Agriculture Equipment Leasing: 7 Key Farmer Benefits

Understanding Agricultural Equipment Leasing

In today’s fast-evolving agricultural sector, agriculture equipment leasing has established itself as a strategic financial avenue enabling farmers and agribusinesses to balance operational efficiency with capital conservation. Rather than purchasing expensive machinery outright, an agricultural equipment lease involves a contractual agreement where a farmer (the lessee) pays regular lease payments in exchange for the right to use machinery and equipment owned by a leasing company (lessor) for a predetermined period.

The agricultural landscape, including regions such as India, the United States, and Europe, is seeing an increasing shift towards equipment leasing as a result of mounting operational pressures, sectoral uncertainties, and the relentless advancement of farming technology. Farm equipment leasing advantages are now recognized for providing not only financial flexibility for farmers but also quick access to advanced technology in agriculture.

At the close of the lease term, farmers typically enjoy the option to purchase the equipment outright, renew the lease, or simply return the equipment to the lessor based on their operational needs and financial situation. This flexibility, in combination with cost savings and access to the latest technology, continues to drive the popularity of leasing vs purchasing farm machinery.

7 Key Benefits of Farm Equipment Leasing for Farmers

1. Financial Flexibility and Capital Conservation

A leading benefit driving the adoption of agricultural equipment leasing is financial flexibility for farmers. Unlike purchasing, which typically requires a significant upfront payment or even full payment, leasing allows farmers to acquire needed machinery with minimal immediate outlay. Lease agreements generally require only the first payment due at signing—dramatically reducing the cash flow impact and preserving working capital for essentials like seed, fertilizer, and labor.

- Minimal initial payment required; often just the first monthly/quarterly lease payment.

- Capital conservation allows farmers to invest in crop improvement, resource management, and risk mitigation strategies.

- Leasing spreads equipment costs across the term of the agreement, smoothing out seasonal cash flow fluctuations.

- This structure also safeguards against tying up substantial resources in depreciating assets, crucial for small and mid-sized farms managing tight budgets.

According to Texas Farm Credit, leasing can free up working capital that would otherwise be locked in equipment purchases, thereby enhancing the ability to respond to unexpected shocks—such as weather events or market downturns.

2. Access to Latest Technology and Advanced Machinery

The agricultural sector is advancing at an unprecedented rate. From GPS-guided tractors and soil sensors to AI-enabled harvesters, new technological advancements aimed at improving productivity and operational efficiency are emerging regularly. Farm equipment leasing advantages include access to this cutting-edge equipment without incurring long-term ownership costs.

- Farmers can utilize the latest technology in agriculture throughout the lease period, maintaining competitiveness.

- Leasing cycles are typically shorter than the useful life of machinery, providing flexibility to upgrade frequently as technology evolves.

- This rapid equipment refresh cycle sees farmers benefitting from better fuel efficiency, precision farming capabilities, and more reliable operations.

- Leasing is particularly advantageous in regions where technological adoption is essential to cope with climate challenges and labor shortages.

Husfarm underscores that leasing provides a strategic opportunity for farmers to remain at the forefront of agricultural innovation, directly contributing to enhanced yield and operational efficiency.

3. Equipment Lease Tax Benefits

One core advantage of agricultural equipment leasing is the favorable tax treatment available in many jurisdictions. Under typical lease agreements, periodic lease payments can often be deducted as a business expense, reducing taxable income and resulting in substantial tax savings compared to the slower, annual depreciation deductions of equipment ownership.

- Lease payments are ordinarily fully deductible, improving after-tax cash flow and effective cost management.

- Immediate write-offs via leasing facilitate better profit-and-loss management throughout the lease period.

- This benefit is particularly significant in countries like the United States and India, where agricultural tax policies encourage operational efficiency.

- Tax treatment can vary, so consulting a farm tax professional is critical to maximize benefits, especially for more complex lease structures.

For detailed guidance on equipment lease tax benefits, refer to the insight from AgAmerica.

4. Predictable Costs: Maintenance and Repair Considerations

Maintenance and repair costs can add unpredictability to farm budgets, particularly as machinery ages. Many farm equipment lease agreements include maintenance provisions—meaning the lessor covers standard upkeep and repairs.

