Kentucky Corn and Soybean Farmers: 7 Key Impacts of Trade and Floods

“In 2019, Kentucky’s corn planting was delayed by over 30% due to severe spring flooding and trade tensions.”

Introduction

In the heart of the Bluegrass State, kentucky farmers corn and soybeans stand as resilient stewards of America’s food supply. Each spring, as we prepare our fields for planting, we face a daunting confluence of historic floods, volatile trade policies, and global market shifts. Recent years, and notably the tumultuous spring of 2024, have forced us to adapt faster than ever, as Ohio River Valley farms confront delayed corn and soybean planting and unpredictable exports to China.

With the trade war impact on crop prices and relentless flooding effects on Kentucky agriculture, our economic and operational realities have changed overnight. This piece explores the seven key impacts these forces exert on Kentucky’s farmers, offering vital insights into industry trends, adaptive strategies, and the advanced technologies that can help us navigate these challenges.

Join us as we delve into the data, the lived experience of farm life near the Mississippi and Ohio rivers, and the tech-based solutions leading us toward resilience in an era where both climate and commerce are in flux.

Kentucky Corn and Soybean Farmers: Regional Overview

Kentucky’s location at the southeastern edge of the U.S. Midwest farm belt positions our fields within a dynamic yet vulnerable agricultural landscape. We farm the southeastern edge of the Midwest, navigating the rolling hills, fertile loams, and alluvial deposits that define the Bluegrass State.

According to the latest USDA crop planting forecast, despite contributing a smaller but significant share to the nation’s total corn (1.5%) and soybean (2.2%) production, Kentucky farmers are integral to U.S. grain markets and tariffs discussions. Our proximity to the Ohio and Mississippi rivers provides critical access to grain elevators—the launching point for our crops’ journey downriver to the Gulf Coast and onward toward global customers.

We routinely implement complex rotations—corn, winter wheat, and “double crop” soybeans—that help maximize yields and sustainability over two-year cycles. The timing of spring planting and harvest across these crops is critical, and any disruption, whether from major rains or global tariffs, can ripple through both our local economy and U.S. exports at large.

Our fields, flanked by the river valleys and bordered to the north and west by major trade arteries, are both opportunity and risk—especially as historic floods meet international trade headwinds.

U.S.-China Trade Wars and Global Markets: A Double Blow

The trade war impact on crop prices cannot be overstated. As one of the world’s largest soybean exporters, the United States once shipped vast volumes to China, the globe’s top importer. However, U.S.-China tariffs and retaliation since 2018 have fundamentally altered these markets. When China responded to U.S. trade actions, it imposed a 125% duty on American agricultural goods, effectively halting imports and shrinking a market that once consumed over 60% of all U.S. soybean exports.

Within Kentucky, these disruptions have slashed both acreage planted and reduced profits, undermining rural livelihoods. Many farmers—long supporters of pro-trade policies—are forced to weigh loyalty against the practical need for profitable markets and stability.

After the initial trade shock, new planting forecasts from the USDA show that many are shifting more corn acres at the expense of soybean seedings, hoping to chase better returns. Yet, the situation remains deeply uncertain, with global demand dynamics and export outlets now more complex than ever.

- Global demand for US crops: is still heavily influenced by Chinese import policies, despite the growth of alternative buyers.

- Tariffs and trade unpredictability: continue to weigh on planting decisions, directly influencing income and farm survival.

“U.S. soybean exports to China dropped by nearly 50% during the trade war, heavily impacting Kentucky farmers’ revenues.”

Spring Flooding and Planting Challenges in Kentucky

On the ground, the flooding effects on Kentucky agriculture manifest in tangible, costly delays and damage. The spring of 2024 echoed historic events, with up to 15 inches of rain falling in some areas over just a few days in April. This relentless onslaught left fields waterlogged, equipment stranded, and the seasonal rush to plant corn and soybeans profoundly disrupted.

For our Kentucky farmers corn and soybeans, the timing is critical—every lost day diminishes yield potential and tightens the window for sequential wheat and double crop soybean rotations. Many acres remain inaccessible weeks after the storms, while others require extensive rehabilitation before even considering seeding.

- 2019 precedent: saw Kentucky corn plantings delayed by over 30%, highlighting the recurring nature of these challenges.

