Unlocking Agricultural Futures: Farmonaut’s Advanced Data Analytics for Precision Farming and Risk Management

“Farmonaut’s data analytics combine precision agriculture tools with commodity market insights, potentially improving trading strategies by up to 30%.”

In today’s rapidly evolving agricultural landscape, the convergence of technology and farming practices has ushered in a new era of precision and efficiency. At the forefront of this agricultural revolution is Farmonaut, a pioneering agritech company that’s reshaping the way we approach farming, risk management, and agricultural futures trading. In this comprehensive blog post, we’ll explore how Farmonaut’s innovative solutions are unlocking new possibilities for farmers, traders, and agribusinesses alike.

The Agricultural Futures Landscape: A New Frontier

Agricultural futures trading has long been a cornerstone of the global commodities market, providing a vital mechanism for managing risk and price discovery in the farming sector. However, the traditional approach to futures trading is undergoing a significant transformation, driven by the integration of advanced data analytics and precision agriculture tools.

We are witnessing a paradigm shift where real-time data, satellite imagery, and artificial intelligence are becoming integral to decision-making processes in both farming and trading. This evolution is not just enhancing productivity on the farm; it’s also revolutionizing how we approach agricultural derivatives and risk management strategies.

Farmonaut: Bridging the Gap Between Farming and Finance

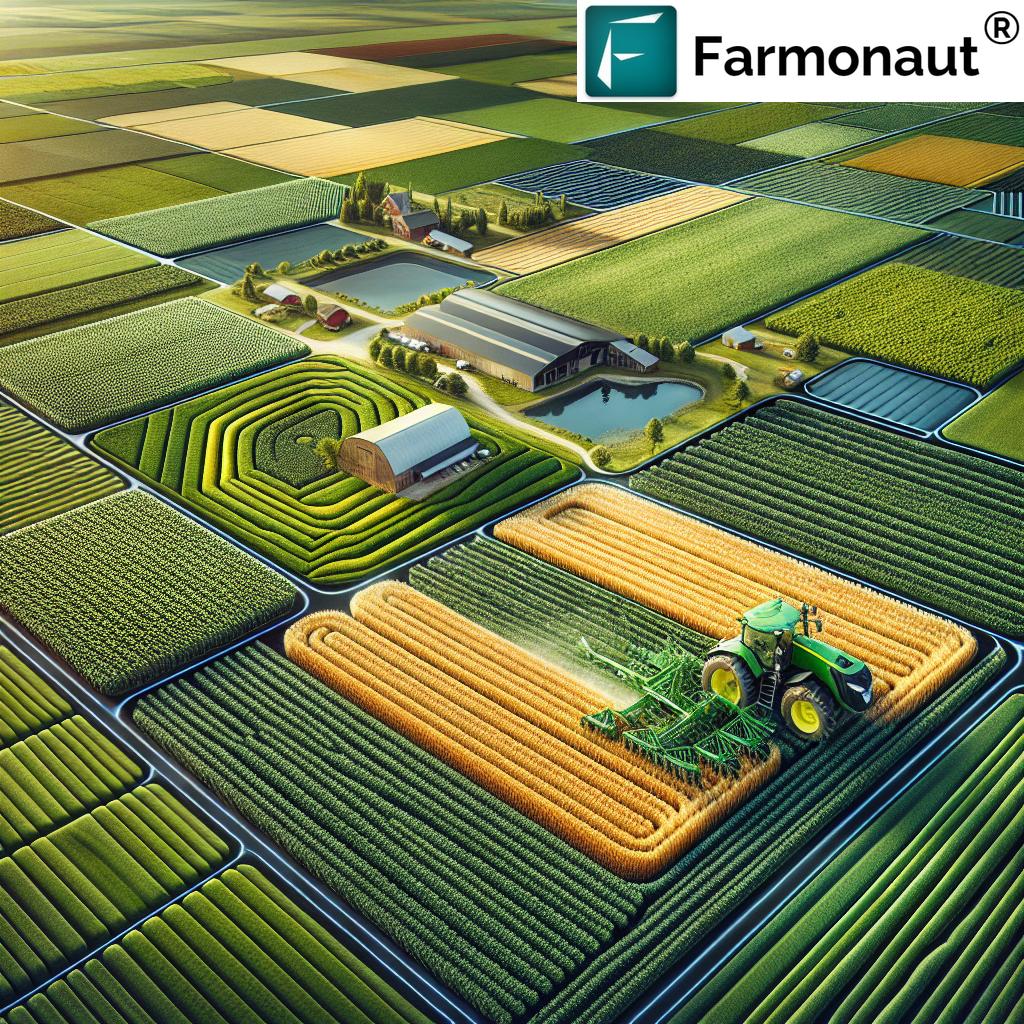

Farmonaut stands at the intersection of agriculture and technology, offering a suite of innovative solutions that cater to the needs of modern farmers, traders, and agribusinesses. By leveraging satellite-based farm management solutions, Farmonaut is making precision agriculture more accessible and affordable than ever before.

- Satellite-Based Crop Health Monitoring: Real-time insights into vegetation health, soil moisture, and critical metrics.

- Jeevn AI Advisory System: Personalized farm advisory tool delivering expert crop management strategies.

- Blockchain-Based Product Traceability: Enhancing transparency and trust in agricultural supply chains.

- Fleet and Resource Management: Optimizing logistics and reducing operational costs for agribusinesses.

- Carbon Footprinting: Helping businesses monitor and reduce their environmental impact.

These tools not only improve on-farm efficiency but also provide valuable data that can be leveraged in the futures and options trading markets.

