Unlocking California’s Agricultural Potential: Farmonaut’s Tech-Driven Approach to Farmland Investment and Water Management

“A prominent farmland REIT’s portfolio includes 169 farms across 15 US states, showcasing the scale of agricultural investments.”

Welcome to our comprehensive exploration of the evolving landscape of agricultural real estate investment and the revolutionary role of technology in farmland management. As we delve into this topic, we’ll uncover how companies like Farmonaut are reshaping the future of farming, particularly in water-stressed regions like California.

The Rise of Farmland REITs: A New Frontier in Investment

In recent years, we’ve witnessed a significant surge in interest towards agricultural real estate and farmland REITs (Real Estate Investment Trusts) as promising avenues for portfolio diversification. This trend has been further solidified by the recent announcement of a monthly dividend by a prominent farmland REIT, highlighting the potential for high-yield farmland stocks in the current market.

Let’s take a closer look at this development:

- Gladstone Land Company (NASDAQ:LANDO) declared a monthly dividend of $0.125 per share on January 16

- The payment is scheduled for March 31 to stockholders of record as of March 19

- This translates to an annualized payment of $1.50, yielding an impressive 7.39%

- The ex-dividend date is set for March 19

This announcement not only underscores the attractive yields offered by farmland stocks but also demonstrates the resilience of the agriculture sector as a whole. Over the past three years, Gladstone Land has shown consistent growth, increasing its dividend payment by an average of 22.4% annually. Such positive trajectories in dividend growth are particularly appealing to income-focused investors seeking reliable returns.

California’s Agricultural Landscape: A Tech-Driven Revolution

As we turn our attention to California, we find a state at the forefront of agricultural innovation and investment. With its vast farmlands and critical water resources, California presents both challenges and opportunities for agricultural real estate investors.

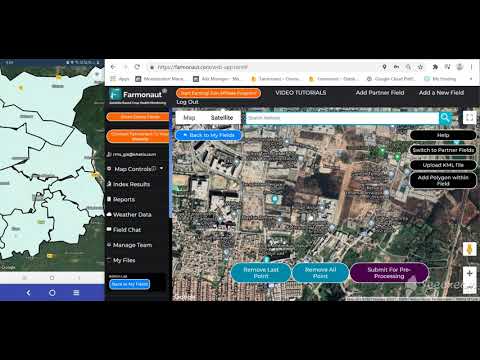

In this context, technologies like those offered by Farmonaut are becoming increasingly crucial. Farmonaut, a pioneering agricultural technology company, provides advanced, satellite-based farm management solutions that are transforming how we approach farmland investment and management, especially in water-sensitive areas like California.

Let’s explore how Farmonaut’s innovative solutions are addressing key challenges in California’s agricultural sector:

1. Precision Water Management

California’s agriculture is heavily dependent on efficient water use. Farmonaut’s satellite-based crop health monitoring system provides real-time data on soil moisture levels, enabling farmers to optimize irrigation practices. This technology is particularly valuable in a state where water rights play a crucial role in farmland investments.

2. Crop Health Optimization

By leveraging multispectral satellite imagery, Farmonaut offers insights into vegetation health (NDVI) and other critical metrics. This data-driven approach allows farmers to make informed decisions about fertilizer usage and pest management, ultimately optimizing crop yields and reducing resource wastage.

3. AI-Powered Advisory

Farmonaut’s Jeevn AI Advisory System delivers personalized farm management strategies based on real-time data analysis. This AI-driven tool is particularly beneficial in California’s diverse agricultural landscape, where crop management needs can vary significantly across regions.

The Intersection of Technology and Farmland Investment

As we consider the impact of technology on farmland investment, it’s clear that platforms like Farmonaut are revolutionizing the way investors approach agricultural real estate. Let’s examine how these technological advancements are reshaping key aspects of farmland investment:

1. Enhanced Due Diligence

Investors can now leverage Farmonaut’s satellite imagery and AI-driven insights to conduct more thorough due diligence on potential farmland acquisitions. This technology allows for a comprehensive assessment of land quality, crop health history, and water management efficiency – crucial factors in determining the value and potential of agricultural properties.

2. Improved Risk Management

By providing real-time monitoring and predictive analytics, Farmonaut’s technology helps investors and farm managers mitigate risks associated with climate variability, pest infestations, and resource scarcity. This is particularly valuable in California, where agricultural operations often face challenges related to water availability and climate change.

3. Optimized Asset Management

For farmland REITs and large-scale agricultural investors, Farmonaut’s platform offers tools for efficient portfolio management. The ability to monitor multiple properties simultaneously, track performance metrics, and receive AI-generated advisory insights enables more informed decision-making and potentially higher returns on investment.

“California’s water rights play a crucial role in farmland investments, highlighting the state’s agricultural significance.”

Farmonaut’s Impact on California’s Agricultural Landscape

As we delve deeper into Farmonaut’s role in California’s agricultural sector, it’s important to understand how its technologies are specifically addressing the state’s unique challenges and opportunities:

1. Water Resource Optimization

California’s agricultural success heavily depends on efficient water management. Farmonaut’s satellite-based monitoring system provides crucial data on soil moisture levels, enabling farmers to implement precision irrigation strategies. This technology is particularly valuable in a state where water rights are a critical component of farmland investments.

For investors interested in California’s agricultural real estate, understanding water management capabilities is crucial. Farmonaut’s technology offers a competitive edge by providing detailed insights into water usage efficiency, a key factor in assessing the long-term viability and profitability of farmland investments in the state.

2. Climate-Resilient Farming

California’s diverse climate zones present both opportunities and challenges for agriculture. Farmonaut’s AI-powered advisory system, Jeevn AI, helps farmers adapt to these varied conditions by providing personalized crop management strategies. This technology enables farm operators to make data-driven decisions that optimize yield while minimizing environmental impact – a crucial consideration for sustainable farmland investment.

3. Enhancing Farmland Valuation

For investors and REITs focusing on California’s agricultural real estate, accurate property valuation is essential. Farmonaut’s comprehensive data analytics provide valuable insights into land productivity, crop health history, and resource management efficiency. This information allows for more precise farmland valuations, potentially uncovering investment opportunities that might be overlooked using traditional assessment methods.

Comparative Analysis: Traditional vs. Tech-Driven Farmland Investment

To better understand the impact of Farmonaut’s technology on farmland investment, particularly in California, let’s compare traditional approaches with the tech-driven methods enabled by Farmonaut:

| Aspect | Traditional Approach | Farmonaut’s Tech-Driven Approach |

|---|---|---|

| Water Management | Reliance on historical data and manual observations | Real-time satellite monitoring of soil moisture and AI-driven irrigation recommendations |

| Crop Yield Optimization | Seasonal planning based on past performance | Continuous monitoring and AI-powered advisory for timely interventions |

| Investment Risk Assessment | Limited to financial metrics and historical yield data | Comprehensive analysis including real-time crop health, weather patterns, and resource efficiency |

| Environmental Sustainability | General practices without precise measurement | Data-driven sustainability metrics, including carbon footprint tracking |

| Real-time Monitoring | Periodic physical inspections | Continuous satellite-based monitoring with instant alerts |

| Data-Driven Decision Making | Reliance on experience and limited data points | AI-powered insights based on vast datasets and real-time information |

| Farmland Valuation | Based on historical yields and market comparables | Incorporates advanced metrics like resource efficiency and technology adoption potential |

| Lease Management | Standard terms based on market norms | Performance-based leases utilizing precise productivity data |

This comparison highlights how Farmonaut’s technology is revolutionizing farmland investment strategies, particularly in regions like California where resource management and sustainability are critical factors.

The Future of Farmland Investment: Integrating Technology and Traditional Practices

As we look to the future of farmland investment, particularly in California, it’s clear that the integration of advanced technologies like those offered by Farmonaut with traditional agricultural practices will play a pivotal role. This synergy has the potential to create more resilient, productive, and valuable agricultural assets.

1. Data-Driven Investment Decisions

Investors in agricultural real estate will increasingly rely on comprehensive data analytics provided by platforms like Farmonaut. These insights will enable more informed decision-making, from initial property acquisition to ongoing management strategies.

