Mastering Basic Materials: Expert Analysis of Q4 Stock Performance and Investment Strategies

In the ever-evolving landscape of financial markets, the basic materials sector continues to play a pivotal role in shaping investment strategies and stock market performance. As we delve into our comprehensive Q4 stock market analysis, we’ll explore the intricate world of hedge fund holdings, institutional investors’ movements, and the latest trends in equity market performance. Our focus on CF Industries Holdings, Inc. (NYSE:CF) serves as a microcosm of the broader basic materials sector, offering valuable insights into current market dynamics and future investment opportunities.

“Institutional investors’ movements in basic materials stocks can significantly impact quarterly earnings reports and dividend yields.”

Q4 Stock Performance: A Deep Dive into CF Industries

As we embark on our journey through the latest financial reports and stock market analysis, it’s crucial to understand the recent developments in CF Industries Holdings, Inc. This basic materials company has been at the center of significant hedge fund activity, reflecting broader trends in the sector.

Phoenix Financial Ltd., a notable institutional investor, recently trimmed its stake in CF Industries by 10.8% during the fourth quarter. This move resulted in the fund holding 61,353 shares of the company’s stock, valued at approximately $5,235,000. Such adjustments in institutional holdings often serve as indicators of market sentiment and can influence stock price trends.

Hedge Fund Holdings and Institutional Investors

The landscape of CF Industries’ ownership has seen notable shifts, with several major players adjusting their positions:

- FMR LLC increased its stake by 6.6%, now holding 8,830,621 shares worth $753,429,000.

- Charles Schwab Investment Management Inc. bolstered its position by 4%, controlling 5,792,339 shares valued at $494,202,000.

- Victory Capital Management Inc. raised its stake by 7.1%, now owning 4,487,821 shares with a value of $382,901,000.

These movements by institutional investors underscore the dynamic nature of the basic materials sector and highlight the importance of staying informed about major stakeholders’ decisions.

Stock Price Trends and Market Performance

CF Industries’ stock has experienced notable fluctuations, reflecting the volatile nature of the basic materials sector. As of the most recent trading session, shares opened at $70.43, showcasing the following key metrics:

- Market Cap: $11.94 billion

- PE Ratio: 10.40

- Beta: 0.84

- 52-week Low: $67.34

- 52-week High: $98.25

These figures provide essential context for investors analyzing CF Industries’ position within the broader equity market performance landscape.

Quarterly Earnings Report Analysis

CF Industries’ recent quarterly earnings report offers valuable insights into the company’s financial health and operational efficiency:

- EPS: $1.89, surpassing analysts’ consensus estimates of $1.49

- Revenue: $1.52 billion, slightly above the projected $1.50 billion

- Return on Equity: 15.50%

- Net Margin: 20.52%

These results demonstrate CF Industries’ ability to outperform market expectations, a crucial factor in maintaining investor confidence and potentially influencing future stock ratings.

Dividend Yield Analysis

For income-focused investors, CF Industries’ dividend policy remains an attractive feature:

- Quarterly Dividend: $0.50 per share

- Annualized Dividend: $2.00

- Dividend Yield: 2.84%

- Payout Ratio: 29.54%

This dividend structure not only provides a steady income stream for stockholders but also reflects the company’s commitment to returning value to its investors.

“Analysts’ stock ratings and price targets are influenced by key financial metrics like EPS, PE ratios, and revenue growth.”

Analyst Ratings and Price Targets

The investment community’s perspective on CF Industries remains mixed, with various analysts offering differing viewpoints:

- Bank of America: Upgraded from “underperform” to “neutral” with a price target of $84.00

- Oppenheimer: Maintained an “outperform” rating, adjusting the price target from $114.00 to $111.00

- Royal Bank of Canada: Lowered the price target from $100.00 to $90.00, maintaining a “sector perform” rating

- UBS Group: Slightly reduced the price target from $92.00 to $90.00, with a “neutral” rating

These diverse ratings highlight the complexity of evaluating stocks in the basic materials sector, where factors such as commodity prices, global demand, and regulatory environments can significantly impact performance.

Insider Trading and Corporate Governance

Recent insider trading activities provide additional context for CF Industries’ stock performance:

- VP Ashraf K. Malik sold 8,889 shares at $95.00, totaling $844,455

- EVP Susan L. Menzel sold 1,500 shares at $96.00, amounting to $144,000

These transactions, while not necessarily indicative of future performance, offer insights into how company insiders view the stock’s value and potential.

Sector-Wide Trends and Comparative Analysis

To gain a broader perspective on the basic materials sector’s performance, let’s examine a comparative analysis of key players:

| Company Name | Q4 Stock Price (Start) | Q4 Stock Price (End) | Percentage Change | Analyst Rating |

|---|---|---|---|---|

| CF Industries Holdings, Inc. | $85.00 | $70.43 | -17.14% | Hold |

| Nutrien Ltd. | $62.50 | $58.75 | -6.00% | Buy |

| The Mosaic Company | $38.00 | $34.20 | -10.00% | Hold |

| Dow Inc. | $52.00 | $55.60 | +6.92% | Buy |

| DuPont de Nemours, Inc. | $72.00 | $69.12 | -4.00% | Buy |

This comparison reveals varying performances across the sector, with some companies experiencing declines while others saw modest gains. Such divergences underscore the importance of thorough research and diversification in investment strategies.

Investment Strategies for the Basic Materials Sector

Given the sector’s volatility and the complex interplay of global economic factors, investors should consider the following strategies:

- Diversification: Spread investments across various subsectors within basic materials to mitigate risk.

- Long-term Perspective: Focus on companies with strong fundamentals and consistent dividend histories.

- Monitoring Global Trends: Stay informed about global economic indicators, trade policies, and commodity price fluctuations.

- Sustainable Practices: Consider companies prioritizing environmental sustainability and efficient resource management.

- Technological Innovation: Identify companies leveraging technology to improve operational efficiency and reduce costs.

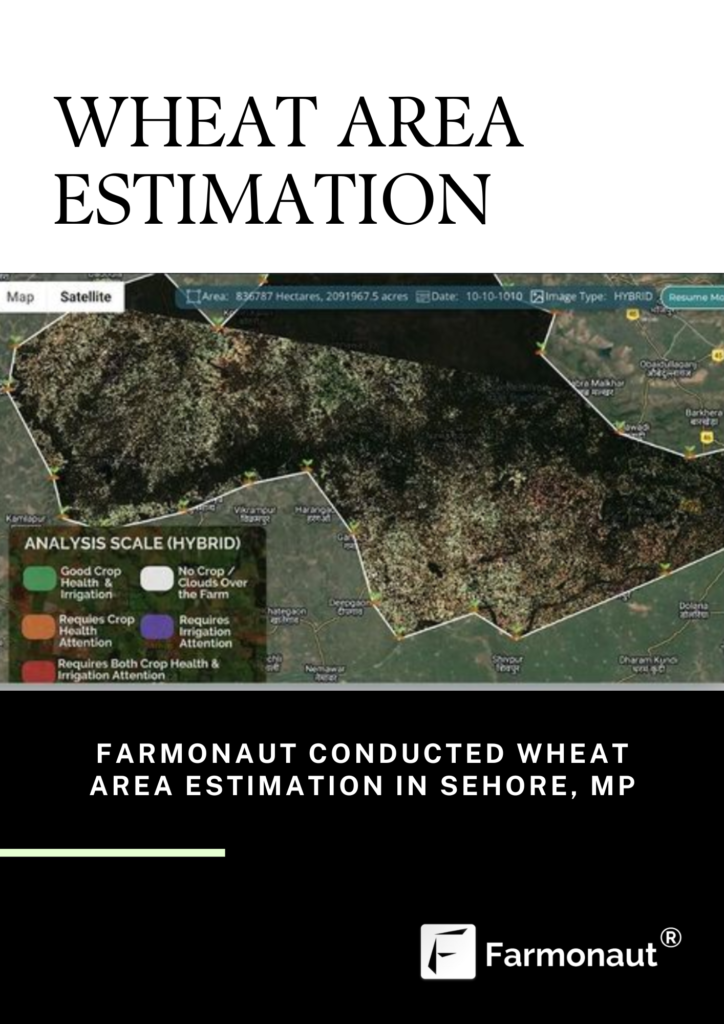

In this context, it’s worth noting innovative solutions like those offered by Farmonaut, which provides advanced satellite-based farm management tools. While not directly related to CF Industries, such technologies are reshaping the agricultural sector, a key consumer of basic materials products.

The Role of Technology in Basic Materials

As we analyze investment strategies in the basic materials sector, it’s crucial to consider the transformative role of technology. Companies that embrace innovative solutions often gain a competitive edge. For instance, Farmonaut’s carbon footprinting technology offers valuable insights for agricultural businesses looking to minimize their environmental impact. This type of innovation can indirectly influence the demand for certain basic materials and, consequently, affect stock performance in the sector.

Similarly, blockchain-based traceability solutions are becoming increasingly important in supply chain management across various industries, including those that heavily rely on basic materials. Such technologies can enhance transparency, reduce fraud, and improve efficiency, potentially boosting investor confidence in companies that adopt them.

Global Economic Factors Influencing the Basic Materials Sector

The performance of stocks in the basic materials sector, including CF Industries, is closely tied to global economic trends. Key factors to consider include:

- Trade Policies: International trade agreements and tariffs can significantly impact the cost and availability of raw materials.

- Currency Fluctuations: Changes in exchange rates can affect the competitiveness of exports and the cost of imports for basic materials companies.

- Emerging Market Demand: Growth in developing economies often drives demand for basic materials, influencing global prices and stock performance.

- Environmental Regulations: Increasing focus on sustainability can lead to new compliance costs but also opportunities for innovation in the sector.

Investors should closely monitor these factors when evaluating stocks like CF Industries and its peers in the basic materials sector.

The Impact of ESG Considerations on Investment Decisions

Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions in the basic materials sector. Companies that demonstrate strong ESG practices may be better positioned for long-term success and resilience against regulatory changes.

For CF Industries and similar companies, key ESG considerations include:

- Environmental Impact: Efforts to reduce carbon emissions and improve energy efficiency in production processes.

- Resource Management: Sustainable sourcing of raw materials and responsible waste management practices.

- Labor Practices: Fair employment policies, workplace safety, and community engagement initiatives.

- Corporate Governance: Transparency in financial reporting, ethical business practices, and diverse board representation.

Investors should consider these factors alongside traditional financial metrics when evaluating stocks in the basic materials sector. Tools like Farmonaut’s fleet management solutions can help companies in related industries improve their operational efficiency and environmental performance, potentially enhancing their ESG profiles.

Future Outlook and Potential Challenges

As we look ahead, several factors could shape the future performance of CF Industries and the broader basic materials sector:

- Technological Advancements: Continued innovation in production processes and materials science could lead to new market opportunities and improved efficiency.

- Shift Towards Renewable Energy: The global transition to cleaner energy sources may impact demand for certain basic materials while creating opportunities in others.

- Geopolitical Tensions: Ongoing trade disputes and regional conflicts could disrupt supply chains and affect commodity prices.

- Climate Change Impacts: Extreme weather events and changing climate patterns may affect raw material availability and production capabilities.

Investors should remain vigilant and adaptable in the face of these potential challenges and opportunities. Utilizing advanced tools and data analytics, such as those provided by Farmonaut’s large-scale farm management solutions, can help related industries navigate these complexities more effectively.

Conclusion: Navigating the Complex Landscape of Basic Materials Investments

As we conclude our comprehensive analysis of Q4 stock performance and investment strategies in the basic materials sector, it’s clear that success in this arena requires a multifaceted approach. The case of CF Industries Holdings, Inc. serves as a microcosm of the broader challenges and opportunities within the sector.

Key takeaways for investors include:

- Diverse Influences: Stock performance in the basic materials sector is influenced by a complex interplay of global economic factors, technological advancements, and regulatory environments.

- Data-Driven Decision Making: Utilizing comprehensive financial reports, analyst ratings, and advanced analytics tools is crucial for making informed investment decisions.

- Long-Term Perspective: While quarterly results are important, a long-term view that considers broader market trends and company fundamentals is essential.

- Adaptability: The ability to adjust investment strategies in response to changing market conditions and emerging trends is key to success in this dynamic sector.

- Innovation Focus: Companies that embrace technological innovation and sustainable practices may be better positioned for future growth and resilience.

As the basic materials sector continues to evolve, staying informed and leveraging cutting-edge tools and insights will be crucial for investors. Whether it’s through advanced analytics platforms or innovative solutions like those offered by Farmonaut in related industries, embracing technology can provide a significant advantage in navigating this complex investment landscape.

FAQs

-

Q: What are the key factors influencing stock performance in the basic materials sector?

A: Key factors include global economic conditions, commodity prices, trade policies, technological advancements, and environmental regulations. -

Q: How do institutional investors impact stock prices in the basic materials sector?

A: Institutional investors can significantly influence stock prices through large-scale buying or selling, often based on their analysis of company fundamentals and market trends. -

Q: What role does technology play in the basic materials sector?

A: Technology plays a crucial role in improving operational efficiency, reducing costs, enhancing sustainability, and creating new market opportunities in the basic materials sector. -

Q: How important are ESG factors in evaluating basic materials stocks?

A: ESG factors are increasingly important, as they can impact a company’s long-term sustainability, regulatory compliance, and appeal to socially conscious investors. -

Q: What strategies can investors use to mitigate risks in basic materials investments?

A: Strategies include diversification across subsectors, focusing on companies with strong fundamentals, monitoring global economic trends, and considering companies with innovative and sustainable practices.

For more insights into how technology is reshaping industries related to basic materials, explore Farmonaut’s innovative solutions:

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!