Unlocking Growth: Strategic Capital Allocation in Southern California’s Thriving Agribusiness and Real Estate Sectors

“A 132-year-old agribusiness in Southern California successfully distributed cash from a housing market project.”

“The company’s strategic capital allocation spans citrus operations, real estate ventures, and sustainable agriculture in a Pacific Ocean community.”

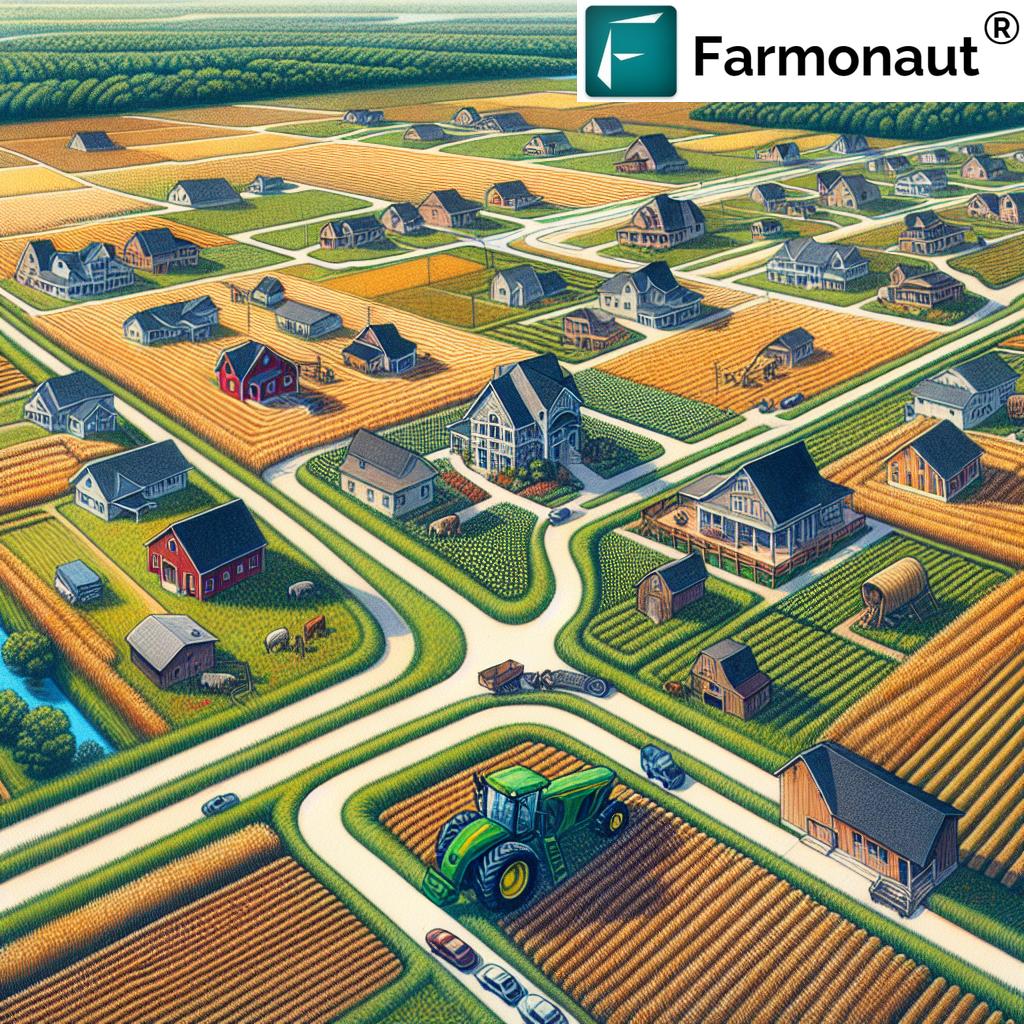

In the sun-drenched landscapes of Southern California, where innovation meets tradition, we’re witnessing a remarkable transformation in the agribusiness and real estate sectors. At the heart of this revolution is Limoneira Company, a venerable 132-year-old international agribusiness that has masterfully woven together the threads of citrus growing, real estate development, and strategic financial management. Today, we delve into the company’s recent milestone: a significant cash distribution from their housing market project, and explore how this move is reshaping the landscape of Southern California’s agriculture and property markets.

The Harvest at Limoneira: A Fruitful Real Estate Joint Venture

Limoneira Company, in partnership with The Lewis Group of Companies, has cultivated more than just citrus in the fertile soil of Santa Paula. Their 50/50 real estate development joint venture, aptly named “Harvest at Limoneira,” has borne fruit in the form of a substantial $20 million cash distribution. This strategic move not only showcases the company’s diversification prowess but also highlights the synergies between agribusiness and real estate development in Southern California.

The joint venture’s success is evident in its robust financial position, with unaudited cash and cash equivalents totaling $62.4 million as of January 31, 2025. This liquidity not only demonstrates the venture’s financial health but also positions Limoneira for strategic growth and capital allocation opportunities.

Strategic Capital Allocation: Planting Seeds for Future Growth

With Limoneira’s share of the distribution amounting to $10 million, the company is poised to make significant strides in its financial strategy. Harold Edwards, President and Chief Executive Officer of Limoneira Company, outlined potential uses for these funds, including:

- Enhancing dividend payouts

- Implementing share repurchase programs

- Reducing company debt

- Investing in future growth opportunities

This multifaceted approach to capital allocation demonstrates Limoneira’s commitment to balancing shareholder returns with long-term growth prospects. By strategically deploying these funds, the company aims to strengthen its financial foundation while remaining agile in a dynamic market environment.

The Citrus-Real Estate Nexus: A Model of Diversification

Limoneira’s success story is not just about numbers; it’s a testament to the power of diversification in agribusiness. The company has successfully integrated its core citrus growing and marketing operations with real estate development, creating a unique synergy that leverages the value of its land assets.

This integrated approach allows Limoneira to capitalize on the burgeoning Southern California housing market while maintaining its position as a leading producer of lemons, avocados, and other crops. The company’s ability to navigate both sectors showcases a level of strategic agility that is increasingly crucial in today’s fast-paced business environment.

Sustainable Agriculture Meets Community Development

The Harvest at Limoneira project is more than just a real estate venture; it’s a vision of sustainable community development. Nestled near the Pacific Ocean, this comprehensively designed community offers:

- A range of new housing options

- Scenic views that capture the essence of Southern California

- Proximity to parks and hiking trails

- Access to popular retail destinations

This thoughtful integration of residential spaces with natural amenities and commercial conveniences has attracted strong interest from new home buyers throughout Southern California. It’s a testament to Limoneira’s commitment to creating value not just for shareholders, but for the broader community as well.

Financial Performance and Capital Allocation Summary

| Financial Metric | Current Year Value | Previous Year Value | Percentage Change | Allocation Strategy |

|---|---|---|---|---|

| Cash Distribution from Housing Project | $10.0 million | N/A | N/A | Strategic reinvestment |

| Citrus Operations Revenue | TBD | TBD | TBD | Core business support |

| Real Estate Venture Revenue | $10.0 million (partial) | TBD | TBD | Diversification |

| Debt Reduction Amount | TBD | TBD | TBD | Financial stability |

| Dividend Payout | TBD | TBD | TBD | Shareholder returns |

| Share Repurchase Value | TBD | TBD | TBD | Stock value enhancement |

| Future Growth Investment | TBD | TBD | TBD | Long-term expansion |

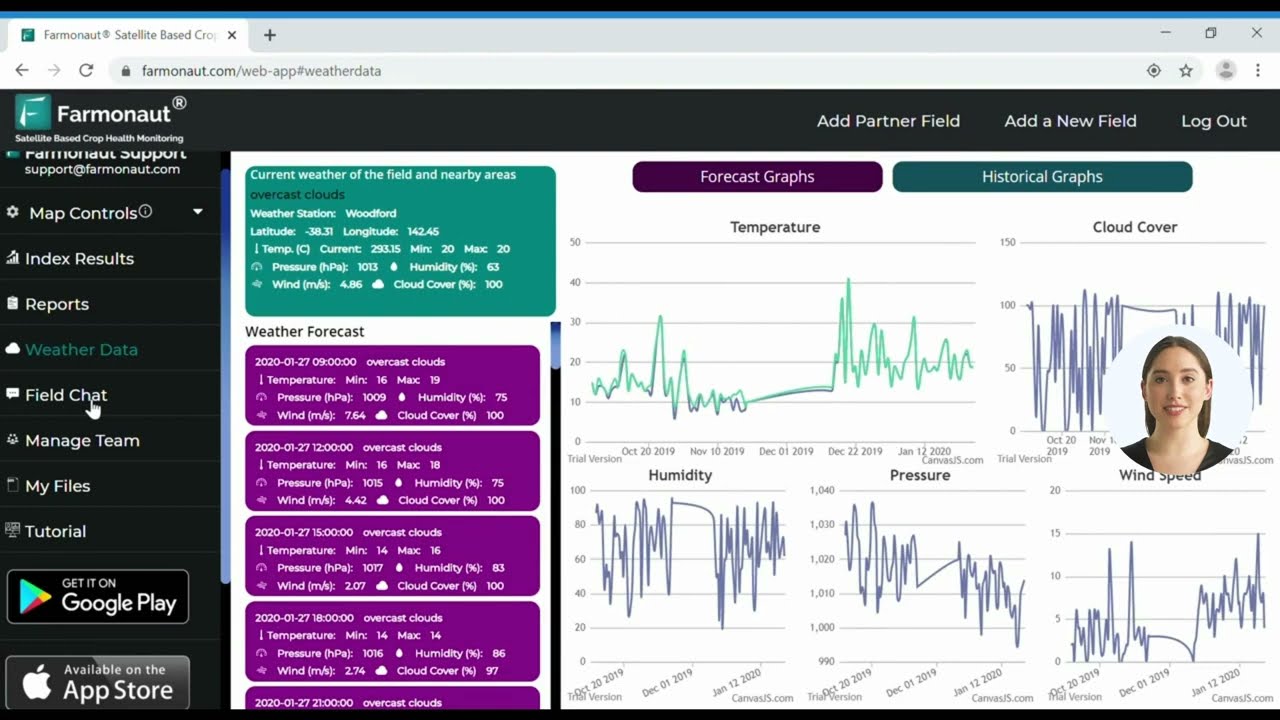

As we analyze Limoneira’s financial strategy, it’s worth noting how modern agricultural technology is revolutionizing land use and management in the sector. Companies like Farmonaut are at the forefront of this transformation, offering satellite-based farm management solutions that can significantly enhance operational efficiency and sustainability in agribusiness.

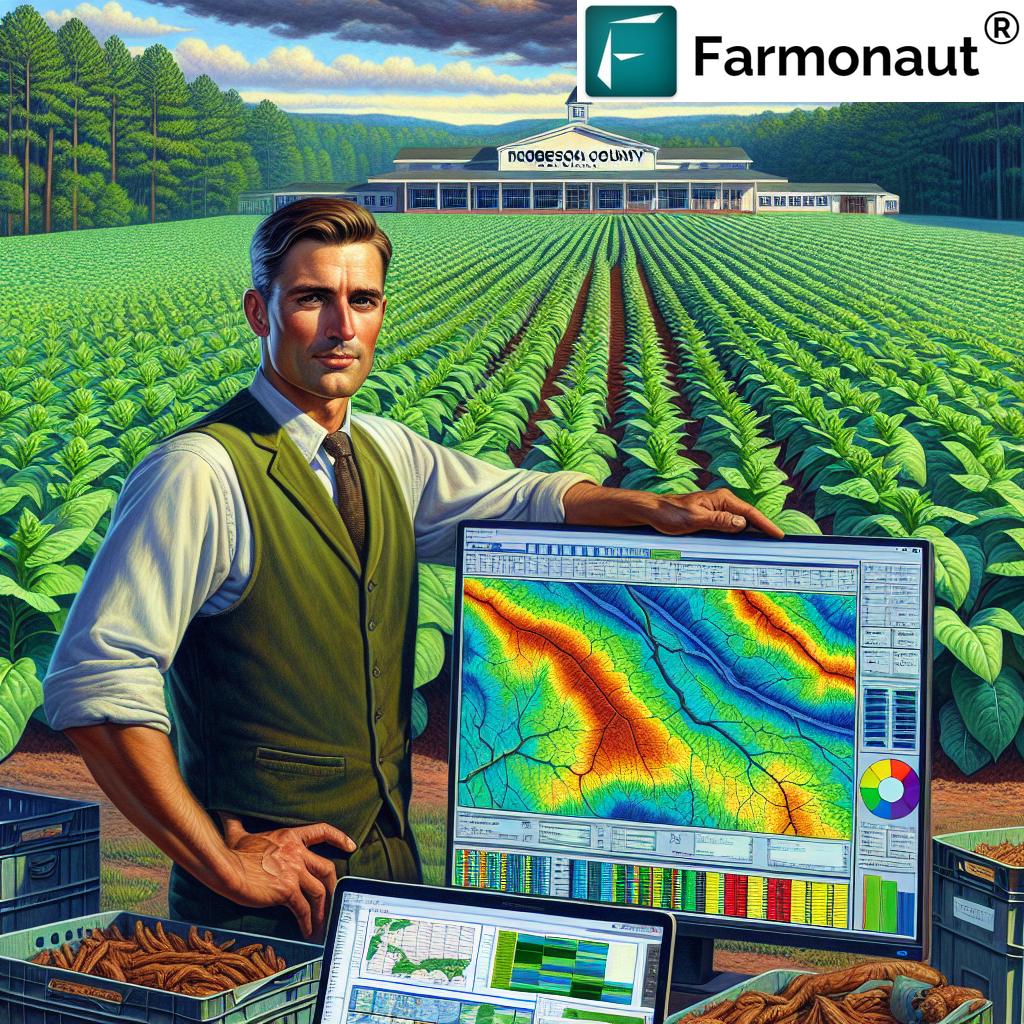

The Role of Technology in Modern Agribusiness

While Limoneira’s success is rooted in its strategic diversification and capital allocation, the future of agribusiness is increasingly intertwined with technological advancements. Satellite-based crop monitoring and management systems, like those offered by Farmonaut, are becoming essential tools for optimizing agricultural operations.

These technologies provide real-time insights into crop health, soil moisture levels, and other critical metrics, enabling farmers and agribusinesses to make data-driven decisions. For companies like Limoneira, integrating such technologies could further enhance their agricultural operations, complementing their strategic approach to land and resource management.

Sustainable Practices in Agribusiness and Real Estate

Sustainability is a key focus for both the agribusiness and real estate sectors, and Limoneira’s integrated approach exemplifies this trend. The company’s commitment to sustainable agriculture in its citrus operations aligns well with the eco-friendly community development principles evident in the Harvest at Limoneira project.

In this context, technologies that support sustainable farming practices are becoming increasingly valuable. For instance, carbon footprinting tools can help agribusinesses monitor and reduce their environmental impact. Such tools allow companies to track emissions in real-time, enabling them to implement more sustainable practices and comply with environmental regulations.

The Future of Agribusiness: Integration and Innovation

Limoneira’s success story illustrates the potential of integrating traditional agribusiness with innovative real estate development and strategic financial management. As the company looks to the future, several key areas of focus emerge:

- Continued expansion of citrus operations

- Further development of real estate ventures

- Exploration of new markets and products

- Investment in sustainable agricultural practices

- Adoption of advanced farming technologies

For agribusinesses looking to emulate Limoneira’s success, embracing technological innovation is crucial. Solutions like fleet management systems can optimize logistics and reduce operational costs, while crop loan and insurance tools can provide financial security and improve access to capital.

The Impact on Southern California’s Economy

The success of Limoneira’s integrated agribusiness and real estate model has significant implications for the Southern California economy. By creating new housing options and job opportunities while maintaining productive agricultural land, the company is contributing to sustainable economic growth in the region.

Moreover, the influx of new residents to developments like Harvest at Limoneira can stimulate local businesses and services, creating a ripple effect of economic activity. This model of development, which balances urban growth with agricultural preservation, could serve as a template for other regions facing similar land-use challenges.

Global Implications: Lessons for International Agribusiness

While Limoneira’s story is rooted in Southern California, its implications resonate globally. As an international agribusiness with operations in multiple countries, the company’s approach to diversification and strategic capital allocation offers valuable lessons for agricultural enterprises worldwide.

In an era of climate change and increasing pressure on agricultural resources, the ability to diversify revenue streams and maximize land value is becoming critical. Limoneira’s model demonstrates how traditional agricultural companies can evolve to meet these challenges while maintaining their core identity and operations.

The Role of Technology in Scaling Agribusiness Operations

As agribusinesses like Limoneira expand their operations and diversify their portfolios, the need for scalable management solutions becomes paramount. This is where technologies like Farmonaut’s large-scale farm management tools can play a crucial role. These platforms enable businesses to efficiently manage vast farming operations, integrating data from multiple sources to provide comprehensive insights and facilitate informed decision-making.

Enhancing Supply Chain Transparency

In today’s market, consumers and regulators alike are demanding greater transparency in agricultural supply chains. For companies involved in both agriculture and real estate development, like Limoneira, maintaining clear and verifiable records of their operations is crucial. Blockchain-based traceability solutions can provide this transparency, ensuring that every stage of the product journey, from farm to consumer, is recorded and accessible.

The Future of Agribusiness Financing

As Limoneira’s success demonstrates, access to capital is crucial for growth and diversification in agribusiness. Looking forward, innovative financing solutions that leverage technology are likely to play an increasingly important role. For instance, satellite-based verification systems for crop loans and insurance can help streamline the financing process for agricultural enterprises, reducing risk for lenders and improving access to capital for farmers and agribusinesses.

Conclusion: A New Era of Integrated Agribusiness

Limoneira’s strategic capital allocation and diversification into real estate development marks a new chapter in the evolution of agribusiness. By leveraging its land assets, embracing sustainable practices, and maintaining a strong focus on its core citrus operations, the company has created a model that balances tradition with innovation.

As we look to the future, it’s clear that success in agribusiness will increasingly depend on the ability to integrate diverse operations, leverage technology, and respond nimbly to market opportunities. Limoneira’s journey offers valuable lessons for agricultural enterprises worldwide, demonstrating how strategic thinking and a willingness to innovate can unlock new avenues for growth and sustainability in the ever-changing landscape of global agriculture.

FAQ Section

- Q: What is the significance of Limoneira’s cash distribution from its real estate joint venture?

A: The $10 million cash distribution demonstrates the success of Limoneira’s diversification strategy and provides the company with additional capital for strategic investments, debt reduction, and shareholder returns. - Q: How does Limoneira balance its agribusiness operations with real estate development?

A: Limoneira integrates its core citrus growing business with real estate development, leveraging its land assets to create value in both sectors while maintaining a focus on sustainable practices. - Q: What are the potential uses for the funds received from the cash distribution?

A: The company may use the funds for enhancing dividends, share repurchases, reducing debt, and investing in future growth opportunities. - Q: How does the Harvest at Limoneira project contribute to the Southern California housing market?

A: The project offers a range of new housing options near the Pacific Ocean, featuring scenic views and proximity to parks, hiking trails, and retail destinations, attracting strong interest from new home buyers. - Q: What role does technology play in modern agribusiness operations like Limoneira’s?

A: While not specifically mentioned for Limoneira, technologies like satellite-based crop monitoring, fleet management systems, and blockchain-based traceability solutions are becoming increasingly important in optimizing agricultural operations and enhancing supply chain transparency.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Farmonaut Subscriptions

For those interested in leveraging cutting-edge technology in agriculture, consider exploring Farmonaut’s offerings:

For developers interested in integrating Farmonaut’s technology into their own applications, check out the API and API Developer Docs.