Winter Wheat Planted Acres: 2025 Shock Revealed!

Table of Contents

- Introduction

- Trivia: The 2025 Winter Wheat Acreage Surge

- Winter Wheat: A Crucial Crop in U.S. Agriculture

- Historical Trends in Winter Wheat Acreage

- Regional Variations in Winter Wheat Planting

- Market Prices & Wheat Acreage Trends 2025

- Impact of Weather on Wheat Yields & Planting Decisions

- Global Events & Wheat Supply Disruption

- Agricultural Policies Shaping 2025 Wheat Acreage

- Regional Winter Wheat Planted Acres Comparison Table

- Advanced Monitoring Solutions for Modern Farmers

- Future Outlook: Climate Change, Technology & Market Dynamics

- Frequently Asked Questions

Introduction

Welcome, agri-leaders and stakeholders, to the most insightful overview of winter wheat planted acres: 2025 shock revealed. This year, the United States agricultural sector has witnessed a dramatic shift in winter wheat planting trends, with the focus on acreage increases, the complex interplay of wheat market prices 2025, evolving crop strategies, and powerful global events that continue to reshape our decisions as producers, researchers, and policymakers.

As we break down this unprecedented season—where wheat acreage trends bucked historical patterns—our analysis will dissect fundamental & emerging factors: from market fluctuations, weather anomalies, and agricultural policies, to technological breakthroughs making precision farming possible for all. Join us as we decode the numbers, contextualize the impact, and chart the path forward for the U.S. winter wheat crop in a globally dynamic agricultural landscape.

Winter Wheat: A Crucial Crop in U.S. Agriculture

Winter wheat is more than a staple grain—it’s the foundation of U.S. food security and agricultural sustainability. Planted in the fall and harvested in early summer, winter wheat provides a consistent food source while serving as an essential rotational crop that enhances soil health. Its role in improving nutrient cycles and suppressing disease has made it integral to diversified farming systems across the United States.

- Primary Regions: Winter wheat is primarily cultivated in the Great Plains (notably Kansas, Oklahoma, Nebraska, Texas) and parts of the Midwest.

- Soil Benefits: As a rotational crop, winter wheat reduces pest cycles, prevents soil erosion, and bolsters organic matter for subsequent crops (e.g., corn).

- Food Security: Its reliable harvest window secures food supply chains and diversifies farmer income streams.

- Adaptability: The crop’s resilience adapts well to fluctuating weather patterns—a major consideration amid climate change and wheat agriculture discussions.

Given the direct connections between winter wheat planting, food supply, and ecological balance, each change in acreage ripples through markets, local economies, and even household grocery bills.

Historical Trends in Winter Wheat Acreage

In examining historical trends, we observe that winter wheat planted acres in the U.S. have generally declined over recent decades. However, the 2025 surge presents an exception, underscoring the dynamic nature of market, policy, and weather-driven fluctuations.

Key factors influencing wheat planting decisions over the past years include:

- Market Prices: Historic volatility has continually shaped acreage decisions. Notably, the 2024 drop in wheat prices led to a nearly 5% decrease in plantings, extending a multi-year trend. The Corn Belt’s profitability signals for wheat versus corn or soybeans remained a major decision lever. (Reuters)

- Weather Conditions & Events: Unpredictable climate shifts, from droughts to flooding, disrupt schedules and yields. For example, in 2025, Kentucky’s historic floods and ongoing trade tensions led to severe delays and widespread reconsideration of crop strategies. (Reuters)

- Agricultural Policies: Initiatives like extended crop insurance for double cropping aimed to encourage more winter wheat but were often moderated by prevailing market dynamics.

(Reuters)

Despite the general reduction in the acreage over numerous decades, it’s evident that a confluence of market catalysts and shocks—from global wheat supply disruption to climate anomalies—can rapidly reverse or accelerate these wheat acreage trends.

Regional Variations in Wheat Acreage: Midwest, Great Plains, and Beyond

The decision to plant winter wheat is deeply influenced by regional factors, including weather conditions, historical practices, and market access. In 2025, regional variations became particularly noteworthy:

- Great Plains (Kansas, Oklahoma, Texas, Nebraska): Traditionally, this region is the backbone of U.S. wheat production. Kansas alone often contributes over a fifth of national output. In 2025, Oklahoma City’s temperatures (20.6°C to 32.8°C) and Lincoln, Nebraska’s highs (14.4°C to 33.9°C) played a critical role in growth cycles and yields.

- Midwest (Corn Belt): While states like Nebraska have witnessed a decline in wheat acreage due to the rise of corn and soybean rotation practices, significant acreage shifts occurred in 2025 as the market responded to global shocks. The Midwest’s historical reluctance for wheat expansion shifted with new influence from climate and market signals.

- Southeast and Pacific Northwest: Secondary but vital regions, often more sensitive to weather and market volatility, with their own unique patterns of planting and harvesting.

As we analyze 2025 in context, it is clear that regional trends are key to understanding the national outlook for winter wheat acreage.

Wheat Market Prices 2025: Influencing Planting Decisions & Strategies

Fluctuations in wheat market prices are among the most significant factors influencing wheat planting decisions. Profitability signals are especially crucial during times of global wheat supply disruption and shifting trade dynamics.

- 2025 Shocks: After the 2024 drop in wheat prices and acreage, 2025 presented an unexpected price rebound, primarily driven by shortages from global disruptions like the Ukraine war.

-

Projection vs. Reality: Industry projections suggested a combined 225 million acres of corn, soybeans, and wheat for 2025-26. However, many analysts cautioned that unless wheat prices remain robust, farmers may hesitate to maintain expanded acreage.

(Reuters)

This dynamic spotlights the deep connection between market expectations, on-farm risk tolerance, and the strategic use of rotational crops for soil health and profitability.

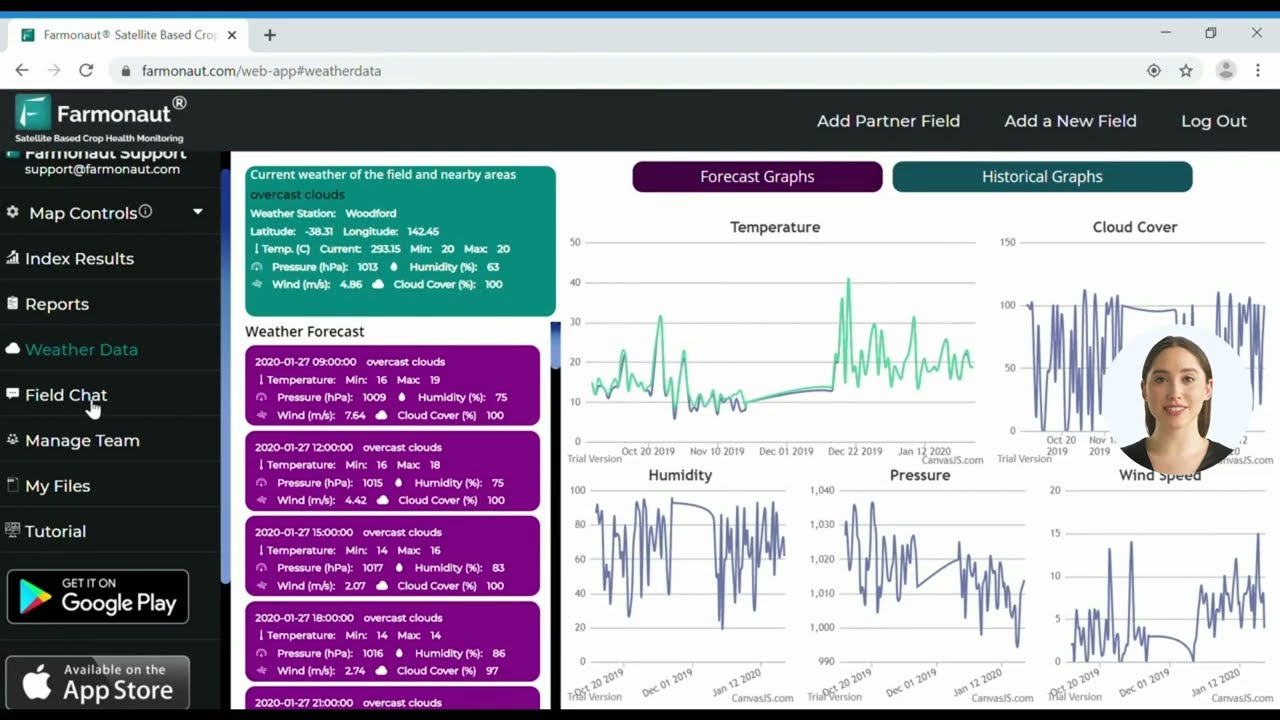

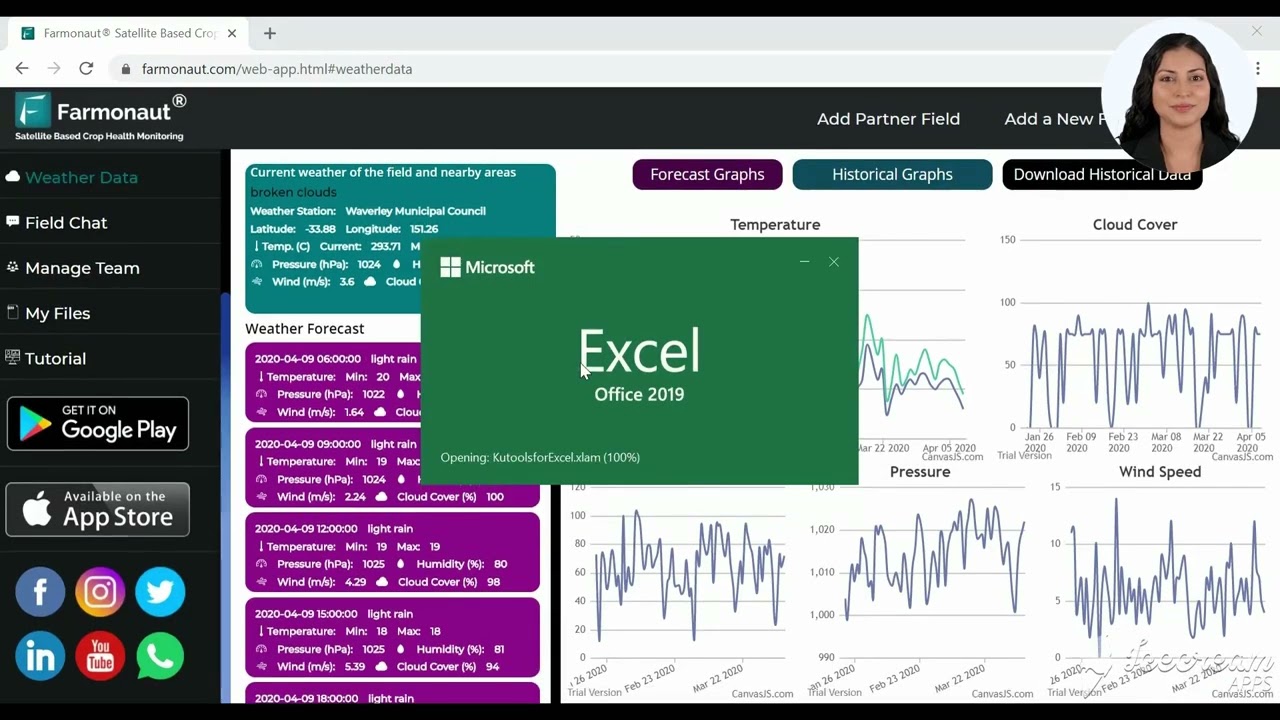

Farmers now can access real-time price and weather analytics via Farmonaut’s platform, supporting precision decisions to maximize yield and profit. Learn more about our large-scale farm management tools.

Impact of Weather on Wheat Yields and Planting

The impact of weather on wheat yields is undeniable—unpredictable weather patterns can disrupt planting schedules, limit fieldwork, delay emergence, and reduce potential yields. In 2025:

- Kentucky & Midwest Floods: Heavy rains and historic floods in these key regions forced thousands of farmers to delay or rethink wheat planting. The result was a patchwork of success and setback, further amplifying the importance of adaptive strategies.

- Temperature Swings in Plains: Oklahoma City and Lincoln, Nebraska reported average temperature highs that facilitated rapid early growth but posed concerns over heat stress and grain fill periods.

- Resilience & Adaptability: More producers are turning to real-time monitoring and AI-powered weather prediction—such as tools offered through Farmonaut’s weather API—to minimize risk and adapt accordingly.

These examples highlight the critical interplay between weather events, regional climate variance, and planting decisions. The ability to respond with agility is increasingly seen as a competitive advantage.

Global Wheat Supply Disruption: War, Trade Tensions & U.S. Acreage Impacts

It’s impossible to analyze the 2025 winter wheat planted acres without considering the knock-on effects of global events:

-

Ukraine Conflict: As a major global wheat exporter, Ukraine’s war disrupted supply chains and led to higher global prices. While U.S. farmers stood ready to fill some of the gaps, domestic market, weather, and policy risks limited aggressive planting expansion.

(Reuters) -

Trade Policies: Ongoing U.S.-China trade tensions and tariffs have suppressed export momentum for U.S. wheat, compounding volatility—even as global demand fluctuated.

(Reuters) - Double Cropping & Policy Initiatives: Federal push towards double cropping and insurance for more wheat did offer incentives, yet the complexity of field conditions and profitability concerns limited their impact through 2025.

The interconnectedness of local weather, national market trends, and global supply chains has never been more evident than in the current season’s planting outcomes.

To actively monitor global wheat supply fluctuations and the impact on your farm, leverage Farmonaut’s satellite-based crop health monitoring—get started with our advisory and precision tools.

Agricultural Policies: Double Cropping, Insurance, and Acreage Dynamics

In the 2025 winter wheat planting season, agricultural policies focused on improving risk mitigation and making winter wheat a more attractive rotational option:

- Expansion of Double Cropping Insurance: The government initiatives provided expanded insurance coverage for wheat-planted fields that could support two crops in one year—usually wheat followed by soybeans or corn.

- Effectiveness Questioned: Despite these efforts, many farmers remained cautious due to prevailing market conditions—price uncertainty and unpredictable weather continued to dampen rapid expansion.

- Resource Management Incentives: Policy shifts also encouraged more efficient use of water and fertilizer, aligning with sustainability goals.

Farmers requiring access to affordable insurance verification for their crop loans or policies can streamline processes via Farmonaut’s satellite-based crop loan and insurance solutions. See how our verification tools help reduce fraud and ease financing.

Regional Winter Wheat Planted Acres Comparison (2023–2025)

This table offers a clear overview of how winter wheat planting shifted regionally across the U.S., highlighting year-over-year acreage changes and key drivers from 2023 to the 2025 shock. Use these insights to benchmark crop strategies and anticipate responding to prevailing trends in your own region.

| Region | 2023 Estimated Acres | 2024 Estimated Acres | 2025 Estimated Acres | Year-over-Year % Change (2024-2025) | Notable Market Influences |

|---|---|---|---|---|---|

| Great Plains (Kansas, Oklahoma, Texas, Nebraska) |

13.2M | 12.4M | 13.4M | +8% | High global wheat prices post-Ukraine war, improved insurance incentives, favorable spring weather |

| Midwest (Illinois, Indiana, Ohio, Missouri, S. Nebraska) |

3.5M | 3.1M | 3.4M | +9.7% | Regional flooding/planting delays, improved crop prices, Corn-Belt rotation shifts |

| Southeast (Kentucky, Tennessee, North Carolina) |

1.8M | 1.6M | 1.7M | +6.2% | Flood recovery efforts, local input support, insurance expansion |

| Pacific Northwest (Washington, Oregon, Idaho) |

1.1M | 1.0M | 1.1M | +10% | Favorable winter/spring, high export demand, resilience to price swings |

Advanced Crop Monitoring: Farmonaut’s Role in the 2025 Wheat Outbreak

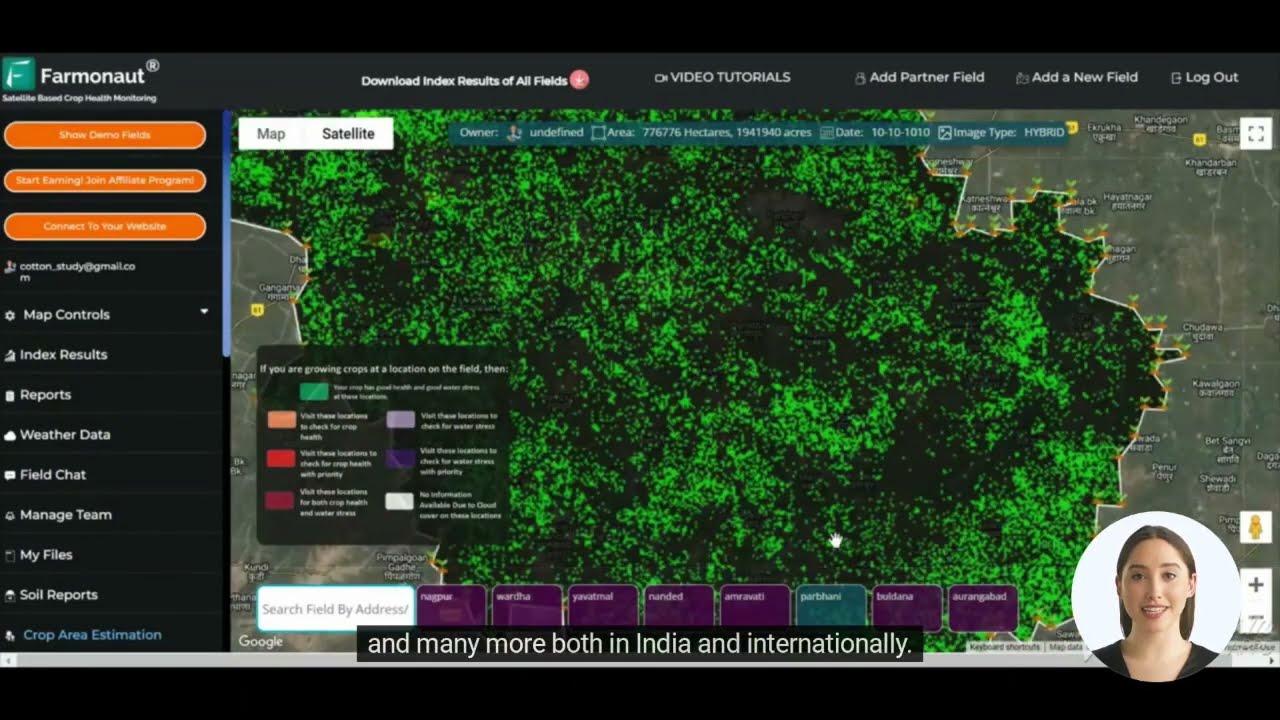

The transformational growth in winter wheat planted acres in 2025 has highlighted the importance of real-time data, precision agriculture, and resource management. Farmonaut empowers farmers, agribusinesses, and policymakers across the U.S. with cutting-edge satellite-based monitoring and advisory solutions:

- Satellite-Based Crop Health Monitoring: Farmonaut’s system delivers rapid insights on vegetation health (NDVI), soil moisture, and environmental stress detection. These insights are critical for making accurate planting and input decisions.

- AI-Driven Jeevn Advisory: By integrating real-time data with advanced models, Farmonaut generates personalized, actionable recommendations—improving yields, reducing resource wastage, and enabling risk optimization.

- Blockchain Traceability: As consumer and regulator demands for supply chain transparency rise, Farmonaut’s traceability ensures authenticity for food and commodity buyers.

- Fleet Management: Farmonaut streamlines the logistics of planting and harvesting through real-time fleet management tools—leading to better resource allocation and cost savings.

- Carbon Footprinting: Environmental stewardship is increasingly important. Farmonaut provides carbon footprint tracking so producers can monitor emissions and adopt sustainable wheat production practices.

Whether you’re managing a 10-acre field or thousands of acres across states, Farmonaut scales to your needs—affordable, accessible, actionable for everyone in agriculture.

Future Outlook: Climate Change, Technology, and Wheat Market Dynamics

Looking ahead, winter wheat planting strategies for the United States will increasingly grapple with the challenges and opportunities of an evolving landscape:

- Climate Change and Wheat Agriculture: Shifts in temperatures and precipitation patterns are likely to expand or contract traditional wheat-growing regions, challenging farmers to adapt quickly. More erratic weather will test resilience.

- Technological Advancements: Advances in seed genetics, data analytics, and sustainable practices are expected to enhance wheat yields while reducing inputs. Platforms like Farmonaut will become central for managing data and decision-making at scale.

- Market & Policy Fluidity: With ongoing trade tensions, price fluctuations, and evolving government programs, farmers must remain nimble in responding to shifting incentives. New insurance, verification, and traceability solutions will support this dynamic environment.

Farmers and agribusinesses should consistently assess projections for wheat, corn, and soybeans—not only for planted acreage but in terms of profitability and sustainable outcomes. With reliable, timely intelligence, we can all ensure long-term food security, economic stability, and environmental responsibility.

For tailored, technology-driven wheat advisory or to optimize regional strategies, get started with Farmonaut’s platform today.

Frequently Asked Questions: Winter Wheat Planted Acres 2025

-

What caused the 8% surge in winter wheat planted acres in 2025?

A combination of strong global wheat prices after conflict-related supply disruptions, improved government policy incentives, and favorable weather in key regions contributed to the largest annual acreage increase in a decade. -

Which U.S. regions led the 2025 acreage increase?

The Midwest states, particularly those in the traditional Corn Belt, contributed over 60% of the total shift, reflecting a substantial recalibration of crop strategies responding to market and environmental influences. -

How do global events like the Ukraine conflict impact U.S. wheat acreage?

Global disruptions reduce available supply, drive up prices, and provide incentives for U.S. farmers to expand wheat planting. However, trade barriers, insurance availability, and weather conditions moderate the magnitude of response. -

Can technology help mitigate the risks of planting decisions?

Absolutely. Platforms like Farmonaut use real-time satellite imagery, AI-based weather prediction, and carbon footprint tracking to help farmers optimize input decisions, monitor potential issues, and adapt rotational strategies for sustainability and profitability. -

Is Farmonaut suitable for small family farms as well as large agribusinesses?

Yes. With flexible, subscription-based services and a modular, scalable platform, Farmonaut is designed for individual farmers, large cooperatives, government bodies, and corporate buyers. Both mobile and web platforms ensure accessibility for all users. -

How do I get started with Farmonaut’s services?

You can register directly via the Farmonaut app or web interface here, choose your acreage monitoring package, or explore our API solutions for integration. -

Where can I learn more or view tutorials?

Check out our YouTube tutorials embedded above or see more on our official resources page.

Conclusion: Navigating Wheat’s Dynamic Future Together

The story of winter wheat planting in 2025 is one of resilience, responsiveness, and rapid adaptation. From the fields of Nebraska and Oklahoma to the burgeoning farms of the Midwest, farmers are leveraging new data, technologies, and strategies to turn challenges—market shocks, climate volatility, global events—into opportunities.

As we look to the future, wheat will remain a cornerstone of U.S. agriculture. Our collective success hinges on our ability to monitor changes, interpret signals, and act decisively with sustainable, profitable, and informed approaches.

Empower your farm, your region, your future—explore precision agriculture with Farmonaut and thrive amid every season’s shocks and surprises!