Farm Cash Flow Mastery: 7 Powerful Strategies for Growth

“Over 60% of farms struggle with cash flow planning, impacting long-term business sustainability and growth potential.”

Introduction: Why Cash Flow Management Matters in Farming

Cash flow management for farms is the cornerstone of building successful and sustainable agricultural operations. For every farm and agribusiness, the ability to plan, monitor, and control the movement of money is what separates enterprises that thrive from those that merely survive. Our goal in this comprehensive guide is to show how effective agricultural financial planning, rigorous monitoring of farm expenses, and the right mix of budgeting strategies unlock stable growth—even against seasonal cash flow fluctuations.

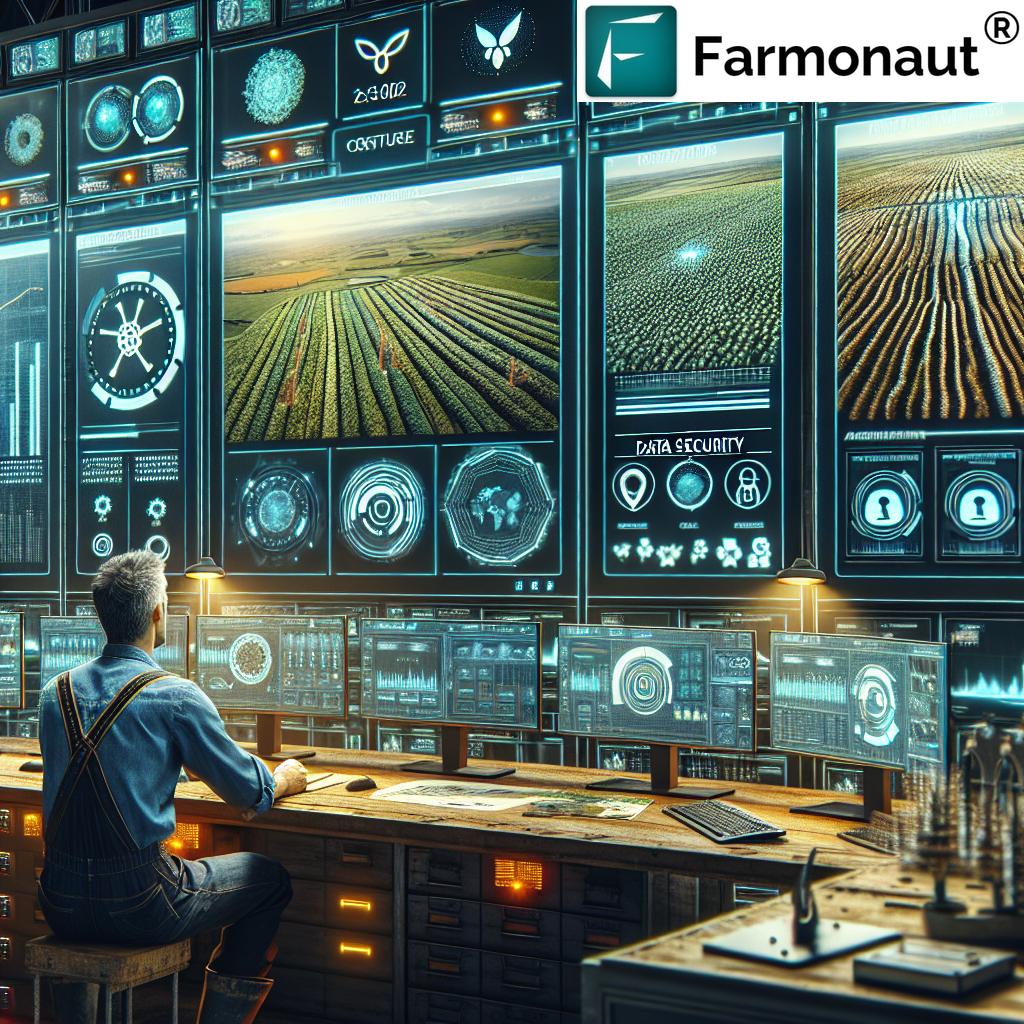

In a rapidly evolving agriculture environment, precision management is key. As technology advances, so do the tools for planning, measuring, and reacting to income variability, operational costs, and investment needs. Farmonaut stands at the forefront, offering advanced, satellite-based management solutions specifically tailored for contemporary agricultural business needs.

Whether you are seeking to improve farm profitability, manage seasonal income fluctuations, or support sustainable farm operations, mastering cash flow is a non-negotiable business skill. Let’s explore how together we can achieve farm cash flow mastery with 7 powerful strategies designed for real-world agricultural growth.

Understanding Cash Flow in Agriculture

Cash flow is the movement of money into and out of our farm business. Unlike net profit, which considers profit and loss over time, cash flow focuses strictly on cash transactions: what’s presently coming in as inflow (income from the sale of crops, livestock, and products) and what’s going out as outflow (purchases, operational costs, labor, and equipment).

- Cash Inflow: Revenue from sales of farm products, livestock, rental income, subsidies, insurance payouts, or off-season enterprises.

- Cash Outflow: Equipment purchases & maintenance, input costs (seed, feed, fertilizer), labor, loan repayments, and other operational expenses.

Liquidity—your farm’s ability to meet financial obligations as they arise—relies on cash flow, and this is central to agricultural financial planning. Understanding these flows helps us maintain operational health, make proactive investment decisions, and plan for the future.

The Importance of Farm Cash Flow Management

Why is cash flow management for farms so critical? Let’s examine the powerful impact it delivers to our business stability and opportunity for growth:

- Managing seasonal income fluctuations:

Most of us experience seasonality—periods with high cash inflow (like post-harvest) and lean periods with minimal sales.

Effective cash flow management enables us to match our essential expenses and obligations with revenues, covering labor and input costs even during off-seasons [reference]. - Ensuring operational continuity:

We need enough liquidity to meet payroll, service debt, buy inputs, and keep our equipment running. Well-managed cash flows reduce reliance on high-interest loans and credit lines, supporting financial stability in farming.

- Driving investment and future growth:

Reliable cash flow means we can reinvest: from purchasing advanced machinery to adopting new sustainable practices. This is essential in improving farm profitability and scaling up large-scale operations.

Let’s not forget: cash flow also impacts loan eligibility, negotiation with suppliers, and business opportunity readiness. For modern farms, developing robust cash flow strategies isn’t optional—it’s vital to our success.

“Implementing just 3 budgeting strategies can improve farm profitability by up to 25% within a single season.”

Farm Cash Flow Mastery: The 7 Powerful Strategies for Growth

Now, let’s dive into actionable strategies designed for managing, controlling, and maximizing cash flow in agricultural enterprises—from small farms to large-scale agribusinesses.

1. Develop a Comprehensive Budget

A detailed budget is our primary planning and monitoring tool. It outlines expected income, operational expenses, investments in new equipment, and debt servicing over a defined period. Creating this budget lets us anticipate periods of surplus and shortfall, enabling proactive financial planning.

- Factor in seasonal cycles and income variability.

- Break down costs for labor, crop inputs, fuel, insurance, and maintenance.

- Use these projections to make timely decisions—whether it’s scaling production, seeking credit, or deferring non-essential purchases.

- Tip: Revisit your budget quarterly to adapt for unexpected price or weather fluctuations.

Farmonaut offers affordable, precision satellite data access, making it easier than ever to forecast yields and plan resource allocation—improving budgeting accuracy.

2. Monitor Farm Cash Flow Regularly

Constant cash flow monitoring (ideally monthly) reveals trends, seasonality, and areas for cost control. Utilize digital cash flow tools for agriculture to track inflow/outflow in real time.

- Record daily, weekly, and monthly transactions: sales, payments, receipts, and expenses.

- Compare actual performance vs. budget projections, making timely adjustments if issues or opportunities arise.

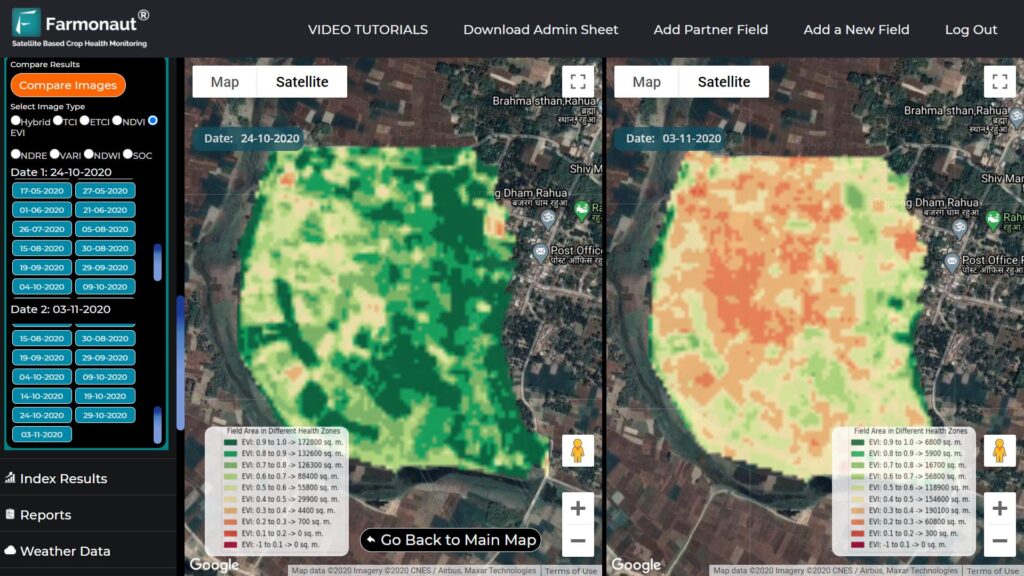

- Tools like Farmonaut offer easy dashboards to visualize and manage cash movement and resource efficiency.

Regular tracking means we never get caught unaware by lean periods or unexpected expense spikes.

3. Diversify Income Streams

Reliance on a single cash-generating enterprise is risky, especially given the inherent price and yield volatility in agriculture.

- Integrate value-added products: packaged foods, processed crops, or agri-tourism experiences.

- Pursue off-season operations—such as greenhouse crops, farm stays, or educational workshops.

- Consider contract growing or custom work for neighboring farms.

- Farmonaut’s resource monitoring tools can highlight underutilized assets or periods when diversification would be most effective.

By expanding cash inflow sources, we balance risks and secure greater financial stability in farming.

4. Negotiate Payment Terms

Negotiating favorable terms with both suppliers and customers smooths the timing between inflow and outflow.

- Request longer payment periods from suppliers for inputs and equipment—frees up working capital during lean periods.

- Encourage early payments from customers with small discounts or incentives.

- Formalize agreements in writing for greater predictability and to improve your ability to meet obligations.

Good terms reduce short-term cash pressure and make budgeting more predictable. Farmonaut’s blockchain-based traceability system adds a layer of trust and assurance for buyers and sellers alike.

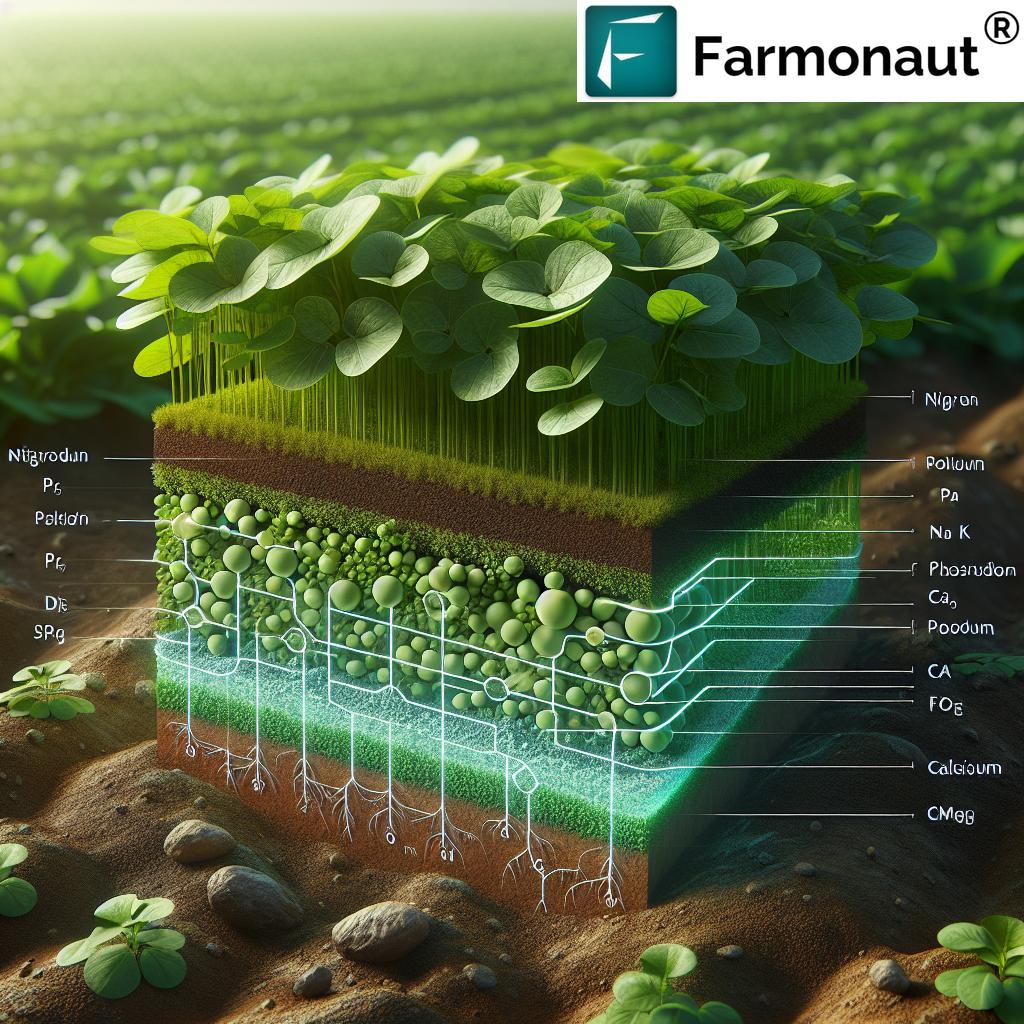

5. Implement Efficient Resource Management

Every rupee—or dollar—we don’t spend is another that adds to positive cash flow. Smart resource management maximizes output while minimizing unnecessary expenses.

- Adopt precision input applications (drip irrigation, variable-rate fertilization) to reduce waste and lower costs.

- Apply nutrient budgeting and targeted pest management to improve yields efficiently.

- Use Farmonaut’s carbon footprinting tools and resource tracking to identify inefficiencies and sustainability risks before they impact profitability.

- Rotate crops or integrate livestock to break disease cycles and lower dependency on external inputs.

Efficient operations help us weather market and weather fluctuations while ensuring long-term farm health.

6. Utilize Financial Tools and Software

Technology streamlines cash flow analysis, making detailed tracking, forecasting, and expense monitoring much easier compared to manual ledgers.

- Leverage software for digital bookkeeping, expense tracking, and automated cash flow calculations.

- Forecast periods of deficit and surplus, helping us plan when to invest, defer, or seek external funding.

- Farmonaut’s API (Direct Access | API Developer Docs) enables seamless integration of precision ag and weather tools with your farm business systems.

- Mobile/web-based dashboards mean real-time monitoring from anywhere.

The right cash flow tools for agriculture save us time, reduce errors, and support informed, proactive decision-making.

7. Build Resilience with Emergency Funds and Insurance

Despite our best efforts and planning, agriculture brings inherent uncertainties: weather extremes, commodity price crashes, or equipment breakdowns can disrupt even the most disciplined cash flow systems. How do we reduce our vulnerability?

- Accumulate cash reserves during good years to cover essential expenses when revenues drop.

- Take out robust, transparent agricultural insurance, ensuring rapid payouts after disasters.

- Explore Farmonaut’s crop loan and insurance verification tools for accurate, satellite-based damage assessment.

By building in this protection, we shield our business and our families from the worst of market and climate shocks.

Farm Cash Flow Strategy Comparison Table

To help visualize and compare each strategy’s strengths and application, here’s a detailed comparison table for quick reference:

| Strategy Name | Purpose/Goal | Estimated Impact on Cash Flow | Application Tips | Potential Challenges |

|---|---|---|---|---|

| Comprehensive Budget | Forecast & control all farm finances for proactive planning | +10–15% cash flow efficiency | Update quarterly; account for every type of inflow/outflow | Accuracy depends on quality of data/projections |

| Regular Monitoring | Track performance, identify risk periods early | +5–10% by preventing unplanned losses | Adopt software or digital dashboards for easy reporting | Time commitment, data discipline |

| Diversify Income Streams | Reduce vulnerability to single crop/farm risk | +20–25% during off-peak cycles | Start small with value-added products or seasonal activities | Requires outlay, marketing skills, added management |

| Negotiate Payment Terms | Align cash inflow with outflow, improve liquidity | Balances monthly cash requirements | Formalize agreements ahead of the season | Supplier/customer resistance |

| Efficient Resource Management | Lower input costs, increase operational sustainability | +10–20% cash savings | Invest in precision tech, detailed input analysis | Requires new skills, technology access |

| Financial Tools & Software | Digitalize, automate, and enhance financial management | Adds up to 10% efficiency through error/speed reduction | Adopt user-friendly solutions with farm-specific features | Learning curve, upfront subscription cost |

| Resilience (Emergency Funds/Insurance) | Protect against business interruption from disasters/shocks | Not a creator of cash flow, but essential for preservation | Budget for reserves; review insurance regularly | Requires sacrifice during good times |

Farmonaut: Advanced Tools for Cash Flow Management in Agriculture

Farmonaut empowers modern farm enterprises by delivering precision agriculture insights—from real-time resource tracking to blockchain-verified transactions—all designed to support smarter, more sustainable cash flow management for farms.

Key Farmonaut Features For Progressive Farmers:

- Satellite-based Crop Health Monitoring: Monitor the health and vigor of every field using multispectral satellite images and NDVI analysis. This directly aids budgeting and fine-tuned resource planning.

- AI-Driven Jeevn Advisory: Receive real-time, crop-specific guidance to maximize productivity and operational efficiency. This means we can plan for periods of high return and reduce losses due to surprise weather or pest outbreaks.

- Blockchain Traceability: Ensure transparent, verifiable records of product origin and movement—crucial for negotiating payment and establishing trust with high-value customers and export partners. Explore traceability solutions.

- Fleet and Resource Management: Optimize how machinery is used and maintained, directly reducing routine and emergency equipment expenses. Fleet management tools streamline logistics and minimize downtime.

- Carbon Footprint Tracking: Track and manage farm emissions for better sustainability, improved market access, and compliance with environmental expectations. Learn about carbon footprinting.

- API Access & Integration: Plug advanced farm analytics into existing systems for seamless financial and operational data flows. Developers and agri-researchers can explore the Farmonaut API or dive into the developer documentation.

