Acres Midwest: 8 Shocking Trends Changing Farmland!

“Over 60% of Midwest farmland is now owned by non-farming investors, reshaping regional agriculture dynamics.”

Introduction: The Heart of U.S. Agriculture

As we delve into the dynamic landscape of the Midwest, it’s impossible to overstate the region’s role as the “breadbasket of the world.” Encompassing Iowa, Illinois, Indiana, Michigan, Minnesota, Missouri, Ohio, and Wisconsin, the Midwest is not only a cornerstone of the United States’ economy but also a linchpin in global food production and natural resource management.

Today, we confront a wave of transformative trends—some promising, some deeply concerning—reshaping the fabric of midwest agricultural land, forestry, and farm ownership. From the steep decline of midsize farms to urbanization and the rise of non-operational investors, these shifts present both challenges and opportunities for the future of Midwest agriculture.

Midwest Farmland Trivia

“Midwest forestry loss accelerated by 15% in the last decade, impacting both land value and crop yields.”

The State of Midwest Agricultural Land

Agriculture remains the backbone of the Midwest economy. As of 2022, the region encompasses about 164.755 million acres of farmland. Iowa stands at the forefront with roughly 30.5 million acres, whereas Michigan, despite its size, holds the least at 9.9 million acres. This vast expanse is instrumental in cementing the Midwest’s reputation as the nation’s agricultural hub (iowafarmbureau.com).

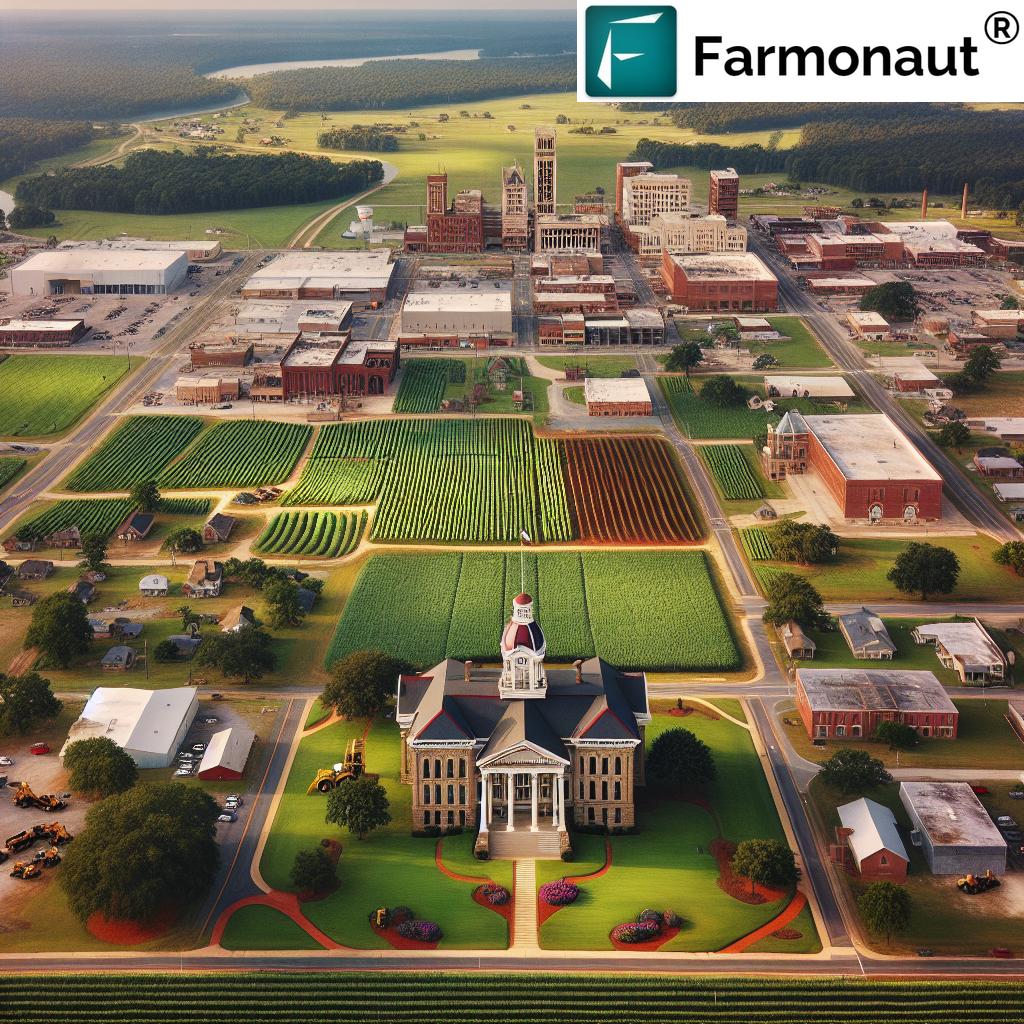

But the story of Midwest agriculture doesn’t end with the present. Over the past two decades, a tangible shift has occurred: the region lost over 1.59 million acres, primarily due to urbanization and infrastructure expansion. Over half of this loss stems from conversion to developed land—a trend with lasting implications (farmdocdaily.illinois.edu).

8 Shocking Midwest Farmland Trends

Let’s explore the 8 most crucial trends that are transforming farmland in the Midwest!

