Missouri State School Funding Formula: 5 Big Changes Ahead in 2026

- Introduction: Missouri’s State School Funding Formula

- Overview of the 2026 Legislative Process

- The Foundation Formula for Schools: Core Concepts

- 5 Big Changes in Missouri State School Funding Formula (2026)

- Rural vs Urban School Funding: Equity in Focus

- The Role of Property Tax and School Funding

- Before & After State Funding Formula Changes

- Fiscal Year Funding Increase: 2026 and Beyond

- Missouri School Funding Modernization Task Force

- Farmonaut: Technology for Rural & Agricultural Advancement

- FAQs: Missouri School Funding Formula 2026

- Conclusion

Introduction: Missouri’s State School Funding Formula

As we look to the fiscal year 2026, attention is intensifying on Missouri’s state school funding formula—the critical equation that determines how public school funding in Missouri is distributed among districts. This formula, often referred to as the foundation formula for schools, is under the microscope in light of impending reforms outlined by state leadership, including a comprehensive review by the school funding modernization task force.

Our state education system has operated under largely unchanged rules for two decades, but now, both the legislature and executive branches are finally committed to rewriting Missouri’s state education funding model. These changes, impacting everything from property tax and school funding to rural vs urban school funding disparities and foundation model updates, could reshape the financial future of the nearly 870,000 students, 518 school districts, thousands of educators, and the communities they serve.

In this comprehensive industry deep-dive, we explore the approaching 2026 transformation of the state school funding formula, how it affects both urban and rural districts, the logic behind the proposed fiscal year funding increase, and what the task force’s recommendations could mean for the future of public education in Missouri.

Overview of the 2026 Legislative Process

When Governor Mike Kehoe delivered his annual State of the State address this January, he delivered a clear mandate: it is time to comprehensively rewrite Missouri’s foundation formula for school funding. For almost three months after his address, we awaited his selections for a school funding modernization task force charged with reviewing, recommending, and ultimately reengineering Missouri’s approach to education finance.

The legislative process involves the executive order by the governor, followed by the appointment of a diversity of members—ranging from large urban and small rural district superintendents to teachers, business and agriculture sector representatives, and others. These appointees will join those nominated by the House and Senate to form a comprehensive committee.

The Missouri General Assembly is actively nominating committee members, with four initial representatives already selected by the House and Senate. The process includes not only legislative voices but also prioritizes the experience of educators and leaders in both business and agriculture, aiming for a formula that genuinely addresses diverse state needs and aligns with broader economic realities.

The Foundation Formula for Schools: Core Concepts

At the heart of public school funding in Missouri lies the foundation formula—an equation designed to determine the baseline amount of funding each school district receives from the state. This complex model factors in:

- State adequacy target for education – the minimum per-student funding schools require to meet educational standards.

- Weighted student counts – addressing higher-cost student populations (special needs, language learners, etc.).

- Local revenue contributions – primarily from property tax and school funding.

- Cost of living in school districts – via the dollar value modifier that considers district and area wage data.

- Rural adjustment and urban impact factors.

- Hold-harmless provision helping stabilize funding year after year.

As we anticipate the task force’s recommendations, understanding these components helps stakeholders—teachers, administrators, parents, and students—grasp where and why the biggest changes matter.

5 Big Changes in Missouri State School Funding Formula (2026)

The approach to public school funding in Missouri is about to shift in at least five significant ways. These changes are designed to tackle long-standing issues and create a more transparent, agile, and equitable funding landscape across both rural and urban districts.

Let’s dive into each:

1. Comprehensive Foundation Formula Rewrite

For the first time in two decades, Missouri is poised to substantively revise and modernize the foundation formula for schools. The task force charged with reviewing and recommending specific changes aims to overhaul the equation that determines how school districts receive funds based on current realities—not data from decades past. This solution serves to address what Governor Kehoe terms a “stagnant, dysfunctional formula,” providing a solid groundwork for students and educators alike.

2. Recalibrating the State Adequacy Target for Education

Central to the funding model is the state adequacy target for education—the per-student dollar amount needed to ensure adequacy. The adequacy target for 2026 stands at $7,145 per the original formula, but the House has proposed an adjusted figure of $6,760. The proposed increase in formula funding to over $4 billion seeks to ensure that this figure is not only fully funded but also reflective of the true cost of providing quality education statewide.

