- Introduction: Unlocking Growth with USDA Loan Zones

- Did You Know?

- Understanding USDA Loan Zones & Their Impact on U.S. Agriculture

- USDA Loan Programs: 7 Powerful Ways for Sustainable Farm Growth

- Promoting Sustainability Through USDA Agricultural Loan Programs

- Farmonaut: Pioneering Tech for Smart, Sustainable Agriculture

- REAP Zones and Rural Development Loan Programs

- USDA Trivia Break

- USDA Loan Programs and Their Impact on Sustainable Growth by Zone (Comparative Table)

- FAQ: USDA Farm Loans & Farmonaut Solutions

- Conclusion: Building Resilient Farms & Sustainable Communities

USDA Loan Zones: 7 Powerful Ways for Sustainable Farm Growth

“Over $38 billion in USDA farm loans have supported sustainable agriculture and conservation efforts across the U.S. since 2009.”

As members of the U.S. agricultural and rural community, many of us have witnessed the transformative power of USDA farm loans and agricultural loan programs. Not only do these programs back the livelihoods of farmers and ranchers across diverse USDA loan zones, but they also uphold the keystones of sustainable growth, conservation, and innovation shaping American agriculture.

In this comprehensive guide, we’ll explore seven powerful USDA loan programs, explain their impact on sustainability, and show how combining these with cutting-edge technologies—like Farmonaut’s satellite-based solutions—empower producers to thrive in every zone, climate, and market condition.

Understanding USDA Loan Zones & Their Impact on U.S. Agriculture

The United States Department of Agriculture (USDA) operates a comprehensive structure of loan zones—regional, demographic, or program-specific areas where distinct financial support is channeled to foster farm development, conservation, and rural sustainability. For farmers and producers, knowing which USDA loan programs are available in their zone is critical for maximizing financial opportunities, boosting production, and securing eco-friendly growth.

- Zone Specificity: USDA loan zones include rural development areas, tribal communities, disaster-impacted locales, and zones prioritizing climate-smart or conservation practices.

- Empowering Sustainability: By directly addressing local needs—whether through rural development loan programs, youth loans, or emergency support—the USDA continually adapts to the evolving landscape of American agriculture.

Let’s now explore the principal USDA agricultural loan programs and how they’re empowering sustainable farm growth—zone by zone—across the nation.

USDA Agricultural Loan Programs: 7 Powerful Ways for Sustainable Farm Growth

Access to loans tailored to specific agricultural needs is transformative for beginning farmers, small operations, established producers, and rural communities alike. Below are the seven most impactful USDA loan programs—each aligning financing with sustainability, innovation, and zone-specific requirements for farms across the United States.

1. Farm Ownership Loans (Direct & Guaranteed)

Farm Ownership Loans represent the cornerstone of long-term agricultural loan programs by enabling farmers and ranchers to purchase, enlarge, or improve their farms. This includes buying land, constructing, or upgrading farm buildings, and supporting soil and water conservation efforts.

- Eligibility: New and experienced farmers, beginning farmers, and those taking over family farm operations.

- Features: Up to $600,000 in direct loans, down payment option (especially for beginning farmers), and flexible terms for soil and water conservation projects.

- More details here.

These loans are instrumental in purchasing farmland, supporting organic transition, and implementing vital conservation structures. USDA’s focus on sustainable land stewardship ensures every farm investment supports the future of American agriculture.

2. Farm Operating Loans

Farm operating loans provide essential financial support for the recurring and seasonal expenses of farm operations. These loans help cover the cost of seed, fertilizer, livestock, equipment, fuel, and even family living expenses.

- Eligibility: Farmers of all sizes who demonstrate need (including those with limited credit history).

- Use Cases: Start or expand production, purchase seed or livestock, repair or acquire equipment, or sustain operational costs between harvests.

- Full program details here.

Operating loans are pivotal for farms aiming at sustainable input management (buying only what’s needed when it’s needed), integrating resource-saving equipment, and ensuring production continues even in challenging seasons.

