Grains Forecasts: Shocking 2025 Trends Rock Markets!

“Global grain production is forecasted to rise by 3% in 2025, despite ongoing climate change challenges.”

Introduction: The Critical Role of Grains Forecasts

Grains are the backbone of global agriculture, constituting staple foods for billions and serving as essential resources for livestock feed. From wheat and corn to rice and barley, these crops underpin food security, nourish economies, and guide government policy worldwide. As we approach 2025, grain production forecasts are in sharp focus, driven by dynamic market conditions, weather events, and policy shifts.

In this comprehensive industry analysis, we explore the shocking 2025 trends shaking up the global grain markets. We break down projected output changes, probe the influence of climate change impacts on agriculture, highlight regional game-changers (EU wheat production 2025, Russia wheat export quota), and analyze economic and policy factors influencing both short- and long-term supply and stability.

As technology transforms farming practices, and as weather and market risks mount, accurate forecasting becomes more important than ever for stakeholders across agriculture, forestry, and food industries. So, what are the critical insights for 2025? Let’s dive into the forecasts, key factors, and actionable implications that will define the year ahead.

Current State of Global Grain Production Forecasts (2025)

Grain forecasting represents a complex interplay of agronomic science, satellite technology, and economic analysis. Today, grain markets are more interconnected than ever, and their forecasts are shaped by a daunting array of factors—from extreme weather events and climate change to trade policies and input costs.

Let’s explore the projected growth and key changes in 2025 for major regions and countries:

European Union (EU): Cultivation and Output Surge

-

The EU is forecasted to produce 274.9 million tonnes of grain in 2025, up from 259.3 million tonnes in 2024—

a robust 6% increase. -

Soft wheat is projected to remain the dominant crop with an expected output of

126.5 million tonnes, registering an impressive 10.9% year-on-year surge. - Corn production in the EU-27 is set to reach 61.8 million tonnes in 2025 (up from 60 million tonnes in 2024).

- These positive developments are attributed to improved yields, expanded cultivation area across member states, and favorable weather conditions in select regions.

Russia: Reduced Wheat Output Amidst Extreme Events

-

Russia continues to be a critical wheat exporter, yet is forecasted to see production fall to an

estimated 78.7 million tonnes in 2025—its smallest crop since 2021. - This reduction is driven by adverse weather (including drought & extreme heat) and growing economic pressures, influencing both yields and the country’s export quota.

- Russia’s wheat export quota is being sharply reduced to 11 million metric tons between February 15 and June 30, 2025—down from 29 million metric tons just a year prior.

United States: Corn & Soy, Stable but Below Expectations

- Favorable planting conditions in the U.S. are leading to increased corn production. The USDA projects

2025-26 corn supplies will be 27% higher than those in 2024. - Nevertheless, overall grain supply is still slightly below analyst expectations, reflecting the delicate equilibrium of market and weather factors.

Asia (China & India): Gradual Growth Amid Sustainability Push

- China and India continue to represent major centers of grain consumption and production, focusing increasingly on sustainable farming.

- These regions have seen incremental growth in yields through a mix of

modern technologies and climate adaptation strategies.

Rest of Europe & Other Regions

- Non-EU Europe and other key grain-producing regions are experiencing mixed outcomes, with extreme weather effects on crops causing localized shortages.

Grain Production & Market Forecast Summary Table (2024 vs 2025 Estimate)

Note: Data are estimates for illustration, focusing on directional and regional market trends, not exhaustive global totals.

Table reflects 2025’s year-over-year change, climate impacts, and market policies—key influences shaping forecasts for

food security and grain supply.

“EU wheat output may drop by 5% in 2025, shaking up global market stability and trade flows.”

Key Factors Influencing Grain Production Forecasts in 2025

What are the underlying elements influencing {grain production forecasts}? The answers lie in a mix of climatic, economic, and policy drivers, each affecting yields, trade flows, and market decisions.

1. Climate Change Impacts on Agriculture

-

Changing weather patterns are introducing major uncertainties for grain farmers worldwide.

Temperatures are rising, rainfall is becoming less predictable,

and frequency of extreme events has intensified. -

A recent study published in Nature indicates that drought and

extreme heat have already reduced crop yields by up to 10% since the 1960s—

and the trend is set to worsen without robust adaptation. -

Sustainable grain farming techniques, such as satellite-based crop monitoring and

carbon footprint tracking,

are rapidly becoming essential for resilience.

2. Extreme Weather Effects on Crops: The New Normal

- In 2024 and 2025, extreme weather events (ranging from catastrophic floods in Asia to historic droughts in Africa and heatwaves in France/Russia) are a primary risk to grain supply.

-

Example: France, a key EU wheat producer, suffered 30–40% yield reductions in 2024

due to relentless rainfall. -

Extreme weather cost EU farmers €28 billion annually, underscoring the sector’s vulnerability and the critical importance of forecasting for actionable decisions.

3. Economic Factors: Demand, Input Costs, and Trade Policy

- Market demand fluctuates in tandem with global food trends, feed needs, and industrial use.

- Input costs—from fertilizer to labor—directly impact farmers’ planting plans and eventual grain outputs.

- Trade policies and export regulations are being rapidly adjusted (notably the Russia wheat export quota or EU subsidy reforms) in response to market instability and projected shortages.

- Tracking such factors is made easier by technologies that streamline agricultural fleet management and logistics—making the grain supply chain more resilient.

4. Policy, Sustainability, and Climate Response

- Policy development is increasingly influenced by grain forecasts. For example, the EU is targeting improved market stability via strategic farming subsidies and weather risk management.

- Initiatives such as blockchain-based traceability foster supply chain transparency, further mitigating risks for international food security.

Focus on EU: 2025 Wheat Production and Climate Change Implications

The European Union stands at the center of 2025’s grain market dynamics due to its massive output, innovative farming policies, and exposure to climate change. While a general increase in grain yields is predicted, soft wheat faces new challenges:

- EU wheat production 2025 faces projected volatility—with some analysts warning of a possible 5% drop if adverse weather persists and if precipitation remains inconsistent in central regions.

- The outlook for corn and barley is more optimistic, as new varieties and sustainable cultivation practices help buffer climate impacts.

- Policy responses are accelerating: the EU is enhancing farming subsidies targeting climate adaptation, regional support, and loss compensation for farmers.

- Satellite-based crop verification is streamlining EU agricultural subsidies and insurance payouts, reducing fraud, and supporting more resilient decision-making.

As a result, the EU grain market will remain a bellwether for global food security, supply stability, and commodity pricing in 2025 and beyond.

- Key takeaway: The EU’s dominance in global grain exports means its weather-driven shocks can ripple through the world market, influencing prices and accessibility globally.

Russia’s Role: Wheat Export Quotas and Market Stability

The grain market of 2025 cannot be analyzed without acknowledging Russia’s strategic role as a top exporter. After a period of strong growth, Russia is facing a potentially disruptive downturn in production and export quotas:

- Adverse weather conditions (notably drought and heat) have culminated in the lowest wheat crop since 2021.

- The dramatically reduced wheat export quota (from 29 to 11 million metric tons between February and June 2025) is set to curtail global supply, creating potential for international shortages and upward market volatility.

- This shift is highly influential. Major grain-importing regions (Middle East, North Africa, Asia) will feel the impact first, while exporters like the EU, US, and Ukraine may see increased demand.

- Such volatility highlights how accurate grain forecasting becomes a vital policy and business tool for stabilizing markets—reinforcing the need for advanced, data-driven solutions.

Implications for Food Security and Agricultural Market Stability in 2025

The implications of grain forecasts extend far beyond farm gates—shaping food security for hundreds of millions, setting policy priorities, and determining the resilience of entire economies and supply chains.

Supply Shock Risks: Shortages and Price Volatility

-

Disruptions in grain production (from weather events or export bans) can rapidly

create supply shortages. This leads to spiked prices, food inflation, and increased hunger in vulnerable regions. - In markets where import dependence is high, accurate grain forecasts are life-or-death metrics for government and humanitarian planning.

- Advanced forecasting—especially using real-time satellite data and AI—is enabling smarter, earlier interventions in farming and policy worldwide.

Policy, Trade, and Sustainable Development

- International trade policies are now more dynamic, adjusting to seasonal disruptions and global supply imbalances within weeks, not months.

- National policies (+ climate-related support schemes) are increasingly using yield predictions and agronomic models to inform subsidy programs.

- Large-scale farm management platforms are supporting governments and agribusinesses in monitoring crop health, tracking losses, and deploying targeted aid.

Food Security: The Global Imperative

- Food security and grain supply are now tightly interwoven with forecasting technology, cross-border trade policies, and science-driven response planning.

- The race is on to mitigate risks in the agricultural sector and enhance adaptive capacity for billions relying on stable, affordable grain staples.

To explore specialized solutions for crop yield, irrigation, and health risk advisory, check out the Farmonaut Crop Plantation and Forest Advisory.

Towards Sustainable Grain Farming: Modern Solutions for 2025

Sustainable grain farming is not simply a buzzword—it’s now central to policy development and market strategy. As climate change accelerates and input pressures mount, the agricultural industry is turning to digital and tech innovations for both sustainability and profitability.

- Precision agriculture powered by satellite monitoring, AI-based advisory systems, and blockchain traceability is driving farm-level decision-making—improving yields and reducing environmental impact.

- On a commercial scale, fleet and resource management tools are optimizing logistics and carbon emissions across vast farming operations.

- Data-driven policy enables swift response to weather shocks, accurate subsidy targeting, and improved disaster readiness.

- Farmonaut’s API and developer documentation allow agritech and research teams to integrate advanced satellite and weather forecasting into their own digital platforms.

Farmonaut’s Impact: Data-Driven Insights for Grains Forecasting and Farming Decisions

As the world navigates more challenging grain market dynamics, Farmonaut stands out as a beacon of digital transformation in agriculture. Let’s explore how our technology and philosophy empower farmers, agribusinesses, and policymakers to succeed in 2025.

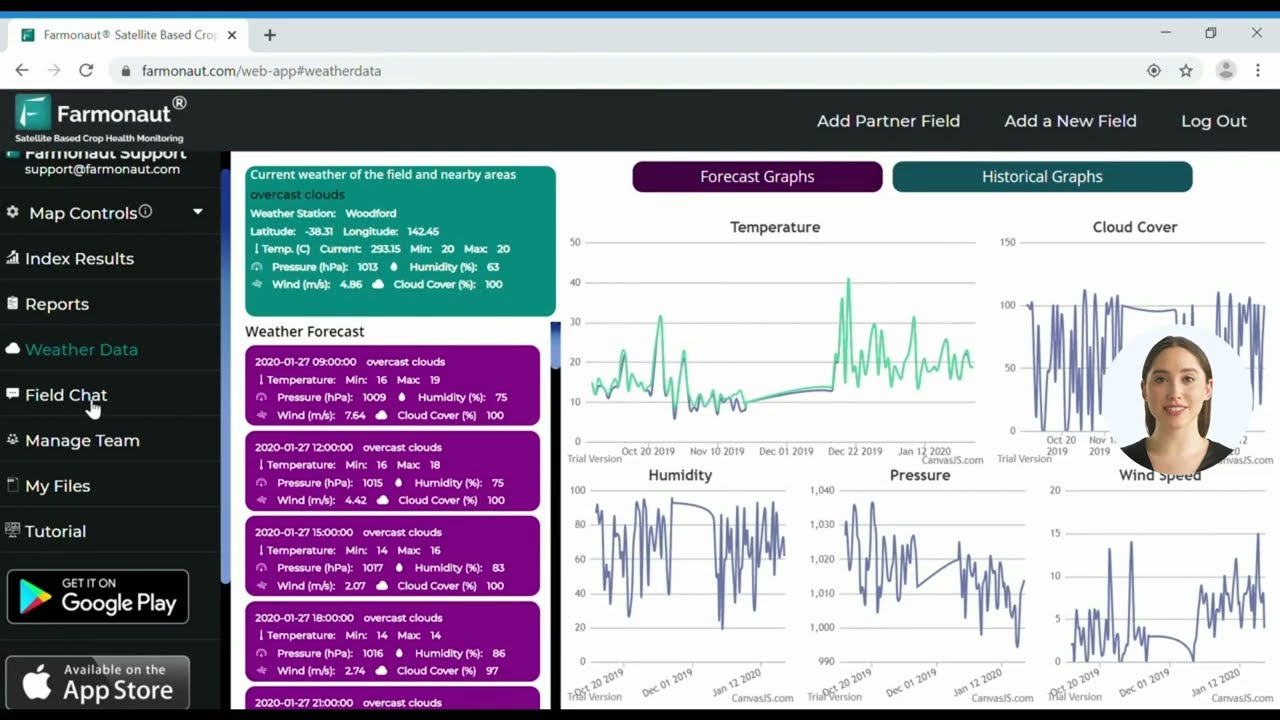

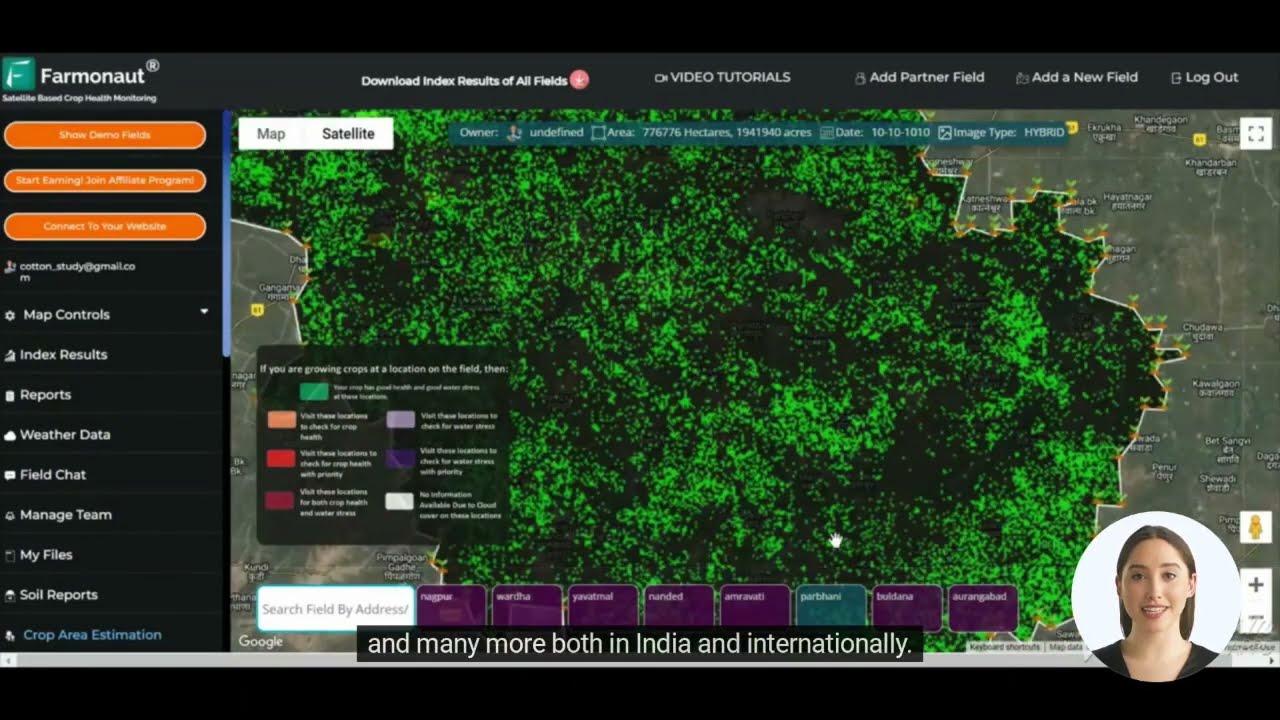

-

Satellite-Based Crop Health Monitoring:

Farmonaut leverages multispectral satellite imagery to monitor vegetation, soil moisture, and environmental risk factors. This real-time health data is used to fine-tune irrigation, fertilizer application, and pest management—optimizing crop yields and reducing losses. -

AI and Blockchain Advisory:

The Jeevn AI Advisory System delivers up-to-the-moment management advice based on weather, crop stage, and historical trends. Our blockchain traceability ensures total transparency in the food supply chain, enhancing consumer trust and reducing supply chain fraud. -

Flexible and Scalable Access:

Farmonaut offers both mobile and web-based platforms for individual farmers, cooperatives, agribusinesses, and institutional users. With tiered subscriptions and on-demand APIs, we empower users to grow, adapt, and scale affordably. -

Focused on Sustainability:

Through features such as carbon footprint tracking and resource management, we’re facilitating a shift to eco-friendly, sustainable farming practices. -

Financial Access and Security:

Our satellite-based crop verification dramatically streamlines crop loan and insurance processes, improving access to financial tools and reducing risk for both farmers and lenders. -

Unmatched Value for All Users:

– Smallholder farmers gain the same precision technology as industrial-scale agribusiness.

– Government and NGOs use Farmonaut for regional yield estimation and policy decision-making.

– Corporate buyers & food brands increase authenticity through traceable, data-secured supply chains.

Farmonaut Subscriptions: Flexible Precision Agriculture for Every Farmer

Choose an affordable and scalable plan to unlock high-resolution satellite monitoring, AI advisory, and full grain forecasting—suitable for individual farmers, agribusinesses, and government use.

Frequently Asked Questions (FAQ): Grain Forecasts & 2025 Trends

What are the biggest risks to global grain production in 2025?

The largest risks stem from climate change impacts on agriculture, intense extreme weather events, policy-driven export restrictions, and rising input costs. Advanced forecasting and tech-driven farming adaptation are now essential for mitigating these risks.

How does the Russia wheat export quota affect global supply?

Russia’s steeply reduced export quota (11M metric tons in H1 2025 from 29M last year) shrinks international supply, potentially causing price spikes, heightened volatility, and regional shortages—especially in importing countries.

Why is EU wheat production so influential?

The EU is a world leader in both grain production and export. Any shift, positive or negative, in EU wheat production 2025 impacts global prices and food security—highlighting the EU’s critical role in market stability.

How do satellite monitoring and AI help grain forecasting?

Satellite imagery and AI-powered analytics (like with Farmonaut) enable real-time, accurate assessment of crop health, identify early-warning signs of yield reduction, and provide actionable advisory for harvest, irrigation, and input management.

Conclusion: Shaping Agricultural Decisions for 2025 and Beyond

The 2025 grain production forecasts reveal a rapidly evolving agricultural landscape. While some regions will see growth in production and yields—notably through advanced farming technology and responsive policy—others face pressing challenges from extreme weather, climate change, and economic disruptions.

- Clarity and accuracy in grain yield predictions are more critical than ever, safeguarding food security and providing a basis for sound market and policy decisions.

- Data-driven solutions—such as those pioneered by Farmonaut—deliver the actionable insights needed to navigate these changes, minimize losses, and empower both smallholder farmers and global corporations.

- Stakeholders must embrace sustainable, tech-enabled agriculture to ensure resilient, reliable grain supply chains for the future.

As we look to the year ahead, let’s leverage forecasting, science, and innovation to ensure a robust, secure, and sustainable food system—no matter what the weather brings.