Utah Contractor Fraud Alert: Protecting Homeowners from Pool Construction Scams and Unlicensed Work

“In Utah, a contractor faced felony charges for accepting large down payments without completing pool installations, affecting multiple homeowners.”

We, as industry experts and consumer advocates, are deeply concerned about the rising trend of pool construction fraud and the severe implications of unlicensed contractor penalties in Utah. Recent events have brought to light the pressing need for homeowners to be vigilant and well-informed when embarking on swimming pool projects. In this comprehensive guide, we’ll explore the alarming case that has shaken Farmington and provide crucial insights on how to protect yourself from similar scams.

The Farmington Pool Construction Fraud Case

In a shocking turn of events, Robert Patrick Riley, a 49-year-old man from Morgan, has been charged with communications fraud, a second-degree felony. This case has sent ripples through the construction industry and raised red flags for homeowners across Utah.

Riley, operating under the business name Triton Pool and Spa, allegedly engaged in a pattern of fraudulent activities that left multiple clients in financial distress. The modus operandi was consistent: accepting substantial down payments for pool installations but failing to deliver on the promised work.

The Hooper Homeowner’s Nightmare

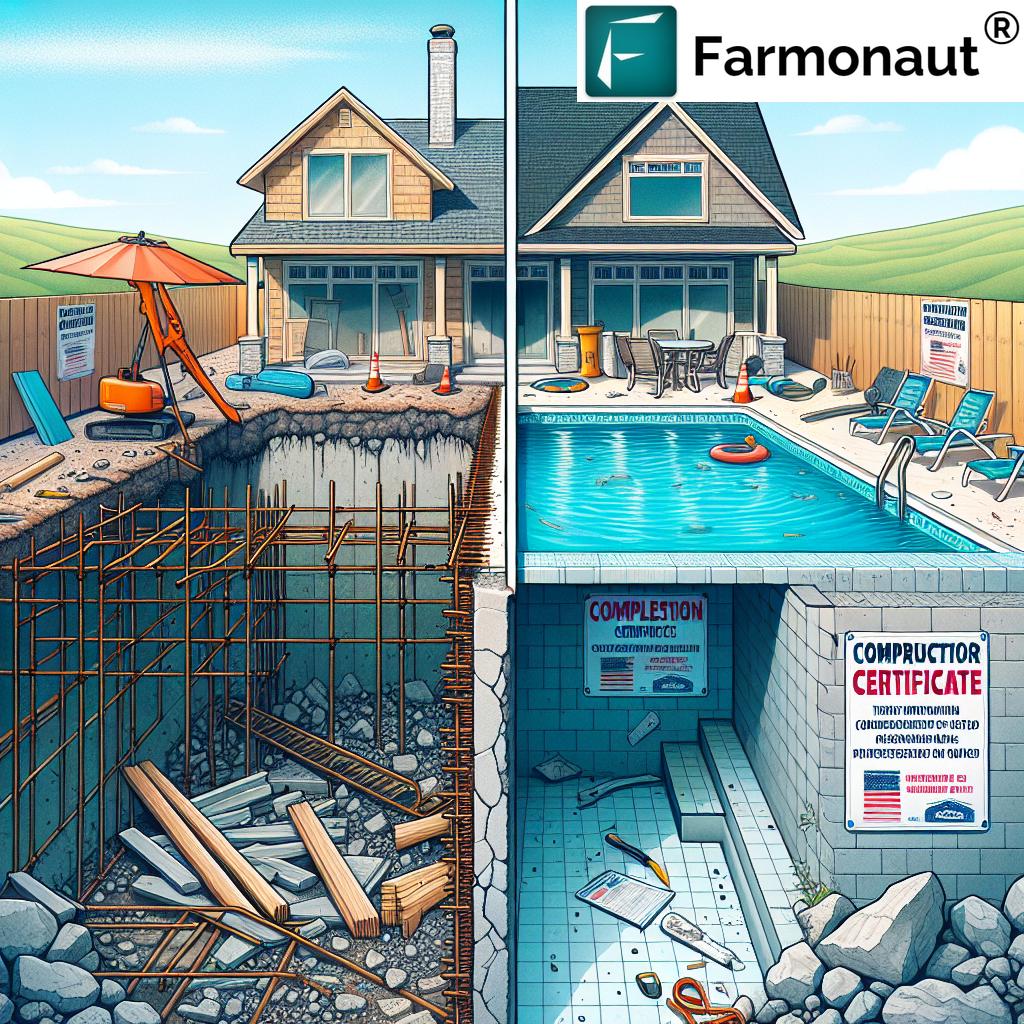

One of the most egregious cases involves a homeowner in Hooper who fell victim to Riley’s scheme in 2023. Let’s break down the timeline of events:

- Initial Agreement: The homeowner paid a $20,000 down payment for a pool project quoted at nearly $200,000.

- Promised Completion: July 2023 was set as the target date for project completion.

