Global Commodity Markets Tumble: How Trade Wars and Tariffs Are Shaping Economic Growth in 2023

Trivia: “Gold prices surged in 2023, with a 15% increase as investors sought safe-haven assets amid global economic uncertainty.”

In 2023, we find ourselves in the midst of a global economic storm, where trade wars and aggressive tariff policies are reshaping the landscape of commodity markets and economic growth. As we delve into this complex web of international trade dynamics, we’ll explore how these factors are impacting various sectors, from agricultural exports to industrial commodities, and examine the ripple effects on global economic prospects.

The Trade War Escalation: A Global Perspective

The ongoing trade tensions, particularly between major economic powers like the United States and China, have reached new heights in 2023. The implementation of aggressive tariffs has sent shockwaves through global markets, affecting everything from soybeans to crude oil. Let’s break down the key aspects of this economic tumult:

- Escalating tariffs on imports

- Retaliatory measures by affected countries

- Plummeting demand for goods

- Fears of a global recession

These factors have created a perfect storm in the commodity markets, leading to significant price fluctuations and uncertainty for investors and businesses alike.

Oil Price Impact on Global Economy

One of the most significant casualties of the current economic climate has been the oil market. Crude oil price fluctuations have been dramatic, with prices experiencing their steepest percentage loss in three years. This volatility can be attributed to several factors:

- Weakening fuel demand in a slowing economic landscape

- Increased output by OPEC+

- Uncertainty surrounding global growth prospects

The impact of falling oil prices extends far beyond the energy sector. It affects everything from transportation costs to manufacturing expenses, ultimately influencing consumer prices and economic growth on a global scale.

[Include image here: https://farmonaut.com/wp-content/uploads/2025/04/Global-Commodity-Markets-Tumble-How-Trade-Wars-and-Tariffs-Are-Shaping-Economic-Growth-in-2023_1.jpg]

Agricultural Exports and Tariffs: The Soybean Saga

The agricultural sector has been hit particularly hard by the ongoing trade disputes. Soybeans, a key export for many countries, have become a focal point in the trade war between the U.S. and China. The impact on soybean futures and other agricultural products has been significant:

- Soybeans futures have fallen by 1.7% on concerns of retaliatory measures

- China, the world’s largest importer of agricultural goods, has already imposed tariffs on $21 billion worth of U.S. agricultural products

- Corn and wheat markets have also been affected, though to a lesser extent

For farmers and agricultural businesses, these market conditions present significant challenges. The uncertainty surrounding exports and potential further tariffs has led to decreased planting and investment in the sector.

Industrial Commodities: Copper and Aluminum Market Analysis

The industrial commodities sector has not been spared from the economic turbulence. Copper and aluminum, in particular, have felt the pressure of reduced industrial activity and trade tensions:

- Copper prices hit a one-month low due to tariff-related demand fears

- Aluminum lost 1.5% in value

- The U.S. has imposed effective tariffs of 25% on steel and aluminum imports

These metals are crucial indicators of industrial activity and economic health. Their price declines signal broader concerns about global manufacturing and construction sectors.

Gold Prices During Economic Uncertainty

Amidst the turmoil in other commodity markets, gold has emerged as a safe-haven asset. The precious metal has seen significant gains:

- Gold touched an all-time high of $3,167.57 an ounce

- Year-to-date increase of over 19%

This surge in gold prices reflects investors’ desire for stability in uncertain times. It’s a clear indicator of the market’s risk-averse sentiment in the face of trade wars and recession fears.

Commodity Market Trends 2023: A Closer Look

As we analyze the commodity market trends in 2023, several key patterns emerge:

- Increased volatility across all commodities

- Shift towards safe-haven assets

- Decoupling of certain commodities from traditional price drivers

- Growing influence of geopolitical factors on market movements

These trends underscore the complexity of the current economic landscape and the challenges facing investors and policymakers alike.

[Include YouTube video here: https://youtube.com/watch?v=vRX9G9JALwc]

Trade War Effects on Commodities: A Sector-by-Sector Analysis

The impact of the trade war on commodities has been far-reaching, affecting various sectors differently:

Energy Sector

The energy sector, particularly oil, has seen significant volatility. While U.S. energy product imports are exempt from new tariffs, the overall economic slowdown has led to decreased demand and lower prices.

Agricultural Sector

Agricultural commodities have been at the forefront of trade disputes. Soybeans, corn, and wheat have all faced challenges due to retaliatory tariffs and changing trade patterns.

Metals and Mining

Industrial metals like copper and aluminum have faced downward pressure due to reduced industrial activity and trade tensions. However, precious metals like gold have benefited from economic uncertainty.