2. Sustainable Agriculture as a Value Driver

With growing emphasis on environmental sustainability, farmland investments that leverage technology for efficient resource use and reduced environmental impact will likely see increased demand and valuation. Farmonaut’s tools for carbon footprint tracking and resource optimization align perfectly with this trend.

3. Adapting to Climate Change

California’s agricultural sector faces ongoing challenges related to climate change. Farmonaut’s predictive analytics and real-time monitoring capabilities will be crucial in helping farmers and investors adapt to changing conditions, ensuring the long-term viability of farmland investments.

Farmonaut’s Role in Shaping Agricultural Investment Strategies

As we continue to explore the impact of technology on farmland investment, it’s crucial to understand how Farmonaut’s specific offerings are shaping investment strategies, particularly in California’s unique agricultural landscape.

1. Precision Agriculture for Enhanced ROI

Farmonaut’s satellite-based crop health monitoring system provides investors with unprecedented visibility into farm performance. This technology enables:

- Real-time crop health assessment using NDVI (Normalized Difference Vegetation Index)

- Early detection of pest infestations and disease outbreaks

- Optimization of fertilizer and pesticide application

For investors, this translates to potentially higher yields, reduced input costs, and ultimately, improved return on investment (ROI) from their agricultural assets.

2. Water Management in Water-Stressed California

California’s agricultural sector faces ongoing challenges related to water scarcity. Farmonaut’s technology addresses this critical issue by:

- Providing accurate soil moisture data through satellite imagery

- Enabling precision irrigation practices

- Helping farm managers comply with water use regulations

For farmland investors in California, the ability to efficiently manage water resources is not just an operational advantage – it’s a key factor in preserving and enhancing the long-term value of their investments.

3. AI-Powered Decision Support

Farmonaut’s Jeevn AI Advisory System represents a significant leap forward in farm management technology. For investors, this means:

- Access to AI-generated insights for optimal crop management

- Personalized recommendations based on local conditions and historical data

- Improved risk management through predictive analytics

This level of technological support can be a game-changer for farmland investments, potentially leading to more consistent yields and reduced operational risks.

Integrating Farmonaut’s Technology into Investment Strategies

For investors looking to leverage Farmonaut’s technology in their agricultural real estate strategies, here are some key considerations:

1. Due Diligence Enhancement

When evaluating potential farmland acquisitions, investors can use Farmonaut’s historical satellite data and analytics to assess:

- Past crop performance and land productivity

- Water management efficiency

- Potential for implementing precision agriculture techniques

This data-driven approach to due diligence can help investors make more informed decisions and potentially identify undervalued properties with high improvement potential.

2. Portfolio Optimization

For investors managing multiple agricultural properties, Farmonaut’s platform offers powerful tools for portfolio optimization:

- Comparative analysis of performance across different properties

- Identification of best practices that can be replicated across the portfolio

- Risk assessment and mitigation strategies based on real-time data

These capabilities enable investors to manage their farmland portfolios more effectively, potentially leading to improved overall performance.

3. Sustainable Investment Practices

With growing emphasis on environmental, social, and governance (ESG) factors in investment decisions, Farmonaut’s technology supports sustainable farming practices:

- Carbon footprint tracking for agricultural operations

- Optimization of resource use, reducing environmental impact

- Support for sustainable farming certifications through data-backed practices

Investors leveraging these capabilities can potentially access new markets and funding sources focused on sustainable agriculture.

The Broader Impact on Agricultural Real Estate Investment

As we consider the implications of Farmonaut’s technology on farmland investment, it’s important to recognize the broader trends shaping the agricultural real estate market:

1. Increased Transparency

Technologies like Farmonaut’s satellite-based monitoring are bringing unprecedented transparency to farmland investments. This increased visibility into farm operations and performance can:

- Attract new investors to the agricultural real estate market

- Facilitate more accurate property valuations

- Support the development of new financial products tied to agricultural performance

2. Evolving Lease Structures

The availability of detailed, real-time farm performance data is likely to influence how farmland leases are structured. We may see a trend towards:

