Maximizing Farmland Asset Performance: Agribusiness Investment Strategies for Ranch Real Estate

“Institutional investors are reshaping farmland asset management, with 15% annual growth in agricultural real estate portfolios.”

In the ever-evolving landscape of real estate investment, a new frontier has emerged that’s capturing the attention of savvy investors and financial institutions alike: farmland and ranch real estate. As we delve into this comprehensive analysis of agribusiness investment strategies, we’ll explore how the convergence of traditional agriculture with modern financial practices is reshaping the way we view and manage farmland assets.

At the forefront of this transformation is Tejon Ranch Co. (NYSE:TRC), a major player in the real estate development and agribusiness sector. Recent stock movements and investment activities surrounding this company offer valuable insights into the current state and future potential of agricultural land investments.

The Rise of Institutional Investors in Agriculture

One of the most significant trends we’re observing is the increased participation of institutional investors in the agricultural sector. Hedge funds, private equity firms, and other financial institutions are turning their attention to farmland as a viable and potentially lucrative investment option. This shift is driven by several factors:

- Stability of agricultural land values

- Potential for steady cash flows from farming operations

- Diversification benefits for investment portfolios

- Long-term appreciation of land values

The case of American Century Companies Inc.’s recent investment in Tejon Ranch Co. exemplifies this trend. By increasing its holdings by 12.0% in the fourth quarter, acquiring an additional 4,672 shares, American Century Companies Inc. now owns 43,636 shares of Tejon Ranch, valued at $694,000. This move underscores the growing confidence institutional investors have in the agricultural real estate sector.

Diversified Real Estate Portfolios: The New Norm

As institutional investors reshape the farmland asset management landscape, we’re witnessing a shift towards more diversified real estate portfolios. This strategy aims to balance risk and reward by incorporating various types of agricultural properties, including:

- Crop lands

- Pastures for livestock

- Orchards and vineyards

- Timberlands

Tejon Ranch Co.’s diverse portfolio, which includes commercial/industrial real estate development, resort/residential real estate development, mineral resources, farming, and ranch operations, serves as a prime example of this approach. This diversification not only spreads risk but also allows investors to capitalize on various revenue streams within the agricultural sector.

