Agriculture Finance Solutions: 7 Shocking Ways to Profit

Discover top agricultural finance solutions, innovative financing options, risk management in farming, and the sustainable agriculture funding tools driving sector growth and profitability.

“Over $500 billion in global agricultural finance is invested annually, fueling innovation and sustainable growth in the sector.”

The Importance of Agricultural Finance Solutions

Agricultural finance solutions form the backbone of the global farming, agriculture, and forestry sectors. These financial tools and products empower farmers and agribusinesses to secure the capital necessary for daily operations, business expansion, technological innovation, and adapting to ever-evolving market demands.

Reliable and accessible agricultural financing is not just about sustaining what we have—it’s about building a future where sustainable practices ensure food security, climate resilience, and higher profitability for all stakeholders.

- Empowering Farmers: Equipping farmers with financial products accelerates prosperity and boosts crop productivity.

- Driving Sector Growth: Capital investments and financing options enable enterprises to thrive, adapt, and innovate.

- Ensuring Stability: Effective risk management in farming and insurance limit the adverse impacts of weather, market volatility, and operational challenges.

With digital and sustainable finance practices reshaping the industry, the time to understand and use the right agricultural finance solutions—from agricultural loans and credit to green investment—is now.

Traditional Farmers Financing Options

Traditional financing options have long supported the growth and stability of agricultural businesses. Let’s explore the mainstays of agricultural finance and how these foundational solutions shape our sector.

1. Bank Loans and Credit Lines

Conventional financial institutions remain major players in farmers financing options. Banks offer agricultural loans and credit lines designed specifically for the unique needs of agriculture and forestry:

- Enabling purchase and upgrade of farm equipment (tractors, irrigation systems, storage).

- Facilitating business expansion, land acquisition, and cash flow management.

- Offering seasonal credit to cover operational and input costs until harvest.

- Supporting long-term investments in infrastructure and sustainable technologies.

With experienced lenders tailoring products for both smallholder and large-scale farmers, these agricultural financing solutions remain a reliable backbone for millions across regions.

2. Government Subsidies and Grants

Across the globe, government subsidies for agriculture have been instrumental in supporting agricultural development. These government assistance programs often focus on sustainability, innovation, and food security:

- Subsidies: Direct payments or cost-sharing for adopting innovative or sustainable practices.

- Grants: Funding research and development, climate adaptation, and pilot projects for eco-friendly farming.

- Incentives: Encouraging investments in advanced technologies, such as drip irrigation, solar pumps, or precision agriculture.

These financing solutions are especially crucial for farmers taking their first steps towards sustainable agriculture funding and adopting new technologies.

3. Cooperative Financing

In many regions, farmer cooperatives play an integral role in offering accessible farmers financing options. Here’s how cooperatives facilitate capital flow:

- Pooling member resources to offer loans, credit, and input financing at favorable terms.

- Fostering a shared risk model, reducing individual vulnerability to crises.

- Leveraging community networks for collective bargaining and lower interest costs.

Cooperative financing not only empowers individual farmers but strengthens community support and sector sustainability.

Innovative and Digital Agriculture Finance Solutions

The rise of digital financial services for farmers, new platforms, and creative investment vehicles has transformed access to agricultural capital. These innovative agriculture finance options unlock opportunities even in previously underserved developing regions.

4. Digital and Mobile Banking

The integration of digital platforms is revolutionizing rural finance:

- Mobile and online banking apps allow real-time management of finances, loans, and payments.

- Remote onboarding and digital KYC improve access to capital for smallholder farmers with limited formal credit history.

- Secure peer-to-peer transfers and payments reduce transaction delays and risk.

We are witnessing a true leap over legacy obstacles, as fintech makes finance accessible, transparent, and less risky for all.

5. Crowdfunding Platforms & Online Investment

Modern crowdfunding platforms enable farmers and agricultural startups to raise funds directly from a global pool of small investors, bypassing traditional banks:

- Online platforms enable democratic access to capital and shared investment in agricultural innovation.

- Community-driven campaigns promote high-impact, sustainable practices.

- Risk and reward are diversified across many stakeholders.

This approach is rapidly gaining traction among new-generation agricultural businesses.

6. Impact Investing in Agriculture

A new wave of impact investing is flooding the sector, aligning profitability with sustainability. Investors increasingly seek opportunities that generate both financial returns and positive environmental or social impacts:

- Impact investing fosters green financing solutions, regenerative practices, and climate-resilient models.

- Popularity of sustainability-linked bonds and funds for forestry, water conservation, and eco-friendly technologies.

- Focused funding for projects tackling climate change and agriculture finance.

Impact investing stands at the intersection of good business and good stewardship, growing in both maturity and influence.

“Innovative financing options have increased farm profitability by up to 30% in emerging markets since 2020.”

Risk Management in Farming: Financial Tools

Effective risk management in farming is crucial for sustainability and food security. Uncertainties such as climate variability, market volatility, disease outbreaks, and pest invasions can severely impact profitability and livelihoods.

Innovative financial products and insurance tools help farmers protect their businesses and investments, ensuring that risks are managed proactively rather than reactively.

- Crop Insurance: Offers financial protection from yield losses due to droughts, floods, pests, or diseases. Modern crop insurance may use remote-sensing and satellite data for quick, accurate claims assessment. Explore Farmonaut’s Crop Loan & Insurance Solutions for advanced, satellite-based verification, reducing fraud, expediting disbursals, and enhancing access to capital.

- Weather-Indexed Insurance: Pays out based on objective weather data (like rainfall or temperature levels) rather than detailed field loss assessments, allowing for immediate support post-disaster.

- Commodity Hedging: Futures, options, and other market instruments help farmers secure stable prices for future harvests, managing the risks of market fluctuations.

- Consortium Risk Solutions: Regional consortia like DRIFCA (Disaster Risk Insurance and Finance in Central America) are being developed to support smallholder farmers with scalable, climate-related risk financial solutions.

Our sector’s sustainability depends on how well we address risk and the availability of robust financial tools—especially as climate change accelerates volatility.

Sustainable Agriculture Funding and Green Finance

Building a future-ready agriculture sector requires sustainable agriculture funding and green investment options. Green finance supports farmers and businesses in adopting eco-friendly practices that preserve critical resources for generations to come.

- Green Loans & Grants: Designed for adopting modern technologies (like no-till planting, carbon sequestration, renewable energy), reducing emissions, and minimizing pollution.

-

Carbon Credits & Incentives: Rewarding farmers for adopting sustainable practices and quantifying emissions reductions.

Farmonaut’s Carbon Footprinting Tool lets agribusinesses track and reduce their carbon emissions—supporting regulatory compliance and unlocking value in sustainability markets.

-

Traceable Supply Chains: Blockchain-driven traceability solutions help secure funding and trust for sustainable food value chains.

Using Farmonaut’s Blockchain-Based Product Traceability, companies and cooperatives can ensure transparency and authenticity across the agricultural supply chain, enhancing both trust and market access for sustainable brands.

Platforms like InSoil facilitate investments in regenerative agriculture, mainstreaming sustainable practices like no-till and diversified crop rotation on a commercial scale.

Technology-Driven Financing: Satellite, AI, Mobile

The march of technology has introduced innovations shaping every part of agricultural finance—from satellite remote sensing for risk assessment, to AI-powered farm management, to mobile apps delivering personalized products and advice.

Satellite-Based Monitoring

Platforms using satellite imagery, such as Farmonaut, allow real-time monitoring of crop health, soil moisture, vegetation indices, and resource usage. These data-driven insights:

- Help farmers optimize irrigation, fertilizer, and pesticide use, reducing risks and resource wastage.

- Offer verifiable, tamper-proof crop data for more accurate insurance, loan approvals, and risk assessment.

- Empower smallholder and commercial farms to boost productivity—a key component of innovative agriculture finance.

With Farmonaut’s subscription-based models (see pricing table below), even the smallest landholder gets affordable, world-class financial solutions and farm monitoring.

Artificial Intelligence (AI) Tools

AI is helping farmers manage risk, maximize yields, and derive timely, actionable insights. Examples:

- Farmonaut Jeevn AI Advisory: Delivers personalized, real-time crop advice, weather updates, and best practices analysis via mobile and web.

- Advanced weather forecasting (Source) helps smallholder farmers improve disaster preparedness, lower debts, and increase savings.

Mobile and API Access

Through intuitive mobile apps and powerful API endpoints, financial and farm management tools are more accessible than ever:

- Farmonaut Apps: Real-time crop monitoring and resource advice on Android, iOS, and web.

- API Integrations: Secure API for seamless data integration with banks, agri-businesses, or developers. See Developer Docs

Institutional Support and Major Initiatives

To ensure resilient, large-scale sector growth, institutional support and policy innovation are essential. Financial institutions, governments, and international agencies are scaling up their roles in providing agriculture finance solutions.

-

World Bank Initiatives: (

Source

) Plans to double annual agricultural finance to $9 billion by 2030, targeting productivity, infrastructure, and food security. -

Farmer Mac’s Agricultural Mortgage-Backed Securities (AMBS):

(Source)

Offering liquidity and credit protection to lenders via AMBS, ensuring more robust agricultural financing solutions eco-system. - Public-Private Models: Governments and private sector finance combine to create large-scale, risk-mitigated lending and insurance for farmers.

Meanwhile, Farmonaut empowers all these interventions by providing the data, monitoring tools, and digital infrastructure to verify, measure, and optimize outcomes for both lenders and borrowers.

Comparative Agriculture Finance Solutions Table

| Solution Name | Type of Financing | Est. Funding Amount (USD) | Risk Management Features | Accessibility | Est. ROI (%) |

|---|---|---|---|---|---|

| Bank Loans & Credit Lines | Loan / Credit | $5,000–$500,000+ | Collateral, payment flexibility | Moderate (requires credit/collateral) | 5–15% |

| Government Subsidies & Grants | Subsidy/Grant | $1,000–$1,000,000+ | Incentives for sustainable practices | Moderate to High (criteria-based) | N/A (non-repayable) |

| Cooperative Financing | Loan / Shared Capital | $1,000–$250,000 | Shared risk; flexible repayment | High (co-op members) | 8–12% |

| Digital/Mobile Banking | Loan, Microcredit, Digital Funds | $100–$50,000 | Automated approvals, quick disbursal | High (via mobile/web) | 10–20% |

| Crowdfunding Platforms | Investment / Loan / Equity | $2,500–$250,000 | Risk shared among pool of backers | High (project-based online) | 8–30% |

| Impact Investing | Equity / Debt / Green Bonds | $10,000–$5,000,000+ | ESG risk rating, sustainability targets | Moderate (due diligence required) | 12–20% |

| Insurance & Risk Management Tools | Insurance, Derivatives | Premiums/coverage $100–$500,000 | Climate/crop/weather risk coverage | High (especially with satellite/AI data) | Protection vs. loss rather than ROI |

Farmonaut: Empowering Profitable and Sustainable Agriculture

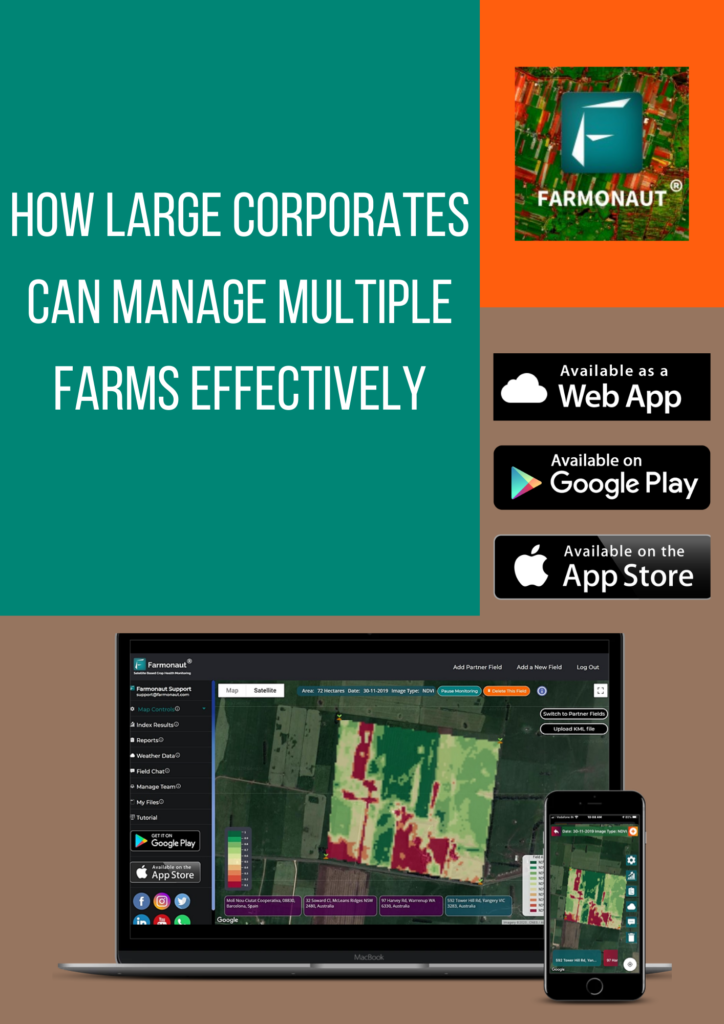

Farmonaut delivers a unique suite of agricultural finance solutions grounded in advanced satellite technology, AI, and blockchain. Our affordable precision farming platform democratizes access to data-driven insights for all—individual farmers, cooperatives, agribusinesses, and even government institutions.

- Real-Time Crop Health Monitoring: Leveraging multispectral satellite imagery, farmers gain insights into NDVI, soil moisture, pest risks, and more to inform daily management—maximizing yield and minimizing resource wastage.

- Jeevn AI Advisory System: Personalized, AI-powered crop management, weather forecasts, and expert strategies increase productivity and resilience to climate risks.

- Blockchain-Based Traceability: Ensures transparency and trust through secure tracking from field to consumer—crucial for premium markets and impact investing projects.

- Fleet & Resource Management: Optimize logistics, manage agricultural machinery, and control resource allocation efficiently. See Fleet Management Solution.

- Carbon Footprinting: Track and reduce operational emissions, lower costs, and participate in climate finance.

We address challenges such as financial literacy, verification for loans and insurance, and regulatory compliance with seamless, user-friendly tools accessible across web, Android, and iOS. For developers and businesses, our satellite/weather API and developer docs offer scalable integration and real-time agricultural insights.

Challenges, Trends & Future Outlook

-

Access to Capital for Smallholder Farmers:

Obtaining credit or loan approval remains difficult for millions due to limited collateral, poor credit histories, and lack of financial literacy. Digital financial services for farmers and satellite-based verification are making vital strides in this area. -

Climate Change and Agriculture Finance:

As erratic weather, pests, and disease outbreaks increase in frequency, innovative risk management in farming and resilient insurance solutions are essential. -

Gap in Financial Literacy:

Many farmers are not fully aware of available financing solutions, digital products, or how to assess costs/risks/returns effectively. - Scalability & Inclusion: Sustainable, climate-smart business models must cater to vast, diverse markets. Scalable, affordable platforms like Farmonaut are crucial for the future of agriculture finance solutions.

Emerging trends like mobile microfinance, satellite AI monitoring, impact investing, and blockchain are converging to reshape agricultural finance. Sector-wide collaboration, ongoing innovation, and focus on value-driven solutions are the keys to adapting and thriving in a changing climate.

FAQ: Agricultural Finance Solutions & Innovations

- What are the key agricultural finance solutions available to farmers?

-

- Traditional bank loans and credit lines

- Cooperative financing via community-based organizations

- Government subsidies and grants

- Modern options like digital banking, crowdfunding platforms, and impact investing

- Insurance and risk management products for climate and market shocks

- How does digital technology improve access to finance for smallholder farmers?

-

- Enables real-time credit assessment and faster approvals

- Reduces paperwork, removes location barriers

- Brings innovative insurance and advisory products to a mobile phone

- Platforms like Farmonaut verify crop status using satellite data, facilitating loans and claims with minimal risk

- What is the role of green financing in agriculture?

-

- Enables the shift towards sustainable practices, rewarding eco-friendly and climate-smart settlements

- Funds the adoption of renewable technologies such as solar irrigation and no-till farming

- Allows participation in carbon trading and ESG-linked investment vehicles

- Supports global objectives like food security and reduced agriculture emissions

- How can Farmonaut help with financing and risk management?

-

- Provides cost-effective crop monitoring, resource management, and advisory services via satellite and AI solutions

- Allows lenders and insurers to verify claims, reduce default or fraud risk, improve loan/insurance accessibility for farmers

- Empowers sustainable agriculture funding through carbon tracking and supply chain transparency

- Are there farmer-specific advisory platforms to help improve finance outcomes?

- Yes. AI-based platforms like Farmonaut’s Jeevn AI provide actionable, personalized crop advice, and business guidance, enhancing both financial literacy and livestock/crop output.

For advice on crop selection, plantation management, and forestry advisory, see our Plantation, Forest & Advisory Tools.

Conclusion: Shaping the Future of Agriculture Finance Solutions

A thriving, resilient agriculture sector depends on a blend of traditional financing options and innovative financial platforms that foster sustainability, risk management, and profitable growth.

The evolution of agricultural finance solutions—spanning loans, mobile banking, green investment, insurance, and satellite AI—is empowering farmers and agribusinesses worldwide to meet today’s challenges and secure tomorrow’s opportunities.

- Farmonaut is proud to be at the forefront of this revolution—lowering barriers, increasing transparency, and extending advanced farm management tools to everyone, at every scale.

- Whether you are a smallholder farmer seeking sustainable profits, an NGO supporting rural livelihoods, or a global agribusiness optimizing operations with real-time data, there is a tailored way to thrive in the new age of agricultural finance solutions.

Join us in building a sustainable, efficient, and secure agricultural future—powered by the right financial solutions and the data-driven edge of Farmonaut.