State Farm Drone Insurance: 7 Powerful Ways to Protect Farms

Introduction: The Rise of Drone Technology and Insurance in Modern Farming

Innovation is transforming every acre of the agricultural sector, and drone technology sits at the epicenter of this revolution. As farmers increasingly integrate drones in farming for aerial crop monitoring, soil analysis, and livestock management, they unlock new levels of efficiency and precision. However, incorporating these advanced capabilities brings not just opportunities but also new types of risks—making comprehensive insurance coverage indispensable.

This blog takes a deep dive into “State Farm Drone Insurance: 7 Powerful Ways to Protect Farms,” exploring why and how insurance is critical to effective risk management for agricultural drone operations. You’ll discover the pivotal role of industry leaders like State Farm, learn about the nuances of drone-specific policies, and gain actionable advice on best practices for liability and property protection. We also introduce key tools from Farmonaut—a pioneer in satellite-based farm management—to show how you can harness both precision agriculture technology and robust insurance for the ultimate in crop safety and operational resilience.

If you’re a farmer, an agribusiness manager, or simply interested in the future of agricultural insurance, you’re in the right place. Let’s explore these 7 powerful protection strategies and how they can shape the future of farming across the United States.

State Farm’s Engagement with Drone Technology: Bridging Innovation and Protection

State Farm stands out in the evolving agricultural insurance sector for its ongoing engagement with cutting-edge drone technology. In 2015, State Farm made history by being the first insurance company to gain official permission from the Federal Aviation Administration (FAA) to conduct commercial drone operations. This was a breakthrough in understanding safety concerns within both insurance and aviation regulation.

Collaborating with the Mid-Atlantic Aviation Partnership at Virginia Tech, State Farm conducted extensive aerial test flights to assess potential risks and set new standards for drone safety.

- Pioneering Use: First allowed by the FAA to use drones for commercial inspections on farms and ranches.

- Expanding Initiatives: By 2017, State Farm extended these operations to include efficient roof inspections—relevant after extreme weather events.

- Disaster Response: After Hurricanes Florence and Michael, State Farm received a crucial national catastrope waiver. This allowed the company to conduct Beyond Visual Line of Sight (BVLOS) and Operations Over People (OOP), dramatically accelerating damage assessment and response.

By efficiently assessing post-storm property damage and deploying resources where needed most, State Farm has exemplified a strong commitment to both customer benefit and technological advancement in agricultural insurance (source).

Drone Insurance Coverage for Agricultural Operations: Why Coverage is Critical

The adoption of drones for integrating drones in farming is accelerating. Tasks like crop monitoring, soil analysis, and livestock assessment provide valuable data—but they also introduce new liabilities. Many standard farm or ranch insurance policies do not explicitly cover drones. While State Farm’s core agricultural insurance covers household personal property, farm personal property, and liability, dedicated insurance for agricultural drone operations is usually not part of the basic package (view policy details).

As a result, if you are running drone operations on your farm, it is essential to:

- Consult your insurance agent to clarify exclusions or gaps in existing coverages

- Investigate options for comprehensive drone insurance policies that include both hull (physical damage) protection and liability coverage

- Understand potential scenarios where insurance defers responsibility (e.g., non-FAA compliant flight operations)

Liability coverage is especially vital with drones. If a drone injures someone, causes property damage, or triggers a chemical incident (when applying pesticides/herbicides), you could face costly legal claims. Without the right insurance, these could be the farmer’s burden alone (reference article).

Specialized Drone Insurance Policies for Farmers: Types of Coverage You Need

General farm insurance policies may not suffice for drone-specific risks. Today’s agricultural drone coverage often includes specialized policies designed to meet the unique challenges and opportunities in modern farming:

- Hull Coverage: Protects against physical damage to the drone itself, whether from crashes, loss, theft, or environmental factors.

- Liability Coverage: Provides protection against claims from bodily injury or property damage caused by drone activities—critical for farm drone liability protection.

- Chemical Drift/Chemical Coverage: For drones used in spraying operations, this covers damage or injury from chemical exposure or drifting treatments.

- Cybersecurity / Data Coverage: Covers the cost of data loss, cyberattack, or privacy-related claims when drones are harnessed for data collection and transmission.

- Personal Accident Coverage: Covers operator injuries occurring during drone operation or launch.

