7 Shocking GIS Insurance Claims Tech Hacks for Agriculture

“Over 80% of leading agri-insurers now use GIS analytics to assess crop damage and streamline claims.”

- Understanding GIS in Agricultural Insurance

- The Power of GIS in Crop Insurance Claims Processing

- Comparison Table: GIS vs. Traditional Insurance Processes

- 7 Shocking GIS Insurance Claims Tech Hacks for Agriculture

- Advanced Technologies Empowering Precision Agriculture

- Critical Benefits of GIS for Insurers & Farmers

- Overcoming Challenges in GIS Insurance Integration

- Farmonaut: Leading the Precision Agriculture Revolution

- FAQ: GIS for Agricultural Insurance

Understanding GIS in Agricultural Insurance

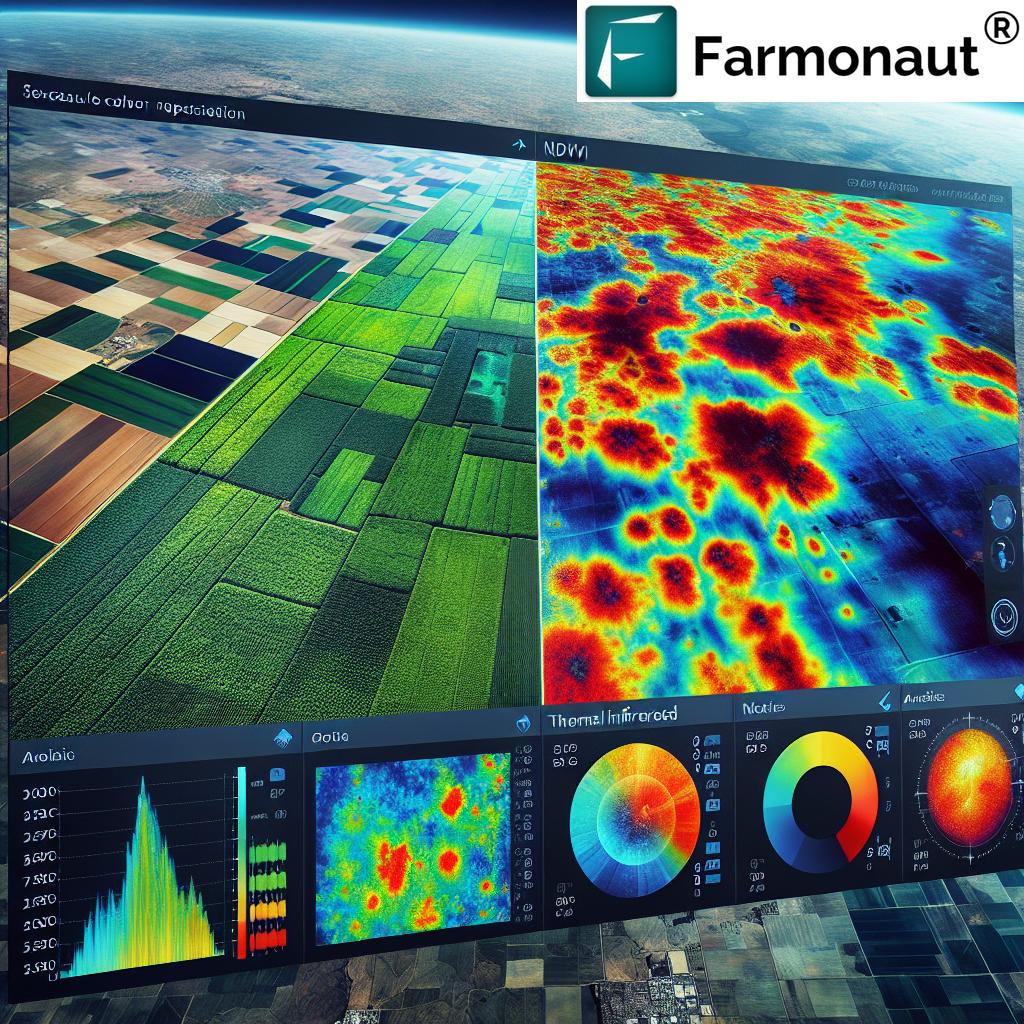

Geographic Information Systems (GIS) have fundamentally transformed the agricultural insurance sector, enabling us to blend spatial data with advanced analytics for superior risk assessment, claims processing, and even fraud detection. At its core, GIS is all about the collection, analysis, and visualization of geographic data. This makes it an invaluable tool for insurers and farmers navigating risks in agriculture.

