Phosphate Fertilizer Market Booms: 2024 Shocking Trends

Table of Contents

- Introduction: Why Are Phosphate Fertilizers Booming in 2024?

- Global Market Overview: The Driving Dynamics

- Key Phosphate Rock Producers & Geopolitical Considerations

- Environmental and Sustainability Challenges

- Technological Innovations and Precision Agriculture in the Phosphate Fertilizer Industry

- Regional Market Dynamics: Asia-Pacific, Europe, North America

- Phosphate Fertilizer Market Trends Comparison Table (2023 vs. 2024)

- Market Challenges and the Changing Competition

- Farmonaut: Empowering Precision Agriculture and Sustainability

- The Future of Phosphate Fertilizers and Sustainable Agriculture

- FAQs: Phosphate Fertilizer Market

- Conclusion

“Global phosphate fertilizer demand is projected to surpass 50 million metric tons in 2024, reflecting a significant market surge.”

Introduction: Why Are Phosphate Fertilizers Booming in 2024?

In 2024, the global phosphate fertilizer market is experiencing a seismic shift. The surging demand for food, rapid population growth, breakthroughs in precision agriculture technology, and fresh sustainability mandates are converging to create one of the most dynamic and complex periods in the sector’s history.

Phosphate fertilizers are essential for replenishing soil phosphorus—a vital nutrient required by plants for strong root development and high crop yields. As farming systems intensify and modernize to feed billions, these fertilizers play a crucial role in securing global food security and driving agricultural productivity.

However, this unprecedented growth also brings formidable environmental challenges, sustainability concerns, geopolitical uncertainties, and resource limitations. In this comprehensive analysis, we provide an in-depth exploration of the latest phosphate fertilizer industry trends, market dynamics, emerging technologies, and actionable solutions for the future.

Let us journey through the latest industry trends & news, challenges, and technologies transforming the phosphate fertilizer landscape.

Global Market Overview: The Driving Dynamics

According to market analyses, the phosphate fertilizer market is projected to reach USD 110.2 billion by 2033, a substantial growth from current levels (news.market.us). The rising demand is fueled primarily by several converging factors:

- Global Population Growth: By 2030, population levels are expected to soar, driving higher food demand and productivity requirements.

- Soil Depletion Concerns: Continuous agricultural activity exhausts native phosphorus in soils, necessitating regular replenishment through phosphate fertilizers.

- Modern Agricultural Practices: Transition from traditional to precision farming boosts fertilizer efficiency and adoption.

- Technological Advancements: Improved sensors, satellite-based analytics, and AI now enable farmers to optimize inputs, minimize waste, and maximize yields.

- Geopolitical Dynamics: From trade disputes to supply chain tensions, external factors significantly influence availability and prices.

- Sustainability Pressures: Regulators, NGOs, and consumers are compelling the sector to reduce the environmental impact of phosphate fertilizers, embrace recycling, and develop alternative nutrient solutions.

In summary, the health and security of our agricultural future depend upon an accessible, resilient, and sustainable phosphate fertilizer sector.

Key Phosphate Rock Producers & Geopolitical Considerations

At the heart of the phosphate fertilizer market are a handful of dominant phosphate rock producers:

- Morocco: Controls more than 70% of the world’s known reserves, making it a pivotal player in the supply chain.

- China: Both a leading producer and consumer, driving regional demand and global trade.

- United States: Substantial production capacity, impacting North American and international pricing.

- Trade disputes between the U.S. and Canada have led to soaring fertilizer prices, challenging farmers and causing ripple effects on input costs worldwide. (Reuters)

- Regional instability in North Africa can threaten supply chain continuity, impacting availability and logistics.

- Global competition for finite resources increases the risk of future pricing shocks and security concerns.

Therefore, close monitoring of geopolitical dynamics and collaboration between states are key to maintaining a secure, stable phosphate fertilizer supply.

Environmental and Sustainability Challenges

Despite powering modern farming, phosphate fertilizers and their supply chains contribute to serious environmental concerns:

- Habitat Destruction: Open-pit mining of phosphate rock can cause severe ecosystem damage and biodiversity loss.

- Water Contamination: Excess phosphorus runoff from fertilizer application leads to eutrophication, polluting water bodies and damaging aquatic life.

- Soil Degradation: Unsustainable nutrient management accelerates soil degradation and reduces long-term agricultural productivity.

- Finite Resource: Phosphate rock is non-renewable—depletion is inevitable if extraction remains unsustainable.

The pressure is on for every industry player to adopt sustainable agriculture practices and seek eco-friendly innovations.

Sustainable Solutions Gaining Momentum

- Phosphorus Recycling: Recovering nutrients from municipal and animal waste streams is gaining traction to reduce reliance on mined rock.

- Eco-Friendly Fertilizer Development: Slow-release and controlled-release products minimize nutrient waste and runoff.

- Regulatory Mandates: Europe and other regions are pushing stricter rules to enforce soil health, reduce contamination, and enhance organic inputs.

Stakeholders across the global phosphate fertilizer market are investing in R&D, compliance, and partnerships with technology leaders to accelerate these sustainability efforts.

Discover how Farmonaut’s Carbon Footprinting tools empower agribusinesses to track and reduce farm-level emissions, supporting your environmental compliance journey.

“Precision agriculture adoption is expected to boost phosphate use efficiency by up to 20% in major farming regions this year.”

Technological Innovations and Precision Agriculture in the Phosphate Fertilizer Industry

The adoption of modern technology and precision agriculture technology is transforming the global phosphate fertilizer market in profound ways.

- Satellite Imagery & Data Analytics: Real-time field monitoring informs optimal fertilizer timing, placement, and dosage for maximizing yields while minimizing waste.

- IoT & Sensors: Wireless devices collect data on soil moisture, crop needs, environmental parameters, and help apply nutrients accurately.

- AI-Powered Advisory Systems: Automated decision-making drives efficiency, lowering input costs and reducing environmental impact.

- Single Superphosphate (SSP): New formulations like SSP can offer cost-effective, crop- and soil-specific solutions.

Learn more about phosphate fertilizer market growth trends.

- Targeted application via sensors and AI can boost fertilizer use efficiency by 15–20%.

- Digital tools identify variability in field phosphorus needs, enabling variable-rate fertilizer application for optimal results.

- Data-driven insights help farmers proactively address soil health and nutrient management, minimizing runoff and lowering emissions.

Precision systems not only increase farmer profitability but also align with sustainability imperatives—future-proofing farms against regulatory, environmental, and resource-driven risks.

Discover how the Farmonaut Traceability Solution brings blockchain-based transparency and trust to your farm produce supply chain.

Regional Market Dynamics: Asia-Pacific, Europe, North America

Asia-Pacific: The Powerhouse of Phosphate Fertilizer Demand

- China and India: These countries are leading consumers, driven by large populations and government initiatives for food security.

- Modern Farming Practices: The shift toward advanced and sustainable fertilizer usage is accelerating yield improvements. (Farmonaut Asia-Pacific Market Analysis)

- Precision Agriculture: Significant regional growth expected in precision agriculture technology adoption for better resource management.

Europe: The Sustainability Vanguard

- Regulatory Pressure: The EU’s strict oversight requires fertilizer suppliers and farmers to reduce nutrient loss and environmental runoff.

- Shift to Organic: Rising popularity of organic farming, bio-based fertilizers, and soil health initiatives (PMarketResearch).

North America: Production and Price Volatility

- US and Canada: Top producers and consumers face price fluctuations due to trade disputes and logistic challenges.

- Innovation Hotspot: Next-generation products and digital farm management tools drive competitiveness.

Regional market dynamics determine how quickly and effectively new fertilizer technologies are adopted and which markets see the highest growth or disruption.

Phosphate Fertilizer Market Trends Comparison Table (2023 vs. 2024)

| Market Segment | 2023 Estimated Market Value (USD Billion) | 2024 Estimated Market Value (USD Billion) | Year-on-Year Growth (%) | Key Trend Drivers |

|---|---|---|---|---|

| Diammonium Phosphate (DAP) | 28 | 31 | 10.7% | Sustainability Initiatives; Asia-Pacific Demand; Precision Application |

| Monoammonium Phosphate (MAP) | 16 | 17.2 | 7.5% | Efficient Nutrient Solutions; Tech Advancements |

| Triple Superphosphate (TSP) | 9.5 | 10.1 | 6.3% | European Sustainability Policies; Crop Diversification |

| Single Superphosphate (SSP) | 7.2 | 7.9 | 9.7% | Low-Cost Fertilizer Demand; Suitability for Various Crops |

| Others (Specialty & Bio-Based) | 5.1 | 6.3 | 23.5% | Sustainable Solutions; Organic Farming Adoption |

| Asia-Pacific | 26.8 | 29 | 8.2% | Food Security; Population Growth; Precision Agriculture Growth |

| Europe | 10.5 | 11.2 | 6.7% | Sustainability Regulations; Organic Agriculture |

| North America | 15.2 | 16.4 | 7.9% | Innovation; Price Volatility; Precision Farming Solutions |

*Values are estimates based on multiple market reviews and may vary.

Market Challenges and the Changing Competition

Despite record opportunity, the phosphate fertilizer market faces intense challenges:

- Resource Depletion: Known phosphate rock reserves are finite, and over-mining accelerates depletion risk.

- Environmental Concerns: Persistent pollution, soil degradation, and water contamination demand rapid and decisive action.

- Alternative Competition: Organic and bio-based fertilizers are gaining traction, presenting stiff competition and requiring the industry to adapt quickly (Verified Market Reports).

- Dynamic Regulatory Environment: More regions are implementing restrictions on chemical fertilizer use, pushing for transparency and sustainability.

- Input Costs and Pricing Volatility: Global geopolitical tensions, especially trade disputes, continue to affect costs and pricing.

To remain resilient, industry stakeholders must invest in eco-friendly innovations and diversify their portfolios for a changing market.

Efficient fleet management solutions can help agribusinesses optimize logistics, reduce costs, and respond swiftly to dynamic fertilizer supply challenges.

Get Started with Affordable Precision Agriculture Today!

Explore Farmonaut’s flexible, scalable subscription plans for farm monitoring, AI-advisory, and environmental solutions:

Farmonaut: Empowering Precision Agriculture and Sustainability

As the phosphate fertilizer market becomes increasingly reliant on precision, analytics, and sustainable solutions, advanced agricultural technology companies play an outsized role in driving transformation.

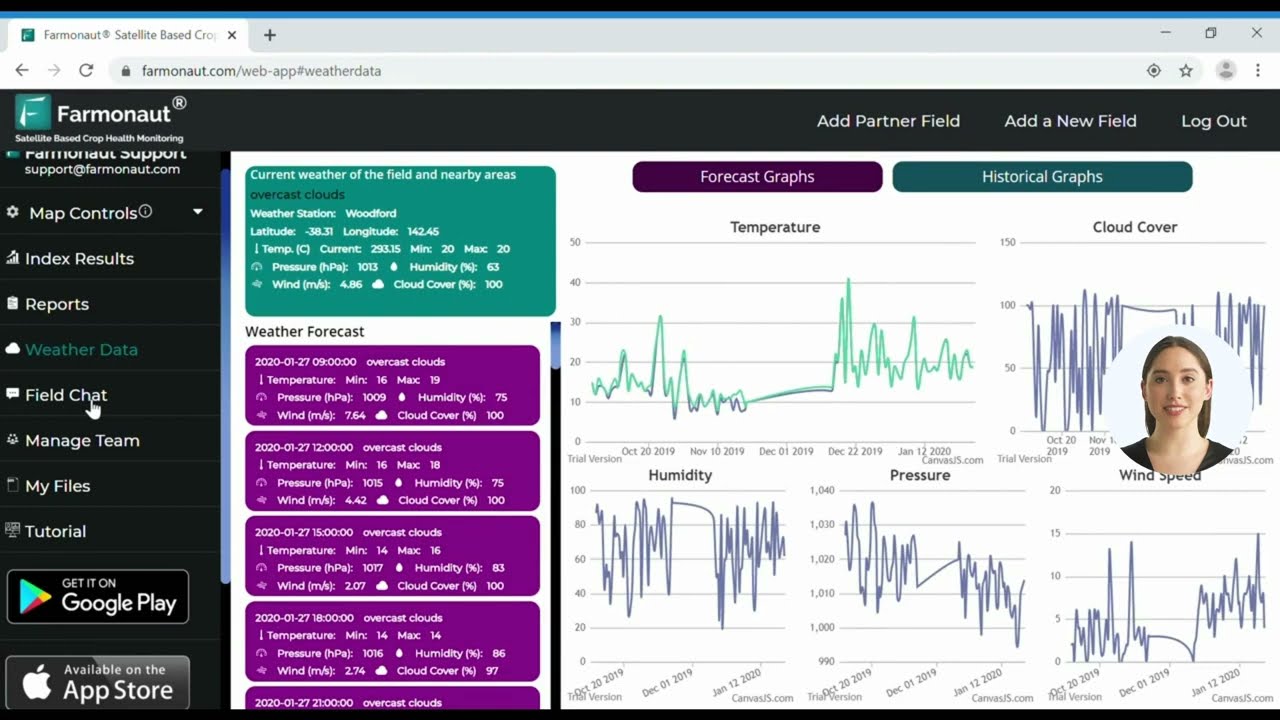

Farmonaut’s Satellite-Based Agri-Tech Platform

- Satellite Crop Health Monitoring: Farmonaut’s multispectral imagery reveals crop vigor, soil moisture, and nutrient needs at a granular field level. This enables farmers and agribusinesses to make informed, timely fertilizer management decisions.

- AI-Based Advisory (Jeevn System): Personalized recommendations, weather forecasts, and data-driven insights help farmers improve productivity and fertilizer efficiency.

- Blockchain-based Product Traceability: Integrating secure supply chain tracking for enhanced transparency and consumer trust. Learn more about Farmonaut’s Traceability.

- Fleet and Resource Management: Streamline fertilizer logistics and input delivery with intelligent fleet tools.

- Carbon Footprinting: Real-time monitoring of environmental impact and emissions. See carbon tracking functionalities.

Farmonaut offers these advanced capabilities through its web, Android, and iOS platforms and robust API for agricultural developers (see our API documentation).

Whether you manage a single farm or operate a global agribusiness, explore hands-on monitoring and precision through Farmonaut’s

large-scale farm management suite.

Integrating sustainable farming practices and digital analytics at your farm gives you a competitive edge and supports your compliance with modern sustainability standards.

The Future of Phosphate Fertilizers and Sustainable Agriculture

The future of phosphate fertilizers hinges on our collective will to balance higher agricultural productivity with robust environmental stewardship and sustainable practices.

- Technological Adoption: AI, ML, IoT sensors, and satellite-driven advisory platforms like Farmonaut will soon be mainstream in fertilizer planning worldwide.

- Sustainable Sourcing: Phosphorus recycling, advanced mining reclamation, and bio-based alternatives will reduce industry footprint and mitigate resource depletion risks.

- Regulatory Momentum: Policies will become ever-stricter on environmental impact, pushing adoption of eco-friendly fertilizers and real-time sustainability assessment tools.

- Data-Driven Decisions: Farm management will become hyper-personalized to each field, season, and crop, with analytics underpinning every application.

- Market Resilience: Diversification, risk management, and traceability are vital to addressing geopolitical tensions and price volatility.

It is clear that technology, particularly precision agriculture and data-driven analytics, will play a leading role in transforming both productivity and sustainability outcomes in the coming decade.

Ready to join the future of scientifically managed crop nutrition? Click to launch the Farmonaut App and experience our tools today!

FAQs: Phosphate Fertilizer Market

- What are phosphate fertilizers, and why are they important?

Phosphate fertilizers are nutrient products derived primarily from phosphate rock. They provide phosphorus, an essential nutrient for plants, ensuring strong root development and improved crop yields. Without regular P supplementation, soils become depleted, reducing food production globally. - What is driving phosphate fertilizer market growth in 2024?

Population expansion, food security demands, technological innovations, regulatory changes, and precision agriculture are converging to boost demand and efficiency in the phosphate sector. - What are the main environmental concerns with phosphate fertilizer use?

Key concerns include pollution of water bodies via runoff, habitat destruction from mining, and finite resource depletion. These impacts have led to urgent calls for recycling, precision management, and sustainable alternatives. - How are advancements in precision agriculture benefiting phosphate fertilizer use?

Precision tools (satellite imagery, sensors, AI) maximize nutrient efficiency by delivering the right product to the right place at the right time. This not only boosts farm profitability but also reduces environmental harm. - How can Farmonaut help my fertilizer management strategy?

Farmonaut provides real-time monitoring, AI-powered crop and soil recommendations, blockchain-based traceability, and sustainability metrics—empowering smarter, more sustainable fertilizer decision-making. - Where can I access Farmonaut’s latest technologies?

Use our web, Android, iOS apps or integrate via our API for seamless farm management.

Conclusion

We are at a pivotal juncture where phosphate fertilizers remain indispensable to global agricultural productivity, yet the environmental and resource challenges they pose can no longer be ignored. By embracing technological advancements, enforcing rigorous sustainable agriculture practices, and staying ahead of market dynamics, our industry can continue to thrive while protecting our planet for future generations.

Digital transformation, transparency, and sustainability are our guiding lights. Leverage Farmonaut’s tools to transform your farm today—because the future of phosphate fertilizers depends on the smart, responsible choices we make now.

Discover the intelligent future of agriculture—start now with Farmonaut!