We believe these technologies are not just for massive corporate farms. Farmonaut’s platform is affordable, scalable, and designed for everyone—from smallholder farmers to national government agencies.

Challenges in Cash Flow Management for Farms

Even with robust strategies in place, farmers may encounter persistent challenges:

- Price Volatility: Unpredictable commodity market swings can rapidly erode expected income—even for the best-planned budgets.

- Unpredictable Weather & Disasters: Droughts, floods, or pest outbreaks may slash productivity and disrupt both cash inflow and outflow.

- Equipment Breakdowns & Input Shortages: Emergency repairs or global supply issues can suddenly increase expenses and reduce available working capital.

- Access to Stable Financing: High interest rates or uncertain credit availability may force us to accept unfavorable terms or delay essential investments.

- Data Capture & Discipline: Tracking every transaction accurately (cash, barter, in-kind, etc.) is time-consuming but indispensable for actionable cash flow insights.

Our approach? Build resilience by maintaining insurance, emergency cash reserves, and a diversified operational model. Technologies like Farmonaut’s monitoring, resource management, and satellite-based verification systems support real-time adaptation, giving a much-needed edge over traditional guesswork.

Frequently Asked Questions (FAQ): Farm Cash Flow Mastery

What is the difference between cash flow and profit on a farm?

Cash flow measures the actual movement of money in and out during a period—what we can spend or save today, regardless of accounting profits. Profit considers income and expenses (including non-cash items like depreciation), giving a long-term view but sometimes masking real-time liquidity issues.

How frequently should farm cash flow be monitored?

Monthly is ideal. Weekly reviews are helpful during busy (or unpredictable) periods. The more regularly we monitor, the faster we can respond to issues or opportunities before they impact our ability to pay bills, invest, or seize market advantages.

What is a healthy cash reserve for most farms?

As a rule of thumb, reserve enough to cover 3–6 months of essential operational expenses. This provides a safety net for covering payroll, crucial input purchases, or temporary drops in income.

Are there tools for automated farm budgeting and resource tracking?

Yes—including Farmonaut’s app and dashboard. These digital solutions let us record, analyze, and project finances using real-world inputs and dynamic weather/yield data.

How does Farmonaut support sustainable farm operations?

Farmonaut’s sustainability suite tracks inputs, emissions, soil health, and more. This not only optimizes cash flow by reducing waste but builds long-term resilience and premium market access.

Can I use Farmonaut if I have a small farm?

Absolutely! Farmonaut’s subscription model is highly flexible, supporting everything from a single plot to hundreds of hectares. Get started with real-time monitoring and personalized financial insights tailored to your farm size and resource availability.

Conclusion: Achieving Financial Stability & Growth in Farming

Mastering cash flow management for farms is the linchpin for building sustainable, scalable, and profitable agricultural enterprises. By adopting comprehensive farm budgeting strategies, closely monitoring income and expenses, diversifying operational risks, and embracing precision technology through platforms like Farmonaut, we unlock resilience during lean periods and position our farms for periods of abundant growth.

In the modern era of agriculture, we can no longer rely on guesswork or outdated tools. Proactive, data-driven financial management—combined with constant adaptation and learning—is our farm’s best insurance against volatility, uncertainty, and risk. Let’s embrace these seven strategies, empower our teams, and invest in cutting-edge, affordable agri-technologies to ensure our success—season after season.

Start Your Farmonaut Journey Today

Learn more about large-scale farm management with Farmonaut

|

Explore satellite-based crop loan and insurance solutions

Get Started: Farmonaut Subscription Options

Farmonaut offers a range of affordable subscriptions suitable for individual farmers, cooperatives, agribusinesses, government agencies, and researchers. Enjoy unlimited access to crop health monitoring, blockchain traceability, AI-powered advisories, and the digital tools you need for better cash flow, planning, and decision-making.