- Permit Issues: Riley failed to obtain a construction permit due to not providing a necessary soil test.

- Illegal Construction: Despite lacking permits, Riley began work on the pool, violating building regulations.

- Minimal Progress: By November 2023, only the pool frame was constructed, and some cement was poured.

- Financial Burden: The homeowner had paid over $150,000 by August 2023 with little to show for it.

- Delayed Completion: Riley pushed the completion date to May 2024, raising suspicions.

- License Expiration: It was discovered that Riley’s contractor’s license expired on November 30, 2023.

This case highlights the critical importance of contractor license verification and adherence to building permit regulations. Homeowners must be aware of the risks associated with pool installation down payments and the necessity of thorough background checks.

The Broader Impact: Multiple Cases and Ongoing Investigations

The Hooper case is not an isolated incident. Investigations have revealed that Riley is facing multiple criminal charges across Weber County, including:

- Three charges of communications fraud

- Theft

- Two counts of theft by deception

All of these charges are second-degree felonies, underscoring the severity of the alleged crimes. The pattern of behavior extends beyond Weber County, with complaints filed in Layton and Clinton as well.

The Financial Toll on Homeowners

The cumulative financial impact on homeowners is staggering:

- $112,000 taken from a homeowner in 2022

- $72,000 from another in the same year

- $90,000 from a client in 2023

In each of these cases, little to no work was completed, leaving homeowners in financial distress and without the pools they had invested in.

Understanding the Risks: Pool Construction Fraud and Unlicensed Work

“Unlicensed contractor penalties and pool construction fraud have become major issues, prompting increased focus on license verification in homebuilding.”

The Riley case serves as a stark reminder of the risks associated with pool construction projects and the importance of consumer protection in construction. Let’s delve into the key issues that homeowners need to be aware of:

1. The Dangers of Large Down Payments

One of the primary red flags in the Riley case was the acceptance of large down payments. While it’s common for contractors to request a deposit, excessive upfront payments can be a sign of potential fraud. Homeowners should be cautious of contractors who demand large sums before any significant work has been completed.

2. The Importance of Proper Licensing

Operating without a valid contractor’s license is not only illegal but also puts homeowners at significant risk. Licensed contractors are required to meet certain standards of professionalism and are subject to oversight by regulatory bodies. Always verify a contractor’s license status before engaging their services.

3. Building Permit Compliance

The failure to obtain proper building permits is a serious violation. Permits ensure that construction projects meet safety standards and local regulations. Working without permits can lead to legal issues, fines, and potentially unsafe structures.

4. The Role of Soil Tests in Pool Construction

In the Riley case, the failure to provide a soil test was a crucial oversight. Soil tests are essential for determining the suitability of the ground for pool construction and ensuring long-term stability. Skipping this step can lead to severe structural issues down the line.

Protecting Yourself: A Homeowner’s Guide to Safe Pool Construction

To help homeowners navigate the complex world of pool construction and avoid falling victim to scams, we’ve compiled a comprehensive checklist of steps to take before and during your pool project:

| Verification Step | Importance/Rationale |

|---|---|

| 1. Contractor License Verification | Ensures the contractor is legally authorized to perform the work and meets state standards. |

| 2. Background Check | Reveals any history of fraudulent activities or legal issues that might indicate potential risks. |

| 3. References from Previous Clients | Provides insight into the contractor’s work quality, reliability, and professionalism. |

| 4. Written Contract Review | Ensures all terms, conditions, and project details are clearly stated and agreed upon. |

| 5. Building Permit Confirmation | Guarantees the project complies with local building codes and regulations. |

| 6. Down Payment Amount (% of total cost) | Protects against financial loss; typically should not exceed 10-25% of the total project cost. |

| 7. Project Timeline Agreement | Sets clear expectations for project milestones and completion date. |

| 8. Insurance Coverage Verification | Protects homeowners from liability in case of accidents or damage during construction. |

Additional Steps for Homeowner Protection

- Get Multiple Quotes: Obtain at least three quotes from different contractors to compare prices and services.

- Research the Company: Look up the contractor’s business history, online reviews, and any complaints filed with the Better Business Bureau.

- Understand Payment Schedules: Agree on a payment schedule tied to specific project milestones, not arbitrary dates.

- Document Everything: Keep detailed records of all communications, payments, and project progress.

- Be Wary of Pressure Tactics: Legitimate contractors won’t pressure you into making immediate decisions.

By following these steps, homeowners can significantly reduce their risk of falling victim to construction fraud and ensure a smoother, more secure pool building experience.

Legal Implications and Consumer Rights

The Riley case brings to light several important legal considerations for homeowners and contractors alike:

Criminal Charges in Construction Fraud

The severity of the charges against Riley – second-degree felonies – underscores the seriousness with which the legal system views construction fraud. These charges can result in significant fines and imprisonment, serving as a deterrent to would-be fraudsters in the industry.

Civil Recourse for Homeowners

Victims of construction fraud have the right to pursue civil action against contractors who fail to fulfill their obligations. This can include lawsuits for breach of contract, fraud, and recovery of damages.

Regulatory Oversight

Cases like Riley’s often lead to increased scrutiny from regulatory bodies such as the Utah Division of Professional Licensing. This can result in stricter enforcement of licensing requirements and more frequent audits of contractors.

Consumer Protection Laws

Homeowners should be aware of their rights under consumer protection laws, which often provide additional safeguards against fraudulent business practices.

Industry Response and Best Practices

The construction industry, particularly in Utah, is responding to these challenges with increased focus on transparency and accountability:

- Enhanced Verification Processes: Many reputable contractors are implementing more robust verification processes to prove their credentials to potential clients.

- Industry Education: Trade associations are increasing efforts to educate both contractors and homeowners about legal requirements and best practices.

- Technology Integration: Some companies are leveraging technology to provide real-time project updates and transparent financial tracking for clients.

- Advocacy for Stricter Regulations: Industry leaders are advocating for stricter regulations and penalties for unlicensed and fraudulent contractors.

The Role of Technology in Preventing Construction Fraud

In today’s digital age, technology plays a crucial role in mitigating the risks of construction fraud. Here are some ways technology is being leveraged to protect homeowners:

- Online License Verification Tools: Many states now offer online databases where homeowners can quickly verify a contractor’s license status.

- Project Management Software: These tools allow for real-time tracking of project progress, expenses, and communication between homeowners and contractors.

- Digital Payment Platforms: Secure, traceable payment methods reduce the risk of financial fraud.

- Drone Technology: Some companies use drones to provide aerial progress reports of construction projects, enhancing transparency.

While technology can be a powerful ally in preventing fraud, it’s important to remember that it should complement, not replace, due diligence and personal judgment.

The Importance of Community Awareness and Reporting

Combating construction fraud requires a community-wide effort. Here’s how individuals and communities can contribute to preventing these scams:

- Share Experiences: If you’ve had a positive or negative experience with a contractor, share it through legitimate review platforms.

- Report Suspicious Activity: Don’t hesitate to report suspected fraud to local authorities or consumer protection agencies.

- Community Education: Participate in or organize community workshops on homeowner rights and contractor verification.

- Support Legislative Efforts: Stay informed about and support legislative efforts aimed at strengthening consumer protection in the construction industry.

Looking Ahead: The Future of Pool Construction and Consumer Protection

As we move forward, several trends are likely to shape the future of pool construction and consumer protection:

- Increased Regulation: We may see stricter licensing requirements and more frequent audits of contractors.

- Technology-Driven Transparency: Expect more widespread adoption of technology solutions that provide real-time project updates and financial tracking.

- Consumer Education Initiatives: There will likely be a greater emphasis on educating homeowners about their rights and responsibilities in construction projects.

- Sustainable and Smart Pool Solutions: As environmental concerns grow, there may be a shift towards more eco-friendly and technologically advanced pool solutions, potentially complicating the construction process and requiring even more specialized expertise.

Conclusion: Empowering Homeowners Through Knowledge and Vigilance

The case of Robert Patrick Riley in Utah serves as a sobering reminder of the potential risks homeowners face when embarking on pool construction projects. However, by arming ourselves with knowledge, leveraging available resources, and remaining vigilant, we can significantly reduce the risk of falling victim to such scams.

Remember, a dream pool should not turn into a financial nightmare. By following the guidelines outlined in this article, verifying credentials, understanding your rights, and staying informed about industry best practices, you can protect yourself and ensure that your pool construction project is a success.

As we continue to advocate for stronger consumer protections and industry standards, let’s work together to create a safer, more transparent environment for homeowners and honest contractors alike. Your dream pool is within reach – just make sure you’re taking the right steps to get there safely and securely.

Frequently Asked Questions (FAQ)

- Q: How can I verify a contractor’s license in Utah?

A: You can verify a contractor’s license through the Utah Division of Professional Licensing (DOPL) website or by calling their office directly. - Q: What should I do if I suspect I’m a victim of contractor fraud?

A: Immediately contact local law enforcement and file a complaint with the Utah Division of Consumer Protection. Also, consider consulting with a lawyer specializing in construction law. - Q: Is it normal for a contractor to ask for a large down payment?

A: While some down payment is standard, it shouldn’t typically exceed 10-25% of the total project cost. Be wary of contractors asking for large upfront payments. - Q: How long does it typically take to build a pool in Utah?

A: The timeline can vary, but most residential pool projects take between 8-12 weeks from start to finish, depending on complexity and weather conditions. - Q: Are there specific regulations for pool construction in Utah?

A: Yes, pool construction in Utah must comply with state and local building codes, including specific requirements for safety features, fencing, and water quality.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

For more information on Farmonaut’s services:

Download our mobile apps: