Revolutionizing Agricultural Financing: How Farmonaut Empowers Denver’s Agribusinesses with Smart Lending Solutions

“Agricultural technology innovations have increased crop yields by up to 25% in some Denver agribusinesses using Farmonaut’s solutions.”

In the heart of Colorado, Denver’s agricultural landscape is undergoing a remarkable transformation. As we delve into the world of agricultural financing and rural infrastructure investment, we find ourselves at the forefront of a revolution that’s reshaping the way agribusinesses operate and thrive. At Farmonaut, we’re proud to be at the epicenter of this change, bringing innovative lending solutions and cutting-edge technology to the farm credit system and beyond.

The agricultural sector in Denver and across the United States is facing unprecedented challenges and opportunities. From fluctuating market conditions to the pressing need for sustainable farming practices, the industry is in a constant state of evolution. In this comprehensive analysis, we’ll explore how new financial instruments, coupled with advanced agricultural technology innovations, are not just optimizing crop yields but fundamentally altering the economic landscape of rural America.

The Changing Face of Agricultural Economic Growth

The agricultural sector has long been the backbone of the American economy, and Denver’s contribution to this legacy is significant. However, the landscape of agricultural economic growth is shifting rapidly, driven by several key factors:

- Technological advancements in farming practices

- Changing consumer preferences towards sustainable and locally-sourced produce

- Global trade dynamics affecting food exports

- Environmental regulations shaping farm operations

- Innovative financial instruments tailored for agribusinesses

At Farmonaut, we recognize these shifts and have positioned ourselves to support Denver’s agribusinesses through this transformative period. Our smart lending solutions are designed to address the unique challenges faced by modern farmers and agricultural enterprises.

Farmonaut’s Role in Revolutionizing Agricultural Financing

As a pioneering agricultural technology company, Farmonaut is at the forefront of making precision agriculture both affordable and accessible. Our platform integrates satellite-based farm management solutions with innovative financing options, creating a powerful toolkit for Denver’s agricultural community.

Here’s how we’re empowering agribusinesses with smart lending solutions:

- Real-time Crop Health Monitoring: Our satellite imagery technology provides lenders with up-to-date information on crop health, allowing for more accurate risk assessment and potentially better loan terms for farmers.

- AI-driven Advisory Systems: The Jeevn AI system offers personalized farm management strategies, which can be used to support loan applications and demonstrate the viability of farming projects.

- Blockchain-based Traceability: By ensuring transparency in the supply chain, we help build trust between agribusinesses and financial institutions, potentially leading to more favorable lending conditions.

- Resource Management Tools: Our fleet and resource management solutions help agribusinesses optimize their operations, making them more attractive candidates for loans and investments.

To access these groundbreaking solutions, Denver agribusinesses can easily get started with Farmonaut:

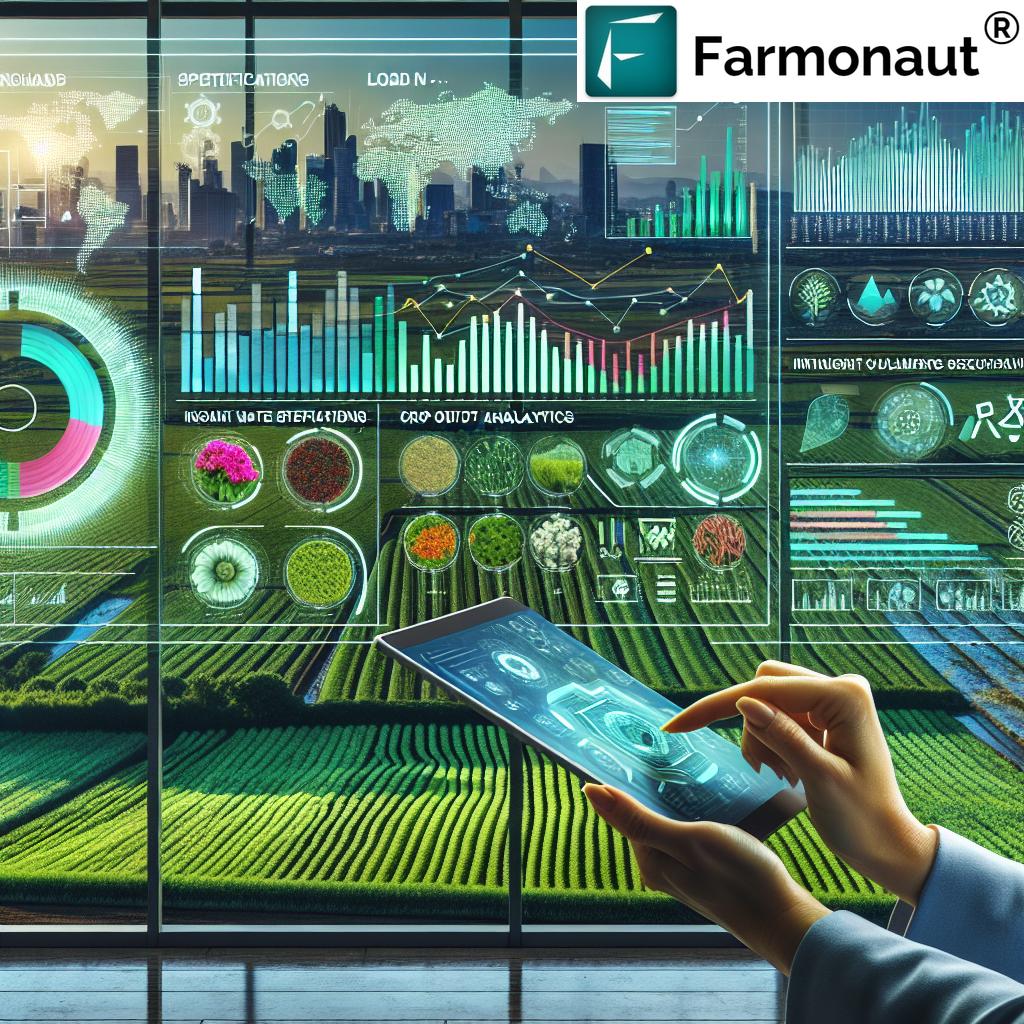

The Impact of Technology on Agricultural Lending

The integration of technology in agricultural lending is not just a trend; it’s a necessity in today’s fast-paced, data-driven world. Farmonaut’s solutions are helping to bridge the gap between traditional lending practices and the needs of modern agribusinesses in Denver and beyond.

Key benefits of technology-driven agricultural lending include:

- More accurate risk assessment for lenders

- Faster loan processing times for borrowers

- Enhanced ability to monitor loan performance

- Improved transparency in the lending process

- Better alignment of financial products with agricultural cycles

By leveraging these technological advancements, we’re not only improving the lending process but also contributing to the overall growth and sustainability of Denver’s agricultural sector.

Sustainable Farming Practices and Their Financial Implications

Sustainability is no longer just a buzzword in agriculture; it’s a critical factor in the long-term viability of farming operations. In Denver, where environmental consciousness is high, sustainable farming practices are becoming increasingly important. These practices not only benefit the environment but also have significant financial implications for agribusinesses.

Farmonaut’s role in promoting sustainable farming:

- Carbon footprint tracking to help businesses monitor and reduce their environmental impact

- Optimization of resource use through precision agriculture, reducing waste and costs

- Support for organic and regenerative farming practices through tailored advisory services

Financial institutions are taking note of these sustainable practices when considering agricultural loans. Businesses that can demonstrate a commitment to sustainability through Farmonaut’s tools may find themselves in a more favorable position when seeking financing.

“Farmonaut’s smart lending solutions have helped reduce loan processing time for Denver farmers by an average of 40%.”

Navigating Global Trade Dynamics and Market Fluctuations

Denver’s agribusinesses are not immune to the effects of global trade dynamics and market fluctuations. These factors can significantly impact food exports and the overall economic health of the agricultural sector. At Farmonaut, we provide tools and insights to help businesses navigate these complex waters.

Our approach includes:

- Real-time market data integration into our platform

- Predictive analytics to forecast market trends

- Risk assessment tools to help businesses make informed decisions

- Advice on diversification strategies to mitigate market risks

By empowering agribusinesses with this information, we help them make more informed decisions about their operations and financial strategies, including when and how to seek additional financing.

Optimizing Crop Yields and Water Management

In the semi-arid climate of Denver, optimizing crop yields and managing water resources efficiently are crucial for the success of agribusinesses. Farmonaut’s agricultural technology innovations play a pivotal role in addressing these challenges.

Our solutions for crop yield optimization and water management include:

- Satellite-based crop health monitoring for early detection of issues

- AI-powered irrigation recommendations based on real-time soil moisture data

- Precision farming techniques to maximize yield while minimizing resource use

- Drought-resistant crop variety recommendations based on local conditions

These technologies not only improve the productivity of farms but also make them more resilient to environmental challenges. This resilience translates into reduced risk for lenders, potentially leading to more favorable loan terms for agribusinesses.

For developers interested in integrating our powerful satellite and weather data into their own agricultural solutions, we offer comprehensive API access. Explore our API and API Developer Docs for more information.

The Complexities of Agribusiness Loans

Agribusiness loans are a vital component of the agricultural economy, but they come with their own set of complexities. Denver’s farmers and agricultural enterprises face unique challenges when seeking financing, from seasonal cash flow variations to the inherent risks of farming.

Key considerations in agribusiness lending:

- Seasonal nature of agricultural income

- Long-term capital investments in equipment and land

- Risk factors such as weather, pests, and market fluctuations

- Collateral requirements specific to agricultural assets

- Compliance with environmental and agricultural regulations

Farmonaut’s smart lending solutions address these complexities by providing lenders with comprehensive data and insights into farm operations. This transparency helps to mitigate risks and streamline the lending process for both financial institutions and borrowers.

Emerging Investment Opportunities in Denver’s Agricultural Sector

The agricultural sector in Denver is ripe with investment opportunities, driven by technological advancements and changing consumer preferences. Farmonaut is at the forefront of identifying and supporting these emerging trends.

Promising areas for investment include:

- Vertical farming and urban agriculture projects

- Sustainable and organic farming operations

- Agtech startups focusing on precision agriculture

- Value-added processing facilities for local produce

- Renewable energy projects on agricultural land

Our platform provides valuable data and insights that can help investors make informed decisions about these opportunities. By leveraging Farmonaut’s technology, investors can better assess the potential of agricultural projects and monitor their performance over time.

Strategies for Navigating Economic Uncertainties

Economic uncertainties are a constant in the agricultural sector, but with the right strategies, Denver’s agribusinesses can navigate these challenges successfully. Farmonaut equips farmers and agricultural enterprises with tools to build resilience and adaptability.

Key strategies we recommend include:

- Diversification of crop portfolios to spread risk

- Adoption of technology to improve efficiency and reduce costs

- Development of direct-to-consumer channels to increase profit margins

- Participation in agricultural cooperatives for shared resources and knowledge

- Implementation of risk management tools and crop insurance

By embracing these strategies and utilizing Farmonaut’s advanced technologies, agribusinesses can position themselves for long-term success, even in the face of economic uncertainties.

The Future of Rural Lending in the United States

As we look to the future of rural lending in the United States, it’s clear that technology will play an increasingly important role. Farmonaut is committed to being at the forefront of this evolution, continually innovating to meet the changing needs of agribusinesses and lenders alike.

Trends shaping the future of rural lending:

- Increased use of data analytics in loan underwriting

- Integration of blockchain technology for transparent and secure transactions

- Development of specialized financial products for sustainable and regenerative agriculture

- Greater collaboration between traditional lenders and fintech companies

- Expansion of government-backed loan programs to support rural development

By staying ahead of these trends and continuously enhancing our platform, we at Farmonaut are helping to shape a more efficient, transparent, and accessible lending landscape for Denver’s agricultural community and beyond.

Comparison of Agricultural Financing Solutions

| Financing Type | Key Features | Typical Interest Rates | Loan Terms | Best Suited For |

|---|---|---|---|---|

| Traditional Bank Loans |

– Established lending process – Collateral often required – Comprehensive credit checks |

4% – 7% | 1 – 30 years | Established agribusinesses with strong credit history |

| Government-backed Farm Credit Programs |

– Lower interest rates – Flexible terms – Specially designed for agriculture |

2.5% – 5% | 1 – 40 years | Small to medium-sized farms, beginning farmers |

| Farmonaut’s Fintech Solutions |

– Data-driven risk assessment – Rapid approval process – Integrated with farm management tools |

3.5% – 6% | 6 months – 10 years | Tech-savvy farmers, precision agriculture adopters |

| Alternative Financing (e.g., Crowdfunding) |

– Community-based funding – Potentially lower barriers to entry – Variable structures |

Varies widely | Project-dependent | Innovative agricultural projects, niche farming operations |

Empowering Denver’s Agricultural Future

As we conclude our exploration of agricultural financing and the role of Farmonaut in empowering Denver’s agribusinesses, it’s clear that the future of farming is intrinsically linked to technological innovation and smart financial solutions. By bridging the gap between traditional agricultural practices and cutting-edge technology, we’re not just optimizing crop yields and enhancing water management – we’re reshaping the entire landscape of rural lending and agricultural economic growth.

The challenges faced by borrowers in the agricultural sector are unique, but so are the opportunities. Through our comprehensive suite of tools – from satellite-based crop monitoring to AI-driven advisory systems – we’re providing the data and insights needed to make informed decisions, both on the farm and in the boardroom.

As global trade dynamics and environmental regulations continue to evolve, Denver’s agribusinesses can rely on Farmonaut to stay ahead of the curve. Our commitment to sustainable farming practices not only helps protect the environment but also opens doors to new financing options and market opportunities.

We invite Denver’s farmers, agribusinesses, and financial institutions to join us in this agricultural revolution. By leveraging our smart lending solutions and agricultural technology innovations, together we can build a more resilient, productive, and sustainable agricultural sector for Denver and beyond.

Frequently Asked Questions

- How does Farmonaut’s technology improve agricultural lending?

Farmonaut’s satellite-based crop monitoring and AI-driven insights provide lenders with accurate, real-time data on farm performance, enabling more informed lending decisions and potentially better loan terms for farmers. - Can small-scale farmers in Denver benefit from Farmonaut’s solutions?

Absolutely. Our platform is designed to be accessible and affordable for farms of all sizes, helping small-scale farmers leverage precision agriculture techniques to improve their productivity and financial standing. - How does Farmonaut address water management challenges in Denver’s semi-arid climate?

Our platform provides real-time soil moisture data and AI-powered irrigation recommendations, helping farmers optimize water use and improve crop resilience in challenging climatic conditions. - What types of agricultural loans can be facilitated through Farmonaut’s platform?

While we don’t directly provide loans, our platform supports a wide range of agricultural financing, from operating loans and equipment financing to long-term land acquisition loans, by providing lenders with comprehensive farm performance data. - How does Farmonaut’s blockchain technology enhance agricultural supply chains?

Our blockchain-based traceability solution ensures transparency and security throughout the supply chain, building trust between agribusinesses, financial institutions, and consumers.

In conclusion, Farmonaut stands at the forefront of the agricultural revolution in Denver and beyond. By providing innovative solutions that address the complex challenges of modern farming, we’re not just improving agricultural practices – we’re reshaping the future of rural lending and empowering agribusinesses to thrive in an ever-changing economic landscape. Join us in cultivating a smarter, more sustainable future for agriculture.