Urea Price Trends 2024: Key Global Market Forces Explained

Introduction: The Role of Urea in Modern Agriculture

Urea, a nitrogen-rich compound, stands as a bedrock of modern agriculture. As a fertilizer, urea’s unparalleled affordability and high nitrogen content have made it the most widely used nitrogen fertilizer globally, enhancing soil fertility and boosting crop yields. However, beneath its widespread use lie complex market dynamics, intricately shaping urea fertilizer prices and availability for farmers around the world.

In 2024, the global urea market faces a convergence of factors affecting urea prices—from natural gas cost volatility and geopolitical events like the Russia-Ukraine conflict, to the relentless push for sustainable fertilizer alternatives and rapid technological advancements in fertilizers. As stakeholders in agriculture, farming, and forestry, it is essential for us to grasp these influences to make informed decisions, improve productivity, and mitigate risk.

In this comprehensive analysis, we’ll explore the latest urea market trends 2024, dissect the interplay of supply, demand, and regulation, and examine how leading-edge platforms like Farmonaut are helping farmers and agribusinesses optimize nitrogen fertilizer demand and sustainability.

Global Urea Market: 2024 Overview & Highlights

- Urea’s role: Critical input for major staple crops including wheat, rice, and maize.

- Market size: The global urea market size continues to grow, fueled by population upticks and ongoing food security initiatives. In 2024, sharp price increases reflected underlying supply constraints and energy issues.

- Key factor: Natural gas accounts for up to 90% of urea production costs, making prices vulnerable to energy market shocks.

- Regional influence: Asia-Pacific, especially India and China, remains the world’s largest consumer hub, while Russia, Middle East, Europe, and the United States play vital roles as producers and exporters.

Let’s unravel the forces shaping urea fertilizer prices and examine why 2024 stands as a pivotal year in urea’s market evolution.

Raw Material Costs and Urea Production Factors

Why Natural Gas Prices Determine Urea Cost

The route from raw material to a marketable bag of granular urea is energy-intensive. Nearly 70–90% of urea production costs directly stem from natural gas. This fossil fuel acts as both a chemical feedstock (providing hydrogen in ammonia synthesis) and a fuel for the high-temperature reactions in the fertilizer production process.

- When natural gas prices rise sharply—as they did during the 2022 energy crisis—urea production costs escalate almost immediately.

- In 2022, European natural gas spot prices soared to $70 per MMBtu, forcing several plants in the region to idle or halt production altogether.

- This drove an 18% reduction in European supply, leading to increased import volumes from lower-cost regions, particularly Russia and North Africa.

The chart below reveals the intrinsic link between raw material volatility and fertilizer pricing—a dynamic likely to persist as energy markets remain turbulent in 2024.

Key Takeaways on Raw Materials

- Natural gas cost shocks = immediate urea price fluctuations (direct and significant effect)

- Production shutdowns in high-cost regions drive global supply/demand imbalances

- Import dependency rises for affected countries, putting additional stress on logistics and local pricing

Access the Farmonaut Satellite & Weather API • API Developer Docs

Impact of Geopolitical Events on Fertilizer Supply and Prices

Few factors shake the global urea market like geopolitical turbulence. The conflict between Russia and Ukraine in 2022 dramatically disrupted global nitrogen fertilizer supply chains. As one of the world’s largest urea exporters, Russia faced sanctions and trade restrictions, causing worldwide supply shortages and acute price volatility.

Quick Facts: How Geopolitical Events Shape the Urea Market

- In 2022–2024, production cutbacks in regions like Trinidad and Egypt further constrained the market.

- By late 2024, ammonia and urea benchmark prices rose sharply, boosting profits for producers in unaffected regions (e.g., North America, Middle East).

- Despite ongoing trade restrictions, Russian urea exports increased by 5% in 2024, as countries like the United States and Brazil continued purchasing Russian fertilizer to stabilize local supply.

- These events also highlight the importance of trade routes, export bans, and logistics bottlenecks in distorting local and international urea prices.

Key takeaway: As long as global agriculture depends so heavily on nitrogen fertilizers, the market will remain sensitive to trade policy, war, sanctions, and other macro-level disruptions.

Environmental Regulations and the Growing Push for Sustainability

Concerns about the environmental impact of urea—especially nitrogen runoff, water contamination, and greenhouse gas emissions—are driving rapid regulatory change.

Latest Environmental Initiatives

- Governments are placing stricter regulations on urea use, particularly near water bodies or sensitive ecosystems.

- There’s increasing momentum behind sustainable fertilizer alternatives (e.g., slow-release/controlled-release fertilizers, organic amendments, precision dosing).

- Major agricultural regions (EU, North America, Australia) are introducing policies to cap nitrogen emissions or tax excessive fertilizer use.

- New labeling, tracking, and data requirements are being introduced for fertilizer producers and distributors for traceability and compliance.

How Farmonaut Supports Sustainability Goals

With Carbon Footprinting tools, Farmonaut enables agribusinesses and farmers to track the environmental impact of their fertilizer use and overall operations—empowering them to meet market and regulatory demands for accountability and eco-friendly practices.

Technological Advancements in Fertilizers and Urea Application

New technological advancements in fertilizers are reshaping the landscape of nitrogen application and efficiency. Science-backed solutions are making it possible for farmers worldwide to increase yields while reducing negative environmental impact of urea.

-

Slow-release and Controlled-release Urea Products:

- Such products release nitrogen over an extended period, improving nutrient uptake and minimizing runoff and volatilization.

- Innovations like ICL Group’s eqo.x coating (launched in 2022) have proven to boost nitrogen use efficiency by up to 80%.

-

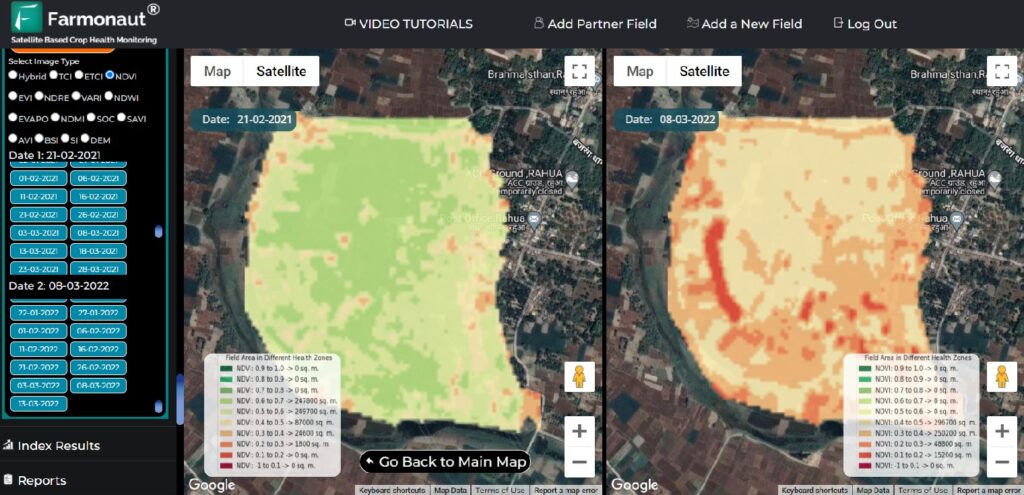

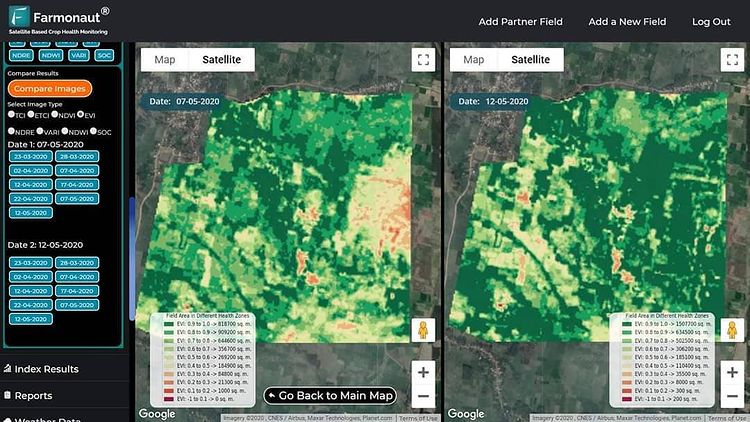

Digital and Satellite Farming Platforms:

- Tools like Farmonaut Large Scale Farm Management use satellite data and AI-driven analytics to guide precise, data-backed fertilizer applications.

- Farmers can monitor field-level nitrogen status, optimize application timing and dosage, and cut waste using predictive algorithms.

-

Blockchain Traceability Systems:

- Blockchain-based product traceability provides end-to-end visibility, helping corporations and regulators verify sustainable fertilizer sourcing and usage, and supports transparent, low-risk supply chains in food, textile, and agricultural export sectors.

Year-over-Year Urea Price and Market Forces Analysis Table

| Year | Estimated Urea Price (USD/tonne) | Major Supply Factors | Major Demand Factors | Key Sustainability Initiatives |

|---|---|---|---|---|

| 2021 | $250 | Stable gas prices; typical global production; moderate trade flows | Typical crop cycles; steady population growth | Initial adoption of controlled-release urea in select markets |

| 2022 | $550 | European energy crisis; high natural gas prices; shutdowns of plants; increased Middle East/Russian exports | Rebound in food demand post-pandemic; defensive buying by nations | Rise in regulation targeting nitrate pollution; more slow-release urea options |

| 2023 | $400 | Partial recovery in European supply; increased Russian/Middle Eastern exports | Steady, strong nitrogen fertilizer demand in Asia-Pacific; major crop seasons | Precision agriculture tools deployed, digital traceability pilots, ESG-focused labeling in the EU |

| 2024 | $520 | Scenario includes Russian export growth, sustained high gas costs, and transport bottlenecks | Population-driven demand increase (+2.5%); supply chain risks boost inventory | Expanded adoption of controlled-release urea, broader use of digital monitoring and carbon tracking |

Global Urea Market Demand and Agricultural Practices

The relentless quest to secure global food supplies makes nitrogen fertilizer demand both stable and ever-increasing. According to the United Nations, the global population is expected to reach nearly 9.7 billion by 2050, profoundly shaping fertilizer market trends.

- Urea remains the go-to solution for farmers due to its high nitrogen content (46% by weight), cost-effectiveness, and ease of application.

- Global agricultural practices favor urea for staple crops, with particularly heavy use in emerging Asian economies, ensuring that demand remains robust.

- Developing regions are unlikely to reduce fertilizer use soon, given food security needs. However, precision in application is increasingly emphasized to curb environmental externalities.

Platforms like Farmonaut allow for nuanced, data-driven application, helping farmers maximize crop performance with less environmental risk.

Regional Dynamics: Focus on India, China, Russia, and Other Key Players

Asia-Pacific: The World’s Fertilizer Engine

- India and China—the two most populous countries—are the largest urea consumers globally.

- India’s government offers substantial urea subsidies, ensuring affordability for farmers and stabilizing domestic fertilizer markets.

- Subsidies impact global prices by anchoring high demand even amid worldwide price shocks.

- Chinese fertilizer output responds quickly to market price signals, often leading to export surges or restrictions that affect global supply and pricing.

Russia: Dynamic Producer and Exporter

- Russia is among the largest urea exporters globally, with its fertilizer sector expanding annual capacity in 2024 by 5%.

- Even amid sanctions, Russia continues to exert strong supply-side influence on global markets, with buyers in the United States, Brazil, and Africa.

- Sanctions and conflict can distort trade flows, causing opportunities for spot market purchases and wild pricing.

Europe and the Middle East

- Europe’s high gas prices have depressed local urea production, boosting imports from the Middle East, Russia, and North Africa.

- Middle Eastern nations (notably Saudi Arabia, Qatar, and Iran) leverage low-cost feedstocks and capture market share in global exports.

United States and Brazil

- The USA, as both an importer and producer, adapts to market shocks using flexible sourcing strategies.

- Brazil’s growing demand is centered around its major crop regions and is fulfilled by diversified imports, including from Russia.

See how Farmonaut’s advanced advisory systems help large growers maximize yield and gain a sustainable edge.

Impact of Urea Price Fluctuations on Farmers and Food Security

The price of urea isn’t just an abstract market metric—it lands squarely on the bottom lines of farmers worldwide, shaping every aspect of agricultural practice.

- Rising urea costs increase cultivation expenses, squeeze profit margins, and may force farmers to reduce fertilizer application rates, jeopardizing crop yields and household food security.

- Falling prices can have a double-edged effect: boosting short-term yields but, when unrestrained, contributing to environmental concerns like soil degradation and nitrogen runoff.

- Access to data—via precision agriculture platforms like Farmonaut—is vital for farmers to make adaptive, cost-effective decisions that balance yield, profit, and ecological responsibility.

Farmonaut Crop Loan & Insurance supports financial institutions and farmers with satellite-verified crop health data for transparent, fraud-resistant lending.

The Future of the Urea Market: Outlook and Opportunities

Looking ahead, the urea market will be shaped by a dynamic intersection of multiple forces:

- Technological Progress:

- More advanced controlled-release and coated products that enhance fertilizer efficiency; AI-driven nutrient recommendations; and digital farm management will become the standard.

- Ongoing development of sustainable alternatives—biofertilizers, slow-release technologies, precise dosing, and integrated soil health management.

- Environment & Regulation:

- Expect tighter controls, especially in developed nations, with greater focus on sustainability reporting, carbon tax schemes, and water protection.

- Farmers who adapt to these requirements could gain access to “green” markets and subsidies.

- Geopolitical Volatility:

- War, sanctions, and trade disputes will continue to produce unexpected supply shocks and price swings.

- Resilient supply chains—diversified sourcing, digitization, and local production—are essential competitive advantages for producers, traders, and national governments.

- Demand Trends:

- Global nitrogen fertilizer demand will rise in line with population growth and changing diets, particularly in Asia, Africa, and South America.

- Precision application will play a vital role in closing the “yield gap” sustainably.

Sustainable, precisely-managed agriculture is becoming not just ideal—but indispensable. Farmonaut is leading the charge by providing large-scale management tools, blockchain-enabled traceability solutions, and real-time carbon footprint monitoring—empowering farmers and agribusinesses to meet this future head-on.

How Farmonaut Empowers Precision Agriculture & Sustainability

At Farmonaut, our mission is to make precision agriculture affordable and accessible to farmers globally. We believe in harnessing the power of innovative technology and data to optimize resource use, reduce fertilizer costs, and minimize environmental risks.

- Satellite-Based Crop Health Monitoring:

Using multispectral imagery, Farmonaut delivers real-time analysis of crop health, soil moisture, and more—enabling farmers to reduce fertilizer overuse and improve nutrient usage efficiency for higher yields and lower cost. - AI-Driven Advisory:

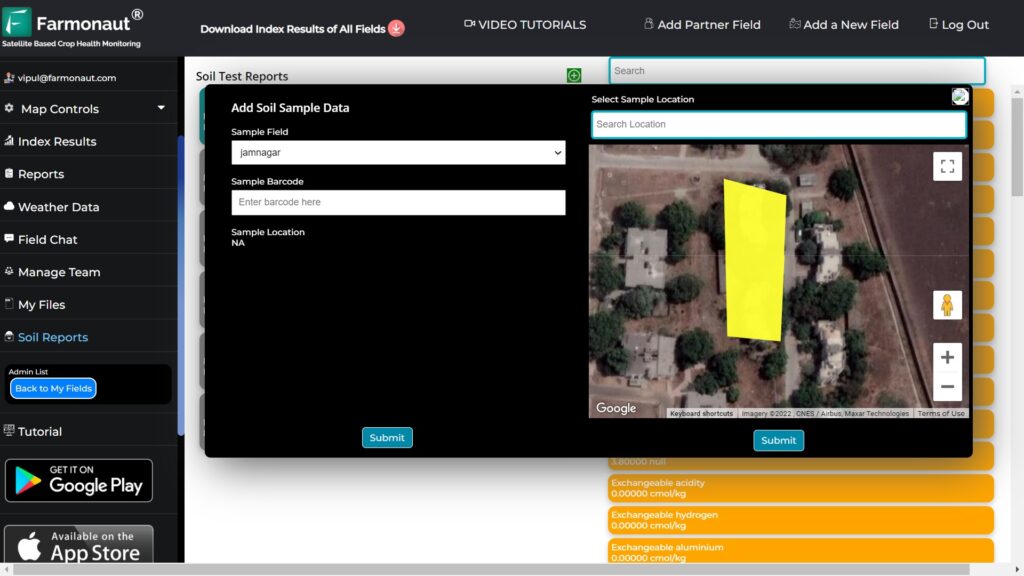

Our Jeevn AI personalizes recommendations based on farm-specific data, guiding decisions on optimal urea fertilizer application and irrigation for every field. - Blockchain Product Traceability:

Complete batch-to-farm traceability for supply chain transparency and regulatory compliance, reducing risk for food companies and exporters. - Fleet and Resource Management:

Efficiency tools for agro-logistics and input transport, saving fuel, time, and money for large agribusinesses. - Carbon Footprinting:

Track, analyze, and cut the carbon impact of fertilizer use and ag operations—critical for sustainability standards and regulatory reporting.

All Farmonaut services are available on Android, iOS, and web apps, as well as through a robust API for developers and enterprises.

FAQ: Urea, Fertilizer Markets & Modern Agriculture

What is urea and why is it so widely used?

Urea is a synthetic nitrogen compound widely employed as a fertilizer due to its high nitrogen content and lower cost per unit of nutrient delivered. Its quick solubility makes it effective for delivering nitrogen directly to plants, which is key for improving soil fertility and boosting crop yields.

Which factors most affect global urea prices?

- Natural gas prices (urea’s primary feedstock and energy source)

- Geopolitical events (e.g., trade sanctions, wars, and export restrictions)

- Environmental regulations targeting fertilizer use and emissions

- Technological advancements improving nitrogen efficiency or reducing production costs

- Regional subsidies and demand patterns (especially in countries like India and China)

How do environmental regulations impact the urea market?

Strict regulations aim to reduce nitrogen runoff into waterways and lower greenhouse gas emissions from fertilizer overuse. This can limit urea application rates, increase demand for slow-release products, and motivate farmers to use technology and data analytics (such as remote sensing) for more precise fertilization.

What are the most promising sustainable fertilizer alternatives?

Examples include controlled-release urea, enhanced efficiency fertilizers, organic nitrogen amendments, biologicals, and digital tools for “as-needed” fertilizer application. These can help reduce the environmental footprint while preserving high crop yields.

How does Farmonaut help farmers and stakeholders adapt to market volatility?

Farmonaut empowers users with real-time crop health monitoring, AI-led fertilizer and irrigation guidance, blockchain traceability, resource management tools, and carbon footprinting. Our solutions reduce risk, boost productivity, and make regulatory compliance easier—for everyone from smallholders to global agribusinesses.

Summary: Navigating Urea Price Trends and Market Complexity in 2024

The urea market in 2024 sits at the nexus of raw material volatility, energy price shocks, geopolitical disruption, environmental regulations, and rapid technology adoption. As we’ve explored, understanding these factors affecting urea prices is critical for farmers, agribusinesses, and all stakeholders whose operations and profitability depend on nitrogen fertilizer availability and affordability.

Solutions like Farmonaut are transforming the landscape—bringing data-driven decision-making, precision application, and sustainability tracking to the hands of every stakeholder. While we cannot control gas prices or world events, we can equip ourselves with knowledge and powerful tools to make smarter, more sustainable choices.