- Mississippi and Ohio Rivers: floodplain farms face above-average risk, given their exposure to upstream rainfall and runoff.

Shifts in the USDA crop planting forecast now indicate only 12% of the state’s corn crop was planted mid-April, compared to an average of 23%. For soybeans, it stands at just 7%—further emphasizing the severe bottleneck.

7 Key Impacts of Trade and Floods on Kentucky Corn and Soybean Farmers

Let us break down the seven primary ways in which trade disruptions and spring flooding have collectively altered the trajectory of Kentucky’s farm economy. From planting decisions to export volumes, each factor reflects the realities on the ground.

1. Delayed Planting Dates

The fundamental impact of persistent spring rains and field flooding is the direct delay in corn and soybean planting. As of mid-April 2024, just 12% of Kentucky’s corn crop had been seeded, vs. a five-year average of 23%. Such delays cascade throughout the season:

- Shorter growing window for corn and soybeans; critical vegetative periods are compressed.

- Reduced opportunity for sequential wheat and double crop soybean rotations.

- More acres left unplanted or converted at the last minute.

Our fields in the Western regions and Ohio River Valley are especially vulnerable, given the low-lying topography and floodplain exposure.

2. Reduced Yields

When planting slips past optimal dates, even a healthy stand is less likely to reach its potential. Flooded fields suffer from:

- Soil compaction and crusting: roots struggle to penetrate.

- Oxygen deprivation for seedlings and young plants.

- Higher susceptibility to spring fungal diseases and pest outbreaks due to prolonged soil moisture.

The result is measurably reduced yields per acre—with some farms, especially along rivers, expecting up to 15% lower yields compared to pre-flood years.

3. Market Price Changes

The trade war impact on crop prices has been direct and relentless. When China reduced its imports of U.S. soybeans by half, prices plummeted, and a global oversupply developed:

- June 2018: Soybean prices fell from $10.50 to under $9 per bushel within weeks of tariffs.

- Corn prices also weakened, despite growing demand elsewhere.

- Market volatility increased; farmer income instability soared.

For Kentucky, where operational costs already outstrip national averages due to smaller scale and field fragmentation, these price drops are especially damaging.

4. Export Disruptions to China

The U.S. crop exports to China have never recovered to pre-trade war levels. For Kentucky farmers, this translates into:

- Lost access to the world’s single largest soybean market.

- Build-up of grain supplies in elevators along the Ohio and Mississippi rivers—reducing cash flow and inflating storage costs.

- Difficulty finding alternative outlets for the region’s unique crop qualities.

5. Crop Switching and Planting Decisions

Faced with planted acres at risk from flooding and lost soybean demand, Kentucky’s farmers are adjusting their planting strategies. The 2024 USDA forecast demonstrates:

- 17% more corn acres planned—farmers hope for higher corn returns.

- 10% reduction in soybean seedings due to market pressure and late-season risk.

- A marked tendency to “switch” acres from corn to soybeans if wet conditions persist into mid-May, since soybeans can be seeded later.

Such reactive shifts increase risk but are often the only option to salvage a tough year.

6. Increased Input and Recovery Costs

Each flood event or spring washout brings fresh expenses, including:

- Labor and machinery costs for cleaning and reconditioning fields.

- Potential double or triple field operations if slogging through wet clay causes ruts, or if replanting is needed.

- More intensive fertility and pest management due to disrupted residue cycles and higher disease risk.

For instance, hundreds of dollars per acre might be spent just to clear debris before planting, as seen on large western Kentucky farms.

7. Long-Term Soil and Field Health

Perhaps most overlooked, but equally important, are the cumulative effects of repeated flooding and rapid planting:

- Soil structure degradation: silt and debris deposit atop valuable topsoil, harming fertility.

- Changes in soil organic matter and carbon content, impacting yields in coming seasons.

- Long-term erosion threatens the overall productivity of the ohio river valley farms.

Sustainable management is now not just about this year’s crop, but about building resilience for years to come.

Comparative Impact Table: Trade and Flooding on Kentucky Crops

| Impact Area | 2018 (Pre-Trade War & Flood) | 2024 (Current Estimate) | Percentage Change (%) |

|---|---|---|---|

| Delayed Planting Dates | ~10% acres delayed | ~35% acres delayed | +250% |

| Reduced Yields | Avg. 170 bu/acre (corn) 55 bu/acre (soybeans) |

Avg. 152 bu/acre (corn) 48 bu/acre (soybeans) |

-10% to -13% |

| Market Price Changes | $10.50/bu (soybeans) $4.10/bu (corn) |

$9.00/bu (soybeans) $3.65/bu (corn) |

-14% (soy), -11% (corn) |

| Export Volume to China | 27 million bushels (soybeans) | 14 million bushels (soybeans) | -48% |

| Corn Soybean Planting Mix | Stable (Corn: 1.65M ac, Soy: 1.55M ac) |

Corn: 1.93M ac Soy: 1.39M ac |

Corn +17%, Soy -10% |

| Input & Recovery Costs | $550/acre (avg) | $650/acre (avg) | +18% |

| Soil & Field Health Metrics (erosion, compaction) |

Low-moderate risk | Moderate-high risk | ↑ Risk |

Farmonaut: Tech Solutions for Modern Kentucky Agriculture

Facing these multifaceted challenges, Kentucky’s corn and soybean farmers require reliable, data-driven decision tools. Farmonaut offers advanced agricultural technology designed to put such actionable insight at every grower’s fingertips.

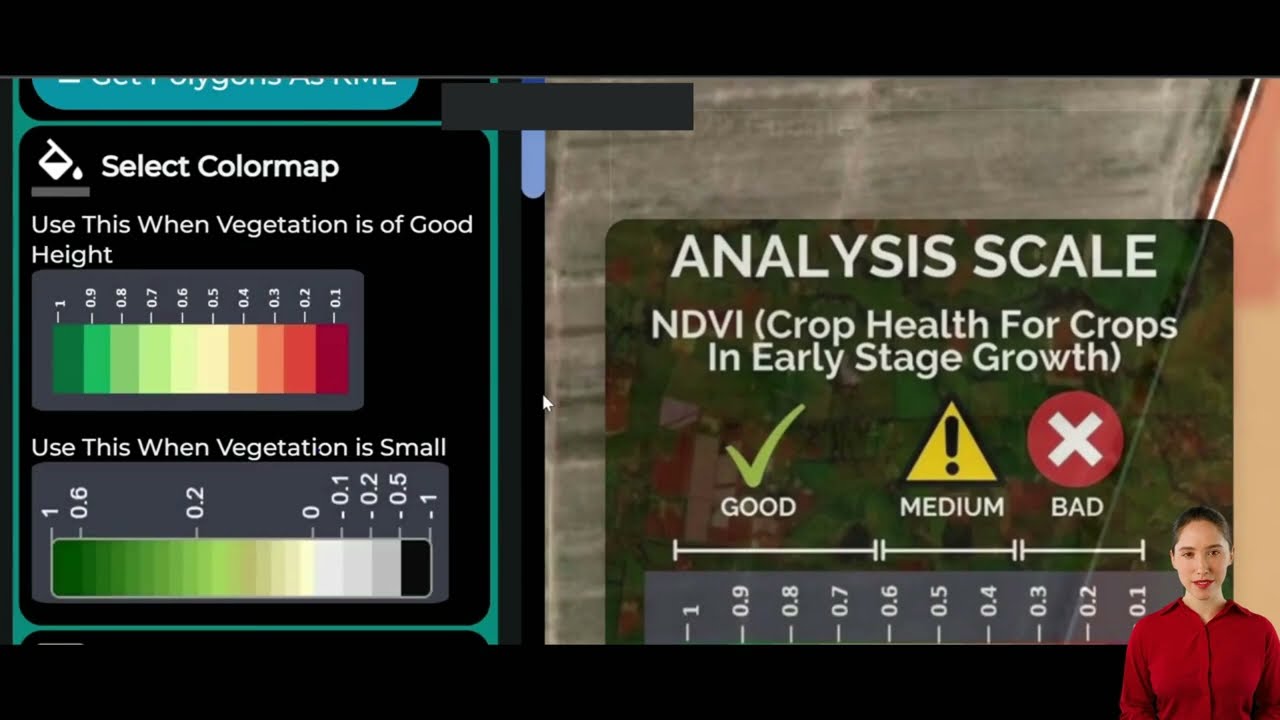

- Satellite-Based Crop Health Monitoring: Leveraging multispectral imagery (NDVI, soil moisture detection), Farmonaut empowers farmers to monitor crops in real time, pinpointing water stress, nutrient needs, and pest pressures—even on waterlogged or flood-prone fields.

