Agriculture Market Report 2024: Shocking Trends & Prices!

“Global wheat prices surged by 18% in early 2024 due to trade policy shifts and supply chain disruptions.”

- Jump to Table of Contents

- Try Farmonaut’s Advanced Farm Management App

- Explore Farmonaut Satellite API

- API Developer Docs

Table of Contents

- Market Overview: 2024

- Agricultural Commodity Prices 2024 & Global Food Trade

- Farming Technological Advancements: The Rise of Agriculture 4.0

- Policy and Legislation: Trade Policy Analysis & Sector Impact

- Environmental and Climatic Factors: Crop Production Challenges

- Comparative Trends Table: Price, Policy, and Technology (2023–2024)

- The Role of Farmonaut in Precision & Sustainable Agriculture

- Key Agricultural Sector Financial Pressures and Opportunities

- Summary & Conclusion

- FAQ: Agriculture Market Report 2024

Market Overview: 2024

In 2024, the global agricultural sector entered a phase characterized by remarkable market dynamics, pressed under ever-shifting commodity prices, evolving trade policy decisions, and an accelerated wave of technological advancements. According to the USDA (U.S. Department of Agriculture), net farm income was projected at $140.7 billion—reflecting a 4.1% decrease from 2023 and a stark 22.6% plunge from the inflation-adjusted peaks of 2022. This decrease stands as a testament to the mounting financial pressures farmers are experiencing due to reduced food commodity prices and rising production costs.

We see that although total production expenses dipped marginally, core costs, especially labor and interest, continued to climb. This intensifies the challenges for both smallholders and large agricultural industries, as fundamental crop production challenges now include increased input costs and navigating more complex economic dynamics.

- USDA net farm income 2024: $140.7 billion (projected)

- Relative decrease: -4.1% YoY from 2023; -22.6% from 2022

- Primary factors: Lower commodity prices, higher labor & interest expenses, continuing agricultural sector financial pressures

- Major Cost Drivers: Fertilizer, fuel, and irrigation costs offset by labor and finance

“Over 60% of farmers adopted new agri-tech tools in 2024, reshaping market dynamics and production efficiency.”

Agricultural Commodity Prices 2024 & Global Food Trade

Current Food Commodity Price Volatility: Index & Trends

2024 was marked by food price volatility. The Food and Agriculture Organization (FAO) Food Price Index registered a cumulative 0.8% decline in May. This was largely due to steep price reductions in cereal, sugar, and vegetable oil categories. Notably, meat and dairy recorded price increases, attributed to persistent demand spikes, changes in consumption patterns, and shorter supply chains.

- FAO Index May 2024: -0.8% YoY

- Cereal Prices: Down (wheat, maize/corn, rice saw declines)

- Sugar and Vegetable Oil: Notable price drops

- Meat & Dairy: Moderate increases, reflecting strong demand

U.S. Trade Deficit and Export Dynamics

The U.S. agricultural trade balance faced heightened challenges, with the trade deficit projected at $30.5 billion for the year—nearly double that of 2023. Lower export values for several essential commodities—including oilseeds, cotton, corn, and beef—outpaced the modest rise in export volumes.

- Trade Deficit 2023: ~$16.4 billion

- Projected Trade Deficit 2024: ~$30.5 billion

- Key Export Challenges: Lower international prices, global competition (notably Brazil’s bumper corn crop), shifting trade policies, and strong USD

This climate signals a turbulent year for farmers depending on stable export-driven income. These market dynamics underlie the importance of robust agriculture trade policy analysis and sustainable, adaptive farming practices worldwide.

Farming Technological Advancements: The Rise of Agriculture 4.0

Accelerating Momentum for Technological Change

The agricultural sector is in the midst of a digital revolution, with precision agriculture technologies reshaping farm management worldwide. The collective drive toward Agriculture 4.0—an era defined by the integrating of the Internet of Things (IoT), artificial intelligence (AI), robotics, and automation—has begun to realize tangible benefits in efficiency, data-based analysis, resource savings, and sustainability.

- Agriculture 4.0 Market Value (2023): $67.73 billion (global)

- Projected 2024: $74.20 billion; CAGR (2024-2030): 11.6%

- Main Drivers: Labor shortages, rising input costs, the need for traceability, pressure for sustainable growth

- Adoption Rate: Over 60% of farms incorporated new agri-tech tools in 2024

Core Technologies Transforming Agriculture

- IoT: Networked soil sensors, weather stations, remote equipment management, and automated irrigation systems optimize real-time resource use.