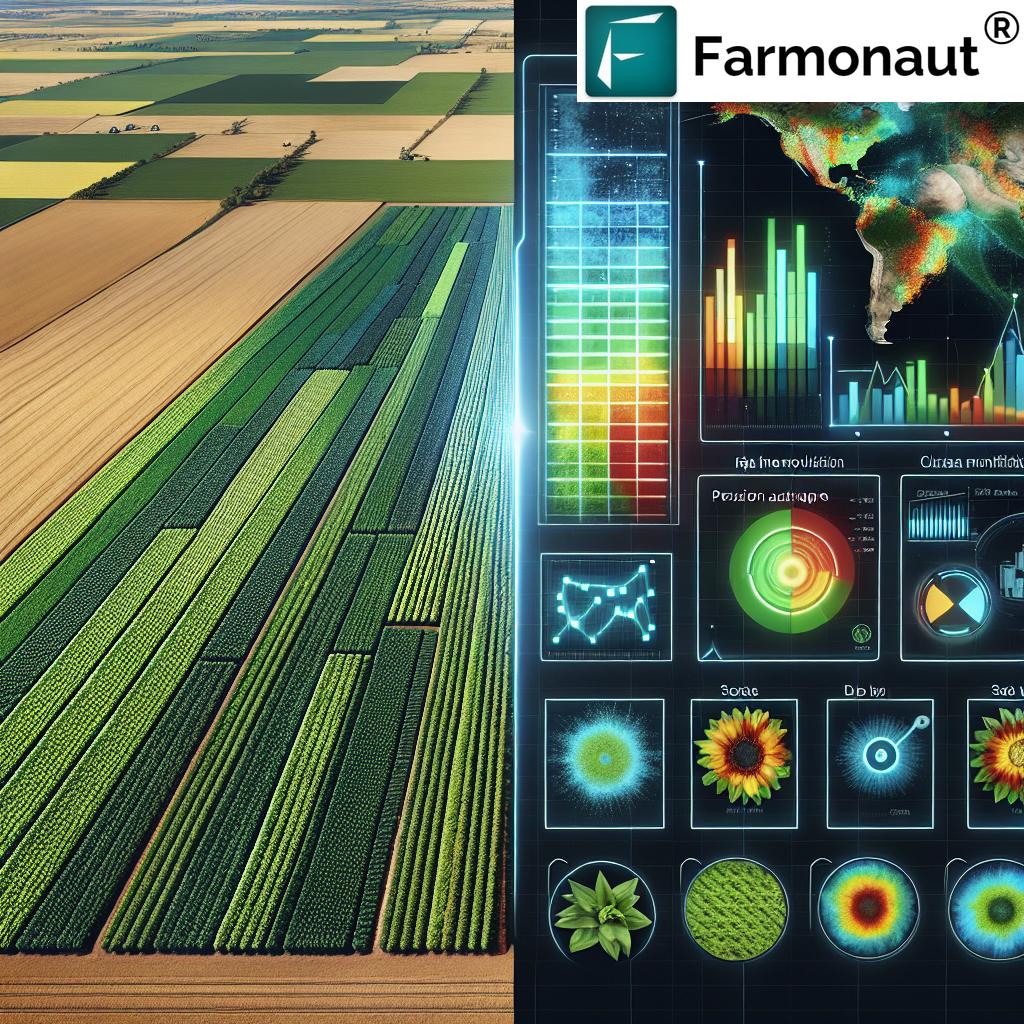

Revolutionizing Agricultural Futures Trading with Data Analytics

The integration of Farmonaut’s advanced data analytics into agricultural futures trading is opening up new avenues for risk management and market insights. Here’s how:

- Enhanced Market Intelligence: By aggregating data from thousands of farms, Farmonaut provides a comprehensive view of crop health, yield projections, and potential supply disruptions. This information is invaluable for traders looking to refine their strategies and make more informed decisions.

- Improved Risk Assessment: The real-time monitoring capabilities allow for better assessment of weather-related risks, pest infestations, and other factors that could impact crop yields. This enables more accurate pricing of futures contracts and options.

- Precision in Hedging Strategies: Farmers and agribusinesses can use Farmonaut’s data to develop more precise hedging strategies, aligning their futures positions with actual crop conditions and projected yields.

- Liquidity and Market Efficiency: As more participants gain access to high-quality data, we expect to see increased liquidity and improved market efficiency in agricultural futures markets.

Crop Risk Management Strategies in the Digital Age

The advent of precision agriculture tools and advanced data analytics has revolutionized crop risk management strategies. Farmonaut’s solutions play a crucial role in this transformation:

- Weather Risk Mitigation: By providing accurate, localized weather forecasts and historical data, Farmonaut helps farmers and traders better assess and manage weather-related risks.

- Pest and Disease Management: Early detection of pest infestations or disease outbreaks through satellite imagery allows for timely intervention, reducing the risk of crop loss.

- Yield Optimization: AI-driven recommendations for crop management help maximize yields, providing a buffer against market volatility.

- Resource Allocation: Efficient management of water, fertilizers, and other inputs reduces operational risks and enhances profitability.

These strategies, powered by Farmonaut’s data-driven insights, enable a more proactive approach to risk management in agriculture.

Commodity Market Analytics: A Game-Changer for Traders

The integration of Farmonaut’s agritech data solutions with traditional commodity market analytics is creating a powerful toolset for traders and analysts:

- Supply Forecasting: Accurate predictions of crop yields and production volumes inform supply-side analysis.

- Demand Modeling: Combining agricultural data with economic indicators allows for more sophisticated demand forecasting.

- Price Discovery: Real-time insights into crop conditions and potential supply shocks enhance price discovery mechanisms in futures markets.

- Sentiment Analysis: By aggregating data from multiple sources, including social media and news feeds, traders can gauge market sentiment more effectively.

These advanced analytics capabilities are enabling traders to develop more nuanced and effective trading strategies in the agricultural futures and options markets.

Precision Agriculture Tools: The Foundation of Modern Farming

Farmonaut’s precision agriculture tools are at the heart of the digital farming revolution. These tools not only enhance on-farm efficiency but also provide valuable data for futures trading and risk management:

- Satellite Imagery Analysis: High-resolution satellite images provide insights into crop health, growth patterns, and potential issues.

- IoT Sensor Integration: Real-time data from on-field sensors complement satellite data for a comprehensive view of farm conditions.

- AI-Powered Recommendations: Machine learning algorithms analyze vast datasets to provide actionable insights and recommendations.

- Precision Application: Variable rate technology enables precise application of inputs, optimizing resource use and crop yields.

These tools form the backbone of data-driven decision-making in modern agriculture, influencing both on-farm practices and market dynamics.

“Agricultural futures trading platforms now process over 1 million data points daily, revolutionizing risk management for modern farmers.”

Agricultural Options Trading: Strategies for the Digital Era

The advent of comprehensive data analytics has transformed agricultural options trading, offering new strategies and opportunities:

- Volatility Trading: Improved forecasting models allow traders to better anticipate and capitalize on market volatility.

- Spreads and Straddles: Data-driven insights enable more precise structuring of complex options strategies.

- Weather-Based Options: The integration of detailed weather data allows for the development of sophisticated weather derivatives.

- Crop-Specific Strategies: Tailored options strategies based on the unique characteristics and risks of specific crops.

Farmonaut’s data solutions provide the granular insights needed to refine these strategies and manage risk more effectively in the options market.

Explore Farmonaut’s API for advanced data integration

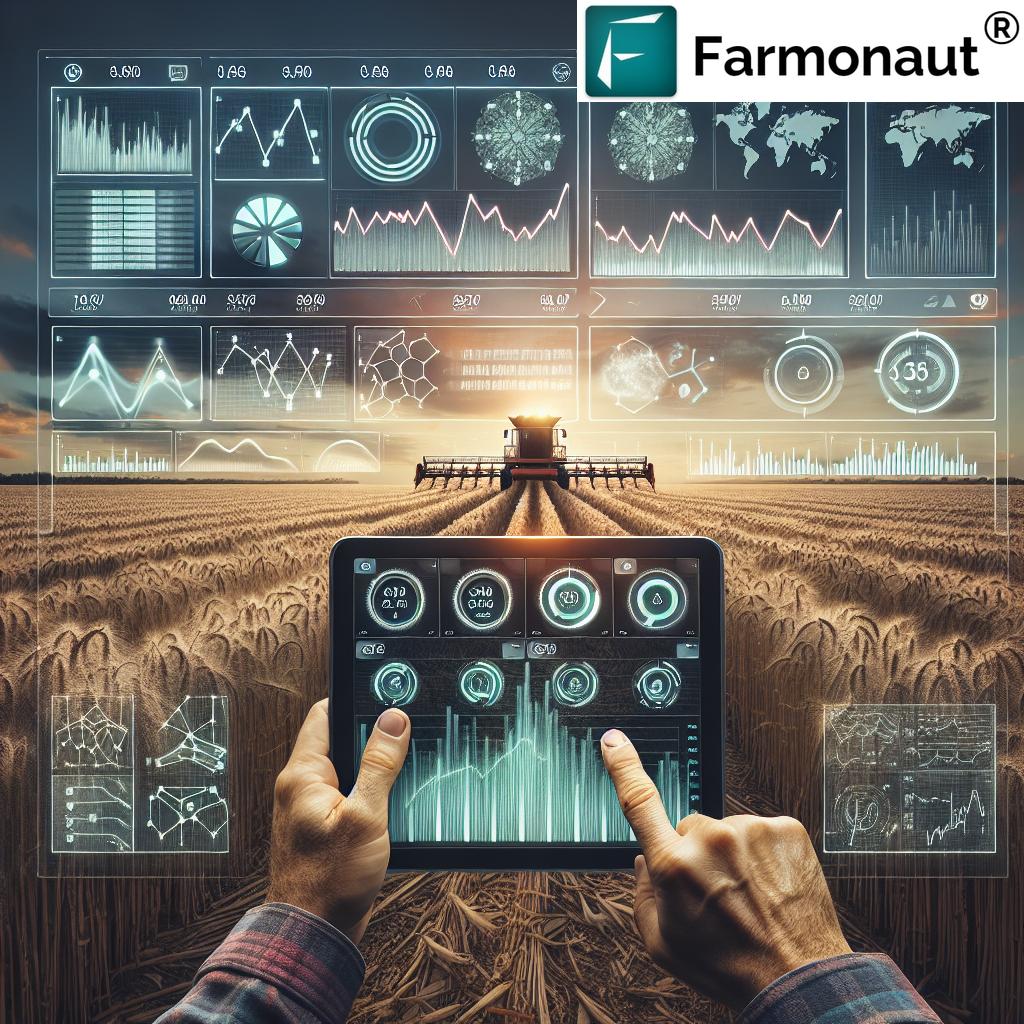

Farm Management Software: The Backbone of Agribusiness

Farmonaut’s farm management software is revolutionizing how agricultural businesses operate, providing a centralized platform for data management, analysis, and decision-making:

- Integrated Dashboard: A comprehensive view of farm operations, market data, and financial metrics.

- Resource Planning: Optimize the use of labor, machinery, and inputs across multiple farms or fields.

- Financial Management: Track expenses, revenues, and profitability at a granular level.

- Compliance and Reporting: Simplify regulatory compliance and generate detailed reports for stakeholders.

This software not only improves operational efficiency but also provides valuable data for futures trading and risk management strategies.

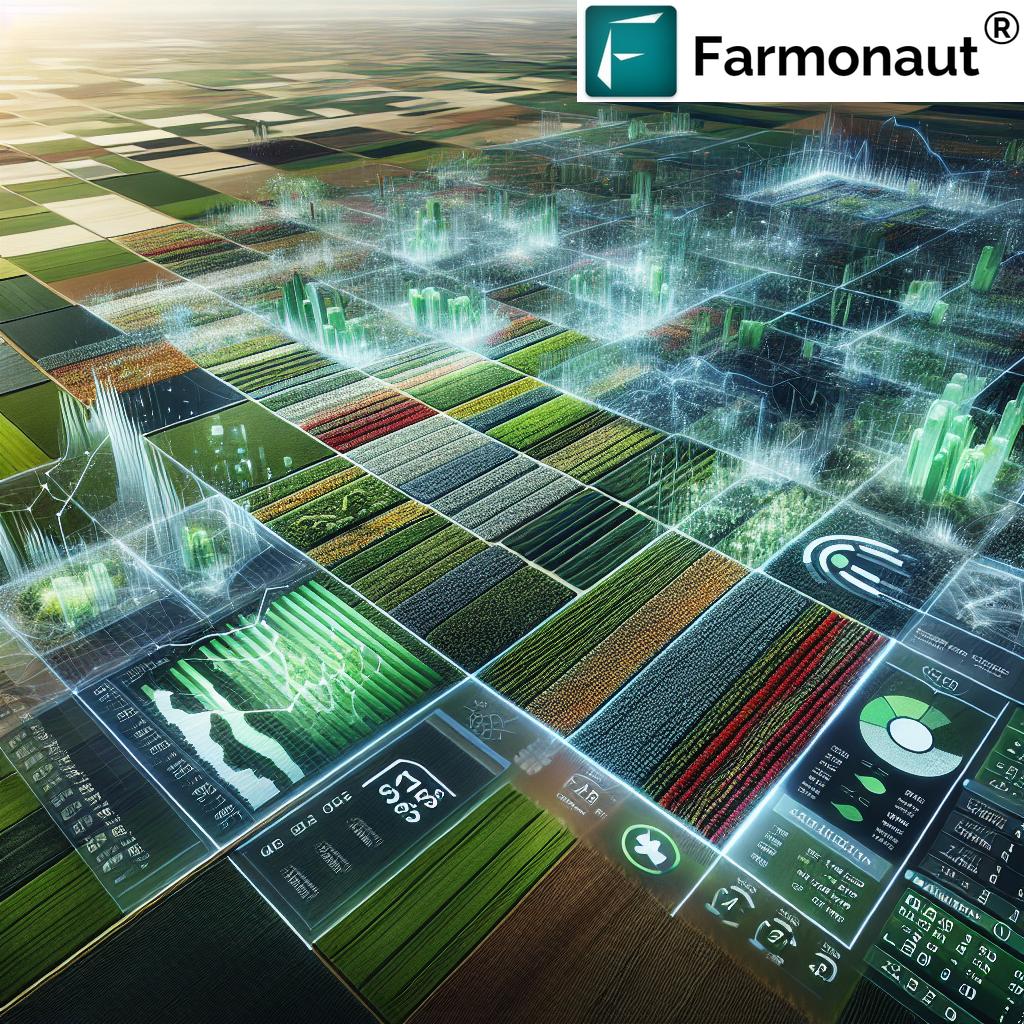

Grain Market Insights: From Field to Futures

Farmonaut’s solutions offer unprecedented visibility into the grain market, from crop conditions in the field to global supply and demand dynamics:

- Production Forecasts: Accurate yield predictions based on real-time crop health data and historical trends.

- Quality Assessment: Satellite-based analysis of crop quality factors that influence pricing.

- Storage and Logistics: Optimize grain storage and transportation decisions based on market conditions.

- Global Market Analysis: Integrate local production data with global market trends for a comprehensive view.

These insights enable more informed decision-making in grain futures trading and risk management.

Agricultural Derivatives: A New Landscape

The integration of precision agriculture data is reshaping the agricultural derivatives market:

- Custom Derivatives: Development of new derivative products based on specific crop metrics or regional data.

- Improved Pricing Models: More accurate pricing of derivatives using real-time and historical data.

- Risk Transfer Mechanisms: Enhanced ability to transfer specific agricultural risks through tailored derivative products.

- Market Transparency: Increased data availability leads to more transparent and efficient derivatives markets.

Farmonaut’s data solutions are instrumental in driving these innovations in the agricultural derivatives space.

Crop Yield Optimization: The Data-Driven Approach

Maximizing crop yields is crucial for both farmers and futures traders. Farmonaut’s solutions offer a data-driven approach to yield optimization:

- Precision Planting: Optimize planting decisions based on soil conditions, weather forecasts, and historical yield data.

- Nutrient Management: Tailor fertilizer applications to specific crop needs and soil conditions.

- Pest and Disease Control: Early detection and targeted treatment of pest infestations and diseases.

- Harvest Timing: Determine optimal harvest times to maximize yield and quality.

These yield optimization strategies not only benefit farmers but also provide valuable data for futures market analysis and risk assessment.

Access Farmonaut’s API Developer Docs for seamless integration

Portfolio Management in Agriculture: A Modern Approach

For investors and traders in agricultural futures and options, effective portfolio management is crucial. Farmonaut’s data analytics can enhance portfolio strategies in several ways:

- Diversification: Use data-driven insights to diversify across different crops, regions, and contract types.

- Risk Assessment: Evaluate and quantify risks associated with different agricultural investments.

- Performance Tracking: Monitor portfolio performance against benchmarks and adjust strategies accordingly.

- Scenario Analysis: Conduct “what-if” analyses using Farmonaut’s comprehensive dataset to test portfolio resilience.

By incorporating Farmonaut’s advanced analytics, portfolio managers can make more informed decisions and optimize their agricultural investments.

Real-Time Market Data: The Pulse of Agricultural Futures

Access to real-time market data is critical for success in agricultural futures trading. Farmonaut’s platform provides:

- Live Price Feeds: Up-to-the-minute pricing information for various agricultural commodities.

- Volume and Open Interest: Real-time data on trading volumes and open interest for futures contracts.

- Market Depth: Insights into order book depth and liquidity across different exchanges.

- News and Alerts: Instant notifications on market-moving events and breaking news.

This real-time data, combined with Farmonaut’s agricultural insights, provides traders with a comprehensive view of market conditions.

Historical Datasets: The Foundation of Market Analysis

While real-time data provides immediate insights, historical datasets are crucial for long-term analysis and strategy development. Farmonaut offers:

- Price History: Extensive historical price data for various agricultural commodities.

- Yield Data: Historical crop yield information across different regions and crop types.

- Weather Patterns: Long-term weather data to analyze seasonal trends and climate impacts.

- Market Events: Archive of significant market events and their impacts on futures prices.

These historical datasets enable traders to conduct thorough backtesting of strategies and identify long-term trends in the agricultural futures market.

Educational Resources: Empowering Traders and Farmers

To help users maximize the benefits of its platform, Farmonaut provides a wealth of educational resources:

- Tutorial Videos: Step-by-step guides on using Farmonaut’s tools and interpreting data.

- Webinars: Regular online sessions covering topics in precision agriculture and futures trading.

- Knowledge Base: Comprehensive articles and FAQs on agricultural technology and market analysis.

- Case Studies: Real-world examples of how Farmonaut’s solutions have been applied successfully.

These resources ensure that both novice and experienced users can effectively leverage Farmonaut’s advanced tools for their farming and trading activities.

Risk Management Simulators: Practice Makes Perfect

To help traders and farmers hone their risk management skills, Farmonaut offers advanced simulation tools:

- Market Scenario Simulator: Test trading strategies under various market conditions.

- Crop Management Simulator: Practice making farming decisions based on simulated crop data.

- Weather Impact Simulator: Analyze the potential effects of different weather scenarios on crop yields and futures prices.

- Portfolio Stress Test: Evaluate how different market events might impact an agricultural futures portfolio.

These simulators provide a risk-free environment for users to experiment with different strategies and improve their decision-making skills.

Regulatory Compliance and Reporting

Navigating the complex regulatory landscape of agricultural futures trading can be challenging. Farmonaut’s platform includes features to assist with compliance:

- Automated Reporting: Generate reports required by regulatory bodies with ease.

- Audit Trails: Maintain detailed records of trading activities and decision-making processes.

- Risk Disclosure: Ensure proper risk disclosure in line with regulatory requirements.

- Data Security: Robust security measures to protect sensitive trading and agricultural data.

These features help traders and agribusinesses stay compliant with regulations while focusing on their core activities.

The Future of Agricultural Futures Trading

As we look to the future, several trends are likely to shape the landscape of agricultural futures trading:

- Increased Data Integration: Greater integration of on-farm data with financial markets for more accurate pricing and risk assessment.

- AI-Driven Trading: Advanced AI algorithms leveraging agricultural data for automated trading strategies.

- Blockchain Technology: Increased use of blockchain for transparent and efficient settlement of futures contracts.

- Climate-Resilient Strategies: Development of new trading strategies and products focused on climate change adaptation.

Farmonaut is well-positioned to lead in these areas, continually innovating to meet the evolving needs of the agricultural and financial sectors.

Comparative Analysis: Agricultural Futures Risk Management Strategies

| Risk Management Strategy | Technology Integration | Potential Risk Reduction (%) | Implementation Complexity | Cost-Effectiveness (1-5) | Market Volatility Impact | Suitability for Farm Size |

|---|---|---|---|---|---|---|

| Traditional Hedging | Basic | 20-30% | Low | 3 | Medium | All Sizes |

| Options Trading | Moderate | 30-40% | Medium | 4 | High | Medium to Large |

| Weather Derivatives | High (Farmonaut’s weather data) | 25-35% | High | 3 | Medium | All Sizes |

| Precision Agriculture Data Analytics | Very High (Farmonaut’s core offering) | 40-50% | Medium | 5 | Low | All Sizes |

| Crop Diversification | Moderate (Farmonaut’s crop recommendations) | 20-30% | Medium | 4 | Low | Medium to Large |

| Forward Contracts | Low | 15-25% | Low | 3 | Low | All Sizes |

| Commodity ETFs | Low | 10-20% | Low | 4 | High | N/A (Investors) |

Conclusion: Embracing the Future of Agricultural Futures

As we’ve explored throughout this blog post, the integration of advanced data analytics and precision agriculture tools is revolutionizing the world of agricultural futures trading and risk management. Farmonaut stands at the forefront of this transformation, providing innovative solutions that bridge the gap between on-farm practices and financial markets.

By leveraging real-time data, historical insights, and cutting-edge technology, Farmonaut is empowering farmers, traders, and agribusinesses to make more informed decisions, optimize their operations, and navigate the complexities of agricultural futures markets with greater confidence.

As we look to the future, the continued evolution of these technologies promises to bring even greater efficiency, transparency, and resilience to the agricultural sector. Whether you’re a small-scale farmer looking to protect your harvest or a large institutional investor managing a complex portfolio of agricultural derivatives, the tools and insights provided by companies like Farmonaut will be instrumental in your success.

We invite you to explore Farmonaut’s suite of solutions and join us in shaping the future of agriculture and financial markets. Together, we can build a more sustainable, efficient, and prosperous agricultural ecosystem for generations to come.

FAQs

- How does Farmonaut’s technology improve agricultural futures trading?

Farmonaut’s advanced data analytics provide real-time insights into crop health, weather patterns, and market conditions, enabling more informed trading decisions and risk management strategies. - Can small-scale farmers benefit from Farmonaut’s solutions?

Yes, Farmonaut’s tools are designed to be accessible and affordable for farmers of all scales, helping them optimize crop yields and manage risks more effectively. - How does Farmonaut ensure the accuracy of its satellite-based crop monitoring?

Farmonaut uses high-resolution satellite imagery combined with advanced AI algorithms to provide accurate crop health assessments, which are continually validated and refined. - Is Farmonaut’s platform suitable for commodity traders who aren’t directly involved in farming?

Absolutely. Farmonaut’s market insights and data analytics are valuable for all participants in the agricultural futures market, including traders, analysts, and investors. - How does Farmonaut’s blockchain-based traceability solution work?

The blockchain solution creates an immutable record of a product’s journey through the supply chain, enhancing transparency and trust in agricultural commodities.