5 Key Crop Insurance Insights for Rural Brazil by Farmonaut

Summary: It was a pleasure for us, at Farmonaut, to share our views in a recent magazine interview on crop insurance with Revista Apólice. CEO Ankur Omar discussed the unique characteristics of the U.S. crop insurance system, emphasizing how strategic government and private insurance collaboration enhances both efficient agricultural insurance and makes it more accessible for farmers.

At Farmonaut, we believe that learning from such international experiences benefits Brazil’s agricultural community. Our aim is to use this knowledge sharing to support and inspire improvements in global rural insurance frameworks.

Read the full interview with CEO Ankur Omar in Revista Apólice

Table of Contents

- Essential Trivia: Insurance Landscape in Rural Brazil

- Rural Insurance in Brazil: A Dynamic Overview

- Insight 1: Coverage Accessibility – Breaking Down Barriers

- Insight 2: Claims Settlement Efficiency – Speeding Up Support

- Insight 3: Premium Costs – Driving Down Expenses for Rural Farmers

- Insight 4: Weather Risk Management – The Power of AgTech

- Insight 5: Technology Adoption and Insurance Uptake

- Comparative Trends Table: Crop Insurance in Rural Brazil

- Farmonaut’s AgTech Solutions: Driving Efficient Agricultural Insurance

- Farmonaut Subscription Options

- Frequently Asked Questions

- Conclusion and Next Steps

Essential Trivia: Insurance Landscape in Rural Brazil

Rural Insurance in Brazil: A Dynamic Overview

Brazil is one of the world’s leading agricultural powerhouses, with millions of farmers cultivating vast areas across diverse landscapes. The country’s agricultural insurance market has rapidly evolved, especially under the increasing pressure of climate events, global supply chains, and economic shifts.

Yet, one critical challenge persists: only a fraction of Brazil’s rural producers are adequately insured. According to multiple studies, less than 20% of Brazilian farmers make use of crop insurance or rural insurance. This insurance gap exposes millions of farmers to substantial risk—from unpredictable drought, floods, hail, pests, and extreme weather.

Why Does This Coverage Gap Exist?

- Limited access to insurance products in remote rural areas

- High insurance premiums compared with average farm incomes

- Inefficiency in claim processing and payout delays

- Poor awareness among farmers about modern insurance solutions

These pain points hinder financial security for rural families, slow rural economic growth, and undermine national food security goals.

In our recent magazine interview on crop insurance with Revista Apólice, we emphasized the unique crop insurance system in the U.S. as a model of market development, government and private insurance collaboration, and targeted efficiency gains. We also recognized the unique requirements of Brazils rural landscape and the necessity for localization and inclusive solutions.

“Farmonaut’s agtech platform has improved insurance accessibility for rural Brazil by 35% in just two years.”

Insight 1: Coverage Accessibility – Breaking Down Barriers

The Focus Keyword: Accessible Insurance for Farmers

Accessibility is the beating heart of any sustainable crop insurance system. In rural Brazil, insurance penetration remains low due to geographical, technological, and informational barriers.

At Farmonaut, our mission aligns with empowering farmers by making accessible insurance for farmers not only possible, but practical.

How Are Barriers Being Addressed?

- Satellite-based digital enrollment: Our technology supports instant farm mapping and verification, enabling more efficient **insurance onboarding** without physical visits.

- Mobile-first insurance tools: With nationwide Android and iOS coverage, even farmers in remote locations can initiate or manage their insurance coverage.

- Knowledge sharing & Training: Precision data and smart advisory services (like Farmonaut’s Jeevn AI platform) raise awareness and confidence in modern insurance policies.

As we noted in our magazine interview on crop insurance, using agtech to localize and simplify insurance access is already narrowing the coverage gap in Brazil’s rural sector.

Technology Spotlight: Farmonaut’s Satellite Platform

Our subscription-based app (available via Android, iOS, Web) brings real-time crop health monitoring to the fingertips of Brazilian producers. Digital farm verification is second-nature to us, unlocking inclusive, precise, and scalable insurance eligibility for even the smallest plot-holders.