- Farmers save on unexpected, and often expensive, repairs outside of normal wear and tear.

- Leased equipment is generally newer and less prone to breakdowns than owned, older fleet, further reducing downtime during busy planting or harvest periods.

- For larger operations and agribusinesses, this can translate into hundreds or thousands of hours saved each season.

- It’s important to review lease terms around coverage limits and lessee responsibilities to avoid surprise penalties.

The resource at AgDirect emphasizes the critical role of maintenance coverage in managing costs and ensuring equipment reliability.

5. Flexibility to Adjust Equipment Portfolio

Leasing adds dynamic flexibility to equipment management. Rather than committing to a single machine for years or even decades, farmers may rotate or add equipment as operational needs shift.

- Seasonal scalability—acquire additional harvesters for bumper crop years, or scale down during low-activity periods.

- If market conditions or crops types change, easily swap machinery for newer models or different implements.

- This adaptability allows for more precise management of resources and budgeting.

Southern AgCredit highlights the value of this flexibility, particularly where farm operations are rapidly scaling or diversifying.

6. Reduction in Equipment Obsolescence Risk

The rapid pace of technological advancements in agriculture can quickly render machinery outdated. Leasing shifts the obsolescence risk to the lessor:

- Farmers avoid being saddled with obsolete or depreciated machinery at the end of its economic life.

- At the completion of the lease period, simply return the equipment and choose from new, advanced options.

- This further enhances operational efficiency in farming by ensuring access to current technology without loss on resale value.

7. Ease of Budgeting and Farm Machinery Cost Savings

Leasing provides predictable cost structures—helping farmers and agribusinesses budget effectively over multiple seasons. With fixed payments, costs are both known in advance and easier to distribute throughout the farm’s operating cycle.

- Helps with financial planning and avoids budget shocks from major repairs or large lump-sum outlays.

- For many farmers, this predictability translates into better financial stewardship and long-term sustainability.

How Farmonaut Enhances Operational Efficiency with Advanced Agricultural Technology

