Unveiled: Canada’s Wholesale Sales Plummet – Shocking Decline in Motor Vehicle Industry Rocks Economic Landscape

In a surprising turn of events, the Canadian wholesale sector has experienced a significant downturn, sending ripples across the nation’s economic landscape. The latest Statistics Canada economic report reveals a concerning decline in wholesale trade, with the motor vehicle industry taking a particularly hard hit.

Canadian Wholesale Sales Decline: A Closer Look

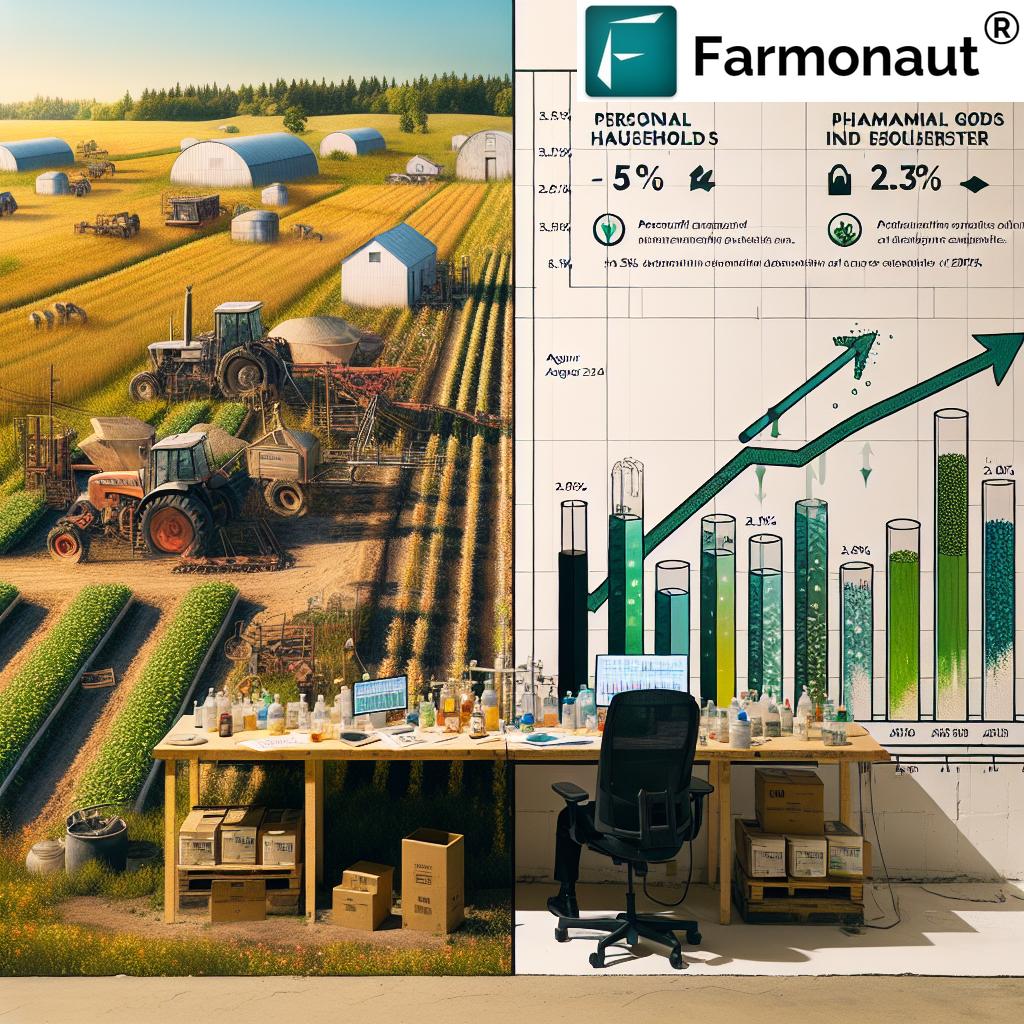

According to the latest data from Statistics Canada, Canadian wholesale sales experienced a 0.6% drop in August 2024, bringing the total to $81.9 billion. This decline has affected five out of seven subsectors, painting a complex picture of Canada’s economic health.