- AI: Crop prediction, yield forecasting, and pest/disease advisories improve with machine-learning models trained on satellite and on-farm data.

- Robotics & Automation: Autonomous machinery, drones, and robotic pickers reduce labor dependency and improve precision in planting, spraying, and harvesting.

- Blockchain: Secure traceability for food supply chains builds consumer trust and meets stricter regulatory demands.

This transformation underscores a pivotal moment as we harness technology to overcome crop production challenges and rising environmental risks, ensuring long-term food security and sustainable farming practices.

Policy and Legislation: Trade Policy Analysis & Sector Impact

Role of Policy in Shaping Agricultural Sector Dynamics

The 2024 season highlighted the pivotal influence of policy decisions and government legislation in shaping market dynamics. The USDA’s controversial redaction of trade analysis in its quarterly report sparked debates about data transparency and the objectivity of official agriculture communications (Reuters).

- Concern: Omission may hinder objective assessment of agricultural trade balance and influence on policy formulation.

- Projected U.S. Ag Trade Deficit 2025: $42.5 billion

- Major factors: Greater import reliance, suppressed export pricing, weaker performance of key U.S. commodities (corn, cotton, oilseeds).

At the global level, food safety protocols, import-export regulations, and climate policy increasingly drive investment and innovation in sustainable farming practices. Meanwhile, the need for data-driven analysis to shape effective trade policies has never been more apparent, particularly given the impact on net farm income and longer-term market growth.

Environmental and Climatic Factors: Crop Production Challenges

Climate Impact on Agriculture and Resource Use

The ongoing threat of climate change continues to present unparalleled challenges to agricultural production and sustainability. In 2024, extreme weather patterns—droughts, record-breaking heatwaves, and devastating floods—disrupted both crop yields and livestock supply chains.

- Examples: Prolonged dry spells stunted wheat and corn growth in major U.S., Australian, and African regions.

- Flooding: Southeast Asian rice harvests delayed; infrastructure damaged in Europe and South America.

- Adaptation: Wide-scale shift to drought-tolerant varieties, precision irrigation, and integrated soil & water management.

This urgency has catalyzed investment in innovative technologies and resilient farming strategies. The drive toward resource efficiency and environmental integration now underpins the most progressive commercial farms and policy frameworks worldwide.

Comparative Trends Table: Price, Policy, and Technology (2023–2024)

This table compares estimated commodity prices, major policy shifts, and technological advancements for 2023 and 2024, helping us visualize global agricultural market trends and the evolving production landscape.

| Commodity | 2023 Est. Price (USD/ton) | 2024 Est. Price (USD/ton) | % Change YoY | Primary Trade Policy Shift (2024) | Major Technological Advancement |

|---|---|---|---|---|---|

| Wheat | $285 | $336 | +18% | Increased export duties by top producers; new import quotas; supply chain disruptions | Wide adoption of AI-driven yield forecasting & drought-resistant varieties |

| Rice | $415 | $390 | -6% | Revised import restrictions in Asia; climate event-based export policies | IoT-based irrigation monitoring & early flood warning systems |

| Soybean | $520 | $495 | -5% | Increasing bilateral trade agreements; shifting tariff structures | Precision nitrogen management & disease prediction with AI |

| Cotton | $2,170 | $2,130 | -2% | Stringent sustainability standards for exports; new traceability mandates | Blockchain-verified commodity traceability |

| Corn | $245 | $210 | -14% | Bumper crops in Brazil; reduced U.S. market share; shifting ethanol mandates | Automated fleet management and yield mapping via satellite |

| Sugar | $440 | $395 | -10% | Tariff removals in parts of Asia; subsidy reductions | AI-enabled pest/disease detection |

| Dairy (milk equivalent) | $480 | $540 | +12.5% | Demand-driven import tariff relaxation in multiple regions | IoT sensors for herd health and automated milking |

| Vegetable oil | $940 | $825 | -12% | Climate-driven policy on palm oil exports; biofuel blending mandates | Remote environmental monitoring for sustainability |