Why does this matter? Because if left too low, schools (especially in higher-need, rural, or urban districts) may not receive sufficient funds to meet minimum standards, leaving teachers, staff, and students at risk.

3. Focus on Rural vs Urban School Funding Equity

The makeup of the task force and the planned formula redesign explicitly recognize disparities in rural vs urban school funding. With 70% of school districts classified as rural (but only serving 21% of students), the formula’s mechanisms—like wage-based dollar value modifiers—can tilt allocations. The new approach aims to balance the cost of living in school districts, local tax capacity, and base student counts to create a fairer playing field for all.

4. Introduction of Dynamic Cost of Living Adjustments

The cost of living in school districts will be reevaluated, relying on more current wage, property value, and local economic data. The existing dollar value modifier (which multiplies the state adequacy target based on area wage data versus state median wage) may be updated to better track and offset disparities, especially as rural and urban economies evolve.

5. Increased Fiscal Year School Funding: $200 Million Surge Proposed

Missouri’s leaders have proposed an additional $200 million for the state foundation formula, bringing the total to far more than $4 billion for the 2026 fiscal year. While the Department of Elementary and Secondary Education calculated that a $500 million increase would better match needs, the legislative compromise marks significant progress, with the House, Senate, and Governor seeking alignment by the May 9 deadline.

Rural vs Urban School Funding: Equity in Focus

Rural and urban school districts in Missouri present vastly different funding landscapes. Rural areas often depend more heavily on state funding due to smaller property tax bases and lower average wages, while urban districts may see higher local revenues but face higher costs of living and unique student needs.

- Rural Districts: Receive more state aid per student but serve fewer students overall. Adjustments to state adequacy targets and local contribution calculations will impact their operations directly.

- Urban Districts: See higher local property tax revenues and cost of living, but state funds are adjusted downward to account for this. The proposed recalibration ensures that burgeoning needs—like support for diverse, high-need populations—are not overlooked.

Exacerbating inequity, the formula’s “hold-harmless” provision ensures nearly 200 of Missouri’s 518 districts (many of them rural) don’t receive less than their 2005-06 allocation. As costs rise, these frozen reference points grow increasingly misaligned. The legislative focus is to right-size allocations without penalizing historically disadvantaged regions.

Did you know? Rural and agricultural districts can also benefit from tools like Farmonaut Carbon Footprinting, a technology that lets farmers and agri-businesses monitor and reduce their environmental impact—thereby supporting sustainable rural community development.

The Role of Property Tax and School Funding in Missouri

Local property taxes form the backbone of Missouri school funding at the district level. Higher property values in urban/suburban areas yield more local revenue, meaning these districts typically receive less direct state aid. Conversely, rural districts with lower property taxes rely more on state funds, a point being re-examined in the formula rewrite.

- Current System: Uses a 2005 frozen property tax value as the benchmark to “hold districts harmless” against annual fluctuations, creating a complex environment where some schools are protected even as their local tax base grows.

- Proposed 2026 Reform: Intends to update local contribution calculations, align benchmarks closer to current-year values, and ensure fair allocations based on up-to-date property and wage statistics.

This can directly affect the money students and teachers receive for classroom resources, salaries, and operational needs. Transparent, current, and fair property tax incorporation remains a core focus for the funding modernization task force.

For school districts, business offices, and agricultural operations looking to better track their resources, Farmonaut Fleet Management offers advanced fleet tracking and resource optimization. This is particularly relevant for large-scale school transportation and food service operations in both rural and urban areas.

Before & After: State Funding Formula Changes for Missouri Schools

| Funding Criteria | Estimated 2025 Value | Projected 2026 Value |

|---|---|---|

| Foundation Allowance (per student) | $6,750 | $7,145 |

| Weighted Student Count | Basic counts, little special weighting | Revised for accuracy, equitable weights (EL, SPED, etc.) |

| Local Revenue Contribution (property tax, frozen at 2005 levels) | Frozen at 2005 rates | Updated to closer reflect 2026 property values |

| State Aid Allocation | Proportional to adequacy target minus local revenue contribution | Potential new formula, adjusted for current local capacity |

| Rural Adjustment | Heavily reliant on state funding; some hold-harmless provisions | Fairer adjustments; fresher population and need factors |

| Urban Impact | Cost of living offset via wage-based dollar modifier | Refined for better alignment with present wage/cost data |

| State Adequacy Target | $6,750–$7,145 (debated, partially funded) | $7,145 (fully funded target proposed) |

| Total State Formula Funding | ~$3.8 billion | $4 billion+ (proposed) |

Fiscal Year Funding Increase: 2026 and Beyond

The 2026 fiscal year stands poised for a notable school funding increase. The Missouri Department of Elementary and Secondary Education (DESE) recommended a $500 million boost, targeting critical areas like elevating the state adequacy target for education and supporting evolving educational programming.

However, the Governor’s office and legislative bodies are debating the final increase, with a $200 million surge likely, pending joint approval before the May 9 final resolution.

- Full funding of the foundation formula ensures fewer schools are left under-resourced and allows for more competitive teacher salaries, curriculum advancement, and comprehensive student support.

- The increased investment signals the state’s recognition of rising costs (transportation, special services, technology integration) across all school districts.

- This move sets a precedent: future fiscal years may see targeted increases to keep the formula reflective of real-world needs.

Supporting teachers and school administrators with real-time, actionable data is crucial in today’s digital age. Farmonaut Large-Scale Farm Management provides web and app tools that enable school ag programs, business managers, and community leaders to make more informed decisions.

Missouri School Funding Modernization Task Force

A cornerstone in the state’s journey to revamped funding is the School Funding Modernization Task Force. This appointed committee is a blend of executive, legislative, and sector representatives. It is tasked with not just reviewing the formula, but actively proposing actionable solutions in a report due December 1, 2026.

- Governor’s Appointees: To include an urban district superintendent, rural district superintendent, representative for charter schools, a teacher, a school choice advocate, and business/agriculture sector voices.

- Legislative Seats: Four nominated members, including bipartisan representation with extensive experience as educators (Rep. Ed Lewis served 32 years as a high school educator; Sen. Rusty Black, 33 years in agriculture education).

- Missouri State Board of Education: Appoints its own representative.

The task force’s implementation, selection timeline, and transparency will be pivotal to achieving a balanced, inclusive outcome. Stakeholders from across the spectrum—including associations like the Missouri State Teacher’s Association—are keen to see robust representation from active public school educators given they comprise the majority (over 72,000 teachers).

For rural, agricultural, and small communities, integrating modern technology is vital for maximizing limited education funds. Learn more about how Farmonaut Traceability solutions support transparency and trust, especially for public spending programs and farm-to-school partnerships.

Farmonaut: Technology for Rural & Agricultural Advancement

As Missouri’s legislature and school funding task force seek to minimize inefficiency and enhance transparency in education finance, Farmonaut stands at the forefront of agricultural innovation—especially for rural school districts and communities with ag-focused education.

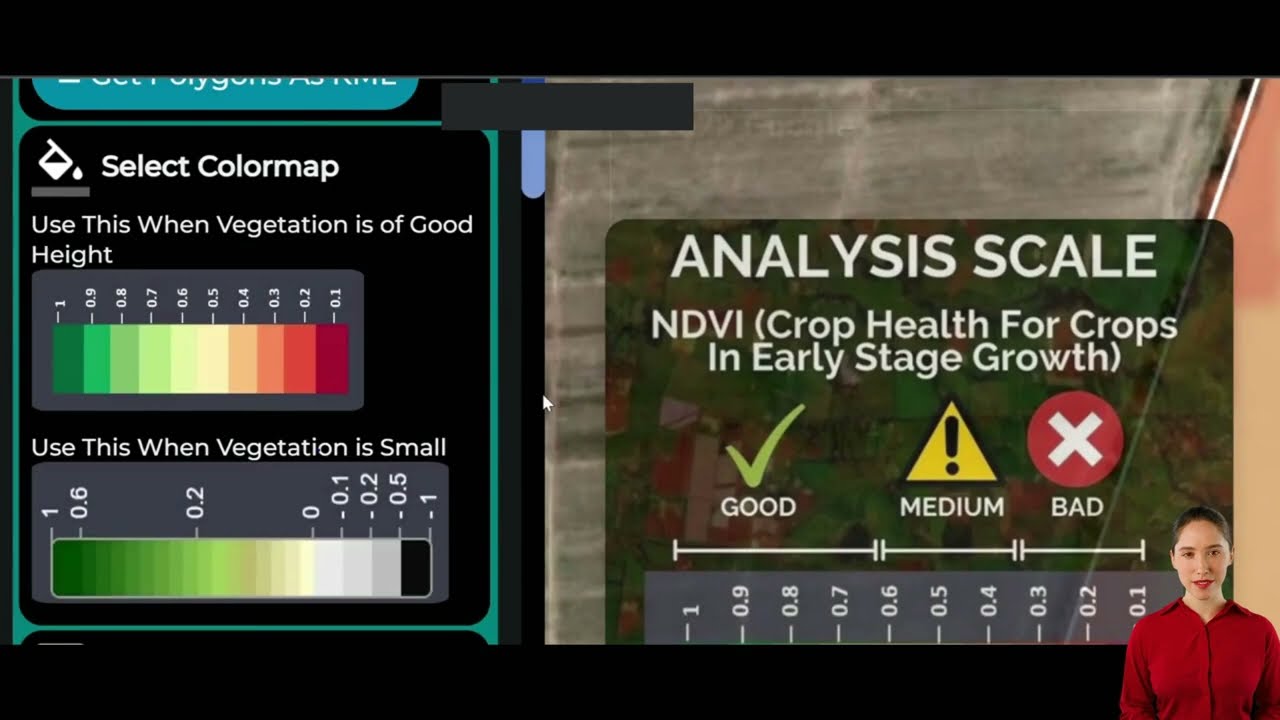

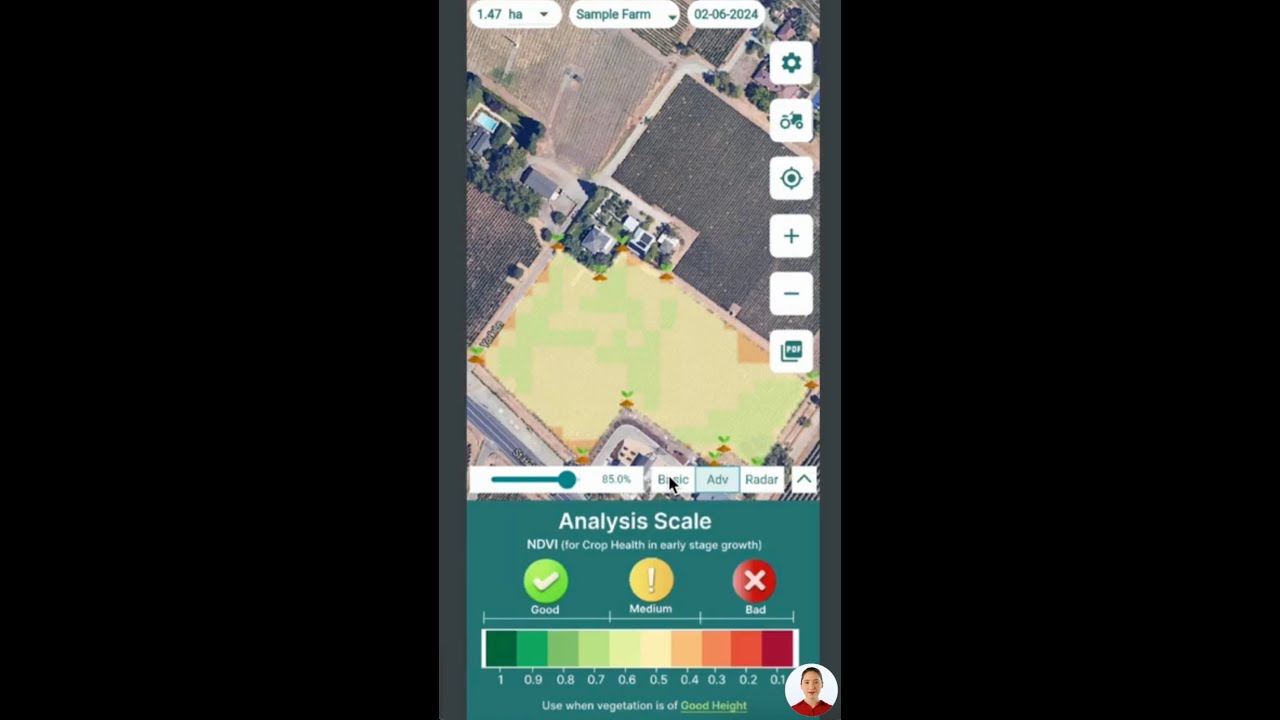

- Satellite-Based Farm Management: Farmonaut’s web, app, and API tools deliver precise, multispectral satellite insights for crop health monitoring. This technology can be woven into school STEM, agricultural curriculum, or district-level resource planning.