- Motor vehicle and parts industry: 1.8% decrease

- Miscellaneous subsector: 3.9% reduction

- Agriculture supplies: 5.6% fall

- Personal and household goods: 2.3% growth

The motor vehicle industry impact is particularly noteworthy, as it represents a significant portion of Canada’s manufacturing and export sectors. This decline could have far-reaching consequences for related industries and employment rates.

Unpacking the Statistics Canada Economic Report

The Statistics Canada economic report provides a comprehensive analysis of the wholesale trade trends in Canada. It’s crucial to understand these figures in the context of broader Canadian economic indicators.

Volume sales, which exclude petroleum and oilseed, decreased by 0.7%. This metric is particularly important as it provides insight into the actual quantity of goods being traded, irrespective of price fluctuations.

Sector-Specific Analysis

Motor Vehicle Industry Decline

The motor vehicle industry decline of 1.8% is a cause for concern. This sector is a crucial component of Canada’s manufacturing industry and a significant contributor to GDP. The decline could be attributed to various factors, including:

- Global supply chain disruptions

- Shifts in consumer preferences towards electric vehicles

- Economic uncertainty affecting big-ticket purchases

For businesses and investors in this sector, it’s crucial to stay informed about these trends. Consider using tools like Farmonaut’s Satellite Weather API to analyze potential impacts of weather patterns on production and logistics.

Miscellaneous Subsector Drop

The miscellaneous subsector drop of 3.9% is largely attributed to a significant decrease in agriculture supplies. This 5.6% fall in agriculture supplies could have implications for Canada’s agricultural sector, potentially affecting crop yields and food prices in the coming months.

Farmers and agribusinesses can leverage technology to mitigate these challenges. The Farmonaut app offers valuable insights for crop management and yield optimization.

Pharmaceutical Industry Growth: A Silver Lining

Amidst the general decline, the pharmaceutical industry growth in Canada stands out as a positive development. The personal and household goods sector, which includes pharmaceuticals, grew by 2.3%. This growth could be attributed to:

- Increased healthcare spending

- Advancements in medical research

- Growing demand for over-the-counter medications

This sector’s resilience highlights the importance of diversification in Canada’s economic portfolio.

Canadian Retail Sector Trends and Analysis

The wholesale trade decline inevitably impacts the Canadian retail sector. As wholesalers face challenges, retailers may experience:

- Increased product costs

- Supply chain disruptions

- Shifts in consumer spending patterns

A comprehensive Canadian retail sector analysis reveals that businesses must adapt to these changing dynamics. Retailers should focus on:

- Diversifying supply chains

- Embracing e-commerce solutions

- Optimizing inventory management

For detailed insights into market trends, businesses can refer to the Farmonaut API Developer Docs.

Economic Impact on Canadian Industries

The economic impact on Canadian industries extends beyond the wholesale and retail sectors. Key areas affected include:

- Manufacturing

- Transportation and logistics

- Agriculture and food production

- Construction

These interconnected industries form the backbone of Canada’s economy, and the ripple effects of the wholesale decline could be significant.

Canadian Economic Indicators 2024: Looking Ahead

As we analyze the Canadian economic indicators for 2024, it’s crucial to consider both short-term fluctuations and long-term trends. Key indicators to watch include:

- GDP growth rate

- Unemployment figures

- Inflation rates

- Export and import volumes

These indicators, along with the wholesale trade analysis for Canada, provide a comprehensive picture of the nation’s economic health.

Conclusion: Navigating Economic Uncertainties

The recent decline in Canadian wholesale sales underscores the dynamic nature of the country’s economy. While challenges exist, particularly in the motor vehicle industry and agriculture supplies sector, opportunities for growth and adaptation remain.

Businesses across industries must stay informed about these economic shifts and leverage technology and data analysis to make informed decisions. Tools like Farmonaut’s satellite imagery and weather data can provide valuable insights for various sectors, from agriculture to logistics.

As Canada’s economic landscape continues to evolve, resilience, innovation, and adaptability will be key to navigating the uncertainties ahead. By closely monitoring Canadian economic indicators and embracing technological solutions, businesses can position themselves to thrive in this changing environment.

Stay tuned for further updates on Canada’s economic performance and industry-specific trends as we continue to analyze the implications of these wholesale trade developments.