Agricultural Machinery Finance: 7 Smart Options for Farmers

Meta Description: Discover the 7 smart agricultural machinery financing options for farmers—loans, leases, tax benefits & more—optimizing equipment purchase and farm operations.

Table of Contents

- Introduction

- Understanding Agricultural Machinery Financing

- Agricultural Machinery Finance: 7 Smart Options at a Glance

- Types of Agricultural Machinery Financing Options

- Key Considerations in Agricultural Machinery Financing

- Tax Benefits & Depreciation for Agricultural Equipment

- Market Dynamics, Challenges & Trends

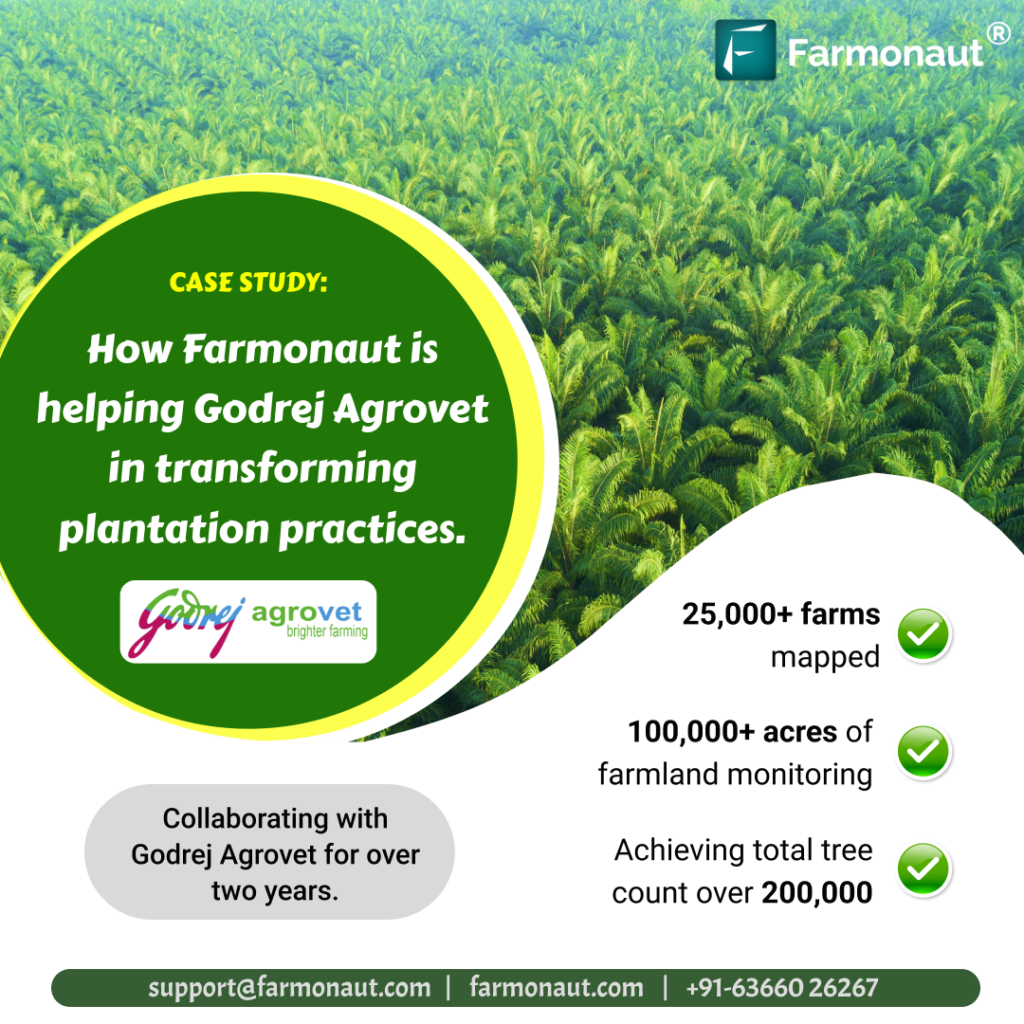

- How Farmonaut Empowers Smarter Financing and Equipment Use

- FAQ – Agricultural Machinery Financing

- Conclusion

Introduction: Agricultural Machinery Financing as a Catalyst for Modern Farming

Agricultural machinery financing is a crucial component of modern farming and agribusinesses. With substantial costs associated with purchasing tractors, harvesters, irrigation systems, and other essential equipment, the ability to acquire machines without exhausting precious capital reserves can be a game changer for farmers. By leveraging farm equipment loans, agriculture equipment leasing options, and other financial products, producers can invest in advanced tools to boost productivity while maintaining healthy cash flow.

