Table of Contents

- Introduction: Farmland Investment Redefined

- Understanding Private Equity in Farmland

- Farmland Investment Growth & 7 Shocking Trends

- Top Strategies: Farmland Acquisition & Land Management

- Sustainable Practices & Technology Integration

- Economic & Social Impacts of Farmland Investment

- Risks & Challenges in Farmland Investment

- Comparative Trend Analysis Table

- How Farmonaut Empowers Sustainable & Profitable Farmland Investment

- Frequently Asked Questions (FAQ)

- Conclusion: The Future of Private Equity Farmland Investment

Private Equity Farmland: 7 Shocking Trends Revealed

Over the past two decades, private equity in farmland has accelerated at a breathtaking pace, fundamentally transforming investment landscapes, agricultural practices, and rural economies worldwide. As global food demand and the need for sustainable farming practices climb higher, we find ourselves at the intersection of finance, technology, and environmental stewardship. But what does this private equity revolution really mean for the future of agricultural land management, farm productivity enhancement, and rural economic growth?

In this comprehensive, data-driven exploration, we at Farmonaut will uncover seven shocking trends that define the world of private equity farmland investment, dive deep into the forces at play, analyze strategies and risks, and offer actionable insights for investors, farmers, and policymakers alike.

Understanding Private Equity in Farmland

Let’s begin by clarifying what private equity in agriculture truly means. Private equity firms are pools of capital sourced from institutional backers, endowments, family offices, and high net-worth individuals. The primary aim is to acquire, manage, and enhance the value of various assets, including farmland. In farmland investment, these firms typically follow three steps:

- Acquiring or Leasing Agricultural Land: Through farmland acquisition strategies such as direct purchase or leasing, firms gain control over high-potential agricultural properties, often focusing on regions with favorable climates and proximity to key food supply chains.

- Management and Value Enhancement: Actively managing operations is at the heart of private equity farmland investments. Management tactics may include diversifying crop production, transitioning from conventional to organic practices, improving infrastructure, and integrating emerging agricultural technologies.

- Profitable Exits: Once farm productivity and land value have been maximized, these assets are sold or recapitalized, generating returns for investors.

It’s crucial to recognize that private equity farmland investment plays an active role in agricultural land management, unlike passive land ownership models. This often creates ripple effects that shape rural economies, food production patterns, and even environmental outcomes on both local and global scales.

For readers seeking to leverage cutting-edge technology in their own farmland management strategies, Farmonaut’s Large-Scale Farm Management platform provides a comprehensive suite of satellite-based monitoring, reporting, and management tools that streamline operations and boost productivity.

Farmland Investment Growth & 7 Shocking Trends

The surge in private equity investment within farmland over recent years cannot be overstated. In the United States alone, institutional investments in farmland more than doubled between 2020 and 2023, surpassing $16.6 billion. The forces fueling this growth are complex and multifaceted:

- Global Food Demand: As the world’s population approaches 10 billion, food security and supply chain resilience have taken center stage. Investing in farmland offers exposure to what many experts consider a recession-resilient asset category.

- Limited Arable Land: With climate change and urbanization reducing the supply of prime agricultural land, the value of existing farmland is expected to rise, contributing to its appeal for investors.

- Focus on Sustainability: A striking shift in investor priorities is the rise of sustainable farming practices and climate-resilient strategies in private equity agriculture.

The 7 Shocking Trends Reshaping Private Equity Farmland Investment

Let’s break down the most impactful developments—our “seven shocking trends”—transforming farmland through private equity:

- Skyrocketing Institutional Investment in Farmland

- Between 2020 and 2023, private equity investment in U.S. farmland more than doubled, from $7.5 billion to $16.6 billion.

- A combination of food security, robust returns, and land scarcity is attracting not just traditional investors but global institutional players.

- Shift Toward Sustainable and Regenerative Practices

- More than 60% of new private equity funds in agriculture demand sustainability metrics, regenerative soil practices, and lower carbon footprints.

