Global Agricultural Commodity Outlook: US Crop Planting Shifts and Market Trends Impact Wheat, Corn, and Soybean Futures

“US farmers are shifting crop strategies, potentially impacting global markets for wheat, corn, and soybeans.”

In the ever-evolving landscape of global agriculture, we find ourselves at a critical juncture where market dynamics, geopolitical factors, and environmental conditions are converging to reshape the future of key agricultural commodities. As we delve into the intricate web of commodity futures trading, particularly focusing on wheat and corn market trends, it becomes evident that significant shifts are underway in the United States crop planting predictions. These changes are poised to send ripples across international grain markets, affecting not only domestic production but also global agricultural exports.

Our comprehensive analysis aims to unravel the complex interplay of factors influencing these market trends, from the impact of agricultural tariff impacts to the promising South American harvest outlook. We’ll explore how farmers are reconsidering their planting strategies, with expected shifts from soybeans to corn and wheat in key producing regions like the United States and Ukraine. Moreover, we’ll examine how these corn vs soybean planting shifts are likely to affect supply and demand dynamics, offering valuable insights for stakeholders across the agricultural sector.

Recent Market Developments

As of February 28, the agricultural commodity markets have witnessed significant volatility. Chicago wheat and corn futures have stabilized after experiencing a sharp decline in the previous session. This downturn was primarily attributed to expectations of increased U.S. plantings, the implementation of new U.S. tariffs, and a strengthening dollar. These factors have collectively contributed to substantial weekly declines in both wheat and corn prices, with wheat facing its most significant weekly drop since July of the previous year.

In contrast, soybean futures have shown a slight uptick but are still on track to end the week lower. This downward pressure on soybean prices can be largely attributed to the massive harvest in Brazil, which has substantially increased the global supply of this crucial oilseed.

Fundamental Market Drivers

Several key factors are currently shaping the agricultural commodity markets:

- Weather Conditions: Improved crop weather in South America and the passing of cold snaps in the United States and Russia have alleviated immediate concerns about production threats.

- Planting Predictions: The U.S. Department of Agriculture has forecasted that U.S. farmers will plant more corn and wheat and fewer soybeans in 2025 compared to 2024.

- Global Shifts: Ukraine is expected to reduce its 2025 soybean and sunflower acreage in favor of corn, according to the country’s first deputy farm minister.

- Tariff Impacts: The announcement of new U.S. tariffs on Mexican and Canadian goods, as well as additional duties on Chinese imports, has raised concerns about potential retaliation against U.S. agricultural exports.

These fundamental drivers are creating a complex market environment, where commodity price fluctuations are becoming increasingly difficult to predict. For farmers and agricultural businesses, staying informed about these trends is crucial for making strategic decisions about planting, harvesting, and marketing their crops.

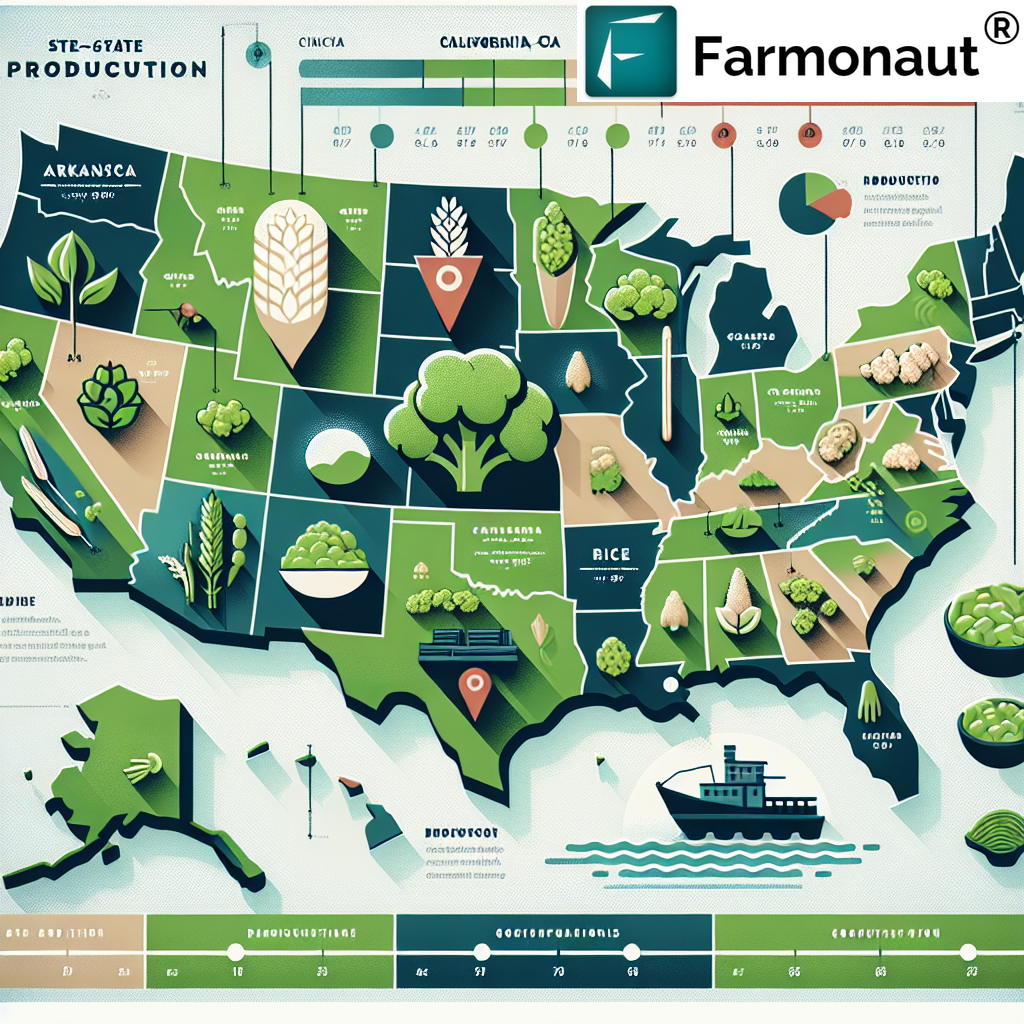

Global Production Outlook

The global agricultural exports landscape is undergoing significant changes, with various regions experiencing shifts in production patterns:

United States

The U.S. is expected to see a notable increase in corn and wheat plantings for the 2025 season. This shift is likely driven by favorable price prospects and the need to diversify crop rotations. The move away from soybeans in some areas could potentially tighten the domestic soybean supply, although this may be offset by increased production in other regions.

Brazil

The soybean production forecast for Brazil remains exceptionally strong. The country is on track to harvest a record soybean crop, which will significantly impact global supply chains and potentially put downward pressure on soybean prices worldwide. This bumper crop is likely to cement Brazil’s position as the world’s leading soybean exporter.

Ukraine

Despite ongoing geopolitical challenges, Ukraine’s agricultural sector is adapting. The country’s shift towards increased corn production at the expense of soybeans and sunflowers reflects a strategic response to market demands and agronomic considerations.

“Brazil’s substantial soybean harvest forecast is influencing global agricultural exports, affecting commodity futures trading worldwide.”

Impact on Commodity Futures Trading

The shifts in crop production and planting intentions are having a profound impact on commodity futures trading. Traders and investors are closely monitoring these developments, as they have significant implications for price movements and trading strategies:

- Wheat Futures: Despite recent stabilization, wheat futures have experienced considerable volatility. The increased U.S. planting intentions for wheat could potentially lead to a more bearish outlook in the medium term, although weather conditions and global demand will continue to play crucial roles in price determination.

- Corn Futures: The expected increase in U.S. corn acreage is likely to put pressure on corn futures prices. However, strong demand from ethanol producers and the livestock sector could provide some support to prices.

- Soybean Futures: The record Brazilian harvest and potential reduction in U.S. soybean acreage are creating a complex picture for soybean futures. While increased supply from Brazil may exert downward pressure on prices, any weather-related issues in key producing regions could quickly reverse this trend.

For stakeholders in the agricultural sector, understanding these market dynamics is crucial for effective risk management and strategic planning. Tools like Farmonaut’s satellite-based crop monitoring can provide valuable insights into crop health and yield potential, helping farmers and traders make more informed decisions in this volatile market environment.

Weather and Climate Considerations

Weather conditions remain a critical factor in shaping agricultural markets. Recent improvements in crop weather across South America have eased concerns about production threats in the near term. However, long-term climate trends and the potential for extreme weather events continue to pose risks to global crop production:

- South America: Favorable weather conditions have supported a strong harvest outlook, particularly for soybeans in Brazil. This positive outlook has been a key factor in recent market movements.

- United States: The passing of cold snaps has alleviated immediate concerns about winter wheat damage. However, spring planting conditions will be crucial in determining the success of corn and soybean crops.

- Russia: As a major wheat exporter, weather conditions in Russia’s key growing regions will be closely monitored. Recent cold snaps have not caused significant damage, but the potential for weather-related disruptions remains a concern for global wheat markets.

The ability to accurately monitor and predict weather patterns is becoming increasingly important for farmers and agricultural businesses. Advanced technologies, such as those offered by Farmonaut, can provide real-time insights into crop health and soil moisture levels, helping farmers adapt to changing weather conditions and optimize their crop management strategies.

Geopolitical Factors and Trade Dynamics

The global agricultural market is increasingly influenced by geopolitical factors and trade policies. Recent developments in international trade relations are having significant impacts on commodity markets:

U.S. Tariffs and Trade Relations

The announcement of new U.S. tariffs on Mexican and Canadian goods, along with additional duties on Chinese imports, has introduced new uncertainties into the agricultural markets. These agricultural tariff impacts could potentially lead to retaliatory measures against U.S. agricultural exports, affecting demand for U.S. crops in key international markets.

Currency Fluctuations

The strengthening of the U.S. dollar has been a contributing factor to recent price declines in agricultural commodities. A stronger dollar typically makes U.S. exports less competitive in international markets, potentially dampening demand for U.S. agricultural products.

Global Supply Chains

The ongoing reconfiguration of global supply chains, partly driven by geopolitical tensions and the aftermath of the COVID-19 pandemic, continues to impact agricultural trade flows. Countries are increasingly focusing on food security and diversifying their sources of agricultural imports, which could lead to shifts in traditional trade patterns.

For agricultural businesses operating in this complex global environment, staying informed about geopolitical developments and their potential impacts on trade is crucial. Farmonaut’s comprehensive data analytics and market insights can help stakeholders navigate these challenges and make informed decisions.

Explore Farmonaut’s API for advanced agricultural data analytics

Comparative Analysis of Major Crops

To provide a clear overview of the current market situation for the three major crops we’ve been discussing, we’ve compiled a comparative analysis table:

| Crop Type | US Planting Forecast (estimated acreage) | Global Production Outlook (estimated million metric tons) | Price Trend | Key Influencing Factors | Major Producing Countries | Export Forecast (estimated million metric tons) |

|---|---|---|---|---|---|---|

| Wheat | Increase expected | 780 | Volatile, recent decline | Weather, increased US plantings, geopolitical factors | China, India, Russia | 205 |

| Corn | Significant increase expected | 1,200 | Declining, but with potential for recovery | Increased US plantings, ethanol demand, livestock feed demand | USA, China, Brazil | 180 |

| Soybeans | Decrease expected | 390 | Slight increase, but overall bearish | Record Brazilian harvest, reduced US plantings, global demand | Brazil, USA, Argentina | 170 |

This table provides a snapshot of the current market dynamics for wheat, corn, and soybeans. It highlights the interplay between production forecasts, price trends, and the various factors influencing each crop’s market outlook. Understanding these relationships is crucial for farmers, traders, and policymakers as they navigate the complex landscape of global agricultural markets.

Implications for Farmers and Agricultural Businesses

The shifting landscape of crop production and market dynamics has significant implications for farmers and agricultural businesses worldwide:

Planting Decisions

Farmers are faced with critical decisions about crop allocation for the upcoming planting season. The expected shift towards increased corn and wheat production in the U.S. suggests that many farmers are responding to market signals and potential profit opportunities. However, these decisions must be balanced against factors such as soil health, crop rotation requirements, and long-term sustainability considerations.

Risk Management

With increased market volatility, effective risk management strategies are becoming more crucial than ever. Farmers and agribusinesses may need to consider diversifying their crop portfolios, utilizing futures contracts, or exploring other financial instruments to hedge against price fluctuations.

Technology Adoption

The complexity of modern agricultural markets underscores the importance of data-driven decision-making. Advanced technologies, such as those offered by Farmonaut, can provide farmers with real-time insights into crop health, weather patterns, and market trends. These tools can be invaluable in optimizing planting strategies, resource allocation, and harvest timing.

Access Farmonaut’s API Developer Docs for integrating agricultural data into your systems

The Role of Technology in Modern Agriculture

As the agricultural sector faces increasingly complex challenges, technology is playing a crucial role in helping farmers and businesses adapt and thrive:

Satellite-Based Crop Monitoring

Advanced satellite imaging technology, like that employed by Farmonaut, allows for real-time monitoring of crop health across vast areas. This technology can provide early warning signs of pest infestations, drought stress, or other issues that might affect crop yields.

AI and Machine Learning

Artificial intelligence and machine learning algorithms are being used to analyze vast amounts of agricultural data, providing insights into optimal planting times, fertilizer application rates, and harvest forecasts. These technologies can help farmers make more informed decisions and improve overall farm efficiency.

Precision Agriculture

Precision agriculture technologies, including GPS-guided machinery and variable rate application systems, allow farmers to optimize resource use and minimize waste. This not only improves profitability but also promotes more sustainable farming practices.

By leveraging these technological advancements, farmers and agricultural businesses can better navigate the challenges posed by market volatility, climate change, and evolving global trade dynamics.

Looking Ahead: Future Trends and Considerations

As we look to the future of global agricultural markets, several key trends and considerations are likely to shape the industry:

Climate Change Adaptation

The ongoing impacts of climate change will require continued adaptation in farming practices. This may include the development of more drought-resistant crop varieties, changes in planting schedules, and increased investment in irrigation infrastructure.

Sustainable Agriculture

There is growing emphasis on sustainable farming practices that minimize environmental impact while maintaining or improving productivity. This trend is likely to influence both farming methods and consumer preferences in the coming years.

Technological Innovation

Continued advancements in agricultural technology, including the use of drones, IoT devices, and blockchain for supply chain traceability, are expected to drive further efficiencies and transparency in the sector.

Changing Global Diets

Shifts in global dietary preferences, including increased demand for plant-based proteins, could have significant impacts on crop production patterns and market dynamics.

For stakeholders in the agricultural sector, staying informed about these trends and leveraging advanced tools and technologies will be crucial for success in an increasingly complex and dynamic global market.

Conclusion

The global agricultural commodity outlook is characterized by significant shifts in US crop planting intentions, volatile market trends, and the interplay of numerous factors including weather patterns, geopolitical events, and technological advancements. As we’ve explored in this analysis, the expected increases in corn and wheat plantings in the US, coupled with a record soybean harvest in Brazil, are reshaping the landscape of international grain markets.

These changes present both challenges and opportunities for farmers, traders, and agricultural businesses worldwide. The ability to adapt to changing market conditions, leverage advanced technologies for decision-making, and implement effective risk management strategies will be crucial for success in this dynamic environment.

As we move forward, the agricultural sector will continue to evolve in response to global challenges such as climate change, changing dietary preferences, and the need for sustainable farming practices. Staying informed about market trends, embracing technological innovations, and maintaining flexibility in crop production strategies will be key to navigating the complexities of the global agricultural market.

For those looking to gain a competitive edge in this rapidly changing landscape, tools like Farmonaut’s satellite-based crop monitoring and AI-driven insights can provide valuable support in making informed decisions and optimizing agricultural operations.

FAQs

- How are US crop planting shifts likely to impact global wheat prices?

The expected increase in US wheat plantings could potentially lead to increased supply, which may put downward pressure on global wheat prices. However, other factors such as weather conditions and global demand will also play significant roles in price determination. - What is driving the shift from soybean to corn production in the US?

This shift is likely driven by a combination of factors, including favorable price prospects for corn, the need for crop rotation, and potentially lower input costs for corn compared to soybeans. - How might Brazil’s record soybean harvest affect global soybean markets?

Brazil’s bumper soybean crop is likely to increase global supply, potentially putting downward pressure on soybean prices. This could affect the competitiveness of soybean exports from other major producing countries. - What role do agricultural tariffs play in shaping global crop markets?

Agricultural tariffs can significantly impact trade flows and market dynamics. They can affect the competitiveness of exports, influence domestic production decisions, and potentially lead to shifts in global supply chains. - How can farmers use technology to adapt to changing market conditions?

Farmers can leverage technologies such as satellite-based crop monitoring, AI-driven analytics, and precision agriculture tools to optimize their planting decisions, improve crop management, and respond more effectively to market signals.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Farmonaut Subscriptions