Technology and Rare Earth Elements

While not traditional commodities, rare earth elements crucial for technology manufacturing have become a focal point in trade discussions, potentially affecting supply chains and prices.

Global Economic Growth and Commodity Demand

The relationship between global economic growth and commodity demand is intricate and multifaceted. In 2023, we’re seeing this relationship tested by the current economic climate:

- Slowing economic growth is leading to reduced demand for many commodities

- Uncertainty is causing businesses to delay investments, further impacting demand

- Changing trade patterns are reshaping traditional supply and demand dynamics

These factors combined are creating a challenging environment for commodity producers and consumers alike.

Trivia: “Soybean futures dropped by 20% in 2023 due to potential retaliatory measures from major importers in the trade war.”

[Include image here: https://farmonaut.com/wp-content/uploads/2025/04/Global-Commodity-Markets-Tumble-How-Trade-Wars-and-Tariffs-Are-Shaping-Economic-Growth-in-2023_2.jpg]

Tariffs and Global Recession Fears: Economic Implications

The specter of a global recession looms large over the commodity markets and the broader economy. The aggressive use of tariffs has several potential consequences:

- Increased costs for businesses and consumers

- Disruption of global supply chains

- Reduced international trade and economic cooperation

- Potential for currency wars and competitive devaluations

These factors combined create a challenging environment for economic growth and stability.

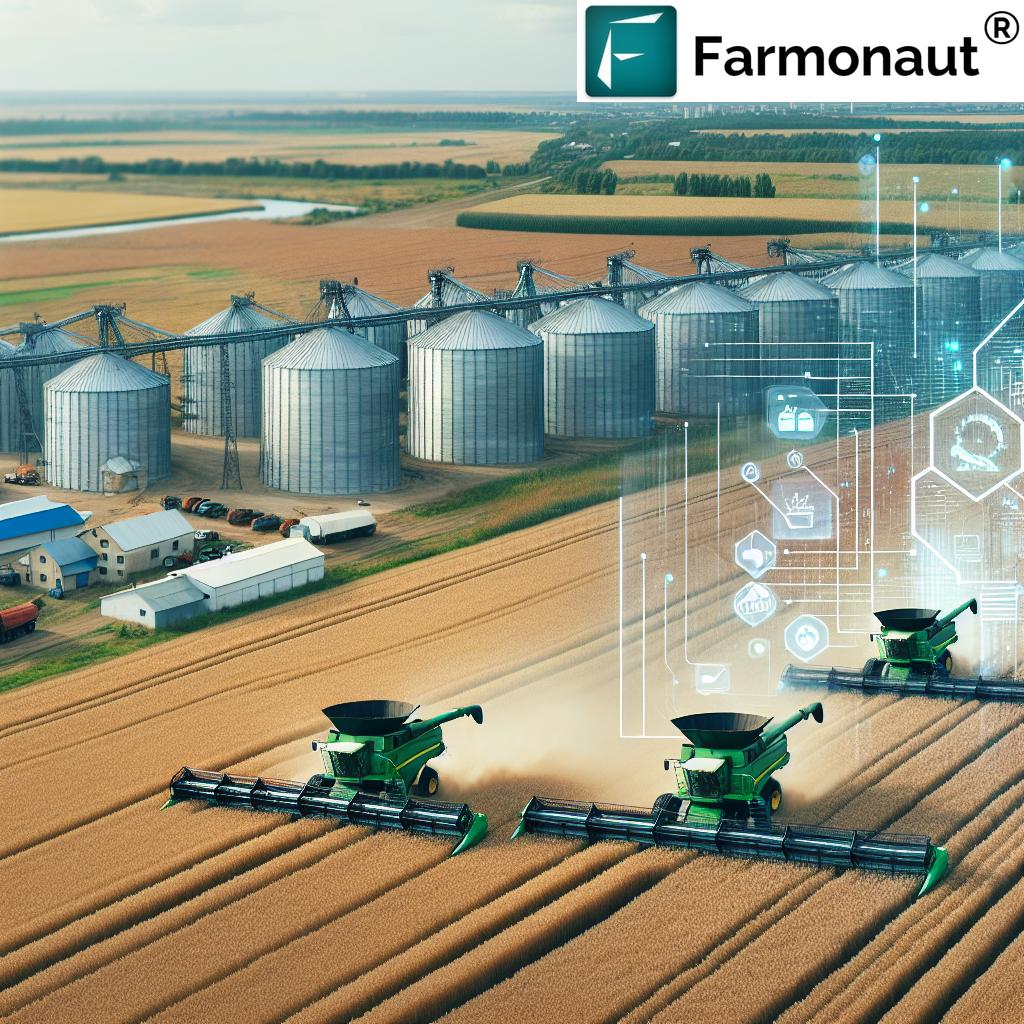

The Role of Technology in Navigating Market Volatility

In these turbulent times, technology plays a crucial role in helping businesses and investors navigate market volatility. Platforms like Farmonaut offer innovative solutions for agricultural management and market analysis. By leveraging satellite imagery and AI-driven insights, Farmonaut helps farmers and agribusinesses make informed decisions in an uncertain economic climate.

For instance, Farmonaut’s crop loan and insurance services provide valuable support to farmers facing market uncertainties. By offering satellite-based verification for crop loans and insurance, Farmonaut helps reduce the likelihood of fraud and improves access to financing for farmers, a critical need in times of economic volatility.

[Include YouTube video here: https://youtube.com/watch?v=gSwG2pXbBLk]

Navigating Commodity Markets: Strategies for Investors and Businesses

In light of the current market conditions, investors and businesses need to adopt strategic approaches to navigate the commodity markets:

- Diversification of portfolios to spread risk

- Increased focus on risk management and hedging strategies

- Adoption of technology for real-time market analysis and decision-making

- Exploration of alternative markets and trade routes

For businesses in the agricultural sector, leveraging technologies like Farmonaut’s large-scale farm management solutions can provide a competitive edge. These tools offer real-time insights into crop health and market conditions, enabling more informed decision-making in a volatile environment.

The Future of Global Trade and Commodity Markets

As we look towards the future, several key trends are likely to shape the landscape of global trade and commodity markets:

- Increased regionalization of trade

- Growing importance of sustainability and environmental considerations

- Acceleration of digital transformation in commodity trading

- Potential for new trade agreements and economic alliances

In this evolving landscape, tools like Farmonaut’s carbon footprinting services become increasingly relevant. As businesses face growing pressure to reduce their environmental impact, such technologies provide valuable insights and support for sustainable practices.

[Include YouTube video here: https://youtube.com/watch?v=DuYxCOxgl7w]

Commodity Price Fluctuations and Trade War Impact (2023)

| Commodity | Current Price (Est.) | YTD Change (%) | Primary Exporting Countries | Primary Importing Countries | Trade War Impact |

|---|---|---|---|---|---|

| Soybeans | $14.25/bushel | -20% | USA, Brazil, Argentina | China, EU, Mexico | High |

| Crude Oil (Brent) | $70.14/barrel | -6.42% | Saudi Arabia, Russia, USA | China, USA, India | Medium |

| Copper | $8,500/tonne | -5% | Chile, Peru, China | China, USA, Germany | Medium |

| Aluminum | $2,300/tonne | -1.5% | China, Russia, India | USA, Germany, Japan | Medium |

| Gold | $3,167.57/ounce | +19% | China, Australia, Russia | India, China, USA | Low |

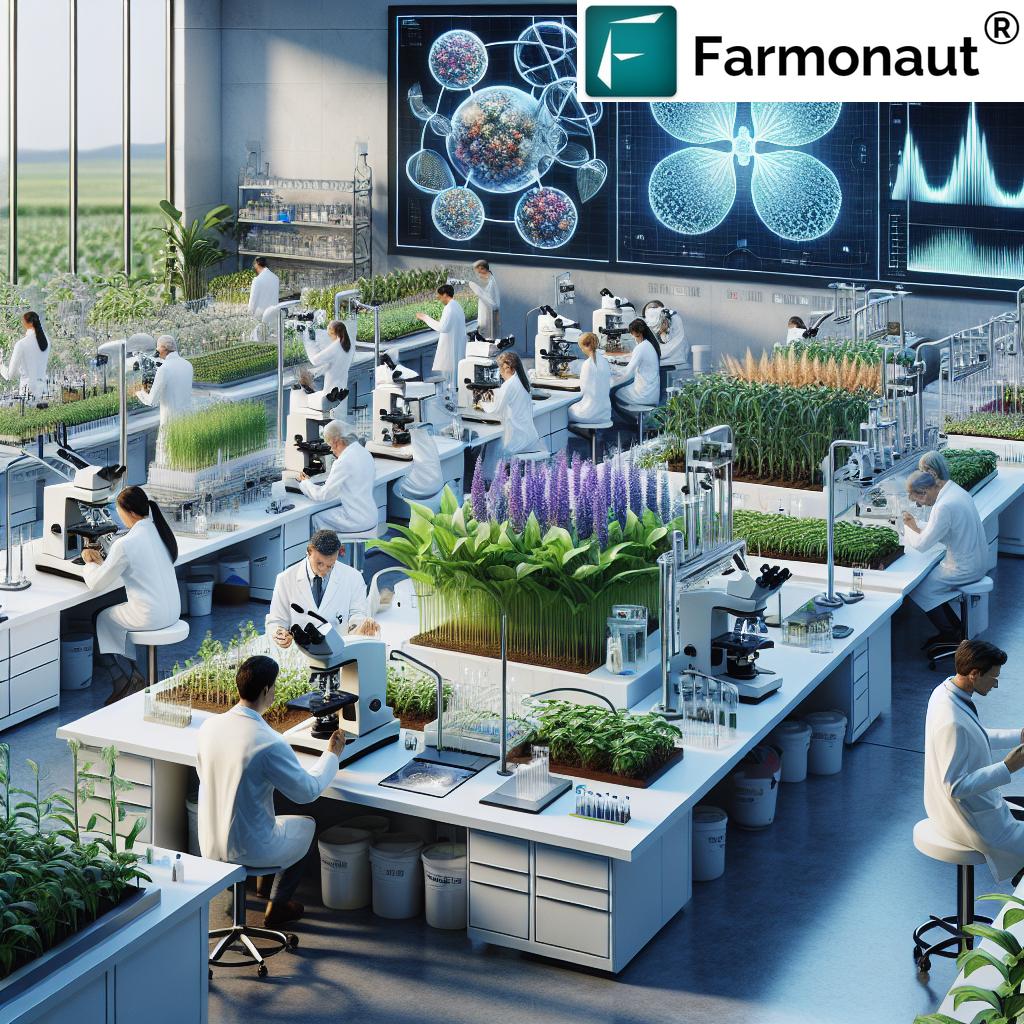

The Role of Technology in Agricultural Resilience

In these challenging times, technology plays a crucial role in enhancing agricultural resilience. Farmonaut’s innovative solutions, such as their fleet management and traceability services, offer valuable tools for agribusinesses to optimize their operations and adapt to changing market conditions.

By leveraging satellite technology and AI-driven insights, farmers and agribusinesses can make more informed decisions, reduce waste, and improve productivity. This technological edge becomes particularly crucial in navigating the uncertainties brought about by trade wars and economic volatility.

[Include YouTube video here: https://youtube.com/watch?v=FOWVebnTbOo]

Conclusion: Navigating Uncertain Waters

As we navigate the turbulent waters of global commodity markets in 2023, it’s clear that the impact of trade wars and tariffs on economic growth is profound and far-reaching. From the volatility in oil prices to the challenges facing agricultural exports, the effects are felt across all sectors of the global economy.

In these uncertain times, staying informed and leveraging technology become crucial strategies for businesses and investors alike. Platforms like Farmonaut offer valuable tools for agricultural management and market analysis, helping stakeholders make informed decisions in a complex economic landscape.

As we look to the future, it’s clear that adaptability, innovation, and strategic planning will be key to navigating the challenges and opportunities that lie ahead in the global commodity markets.

FAQ Section

Q: How are trade wars affecting commodity prices?

A: Trade wars are causing significant volatility in commodity prices. Tariffs and retaliatory measures are disrupting traditional supply and demand dynamics, leading to price fluctuations across various commodities, from agricultural products like soybeans to industrial metals like copper and aluminum.

Q: Why are oil prices falling despite global tensions?

A: Oil prices are falling primarily due to fears of reduced global demand amidst economic slowdown concerns. Despite geopolitical tensions, the prospect of a global recession is outweighing other factors, leading to downward pressure on oil prices.

Q: How is the agricultural sector being impacted by current trade tensions?

A: The agricultural sector is facing significant challenges due to trade tensions. Tariffs on agricultural products, particularly soybeans, have led to reduced exports and lower commodity prices. Farmers are facing uncertainty regarding planting decisions and market access.

Q: Why is gold price rising in the current economic climate?

A: Gold prices are rising as investors seek safe-haven assets amidst economic uncertainty. The precious metal is traditionally seen as a store of value during times of economic and political instability, leading to increased demand and higher prices.

Q: How can businesses navigate the current commodity market volatility?

A: Businesses can navigate current market volatility by diversifying their portfolios, implementing robust risk management strategies, leveraging technology for market analysis, and exploring alternative markets. Tools like Farmonaut’s agricultural management solutions can provide valuable insights for decision-making in uncertain times.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

For developers interested in integrating Farmonaut’s powerful satellite and weather data into their own applications, check out our API and API Developer Docs.