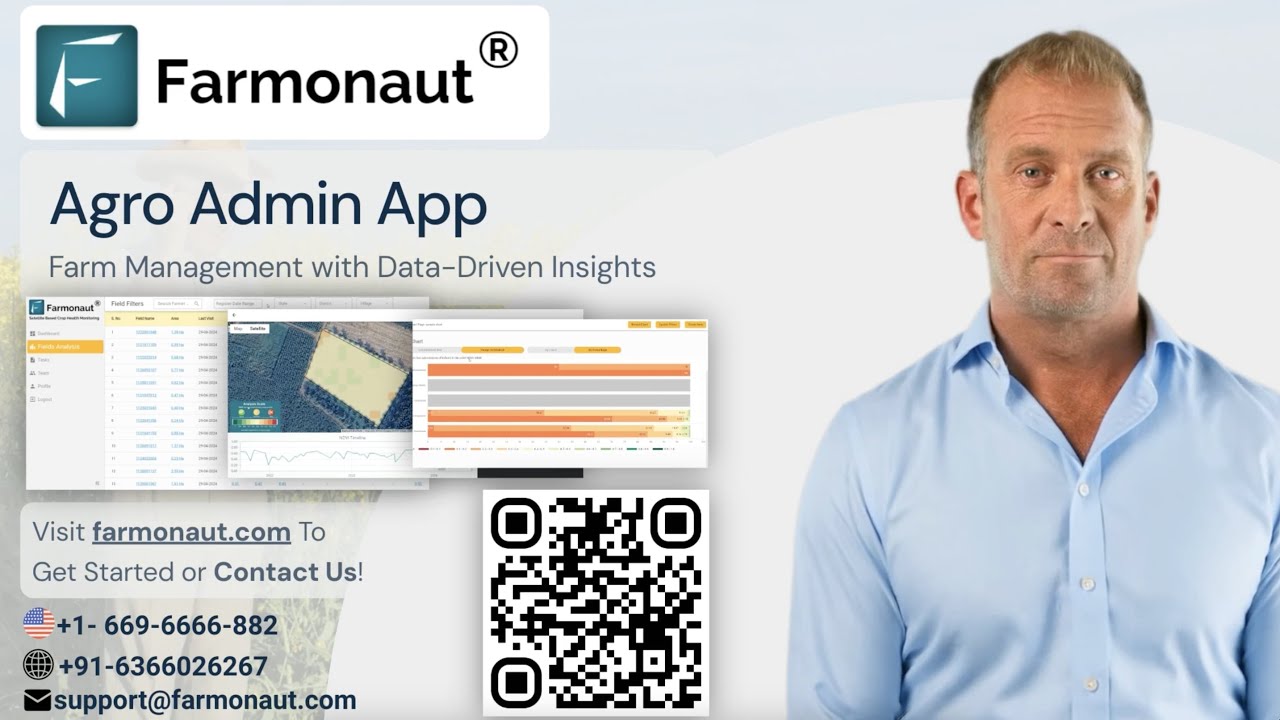

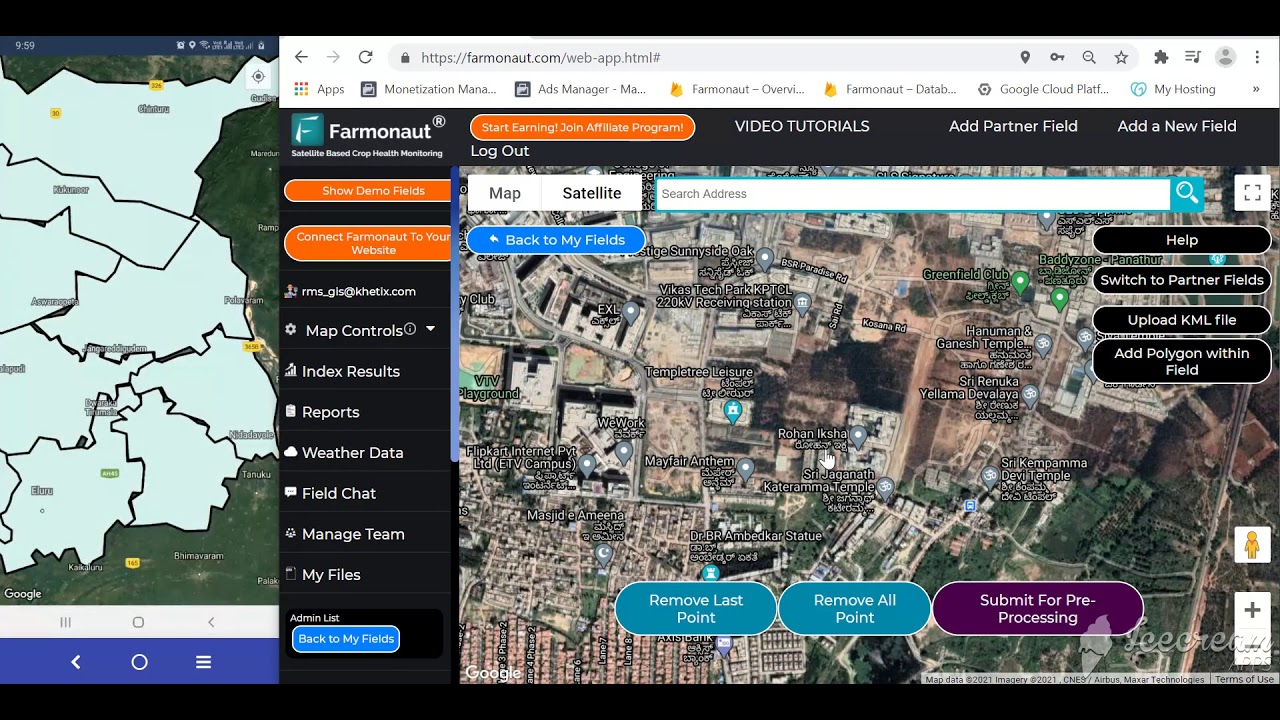

As an agricultural technology company, Farmonaut’s primary mission is to make precision agriculture accessible and affordable to farmers globally. While Farmonaut does not lease or manufacture equipment, our satellite-based and AI-driven platform complements agricultural equipment leasing by enabling farmers, agribusinesses, and government agencies to maximize equipment efficiency and manage resources with actionable data insights.