As the agricultural sector evolves, with new market trends and challenges in both India and globally, understanding financing options and their benefits becomes increasingly important. It’s not just about making the right purchase—it’s about aligning operational needs with the most cost-effective, tailored approach for farm growth and sustainability.

This definitive guide explores the seven smartest ways for farmers to finance agricultural machinery, examining loan structures, leasing options, tax advantages, and the dynamics of a rapidly developing market. By the end, you’ll have a clear understanding of how to maximize your next farm equipment purchase—from assessing farm machinery loan interest rates to leveraging the agricultural equipment tax benefits and seasonal repayment plans.

Understanding Agricultural Machinery Financing: The Basics

In essence, agricultural machinery financing refers to financial solutions that enable farmers to acquire equipment over time, rather than paying a lump sum upfront. This model is perfectly aligned with the seasonal nature of agricultural incomes, giving farmers the vital flexibility to match income flows with loan repayments or lease payments.

- What does it finance? — From tractors and harvesters to high-tech irrigation systems and harvest processing machines.

- Why finance? — Upfront purchase often means tying up capital; financing provides the means to spread costs, protect reserves, and keep operations nimble.

- Who offers it? — Banks, NBFCs (Non-Banking Financial Companies), government agencies, agribusinesses, rental providers, and even manufacturers themselves.

- What are the core benefits? — Improved cash flow management, access to updated machinery, and potential tax advantages like the farm machinery depreciation deduction.

Throughout this blog, we will go deep into how agricultural machinery financing can optimize equipment purchases, increase efficiency, and future-proof farm operations.

Agricultural Machinery Finance: 7 Smart Options at a Glance

Given farming’s unique needs and the diversity in financial products available, we’ve compiled a comprehensive comparison table for the 7 major financing options for farmers. This allows an instant, side-by-side overview—perfect for informed, strategic business decisions.

| Financing Option | Description | Eligible Machinery Types | Estimated Interest Rate (%) | Repayment Period (Years) | Estimated Processing Time (Days) | Upfront Costs | Tax Benefits | Suitable For |

|---|---|---|---|---|---|---|---|---|

| Bank Loan | Traditional fixed/variable rate loans from commercial banks for machinery acquisition. Asset usually used as collateral. | Tractors, Harvesters, Combines, Irrigation | 9–14% | 3–7 | 7–21 | Moderate (margin money/down payment) | Yes (Section 179, Depreciation) | Small / Medium / Large Farmers |

| Government Subsidy | State/National programs subsidizing a portion of corporate or individual machinery purchase/interest cost. | Mostly essential agri equipment; varies by scheme | 5–10% | 1–6 | 20–60 | Low | Yes | Marginal / Small / Priority Sectors |

| Leasing | Pay periodic rentals for machinery use; option to buy/return/upgrade at lease end. | All standard equipment; ideal for tech updates | 8–16% | 1–5 | 5–14 | Very Low | Limited (Rental deduction) | All Sizes, especially tech-upgraders |

| Hire Purchase | Installment-based acquisition—ownership transfers after all payments are made. | Tractors, Combines, Implements | 10–16% | 3–6 | 7–21 | Moderate | Yes (Depreciation post-ownership) | Medium–Large, Long Term Buyers |

| Agribusiness Partnership | Finance/equipment provided in contract farming, often tied to post-harvest supply agreements. | Tech-based, niche, large-scale implements | Varies | 1–10 (contractual) | 30–90 | Varies (negotiated) | Possible | Large, Progressive Farmers |

| Equipment Rental | Short-term rental; pay-per-use; flexible for seasonal/occasional needs. | All (tractors, harvesters, etc.) | N/A | Flexible | 1–7 | Lowest | No | Marginal/Small, Occasional Users |

| NBFC Financing | Loans or leases by Non-Banking Financial Companies specializing in agri/machinery. | Broad range including high-value assets | 11–18% | 2–5 | 3–14 | Low–Moderate | Possible | Small/Medium/Underserved |

For the most accurate and updated rates, processing times, and eligibility, please refer directly to the corresponding financial provider or agency, as terms and conditions may vary based on the year, market scenario, and location.

