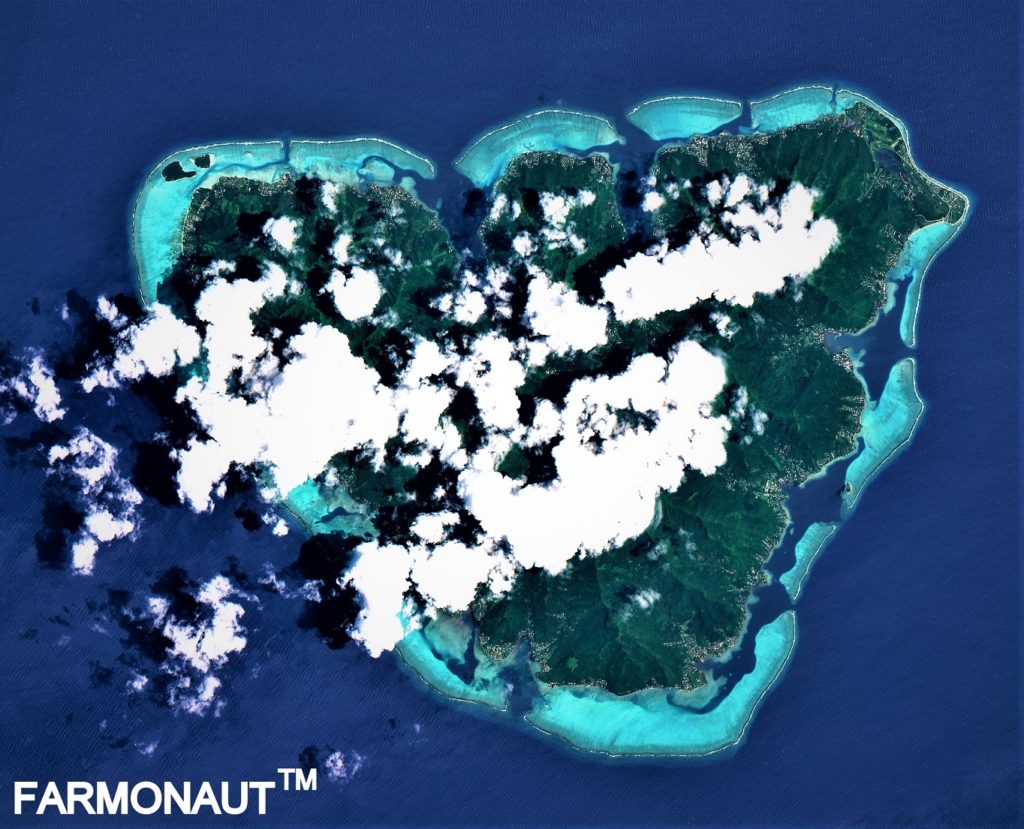

The Role of Farmonaut in Modern Agriculture

While our focus has been on technology sector stocks, it’s worth noting the growing intersection between technology and agriculture. Companies like Farmonaut are leveraging advanced technologies to revolutionize farming practices. Farmonaut’s platform offers satellite-based farm management solutions, demonstrating how tech innovation extends beyond traditional IT companies.

Key features of Farmonaut’s technology include:

- Real-time crop health monitoring using satellite imagery

- AI-driven advisory systems for optimized farm management

- Blockchain-based traceability solutions for supply chain transparency

- Resource management tools for improved efficiency

For investors interested in the intersection of technology and agriculture, companies like Farmonaut represent an intriguing area to watch. The application of cutting-edge technology to address global challenges in food production and sustainability could present significant investment opportunities in the coming years.

Conclusion: Navigating the Evolving Investment Landscape

As we’ve seen through our analysis of Q4 stock market trends and institutional investor movements, the investment landscape is constantly evolving. Key takeaways include:

- The importance of monitoring institutional investor activities and SEC filings

- The need for a balanced approach that considers both technical indicators and fundamental analysis

- The growing influence of technology across various sectors, including agriculture

- The potential for significant market shifts driven by institutional investor decisions

By staying informed, diversifying portfolios, and adapting to changing market dynamics, investors can position themselves to capitalize on emerging opportunities while managing risk effectively.

FAQ Section

Q: How often do institutional investors report their holdings?

A: Institutional investors with over $100 million in assets under management are required to file Form 13F with the SEC quarterly, disclosing their equity holdings.

Q: What is the significance of insider trading activity?

A: Insider trading activity can provide insights into management’s confidence in the company’s prospects. However, it’s important to consider the context and reasons behind these trades.

Q: How can retail investors use institutional investor data in their decision-making?

A: Retail investors can use institutional investor data as one of many inputs in their analysis. It’s important to understand the reasons behind institutional moves and not simply follow them blindly.

Q: What are some key factors driving institutional investor decisions in the tech sector?

A: Key factors include technological innovation, market trends, regulatory environment, company financials, and broader economic conditions.

Q: How do analyst recommendations impact stock prices?

A: Analyst recommendations can significantly impact stock prices in the short term. However, long-term performance is more closely tied to a company’s fundamental strength and market position.

As we conclude our analysis, it’s clear that staying informed about institutional investor movements and market trends is crucial for making sound investment decisions. By leveraging tools and insights from various sources, including innovative platforms like Farmonaut in the agritech space, investors can navigate the complex financial landscape more effectively.

For those interested in exploring how technology is transforming agriculture, consider checking out Farmonaut’s offerings:

For developers interested in integrating agricultural data into their applications, Farmonaut also offers an API with comprehensive documentation.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!