- Satellite Crop Health Monitoring: Our system leverages multispectral satellite imagery for real-time monitoring of vegetation health (NDVI), soil moisture, and crop stress, supporting data-driven decisions for irrigation, fertilizer, and pest management. This ensures your leased or owned machinery is optimally deployed for field operations.

- AI-Based Advisory (Jeevn AI): We deliver weather forecasts, disease/pest alerts, and expert agronomy recommendations customized to your crops and regions, enhancing decision-making for equipment use and scheduling.

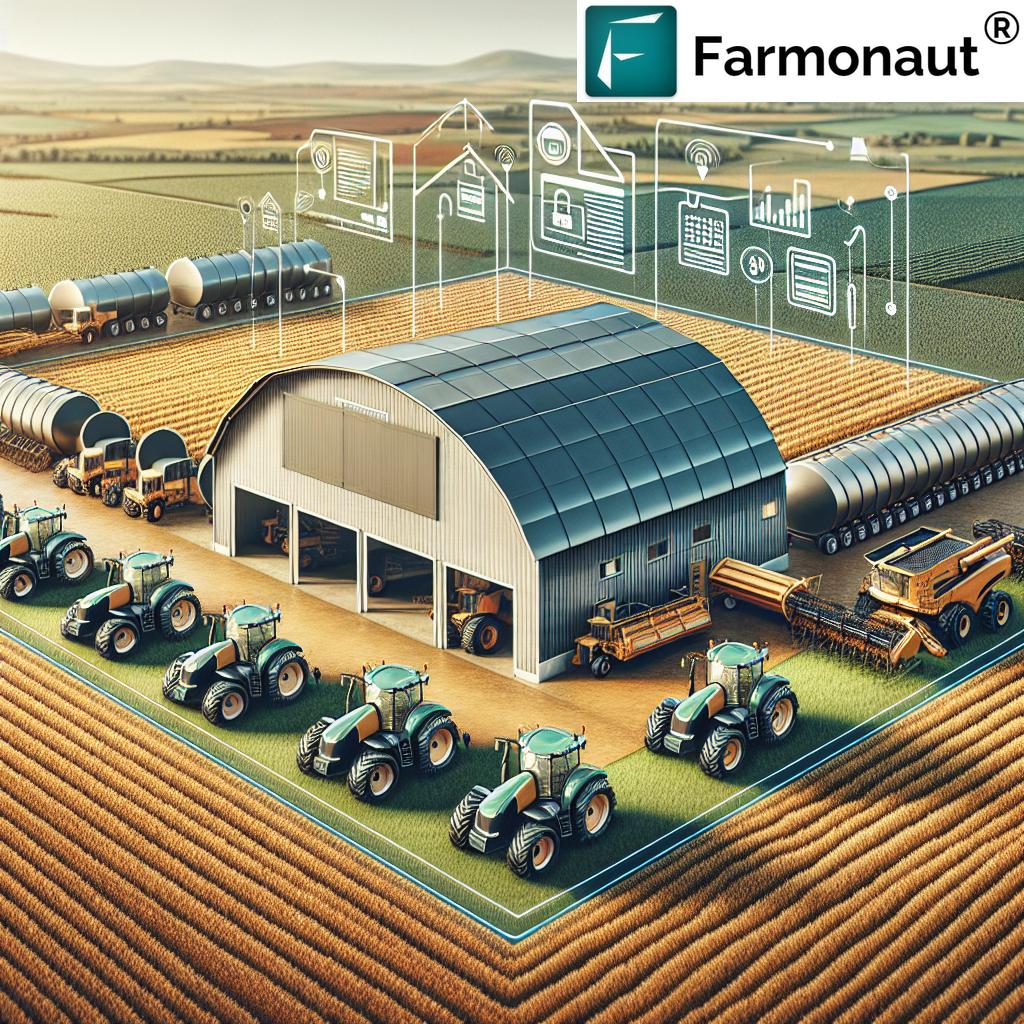

- Fleet & Resource Management: Our Fleet Management tools help agribusinesses track, allocate, and optimize use of expensive leasing assets—lowering costs and improving field logistics.

- Carbon Footprinting: Carbon Footprinting on Farmonaut empowers sustainability initiatives by allowing you to monitor and reduce the environmental impact of your field operations, critical as more lessors and buyers seek climate data for ESG compliance.

- Traceability & Compliance: Our Blockchain-based Traceability solution helps agribusinesses and cooperatives ensure transparency from field to fork—synergizing with the operational flexibility and seasonal fleet upgrades that leasing enables.

- Large-Scale Farm Management: Through the Agro Admin App, estate and plantation managers gain oversight and analytics over thousands of hectares, supporting cost control, scheduling, and deployment of leased equipment across extensive tracts.

With our subscription-based model, individual farmers, cooperatives, and government programs can access affordable, scalable technology to maximize returns from both their owned and leased farm machinery. Explore integrations via our Farmonaut API or review our API Developer Documentation for enterprise applications.

Leasing vs Purchasing: Cost-Benefit Comparison Table

Making the right choice between leasing vs purchasing farm machinery shapes the long-term operational efficiency, capital allocation, and profitability for any farm or agribusiness. The following table compares key criteria for each option, reflecting both direct and indirect cost impacts.

| Criteria | Leasing | Purchasing |

|---|---|---|

| Initial Investment / Upfront Costs | Typically 10–15% of equipment value (1st month/quarter payment) | 80–100% of equipment value |

| Maintenance Costs | Often covered by lessor; more predictable (included in payments) | Borne by owner; can rise as equipment ages |

| Access to Latest Technology | Easy upgrades every lease term (2–5 years) | Limited to budget and resale value; risk of obsolescence |

| Flexibility | Adjust fleet as needs change; short & medium-term commitment | Low; equipment is locked in for its lifespan |

| Tax Benefits | Lease payments fully deductible (see tax advisor) | Depreciation over several years; partial expense deduction |

| Depreciation Risk | No direct exposure—risk held by lessor | Borne by owner; value drops rapidly in initial years |

| Ownership & Equity | No equity built; option to buy at end of lease | Full ownership and resale value |

| Average Useful Lifespan | Modern equipment for 2–5 years lease term | 5–15+ years, diminishing reliability |

| Annual Savings Potential | Up to 30–60% savings in initial years from reduced upfront and repair costs | Potential higher costs in initial purchase; better long-term value for heavy annual use |

| Suitability | Ideal for farms needing flexibility, wanting the latest tech, or managing cash flow | Better for operations that use equipment intensely and over long periods |

By reviewing this table, farmers and decision-makers can evaluate which approach matches their farm’s strategic goals and financial situation. Leasing delivers dynamic resource allocation, while purchasing secures long-term ownership and potential for capital appreciation.

Challenges and Considerations in Leasing Agricultural Equipment

Despite its many advantages, agriculture equipment leasing is not without trade-offs. Farmers should carefully weigh the following challenges and considerations before entering a lease agreement:

1. Long-Term Financial Implications

While leasing typically has lower up-front costs, the cumulative payments over longer periods may exceed the purchase price of the equipment if machinery would have been retained for its full lifespan. A thorough analysis of total costs, expected usage, and operational needs is critical. AgAmerica suggests comprehensive cost-benefit calculation for each individual situation.

2. Lack of Ownership and Equity

Unlike purchasing, leasing means farmers do not own the equipment—they build no equity, cannot resell, and might miss out on potential gains if equipment retains value. Some leases offer purchase options at end of term, but these usually require an additional payment.

For those prioritizing asset building, purchasing may be better aligned with their long-term financial goals.

3. Usage Restrictions and Penalty Provisions

Farm equipment lease agreements often impose limits on total engine hours, annual use, or require machines be returned in near-original condition. Exceeding contract thresholds may result in penalty fees, or restrict modifications, which could affect operational flexibility and usability.

It is crucial that farmers review lease terms and assess anticipated machinery usage before signing.

4. Dependency on Lessor and Service Continuity

Lessees are reliant on the lessor’s support for equipment delivery, servicing, and timely maintenance. Any disruption in lessor operations (such as insolvency or equipment shortages) could impact farm operations. Choosing reputable lessors and understanding liability and remedy clauses helps reduce such risk.

Evaluating Leasing vs Purchasing Farm Machinery: Which Is Right For You?

The choice between agricultural equipment leasing and purchasing pivots on a variety of operational, financial, and strategic criteria. Factors to consider before making your final decision:

- Cash Flow Position: Are substantial up-front payments feasible?

- Operational Needs: Will your equipment needs change over time?

- Usage Level: Will you utilize the equipment extensively, or is it for seasonal/occasional work?

- Tax Implications: Which option offers greater tax efficiency under current laws?

- Desire for Latest Technology: Is frequent upgrade of machinery a core business priority?

- Risk Tolerance: Is avoiding depreciation risk more important than owning assets outright?

- Equity Building: Is asset ownership and resalability central to your business growth plans?

Both strategies offer valuable benefits depending on the specific characteristics of individual farms and agribusinesses. In many cases, a hybrid approach—leasing certain equipment while purchasing other essential machinery—can strike a balanced, cost-effective solution.

Consider bolstering your decision-making process using Farmonaut Agro Admin App, which supports operational planning and field mapping for large-scale farm management, regardless of whether your machinery is leased or owned.

FAQ: Agricultural Equipment Leasing

Q: What is agricultural equipment leasing?

A: Agricultural equipment leasing is a financial arrangement where a farmer (lessee) pays periodic lease payments to use machinery owned by a lessor (leasing company) for a fixed period. At lease end, the farmer may purchase, renew, or return the equipment.

Q: What are the primary advantages of leasing farm equipment?

A: Key advantages include reduced up-front costs, access to the latest technology, improved financial flexibility, predictable maintenance expenses, tax benefits, flexibility to upgrade, and risk reduction for equipment obsolescence.

Q: Are there tax benefits to leasing over purchasing?

A: Yes. Lease payments are often fully deductible as business expenses, providing immediate tax savings. In contrast, owned equipment typically provides deductions only through annual depreciation.

Q: Does leasing make sense for small farms or only large agribusinesses?

A: Leasing can benefit both smallholder farmers and large agribusinesses. Small farms gain access to modern equipment with limited capital outlay, while large operations can efficiently manage extensive fleets and upgrade more frequently.

Q: Is it possible to buy my leased equipment at the end of the lease?

A: Many lease agreements offer a “lease-to-own” or purchase option, typically allowing you to buy the machinery at a predetermined price at lease end.

Q: What key points should farmers review in a lease agreement?

A: Farmers should review payment structure, maintenance responsibility, usage limits, penalty provisions, option to buy, warranty terms, and end-of-lease return conditions.

Q: How does Farmonaut support farmers who lease equipment?

A: Farmonaut offers satellite-based crop monitoring, fleet and resource management, carbon footprinting, and traceability tools—enabling farmers and agribusinesses to extract maximum value from both leased and owned machinery and to operate with data-driven efficiency.

Q: Where can I learn more about managing large-scale fleets or integrating advanced operational analytics?

A: Visit our Fleet Management page and browse Agro Admin App information, designed specifically for streamlining operations, fleet logistics, and resource allocation at scale.

Conclusion: Is Agricultural Equipment Leasing Right For Your Operation?

Agricultural equipment leasing is transforming how farmers and agribusinesses approach operational efficiency, capital management, and technological advancement. The farm equipment leasing advantages—from lower upfront costs, improved flexibility, and access to new technologies, to potential tax benefits and reduced risk of equipment obsolescence—provide tangible economic and operational improvements for diverse farm types and sizes.

However, prudent evaluation is necessary. Consider the challenges, including long-term financial implications, lack of equity, contract usage restrictions, and dependency on lessor reliability. For many farms, the strategic blend of leasing and purchasing delivers the highest value, allowing optimal resource allocation while supporting growth objectives.

We at Farmonaut are committed to supporting farmers and agribusinesses as they navigate these critical equipment decisions. By integrating our advanced satellite technology, AI-powered analytics, and management tools, you can further enhance equipment efficiency—whether leasing or owning—ensuring your farm is equipped for a sustainable and productive future.

Ready to revolutionize your field management and operational analytics? Start with Farmonaut’s app today or explore our large-scale farm management system—engineered for the needs of the next generation of agriculture.

Discover the cost-effective, flexible, and advanced future of farming equipment with agricultural equipment leasing—empowered by modern technology platforms like Farmonaut.

Monitor and reduce your farm’s environmental impact with Carbon Footprinting.

Access satellite-powered verification for crop loans and insurance for financial peace of mind.