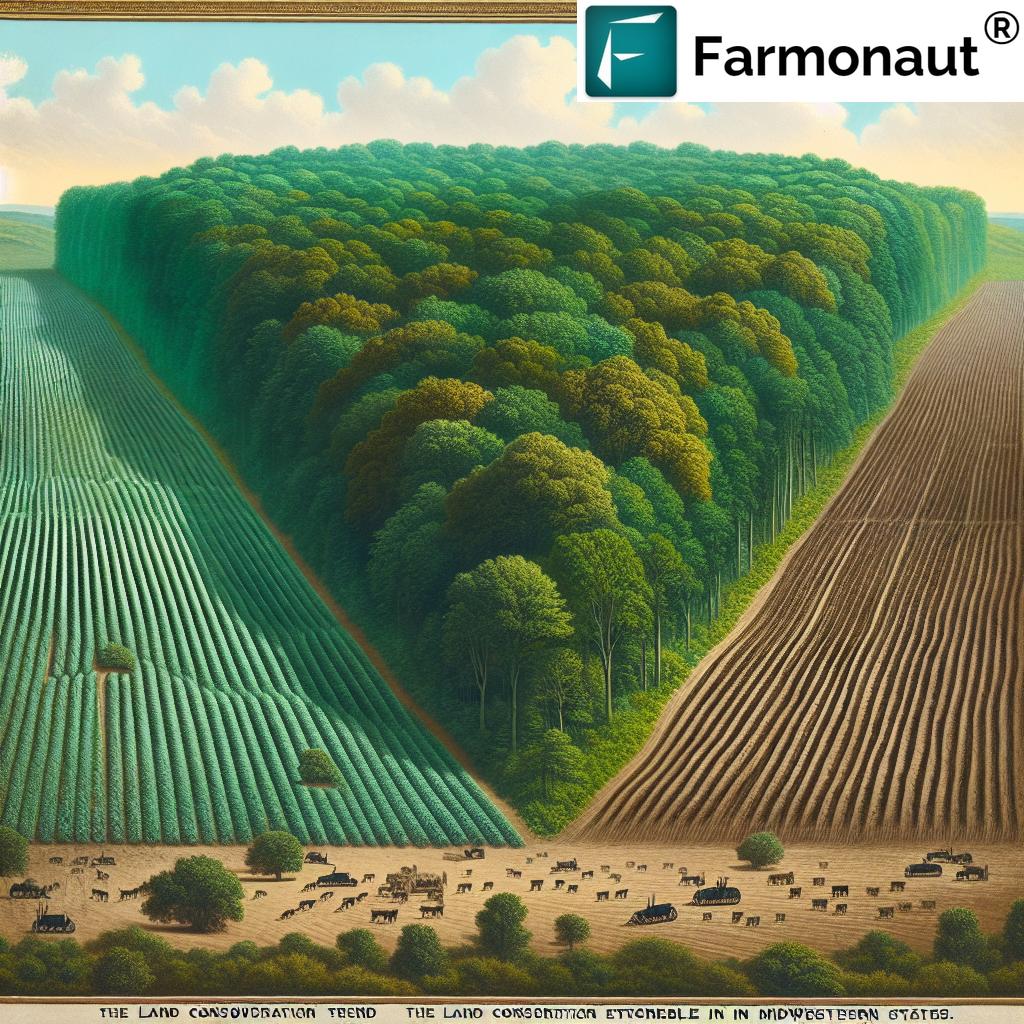

1. Farmland Consolidation in the Midwest

One of the most defining changes is the trend toward fewer, larger farms. Over four decades, nearly 700,000 midsize farms (50-999 acres) disappeared nationally; 230,000 of these losses were from the Midwest alone. Large operations now control immense swathes of acreage, making it increasingly challenging for new and young farmers to enter the industry (ucsusa.org).

- 🟢 Opportunities: Economies of scale, mechanization, efficient resource management

- 🛑 Challenges: Barriers for small/midsize farms, higher land prices, riskier farm succession

2. Declining Farmland Acreage

Between 2001 and 2021, Midwest agricultural land declined from 150.3 million to 148.7 million acres, with 1.6 million acres lost—55% to development. Urban pursuits (urbanization and infrastructure) are the key drivers, especially near metropolitan nodes, causing concerns over the region’s food security and rural economies.

3. Midwest Farmland Conversion to Development

The conversion of prime farmland for housing and commercial uses remains stark. For example, counties surrounding Chicago, St. Louis, and Minneapolis experience aggressive expansion at the cost of valuable farmland (drgnews.com). This trend not only impacts local food production but shifts the fundamental economies of small towns.

4. Increasing Non-Operator (Investor) Ownership

In today’s Midwest, almost 37% of agricultural land is owned by non-operators—the highest of any U.S. region. In Iowa, that figure jumps to 41%. Investors, including pension funds and real estate trusts, see farmland as a stable asset, fundamentally reshaping ownership patterns and midwest farmland trends. Rental agreements help farmers expand operations but often create instability for those lacking secure tenure.