Scale up your farm’s operational intelligence and sustainability with Farmonaut’s Large Scale Farm Management App. Seamlessly monitor crop health using satellite data, optimize resource use, and make better seasonal decisions—vital for leveraging USDA farm loans efficiently.

3. Microloans for Farmers

Microloans are crafted for beginning farmers, small and specialty operations, and producers pursuing non-traditional farming methods. With streamlined paperwork and flexible criteria, microloans are an efficient gateway for new entrants looking to start or stabilize small farms.

- Eligibility: Small-scale, specialty crop growers, niche livestock producers.

- Features: Microloans (up to $50,000) cover operating expenses or minor purchasing needs (seed, equipment, livestock).

- Benefits: Quick access, less paperwork, adaptable requirements—with a strong focus on underserved and minority communities.

- Details on microloan eligibility.

These are a lifeline for urban, organic, hydroponic, and emerging-market farmers, and ensure the democratization of sustainable agriculture practices.

Our satellite-backed crop loan verification optimizes the loan and insurance process for small farmers—a big step towards securing microloans for farmers more efficiently.

4. Youth Loans

Designed specifically for the next generation, Youth Loans provide funding to young people ages 10 to 20 undertaking agricultural projects as part of initiatives such as 4-H, FFA, or local tribal youth groups.

- Eligibility: U.S. citizens/qualified residents, aged 10–20, with a viable ag project and responsible adult support.

- Features: Funds can cover purchasing livestock, starting a market garden, or acquiring equipment for a short-term project.

- Benefits: Encourages youth to lead in climate-smart farming, conservation, and rural community involvement.

- Youth loan details here.

Youth loans help seed inspiration and a sense of stewardship among young producers, broadening the reach of climate-smart and conservation agriculture.

5. Native American Tribal Loans

Native American Tribal Loans assist tribal governments and individual Native American farmers to acquire, develop, and sustain farmland within reservations or Alaskan native areas, boosting agricultural productivity and cultural preservation.

- Eligibility: Federally recognized tribal entities and individual Native American producers operating within tribal zones.

- Features: Access to ownership, operating, micro loan, and conservation programs; competitive rates and tailored technical support.

- Purpose: Enhance resource management, promote stewardship practices, and ensure sustainable ways of farming on ancestral lands.

- Eligibility and application details.

Supporting agricultural development and conservation ensures cultural roots and future agricultural innovation remain strong in Native American communities.

6. Emergency Farm Loans

Emergency Loans are a critical safeguard for farmers and ranchers reeling from natural disasters—such as drought, extreme flooding, hurricanes, or fires.

- Eligibility: Producers in officially declared disaster zones, including those with crop and physical losses.

- Coverage: Restore and replace production assets, rebuild structures, or compensate for lost income and livestock.

- Flexibility: Immediate support, flexible repayment, and tailored support by crop, region, or type of loss.

- Full guidelines here.

Emergency farm loans minimize interruption in food supply, keep operations afloat, and allow timely re-establishment of cultivation and livestock—especially vital in climate-volatile areas.

Streamline your emergency claim processes and insurance with Farmonaut’s satellite-based farm monitoring and insurance verification.

7. Farm Storage Facility Loans

Farm Storage Facility Loans finance the construction, upgrade, or acquisition of essential storage facility infrastructure on U.S. farms. Secure storage ensures efficient commodity handling and reduces post-harvest losses.

- Eligibility: Producers of eligible commodities (grains, oilseeds, hay, honey, and more).

- Features: Low-interest rates, flexible terms; covers construction of bins, silos, refrigeration, and handling equipment.

- Focus on Sustainability: Encourage investment in energy-efficient, climate-resilient storage options.

- Eligible commodities and details.

By modernizing storage facilities, U.S. farms reduce spoilage, retain quality, and gain greater control over marketing commodities—a foundation for both resilience and profitability.

Enhance transparency in your supply chain with Farmonaut’s Blockchain-Based Product Traceability—a perfect companion for grain and commodity storage programs, ensuring proof of origin and safe, fraud-resistant agricultural exports.