- Performance-based leases that align farmer and investor interests

- More flexible lease terms that account for technological improvements

- Inclusion of sustainability metrics in lease agreements

3. Redefining Farmland Valuation

Traditional methods of farmland valuation may evolve to incorporate technological factors. Future valuations might consider:

- A property’s technological infrastructure and readiness for precision agriculture

- Historical satellite data showing long-term trends in land productivity

- Potential for resource optimization based on AI-driven analysis

Challenges and Considerations

While the integration of technology like Farmonaut’s into farmland investment strategies offers numerous benefits, it’s important to consider potential challenges:

1. Technology Adoption

The successful implementation of these technologies depends on farmer adoption and proficiency. Investors may need to consider:

- Training and support for farm operators

- Potential resistance to new technologies from traditional farming communities

- The need for robust internet connectivity in rural areas

2. Data Privacy and Security

As farm management becomes increasingly data-driven, concerns about data privacy and security may arise. Investors should be aware of:

- Regulatory compliance requirements for data collection and storage

- The need for secure data transmission and storage systems

- Potential sensitivities around sharing detailed farm performance data

3. Balancing Technology with Traditional Knowledge

While technology offers powerful tools for farm management, it’s crucial to balance these innovations with traditional agricultural knowledge. Successful farmland investments will likely require:

- Integration of local farming expertise with technological insights

- Adaptation of technology recommendations to specific local conditions

- Ongoing dialogue between technologists, farmers, and investors

Conclusion: The Future of Tech-Driven Farmland Investment

As we look to the future of agricultural real estate investment, particularly in regions like California, it’s clear that technology will play an increasingly crucial role. Farmonaut’s innovative solutions represent a significant step forward in how we approach farmland management and investment.

Key takeaways for investors considering the California agricultural market include:

- The importance of water management technology in water-stressed regions

- The potential for AI and satellite technology to optimize crop yields and resource use

- The growing emphasis on sustainable farming practices and their impact on investment value

- The need for a balanced approach that integrates technology with traditional agricultural knowledge

As farmland REITs and individual investors navigate this evolving landscape, those who effectively leverage technologies like Farmonaut’s are likely to gain a significant competitive advantage. The future of farmland investment in California and beyond will be shaped by those who can successfully blend the art of agriculture with the science of data-driven decision-making.

For more information on how Farmonaut’s technology can support your farmland investment strategies, visit their website or explore their mobile applications:

For developers interested in integrating Farmonaut’s technology into their own applications, check out the API and API Developer Docs.

Farmonaut Subscription Options

Earn With Farmonaut

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Frequently Asked Questions

Q: How does Farmonaut’s technology improve water management in California?

A: Farmonaut uses satellite-based monitoring to provide real-time data on soil moisture levels, enabling precise irrigation management. This is crucial in California, where water conservation is a top priority for agricultural operations.

Q: Can Farmonaut’s technology be used for both small farms and large agricultural operations?

A: Yes, Farmonaut’s solutions are scalable and can be applied to farms of various sizes, from small family-owned operations to large commercial farms managed by REITs.

Q: How does Farmonaut’s AI advisory system work?

A: The Jeevn AI Advisory System analyzes satellite data, weather patterns, and historical farm performance to provide personalized recommendations for crop management, including irrigation, fertilization, and pest control strategies.

Q: Is Farmonaut’s technology specific to certain types of crops?

A: While Farmonaut’s technology can be applied to a wide range of crops, it’s particularly valuable for high-value crops common in California, such as almonds, grapes, and various fruits and vegetables.

Q: How can investors use Farmonaut’s data for farmland valuation?

A: Investors can leverage Farmonaut’s historical satellite data and performance analytics to assess land productivity, resource efficiency, and potential for improvement, all of which can inform more accurate farmland valuations.

By embracing technologies like those offered by Farmonaut, investors in California’s agricultural real estate market can position themselves at the forefront of a tech-driven revolution in farming. As we continue to face challenges related to climate change, water scarcity, and the need for sustainable food production, these innovative solutions will play an increasingly vital role in shaping the future of agriculture and farmland investment.