API for Farm Management: Developers and agribusinesses can seamlessly integrate satellite data for crop monitoring or field analysis in their own systems using our Farmonaut Satellite & Weather Data API. See details in our API Developer Docs.

Types of Agricultural Machinery Financing Options Explained

Selecting the right agricultural machinery financing option depends on your farm’s size, cropping cycle, market stability, and modernization goals. Below, we break down the most popular approaches and what makes each unique:

1. Bank Loans: The Classic Farm Equipment Loan Route

- Definition: A traditional loan where a bank gives you a lump sum to purchase machinery, paid back in EMIs over a set period.

- Interest Rates: Generally 9–14%, but farm machinery loan interest rates may drop as low as 5% with priority sector lending and subsidies.

- Repayment: Flexible “seasonal payment plans agriculture” are often available—meaning annual, semi-annual, or as-per-harvest repayments.

- Collateral: Usually the equipment itself; sometimes additional collateral required.

- Best for: Owners seeking full ownership, potential tax deductions, and building farm assets over time.

2. Government Subsidy Programs (India-Focused)

- Definition: Central or state investment or interest subvention on eligible agro-equipment.

- Benefit: Reduces total costs, brings down the upfront amount, occasionally covers partial interest payments on loans.

- Availability: Often offered under schemes such as the Sub-mission on Agricultural Mechanization or PM Kisan Tractor Yojana.

- Best for: Small and marginal farmers in priority sectors. Terms and coverage frequently change, so verify with your local Department of Agriculture.

3. Leasing: The Flexible Agriculture Equipment Leasing Option

- Definition: Pay monthly/seasonal lease payments to use the machine for a fixed term.

- Ownership: No transfer until buyout; ideal for easy upgrades or not committing to one machine.

- Pros: Low initial outlay, flexible terms, optional maintenance bundled.

- Cons: Potentially higher cumulative cost, less tax deduction on depreciation (but lease payment may be deductible as expense).

- Use: Suits rapidly evolving tech (e.g., precision planters, drones, modern tractors).

4. Manufacturer/Dealer Financing: Direct from the Source

- Definition: Equipment manufacturers (like John Deere, Mahindra, New Holland) offer tailored financing solutions directly or via dealer partners.

- Offerings: Includes low/no interest promotional rates, deferred payment options, easy upgrades.

- Sometimes bundles: Insurance, extended warranties, maintenance.

- Best for: Farmers loyal to a brand or needing specialty machines.

5. Equipment Rental Services: Pay per Use, No Strings Attached

- Definition: Short-term, seasonal rental—no asset ownership or lease liability.

- Cost: Minimal upfront, pay only for the period/season/equipment needed—e.g., combine harvester for rice harvest.

- Best for: Micro, marginal, smallholders (< 2 ha) and custom hiring centers.

6. Hire Purchase: Ownership in Installments

- Definition: Pay part upfront, then spread balance cost over installments; ownership transfers at the end of the term.

- Feature: Similar to loans but with legal nuances—asset technically remains with financier until all payments complete.

- Suitable for: Farmers seeking asset building with delayed full payment.

7. NBFC Financing: Specialized, Accessible Alternatives

- Definition: Non-banking finance companies offer agricultural equipment financing solutions usually to individuals and SMEs in rural/underserved areas.

- Pros: Faster processing, less stringent documentation, tailored to agri cash-flows (crop cycles, festivals).

- Use Cases: When banks won’t lend, or for newer machines and lower/no-credit borrowers.

Key Considerations in Agricultural Machinery Financing

Every financing decision should be business-driven, reflecting your farm’s operational needs, growth strategy, and risk appetite. Here are critical factors to weigh:

Interest Rates, Terms, and Repayment Schedules

- Interest Rates: Always compare across lenders/manufacturers; even a 1–2% difference greatly impacts overall outgo.

- Terms: Is tenure adjustable? Can you prepay? Are there “seasonal repayment plans in agriculture” or must you pay monthly?

- Repayment Schedules: The right schedule will align with your income. Seasonal (linked to harvest) or balloon payments can help stabilize cash flow.

Collateral, Down Payment, and Flexibility

- Collateral: Most finance options use the purchased machinery as the primary collateral; the risk is repossession if you can’t pay.

- Down Payment: Typically 10–30% of the purchase price (varies by financier and product).

- Flexibility: Evaluate if you can refinance, upgrade, or exit early if needed.

Processing, Documentation, and Insurance

- Processing Time: Can vary from same-day (rental/NBFC) to 1–2 months (some government schemes).

- Documentation: Proof of landholding, income statement, past repayment record. Digitization and satellite-based verification (like with Farmonaut) are making this faster and more transparent.

- Insurance Bundling: Many lenders offer bundled machinery insurance to protect both parties from loss or damage risk.

Explore Farmonaut’s Fleet & Resource Management Tools — perfect for optimizing machine performance, reducing operational costs, and getting the most out of every rupee invested in equipment.

Tax Benefits & Depreciation for Agricultural Equipment

One of the stand-out advantages of financing agricultural equipment is the tax benefit—significantly reducing your overall acquisition costs.

Section 179 Deduction & Bonus Depreciation (US Focus)

- Section 179 Deduction: For 2025, up to $1,220,000 can be deducted for new and used agricultural equipment placed in service before year end (purchase limit $3,050,000).

- Bonus Depreciation: Additional, accelerated deduction after Section 179 is used up.

- Effect: Massive saving in initial year, boosts working capital.

- Eligibility: Applies whether bought using loan or qualifying lease; check with tax advisor for local (India/Asia/Europe) rules.

In India, similar asset depreciation deductions (currently 15% per year for tractors/harvesters and 40% for specialized equipment) help reduce taxable farm profits and encourage mechanization.

Looking for modern traceability & compliance? See Farmonaut’s Blockchain Product Traceability Solutions — ensuring transparent, tamper-proof records for machinery, supply chain, and agri-products, useful for both farm audits and insurance claims documentation (especially if you claim depreciation).

Other Tax-Related Tips

- Depreciation Schedules: Know your eligibility by equipment type—shorter life, bigger annual write-off.

- GST/VAT Credits: For commercial farming, input tax credits may apply. Always review after purchasing a new machine.

- Rental/Lease Deductions: Lease/rental payments usually counted as expense, not asset depreciation (but consult a tax advisor).

- Compliance: Maintain detailed, verifiable records—tech-driven platforms help automate this for you.

Market Dynamics, Financing Challenges & Industry Trends

The agricultural equipment financing market is highly dynamic, responding to a mix of policy, demand cycles, climate variables, and innovation. Let’s examine the most impactful industry trends and current challenges:

Macro-Economic Challenges

- Fluctuating Commodity Prices: Lower produce prices can delay equipment purchases and impact loan eligibility/cash flow analysis.

- High-Interest Rates: In periods of inflation and monetary tightening, total outgo for financing increases, making financial planning vital.

- Access to Credit: Many small and marginalized farmers still face hurdles with documentation and collateral demands, especially from formal banks.

- Market Uncertainty: Recent surveys show some manufacturers, like Deere & Co in 2024, anticipating lower profits due to decreased demand, rising input costs, and falling farm incomes. (Reuters 2024)

Global & Local Trends in Agriculture Equipment Finance

- Asia-Pacific Growth: Countries such as India and China are the largest growth engines—driven by labor shortages and government mechanization initiatives.

- Digitization: Application processes are rapidly moving online, with satellite-based land/crop verification fast-tracking loan/insurance approvals.

- Green & Smart Equipment Demand: Growing focus on eco-friendly, low-emission equipment is transforming both equipment design and financing terms (e.g., preferential rates for sustainable practices).

- Leasing Surge: Flexible, upgrade-friendly leasing and rental is seeing double-digit annual growth. (Mordor Intelligence)

- Risk Mitigation: Increased synergy between technology and finance: e.g., real-time crop monitoring data from Farmonaut’s Crop Loan & Insurance Services is facilitating quicker, less risky lending and claims settlement.

Discover Farmonaut Agro Admin App for Large-Scale Farm Management — empowering top management or cooperatives to centrally track multiple fields, manage machinery fleets, and get financial insights for big equipment investments.

How Farmonaut Empowers Smarter Financing and Equipment Use

As an agricultural technology company, Farmonaut is dedicated to making precision agriculture affordable and accessible to farmers worldwide. Our satellite-based platform adds distinct value at every step of the equipment financing journey, helping farmers and agribusinesses make data-driven decisions when investing in new machinery—or maximizing existing resources.

- Satellite-Based Crop Health & Yield Monitoring:

Understand exactly where machinery upgrades will provide the biggest efficiency gains—optimize ROI from every loan or lease. - AI-Driven Farm Advisory:

Use real-time data and predictive analytics to plan repayment schedules in sync with forecast yield and revenue. This reduces risk for both farmers and lenders. - Blockchain Traceability:

Document every asset purchase, movement, and service record—vital for compliance, insurance, tax assessment, and for negotiating better financing terms with lenders. - Fleet & Resource Management:

Always know where your machines are, how efficiently they’re running, and when it’s time to repair/replace—preventing over-investment and extending equipment life. - Carbon Footprinting:

Track and reduce the environmental impact of your machinery: get a head start in accessing green loans or preferential rates for sustainable practices. Learn More. - Satellite-Based Verification for Crop Loans & Insurance:

Get your farm data verified remotely (no need for endless paperwork or field visits), improving access to financing especially for those with limited documentation—vital for quick-approval agricultural equipment financing solutions. Read about Farmonaut Crop Loan & Insurance.

Our platform is available via Android, iOS, Web App, and API—making it easy for every stakeholder in the agricultural sector to access powerful insights, wherever they are.

Ready to experience smarter, more profitable agriculture?

FAQ – Agricultural Machinery Financing

What is agricultural machinery financing?

Agricultural machinery financing refers to financial products (such as loans, leases, and subsidies) designed to help farmers acquire essential farm equipment by spreading payments over a period, instead of one-time purchases. It’s vital for optimizing cash flow and upgrading to modern farming equipment with minimal capital strain.

How do farm machinery loans differ from leasing?

Loans provide direct ownership of the equipment after purchase (subject to repayment), along with potential tax benefits from depreciation. Leasing gives you use of the machinery for a set period with lower upfront costs, but often no ownership unless you opt to buy at lease-end.

What are the main tax benefits for purchasing farm equipment?

These typically include depreciation deductions (e.g., Section 179 Deduction in the US, asset depreciation schedules in India), GST/VAT input credits, and sometimes interest deduction on loans. Leasing expenses may also be tax-deductible as an operational expense.

Can I get seasonal repayment plans for agricultural equipment loans?

Yes. Many lenders and NBFCs provide “seasonal repayment plans,” meaning repayments fall due in periods matching your harvest/sales cycle (annual, semi-annual, balloon payments), thus aligning your debt servicing with cash inflows.

What if I have a poor credit history or limited documentation?

NBFCs and rural lenders may still provide financing, often at higher rates. Utilizing platforms like Farmonaut for crop verification can also help you secure loans by validating your farm’s productivity remotely.

How does digital or satellite-based verification help in getting farm equipment loans?

Digital tools and satellite data (as used by Farmonaut) reduce fraud risk, accelerate documentation and approval, and facilitate better-tailored financing—especially for smallholders in remote regions.

What role does Farmonaut play in the agricultural machinery financing process?

We provide advanced decision support through satellite crop monitoring, farm advisory, and blockchain traceability, which helps farmers present stronger cases for loan approval, optimize equipment use, and maximize the ROI from financed machinery purchases.

Conclusion: Optimizing Farm Growth Through Smart Agricultural Machinery Financing

Agricultural machinery financing is no longer just a necessity—it’s a strategic business tool for enabling better productivity, cost management, and competitiveness in a rapidly changing agricultural sector.

- From traditional bank loans to flexible lease and rental models, farmers today have an unprecedented range of options to spread payments and align financing to real-world operational needs.

- Tax benefits, depreciation deductions, and government subsidy programs further improve the economics of equipment investment.

- Emerging market trends—especially the rise of digital tech, satellite-based verification, and green lending—give proactive farmers even more ways to optimize their financial decisions.

- We at Farmonaut continue to empower agricultural stakeholders globally, democratizing precision agriculture so farmers of all sizes can thrive—maximizing every rupee or dollar spent on equipment and every acre of land cultivated.

The key to success? Stay informed, leverage tailored agricultural equipment financing solutions, measure your outcomes, and never hesitate to adopt innovation that directly aligns with your bottom line.

Explore Farmonaut’s full range of agri-tech solutions, and step confidently toward smarter mechanization and financing today:

Take the next step in agricultural efficiency—choose the financing option that fits you, and let technology do the rest.