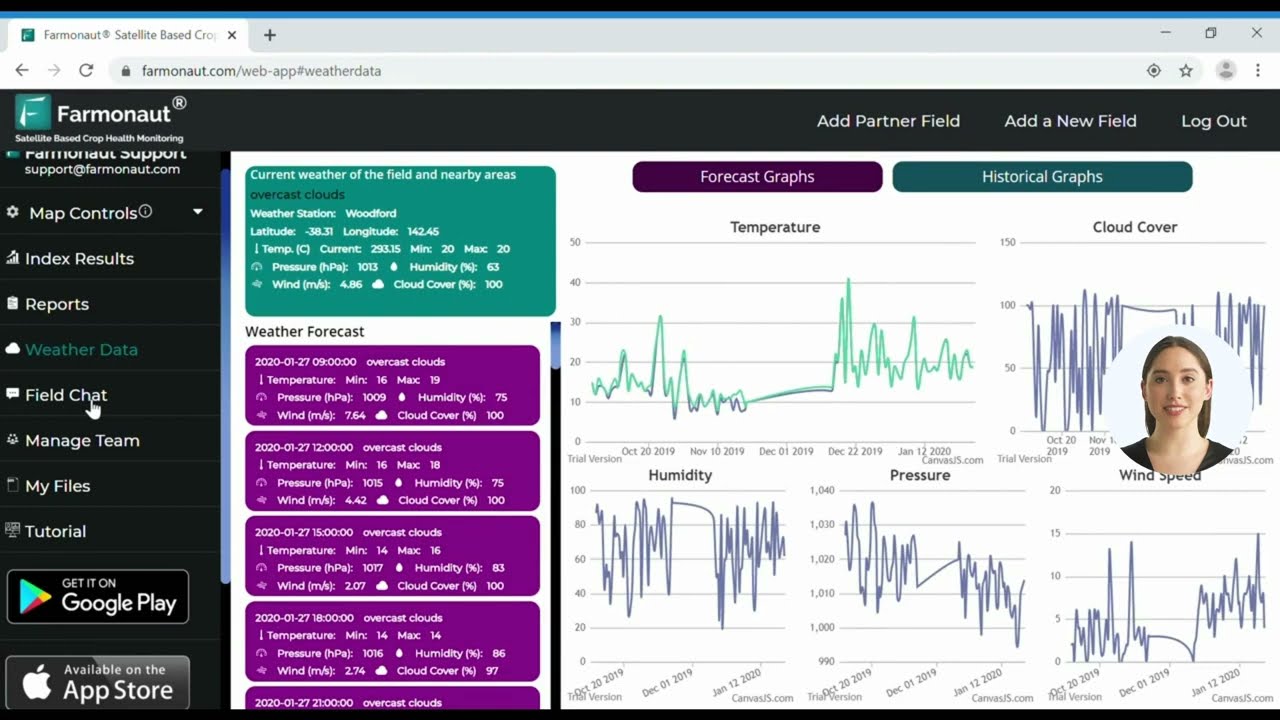

- AI-Powered Jeevn Advisory: Get real-time weather forecasts and crop-specific management advice to optimize timing—critical for squeezing the most from short springs or rapid planting windows.

- Blockchain Traceability: Ensure that products moving from Kentucky fields through global supply chains are secure, fully traceable, and fraud-resistant—crucial in maintaining export trust during volatile trade periods.

- Fleet & Resource Management: Optimize equipment use and logistics via fleet management tools, reducing operational bottlenecks when fields repeatedly flood or are too wet for heavy machinery.

- Carbon Footprinting: Monitor and lower your farm’s environmental impact, as outlined in our carbon footprinting platform, and bolster long-term land health.

- API Integration: For agribusinesses and developers, Farmonaut provides robust API access to integrate satellite and weather data into in-house management systems. Explore detailed documentation here.