- This is transforming farming from conventional monoculture approaches to crop rotation, organic transitions, and eco-friendly land management.

- Accelerated Technological Integration in Farmland Management

- Advanced technologies like AI-powered crop health monitoring, satellite imagery, and precision irrigation are being embedded into large-scale farming operations.

- This digital evolution not only boosts farm efficiency and yields, but also increases transparency for investors and stakeholders.

- Consolidation & Scale: The Big Farm Takeover

- Private equity increasingly favors consolidation, driving a shift from small, fragmented farms toward large-scale, professionally managed agricultural operations.

- This trend can lead to greater economies of scale, but also sparks debates around local community impacts and land access for new farmers.

- New Fund Structures and Partnerships

- Joint ventures, leasing models, and flexible ownership arrangements with local farmers or agribusinesses are on the rise.

- These structures enable investors to share operational risks, access local expertise, and maximize returns while fostering stronger community integration.

- Focus on Agricultural Infrastructure Development

- Capital is increasingly being allocated to on-farm infrastructure—think cold storage, logistics, renewable energy, and farm mechanization.

- These assets support both productivity enhancement and reduction in post-harvest losses, further increasing the value of farmland.

- Heightened Attention to Risk Mitigation

- The risks of farmland investment—such as climate volatility, commodity price fluctuations, and regulatory uncertainty—have encouraged the use of risk assessment tools and diversification strategies.

- Leading firms deploy precision monitoring, insurance solutions, and tailored portfolio management to safeguard returns.

Why is Farmland Investment Surging Now?

We’re witnessing a unique convergence of factors: The recognition of farmland as a resilient, long-term asset; new, data-driven management tools; and increasing institutional demand for investments that align with global climate and sustainability goals.

Top Strategies: Farmland Acquisition & Land Management

Private equity firms don’t just buy land—they leverage a toolkit of farmland acquisition strategies and management structures designed to enhance farm productivity, generate steady rental income, and protect against market volatility:

Direct Acquisition and Active Management

- Purchasing Farmland: Firms acquire agricultural land directly, often focusing on properties with existing irrigation, high soil fertility, and proximity to key infrastructure.

- Operational Management: They may oversee everything from crop selection and supply chain development to adopting cutting-edge technologies and transitioning from conventional to organic farming.

Leasing Arrangements

- Investor-Owned, Farmer-Operated: Firms purchase lands and lease back to qualified farmers, providing access to capital resources while generating predictable rental income.

- These models can be win-win, increasing land use efficiency and offering farmers needed long-term stability.

Joint Ventures & Partnerships with Agribusinesses

- Collaborating for Expertise: Leading private equity groups partner with local farmers or established agribusinesses for both management expertise and risk sharing.

- Joint ventures create economic incentives on both sides and can spur rural economic growth through increased investment and employment opportunities.

Choosing the Right Approach

Each structure—direct management, leasing, partnerships, or joint ventures—brings unique combinations of potential reward, operational complexity, risk exposure, and positive community impact. How private equity firms structure their farmland investment vessels is often driven by local market conditions, available expertise, and long-term sustainability objectives.

Efficient logistical oversight drives successful farmland investment. Discover Farmonaut’s Fleet Management solution to optimize vehicle use, monitor operations, and reduce costs—essential for large-scale agricultural operations and agribusinesses.

Sustainable Farming Practices & Technology Integration

No analysis of private equity farmland investment would be complete without examining the growing intersection of sustainability and technology in the agricultural sector.

Regenerative, Sustainable, and Organic Transitions

- Soil Health and Crop Diversity: Many new investments stipulate the adoption of regenerative agricultural practices, such as crop rotation, cover cropping, reduced tillage, and engineered biodiversity restoration.

- Organic Certification: Transitioning land from conventional to organic production not only aligns with market demand, but can also significantly increase land value and open new retail channels.

- Climate-Resilient Farming: Drought-tolerant seed varieties, water conservation practices, and digitally tracked carbon reductions are now central in farmland management.