The Role of Technology in Farmland Asset Management

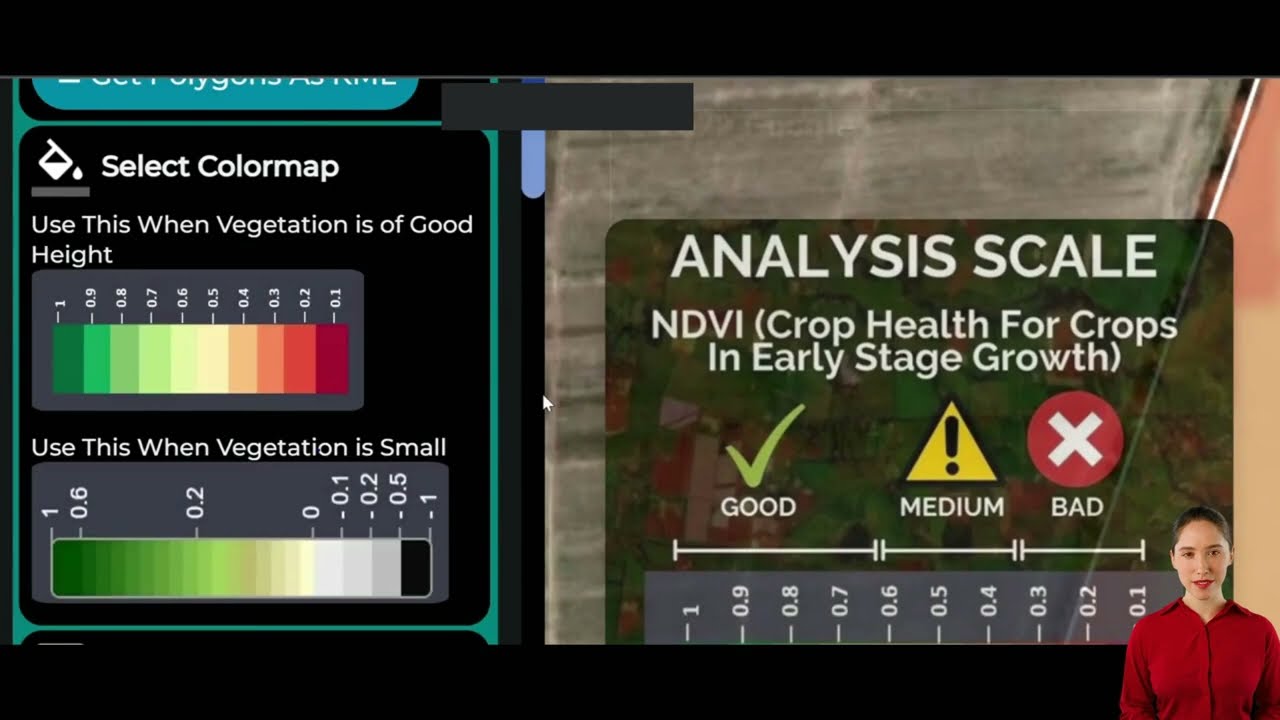

In the digital age, technology plays a crucial role in optimizing farmland asset performance. Advanced tools and platforms are revolutionizing how we manage and monitor agricultural investments. One such innovative solution is provided by Farmonaut, a cutting-edge agricultural technology company.

Farmonaut offers satellite-based farm management solutions that enable investors and farm managers to:

- Monitor crop health in real-time

- Optimize resource allocation

- Make data-driven decisions to improve yields

- Track environmental impact through carbon footprinting

By leveraging technologies like satellite imagery and artificial intelligence, investors can gain unprecedented insights into their farmland assets, potentially leading to improved performance and returns.

Mineral Resources: An Often Overlooked Asset

When discussing farmland investments, it’s crucial not to overlook the potential value of mineral resources. Many agricultural properties may have untapped mineral deposits that can significantly enhance their value. Tejon Ranch Co.’s inclusion of mineral resources as one of its business segments highlights the importance of this often-overlooked aspect of farmland investment.

Investors should consider:

- Conducting geological surveys of potential investment properties

- Understanding mineral rights laws in the region

- Evaluating the potential impact of mineral extraction on agricultural operations

- Assessing the long-term value proposition of mineral resources

By factoring in mineral resource potential, investors can uncover hidden value in their farmland assets and potentially diversify their revenue streams.

Farming Revenue Analysis: Key to Successful Agribusiness Investments

A thorough understanding of farming revenue is essential for making informed investment decisions in the agricultural sector. This analysis should consider various factors, including:

- Crop yields and market prices

- Operating costs and efficiency

- Government subsidies and support programs

- Weather patterns and climate risks

Tejon Ranch Co.’s farming segment provides a real-world example of how agricultural operations contribute to overall business performance. By closely analyzing farming revenues, investors can better assess the potential returns and risks associated with farmland investments.

“Hedge funds have increased agriculture investments by 30% in the past year, signaling new opportunities in the sector.”

Ranch Property Market Trends: A Growing Opportunity

The ranch property market has been experiencing significant growth and transformation in recent years. Several factors are driving this trend:

- Increased demand for recreational properties

- Growing interest in sustainable and organic farming practices

- Potential for eco-tourism and agritourism

- Appreciation of land values in prime locations

Tejon Ranch Co.’s resort/residential real estate development segment capitalizes on these trends, demonstrating the potential for value creation beyond traditional farming activities. Investors looking to maximize their farmland asset performance should consider the broader potential of ranch properties, including opportunities for development and alternative land uses.

Hedge Funds and Agriculture Investments: A Growing Trend

The increased interest of hedge funds in agriculture investments is a trend worth noting. This shift signifies the sector’s potential for attractive returns and its role in portfolio diversification. Some key reasons behind this trend include:

- Global food demand growth

- Inflation hedging properties of agricultural assets

- Technological advancements improving agricultural productivity

- Potential for value-add strategies in farmland management

As more hedge funds enter the agricultural investment space, we can expect to see increased competition for prime farmland assets and potentially more sophisticated management strategies being employed.

Key Financial Metrics for Agribusiness Investments

When evaluating agribusiness investments like Tejon Ranch Co., it’s essential to consider several key financial metrics:

- Market Capitalization: Tejon Ranch Co.’s market cap of $428.95 million provides insight into the company’s size and market valuation.

- Equity Positions: The ownership structure, with institutional investors holding 60.63% of the company’s stock, indicates strong institutional confidence.

- Net Margins: Tejon Ranch reported a negative net margin of 0.57%, highlighting the importance of understanding profitability challenges in the sector.

- Debt-to-Equity Ratio: With a ratio of 0.12, Tejon Ranch demonstrates a relatively low level of leverage, which can be viewed favorably by risk-averse investors.

These metrics provide a snapshot of the company’s financial health and can serve as a starting point for analyzing potential agribusiness investments.

Sustainable Farming Practices: A Value-Add Strategy

In today’s environmentally conscious market, implementing sustainable farming practices can significantly enhance the value of farmland assets. Investors should consider:

- Organic farming certifications

- Regenerative agriculture techniques

- Water conservation methods

- Renewable energy integration

By adopting sustainable practices, investors can not only improve the long-term productivity of their farmland but also potentially command premium prices for their products. Farmonaut’s carbon footprinting tool can be invaluable in monitoring and optimizing the environmental impact of farming operations.

Real Estate Investment Strategies for Farmland Assets

When it comes to investing in farmland and ranch real estate, several strategies can be employed to maximize asset performance:

- Direct Land Ownership: Purchasing farmland outright for long-term appreciation and rental income.

- Agricultural REITs: Investing in Real Estate Investment Trusts specializing in farmland properties.

- Agribusiness Stocks: Buying shares in publicly traded agricultural companies like Tejon Ranch Co.

- Private Equity Funds: Participating in funds that acquire and manage portfolios of agricultural properties.

- Crowdfunding Platforms: Investing in fractional ownership of farmland through online platforms.

Each strategy comes with its own set of risks and potential rewards, and investors should carefully consider their goals and risk tolerance when choosing an approach.

Comparative Analysis of Farmland Investment Strategies

| Investment Strategy | Potential Returns | Risk Level | Diversification Benefits | Institutional Investor Interest |

|---|---|---|---|---|

| Direct Land Ownership | 8-12% | Medium | 4 | High |

| Agricultural REITs | 6-10% | Low-Medium | 3 | Medium |

| Agribusiness Stocks | 10-15% | High | 2 | High |

| Private Equity Funds | 12-18% | High | 5 | High |

| Crowdfunding Platforms | 7-11% | Medium | 3 | Low-Medium |

The Role of Technology in Optimizing Farmland Investments

As we continue to explore strategies for maximizing farmland asset performance, it’s crucial to highlight the transformative role of technology in this sector. Advanced agricultural technologies are not just improving farm operations; they’re also providing investors with powerful tools for asset management and decision-making.

Farmonaut’s suite of technologies offers several key advantages for farmland investors:

- Satellite-Based Crop Health Monitoring: Real-time insights into vegetation health and soil moisture levels allow for proactive management of crop health, potentially leading to improved yields and asset performance.

- AI-Driven Advisory Systems: Personalized farm management strategies based on data analysis can help optimize resource allocation and improve overall farm productivity.

- Blockchain-Based Traceability: Enhancing supply chain transparency and product authenticity can add value to agricultural products and potentially command premium prices in the market.

- Fleet and Resource Management: Efficient management of agricultural machinery and resources can lead to significant cost savings and improved operational efficiency.

By leveraging these technologies, investors can gain a competitive edge in farmland asset management, potentially leading to superior returns and more sustainable farming practices.

Risk Management in Farmland Investments

While farmland investments offer numerous benefits, they also come with inherent risks that investors must carefully manage. Some key risk factors include:

- Weather and climate variability

- Market price fluctuations for agricultural commodities

- Regulatory changes affecting farming practices or land use

- Operational challenges in farm management

To mitigate these risks, investors can employ several strategies:

- Geographical Diversification: Investing in farmland across different regions can help spread weather-related risks.

- Crop Diversification: Growing a variety of crops can reduce exposure to price fluctuations in any single commodity.

- Insurance: Crop insurance and other risk management tools can provide financial protection against unforeseen events.

- Technology Adoption: Utilizing advanced farming technologies, like those offered by Farmonaut, can help optimize operations and reduce risks associated with resource management and crop health.

- Crop Loan and Insurance Solutions: Leveraging satellite-based verification for crop loans and insurance can improve access to financing while reducing risks for both farmers and lenders.

The Future of Farmland Asset Management

As we look to the future of farmland asset management, several trends are likely to shape the industry:

- Increased Institutional Investment: We expect to see continued growth in institutional investment in the agricultural sector, potentially leading to more sophisticated management practices and increased competition for prime assets.

- Technological Integration: The adoption of advanced technologies like those offered by Farmonaut will likely become standard practice, enabling more precise and efficient farmland management.

- Sustainability Focus: Growing emphasis on sustainable and regenerative farming practices will likely influence investment decisions and potentially create new value streams for environmentally conscious operations.

- Alternative Revenue Streams: Farmland investors may increasingly explore alternative revenue sources such as agritourism, renewable energy generation, and carbon credit markets.

By staying attuned to these trends and leveraging the latest technologies and management strategies, investors can position themselves to maximize the performance of their farmland assets in the years to come.

Conclusion: Embracing the Future of Agribusiness Investments

As we’ve explored throughout this analysis, the landscape of farmland and ranch real estate investments is evolving rapidly. The convergence of traditional agriculture with modern financial practices and cutting-edge technologies is creating new opportunities for investors to maximize the performance of their farmland assets.

Key takeaways for investors considering farmland and agribusiness investments include:

- The growing interest of institutional investors in the agricultural sector

- The importance of diversified real estate portfolios that include various types of agricultural properties

- The transformative role of technology in optimizing farmland management and performance

- The potential value of mineral resources and alternative land uses in enhancing asset value

- The need for thorough farming revenue analysis and understanding of key financial metrics

- The importance of sustainable farming practices in creating long-term value

By leveraging advanced technologies like those offered by Farmonaut, employing sophisticated investment strategies, and staying attuned to market trends, investors can position themselves to capitalize on the promising opportunities in the farmland and agribusiness sector.

As we move forward, the integration of data-driven insights, sustainable practices, and innovative management approaches will be key to maximizing farmland asset performance and ensuring the long-term success of agribusiness investments.

FAQ Section

Q: What are the main advantages of investing in farmland and ranch real estate?

A: Farmland investments offer potential benefits such as stable asset values, steady cash flows, portfolio diversification, and long-term appreciation. Additionally, they can provide a hedge against inflation and food security concerns.

Q: How are institutional investors changing the farmland investment landscape?

A: Institutional investors are bringing more capital, sophisticated management practices, and advanced technologies to the sector. This is leading to increased competition for prime assets and potentially higher standards of farmland management.

Q: What role does technology play in modern farmland asset management?

A: Technology, such as Farmonaut’s satellite-based solutions, plays a crucial role in optimizing farm operations, monitoring crop health, managing resources efficiently, and providing data-driven insights for decision-making.

Q: How can investors mitigate risks associated with farmland investments?

A: Risk mitigation strategies include geographical and crop diversification, use of insurance products, adoption of advanced farming technologies, and staying informed about market trends and regulatory changes.

Q: What are some emerging trends in farmland asset management?

A: Emerging trends include increased focus on sustainability, exploration of alternative revenue streams like agritourism, integration of advanced technologies, and growing interest from institutional investors.

Farmonaut Subscriptions

Earn With Farmonaut

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

For more information on Farmonaut’s innovative solutions:

For developers interested in integrating Farmonaut’s technology: