2025 Drill Targets Revealed for Gold Exploration in Nevada

Welcome to our comprehensive industry update, where we reveal new 2025 drill target areas in Nevada for gold exploration. As the gold mining sector continues its upward trajectory, the mining district Battle Mountain Eureka Trend in Nevada solidifies its status as a global hub. We present detailed survey results, district developments, and strategic plans supporting the pipeline of exploration in this prolific region. In this release, we’re also showcasing how technology—particularly satellite-driven insights through Farmonaut—continues to transform both exploration and agricultural resource management.

Discover essential trends, survey data, drill program information, and actionable insights from one of North America’s most important gold districts.

Table of Contents

- Introduction: Gold Exploration Nevada in 2025

- Recent Nevada Gold Exploration Industry Trends & News

- Battle Mountain–Eureka Trend: 2025 Exploration & Development

- 2025 Drill Target Areas Nevada: Analysis and Details

- Soil Survey Results in Nevada: Foundation for 2025 Drilling

- Cortez Mining District Exploration: Project Mapping and Geology

- 2025 Nevada Gold Exploration Drill Targets Overview Table

- Farmonaut Technology: Precision Resource Management and Survey Benefits

- FAQ: Nevada Gold Exploration & Technology

Gold Exploration Nevada in 2025: Introduction & Context

With increasing gold prices and ongoing advancements in exploration technology, Nevada stands out as the epicenter for gold mining. The region hosts substantial land packages with a proven record of high-grade and large tonnage gold deposits, making it exceptionally attractive for investment and development.

The PWC (Pipeline West/Clipper) Gold Project—operated by Kinross Gold U.S.A., under an earn-in agreement with Riley Gold Corp.—highlights the shift towards methodical, data-driven exploration in the Cortez mining district along the lucrative Battle Mountain-Eureka Trend.

Here, we focus on key discoveries, soil survey results, technical planning, and the strategic roadmap shaping 2025’s most exciting drill target areas in Nevada.

Nevada Gold Exploration Industry Trends & 2025 News

The gold exploration Nevada sector continues to evolve rapidly. We are witnessing significant investments in geophysical, geochemical, and structural mapping—tools that are critical for delineating new resource potential. This approach is reflected in the 2025 plans for the Pipeline West/Clipper Project (PWC), where multiple high-priority drill target areas Nevada have been defined based on deep analysis of soil survey data, geologic mapping, and advanced software modeling.

Major mining corporations, including Kinross, emphasize transparency and technical diligence. They utilize platforms such as Leapfrog for data compilation, ensuring that every new exploration program Nevada aligns with industry best practices—focusing intensely on zones with the highest gold-in-soil anomalies.

These trends help market participants, from prospectors to institutional capital, make informed decisions regarding current and future investments.

- Application of Soil Surveys: Extensive gold-in-soil surveys, covering thousands of acres, provide a critical geochemical roadmap for targeting zones with anomalous gold values and pathfinder elements.

- Structural Targeting: The 2025 program in Nevada specifically targets the intersections of major northwest-southeast structures, aligning with models from world-class gold districts like Pipeline and Gold Acres.

- Technical Team Integration: Cross-collaboration between field geologists, data scientists, and technical exploration teams leads to smarter, more efficient drilling plans.

To enhance survey-based exploration and operational efficiency, farm and resource managers across industries are turning to solutions like Farmonaut’s satellite-based crop monitoring and resource management, enabling precise, real-time insights and cost-effective land management.

Battle Mountain-Eureka Trend: 2025 Exploration & Development

The Battle Mountain-Eureka Mining District hosts some of Nevada’s—and the world’s—most prolific gold deposits. Recent exploration information, especially from the PWC project adjacent to the substantial Pipeline and Cortez complexes, underscores the trend’s ongoing significance.