- API Integration & Developer Docs: Enables school boards and administrators to overlay state funding, yield estimation, and resource utilization data—turning raw info into actionable results.

- Advisory Systems & Resource Management: Automate logistics and optimize spending decisions—whether for rural transportation fleets or urban community gardens—via AI-based agricultural advisory solutions.

Farmonaut’s mission aligns closely with Missouri’s legislative objectives: harnessing real-time, data-driven insights to make funding models more efficient, accountable, and sustainable—regardless of a district’s size or location.

Ready to make smarter decisions for your district or ag business? Explore Farmonaut subscription options below and discover how satellite-backed resource management can bolster your bottom line—while supporting student learning and agricultural progress:

FAQs: Missouri School Funding Formula 2026

What is the Missouri state school funding formula?

The state school funding formula is the mathematical equation the state uses to determine how education funds are allocated among Missouri’s 518 public school districts. It accounts for variables such as the state adequacy target, weighted student counts, local property tax contributions, and cost of living adjustments. The foundation formula ensures each district receives a minimum level of support based on need and economic indicators.

Why is Missouri planning to change its school funding formula in 2026?

The formula hasn’t been substantively revised in over 20 years. The state aims to modernize it to reflect current socioeconomic realities, address funding equity between rural and urban districts, fix inefficiencies caused by outdated rules (such as 2005 property tax freezes), and ensure all students have access to adequate resources for success.

How does property tax affect school funding in Missouri?

Each district’s local property tax revenue is subtracted from its state aid allocation. Districts in areas with high property values generate more local funding and typically receive less from the state, while rural districts rely more heavily on state aid due to lower property tax bases. The upcoming funding formula rewrite will update how these contributions are calculated.

What is the “hold-harmless” provision?

The hold-harmless rule ensures certain districts don’t receive less than their 2005-06 school year allocation, even if declines in enrollment or local revenues would otherwise reduce their funding. This was intended as a cushion for financial stability but may now cause inequities the task force seeks to address.

How will the funding changes impact teachers and students?

Funding reforms are designed to better align resources with actual school needs, allowing for improved teacher salaries, enhanced student support services, and updated instructional materials. By raising the state adequacy target and increasing total state investment, the changes are expected to benefit the majority of Missouri teachers and students, especially in underfunded regions.

What role does the School Funding Modernization Task Force play?

The task force is charged with reviewing current funding practices, analyzing data, and providing final recommendations by December 1, 2026. It is composed of appointees representing urban and rural educators, charter schools, business and agriculture sectors, teachers, and school choice advocates. Their work will directly inform new legislation.

How can agricultural communities and schools leverage Farmonaut solutions?

Farmonaut provides affordable, satellite-driven resource management, traceability, and carbon footprinting solutions that can help rural schools, agricultural educators, and district fleet managers optimize spending and support local sustainability efforts. Learn more about these tools for carbon footprinting, product traceability, and AI-based advisory systems.

Conclusion

As Missouri’s state school funding formula faces its most significant modernization in a generation, we stand at a crossroads for public school funding, educational equity, and smart resource allocation. The coming changes—built on recalibrating the foundation formula for schools, introducing dynamic cost-of-living adjustments, reassessing property tax models, and aligning the fiscal year school funding increase—hold tremendous promise for teachers, students, administrators, and communities, both rural and urban.

The deliberations of the school funding modernization task force and legislative bodies will be instrumental in crafting a model that not only reflects today’s Missouri, but anticipates tomorrow’s needs. Through robust stakeholder engagement and transparent analysis, the aim is clear: empower every district to fully serve its students—regardless of zip code, property values, or economic background.

Agricultural and rural communities play a vital role in this transformation. As Farmonaut demonstrates, leveraging technology—from satellite data to blockchain-based traceability and resource management—can vastly improve outcomes in both field and classroom. Our collective commitment to equity and efficiency will shape the future of education finance in Missouri, ensuring that our students, teachers, and communities continue to thrive.

Explore advanced agri-technology resources and stay ahead of funding, resource management, and sustainability challenges with Farmonaut. Together, let’s build smarter, fairer, and stronger Missouri schools for 2026 and beyond.