Unleashing the Power: Corn and Soybean Futures Surge as Global Weather Shifts Impact CBOT Grain Prices

In a dramatic turn of events, the commodity market trends have taken center stage as corn futures and soybean futures rally on the Chicago Board of Trade (CBOT). This surge comes amidst a complex interplay of global weather patterns, harvest progress, and shifting export dynamics, painting a vivid picture of the ever-evolving agricultural commodities landscape.

CBOT Grain Prices Update: A Closer Look at the Rally

The recent corn and soybean futures rally has sent ripples through the agricultural sector. Let’s break down the numbers:

- Corn futures rose 0.3% to $4.02-1/2 per bushel

- Soybean futures climbed 0.8% to $9.98-1/2 per bushel

- Wheat futures increased 0.3% to $5.81-1/4 per bushel

While these gains are noteworthy, it’s crucial to understand that CBOT grain prices remain near four-year lows, highlighting the complex nature of the current market dynamics.

Global Weather Impact on Commodities: South America in Focus

The global weather impact on commodities cannot be overstated, with South American weather playing a pivotal role in shaping market sentiments. Improved weather forecasts for Brazil and Argentina have eased production concerns, contributing significantly to the recent rally.

This weather-driven optimism is particularly evident in the Brazil crop forecast, which projects a staggering 12.7% increase in soybean harvest for the 2024/25 season. This forecast not only bolsters Brazil’s position as the world’s top soybean exporter but also has far-reaching implications for global grain exports.

U.S. Harvest Progress and Its Impact on Futures

While South American weather patterns are crucial, the U.S. harvest progress remains a key factor influencing futures prices. Current data paints an encouraging picture:

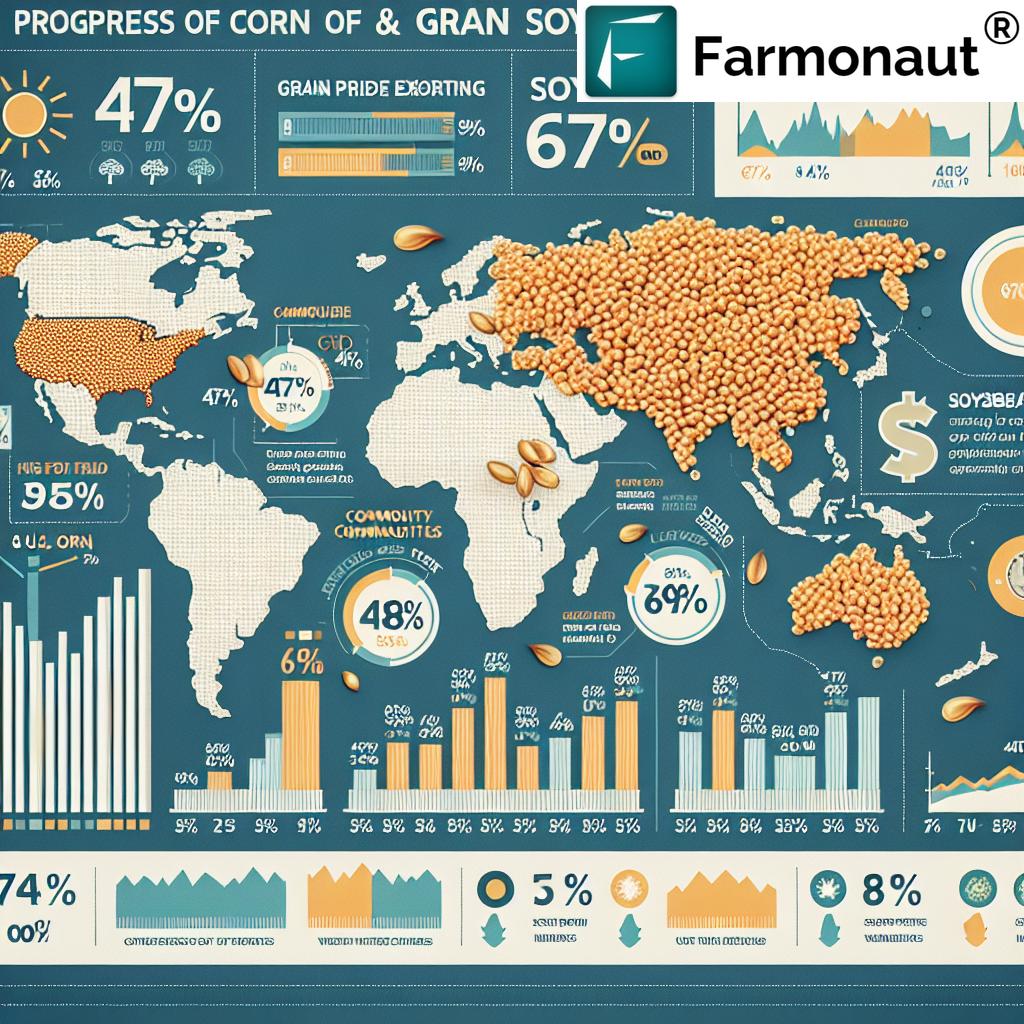

- Corn harvest is 47% complete

- Soybean harvest has reached 67% completion

This strong progress in the U.S. harvest is a double-edged sword for futures prices. On one hand, it ensures a stable supply, potentially tempering price spikes. On the other, it could lead to increased selling pressure as more crops enter the market.

Stay ahead of the agricultural market with Farmonaut’s cutting-edge satellite and weather API. Explore our API now for real-time insights!

South American Weather and Grain Exports: A Delicate Balance

The intricate relationship between South American weather and grain exports continues to be a focal point for market analysts. As weather patterns in Brazil and Argentina improve, the outlook for grain exports from these regions brightens, potentially reshaping global trade flows.

However, this optimism is tempered by challenges in other key exporting regions:

- Reduced Russian wheat exports due to geopolitical tensions

- French crop downgrades impacting European grain output

These factors underscore the delicate balance in the global grain market and the importance of diversified sourcing strategies for importing nations.

Agricultural Commodity Market Trends: Beyond Weather and Harvests

While weather and harvest progress are crucial, other factors are shaping agricultural commodity market trends:

- Currency Fluctuations: A stronger U.S. dollar is exerting pressure on commodity prices, making American exports less competitive in the global market.

- Oil Prices: Lower oil prices are impacting the biofuel sector, particularly affecting corn demand for ethanol production.

- Geopolitical Tensions: Ongoing conflicts and trade disputes continue to introduce uncertainty into the market.

These factors, combined with weather patterns and harvest progress, create a complex tapestry of influences on CBOT grain prices.

Optimize your farming decisions with Farmonaut’s mobile app.

Looking Ahead: Implications for Farmers and Traders

As we navigate these turbulent waters in the agricultural commodities market, several key considerations emerge for stakeholders:

- Risk Management: The volatility in futures prices underscores the importance of robust hedging strategies for both producers and consumers of grains.

- Diversification: With regional variations in production and export capabilities, diversifying sourcing and marketing strategies becomes crucial.

- Technology Adoption: Leveraging advanced forecasting tools and data analytics can provide a competitive edge in navigating market fluctuations.

For farmers and traders alike, staying informed about global weather patterns, harvest progress, and broader economic indicators is more critical than ever.

Conclusion: Navigating Uncertainty in the Grain Markets

The recent rally in corn and soybean futures serves as a stark reminder of the dynamic nature of agricultural commodities markets. As global weather patterns shift, harvest progress unfolds, and geopolitical factors come into play, the landscape of grain trading continues to evolve.

While current prices remain near multi-year lows, the potential for rapid changes underscores the need for vigilance and adaptability. Farmers, traders, and policymakers must remain attuned to both local and global factors that can swiftly alter market dynamics.

As we move forward, the interplay between South American weather, U.S. harvest progress, and global export trends will continue to shape the trajectory of grain prices. By staying informed and leveraging cutting-edge tools and analyses, stakeholders can position themselves to navigate these challenging waters successfully.

Elevate your agricultural insights with Farmonaut’s comprehensive solutions.

In this era of unprecedented market volatility and climate uncertainty, the ability to quickly adapt and make informed decisions will be the key to success in the agricultural commodities sector. As we’ve seen, even small shifts in weather patterns or harvest progress can have significant ripple effects across global markets.

For those looking to stay ahead of the curve, leveraging advanced technologies and data-driven insights is no longer optional—it’s essential. From satellite imagery to real-time weather data and AI-powered forecasting models, the tools available to today’s agricultural professionals are more powerful than ever.

Ready to revolutionize your approach to agricultural data? Dive into our API Developer Docs and unlock the power of precision agriculture today!