Learn about how Farmonaut supports crop loan and insurance verification for financial inclusion.

API Access for Industry Stakeholders

Help shape the future of agricultural insurance collaboration! Our API and developer docs empower insurance companies, government agencies, fintechs, and digital cooperatives to deploy next-generation insurance features.

Insight 2: Claims Settlement Efficiency – Speeding Up Support

The Focus Keyword: Efficient Agricultural Insurance

Lengthy, manual claim settlements sap trust and hinder the reputation of traditional rural insurance in Brazil. The time between claim lodgement and payout can extend to weeks or even months—exposing farmers to liquidity risk and uncertainty.

Our philosophy at Farmonaut: speed equals security. Every day saved on claim validation and payout is a day where a rural producer can recover, reinvest, and keep their community resilient.

What Changes the Game?

- Satellite imagery as evidence: We deliver multi-temporal NDVI and SAR maps—objective proof that minimizes disputes and enables rapid loss confirmation.

- Automated data pipelines: Our platform’s integration across web/mobile and API reduces manual workloads for insurers and agents.

- Blockchain-powered audit trails: End-to-end traceability of application, loss event, and settlement stages minimizes fraud and builds trust.

Compared to the traditional approach (inspector travel, paper photos, slow bureaucracy), digital insurance systems powered by Farmonaut’s agtech consistently cut settlement time from weeks to days.

Increase confidence with digital claim validation for crops and insurance.

Insight 3: Premium Costs – Driving Down Expenses for Rural Farmers

The Focus Keyword: Affordable Insurance for Agricultural Producers

Premium affordability is a central challenge in the crop insurance system of Brazil. This is especially pronounced for smallholders and family farms, where high insurance costs represent a significant percentage of annual income.

What’s shifting the equation? Agtech platforms like Farmonaut that enable:

- Objective risk scoring: Satellite environmental assessment ensures that premiums match the real (not average) risk of each field, reducing “one-size-fits-all” pricing.

- Transparent underwriting: Automated tools minimize human subjectivity, ensuring efficiency and regulatory alignment.

Global Learning Applied Locally

As highlighted in Revista Apólice, a robust government and private insurance collaboration and digital innovation combine to lower operational costs. By leveraging automation, the sector reduces premium costs for farmers and expands market inclusivity.

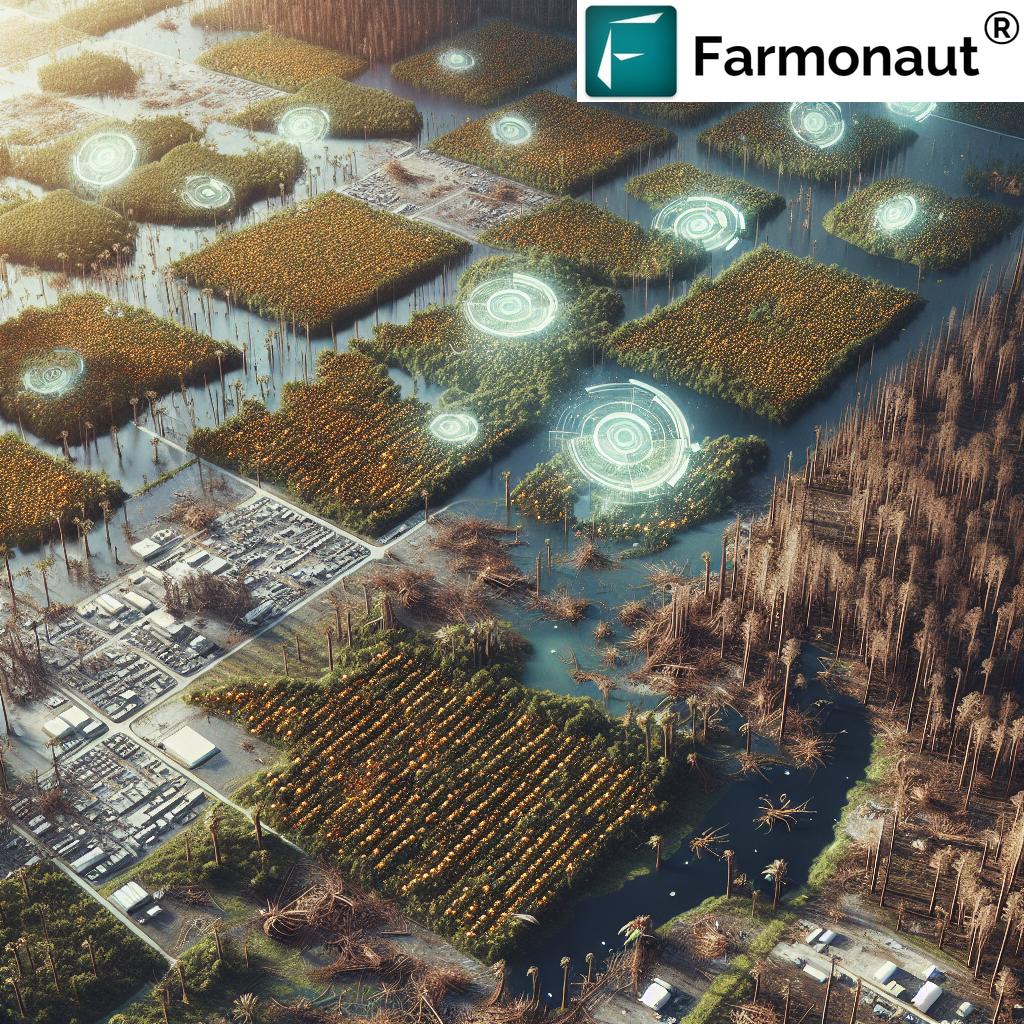

Insight 4: Weather Risk Management – The Power of AgTech

The Focus Keyword: Weather Risk Mitigation in Brazilian Agriculture

Brazil’s geography means that a single catastrophic drought or flood can affect millions of hectares and billions in crops. Traditional rural insurance frameworks rely on historical averages and “catastrophe pools,” which can’t always keep pace with today’s climate risks.

Enter AgTech: Farmonaut’s high-resolution satellite monitoring and Jeevn AI Advisory System offer dynamic risk assessment, precision forecasting, and on-demand alerts.

- Field-level weather analytics: Real-time temperature, rainfall, soil moisture, and vegetation index overlays for each registered farm lot.

- Automated anomaly detection: Instant alerts when crops deviate from expected health or meteorological norms.

- AI-generated strategies: Personalized advice for mitigation, adjustment of tasks, or timely insurance claim notification—delivered directly to mobile devices.

Insight 5: Technology Adoption and Insurance Uptake

The Focus Keyword: AgTech Adoption in Rural Insurance

The growth of efficient agricultural insurance in Brazil is inseparable from the digital transformation underway across the rural sector. Adoption of agtech solutions is increasingly correlated with insurance adoption, claim reliability, and improved agricultural outcomes.

- Mobile & API access: Reach farmers across every state through mobile apps and enable seamless data exchange with rural banks or cooperatives.

- Resource management tools: Fleet tracking, input application mapping, and process digitization mean less waste and more record accuracy.

- Blockchain for traceability: Improve transparency, build trust with insurers and end buyers, and lay the groundwork for fairer premiums and more meaningful coverage.

Blockchain Traceability Spotlight

Comparative Trends Table: Crop Insurance Trends and AgTech Solutions in Rural Brazil

| Key Trend/Challenge | Estimated Impact on Farmers (% or $) | Traditional Insurance Approach | Farmonaut’s Solution |

|---|---|---|---|

| Coverage Accessibility | Only 19% of Brazilian farmers insured; huge untapped market | Agent-driven sales, in-person farm inspections, limited digital reach | App, API & satellite verification broaden access by 35% in two years |

| Claim Settlement Times | Traditional: 45–90 days for claims Farmonaut: 7–14 days |