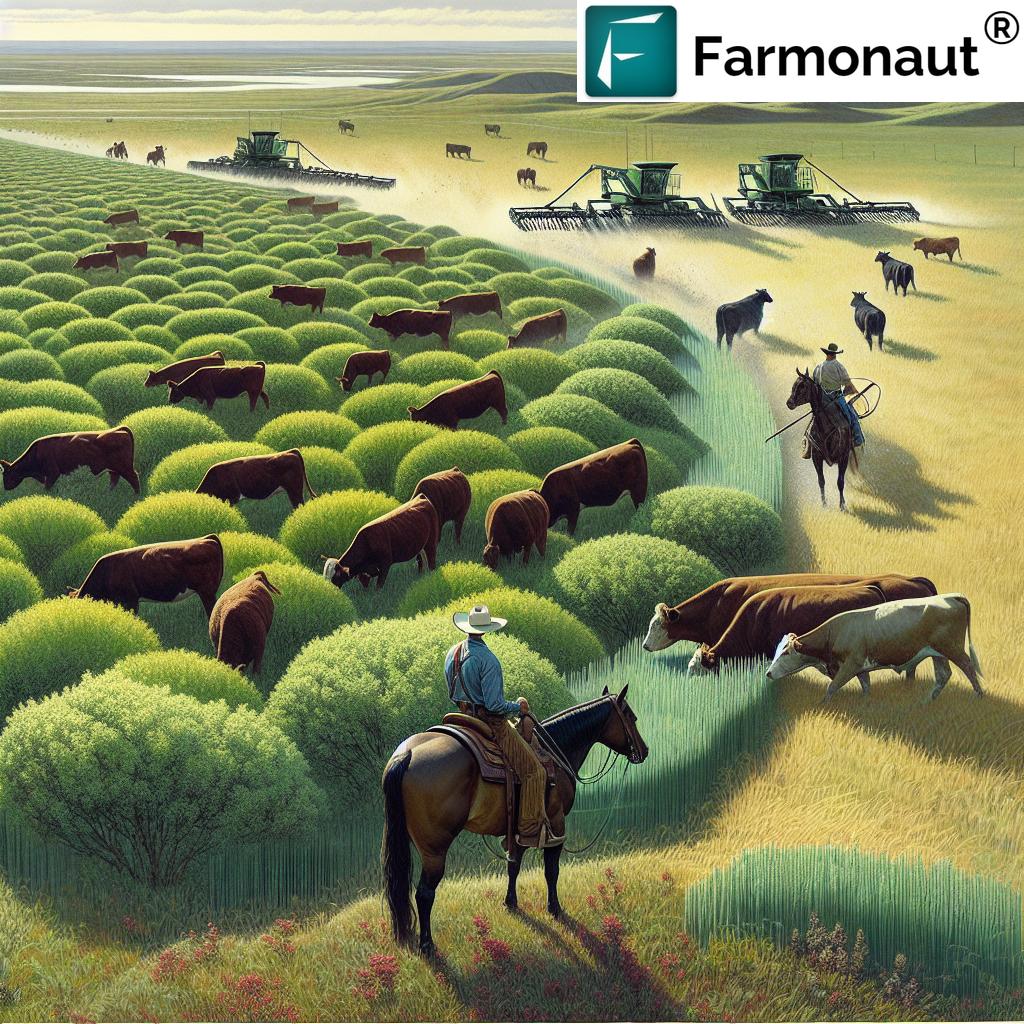

5. Rising Midwest Farm Rental Rates & Increased Competition

The spike in midwest farm rental rates and growing interest from institutional investors have put significant upward pressure on land prices. As a result, local farmers are often priced out, especially in counties where farmer numbers decline and land values have increased by as much as 31% in five years (investigatemidwest.org).

- 🔺 Opportunities: Rental flexibility, access to larger tracts

- ⬇️ Challenges: Short-term leases, lack of control over major decisions, instability for farm families

6. Declining Forestry and Ecological Pressure

Our forests in the Midwest are shrinking, with a 15% decline in the last decade. While Michigan and Wisconsin remain leaders in forested areas, the loss affects biodiversity, reduces timber resources, and disrupts vital ecological services such as carbon sequestration, wildlife habitat, and recreational opportunities.

7. Technology Adoption & Sustainable Agriculture in the Midwest

Advancements in technology, especially satellite-based monitoring and AI tools, are enabling farmers to optimize resource use, enhance yields, and implement more resilient, sustainable practices. Apps like Farmonaut, leveraging real-time crop health data and climate risk advisories, empower us to manage larger farms efficiently and reduce input costs. Explore Farmonaut’s carbon footprinting tool for actionable steps towards smarter, eco-friendly farming.

8. Changing Demographics & Succession Challenges

Aging farmers and the outflux of younger generations drive concerns about succession planning and long-term management. As non-owner landlords increase, fewer farm families pass down land, resulting in a more corporate, less family-focused industry. Addressing these implications is crucial for shaping the future of Midwest agriculture.

Agricultural Land Ownership in the Midwest

The Midwest displays a distinct pattern of agricultural land ownership. About 37% of farmland is rented from non-operating owners, surpassing rates in any other U.S. region. In states like Iowa, nearly 41% of farmland is under rental agreements. This reflects a broader trend of investors, retired farmers, and corporate entities buying land for financial stability (iowa farmland ownership).

- Farmers rely on rented acres to gain scale without the debt associated with purchasing land outright.

- Non-operator ownership increases flexibility but can shorten planning horizons or make succession tricky.

- Main implications: Rental uncertainty, reduced farm family ownership, and complex succession planning.

Farmonaut’s satellite-based monitoring can be particularly beneficial for owners (both private and corporate) in verifying land use, crop status, and environmental compliance—especially in rented arrangements. Discover how Farmonaut helps streamline crop loan and insurance verification.

Forestry in the Midwest: A Vital Resource Under Pressure

The Midwest’s forests function as critical reservoirs for timber, wildlife, and recreation, in addition to their ecological services. Michigan and Wisconsin lead in forested land, but precise data on total acreage remains elusive due to changing definitions and measurement techniques. However, what’s clear is the downward trend: 15% forestry loss across the region in the last decade. The resulting impact disrupts timber availability, reduces recreational spaces, and lowers crop pollination—affecting both per-acre land value and the sustainability of local economies.

- Forestry contributes to jobs, eco-tourism, and ecosystem stability across the Midwest.

- Increasing conversion to development is fragmenting forests and wildlife corridors.

- Sustainable forestry management, supported by high-resolution satellite imagery, is increasingly essential.

Explore Farmonaut’s plantation, crop & forest advisory features for comprehensive map-based management—helpful for both farmers and institutions focused on sustainable forestry.

Comparative Trend Table: Midwest States

| State | Avg. Farmland Price per Acre (2024) | Ownership (% Private / Corporate / Public) | Forestry Land (%) | Main Challenge |

|---|---|---|---|---|

| Iowa | $11,200 | 58 / 38 / 4 | 7% | Urbanization, investor competition |

| Illinois | $8,900 | 65 / 30 / 5 | 14% | Farmland conversion, soil health |

| Indiana | $8,000 | 63 / 33 / 4 | 18% | Forest loss, aging farmers |

| Ohio | $7,800 | 67 / 29 / 4 | 27% | Development, non-farmer ownership |

| Minnesota | $6,800 | 61 / 36 / 3 | 34% | Urbanization, forest fragmentation |

| Michigan | $5,800 | 62 / 32 / 6 | 53% | Forest loss, rental instability |

| Missouri | $5,650 | 69 / 27 / 4 | 34% | Farm consolidation, succession |

| Wisconsin | $5,100 | 70 / 25 / 5 | 46% | Aging owners, forest management |

Technology: Transforming Farm Management in the Midwest

The ongoing revolution in farm management is increasingly powered by satellite imagery, artificial intelligence, remote sensing, and analytics platforms. We see leading-edge tools like Farmonaut making precision farming affordable and accessible for farms of all scales across the Midwest and globally.

- Satellite-Based Crop Monitoring: Farmonaut uses data from multispectral satellites to track vegetation health (NDVI), surface moisture, and yield estimates—helping optimize irrigation, fertilization, and timely response to threats.

- AI-Driven Farm Advisory: The Jeevn AI system delivers tailored advisories on crop management, weather forecasts, and best practices based on real-time satellite and historical data.

- Blockchain Traceability: Ensuring transparent, tamper-proof food production chains from Midwest fields to global markets. Learn more about Farmonaut’s traceability solution here.

- Resource & Fleet Management: Users can efficiently dispatch machinery, track field activity, and lower operational costs. Discover the benefits of Farmonaut Fleet Management.

- Environmental Impact: With Farmonaut’s Carbon Footprinting, we can monitor greenhouse emissions—a vital step towards sustainable agriculture midwest.

For developers and businesses, Farmonaut also offers full API access to satellite and weather data (Farmonaut Satellite API), with comprehensive information available in the developer docs.

Challenges and Opportunities Facing Midwest Farmers

What Are the Core Challenges?

- High Competition: Large institutional investors bidding up land prices make acquisition difficult for traditional farm families.

- Land Conversion: The ongoing loss to developed land threatens both food output and the rural heritage of many Midwest towns.

- Uncertain Tenure: Rental dependence can mean unpredictable annual costs, lost land, or sudden sale by non-operator owners.

- Succession Planning: Demographic shifts, with more aging operators and non-farming heirs, complicate intergenerational transfer.

- Forestry Decline: Urbanization, sprawl, and climate change are accelerating loss, threatening biodiversity and income from timber and eco-tourism.

What Opportunities Are Emerging?

- Precision Technology: Remote-sensing, AI-driven advice, and fleet/resource management lower input costs and improve yields—crucial for maintaining competitiveness. Platforms like Farmonaut have democratized access to high-level analytics for Midwest farmers.

- Access to New Financing: Satellite-based verification supports easier and more secure crop loan and insurance processes. (See how Farmonaut supports financing and risk reduction)

- Sustainable & Profitable Forestry: With real-time monitoring, sustainable timber management can help offset losses and open eco-tourism or carbon credit opportunities in the region.

- New Data Streams: Use cases range from environmental compliance to optimizing cropping patterns—delivering long-term resilience and higher returns per acre.

Embracing the Farm of the Future

It’s clear that the future of Midwest agricultural land will be shaped by our willingness to embrace new management strategies, sustainable practices, and technology-driven solutions. Whether tackling threats of farmland conversion, rapid consolidation, or shifting ownership patterns, the answer lies in adapting—together.

Farmonaut Subscription Plans

Explore accessible and scalable satellite, AI advisory, and blockchain solutions tailored for every size of farm and agribusiness in the Midwest—backed by real-time, actionable insights and farm management features.

FAQ: Midwest Farmland, Forestry & Technology

Q: What is driving the rapid consolidation of Midwest farms?

A: Key factors include economies of scale, increasing machinery costs, and the entrance of large investment firms, resulting in fewer but larger farming operations. This trend is particularly evident in the Midwest.

Q: How much agricultural land in the Midwest is lost to urban development?

A: From 2001 to 2021, 1.6 million acres of Midwest farmland was lost, with most converted to developed land due to urban expansion and infrastructure projects.

Q: Why is non-operator ownership a concern?

A: It leads to a high proportion of rented land and less security for operating farmers. Instability arises from short-term leases, resale risk, and diminished farm family ownership.

Q: How is technology helping Midwest farmers?

A: Platforms like Farmonaut provide affordable, real-time satellite monitoring, AI-driven advisory, and blockchain-based traceability, allowing for efficient farm management, better resource allocation, and sustainable practices.

Q: What sustainable practices are being adopted in the Midwest?

A: Sustainable agriculture midwest includes crop rotation, reduced tillage, precision irrigation, monitoring of carbon emissions, and improved biodiversity, all increasingly supported by data-driven tools.

Q: Where can I find more information on Midwest farm management technologies?

A: Visit the Farmonaut app and web portal for detailed information on their satellite-based farm management, or explore their API platform and developer docs for integration possibilities.

Conclusion: Navigating the Future of Midwest Farmland

Midwest farmland is not just ground beneath our feet; it’s the beating heart of the nation’s food system and a global model for agricultural success. Yet, this region faces profound challenges: consolidation, urbanization, forest loss, and aging demographics—all complicated by shifting ownership patterns and intense competition.

However, with commitment to sustainable agriculture, adoption of advanced farm management technologies, and sound policy frameworks, we have the ability—and duty—to safeguard the Midwest’s agricultural heritage for generations to come. Let’s use tools like Farmonaut to unlock data-driven opportunity, strengthen resilience, and ensure every acre of midwest farmland remains productive, sustainable, and ready to feed the world.