Ammonia Fertilizer Market Booms: Shocking Asia-Pacific Trends

Table of Contents

- Introduction: The Ammonia Market’s Meteoric Rise

- Asia-Pacific Trivia

- Ammonia Production Methods & Environmental Impact

- Global Ammonia Market Dynamics

- Regional Ammonia Fertilizer Market Insights

- Asia-Pacific Ammonia Market: Growth, Technology, and Sustainability

- Market Drivers, Challenges & Sustainability Goals

- Technological Innovations Transforming Ammonia Production

- Farmonaut: Powering Data-Driven, Sustainable Agriculture

- Farmonaut Subscriptions

- Frequently Asked Questions

- Conclusion: The Road Ahead for the Global Ammonia Industry

Introduction: The Ammonia Market’s Meteoric Rise

The global ammonia fertilizer market is capturing headlines as it surges to new heights, fueled by the urgent global demand for food security and sustainable energy. Asia-Pacific stands at the very center of this boom — not just as a consumer but as a stunning major player in advances, innovations, and green transformation. Here, we explore the current landscape, technological leaps, and sustainability trends that are revolutionizing how ammonia is produced, utilized, and perceived worldwide.

With ammonia serving as a fundamental component in chemical fertilizers, especially nitrogen-rich ones, we recognize its pivotal role in boosting soil fertility, enhancing crop yields, and supporting global food production. Yet, behind this essential resource are complex dynamics: shifting production methods, mounting environmental concerns, the rise of green ammonia production, and ambitious regional initiatives driving sustainability.

Ammonia Production Methods & Environmental Impact

To understand the ammonia fertilizer market, we must first grasp how ammonia is produced and its environmental impact. Traditional ammonia production methods have been longstanding, but as we’ll see, transformation is underway.

Traditional Production: The Haber-Bosch Process

Ammonia is primarily produced using the Haber-Bosch process, which synthesizes ammonia from atmospheric nitrogen (N₂) and hydrogen derived from natural gas. This method, while reliable and proven, comes with significant energy demands:

- Accounts for about 1.3% of global CO₂ emissions, marking it as a notable industrial contributor to carbon dioxide release.

- Heavily reliant on natural gas, both as a feedstock and energy source.

- The environmental impact of this process has prompted widespread concern and regulatory scrutiny.

The Shift to Green Ammonia Production

In response to growing environmental concerns and the need to reduce emissions, the industry is shifting toward “green ammonia production”. How does this differ from traditional methods?

- Hydrogen required for ammonia synthesis is produced using renewable energy sources — wind, solar, hydroelectric power, or biomass.

- This process reduces the carbon footprint associated with ammonia production, aligning with global sustainability goals.

- Green ammonia can serve dual purposes: as an eco-friendly fertilizer and as a sustainable energy carrier for the future.

As countries—the Asia-Pacific region in particular—adopt these new methods, we witness a profound market shift towards environmentally responsible ammonia. The collective push towards green ammonia is fundamental in reducing global industrial emissions and pioneering a more sustainable agricultural sector.

Global Ammonia Market Dynamics: Trends, Growth, and Major Players

Let’s examine the global ammonia market — its scale, projected valuation, key players, and the current market forecast. By grasping these market dynamics, we understand why the Asia-Pacific ammonia market is drawing the world’s attention.

- The global ammonia market is projected to reach a whopping USD 190 billion by 2031.

- A compound annual growth rate (CAGR) of around 6.0% is expected between 2024 and 2031.

- Asia-Pacific dominates the scene, contributing to over 60% of global ammonia production and consumption.

- China emerges as the world’s largest producer and consumer, with its immense agricultural base driving fertilizer demand.

Our deeper look at regional trends will reveal why and how these countries have secured such a commanding role in the supply, consumption, and innovation of this essential agricultural input.

Regional Ammonia Fertilizer Market Insights: Asia-Pacific Leads the Way

Regional dynamics provide critical context in the ammonia fertilizer market. Let’s delve into the unique attributes, growth patterns, and sustainability initiatives distinguishing Asia-Pacific from other regions.

| Country/Region | Estimated Ammonia Fertilizer Demand (2023, MT) | Forecasted Demand Growth (% CAGR, 2024-2030) | Estimated Green Ammonia Production (%) of Total (2023) | Major Technological Initiatives | Key Sustainability Drivers |

|---|---|---|---|---|---|

| China | 37 million MT | ~5.3% | <2% | Investments in green hydrogen plants, digital fertilizer platforms | Emission reduction mandates, food security needs |

| India | 19 million MT | ~5.8% | <1.5% | Pilot solar-powered ammonia units, digital agri-advisory expansion | Rising population, digital agriculture policy |

| Japan | 2 million MT | ~4.1% | ~6% | Large green ammonia demonstration projects, ammonia-fueled power turbines | Decarbonization, energy transition policies |

| Australia | 1.65 million MT | ~6.2% | ~11% | Wind/solar-powered ammonia export hubs, large-scale electrolysers | Renewable energy leadership, export ambitions |

| Southeast Asia | 10 million MT+ | ~6.7% | <1% | Biomass-derived ammonia, smart farming tools | Land scarcity, food production needs, climate resilience strategies |

Asia-Pacific Ammonia Market: Growth, Technology, and Sustainability

Let’s focus on why the Asia-Pacific ammonia market is the epicenter of global change, blending technological advancements with sustainability goals:

- China is both the largest producer and consumer of ammonia globally; its fertilizer consumption underpins sustained national food security and export capacity.

- India’s ammonia demand is fueled by its vast agricultural sector and a population exceeding 1.4 billion.

- Emerging green ammonia production facilities in Japan, Australia, and select ASEAN countries mark a paradigm shift in both agricultural fertilizer and energy storage solutions.

The interplay between production, consumption, innovation, and environmental impact renders this region integral to the future of the global ammonia industry.

Key Regional Insights

- China: Rapid adoption of digital agriculture and pilot green ammonia projects.

- India: Advancement in AI-based fertilizer application tools and government focus on renewable energy ammonia solutions for rural areas.

- Japan & Australia: International investments in wind and solar-powered ammonia plants targeting both local use and global exports.

- Southeast Asia: Biomass integration and small-scale distributed green ammonia units, driven by climate resilience strategies.

North America & Europe: Comparisons and Contrasts

While the Asia-Pacific region dominates the market, both North America (United States, Canada) and Europe (Germany, France, Netherlands) contribute significantly to production and technological advancements:

- United States: Significant producer and consumer, heavily reliant on fertilizer imports from countries like Trinidad, Tobago, and Canada.

- Europe: Intensified focus on reducing carbon emissions and scaling renewable energy ammonia through EU-led green transition incentives.

Both regions are enhancing their sustainability profiles but lag behind Asia-Pacific in terms of production share, demand volume, and flexible adoption of “green ammonia production methods.”

Market Drivers, Challenges & Sustainability Goals

Key Drivers Fueling the Ammonia Market

- Rising Food Demand: Population growth in China, India, and Southeast Asia is escalating fertilizer use, pushing up ammonia demand in agriculture.

- Agricultural Modernization: Adoption of precision farming, data-driven advisory, and advanced farm management tools (see how Farmonaut makes satellite-powered farming accessible globally).

- Environmental Regulations: Global and regional initiatives to reduce carbon emissions and transition to green ammonia.

- Technological Innovations: AI, blockchain, and satellite monitoring revolutionize resource allocation and enable more efficient fertilizer application.

Market Challenges

- Environmental Concerns: Traditional ammonia production methods impact air, water, and soil health due to CO₂ emissions and natural gas dependency.

- Regulatory Pressure: Increasing government scrutiny on emissions and chemical use, raising compliance costs for the industry.

- Volatile Natural Gas Prices: Supply disruptions and regional price fluctuations directly affect ammonia production costs, influencing affordability for farmers.

- Technological Investment Barriers: Green ammonia facilities require hefty R&D and infrastructure investments, slowing widespread adoption in developing markets.

Technological Innovations Transforming Ammonia Production

Our time is defined by industry-wide advancements in ammonia production technologies that target both energy savings and emissions reduction:

- Green ammonia plants in Norway, Australia, and Northeast Asia (Japan, Korea) leverage wind and solar energy to dramatically lower carbon intensity.

- Fertilizer companies invest in electrolysers to produce renewable hydrogen for emission-free ammonia synthesis.

- Development of ammonia as an energy storage medium improves overall grid stability and supports alternative carbon-free fuel options for industries like shipping and clean power generation.

- AI and Satellite Imagery (see Farmonaut’s farm management platform) enable optimizing fertilizer use, reducing runoff and environmental waste on a field-by-field basis.

Case-in-Point: Yara International’s Green Hydrogen Plant

European fertilizer giant Yara International is pioneering green hydrogen and ammonia at scale. Their plant in Norway is among the largest in the world to use only renewable power to synthesize both hydrogen (via water electrolysis) and ammonia, setting a benchmark for the global ammonia industry.

Future Applications: Storage & Clean Energy

- Ammonia as Energy Storage: Enables large renewable energy deployment by storing solar/wind excess as ammonia, then converting back to power or hydrogen when needed.

- Alternative Fuel: Ammonia’s carbon-free combustion potential positions it as a shipping and power generation fuel — opening new frontiers for sustainable energy globally.

For developers seeking to integrate ammonia market insights, satellite-based crop health, and climate data into their own agri-platforms, explore the Farmonaut API and Developer Documentation.

-

Farmonaut Carbon Footprinting:

Track and manage carbon and CO₂ emissions across agricultural operations to support compliance with environmental regulations and advance sustainability goals. -

Product Traceability by Farmonaut:

Ensure fertilizer, crop, and food supply chains are transparent and tamper-proof, fostering trust among all stakeholders. -

Crop Loan and Insurance Solutions:

Facilitate reliable crop verification for agricultural finance, enabling better access to credit for farmers and reducing risk for lenders. -

Fleet Management by Farmonaut:

Optimize logistics and machinery use for larger agri-enterprises and cooperatives, aiding efficient fertilizer transportation and application. -

Large Scale Farm Management:

Manage thousands of hectares—from input application to harvest monitoring—via a unified dashboard, boosting yields and reducing costs. -

Crop, Plantation, and Forestry Advisory:

Receive AI-powered insights for effective fertilizer management, irrigation, and climate resilience via mobile and web.

Farmonaut: Powering Data-Driven, Sustainable Agriculture in the Ammonia Fertilizer Market

Modern ammonia fertilizer market trends are inseparable from the digitization of agriculture. Farmonaut, as a pioneering agtech company, plays a crucial role in translating planetary-scale data into actionable, field-level decisions.

-

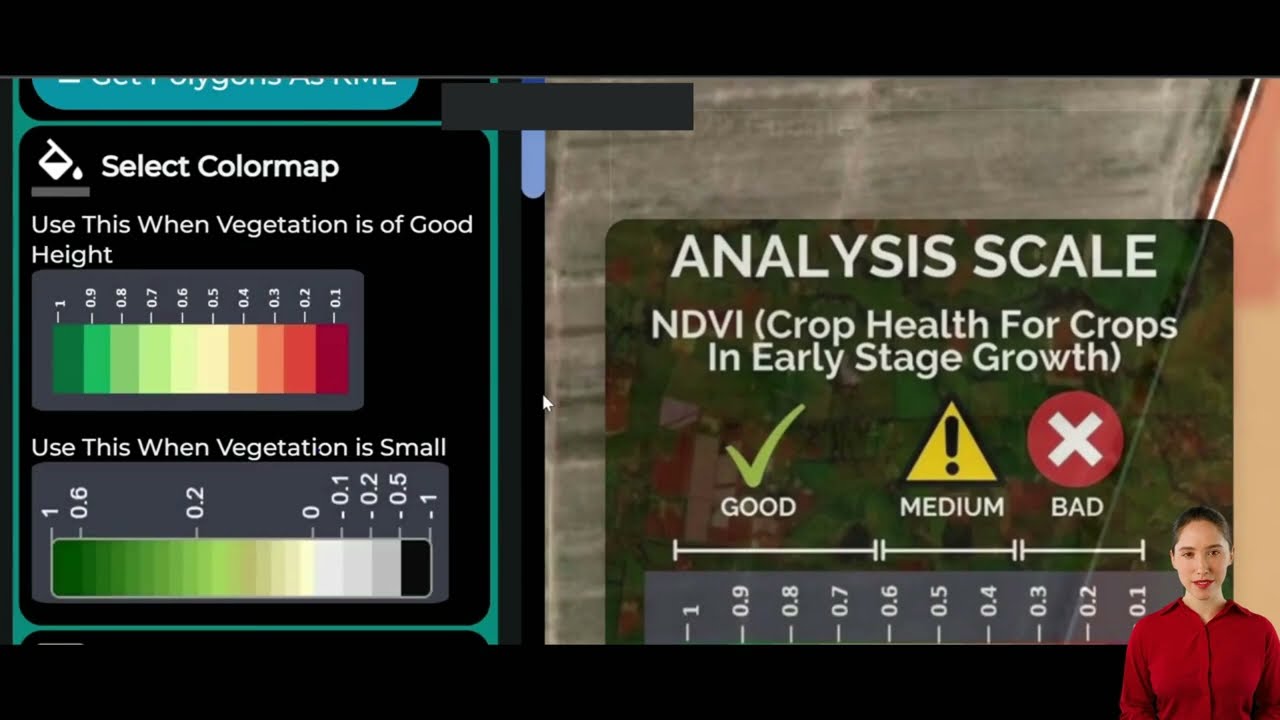

Satellite-Based Crop Health:

Farmonaut’s platform bridges the gap between high-level ammonia market trends and farm-specific actions. Through NDVI and soil moisture analytics, farmers optimize nitrogen fertilizer application, improving soil fertility while minimizing environmental impact. -

AI-Driven Advisory:

Personalized recommendations via Farmonaut’s Jeevn AI system align fertilizer doses with satellite-detected crop health, weather, and pest trends—leading to higher efficiency and sustainability. -

Blockchain Traceability:

Real-time, tamper-proof traceability supports food safety and food exporters’ needs, furthering trust in supply chains managing fertilizer inputs and agricultural outputs. -

Resource & Fleet Management:

Farmonaut helps agribusinesses efficiently manage machinery, fertilizer transport, and application, reducing waste, labor, and input costs. -

Carbon Footprinting:

By tracking field-level emissions, Farmonaut empowers farms and agribusinesses to prove their green credentials and comply with emerging sustainability standards in fertilizer use.

Explore solutions for all scales—smallholder to enterprise—using Farmonaut’s integrated web and mobile platforms. Our mission is making sustainable, data-driven farming accessible and affordable for all, aligning with global ammonia market sustainability transitions.

Farmonaut Subscriptions

To empower every segment of the agricultural sector, Farmonaut offers flexible subscription models supporting satellite monitoring, AI advisory, resource tracking, and key tools for ammonia fertilizer management. Whether you manage a single farm or oversee thousands of hectares, you can start today.

Frequently Asked Questions: Ammonia Fertilizer Market

Q1. What is green ammonia, and why is it important?

Green ammonia is produced using hydrogen from renewable energy sources like wind, solar, or hydro power, instead of natural gas. This drastically reduces the carbon emissions associated with traditional ammonia production, directly supporting environmental sustainability goals in both agriculture and energy.

Q2. Which region leads global ammonia production and why?

The Asia-Pacific region—especially China—leads due to its massive agricultural sector, sustained population growth, and robust investment in both fertilizer manufacturing capacity and technological innovation.

Q3. How do ammonia market trends impact food security?

Ammonia-based fertilizers are essential for boosting crop yields and meeting rising global food demand. Market shifts—such as supply disruptions, price volatility, or advancements in green technology—have downstream effects on food production costs, availability, and sustainability.

Q4. What are the main challenges for green ammonia production?

The top challenges include high capital investment for new plants, the need for abundant and affordable renewable electricity, and transitioning legacy infrastructure. However, annual growth in green ammonia production is accelerating, especially in Asia-Pacific.

Q5. How does Farmonaut support ammonia fertilizer management?

Farmonaut’s platform delivers field-level AI insights for precision fertilizer use, monitors soil and crop health via satellite, and tracks carbon footprint for sustainable reporting. It is accessible via web, Android, or iOS, making cutting-edge technology available to growers worldwide.

Conclusion: The Road Ahead for the Global Ammonia Industry

As we reflect on the state and future of the ammonia fertilizer market, several themes become clear:

- Asia-Pacific is the undisputed leader in scale, consumption, and green innovation for ammonia-based fertilizers.

- The global transition toward green ammonia production is essential in curbing industrial emissions and meeting both food security and clean energy goals.

- Technological advancements—from hydrogen electrolysis to digital farm management—are redefining both agricultural productivity and sustainability.

- Farmers, agribusinesses, and governments must embrace innovation, adapt to new regulations, and invest in resource-optimizing tools like Farmonaut’s platform.

By aligning global and regional ammonia market trends with technology-driven, sustainable farming practices, we help secure the future of global food supply, enable environmental stewardship, and ensure that the agricultural sector meets the demands of generations to come. For anyone engaged in the agricultural sector—from individual growers to food supply chain managers and policy makers—the evolution of the ammonia market will shape our shared landscape for years ahead.

Want to explore more efficient, sustainable, and innovative farming? Visit Farmonaut for best-in-class digital solutions.

Integrate API access

or review the Developer Docs to power your agri-tech products with ammonia fertilizer market data, weather, and satellite insights.

© 2024-2025 Farmonaut. All Rights Reserved.