By integrating satellite imagery with data on weather patterns, soil conditions, and more, GIS provides a rich, layered understanding of agricultural landscapes. This integration empowers us to assess risks with unmatched accuracy—an incredible leap over conventional field-based or manual approaches.

Let’s delve into the major components:

- Spatial Data Integration: GIS assimilates information from satellite images, field sensors, drone-acquired imagery, and historical data sources.

- Visualization: Interactive maps let us visualize risk zones, crop health, and weather patterns across diverse regions.

- Analysis: Layered spatial analysis helps identify high-risk areas prone to droughts, floods, pest infestations, or other threats.

- Actionable Insights: Real-time, accurate, and location-based insights drive informed policy development and intervention.

This holistic approach not only enhances transparency throughout the insurance process but also supports sustainable agricultural practices and better outcomes for farmers and insurers alike.

The Power of GIS in Crop Insurance Claims Processing

One of the most profound impacts of GIS and satellite technology has been on crop insurance claims processing. Traditionally, inspecting and verifying insurance claims required human adjusters to visit fields, often taking days—or even weeks—resulting in delays, additional administrative burden, and increased opportunity for error or fraud. The integration of gis and remote sensing in agriculture has changed this scenario dramatically.

- Time Efficiency: Satellite imagery for crop monitoring can quickly pinpoint areas impacted by natural disasters or adverse events, slashing on-site inspection time from days to mere hours.

- Enhanced Accuracy: Multispectral imagery and indices like NDVI allow us to assess crop health, extent of damage, and yield forecasts with precise, objective data.

- Risk Assessment in Agriculture: Historical GIS data and weather models enable us to analyze patterns and create better, more targeted policies.

- Transparency: GIS mapping ensures every step—from risk assessment through to payout—is documented and verifiable, increasing trust for both farmers and insurers.

The result? Improved efficiency, fairness, and fraud detection in the agricultural insurance sector.

Comparison Table: Traditional vs. GIS-Driven Insurance Processes in Agriculture

To truly appreciate the leap GIS offers, let’s compare traditional insurance processes with GIS-driven methods across key insurance stages:

| Insurance Process Stage | Traditional Method (Estimated Time/Cost/Accuracy) |

GIS Tech-Enhanced Method (Estimated Time/Cost/Accuracy) |

Key Benefits of GIS |

|---|---|---|---|

| Risk Assessment | Manual Field Surveys: 14-21 days; Cost: High; Accuracy: 65% |

Automated Spatial Analysis: 2 days; Cost: Moderate (shared platform); Accuracy: 90% |

Faster decisions; Higher precision; Consistent assessments across regions |

| Claims Verification | Field Visits; photos/manual data; 10-14 days; Cost: High; Accuracy: 70% |

Satellite Analysis; geotagged evidence; 2-3 days; Cost: Moderate; Accuracy: 90% |

Accelerated claims; Remote, verifiable data; Reduces disputes |

| Fraud Detection | Cross-verification by field officers; Time-consuming; Accuracy: 60% |

Spatial anomaly detection; pattern analysis; Accuracy: 92% Time: Real-time |

Early warning systems; Data-backed fraud investigation |

| Payout Duration | 3-4 weeks | 3-7 days | Faster relief for farmers; Lower administrative overhead |

“Satellite imagery can reduce agricultural insurance claim processing time by up to 60% compared to traditional methods.”

7 Shocking GIS Insurance Claims Tech Hacks for Agriculture

Let’s explore the seven most surprising and transformative GIS-powered innovations reshaping agricultural insurance claims—increasing accuracy, streamlining processing, and ensuring transparency for both insurers and farmers.