Optimize your grain logistics or agricultural machinery with Farmonaut Fleet Management—reducing operational costs and improving resource usage, which is vital for loan-supported storage and operational upgrades.

“USDA loan zones cover over 70% of U.S. farmland, empowering farmers to adopt eco-friendly practices and boost sustainability.”

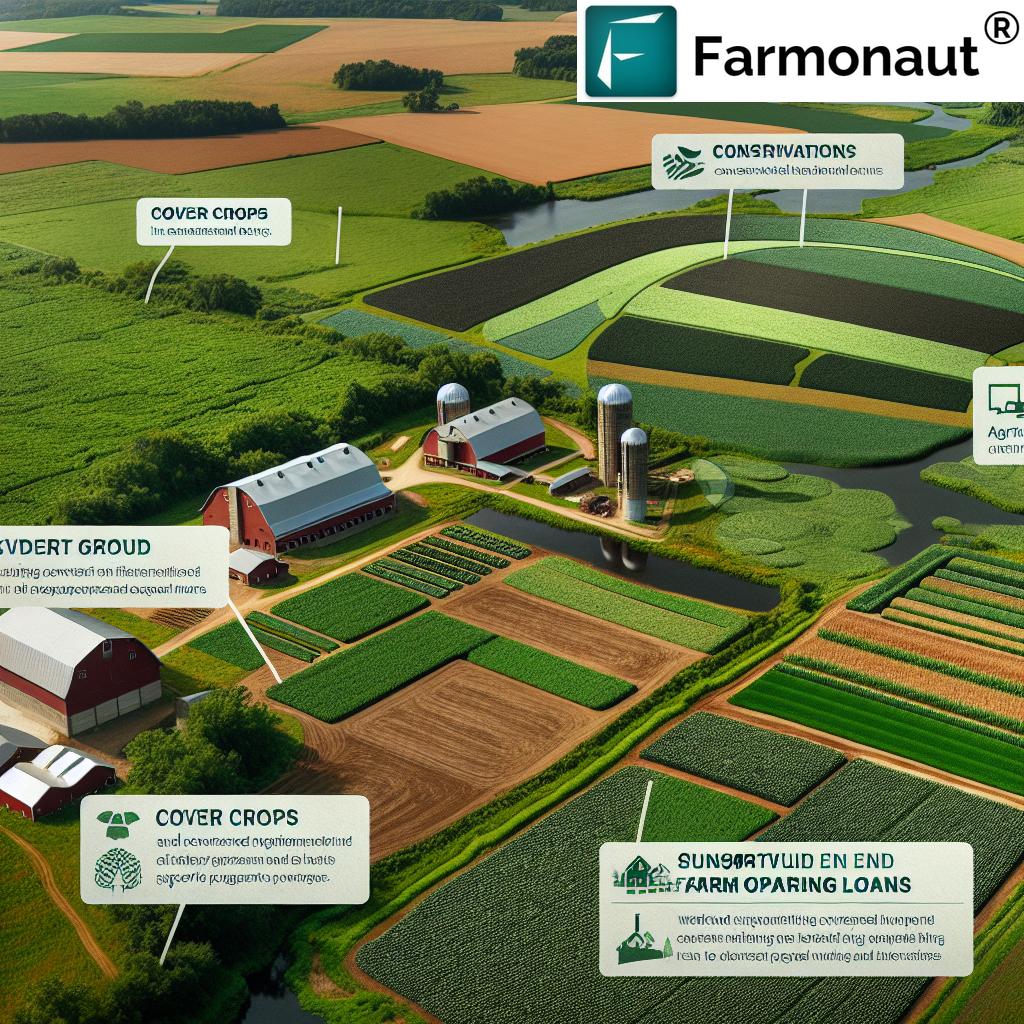

Promoting Sustainability Through USDA Agricultural Loan Programs

From the Pacific Northwest to the Great Plains and the Southeastern United States, USDA farm loans drive farm evolution by embedding conservation and climate-smart agriculture into their core criteria.

How USDA Loans Support Sustainability

- Soil Health: Many loan programs include direct incentives for soil improvement, cover cropping, and organic transition—elements essential for resilient food systems.

- Water Conservation: Ownership and operating loans can fund water-saving technologies—like drip irrigation, runoff management, and energy-efficient pumps.

- Equipment Modernization: Upgrade to fuel-efficient and precision-ready equipment for less waste, reduced emissions, and lower input costs, supporting both productivity and conservation goals.

- Disaster Recovery: Emergency loans include provisions to rebuild farms in a climate-resilient manner—modernized outbuildings, windbreaks, and more robust infrastructure.

- Community Empowerment: Youth and tribal loans foster new leadership and cultural preservation, broadening participation in eco-friendly agriculture from the ground up.

Gain greater insight on your farm’s eco-footprint and sustainability progress using Farmonaut’s Carbon Footprinting Solution. This cloud-based tool uses real-time data to help you track, analyze, and reduce agricultural emissions, making it easier to qualify for conservation loan programs!

For developers or agribusinesses seeking to integrate satellite or weather data into their USDA loan compliance or sustainability reporting, explore our API platform and developer docs.

USDA Loan Programs and Their Impact on Sustainable Growth by Zone

| USDA Loan Type | Eligible Zone(s) | Estimated Loan Amount Range | Sustainability Focus | Estimated Approval Rate (%) | Example Initiative Supported |

|---|---|---|---|---|---|

| Direct Farm Ownership Loan | Nationwide | $5,000 – $600,000 | Soil/water conservation; organic transition; land purchase | ~65–75% | Acquiring farmland, building high-efficiency barns |

| Guaranteed Farm Ownership Loan | Rural, REAP, Tribal | $5,000 – $1,825,000 | Habitat restoration, energy-efficient upgrades | ~60–72% | Buying land in rural/tribal areas |

| Farm Operating Loan | Nationwide | $5,000 – $400,000 | Crop rotation, sustainable input use, equipment | ~73–85% | Purchasing seed, livestock, modernizing tools |

| Microloan (Operating/Ownership) | Urban, Tribal, Minority, beginning farms | $1,000 – $50,000 | Small/organic startups, low-input/eco-farms | ~80–85% | Starting hydroponic or specialty crops, greenhouse tools |

| Emergency Farm Loan | Disaster Zones, Drought/Flood Impacted | $5,000 – $500,000 | Disaster recovery, climate resilience | ~68–80% | Rebuilding irrigation, replacing lost livestock |

| Farm Storage Facility Loan | Nationwide; Grain Belt; Tribal | $15,000 – $500,000 | Commodity storage, energy-saving upgrades | ~75–83% | Building solar-powered grain bins |

| Youth Loan | All 50 states; Rural; Tribal areas | $1,000 – $5,000 | Community education; next-gen leadership; school gardens | ~83–85% | Youth-led organic gardening, livestock raising |

| Environmental Quality Incentives Program (EQIP) | High-priority conservation areas | $5,000 – $450,000 | Conservation tillage; pollinator habitat; nutrient management | ~62–72% | Cover cropping, buffer installation for waterways |

Farmonaut: Pioneering Tech for Smart, Sustainable Agriculture in Every Zone

At Farmonaut, we recognize that access to USDA loan programs is only one part of a successful, sustainable farming operation. The right technology—delivering real-time insights and practical resource management tools—amplifies the impact of your farm loan investments and helps you meet conservation standards more easily.

Farmonaut’s Core Technologies for USDA Loan Recipients

- Satellite-Based Crop Health Monitoring: Using multispectral satellite imagery, we track NDVI, soil moisture, pest outbreaks, and growth dynamics season after season, empowering smarter financial and agricultural decisions.

- Jeevn AI Advisory System: Our advanced AI delivers weather forecasts, yield predictions, and customized crop management strategies to reduce risk and enhance ROI of loan-backed projects.

- Blockchain Traceability: Track every stage of your commodities with blockchain-secured data, increasing transparency for processed foods, grains, and livestock—vital for food quality, branding, and compliance.

- Fleet and Resource Management: Reduce production and logistics costs with our real-time fleet solutions—vital for maximizing the operational benefits of USDA farm loans spent on equipment or facility upgrades.

- Carbon Footprinting: Monitor, report, and lower your emissions with our built-in carbon tools. This makes it easier to align with the growing number of conservation loan programs and environmental grant schemes.

Our mobile, web, and API platform is trusted by farm managers, agribusinesses, and government agencies across every USDA loan zone—bringing affordable, actionable precision agriculture to all.

REAP Zones and Rural Development Loan Programs

Rural Economic Area Partnership (REAP) zones are rural regions with geographic, economic, or demographic challenges—such as isolation, declining populations, or infrastructure gaps. USDA’s rural development loan programs and grants (REAP zones) provide dedicated technical and financial assistance for long-term rural revitalization.

- Benefits: Increased access to farm loans, grants, and business development support.

- Support Areas: Sustainable housing, broadband installation, business incubators, farm cooperatives, renewable energy and water projects.

- Empowerment: REAP zones are pivotal for both economic and environmental transformation—helping communities invest in green infrastructure and agricultural innovation.

- See USDA’s official REAP information for eligibility and application.

Our satellite advisory platform helps rural and REAP operators design, implement, and monitor the very projects USDA loans are supporting—from crop rotations and agroforestry to infrastructure upgrades.

Frequently Asked Questions (FAQ): USDA Loan Zones, Programs, and Farmonaut Solutions

What is a USDA loan zone, and why does it matter for farm financing?

A USDA loan zone is a designated area (by geography or special program) receiving specific types of financial and technical USDA support. Understanding your loan zone helps you target the right agricultural loan programs for your location and needs, boosting approval chances and alignment with sustainability goals.

Who qualifies for loans for beginning farmers and what are the typical requirements?

Beginning farmers (with less than 10 years of experience) often gain priority for microloans, operating loans, or farm ownership loans. Basic requirements include demonstration of need, basic business planning, U.S. residency, and, in some cases, a minimum level of farm management experience. See here for details.

Can I use my USDA loan to invest in technology or sustainability upgrades?

Yes. Many USDA loans—especially through operating, micro, conservation, and rural development programs—encourage investment in water conservation, energy efficiency, renewable infrastructure, new equipment, and precision farming solutions. This makes Farmonaut’s technology a perfect companion.

How can advanced satellite and AI platforms help USDA loan recipients?

Solutions like Farmonaut deliver real-time farm health, soil, irrigation, and resource management data. This digitization helps farmers demonstrate compliance, meet conservation requirements, maximize operational efficiency, and access new financial opportunities.

What’s the advantage of blockchain-based traceability for USDA loan recipients?

It provides tamper-proof tracking of agricultural products, increasing transparency, reducing fraud, meeting consumer/supplier quality requirements, and often improving market access and loan terms for compliant producers.

What support is available for tribal farmers and Native American communities?

Special USDA programs (such as tribal loans and certain REAP initiatives) prioritize land acquisition, resource restoration, conservation, and preservation for Native American and Alaska Native producers, offering targeted technical and financial aid.

Conclusion: Building Resilient Farms & Sustainable Rural Communities

USDA loan zones and loan programs are a robust foundation for American farm growth, offering pathways for purchasing land, expanding operations, recovering from disaster, and—critically—adopting conservation and climate-smart practices at scale. When combined with next-generation agri-tech like Farmonaut’s, ranchers and producers in every zone—from the Heartland to tribal regions to rural REAP communities—gain the power to farm smarter, more sustainably, and more profitably.

Our commitment, at Farmonaut, is to democratize access to actionable data, making precision agriculture achievable for every farmer, in every zone—so that the fruits of USDA loan programs are maximized for productivity, profitability, and a sustainable future.

Ready to lead the next chapter of sustainable ag?

References: