Lease Agriculture Equipment: 7 Key Benefits & Tips

“Leasing can reduce upfront equipment costs by up to 60% compared to purchasing new agricultural machinery.”

“Over 70% of farmers report improved cash flow management after switching to equipment leasing agreements.”

Table of Contents

- Understanding Equipment Leasing

- Why Lease Agriculture Equipment? 7 Key Benefits

- Costs and Tax Benefits of Agricultural Equipment Leasing

- Drawbacks & Considerations with Leasing Farm Machinery

- Leasing vs. Purchasing: Detailed Cost & Benefit Comparison Table

- Essential Steps & Tips for Effective Equipment Lease Agreements

- FAQ: Lease Agriculture Equipment

- Conclusion: Making the Right Strategic Decision in Agriculture

Understanding Equipment Leasing in Agriculture & Forestry

Agricultural equipment leasing is a financial arrangement in which a lessor (the equipment owner) gives a lessee (farmer or forestry operator) the right to use specified machinery or equipment for a defined period and in exchange for regular payments. At the end of the lease term, participants can typically choose to purchase, renew, or return the equipment, depending on the agreement.

- Contractual Agreement: Structured document outlining terms, responsibilities, conditions, and payment plans.

- Ownership: The lessor retains asset ownership; the lessee gains usage and operational benefits.

- Options: At term-end, decide to buy (at a residual value), renew the lease, or return the equipment.

This process enables farmers and professionals in the agriculture and forestry sectors to access vital machinery without hefty upfront investments, providing significant operational flexibility.

Why Lease Agriculture Equipment? 7 Key Benefits

The benefits of equipment leasing are increasingly recognized in agriculture and forestry. Here are seven compelling reasons to consider leasing farm machinery for your operation:

1. Financial Flexibility & Strategic Cash Management

Leasing farm equipment offers substantial financial flexibility by reducing the upfront investment typically required for purchasing new machinery. Instead of allocating a large sum toward a single asset, you can preserve working capital, maintaining healthy cash flow for other essential expenses such as crop production, labor, or resource allocation.

Trivia: Leasing can reduce upfront costs by up to 60% compared to purchasing new equipment.

This strategic decision is crucial in the agriculture sector, where cash flow can fluctuate with seasonal plantings and market prices. Lower initial costs allow for funds to be allocated to vital operations, ensuring your business remains resilient and agile.

2. Access to Latest Technology and Improved Productivity

Agricultural equipment leasing enables operators to access cutting-edge technology that might otherwise be out of reach. Keeping up with the latest developments in efficiency, automation, GPS-guided equipment, and emissions standards is essential for maintaining a competitive edge.

Through leasing, you can upgrade to newer models at the end of each term, ensuring your operations run at peak efficiency with minimal downtime. This is a game-changer in modern agriculture, where innovation directly translates into higher yields and reduced costs.

3. Tax Benefits of Equipment Leasing in Agriculture

One of the most significant advantages of leasing in agriculture is its impact on taxable income:

- Lease payments are treated as business expenses and are generally fully tax-deductible.*

- This deduction lowers your taxable income, resulting in direct tax savings compared to the gradual depreciation of owned equipment.

The tax benefits of equipment leasing often make leasing more cost-effective when compared with traditional purchasing, especially in regions with favorable tax codes.

4. Reduced Maintenance and Repair Burden

Many farm equipment lease agreements include maintenance and repair provisions, either partially or fully covered by the lessor. This arrangement minimizes unexpected operational expenses, ensuring your machinery is reliable during peak periods (such as planting or harvest).

- This transfers a sizeable portion of risk and responsibility from the farmer/operator to the owner (lessor).

- You gain the benefit of planned, expert-serviced equipment, reducing downtime and maximizing productivity.

5. Risk Management: Depreciation & Obsolescence

- Leasing helps shield operations from depreciation risks and equipment obsolescence.

- In leasing farm machinery, you’re insulated from the unpredictable resale market and technical advances that can render equipment outdated.

- This form of risk management is strategic for adapting to rapid industry changes without being burdened by declining asset value.

6. Easier Budgeting and Predictable Payments

With fixed, regular payments, equipment leasing for farmers simplifies budgeting and financial planning. You avoid the uncertainty of large one-off purchases and can plan operational expenses with increased confidence and accuracy.

7. Flexible End-of-Lease Options

At lease renewal or expiration, you have several options:

- Renew the lease for additional time at a preferred rate.

- Purchase the equipment at a predetermined residual value if long-term use is justified.

- Return the machinery, freeing you from storage, sale, or disposal headaches.

These operational options add substantial flexibility—vital as agricultural and forestry sectors often face volatile conditions.

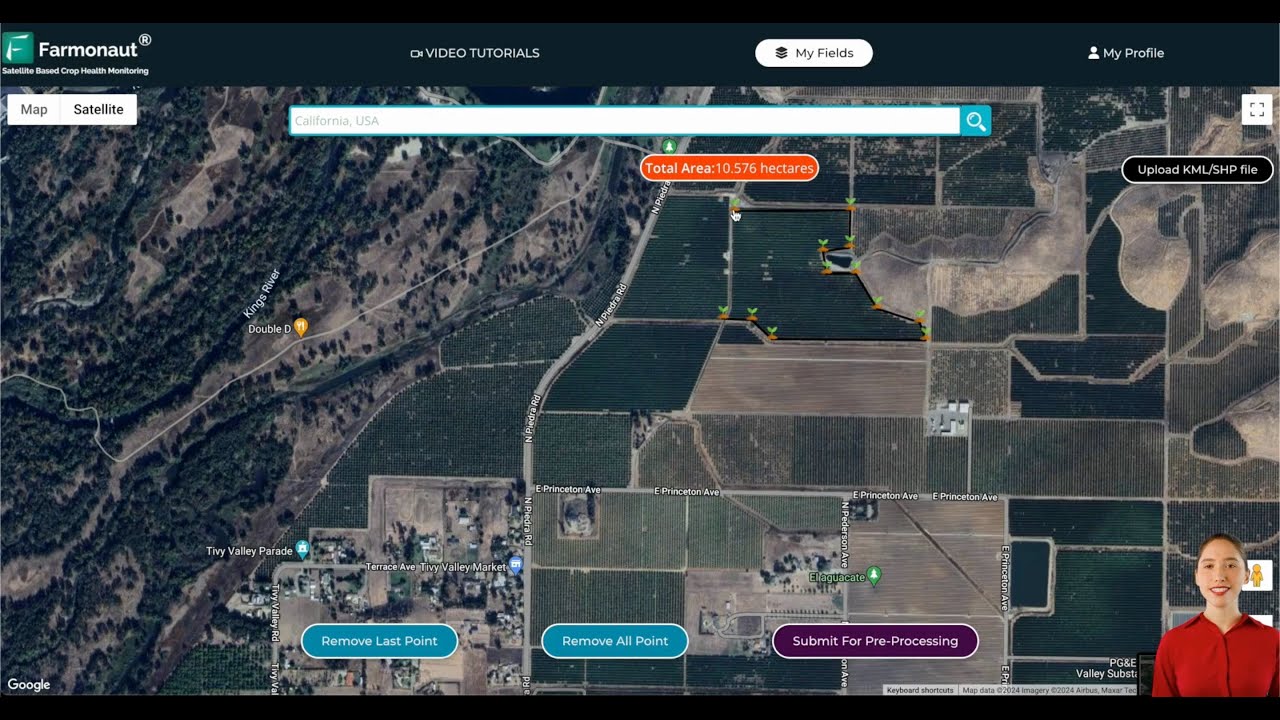

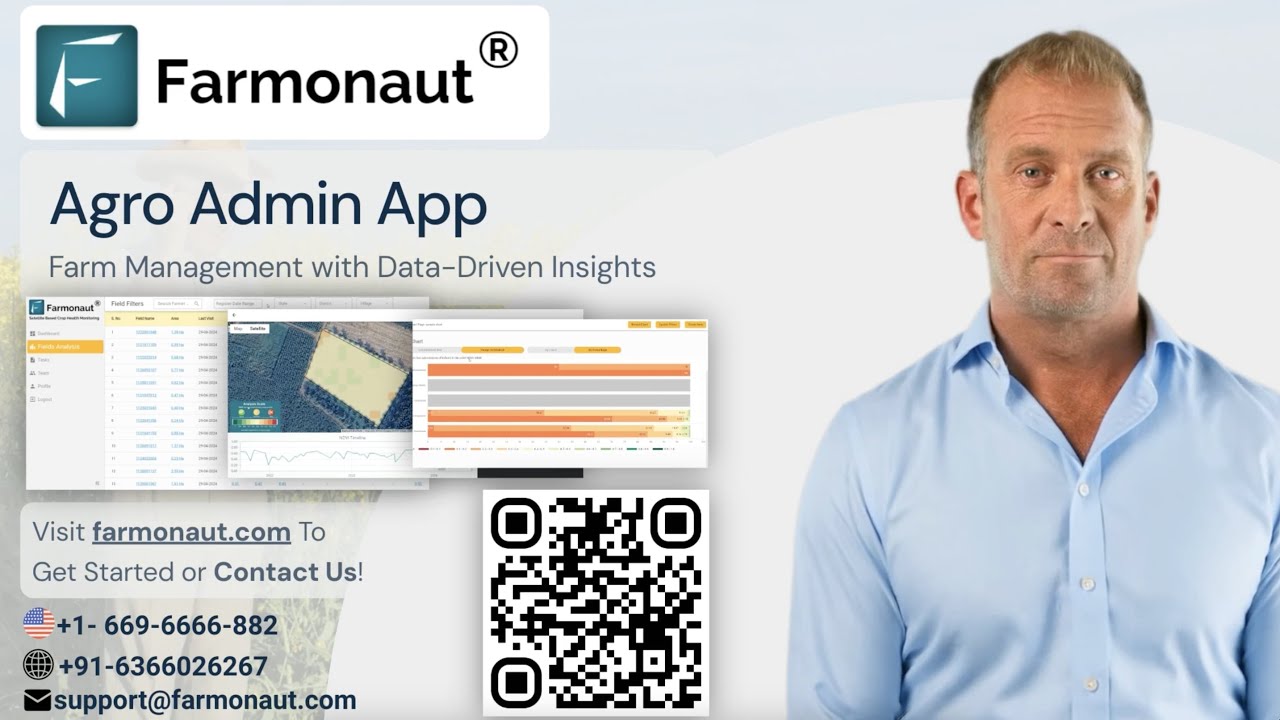

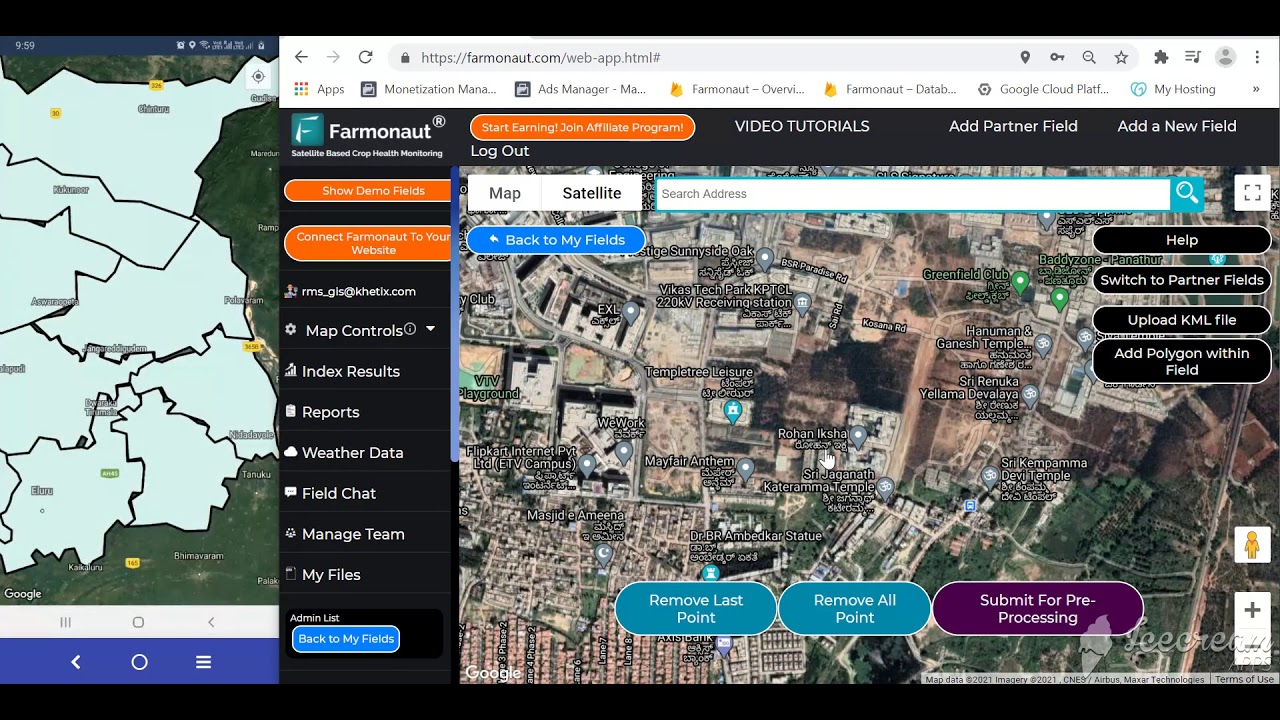

For agribusinesses operating multiple machines, effective fleet management is essential to maximize leasing efficiency, reduce operational costs, and optimize utilization. Farmers can leverage our platform to track and manage machinery usage seamlessly.

Costs and Tax Benefits of Agricultural Equipment Leasing

Evaluating the Cost of Leasing Agricultural Equipment

When comparing leasing vs purchase farm equipment, it’s crucial to evaluate total costs over the intended operational period:

- Initial Investment: Leasing typically requires just 10–20% of the equipment’s total value as a down payment versus 100% for purchasing.

- Regular Payments: Lease payments are fixed for the period, making budgeting simpler.

- Maintenance, Repair, and Upgrades: Many agreements include maintenance costs; lessors may also offer flexible upgrade paths.

- End-of-Term Options: You can opt to buy, renew, or return the machinery.

The cost of leasing agricultural equipment is often lower initially, but over a very long term, cumulative lease payments could exceed the total purchase price. Always assess the full financial implications for your operation.

Tax Efficiency with Agricultural Equipment Leasing

- Immediate Deduction: Monthly/annual lease payments are generally considered operating expenses, deducted fully in the period incurred, reducing taxable income and improving after-tax cash flow.

- Depreciation Benefit: When purchasing, depreciation claims are often spread over several years, not offering the same up-front tax benefit.

- Consult Financial Advisors: Always check specific local tax regulations or seek advice on agricultural equipment financing options to optimize your tax structure.

Drawbacks & Considerations in Leasing Farm Machinery

While agricultural equipment leasing offers numerous advantages, it’s important to consider potential drawbacks and review whether leasing aligns with your long-term goals:

-

Long-Term Costs:

- For longer-term or very intensive use, the total cost of leasing may exceed that of purchasing. Do a detailed cost-benefit analysis for your use case.

-

Lack of Ownership and Customization:

- You do not accumulate assets, which might limit the long-term equity of your farm or business. Customizing or modifying leased equipment is often restricted or prohibited.

-

Usage Restrictions and Limitations:

- Some agreements restrict usage hours, operating environments, or modifications. Violating these restrictions can result in penalties or loss of flexibility.

-

Early Termination Penalties:

- Terminating before the lease period ends often incurs financial penalties or additional fees, making it vital to understand contract terms.

-

Alignment with Operations:

- Seasonal businesses may find annual lease payments less ideal compared to usage-based financing models. Assess your operational requirements for optimal fit.

“Over 70% of farmers report improved cash flow management after switching to equipment leasing agreements.”

Use Farmonaut’s Blockchain-Based Traceability Solution to monitor machine usage, maintenance, and audit trails—critical for both operational optimization and compliance in leased equipment scenarios across the agricultural supply chain.

Leasing vs. Purchasing: Detailed Cost & Benefit Comparison Table

| Aspect | Leasing (Estimated Values) | Purchasing (Estimated Values) | Notes |

|---|---|---|---|

| Initial Cost | 10–20% of equipment value | 100% of equipment value | Leasing preserves working capital for other uses |

| Ongoing Expenses | Regular fixed payments incl. possible maintenance fees | Variable – includes repairs, insurance, etc. | Leases often include maintenance, reducing surprise costs |

| Tax Benefits | Lease payments fully deductible | Depreciation deductions over several years | Leasing may offer higher short-term tax savings |

| Upfront Payment | Low (first month + fee) | High (full asset purchase) | Leasing accessible to more operators |

| Maintenance Responsibility | Shared or handled by lessor | Owner (farmer) is fully responsible | Reduced repair and maintenance burden with leasing |

| Upgrade Flexibility | Easy – at lease end | Difficult – must sell and repurchase | Leasing supports technology turnover |

| Long-term Financial Impact | May cost more if lease extended over 10+ years | Lower over very long term if usage is intensive | Evaluate usage period to determine best option |

Our satellite imagery and crop health monitoring tools help both lessors and lessees evaluate machinery allocation, operational performance, and efficiency, creating added value for large-scale farm management and equipment-intensive operations.

Essential Steps & Tips for Effective Equipment Lease Agreements

Establishing a farm equipment lease agreement doesn’t need to be complex if you follow these well-structured steps:

-

Assess Your Needs

- Define specifically what equipment you require: type, capabilities, and duration of use.

- Consider seasonality, frequency of use, and expected productivity improvements.

-

Research Leasing Options

- Explore multiple lessors and compare terms, cost structures, service inclusions, and machinery selection.

- Use resources or consult trade associations to identify reputable providers.

-

Review Lease Agreements Thoroughly

- Scrutinize payment schedules, use and maintenance conditions, end-of-term options, penalties, and liability clauses.

- Understand insurance requirements, return conditions, and upgrade or buyout options.

-

Consult Financial and Tax Advisors

- Seek expert guidance to assess implications for your financial statements, loan agreements, and tax reporting.

- Leverage local expertise to maximize tax benefits, particularly for small and medium-sized farms.

-

Negotiate Terms to Align with Your Operation

- Bargain for flexible usage terms, transparent maintenance responsibilities, favorable buyout clauses, and support for unexpected breakdowns.

- Negotiate to ensure lease durations, payment structures, and upgrade options fit your seasonal or growth needs.

-

Plan Transitions

- Have a clear strategy for end-of-lease transitions: purchasing, renewing, or returning the equipment.

- Prepare for equipment changeovers to prevent operational disruptions.

FAQ: Leasing Agriculture Equipment

Q1: What are the main differences between leasing and purchasing agricultural equipment?

Leasing involves regular payments during a set period with flexible end-of-term options (buy, renew, or return), less upfront investment, and often maintenance included. Purchasing requires 100% payment upfront, full ownership, higher customization, and responsibility for all maintenance and risk of depreciation.

Q2: Can I claim tax benefits with equipment leasing?

Yes. Lease payments are generally classified as business expenses, making them fully tax-deductible (vs depreciation claims for owned equipment). However, always consult a tax professional for your local rules.

Q3: Who is responsible for maintenance and repairs in a lease?

This depends on the lease agreement. Many leases include maintenance and repair coverage, but it’s crucial to review all terms and specify responsibilities before signing.

Q4: Am I allowed to customize leased equipment?

Usually, customization or modification is limited or prohibited under most lease agreements—you must return the equipment in original or agreed-upon condition. Always review restrictions in advance.

Q5: What if I want to end my lease early?

Early termination typically incurs penalties or additional fees. Ensure you are aware of these conditions and penalties before signing a lease.

Q6: Is leasing more suitable for small farms or large agribusinesses?

Both can benefit: small farms gain easier entry and less risk, while large operations can optimize their fleets, cash flow, and access continuous equipment upgrades.

Q7: How can I monitor and manage my leased equipment more efficiently?

Use our advanced satellite-based farm management tools for real-time equipment monitoring, precision crop planning, and operational analytics. Our solutions integrate seamlessly with all major devices and platforms. Read more on our API & Developer Docs if you wish to build custom dashboards or automate operations.

Conclusion: Making the Right Strategic Decision in Agriculture

Agricultural equipment leasing offers compelling advantages for farmers and forestry professionals, including improved financial flexibility, access to the latest technology, and potential tax benefits. However, thorough review of the terms, costs, and operational needs is essential for determining whether a lease or purchase is best for your business.

Before signing a farm equipment lease agreement:

- Assess long-term operational requirements and cost implications

- Review all contractual agreements for usage restrictions, penalties, and other potential limitations

- Consult financial and tax advisors to optimize your decision

- Negotiate to align lease structures with your evolving business strategies

In the fast-evolving agricultural and forestry sectors, leasing is a powerful tool for remaining competitive, responsive, and efficient. By following these guidelines and leveraging technology-enabled management tools (such as those offered by Farmonaut), operators can make informed choices for long-term success.

Ready to optimize your equipment management?

Start leveraging Precision Farming Technologies and Fleet Management features to ensure your leased or owned machinery delivers peak value year after year.