Ready to track and minimize your own farm’s environmental impact? Leverage Farmonaut Carbon Footprinting for real-time carbon emissions monitoring to ensure compliance with global environmental standards while enhancing sustainability credentials.

Technological Integration in Land Management

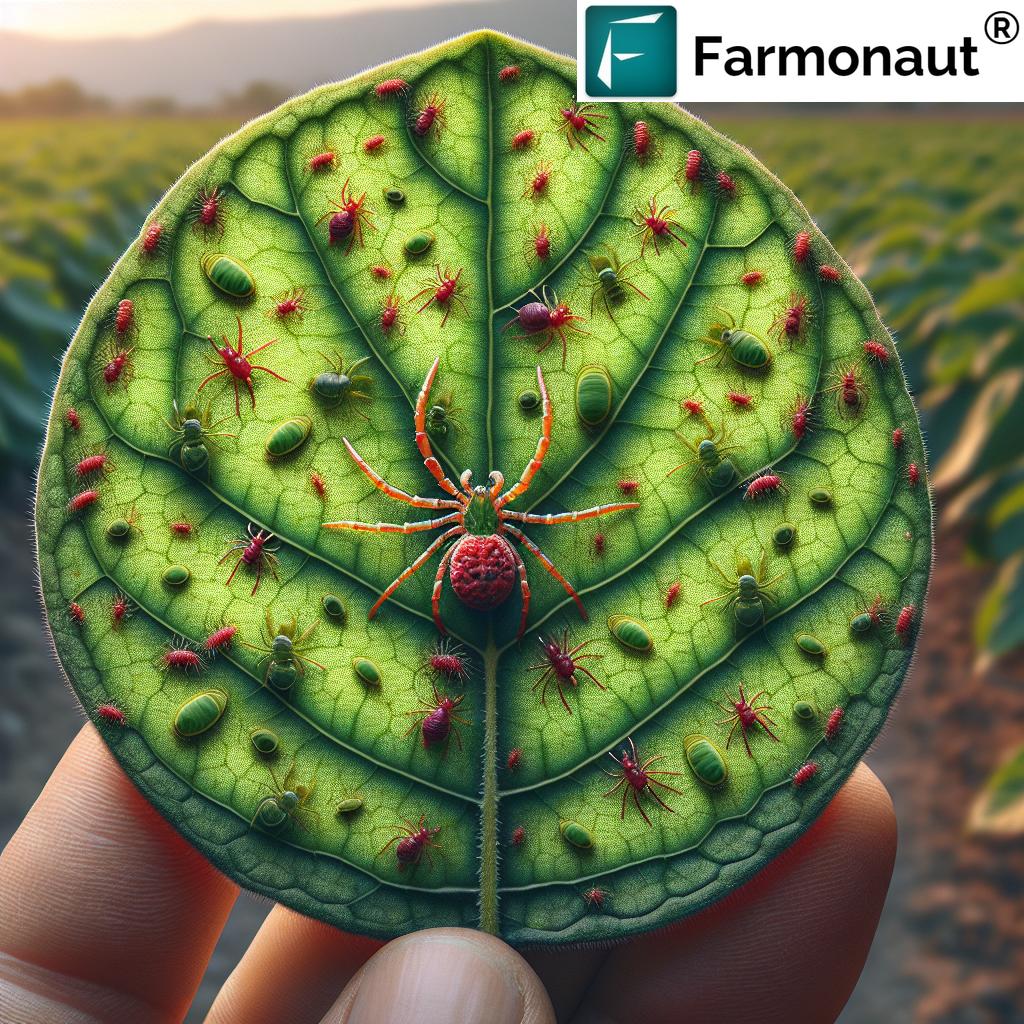

- Satellite Crop Health Monitoring: Private equity-backed operations increasingly use satellite imagery and drone data for real-time crop health, pest, and water stress monitoring—improving yield forecasts and resource allocation.

- AI-Based Advisory Systems: Decision-making is now augmented by AI-powered systems that synthesize weather, crop, and soil data to generate expert recommendations and support farm productivity enhancement.

- Blockchain Traceability: Secure, transparent supply chains reduce fraud and meet modern consumer demands for traceable, sustainable food products.

- Resource and Fleet Management: Crop irrigation, equipment usage, and supply logistics are mapped, tracked, and optimized—reducing waste and maximizing operational efficiency.

Ensure the highest level of transparency in your food supply chain using Farmonaut’s Blockchain-based Product Traceability platform. Protect your product’s integrity from farm to fork, reinforce trust, and differentiate your agricultural business.

Infrastructure Development: The New Goldmine

From cold storage facilities and climate-controlled warehouses to renewable energy installations, investments in agricultural infrastructure development underpin sustainable scaling. These enhancements:

- Enable longer storage of perishable produce, reducing food waste and stabilizing prices

- Support better logistics and distribution, reaching wider markets

- Increase land value and long-term returns for investors

Economic & Social Impacts of Private Equity Farmland Investment

Private equity isn’t just transforming farming operations; it’s reshaping entire rural economies. Here’s how:

Economic Revitalization & Rural Growth

- Job Creation: Modernized, large-scale farms require skilled labor for management, data analysis, machine operation, and logistics—boosting rural employment.

- Increased Tax Base: Improved profitability from investment upgrades helps fund local schools, healthcare, and infrastructure.

- Stimulus for Ancillary Sectors: Enhanced farm operations generate secondary growth for local equipment dealers, transport services, and processors.

Land Access & Affordability Challenges

- Property Price Inflation: Rising demand for arable land has led to higher farmland values—posing barriers to entry for new, small, or historically disadvantaged farmers.

- Preservation Initiatives: Some funds are experimenting with permanent agricultural easements and land trusts to ensure continued farming use and avoid conversion to urban development.

Consolidation & Impact on Traditional Communities

- While consolidation can increase sectoral efficiency, there are real concerns over the survival of family farms and shifts in local identity.

Farmonaut’s Crop Loan and Insurance Verification service leverages satellite data to simplify loan approval and insurance verification, lowering barriers for individual farmers to access financing and manage risk.

Risks & Challenges in Farmland Investment

No discussion of private equity in agriculture would be complete without a candid assessment of the risks of farmland investment:

Market Volatility and Uncertainty

- Price Swings: Commodity, input, and land values can be affected by unpredictable factors—from severe weather events to trade policy shifts and geopolitical unrest.

Regulatory & Environmental Risks

- Policy Changes: New laws affecting land use, water access, or chemical applications can quickly alter investment returns.

- Environmental Compliance: Regulations are only growing more stringent, especially around water quality, carbon emissions, and biodiversity impact.

Operational & Management Risks

- Expertise Shortages: Large, technologically advanced capital-intensive farms require specialized managers and skilled labor, which can be hard to find—especially in rural or remote regions.

- Poor Implementation: Failure to successfully integrate advanced technology or sustainable practices may reduce potential gains and increase losses.

For those seeking to minimize risk, accurate data will be your greatest ally. Farmonaut APIs (API access | Developer Docs) offer seamless integration of satellite-driven, weather, and crop health data for agriculture-related apps and IT systems—empowering informed decision-making and risk mitigation.

Comparative Trend Analysis Table: Private Equity Farmland Investment at a Glance

To make sense of these developments, we’ve assembled a Comparative Trend Analysis Table showing estimated data for private equity farmland investment trends (2019–2025). This table highlights the growth, shift towards sustainability, productivity gains, associated risks, and economic impacts of these investments:

| Year | Estimated Private Equity Investment in Farmland ($ Billion) | Share of Sustainable Projects (%) | Average Farm Productivity Increase (%) | Risk Level Index (1-10) | Estimated Rural Economic Impact ($ Million) |

|---|---|---|---|---|---|

| 2019 | $7.0 | 18% | 2.1% | 8.0 | $350 |

| 2020 | $7.5 | 23% | 2.4% | 7.5 | $410 |

| 2021 | $9.3 | 32% | 3.0% | 7.0 | $530 |

| 2022 | $12.9 | 44% | 3.7% | 6.5 | $905 |

| 2023 | $16.6 | 58% | 4.4% | 6.0 | $1370 |

| 2024 (est.) | $18.3 | 65% | 4.7% | 5.5 | $1535 |

| 2025 (projected) | $21.0 | 70% | 5.1% | 5.0 | $1780 |

This table makes clear: private equity farmland investment is not only growing rapidly, but is also becoming more sustainable, productive, and impactful on rural economies—albeit with a gradual reduction in sectoral risk as management techniques and technologies mature.

How Farmonaut Empowers Sustainable & Profitable Farmland Investment

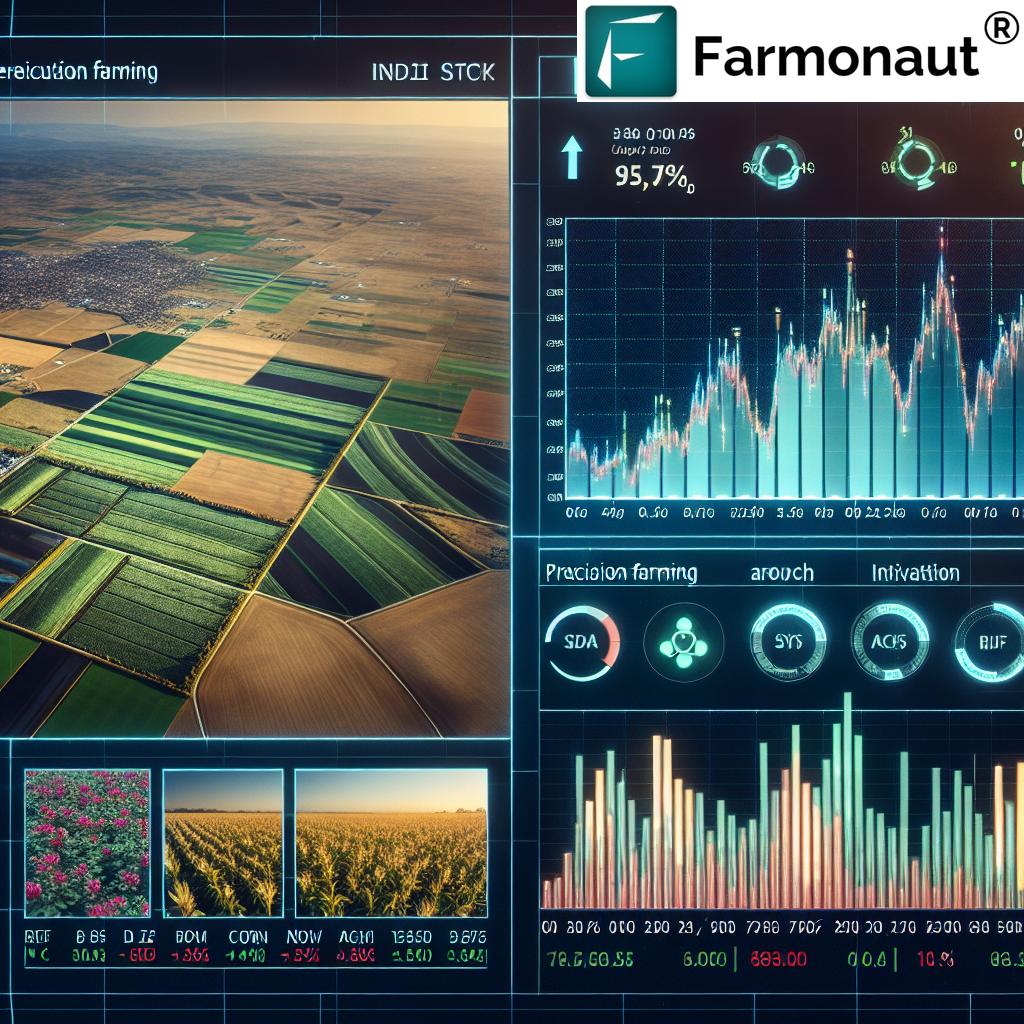

As the agricultural sector undergoes digital transformation, Farmonaut stands at the vanguard—making precision agriculture technologies affordable, accessible, and actionable for farmers, investors, and agribusinesses across the globe.

- Satellite-Based Crop Health Monitoring: Using advanced multispectral imaging, Farmonaut’s platform analyzes vegetation, moisture, and stress indicators on every hectare of monitored farmland—enabling rapid crop health assessment and timely interventions.

- AI-Driven Jeevn Advisory: A truly global farm advisory system, Farmonaut’s Jeevn AI delivers personalized, real-time guidance on irrigation, fertilizer management, pest control, and yield optimization.

- Blockchain Traceability: Powerful traceability tools create transparent supply chains from field to customer, dramatically reducing the risk of food fraud and boosting market recognition of sustainably grown products.

- Resource & Fleet Management: From machinery tracking to logistics optimization, Farmonaut empowers agribusinesses and investment funds to deploy resources efficiently—reducing costs and environmental impact.

- Carbon Footprinting & Compliance Tools: Farmonaut’s real-time carbon tracking empowers agricultural investors to comply with regulatory standards and satisfy sustainability targets.

- Affordable & Scalable Access: With subscription packages for everyone from smallholder farmers to large agribusinesses, Farmonaut democratizes access to next-gen agricultural innovation.

Frequently Asked Questions (FAQ): Private Equity Farmland Investment

What is private equity farmland investment?

Private equity farmland investment involves pooling capital to acquire, enhance, and manage agricultural land for financial returns. It often includes actively upgrading farming practices, integrating technology, leasing to professional farmers, or entering into joint ventures with agribusinesses. Returns are generated from both asset appreciation and ongoing farm operations.

What are the main risks of farmland investment?

The key risks include agricultural market volatility, unpredictable weather and climate events, geographic and regulatory risks, environmental compliance, and operational management challenges—especially during transitions to advanced, technology-driven, or sustainable farming models.

How has private equity changed farming practices?

Private equity has driven adoption of sustainable agriculture, regenerative soil practices, technological integration (like satellite and AI-based monitoring), and professionalized farm management. It’s accelerated transitions to organic production and introduced sophisticated risk management frameworks.

Is investing in farmland only for large institutions?

While direct farmland acquisition is often capital intensive, a growing range of vehicles—from publicly listed farmland REITs to fractional ownership apps—are making farmland investment more accessible to individual investors and smaller institutions.

How does Farmonaut help with risk and sustainability in farmland investment?

Farmonaut provides satellite-based crop and soil health monitoring, AI-driven advisory for sustainable management, blockchain-based traceability, carbon tracking, and fleet/resource optimization—enabling investors and managers to mitigate risk while supporting sustainability objectives.

Conclusion: The Future of Private Equity Farmland Investment

Our exploration into private equity farmland reveals a sector transformed by institutional capital, technology, and a powerful new focus on sustainability. The seven trends highlighted illustrate pathways to higher productivity, increased rural economic growth, and lower sectoral risk—but also expose new challenges in land access, traditional community impacts, and changing regulatory landscapes.

The way forward? As demand for food and sustainable practices grows, the balance between financial imperatives and social and environmental responsibility only becomes more important. Emerging technologies—like those pioneered by Farmonaut—offer a way to improve both returns and resilience, ensuring that the next generation of farmland investment benefits everyone from farmers and investors to consumers and rural communities worldwide.

Whether you’re an institutional investor, agribusiness, or an innovative farmer, the tools and insights are now available for you to thrive in this new era of smart, sustainable agricultural investment.