- Satellite-Based Rapid Damage Assessment

When natural disasters—like droughts, floods, or storms—strike, every minute lost is potential income lost for farmers. Satellite imagery for crop monitoring allows insurers to immediately analyze damage, pinpointing affected zones and prioritizing assistance. Advanced spatial analytics overlay event data (such as hurricane tracks) with field boundaries, slashing assessment time from weeks to hours.

- Faster response enables quicker payouts and immediate relief.

- Insurers can visualize disaster impact using interactive maps.

- Precision Risk Assessment through Multi-Layered GIS Analytics

By integrating satellite imagery, historical weather, soil moisture, and crop data in a single platform, GIS enables us to construct layered risk profiles for any region. These insights help insurers develop tailored, accurate policies that reflect the unique risks of diverse environments and microclimates.

- Identification of high-risk zones ensures proactive risk management.

- Improved policy development that can even adjust premiums by plot-specific risk scores.

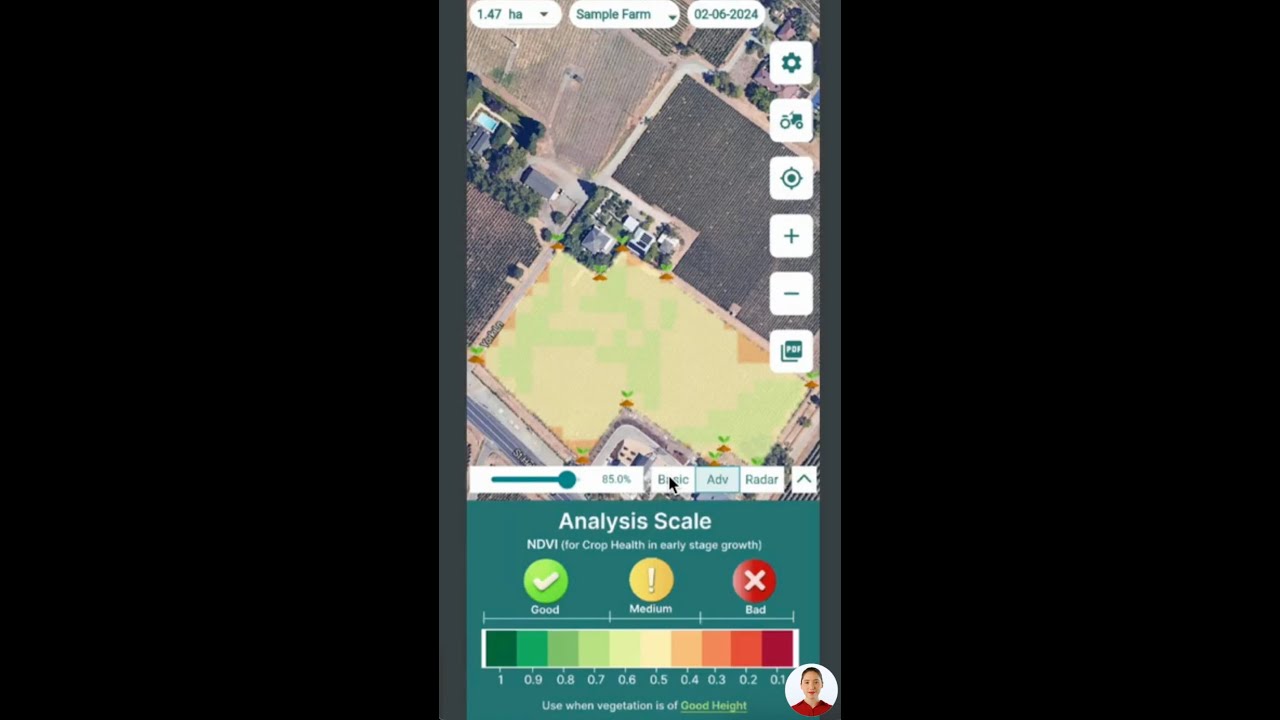

- Remote Sensing-Based Crop Health Monitoring

Continuous, large-scale crop monitoring is achieved through remote sensing in agriculture—especially via satellite and drones. Vegetation indices like Normalized Difference Vegetation Index (NDVI) provide objective readings on plant vigor, biomass, and moisture.

- Timely detection of disease, infestation, or nutrient deficits allows rapid intervention and reduced losses.

- Data-driven yield forecasting with GIS ensures that farmers and insurers are prepared for market fluctuations or potential shortfalls.

For more on how satellite technology drives monitoring, see our Large-Scale Farm Management solutions, used by agribusinesses for plantation monitoring, yield prediction, and best practice adoption.

- Automated, Transparent Claims Verification

Forget manual paperwork and field visits. GIS-based claims processing automates the verification of damage by cross-referencing reported events with satellite-derived evidence. This not only expedites the process but also increases objectivity and fairness.

- Reduces disputes between insurers and farmers.

- Boosts trust in the insurance system by offering transparent, geotagged digital evidence.

- Supports efficient Crop Loan and Insurance verification by providing satellite-based confirmation of field health and disaster impact.

- Spatial Data Analytics for Agricultural Insurance Fraud Detection

The risk of fraudulent claims, such as false yield reductions or acreage inflation, has long plagued the sector. GIS for agricultural insurance steps up by identifying anomalies between current and historical patterns—flagging suspicious practices.

- GIS analytics even detect “yield switching” or undocumented land use changes.

- Integration with blockchain-based traceability systems solidifies the evidence trail, protecting both farmers and insurers from manipulation.

- Dynamic Yield Forecasting and Real-Time Monitoring

Accurate yield forecasting with GIS is one of the most powerful uses of precision agriculture technology. Leveraging live spatial data, weather analytics, and NDVI, insurers can preemptively flag fields at risk and adjust coverage dynamically.

- This enables insurers to balance their portfolios, price policies competitively, and ensure preparedness for large-scale damage events.

- Farmers gain access to AI-driven advisories (see Jeevn AI overview below) for real-time decision support, cutting input costs and maximizing returns.

- Automated Disaster Response and Claims Prioritization

After catastrophe, rapid disaster response in agricultural insurance is critical. GIS maps dynamically rank affected zones, prioritize field visits, and expedite support where it is needed most—all through live dashboards.

- Enables insurers to allocate resources efficiently, reducing both time and cost burdens.

- Ensures no affected farmer is overlooked, improving both humanitarian and business outcomes.

Fleet management solutions from Farmonaut further optimize logistics for disaster response, ensuring the right support reaches the right areas when every minute counts.

Advanced Technologies Empowering Precision Agriculture

GIS doesn’t work in isolation. The best outcomes come from the integration of advanced digital systems, including:

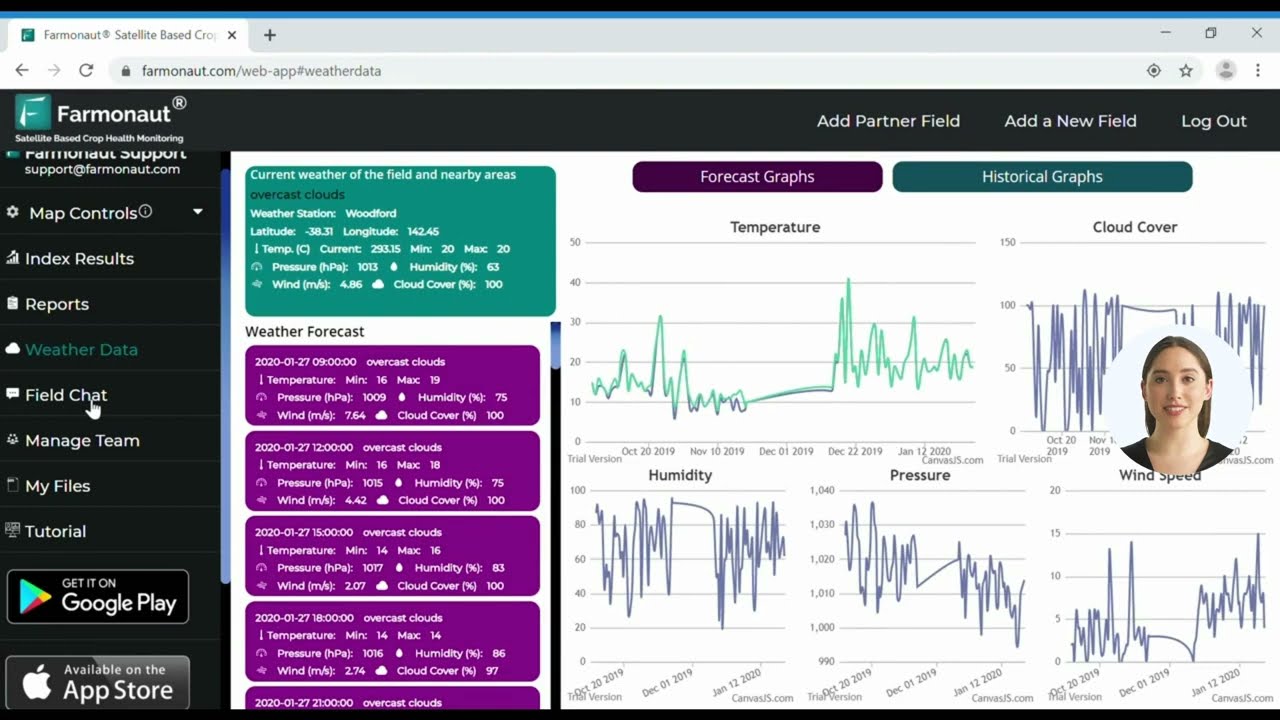

- Satellite Imagery: Offers real-time crop health insights, soil moisture metrics, and early signs of problems. Farmonaut’s platform sources multispectral imagery with frequent updates, making precision agriculture affordable and scalable.

- AI Algorithms: Predict threats and generate AI-based advisory systems for crops, irrigation, and resource management. Jeevn AI provides tailored forecasts and real-time risk alerts.

- Drones: Enhance GIS by providing ultra-high-resolution local imagery for assessments where satellites can’t see due to cloud cover or scale.

- IoT Sensors: Field data (like in-soil moisture, fertilizer, and irrigation patterns) is layered with satellite analytics for actionable interventions.

- Carbon Footprinting Tools: Monitor and reduce farm-based emissions, allowing for sustainable practices that also affect insurance risk profiles and incentives.

All these data streams are unified within GIS-enabled platforms (such as Farmonaut), enabling rapid spatial analysis and faster, better-informed decisions.

Critical Benefits of GIS for Insurers & Farmers

- Unparalleled Accuracy – Move from subjective, manual readings to precision, evidence-based analytics for every stage of insurance claim processing.

- Efficiency Gains – Slash timelines for risk assessment, claims processing, and payouts from weeks to days with GIS, remote sensing, and satellite platforms.

- Fraud Reduction – Automated anomaly detection and blockchain-enabled traceability offer transparency and virtually eliminate common fraud vectors.

- Sustainability Alignment – GIS allows for tracking emissions, resource use, and soil health, promoting climate resilience and in some cases opening doors to carbon credits. Read more about sustainable farming with precision analytics via Farmonaut’s Carbon Footprinting tools.

- Accessibility – Affordable platforms like Farmonaut democratize access to precision agriculture technology, allowing both smallholders and large agribusinesses to participate—no need for expensive hardware.

- Policy Innovation – Spatial evidence powers underwriting for personalized insurance products and microinsurance tailored to diverse farm environments.

- Transparency for All Stakeholders – GIS-powered visualization builds trust, as insurers, farmers, and even regulators work from the same objective, up-to-date data set.

Overcoming Challenges in GIS Insurance Integration

While the case for GIS for agricultural insurance is overwhelmingly positive, several hurdles require attention for universal adoption:

- Data Quality and Resolution: High-resolution satellite imagery and consistent ground-truth data are key. Areas with limited access to satellites or poor infrastructure may face challenges.

- Integration Costs: Upfront investment in technology (training, platform subscriptions) is required but is quickly offset by long-term cost savings and efficiency.

- Change Management: Effective onboarding and user education ensure that all stakeholders—insurers, agribusinesses, and farmers—can confidently interpret GIS analytics.

- Data Privacy: Clear rules and transparent protocols are necessary to balance the benefits of big data analytics with farmer privacy.

Progress is being made on all these fronts through the advancing ecosystem of affordable, user-friendly GIS applications—such as those provided by Farmonaut on Android, iOS, web, and via robust APIs for custom integration.

Developers and insurers can safely build on these tools thanks to comprehensive API developer documentation from Farmonaut, enabling seamless custom workflows.

Farmonaut: Leading the Precision Agriculture Revolution

Farmonaut is at the forefront of GIS, satellite imagery, and analytics integration for the agricultural sector. Our mission is to make precision agriculture affordable and accessible to farmers worldwide, whether they operate small, medium, or large holdings.

- Satellite-Based Crop Health Monitoring: Derive NDVI and multiple spectral indices for real-time monitoring and insights into vegetation health, soil moisture, and pest risks.

- AI-Powered Jeevn Advisory System: Delivers customized risk warnings, crop management plans, and yield-boosting tips from spatial data analytics.

- Blockchain Product Traceability: Generate tamper-proof records for every product batch, powering trust and reducing agricultural insurance fraud detection risks.

- Resource Management: Optimize fertilizer, irrigation, fleet, and operations for cost-efficiency and sustainability via integrated dashboards. Learn how Fleet Management and Carbon Footprinting features drive operational excellence.

- Accessible Globally: Use Farmonaut via web, Android, iOS, or API—at price points scalable for any farm size or agribusiness.

Our subscription-based model allows all users—from smallholder farmers to large agribusiness managers—to select the service tier that fits their needs and budget. Real-time updates, powerful dashboards, and AI-driven advisories mean that the benefits of GIS-driven agricultural insurance are now within reach for all.

See available packages and subscribe instantly:

FAQ: GIS for Agricultural Insurance

1. How does GIS improve risk assessment in agriculture?

GIS combines spatial data from satellites, weather history, and soil records to provide a detailed, layered analysis of agricultural fields. This makes it easy to identify high-risk zones, assess crop vulnerability, and develop insurance policies specific to each region’s environmental risks.

2. What kind of spatial data do insurers use to verify claims?

Insurers leverage satellite imagery, remote sensing indices (such as NDVI), and GIS-based field boundaries to cross-verify crop damage, disease spread, and compliance with insurance policy criteria. The result is faster, more accurate, and transparent claims processing.

3. How does GIS help detect fraud in agricultural insurance?

GIS analyzes historical and current spatial patterns to flag anomalies, such as inconsistent reported yields or changes in field boundaries. With the addition of blockchain traceability, insurers can ensure claims align with verified records, reducing the risk of fraudulent activity.

4. Can smallholder farmers access GIS-driven insurance technologies?

Yes! Platforms like Farmonaut are designed to be affordable and accessible. Through web, Android, iOS apps, or even API integration, all farm sizes can benefit from GIS, AI-driven insights, and advanced monitoring without high upfront costs or specialized hardware.

5. What is the future of GIS in agricultural insurance?

As satellite imagery, AI, and big data analytics become more advanced and affordable, GIS adoption in the agricultural insurance sector will accelerate. This promises more precise risk assessment, fraud resistance, faster claims, and sustainable farming—all backed by real-time spatial data.

Conclusion: A New Era for Crop Insurance with GIS-Powered Precision

The revolution brought by GIS, satellite imagery, and data analytics is undeniable. Empowering insurers with tools for risk assessment in agriculture, precision crop insurance claims processing, and fraud prevention, these technologies make sustainable and transparent farming a global reality. By embracing powerful GIS-enabled platforms such as Farmonaut, we’re not just safeguarding harvests—we’re building a resilient, data-driven future for farmers, agribusinesses, and the entire agricultural sector.

With GIS integration now more accessible and affordable than ever, there’s never been a better time for all stakeholders—from governments and financial institutions to individual farmers—to harness the power of spatial data. The path to efficiency, fairness, and sustainability in agricultural insurance runs through technology, and the journey is only beginning.