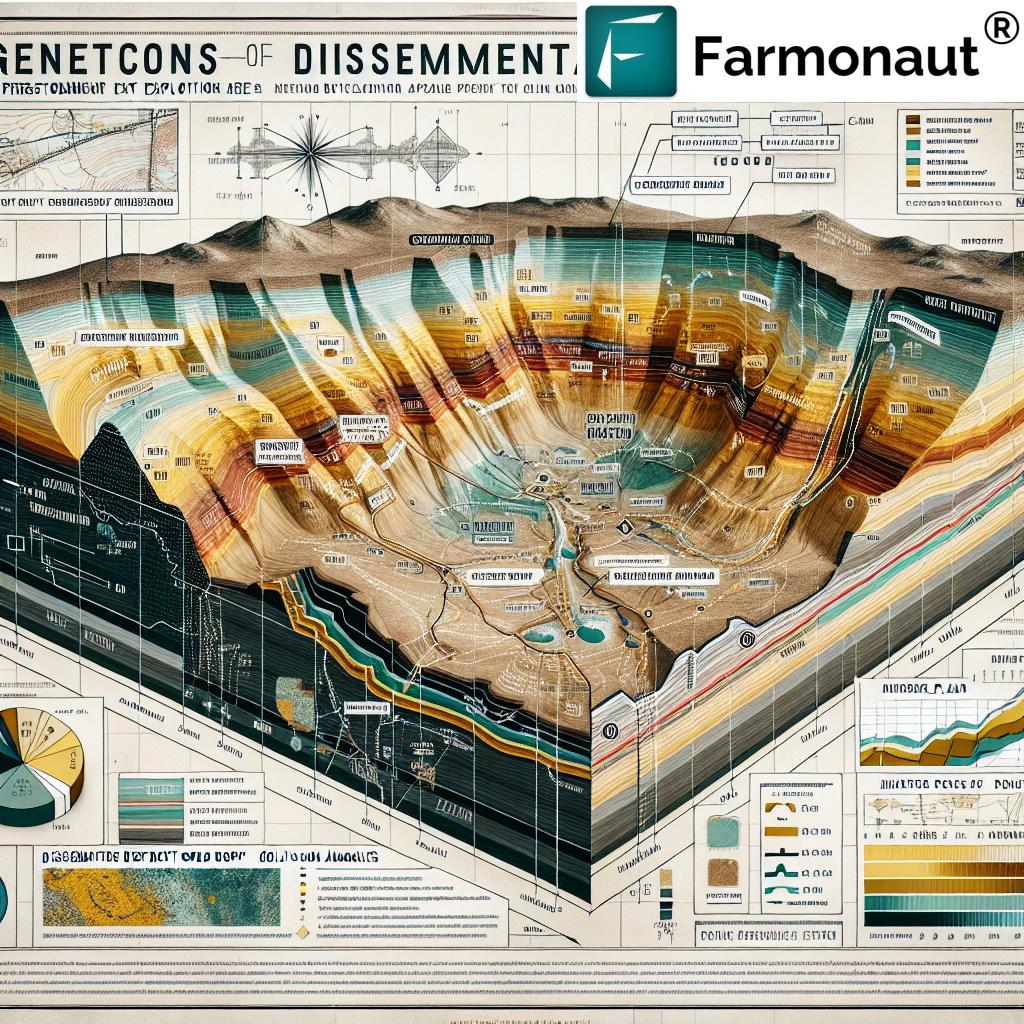

- Geologic Significance: The region is characterized by large, structurally controlled disseminated gold deposits, many of which are Carlin-type—renowned for size and high market value. Recent drill results further verify the presence of favorable host lithologies over large, untested areas.

- Strategic Planning:

The 2025 drill plan marks a leap forward: Kinross’s technical team identified new priority zones located up to 2.5km northwest of historic holes, specifically vectoring toward areas of intense gold-in-soil anomalies and structural intersections. - Development Status:

Drilling contracts have been awarded, with permitting underway. Initial holes will target deep, lower-plate carbonate belts analogous to those in the Fourmile and Cortez deposits.

For exploration teams, understanding this trend’s geology and proven endowment is vital:

- Over 50 million ounces of cumulative historic gold production

- Consistent annual output of 4–5 million ounces from the area

- Continued district-scale exploration supported by both soil and geophysical surveys

2025 Drill Target Areas in Nevada: Analysis and Details

Let’s break down the high-priority drill target areas Nevada for 2025. Guided by integrated geologic, geophysical, and soil survey data, these targets represent zones with exceptional resource potential:

- Framework Drilling Zones:

- Newly planned wide-spaced drill holes, 2.5km north-northwest of the previous Kinross hole, allow for system expansion into largely untested but geochemically promising areas.

- Gold-in-Soil Anomalies:

- Targeting the highest concentration of gold-in-soil anomaly zones, as revealed in the 2023–2024 surveys, is a powerful approach. These areas correlate strongly with known disseminated gold deposit types in the region.

-

Structural Intersections:

- The highest-priority holes are positioned near the intersection of two significant northwest-trending structures, a proven control for ore deposition in the Cortez complex and similarly endowed districts.

The potential for discovering another large-scale, disseminated gold deposit remains considerable, with drill contracts already assigned and permits in process.

Soil Survey Results Nevada: Foundation for 2025 Drilling

The 2023 and 2024 soil survey results Nevada underpin the entire 2025 exploration drill plan.

Soil sampling returned significant gold-in-soil values extending over 3km, with additional pathfinder elements—common in Carlin-type and intrusive-related deposits—also registering highly anomalous levels. This corroborates both the geologic and geophysical assessments and provides a cost-effective vectoring tool for subsequent drilling.

- Coverage: The previous soil survey encompassed the heart of the PWC land package, and new sampling in 2025 aims to expand geochemical coverage further northwest, adjacent to the 2023 grid.

- Data Integration: All gold-in-soil, lithologic, and structural data are systematically uploaded to Leapfrog software, producing a powerful, three-dimensional target model.

- Outcomes: Areas exhibiting contiguous high gold-in-soil readings are directly prioritized as framework drill hole locations, maximizing exploration efficiency and resource allocation.

Utilizing soil survey patterns to guide drilling in the Battle Mountain-Eureka Trend not only improves technical success rates but aligns with industry movement toward data-driven, environmentally conscious exploration.

The integration of blockchain-based traceability and satellite monitoring, available from Farmonaut’s Traceability Solution, is becoming increasingly vital for sustainable resource validation in both agriculture and mineral exploration supply chains.

Cortez Mining District Exploration: Project Mapping and Geology

The Cortez mining district exploration model is world-renowned for its prolific gold output and innovative technical methodologies.

In 2025, the geologic mapping for the PWC project included the following:

- Stratigraphic Targeting: Deep framework drill holes (such as PW1-24) have confirmed thick, complex lower-plate carbonates—key host rocks for large-scale gold mineralization, especially comparable to the Devonian Wenban Formation found in the adjacent Pipeline complex.

- Lithologic Models: Robust comparative modeling with other >5-million-ounce discoveries (e.g., Goldrush, Cortez Hills, Fourmile) supports the current exploration vectoring.

- 3D Framework: Continuous assembly and refinement of exploration data, including soil, geophysics, and historical drill results, provide a comprehensive basis for ongoing drill siting and resource estimation.

The PWC land package mining project, totaling approximately 24.7 km², is strategically located along the Cortez Structural Zone, adjacent to world-class deposits owned by Nevada Gold Mines LLC. This unrivaled district positioning heightens both the technical excitement and market interest in upcoming drill results and development plans.

2025 Nevada Gold Exploration Drill Targets Overview Table

| Drill Target Area | Estimated Gold Grade (g/t) | Projected Drill Depth (m) | Soil Survey Result Summary | Mining District Name | Development Status | Target Size (hectares) | Estimated Resource Potential (ounces) |

|---|---|---|---|---|---|---|---|

| PWC North-Northwest Zone | up to 3.5 (projected)* | 1,100+ | High gold-in-soil anomalies, multi-element pathfinder association, over 3km trend | Battle Mountain-Eureka Trend | Planned Drill Program | 750+ | To be determined post-drilling |

| PWC Central Structural Intersection | 2.5–3.0 (estimated)* | 1,000+ | Elevated gold and arsenic, correlating with northwest structure intersection | Cortez District | Permitting/In-Progress | 500 | Pending framework drilling |

| Historic Riley Grid Expansion | 1.0–2.2 | 850–1,200 | Sustained moderate gold-in-soil readings, with intrusive-related alteration halos | Battle Mountain-Eureka Trend | Soil Survey / Awaiting Drill | 1,000 | Early-stage estimate: medium potential |

| PWC Southern Margin | up to 1.6 | 700+ | Marginal but contiguous pathfinder anomalies; secondary/step-out priority | Cortez District | Under Review | 400 | Minor/Secondary target |

*Gold grades and resource potential are estimated projections prior to 2025 drilling results. Final results may vary based on drill recoveries and geologic complexity.

Farmonaut Technology: Precision Resource Management & Survey Support

Farmonaut is at the forefront of affordable, advanced geospatial monitoring for land, soil, and crop resource management. While dedicated to agricultural technology, the company’s solutions illustrate many principles fundamental to today’s mineral exploration—leveraging data, satellite insight, and AI to facilitate more targeted, sustainable, and cost-efficient decisions.

-

Satellite-Based Crop and Soil Health Monitoring:

Farmonaut’s satellite crop monitoring platform delivers multispectral field data (incl. NDVI, soil moisture, and vegetation health), empowering users to plan precise interventions and optimize input use. -

AI Advisory Systems:

The Jeevn AI Advisory System automatically generates real-time, hyperlocal insights for farm management based on satellite and environmental data—promoting increased productivity and resiliency. -

Blockchain-Based Product Traceability:

Farmonaut’s traceability solution enables transparent, secure validation for agricultural products and land management—useful for industries where authentication and source tracking are paramount. -

Fleet and Resource Management:

Agribusinesses utilize Farmonaut’s fleet management tools to streamline logistics, monitor vehicles, reduce costs, and achieve greater field safety. -

Carbon Footprinting:

The carbon footprinting suite allows users to track, analyze, and report agricultural and land development emissions metrics—supporting regulatory compliance and ESG market demands. -

API Access:

For technical exploration teams, Farmonaut’s API and developer documentation extend the platform’s monitoring capabilities into custom software and advanced geospatial workflows. -

Large-Scale Farm & Plantation Management:

Sophisticated users—such as government agencies or large landholders—benefit from Farmonaut Admin App, providing scalable, centralized field management across vast operational footprints.

Farmonaut operates on a flexible, subscription-based model—making premium satellite data accessible for users small and large. Explore current pricing and start modernizing your land or resource management below:

FAQ – Nevada Gold Exploration & Resource Monitoring

Q1: What are the main benefits of using soil survey results in defining new drill targets in Nevada?

Soil survey results in Nevada provide precise geochemical data, enabling technical exploration teams to rapidly identify anomalous gold zones and prioritize drilling in those areas with the highest probability of success.

Q2: How does the Battle Mountain–Eureka Trend influence gold exploration Nevada efforts?

The Battle Mountain-Eureka Trend is one of the world’s most productive gold belts. Its proven endowment, favorable geology, and ongoing exploration success draw significant investment and technical innovation, leading to continuous discovery and development of new gold deposits.

Q3: In what ways can satellite-based platforms, like Farmonaut, support exploration and land resource management projects?

Satellite-based platforms (e.g., Farmonaut) deliver real-time monitoring of land conditions, offering actionable data on soil health, vegetation vigor, and resource use. This is invaluable for optimizing plans, reducing costs, meeting environmental standards, and supporting precise survey workflows.

Q4: Where can I access developer-friendly APIs for agricultural or land monitoring?

You can access Farmonaut’s API for seamless integration of satellite and weather data into your software, with further guidance available at Farmonaut API Developer Docs.

Q5: What is the role of technical exploration teams in modern mining projects?

Technical exploration teams combine field mapping, digital modeling, geophysical analysis, and geochemical surveys to identify, rank, and site new drill targets—maximizing exploration success rates and responsible resource development.

Q6: How does blockchain-based traceability impact agricultural and mineral resource sectors?

Blockchain-based traceability ensures that products and resources are tracked securely and transparently from source to destination, strengthening supply chain authenticity, supporting regulatory compliance, and enhancing stakeholder trust.

Q7: What are some key features in Farmonaut’s carbon footprinting product?

With Farmonaut’s carbon footprinting suite, users gain real-time monitoring of their land-related emissions, allowing more efficient planning and greener, more sustainable operations.

Summary:

Our review of the 2025 drill targets for gold exploration in Nevada highlights the region’s ongoing commitment to technical excellence, sustainable resource development, and innovation in exploration program Nevada design. By integrating leading-edge soil survey results, detailed geologic modeling, and robust technical exploration team plans, the mining district Battle Mountain Eureka Trend continues to set the industry’s pace. Moreover, advancements in precision resource management—such as Farmonaut’s satellite and AI-driven technology—provide a powerful template for both agriculture and mineral exploration.

We remain excited to track further advancements and invite you to explore Farmonaut’s advanced monitoring, traceability, crop loan and insurance validation, and land management toolkits for actionable, real-time decision-making.

Have questions or need tailored resource management?

Explore Farmonaut’s technology suite or reach out for a free platform demo, available across Android, iOS, Web, and API!