Global Crop Market Trends: How Weather and Tariffs Impact Corn, Wheat, and Soybean Futures in Chicago

“Argentina’s weather conditions and US corn planting estimates are key factors influencing global corn futures prices.”

Welcome to our comprehensive analysis of the global crop market trends, focusing on how weather patterns and tariff concerns are shaping the futures of corn, wheat, and soybeans in Chicago. As we delve into this complex world of agricultural commodities, we’ll explore the intricate interplay between various factors that influence crop prices and market dynamics.

Understanding the Current Landscape

The agricultural commodities market is a dynamic arena where numerous factors converge to influence prices and trading strategies. In recent weeks, we’ve observed significant movements in corn futures prices, wheat market trends, and soybean harvest forecasts. These fluctuations are primarily driven by global crop weather impacts, geopolitical tensions, and evolving commodity trading strategies.

Let’s begin by examining the current state of CBOT commodity trading and how recent events are shaping the market:

- Corn futures have experienced a sharp decline in recent sessions

- Wheat futures have stabilized after a series of declines over the past week

- Soybean prices are under pressure due to Brazil’s massive ongoing harvest

These market movements are intrinsically linked to various factors, including weather conditions, planting estimates, and international trade dynamics. As we explore these elements in detail, we’ll gain valuable insights into the agricultural futures market analysis and the strategies employed by commodity funds.

Corn Futures: A Rollercoaster Ride

The corn market has been particularly volatile in recent weeks. Let’s break down the key factors influencing corn futures prices:

Weather Conditions in Argentina

Improving crop weather in Argentina has been a significant driver of the recent downturn in corn futures. As one of the world’s largest corn exporters, favorable conditions in Argentina can lead to increased supply expectations, putting downward pressure on prices.

US Corn Planting Estimates

Expectations of increased corn acreage in the United States are also influencing market sentiment. The USDA is projected to report a rise in U.S. corn plantings, with analysts at JPMorgan estimating an increase of 2.9 million acres from last season, bringing the total to 93.5 million acres.

Speculative Investors and Long Positions

The market’s vulnerability to profit-taking has been exacerbated by the large net long positions held by commodity funds. As prices surged to an 18-month high of $5.13-3/4 per bushel last Friday, these funds have since become significant net sellers, contributing to the price decline.

Wheat Market Trends: Stabilizing After Declines

The wheat market has shown signs of stabilization after a series of declines. Here are the key factors at play:

Diminishing Frost Damage Risks

Warmer weather in the Northern Hemisphere has decreased the threat of frost damage to winter wheat crops. This improved outlook has helped to stabilize wheat futures after recent declines.

Global Supply and Demand Dynamics

While immediate supply remains ample, there are indications of a gradually tightening market. As Ole Houe from IKON Commodities in Sydney notes, “Russia will most likely have a smaller crop than last year and demand is relatively strong. There’s lots of immediate supply. But physical prices are gradually going up as the market gets tighter.”

Projected Increase in US Wheat Acreage

Analysts expect U.S. wheat area to grow by 0.6 million acres to 46.7 million acres, potentially impacting future supply levels and price trends.

“Brazil’s massive soybean harvest, estimated at over 150 million tons, is putting downward pressure on global soybean prices.”

Soybean Market: Pressure from Brazil’s Harvest

The soybean market is facing downward pressure, primarily due to Brazil’s ongoing harvest. Let’s examine the key factors:

Brazil’s Record-Breaking Harvest

Brazil’s massive soybean harvest is in full swing, with production estimates exceeding 150 million tons. This abundance of supply is putting significant pressure on global soybean prices.

US Soybean Planting Projections

In contrast to corn and wheat, US soybean plantings are expected to decrease. Analysts project a reduction of 2.7 million acres, bringing the total to 84.4 million acres.

Trade Dynamics and Export Outlook

The soybean export outlook remains uncertain, with potential tariff implementations adding complexity to the crop supply and demand outlook.

The Impact of Tariffs on Agricultural Futures

Tariff concerns are playing a significant role in shaping the agricultural futures market. Here’s how:

Potential Tariffs on Imports from Mexico and Canada

Recent statements from former President Donald Trump suggesting that levies on imports from Mexico and Canada were on track to be implemented have raised concerns about potential impacts on U.S. farm exports.

Grain Export Outlook

The uncertainty surrounding potential tariffs has added complexity to the grain export outlook. This uncertainty is influencing commodity fund trading strategies and overall market sentiment.

Long-Term Market Implications

The potential implementation of tariffs could have far-reaching effects on international trade dynamics, potentially reshaping global supply chains and altering the competitive landscape for U.S. agricultural exports.

Weather Patterns and Their Influence on Crop Markets

Weather conditions play a crucial role in shaping agricultural markets. Let’s explore how recent weather patterns are impacting various regions:

Argentina’s Improving Crop Weather

Recent rains in Argentina have improved the outlook for corn and soybean crops, contributing to the downward pressure on futures prices.

Northern Hemisphere Winter Crop Conditions

Warmer weather in the Northern Hemisphere has reduced the risk of frost damage to winter wheat crops, helping to stabilize wheat futures.

Brazil’s Favorable Conditions

Optimal weather conditions in Brazil have supported a record-breaking soybean harvest, significantly impacting global supply levels.

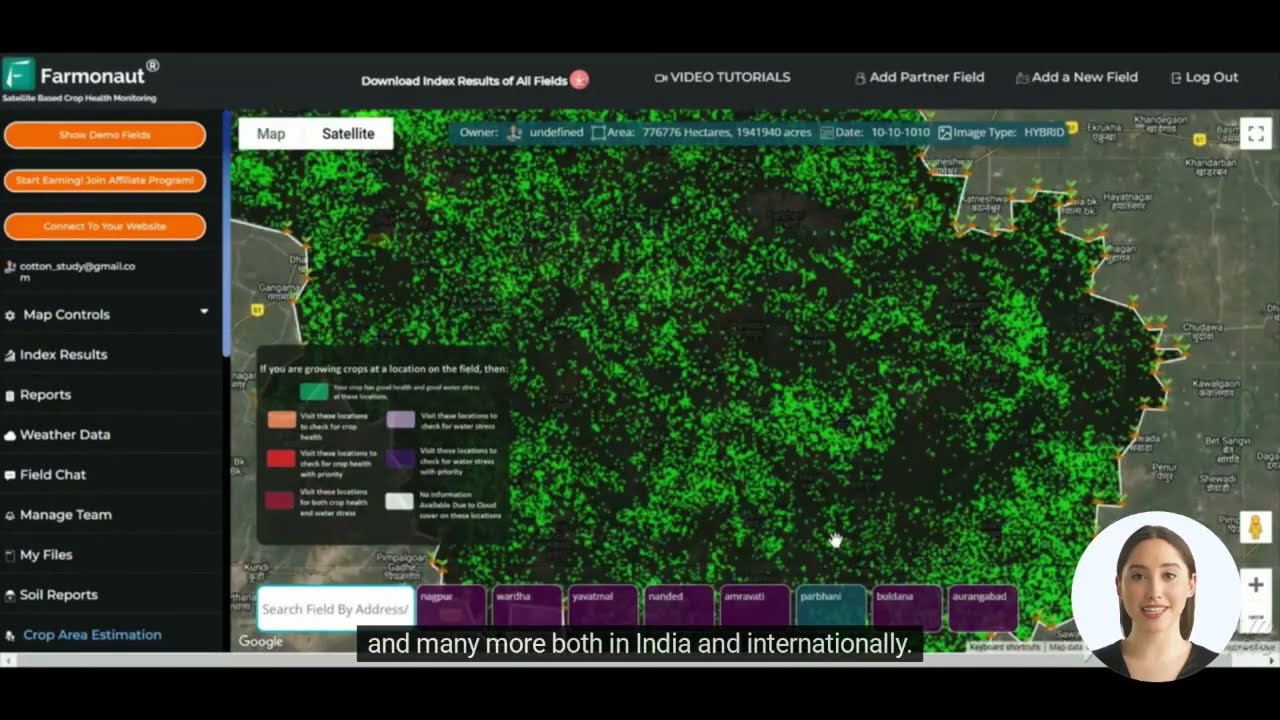

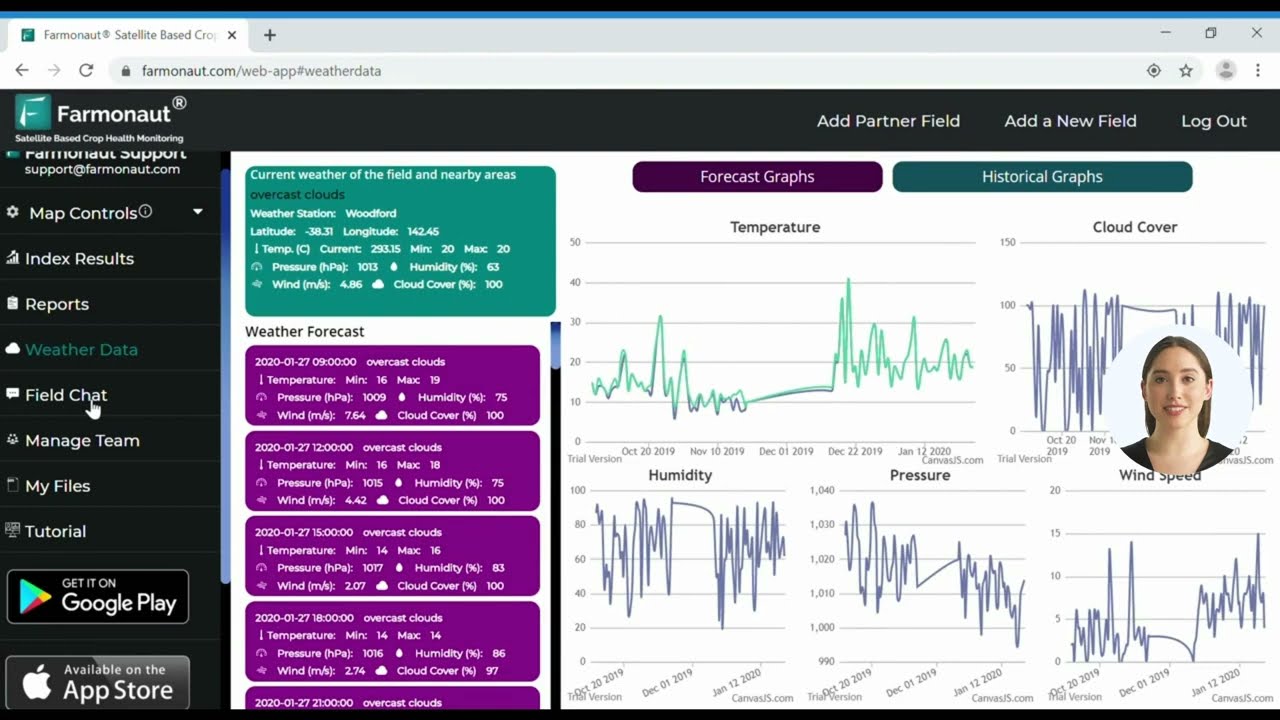

Understanding these weather patterns is crucial for investors and traders engaged in agricultural futures market analysis. Farmonaut’s satellite-based crop health monitoring can provide valuable insights into these weather impacts, helping stakeholders make informed decisions.

Commodity Fund Trading Strategies

The actions of commodity funds have a significant impact on market movements. Here’s an overview of current strategies:

Building and Unwinding Long Positions

Commodity funds had built up substantial long positions in corn futures, responding to a tightening supply outlook. However, recent market conditions have prompted these funds to unwind some of these positions, contributing to price declines.

Reacting to Weather and Planting Forecasts

Fund managers are closely monitoring weather patterns and planting estimates, adjusting their positions based on these forecasts to optimize their trading strategies.

Navigating Tariff Uncertainties

The potential implementation of tariffs has introduced new complexities for commodity fund managers, who must now factor in possible trade disruptions when formulating their strategies.

Crop Supply and Demand Outlook

The interplay between supply and demand is at the heart of agricultural commodity markets. Let’s examine the current outlook:

Corn Supply Projections

With expectations of increased U.S. corn plantings and improving conditions in Argentina, the global corn supply outlook is shifting. This could potentially lead to a more balanced market in the coming months.

Wheat Market Dynamics

While immediate wheat supply remains ample, there are indications of a gradually tightening market. Reduced production in Russia and strong global demand could support prices in the medium term.

Soybean Abundance

Brazil’s record soybean harvest is creating an abundance of supply, which is likely to keep pressure on prices in the near term. However, reduced U.S. soybean plantings could help balance the market later in the year.

For a detailed analysis of crop health and yield predictions, consider using Farmonaut’s AI-powered advisory system, which can provide valuable insights for crop management and market analysis.

Commodity Price Comparison Matrix

| Commodity | Current Price (per bushel) | 30-Day Change | 90-Day Forecast |

|---|---|---|---|

| Corn | $4.94 | -3.7% | Slight increase expected |

| Wheat | $5.87 | -2.1% | Stabilization likely |

| Soybeans | $10.45 | -1.8% | Continued pressure |

| Key Influencing Factors | Weather conditions in Argentina and Brazil, U.S. planting estimates, potential tariffs, global demand fluctuations | ||

The Role of Technology in Agricultural Markets

As the agricultural sector becomes increasingly data-driven, technology plays a crucial role in shaping market trends and decision-making processes. Here’s how innovative solutions are transforming the industry:

Satellite-Based Crop Monitoring

Advanced satellite technology, such as that employed by Farmonaut, allows for real-time monitoring of crop health and growth patterns across vast areas. This information is invaluable for predicting yields and anticipating market movements.

AI and Machine Learning in Agriculture

Artificial Intelligence and machine learning algorithms are being used to analyze complex datasets, providing insights into weather patterns, pest outbreaks, and optimal planting strategies. These technologies are helping farmers make more informed decisions, potentially impacting overall crop yields and market supply.

Blockchain in Agricultural Supply Chains

Blockchain technology is enhancing transparency and traceability in agricultural supply chains. This increased visibility can lead to more efficient markets and potentially influence commodity pricing by providing clearer information on supply and demand dynamics.

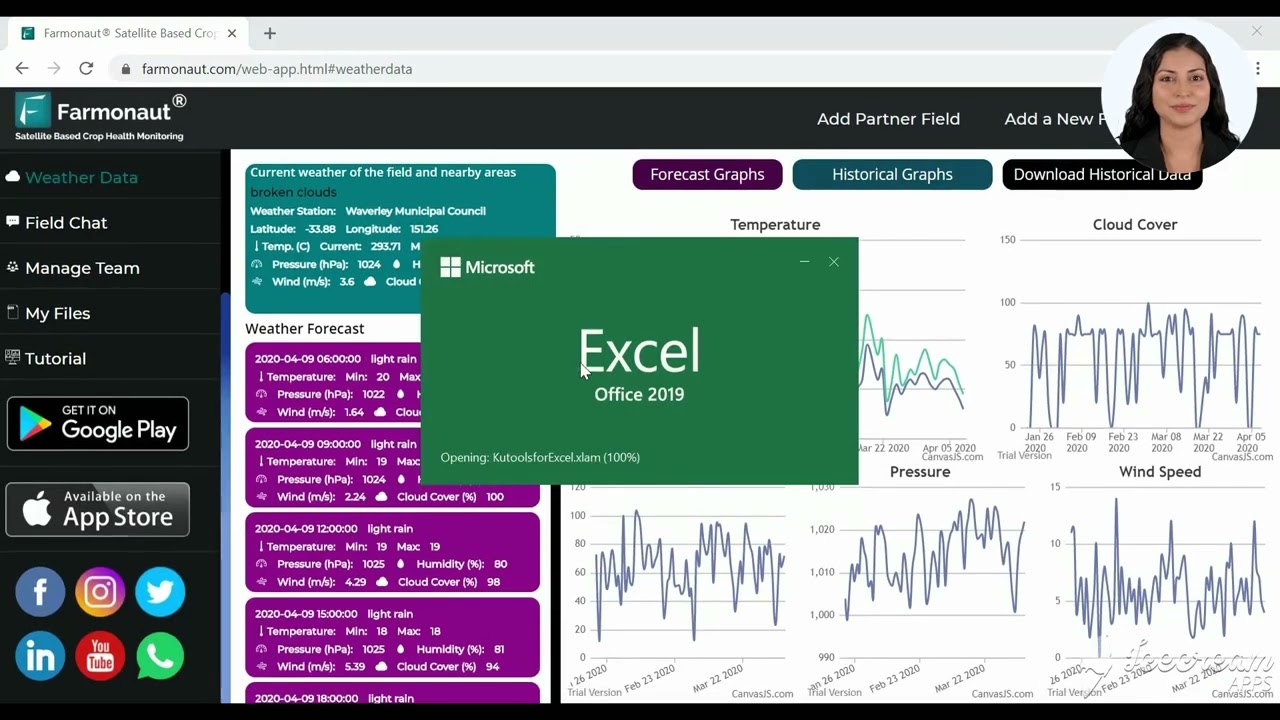

To leverage these technological advancements in your agricultural operations or market analysis, consider exploring Farmonaut’s API for integrating satellite and weather data into your systems.

Global Economic Factors Influencing Agricultural Markets

The agricultural commodities market doesn’t exist in isolation; it’s deeply interconnected with broader economic trends and global events. Let’s examine some of the key economic factors currently influencing crop markets:

Currency Exchange Rates

Fluctuations in currency exchange rates, particularly the value of the U.S. dollar, can significantly impact agricultural commodity prices. A stronger dollar typically makes U.S. exports less competitive in the global market, potentially affecting demand for crops like corn, wheat, and soybeans.

Energy Prices

The cost of energy, especially oil, has a direct impact on agricultural production and transportation costs. Higher energy prices can lead to increased production costs, potentially influencing crop prices and futures contracts.

Global Economic Growth

Overall economic growth trends, particularly in major agricultural importing countries, can significantly affect demand for commodities. Slower economic growth might lead to reduced demand, while robust growth could increase consumption and support higher prices.

Trade Policies and Agreements

International trade policies and agreements play a crucial role in shaping agricultural markets. Changes in trade relationships, such as the implementation of new tariffs or the formation of new trade agreements, can have substantial impacts on global crop supply and demand dynamics.

For those looking to stay ahead of these complex market dynamics, Farmonaut’s comprehensive platform offers valuable insights and data-driven analysis to support informed decision-making in the agricultural sector.

The Future of Agricultural Futures Trading

As we look ahead, several trends and factors are likely to shape the future of agricultural futures trading:

Increased Use of Technology

The integration of advanced technologies like AI, machine learning, and blockchain is expected to continue, providing traders and investors with more sophisticated tools for market analysis and risk management.

Climate Change Considerations

The growing impact of climate change on agricultural production is likely to become an increasingly important factor in futures trading strategies. Traders will need to consider long-term climate trends and their potential effects on crop yields and market dynamics.

Evolving Global Trade Dynamics

Shifts in international trade relationships and policies will continue to influence agricultural markets. Traders will need to stay informed about geopolitical developments and their potential impacts on crop supply and demand.

Sustainability and ESG Factors

Environmental, Social, and Governance (ESG) considerations are becoming increasingly important in investment decisions. This trend is likely to extend to agricultural futures trading, with a growing focus on sustainable farming practices and their market implications.

To stay at the forefront of these trends and leverage cutting-edge technology in your agricultural operations or trading strategies, consider exploring Farmonaut’s API Developer Docs for integration options.

Conclusion: Navigating the Complex World of Crop Markets

As we’ve explored in this comprehensive analysis, the global crop market is a complex and dynamic ecosystem influenced by a myriad of factors. From weather patterns and planting decisions to international trade dynamics and technological advancements, numerous elements converge to shape the futures of corn, wheat, and soybeans in Chicago and beyond.

Key takeaways from our analysis include:

- The significant impact of weather conditions in major agricultural regions on global crop prices

- The importance of U.S. planting estimates in shaping market expectations

- The potential disruptions caused by tariff implementations and changes in trade policies

- The growing role of technology in providing data-driven insights for market analysis and decision-making

- The influence of global economic factors on agricultural commodity markets

For investors, traders, and agricultural professionals navigating this complex landscape, staying informed and leveraging advanced technological tools is crucial. Platforms like Farmonaut offer valuable resources for real-time crop monitoring, weather analysis, and market insights, helping stakeholders make more informed decisions in an increasingly data-driven agricultural sector.

As we look to the future, the agricultural futures market will likely continue to evolve, shaped by technological advancements, climate change considerations, and shifting global trade dynamics. By staying attuned to these trends and leveraging the power of data and analytics, market participants can better position themselves to navigate the challenges and opportunities that lie ahead in the world of crop markets.

FAQs

- How do weather conditions impact crop futures prices?

Weather conditions significantly influence crop yields and quality, affecting supply expectations. Favorable weather can lead to price decreases due to anticipated higher supply, while adverse conditions can drive prices up. - What role do tariffs play in agricultural commodity markets?

Tariffs can disrupt international trade flows, potentially reducing demand for exports or increasing costs for imports. This can lead to shifts in global supply and demand dynamics, impacting futures prices. - How do commodity funds influence market trends?

Commodity funds can significantly impact prices through their trading activities. Large long or short positions taken by these funds can amplify price movements in either direction. - What is the significance of U.S. planting estimates?

U.S. planting estimates provide insights into potential future supply levels. Increases or decreases in planted acreage can influence market expectations and futures prices. - How does Brazil’s soybean harvest affect global markets?

As a major soybean producer, Brazil’s harvest significantly impacts global supply. A large harvest can put downward pressure on prices, while a poor harvest can lead to price increases.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Farmonaut Subscriptions