Farm Land REIT: 5 Powerful Income Streams for Investors

“Farmland REITs delivered average annual returns of 11% from 1992 to 2022, outperforming many traditional asset classes.”

Introduction: Understanding Farmland REITs

Farmland Real Estate Investment Trusts (REITs) have surged in popularity as a compelling avenue for investors seeking exposure to the agricultural sector without the complexities associated with direct land ownership. Acting as specialized investment vehicles, these REITs acquire, manage, and lease agricultural properties—bridging the gap between private farmland investments and listed real estate securities. By pooling resources, farmland REITs enable investors to access a diversified portfolio of farmland assets—a feat often challenging to assemble individually.

The demand for agricultural real estate investment continues to grow, as investors look for:

- Steady, inflation-resistant income from land leases

- Protection against market volatility

- Long-term capital appreciation

Unlike traditional REITs that focus on commercial, retail, or residential properties, farmland REITs operate in the unique sector of food production, rural land, and agri-business, offering both stability and growth potential. The primary revenue streams for these trusts stem from rental income from land leases, crop share agreements, and novel opportunities like renewable energy leasing—all contributing to attractive and consistent dividend payouts for investors.

But what sets farmland REITs apart? Their ability to generate diversified and powerful income streams stands as a cornerstone of their appeal. We’ll explore these streams in depth, analyze the advantages and risks, and show how innovative technology providers like Farmonaut are empowering farmland management and investment intelligence across this sector.

Why Farmland REITs? The Compelling Case

A farmland REIT is a company that owns, operates, and leases agricultural land, typically to commercial farmers and agribusinesses. The REIT structure allows investors to purchase shares in the trust, thereby gaining indirect exposure to agricultural real estate as an asset class.

- Portfolio Diversification: Farmland investments have exhibited low correlation with assets like stocks and bonds, making them powerful diversification and inflation hedge investments.

- Resilient Income Streams: Most farmland REITs derive steady rental income from long-term leases, frequently aligned with inflation or agricultural commodity prices.

- Accessibility: Unlike direct land ownership, REIT shares can be bought in public markets, offering liquidity, transparency, and ease of entry—even with modest capital.

The underlying value proposition of agricultural real estate investment lies in its ability to deliver both consistent cash flow and capital appreciation, powered by growing food demand, technological advances in farming, and the enduring nature of fertile land.

“Over 80% of U.S. farmland is owned by non-operator landlords, fueling steady income streams for REIT investors.”

Farm Land REIT: 5 Powerful Income Streams for Investors

When we explore farmland investment returns, it’s critical to recognize the unique combination of income streams that set this sector apart from traditional real estate. Here’s how investors can benefit by owning shares in a well-managed farmland REIT:

| Income Stream | Description | Estimated Annual Return (%) | Risk Level | Typical Example |

|---|---|---|---|---|

| Land Lease Income | Regular rental payments from farmers or agribusinesses for using REIT-held farmland. | 2–5% | Low | Annual or multi-year lease to a row-crop farmer. |

| Crop Share Agreements | A percentage of the tenant’s agricultural produce revenue contracted back to the REIT. | Varies (3–7%) | Medium | REIT receives 25% of corn yield revenue from tenant farmer. |

| Land Appreciation | Increase in asset value over time, typically realized upon sale or refinancing. | 2–4% | Low–Medium | Rising farmland prices in high-demand regions. |

| Renewable Energy Leasing | Leasing land for solar panels, wind farms, or biogas installations. | 3–6% | Medium | Solar farm lease on non-arable sections of REIT property. |

| Ancillary Agri-Business Income | Earnings from storage, processing, commercial leases, or value-added services. | 1–3% | Medium–High | Leasing out equipment barns or logistics facilities. |

These income streams empower REITs to provide real estate income streams that are both robust and diversified, supporting overall portfolio stability, consistent dividend payouts, and capital preservation.

Advantages of Investing in Farmland REITs

Let’s break down the specific advantages that make farmland REITs such compelling investments and explore why they’ve become a favourite among income-seeking investors:

- Portfolio Diversification: Farmland and agricultural real estate often exhibit low correlation with traditional asset classes like stocks and bonds. This non-correlation helps hedge portfolio volatility and market downturns.

- Inflation Hedge: Farmland values and agricultural commodities tend to rise during inflationary periods. This makes farmland REITs attractive as inflation hedge investments and store of real wealth.

- Steady Income Streams: Through long-term land leases and predictable rent or crop share payments, REITs offer consistent income, supporting quarterly or monthly dividend payouts. For instance, companies like Gladstone Land Corporation maintain a history of increasing dividends, reflecting their stability and commitment to shareholders.

- Capital Appreciation: Over time, agricultural land demonstrates a solid tendency for value appreciation. Population growth and rising food demand underpin this effect.

- Liquidity and Accessibility: Unlike direct farmland ownership, REIT shares can be easily bought or sold on public exchanges, offering capital flexibility and scalability.

- Professional Management: Farmland REITs employ experienced teams to acquire, operate, and manage high-quality agricultural assets, offsetting the operational burdens that direct investors face.

🌎 Boost Your Agricultural Real Estate Investments with Farmonaut

Take farm management efficiency to the next level. Our Large-Scale Farm Management solution leverages satellite imagery and AI to monitor crops, lands, and resources in real time. Perfect for investors and agribusinesses seeking strong oversight and risk mitigation in diversified farmland portfolios.

Risks of Farmland Investment: Know Before You Invest

While farmland REITs present strong advantages, savvy investors must also understand the risks associated with farmland investment. Key risks include:

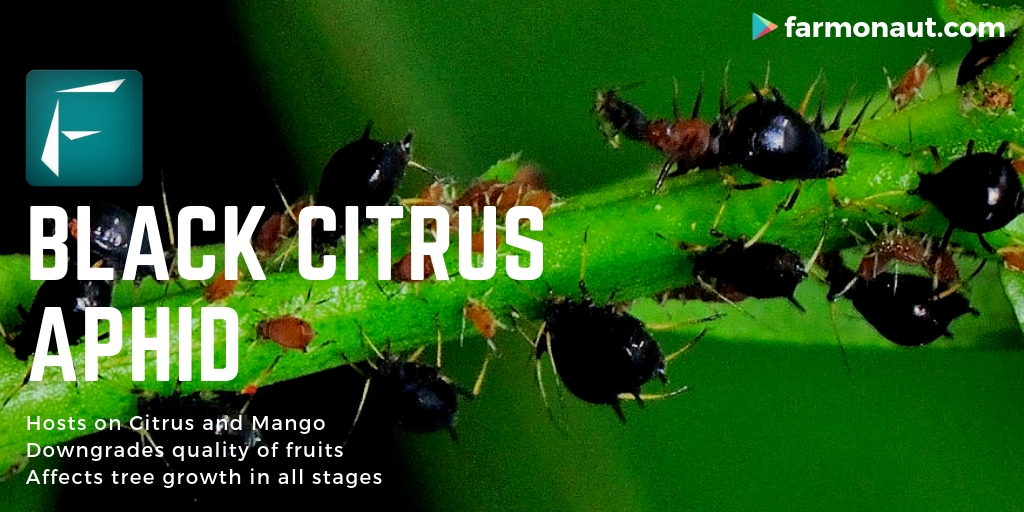

- Commodity Price Volatility: The profitability of tenant farmers is directly impacted by agricultural commodity price swings. Falling corn, wheat, or soybean prices can challenge farmer stability, in turn affecting your REIT returns.

- Weather and Climate Risks: Drought, flooding, and abnormal weather can severely impact crop yields and income from land leases, especially where lease payments depend on production.

- Tenant Quality and Financial Stability: The financial health of tenant farmers is crucial for stable rental streams. Defaults or tenant turnover can disrupt consistent payouts.

- Regulatory and Policy Shifts: Government subsidies, tariffs, and sudden policy changes (environmental laws, water restrictions) may affect profitability at the farm level and thus the REIT’s distributions.

- Concentration & Geographic Risks: REITs focusing on a narrow crop type or few states may experience higher volatility if local events impact their assets more significantly.

Balancing these risks with thorough due diligence and choosing REITs with diversified portfolios and strong management is vital for long-term success.

🔍 Lower Risk in Farmland Investing with Farmonaut’s Satellite Verification

Enhance due diligence and mitigate agricultural lending risk. Our Crop Loan & Insurance API uses satellite imagery to verify farm activity and crop health in real-time—boosting lender confidence and protecting both REIT shareholders and operators.

Integrate our API for seamless monitoring: Farmonaut API | Developer Docs

Notable Farmland REITs: Leaders in the Sector

While hundreds of private trusts exist, only a handful of publicly traded farmland REITs offer easy access and liquidity for all investors. Two notable examples stand out in the U.S. market:

- Farmland Partners Inc. (NYSE: FPI):

- Owns and manages nearly 300 farms across 17 states, totaling about 180,063 acres (as of June 21, 2025).

- Quarterly dividend: $0.06/share (annualized yield ~2.4%).

- Assets include a mix of row crops, permanent plantings, and some energy leasing operations.

- Gladstone Land Corporation (NASDAQ: LAND):

- Owns and manages 168 farms in 15 states, covering approximately 111,836 acres.

- Monthly dividend: $0.0467/share (annualized yield ~4.1%).

- Focuses on specialty crops (nuts, fruits, vegetables), enhancing risk diversification and exposure.

These REITs exemplify diversified farmland portfolios—mixing crop types, regions, and revenue models to maximize long-term farmland investment returns and reduce downside risk.

Key Strategies: Maximizing Returns with Farmland REITs

To maximize returns and control risk when investing in farmland REITs, consider these strategies:

- Evaluate Property Quality and Location: Not all farmland is equal. Assess the soil, water access, infrastructure, and proximity to markets or distribution networks—as these factors directly impact both lease rates and long-term appreciation.

- Review Lease Structures: Longer-term leases with escalation clauses often provide more predictable income than short, variable leases. Know whether your REIT includes crop-share models, base rent, or both.

- Diversify Across Crops and Regions: Seek REITs that spread risk across row crops and permanent plantings, multiple states or regions, and even into renewable energy or logistics leasing for greater downside protection.

- Assess Management Expertise: Trusts with deep agricultural and financial experience are better positioned to source quality tenants, negotiate lease terms, and identify new revenue streams.

- Track Dividend Growth: A history of growing or stable dividends alongside rising NAV (Net Asset Value) is a positive signal for ongoing income and capital appreciation.

🚚 Optimize Farm Operations & Lease Revenues with Fleet Management

Farmonaut’s Fleet Management solution empowers agribusinesses and farmland owners to track vehicles, machinery, and logistics—reducing operational costs, safeguarding assets, and enhancing lease profitability.

Alternative Farmland Investment Options

Beyond listed REITs, several approaches allow investors to access agricultural real estate and income from land leases:

-

Farmland Crowdfunding Platforms:

Digital platforms such as AcreTrader allow fractional investment in individual farms—providing direct exposure to specific properties with lower minimums. ( Learn more about AcreTrader ) -

Direct Farmland Ownership:

Large investors or institutions may acquire farmland outright, reaping full control of management and lease terms. Direct ownership often offers greater upside (and risk), but requires significant capital, expertise, and hands-on engagement.

Each investment type varies in liquidity, accessibility, risk, and required knowledge—but all benefit from advances in farm information technology, which improve acquisition, monitoring, and value generation.

🌱 Sustainability & Transparency for Your Farmland Portfolio

Farmonaut’s Carbon Footprinting solution helps track, reduce, and certify the environmental impact of your farmland investments—attracting ESG-focused capital.

Our Traceability product ensures blockchain-enabled proof of origin and supply chain transparency, enhancing trust with tenants, partners, and end consumers.

The Technology Edge: How Farmonaut Empowers Farmland Investments

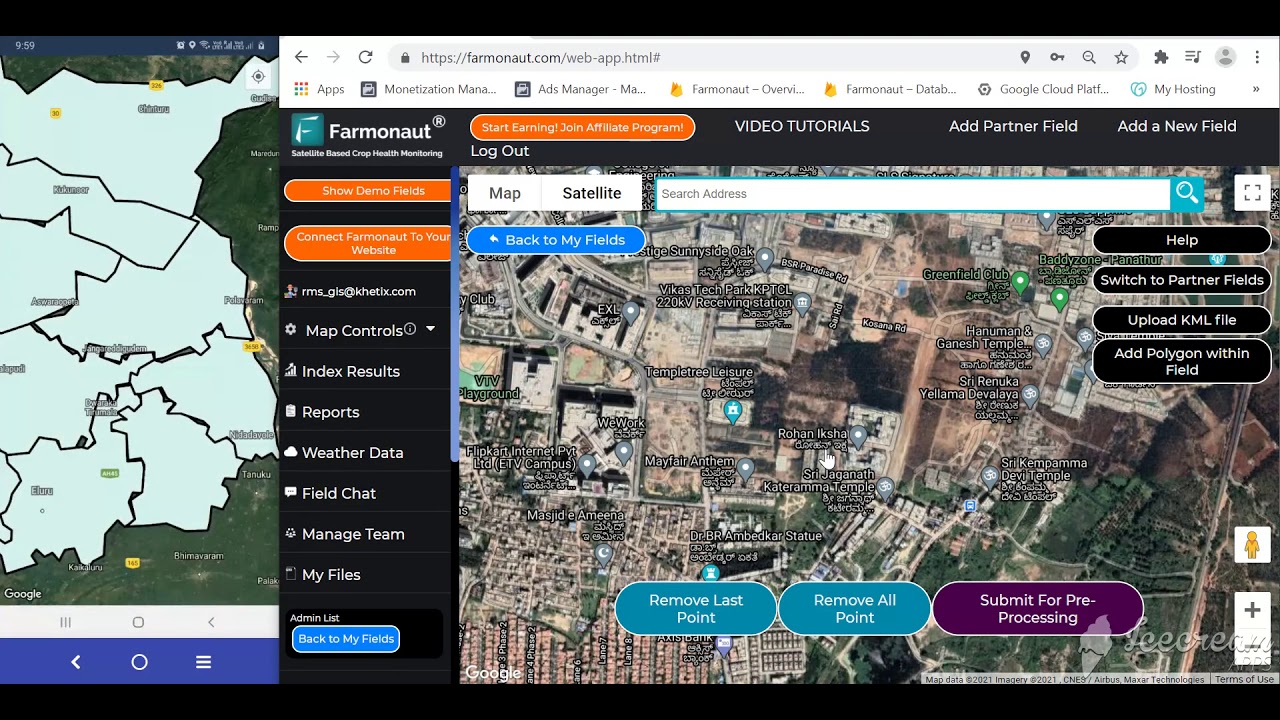

Modern farmland investment thrives at the intersection of traditional asset stability and cutting-edge technology. At Farmonaut, our mission is to democratize access to precision agriculture for all—from individual farmers to large institutional investors and governments. Here’s how we contribute to safer and more profitable farmland REITs and agricultural real estate investment:

- Satellite-Based Crop Health Monitoring: Our satellite imagery platform delivers real-time insights on crop vigor, soil moisture, and resource utilization—ensuring farmland REITs maintain top-tier assets with minimal input waste.

- Jeevn AI Advisory System: We empower agricultural operators with AI-driven, personalized recommendations on weather, irrigation, pest management, and more—maximizing tenant profitability and risk-adjusted returns.

- Blockchain-Based Traceability: Our platform tracks every stage of the agricultural supply chain, delivering transparency and fraud-resistance for landlords, REIT managers, and investors alike.

- Fleet & Resource Management: We make it simple to monitor equipment, reduce downtime, and boost operational efficiency—crucial for large portfolios spread across states and distinct asset types.

- Carbon Footprinting: By actively tracking and certifying carbon emissions, Farmonaut helps REITs and investors improve their sustainability profiles and attract ESG capital committed to climate-friendly agriculture.

- API Integration for Data-Driven Due Diligence: Our robust API suite allows REIT managers and technical teams to plug Farmonaut’s satellite and weather datasets directly into in-house analytics and reporting tools.

- Scalable, Cloud-first Products: Our solutions serve operators from small family-owned farms to transnational agribusinesses, supporting everything from plot-level monitoring to state-level estimation, policy, and farm mapping needs.

Ready to amplify your farmland portfolio management?

Use our Web, Android, and iOS Apps to bring precision, transparency, and data-driven decision-making to your agricultural assets.

FAQ: Farmland REITs Simplified

What is a farmland REIT?

A farmland REIT (Real Estate Investment Trust) is a company that owns, operates, and leases agricultural land to farmers or agribusinesses. Investors buy shares of the REIT to gain diversified exposure to farmland assets, often receiving income from land leases and a share of appreciation without the need for direct land ownership.

How do farmland REITs generate income?

The five major income streams are: (1) land lease payments from tenant farmers, (2) crop share agreements where REITs get a portion of production revenue, (3) appreciation in land value, (4) leasing land for renewable energy projects (solar/wind/biogas), and (5) ancillary business earnings such as equipment storage or processing facilities.

Are farmland REITs a good inflation hedge?

Yes, farmland and agricultural commodities typically appreciate during inflationary periods, making REITs in this sector attractive inflation hedge investments. Lease payments and land values may also be linked to commodity prices.

What are the main risks of investing in farmland through REITs?

The key risks are commodity price volatility, unpredictable weather or natural disasters, tenant financial instability, and abrupt regulatory changes affecting agricultural profitability.

Who should consider farmland REITs for their portfolio?

Farmland REITs may suit income-seeking investors, those wanting portfolio diversification, and individuals looking for inflation resistance without the burdens of direct land ownership and active management.

Can technology improve farmland REIT investing?

Absolutely. Farmonaut’s technology, including satellite crop monitoring, AI-driven advisory, blockchain traceability, and real-time resource management, provides crucial transparency, risk management, and optimization for both REITs and their tenants.

Conclusion: Empowering Your Agricultural Real Estate Investment Journey

Farmland REITs represent a unique blend of income stability, growth potential, and protection against economic uncertainty. With five powerful income streams, low market correlation, and a proven record of delivering compelling farmland investment returns, these specialized trusts provide an accessible and efficient route to agricultural investing.

As investors navigate the complex landscape of inflation, market cycles, and global food demand, farmland REITs—backed by responsible management and supported by 21st-century technology—stand as a resilient and rewarding asset class.

At Farmonaut, we’re dedicated to empowering smarter, more sustainable agricultural investment by making precision data, monitoring, and advisory practical for everyone involved in farmland—from the investor to the farmer. Explore our platform, leverage our tools, and take the next step toward a thriving, future-forward farm investment journey.