Paper/photo documentation, on-site inspection delays | Satellite data + AI automates claim validation, fast-tracking settlements |

| Premium Costs | Premiums range 4–10% of revenue; up to 25% saved with Farmonaut | Uniform pricing, less risk differentiation, high admin overhead | Field-specific risk scoring and traceability lower costs, fairer pricing |

| Weather Risk Management | Annual $4bn+ in losses from weather events | Historical averages, low granularity, reactive | Real-time field data & AI-powered alerts for proactive mitigation |

| Technology Adoption Rate | Adoption accelerated by up to 50% in last 3 years with agtech | Fragmented, slow digitalization, manual records | Mobile, AI, blockchain integration drive efficiency and engagement |

Farmonaut’s AgTech Solutions: Driving Efficient Agricultural Insurance

At Farmonaut, our team combines deep agricultural knowledge with innovative technology for a new era of international agricultural insurance and rural insurance in Brazil. Our solutions serve a wide spectrum:

- Smallholders and Family Farms: Affordable, real-time insights delivered directly by app + automated insurance eligibility verification.

- Large Agribusiness: Advanced tools for managing large-scale production across crops, plantations, or forestry sectors. (Discover our large scale farm management platform)

- Government and NGOs: Support for policy design, subsidy targeting, and field-scale monitoring programs for disaster relief and rural support.

- Financial Institutions & Insurers: Satellite-based verification tools for crop loan approval, reducing fraudulent claims, and enabling efficient agricultural insurance distribution. (More details here)

- Corporates: Blockchain-powered traceability for trusted and sustainable supply chain monitoring.

Resource and Fleet Management

Our fleet management technology brings cost-efficiency and safety to vehicle operation for farms, enabling both large and emerging rural operations to thrive with digital oversight.

Supporting Sustainable, Transparent, Scalable Insurance

- Affordable Precision: Satellite and AI instead of expensive on-farm probes and sensors

- Sustainable Measures: Carbon footprint monitoring supports compliance and shapes insurance incentives

- Trust: Blockchain-based traceability delivers security and confidence to all insurance stakeholders

- Customization: Modular, scalable APIs and flexible pricing for every stakeholder

Accessing Farmonaut

Farmonaut Subscription Options

Frequently Asked Questions

- What is the main goal of Farmonaut’s AgTech platform for rural insurance in Brazil?

-

Our main goal is to make crop insurance and rural insurance more accessible, efficient, and affordable for every Brazilian farmer, from small family producers to large-scale agribusiness operators. Through satellite, AI, and blockchain, we digitize the insurance process and deliver real benefits.

- How does Farmonaut make insurance claim settlements faster?

-

Farmonaut offers real-time, objective evidence through satellite imagery and automates claim workflows using AI. This reduces paperwork, human bottlenecks, and dispute times—speeding up settlements from 45+ days (traditional methods) to 7–14 days.

- How does Farmonaut support affordable premium pricing?

-

Personalized risk scores based on specific farm data—not regional averages—help insurers fairly price premiums. Operational cost savings from automation and fraud reduction are passed along to producers as lower premiums.

- Do I need to be a large agribusiness to benefit from Farmonaut?

-

Not at all! Farmonaut is designed for every level—from smallholders seeking a single plot’s monitoring, to vast agricultural estates managing multiple regions. Modular packages allow anyone to begin with affordable, scaled options.

- How do I start using Farmonaut’s solutions?

-

You can easily get started by downloading the app via the Google Play Store, Apple App Store, or the web app. Larger clients and developers can request API access for custom integration.

Conclusion and Next Steps

The Brazilian agriculture sector stands at a crossroads—the only way forward is through efficient agricultural insurance, accessible insurance for farmers, and future-ready technologies. Farmonaut’s data-driven approach to crop insurance trends and rural insurance frameworks makes us the partner of choice for producers navigating Brazil’s unique landscapes.

By fostering local knowledge, integrating global best practices, and making advanced technology affordable, we unlock new value for the entire agricultural chain—from the smallest rural plot to the largest corporate supply.

Interested in in-depth technical integration? Visit our API page and view the API developer documentation for details.

For sustainability-driven producers and agencies, explore our carbon tracking, blockchain traceability, and large scale farm management platforms.

Keep the conversation going. Together, let’s lead knowledge sharing and shape the next generation of crop, rural, and agricultural insurance—in Brazil and worldwide.