Global Energy Market Shifts: Winter Challenges and Trade Uncertainties Impact US, Canada, and European Commodity Flows

“European Commission’s gas storage target faces pressure, with LNG export terminal outages impacting storage levels across the continent.”

In the ever-evolving landscape of global energy markets, we find ourselves at a critical juncture where winter challenges and trade uncertainties are reshaping commodity flows across the United States, Canada, and Europe. As we delve into this complex web of factors, it’s crucial to understand how these shifts are impacting various sectors and what they mean for the future of energy and agriculture.

The Shifting Sands of Oil Market Trends

The oil market has been experiencing significant turbulence in recent months, with global energy prices fluctuating in response to a myriad of factors. One of the most prominent drivers of this volatility has been the geopolitical tensions surrounding trade policies and potential tariffs.

As of yesterday, we witnessed Brent crude oil prices dipping below the $80 per barrel mark, a move largely attributed to renewed threats from the US administration. President Trump has signaled intentions to impose a 25% tariff on imports from both Canada and Mexico, with a projected implementation date of February 1. This potential trade tariff impact has sent shockwaves through the market, causing traders and analysts to reassess their positions.

But the impact doesn’t stop there. The US administration has also hinted at a 10% tariff on China, citing concerns over the shipment of narcotics like fentanyl into the country. This multifaceted approach to trade policy has created a complex environment for oil market dynamics, with potential reverberations across global supply chains.

Winter Energy Concerns: Europe’s Natural Gas Conundrum

While oil markets grapple with trade uncertainties, Europe faces its own set of challenges, particularly in the natural gas sector. The European natural gas market has seen a significant surge, with the TTF index rising over 4.5% and exceeding EUR50/MWh—the highest level since early 2025. This spike is not without cause; it’s directly linked to an outage at the Freeport LNG export terminal in the United States.

The Freeport terminal, with its capacity of slightly above 20 billion cubic meters, has been grappling with power supply issues amid extremely cold weather conditions. This shutdown is particularly critical as Europe faces a pressing need for liquefied natural gas (LNG) this winter. The ongoing loss of Russian pipeline gas flows through Ukraine, coupled with increased demand, has resulted in European gas storage levels falling to a concerning 59%.

The European Commission’s Storage Target Under Pressure

Meeting the goal set by the European Commission to maintain gas storage above 50% by February 1 is becoming increasingly challenging. This target, crucial for ensuring energy security across the EU, is now under significant pressure due to the combination of LNG export terminal outages and increased winter demand.

In response to these winter energy concerns, discussions are emerging in Germany regarding potential subsidies for refilling gas storage in anticipation of the 2025/26 winter. This forward-looking strategy underscores the growing concern within the EU regarding gas supply stability and highlights the need for proactive measures to address energy market uncertainties.

Commodity Market Geopolitics: A Global Perspective

The interplay between energy prices, trade policies, and geopolitical tensions is creating a complex landscape for commodity markets worldwide. As countries grapple with balancing import strategies, export capacities, and domestic demands, we’re seeing a ripple effect across various sectors.

In the metals complex, for instance, the potential for trade retaliation and shifting flows of resources is causing market participants to reassess their strategies. The uncertainty surrounding US trade policies with Canada, Mexico, and China is not only affecting oil and gas markets but also impacting the broader commodity landscape.

Agricultural Output Forecasts: Climate Factors and Market Dynamics

The agricultural sector is not immune to these global shifts. Recent adjustments to coffee output estimates by CONAB highlight the impact of climate-related factors on crop production. This serves as a reminder of the intricate connections between energy markets, climate conditions, and agricultural outputs.

“Climate-related factors are prompting revisions in global coffee production forecasts, affecting agricultural commodity markets and trade flows.”

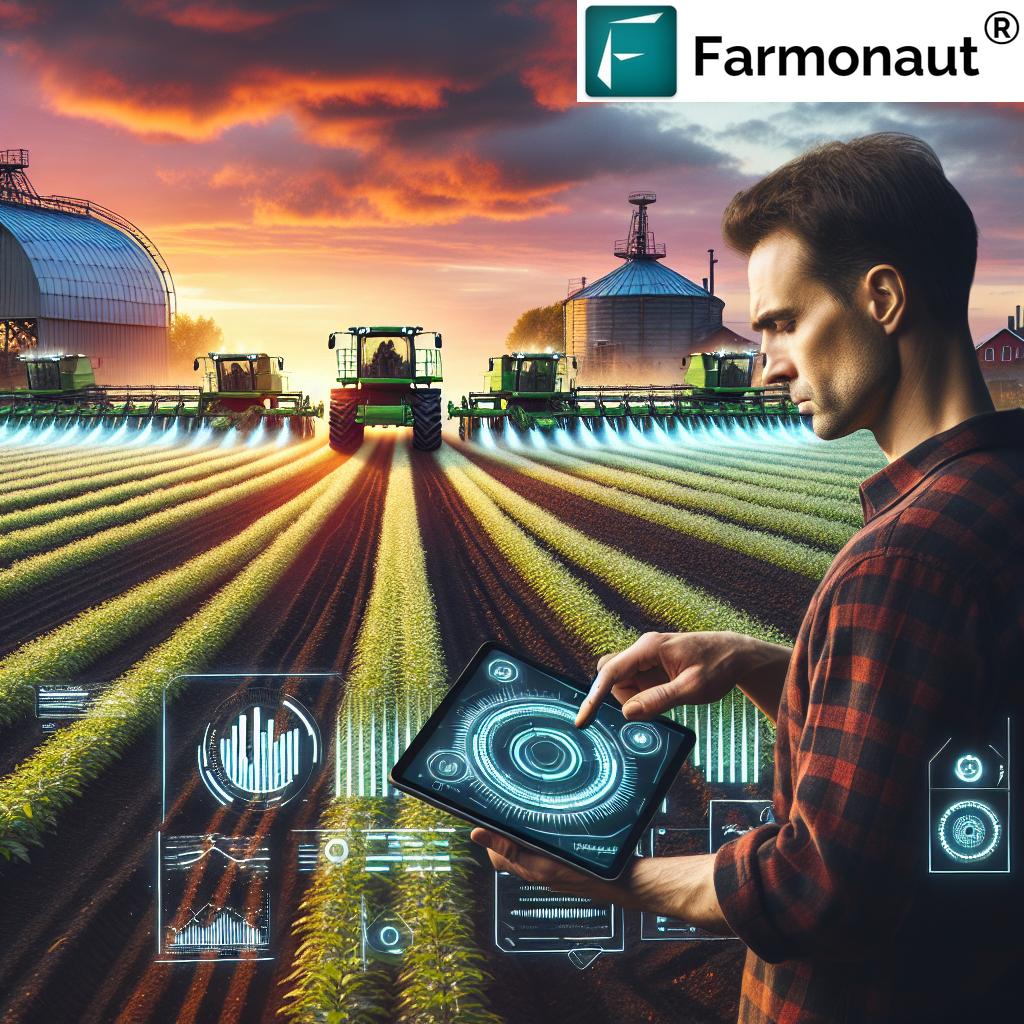

As we navigate these complex market conditions, tools like Farmonaut’s satellite-based crop monitoring can provide valuable insights for agricultural stakeholders. By leveraging advanced technology, farmers and agribusinesses can make more informed decisions in the face of market uncertainties and changing climate patterns.

Trade Tariff Impacts: Reshaping Global Energy Flows

The potential implementation of trade tariffs by the US on imports from Canada, Mexico, and China is poised to have far-reaching consequences on global energy flows. These policy shifts could lead to significant changes in how oil and other energy resources are traded and transported across borders.

- Impact on US-Canada Energy Relations: The proposed 25% tariff on Canadian imports could disrupt the well-established energy trade between the two countries, potentially leading to shifts in pipeline utilization and refinery operations.

- Mexico’s Energy Sector: Similar tariffs on Mexican imports may affect the flow of refined products and crude oil between the US and Mexico, potentially altering regional energy dynamics.

- China and Global Oil Markets: A 10% tariff on Chinese imports could have broader implications for global oil demand and trade patterns, given China’s significant role as an energy consumer.

These potential trade tariff impacts underscore the need for countries and companies to develop flexible strategies that can adapt to rapidly changing market conditions.

Natural Gas Supply in Europe: Challenges and Strategies

The natural gas supply situation in Europe remains a critical concern, especially as the region heads into the winter months. The outage at the Freeport LNG export terminal in the US has exposed the vulnerability of Europe’s energy supply chain and highlighted the importance of diversifying sources.

LNG Export Terminal Outages: A Wake-Up Call

The recent issues at the Freeport terminal serve as a stark reminder of the risks associated with relying heavily on specific LNG export facilities. This event has prompted European policymakers and energy companies to reassess their strategies for ensuring a stable natural gas supply.

- Diversification of LNG Sources: European countries are now looking to expand their portfolio of LNG suppliers to reduce dependency on any single source or facility.

- Infrastructure Investment: There’s a growing push for investment in LNG import terminals and storage facilities across Europe to enhance the region’s ability to receive and distribute natural gas.

- Long-term Contracts: Some European buyers are considering longer-term LNG purchase agreements to secure more stable supply arrangements.

As Europe grapples with these challenges, the role of advanced monitoring and forecasting tools becomes increasingly important. Farmonaut’s satellite-based technology, while primarily focused on agriculture, demonstrates the kind of innovative approaches that could be applied to energy resource management and planning.

Explore Farmonaut’s API for advanced data insights

European Gas Storage Levels: A Race Against Time

The current state of European gas storage levels is a cause for concern as we approach the peak winter demand period. With levels hovering around 59%, there’s a real risk of falling short of the European Commission’s target of maintaining storage above 50% by February 1.

Strategies for Boosting Storage Levels

To address this critical situation, several strategies are being considered:

- Increased LNG Imports: Despite the challenges posed by terminal outages, Europe is ramping up efforts to secure additional LNG cargoes.

- Demand Reduction Measures: Governments and businesses are implementing energy-saving initiatives to reduce overall gas consumption.

- Alternative Energy Sources: There’s a renewed focus on accelerating the adoption of renewable energy sources to reduce reliance on natural gas.

The situation underscores the importance of robust energy policies and the need for innovative solutions in managing resources. While Farmonaut’s expertise lies in agricultural monitoring, the principles of data-driven decision-making and resource optimization are equally applicable to the energy sector.

Check out Farmonaut’s API Developer Docs for integration possibilities

Winter Energy Concerns: Preparing for the Worst, Hoping for the Best

As winter approaches, the energy concerns in Europe are becoming increasingly acute. The combination of reduced gas flows from Russia, LNG supply disruptions, and potentially harsh weather conditions could create a perfect storm for energy markets.

Potential Scenarios and Preparedness Measures

- Worst-Case Scenario Planning: Energy companies and governments are developing contingency plans for severe supply shortages.

- Industrial Demand Management: Agreements with large industrial consumers to reduce gas usage during peak demand periods are being put in place.

- Consumer Awareness Campaigns: Efforts to educate the public about energy conservation are being intensified.

These winter energy concerns highlight the need for robust forecasting and monitoring systems across the energy sector. While Farmonaut’s focus is on agricultural monitoring, the principles of using satellite data and AI for predictive analysis could potentially be applied to energy demand forecasting and resource management.

Commodity Market Geopolitics: A Delicate Balance

The current state of commodity markets is intricately linked to geopolitical dynamics. From oil and gas to metals and agricultural products, the flow of commodities is being shaped by a complex web of international relations and policy decisions.

Key Geopolitical Factors Influencing Commodity Markets

- US-China Relations: The ongoing tensions between these two economic powerhouses continue to impact global trade patterns.

- Russian Energy Policies: Russia’s decisions regarding gas exports to Europe remain a critical factor in energy market dynamics.

- Middle East Stability: Developments in oil-producing countries in the Middle East can have significant effects on global oil prices.

Understanding these geopolitical factors is crucial for stakeholders across various industries, including agriculture. Farmonaut’s satellite-based monitoring tools can provide valuable insights into how these global trends might impact local agricultural production and market conditions.

Agricultural Output Forecasts: Navigating Uncertainty

The agricultural sector is facing its own set of challenges amidst these global market shifts. Recent adjustments to coffee output estimates by CONAB serve as a prime example of how climate-related factors and market dynamics can impact agricultural production forecasts.

Factors Influencing Agricultural Forecasts

- Climate Variability: Changing weather patterns are affecting crop yields and production timelines.

- Market Demand Shifts: Global economic conditions and changing consumer preferences are influencing crop choices and production volumes.

- Trade Policies: The potential implementation of tariffs can significantly impact agricultural trade flows and market access.

In this context, tools like Farmonaut’s satellite-based crop monitoring system become invaluable. By providing real-time data on crop health and growth patterns, Farmonaut empowers farmers and agricultural businesses to make more informed decisions in the face of market uncertainties.

Energy Market Uncertainties: Strategies for Resilience

As we navigate through these turbulent times in the energy markets, it’s crucial for stakeholders to develop strategies that can withstand the current uncertainties and prepare for future challenges.

Key Approaches for Managing Energy Market Risks

- Diversification of Energy Sources: Countries and companies are increasingly looking to diversify their energy portfolios to reduce dependence on any single source or supplier.

- Investment in Infrastructure: Enhancing storage capabilities and improving distribution networks can help buffer against supply disruptions.

- Adoption of Advanced Technologies: Leveraging AI, satellite data, and predictive analytics can improve forecasting and decision-making in energy markets.

- Policy Flexibility: Governments need to develop adaptable energy policies that can respond quickly to changing market conditions.

While Farmonaut’s primary focus is on agricultural monitoring, the principles of data-driven decision-making and resource optimization that we employ are equally relevant to the energy sector. Our satellite-based monitoring technology demonstrates the potential for innovative solutions in resource management across various industries.

Global Energy Prices: A Multifaceted Perspective

The current state of global energy prices reflects a complex interplay of supply and demand factors, geopolitical tensions, and market sentiment. Understanding these dynamics is crucial for businesses and policymakers alike.

Key Factors Influencing Global Energy Prices

- Supply Constraints: Issues such as the Freeport LNG terminal outage and reduced Russian gas flows are putting upward pressure on prices.

- Demand Fluctuations: Economic recovery patterns and seasonal variations continue to impact energy demand globally.

- Policy Decisions: Potential trade tariffs and energy policies in major economies can significantly sway market sentiment.

- Technological Advancements: Innovations in renewable energy and energy efficiency are gradually reshaping the global energy landscape.

As we navigate these complex market conditions, the importance of data-driven insights becomes ever more apparent. While Farmonaut’s expertise lies in agricultural monitoring, the principles of using satellite data and AI for predictive analysis could potentially be applied to energy market forecasting and risk assessment.

The Interconnected Nature of Global Markets

As we’ve explored throughout this analysis, the global energy market is intricately connected to various other sectors, including agriculture, manufacturing, and transportation. These interconnections mean that shifts in one area can have far-reaching consequences across the entire economic landscape.

Key Takeaways

- Trade Policies Matter: The potential implementation of tariffs by the US could reshape global energy flows and impact commodity markets worldwide.

- Winter Challenges: Europe’s natural gas supply situation remains precarious, highlighting the need for diversified energy sources and robust storage strategies.

- Agricultural Impacts: Climate-related factors and market dynamics are influencing agricultural output forecasts, emphasizing the importance of adaptive farming practices.

- Technological Solutions: Advanced monitoring and forecasting tools, like those offered by Farmonaut for agriculture, demonstrate the potential for data-driven decision-making across sectors.

As we move forward, it’s clear that adaptability and informed decision-making will be key to navigating the complex landscape of global energy and commodity markets. While challenges abound, so do opportunities for innovation and strategic planning.

Global Energy Market Trends Comparison

| Region | Natural Gas Storage Levels (% of capacity) | LNG Export Capacity (estimated million cubic meters/day) | Winter Energy Concern Level | Potential Trade Tariffs Impact |

|---|---|---|---|---|

| US | 72% | 380 | Medium | High |

| Canada | 68% | 40 | Medium | High |

| Europe | 59% | 15 | High | Medium |

| Global Average/Total | 66% | 435 | High | High |

This table provides a concise overview of the current global energy market trends, highlighting the regional differences and overall market dynamics. It’s clear that Europe faces the highest winter energy concern level, while the US and Canada are grappling with potentially high impacts from trade tariffs. The global averages underscore the widespread nature of these challenges and the need for coordinated international responses.

Looking Ahead: Navigating Future Challenges

As we look to the future, it’s clear that the global energy landscape will continue to evolve, presenting both challenges and opportunities. Stakeholders across industries must remain vigilant and adaptable to navigate these complex market conditions successfully.

Key Areas to Watch

- Policy Developments: Keep a close eye on trade policies, particularly those involving the US, Canada, Mexico, and China.

- Technological Advancements: Innovations in energy production, storage, and distribution could reshape market dynamics.

- Climate Change Impacts: Ongoing climate shifts will continue to influence both energy demand and agricultural production.

- Geopolitical Shifts: Changes in international relations could significantly impact global energy flows and commodity markets.

In this context, the role of data-driven insights and advanced monitoring tools becomes increasingly crucial. While Farmonaut’s primary focus is on agricultural monitoring, the principles of using satellite data and AI for predictive analysis could potentially be applied to various aspects of energy market analysis and resource management.

FAQ Section

Q: How are trade tariffs likely to impact global energy flows?

A: Trade tariffs can significantly alter the economics of energy trade, potentially leading to shifts in export and import patterns. For instance, tariffs on Canadian or Mexican imports to the US could redirect oil flows to other markets, impacting global supply chains and prices.

Q: What are the main factors contributing to Europe’s winter energy concerns?

A: Europe’s winter energy concerns stem from a combination of factors, including reduced gas flows from Russia, LNG supply disruptions (such as the Freeport terminal outage), lower-than-ideal storage levels, and the potential for harsh winter weather conditions.

Q: How are agricultural output forecasts being affected by current market conditions?

A: Agricultural output forecasts are being influenced by several factors, including climate-related challenges, shifting trade policies, and changes in global demand patterns. Tools like Farmonaut’s satellite-based crop monitoring can help provide more accurate and timely forecasts in this uncertain environment.

Q: What role can technology play in addressing energy market uncertainties?

A: Advanced technologies, such as AI-driven predictive analytics, satellite monitoring, and blockchain for supply chain transparency, can help stakeholders make more informed decisions, optimize resource allocation, and improve overall market resilience.

Q: How might the current energy market shifts impact long-term sustainability goals?

A: While short-term challenges may create pressure to rely on traditional energy sources, the current market volatility could also accelerate the transition to renewable energy as countries and companies seek to reduce their dependence on fossil fuels and enhance energy security.

Conclusion: Embracing Adaptability in a Changing World

As we’ve explored throughout this analysis, the global energy market is undergoing significant shifts, driven by a complex interplay of factors including winter challenges, trade uncertainties, and geopolitical tensions. These changes are having far-reaching impacts across various sectors, from oil and gas to agriculture and manufacturing.

In this rapidly evolving landscape, the ability to adapt and make informed decisions based on real-time data and insights is more crucial than ever. While Farmonaut’s primary focus is on providing cutting-edge solutions for agricultural monitoring and management, the principles of data-driven decision-making and resource optimization that we champion are equally relevant to the energy sector and beyond.

As we move forward, it’s clear that stakeholders across industries will need to remain vigilant, flexible, and innovative in their approaches to navigating market uncertainties. By leveraging advanced technologies, fostering international cooperation, and prioritizing sustainable practices, we can work towards a more resilient and stable global energy future.

The challenges we face are significant, but so too are the opportunities for growth, innovation, and positive change. By staying informed, embracing new technologies, and working collaboratively, we can navigate these complex market conditions and emerge stronger on the other side.

Earn With Farmonaut

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Learn more about our affiliate program

Farmonaut Subscriptions

As we navigate these complex global energy and commodity markets, tools like Farmonaut’s satellite-based crop monitoring system can provide valuable insights for agricultural stakeholders. By leveraging advanced technology and data-driven approaches, we can work towards more resilient and sustainable practices across industries.