With a large-scale farm management solution, Kentucky operations can monitor hundreds—or thousands—of acres from a single dashboard, managing crop health even during rapidly changing weather or market conditions.

Our platform is accessible on all major devices:

For agribusinesses, satellite-based crop loan and insurance verification streamlines access to credit and reduces risk—an invaluable asset in seasons of uncertainty.

Our subscription model lets you monitor as many fields and acres as required—at affordable rates. See below for current plan offerings:

Practical Solutions and Resources for Kentucky Farmers

Our experiences underscore not only the acute risks we face each spring, but also the evolving toolkit at our disposal. Here are practical steps and resources for navigating today’s challenging farm environment:

- Plan for variable planting: Use historical and real-time satellite imagery to anticipate soil moisture conditions and flooding risk. Farmonaut’s large-scale management tools can help you select the best timing and inputs.

- Prioritize field recovery: Use AI-driven advisories to optimize field rehabilitation between storms, maximizing your remaining planting window.

- Maintain export readiness: With blockchain-based traceability, Kentucky crops remain competitive and trustworthy even as global markets shift.

- Monitor financial health: Consider remote crop insurance validation tools to speed up claims or loan approvals during extreme seasons.

- Adopt climate and soil resilience: Reduce erosion and support soil health using carbon monitoring and field-level data from Farmonaut’s carbon footprinting services.

- Expand digital infrastructure: Integrate your farm data with Farmonaut’s robust API for a seamless, tech-enabled workflow. Explore the developer docs here.

The goal is not merely recovery, but building agility into our agricultural operations—so that each season, whatever it brings, we are better prepared.

Frequently Asked Questions (FAQ)

What are the main factors delaying Kentucky corn and soybean planting in 2024?

Unusually heavy spring rainfall, up to 15 inches in parts of the state, caused fields to remain waterlogged, directly delaying planting operations for corn and soybeans. This challenge is compounded by saturated soils, disrupted field rotation schedules, and persistent equipment access issues.

How have U.S.-China trade wars affected Kentucky farmers?

The trade war impact on crop prices has been severe, as China was once the single largest market for American soybeans. With tariffs and retaliatory duties, U.S. exports to China were cut by nearly half, causing prices to drop and income volatility to rise for Kentucky farmers.

Can farmers recover yield losses from late planting or flooding?

While some yield may be recovered with improved late-season weather and smart management, prolonged delays generally reduce final yields. Data-driven advisories and timely recovery steps—such as those provided by Farmonaut—can help mitigate losses, but the effects cannot be fully eliminated.

What technologies can help Kentucky farmers manage these risks?

Satellite imagery, AI-powered advisory systems, blockchain-based traceability, and digital fleet/resource management tools provide critical real-time information for planning, recovery, and compliance. These help farms optimize decisions, lower costs, and improve sustainability—even in volatile years.

How does Farmonaut support Kentucky corn and soybean growers?

Farmonaut delivers affordable, real-time satellite-based crop health monitoring, AI-driven field advisories, and blockchain solutions for traceability and insurance/loan validation. Apps are available for web, Android, and iOS devices, ensuring accessibility for farms of all sizes and types.

What crop planting shifts are Kentucky farmers making post-2024 flood season?

The 2024 season saw a 17% increase in corn acreage and a 10% reduction in soybean seedings, according to the USDA. Many farmers are prepared to switch acres from flooded corn fields to soybeans if wet conditions persist into May.

Where can I access Farmonaut’s services and products?

Farmonaut’s platform is available via web and mobile apps. For developers and larger enterprises, the APIs and developer documentation offer deep integration options.

Conclusion

To thrive as Kentucky corn and soybean farmers amidst spring flooding and international trade upheaval, we rely on both our resilience and the technological advances shaping modern agriculture. Data-driven decision tools like Farmonaut now make it possible to monitor fields, manage risk, and pursue sustainability at a scale that was once unimaginable—enabling us to boost yields, balance economics, and keep our operations viable for the next generation.

By embracing advanced monitoring, smart advisories, and and transparency in our supply chains, Kentucky’s Bluegrass and River Valley farms remain a vital, innovative part of the national and global food system—equipped to handle whatever the next season brings.