The Role of Farmonaut in Precision & Sustainable Agriculture

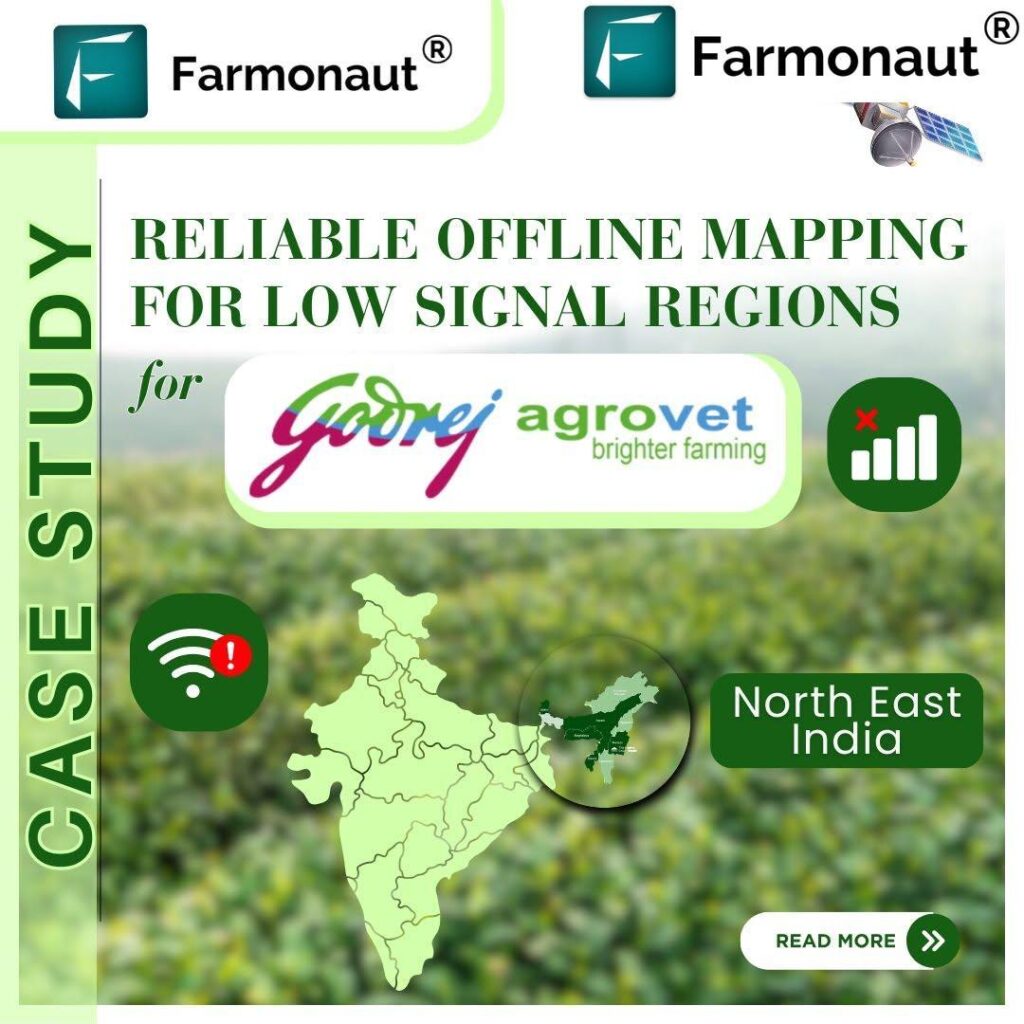

At Farmonaut, we are dedicated to transforming agricultural management through precision, accessibility, and sustainability. Our mission is to democratize advanced technology, making precision agriculture and farming technological advancements available to all farmers, regardless of scale.

How We Empower Farming Practices Worldwide

- Satellite-Based Crop Health Monitoring: Using multispectral satellite imagery, our platform provides real-time analysis of vegetation health (NDVI), soil moisture, crop stress, and disease risk.

- AI Advisory Systems: Jeevn AI delivers personalized insights—from weather forecasts to nutrient optimization and integrated pest management—boosting productivity and reducing costs.

- Blockchain-Based Traceability: Our traceability solutions assure transparency in agri and food supply chains, helping agribusiness and corporate clients meet strict global standards and enhance trust.

- Fleet & Resource Management: Optimize resource deployment and reduce logistics overhead for plantation managers and large farms with automated tracking and maintenance.

- Carbon Footprinting: Monitor and minimize emissions, helping farms and agribusinesses achieve regulatory compliance and enhance environmental stewardship.

- API & Developer Support: Integrate satellite and weather data directly into your existing platforms to support custom analytics and operational scale-up. Get started with our API Developer Documentation.

- Crop Loan & Insurance Services: Farmers and institutions can leverage satellite-based verification to streamline loan and insurance access with reduced fraud risk.

Accessible Platforms

Accessible through Android, iOS, web apps, and robust APIs, Farmonaut’s platform places actionable intelligence directly in the hands of our users. Whether you’re a smallholder looking to adopt real-time health monitoring, a government running a large-scale farm management program, or an agrifood enterprise seeking to reinforce product integrity, Farmonaut offers scalable, cost-effective solutions grounded in “precision for all.”

Key Agricultural Sector Financial Pressures and Opportunities

As our 2024 agriculture market report analysis highlights, navigating market downturns and persistent financial pressures requires agility and data-driven planning. With commodity price fluctuations (notably in cereal, sugar, and corn), increasingly complex trade policy environments, and mounting production costs, the sector faces a defining moment.

- Cost-Efficiency Through Digitalization: Embracing precision agriculture technologies (remote sensing, automation, and AI-based advisory) is key to sustaining profitability and managing input expenses.

- Sustainable Farming Practices: Adopting traceability, carbon management, and resource optimization not only facilitates compliance but also meets evolving market preferences for responsible production.

- Risk Mitigation: Integrated weather analytics and satellite-driven early warning systems help farms anticipate and limit climate-based losses, protecting both yields and long-term food security.

With climate unpredictability as a new normal, investments in sustainable growth and resilient supply chains are now a competitive imperative for forward-thinking agri-businesses, policy makers, and producers.

Explore More on Sustainable Agriculture:

-

Unlocking Soil Health and Sustainability:

Farmonaut Carbon Footprinting Service: Monitor, report, and reduce your farm’s carbon emissions with real-time analytics and compliance tools. -

End-to-End Traceability:

Farmonaut Product Traceability: Ensure product origin, authenticity, and full supply chain transparency using blockchain-backed records. -

Large-Scale Farm & Forestry Management:

Farmonaut Agro-Admin App: Centralized platform for large-scale monitoring, reporting, and fleet management.

Summary & Conclusion: Adapting to Agricultural Market Changes

The global agricultural market landscape in 2024 stands as a testament to the sector’s adaptability amid economic downturns, technology-driven transformation, volatile commodity prices, evolving trade policy, and rising environmental challenges. We have seen that:

- Farm finances remain under significant pressure, due to falling prices (cereal, corn, sugar) and rising labor/interest costs.

- Technological advancements, particularly in precision agriculture, blockchain traceability, and AI-based advisory, are accelerating recovery and empowering sustainable, efficient production.

- Major trade policy shifts—including redacted USDA analyses and changing export/import regulations—emphasize the importance of transparent, data-driven reporting and adaptive strategies.

- Environmental threats demand integrated, climate-resilient solutions and the widespread adoption of sustainable farming practices.

At Farmonaut, we are proud to support this evolution—making next-gen technologies accessible, data actionable, and sustainability achievable for all, across every level of the food and agri supply chain.

Stay ahead in a rapidly changing world—explore Farmonaut for the tools and intelligence your journey demands.

FAQ: Agriculture Market Report 2024

What are the top trends in the global agricultural market in 2024?

The most significant trends include increased adoption of precision agriculture and digital technologies (over 60% of farmers globally), volatile commodity prices (with major swings in wheat, corn, sugar, and oilseeds), growing prominence of AI and blockchain in farm management, accelerated trade policy changes, and heightened focus on sustainable farming practices and climate adaptation.

Why did farm incomes decline in 2024?

USDA projected a 4.1% decrease in net farm income, mainly due to lower average commodity prices, increased production, labor, and interest costs, and a widening U.S. agricultural trade deficit that depressed export values for major crops.

How have technological advancements impacted farming in 2024?

There has been a surge in Agriculture 4.0 tech adoption: IoT devices gather real-time farm and crop data, AI systems provide decision support, blockchain enhances supply chain transparency, and automation (including robotics) improves labor efficiency—all leading to improved yield, sustainability, and profit margins.

What is causing increased volatility in food prices?

Volatility is mainly due to climate-driven supply disruptions, sudden trade policy changes, exchange rate movements, and a growing reliance on complex, interconnected global supply chains. Examples include wheat price surges driven by political and environmental events, and sharp drops in corn and vegetable oil prices due to bumper crops and reduced demand.

How does Farmonaut help with sustainable farming?

Farmonaut provides affordable, real-time satellite monitoring, AI-based crop advisories, traceability solutions via blockchain, carbon footprint tracking, resource/fleet management, and integration APIs—delivering actionable insights and tools for farmers, agri-businesses, and government agencies worldwide. This all-in-one approach promotes efficiency, transparency, and environmental stewardship at every scale.

You have mentioned very interesting points! ps nice website.