Cost Breakdown: Specialized comprehensive drone insurance policies typically range from $2,500 to $6,000 annually for a single drone in agricultural operations—a significant drop from previous rates of $8,000 to $11,000 (more info). This reflects advances in risk models, wider adoption, and improved safety standards.

Factors influencing policy costs:

- Drone value and size

- Intended use (e.g., pesticide application vs. aerial surveying)

- Coverage limits chosen

- Experience and training of the operator

Comparison Table of Key Insurance Coverage Areas for Farm Drone Operations

| Coverage Type | Estimated Coverage Limit | Estimated Annual Premium | Key Benefits | Applicability |

|---|---|---|---|---|

| Liability Protection | $100,000 – $1M+ | $500 – $2,200 |

|

Individual Farmers, Agribusiness |

| Property Protection (Drone Hull Insurance) |

Up to $100,000 | $300 – $1,500 |

|

Individual Farmers, Agribusiness |

| Personal Injury | $25,000 – $500,000 | $120 – $400 |

|

Drone Operators |

| Equipment Replacement | $50,000 – $250,000 | $220 – $800 |

|

Agribusiness, Co-ops |

| Crop Data Coverage | $10,000 – $50,000 | $150 – $350 |

|

Precision Ag Users |

| Privacy Protection | $50,000 – $200,000 | $100 – $300 |

|

All Operators |

| Cybersecurity | $50,000 – $150,000 | $250 – $700 |

|

Precision Ag & Data-Driven Farms |

Risk Management for Drone Operations: 7 Powerful Practices to Reduce Insurance Costs

Using drones brings remarkable advantages—real-time insights, enhanced data collection, and greater crop protection. But these benefits come with added responsibility, especially for proper risk management. Implement the following best practices to both reduce risk and secure the most favorable insurance terms:

- Maintenance & Safety Practices: Regularly inspect and maintain drones. Include battery health checks, firmware updates, and pre-flight inspections. Store UAVs in secure and dry environments.

- FAA Regulations & Operator Certification: Comply with FAA rules—maintain visual line of sight, fly below 400 feet, and register all commercial drones. Ensure all pilots are properly certified.

- Hull & Liability Protection: Verify with your insurer if your policy covers “farm property and drone protection” or if supplemental “farm drone liability protection” is needed.

- Standardized Operating Procedures: Develop and document procedures for launches, landings, and emergency scenarios. This minimizes error and strengthens claims in case of an incident.

- Comprehensive Operator Training: Require thorough operator training (e.g., through drone pilot schools or manufacturer programs).

- Risk Management Planning: Prepare for risks unique to agricultural drones, such as chemical drift, wildlife interference, weather hazards, and privacy issues.

- Computational Data Management: Use secure, compliant data systems—especially crucial when storing and transmitting crop monitoring data.

By implementing these strategies, farms and agribusinesses can not only reduce insurance premiums but also build stronger, safer, and more resilient drone operations.

Farmonaut’s Precision Agriculture Technology & Insurance: Enhancing Safety and Data-Driven Decisions

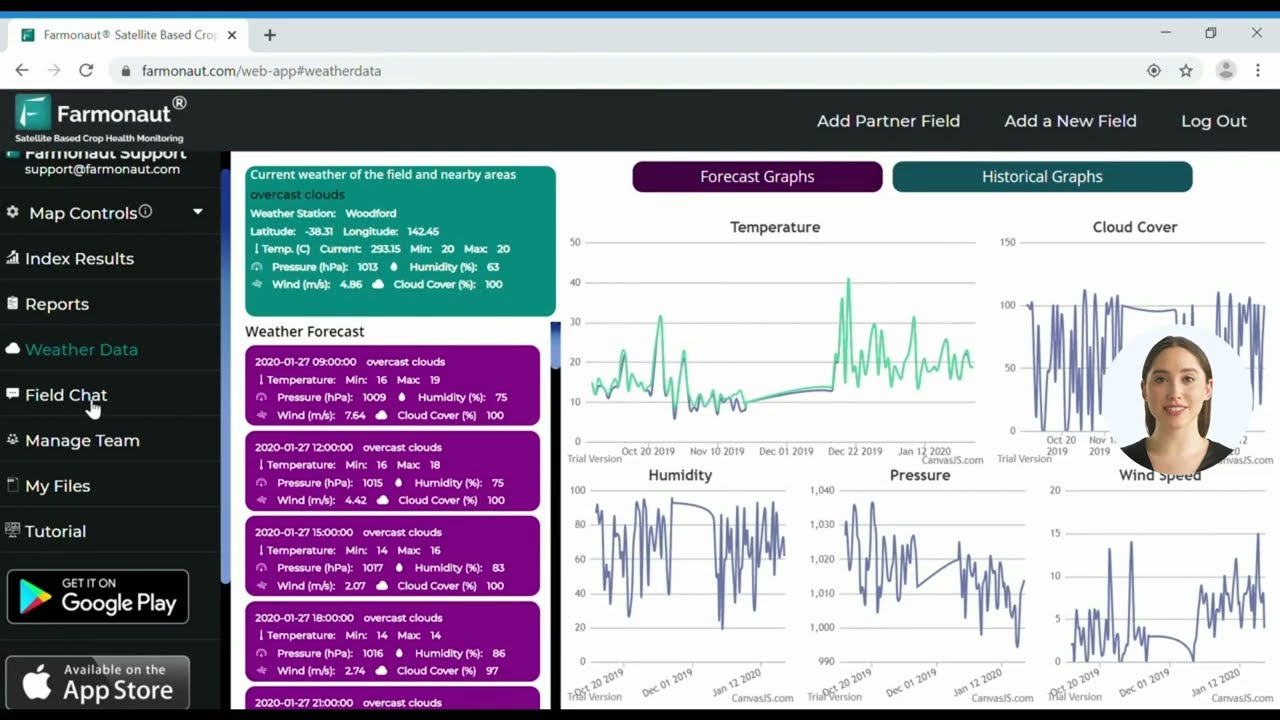

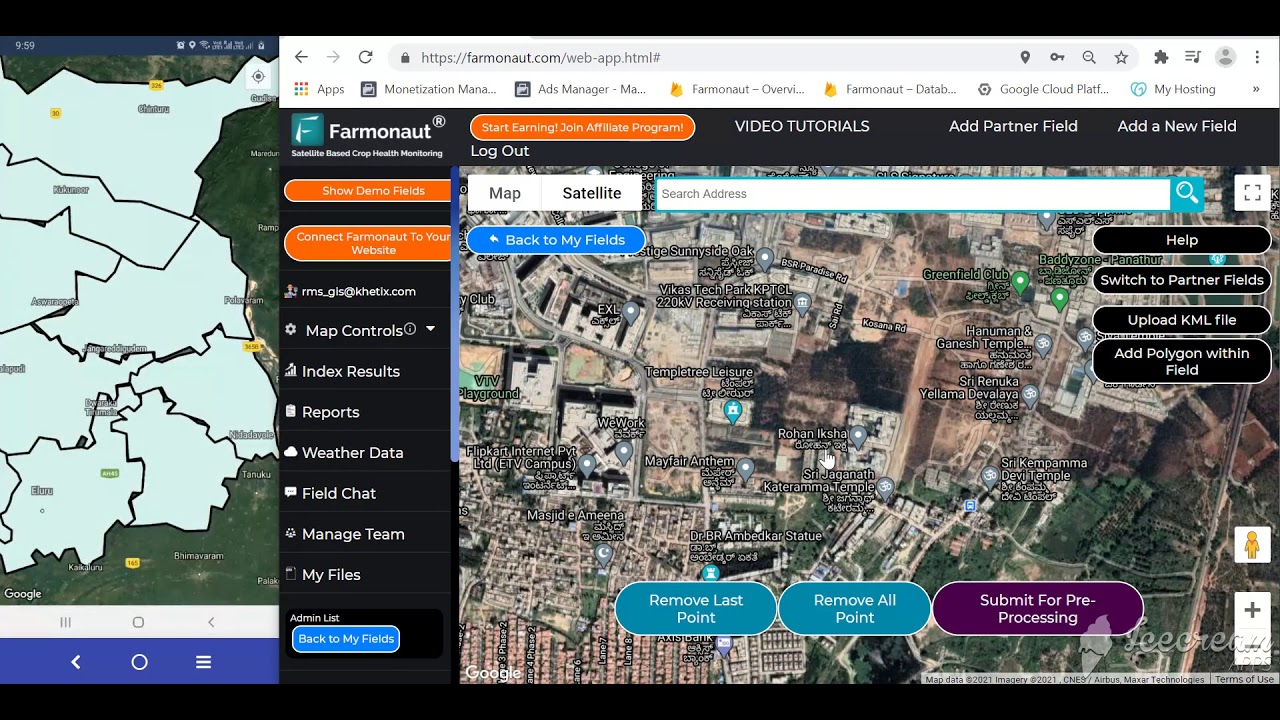

At Farmonaut, we recognize that precision agriculture technology insurance is most effective when paired with robust, data-driven risk management. Drones excel at monitoring crops and capturing real-time data—but this data must be intelligently managed and protected. Here’s where we deliver unique advantages:

- Satellite-Based Crop Health Monitoring: Our Android, iOS, and web app platform leverages multispectral satellite imagery for daily or weekly crop health analysis. Farmers receive actionable insights to optimize irrigation, fertilizer use, and pest control—helping minimize loss before it happens.

- Jeevn AI Advisory: Real-time AI-based advisories transform satellite data into actionable crop management strategies—helping mitigate risks from weather swings, pests, or soil health issues.

- Blockchain-Based Traceability: Our Traceability solution ensures that crop data—from drone or satellite collection—remains transparent, secure, and fraud-resistant throughout the supply chain. This supports regulatory compliance and insurance verifiability.

- Fleet & Resource Management: Our fleet management tools help agribusinesses streamline machinery and logistics, reducing cost and improving safety across all assets (including drones).

- Carbon Footprinting & Sustainability: Track carbon emissions and optimize resource allocation using satellite-based monitoring to strengthen sustainability and compliance.

- App, API, and Developer Tools: Access our API (for farm data; developer docs) to automate and scale data flows into insurance, compliance, or agri-management systems.

By integrating drones in farming with our platform, farms gain more accurate assessments and insights—resulting in a lower risk profile, smoother insurance claims, and improved long-term resilience.

Farmonaut’s Insurance-Related Solutions and Subscription Options

Farmonaut uniquely supports the insurance journey for farms and agribusinesses, especially those relying on drone-based crop monitoring and advanced digital data collection. Here’s how our solutions can work in synergy with your risk management and insurance needs:

- Crop Loan and Insurance Verification: We provide satellite-based field verification for crop loan and insurance applications, reducing fraud and expediting approvals for both banks and farmers.

- Large Scale Farm Management: Ideal for cooperatives and agribusinesses managing vast assets, our platform supports custom mapping, reporting, and drone fleet integration.

- Crop Plantation & Forest Advisory: Make the most of both satellites and drones for tailored agronomic recommendations at every growing stage—including insurance-relevant health signals.

Use the links above to access our solutions. You can subscribe or get started right away with our dynamic pricing plans for all scales of operation below:

Frequently Asked Questions (FAQ) about Farm Drone Insurance Coverage

1. Do standard farm insurance policies cover drone operations?

Most standard farm and ranch insurance policies do not explicitly cover drones. It’s critical to consult your insurance agent for details and secure specialized drone insurance for farmers for both liability and equipment protection.

2. What is “hull coverage” in agricultural drone insurance?

“Hull coverage” refers to insurance protecting physical damage to the drone itself, including crashes, theft, or weather events. It is a key component of comprehensive drone insurance policies.

3. How does liability protection work for drones in farming?

Liability protection covers accidental property damage or bodily injury caused by drone operations. This safeguards farmers from lawsuits, regulatory penalties, and potential bankruptcy from major incidents.

4. How can precision agriculture technology help reduce insurance costs?

By implementing reliable data collection tools like Farmonaut’s satellite crop monitoring, farmers can reduce operational risks, prove compliance, and provide better documentation for insurers, often leading to lower premiums.

5. What should I do before flying drones commercially for farm purposes?

- Ensure FAA registration and pilot certification

- Obtain the appropriate drone insurance for farmers

- Check that your coverage meets the intended scope (e.g., crop spraying, aerial imaging, livestock management)

6. Are there insurance options for data loss or cyberattacks on farm drones?

Yes, robust agricultural drone coverage can include cybersecurity and data loss components to protect critical crop data and farm operational continuity.

7. Can I use Farmonaut data for insurance claims?

Yes. Satellite-based crop health data provided by Farmonaut supports insurance claims and helps demonstrate compliance or loss circumstances.

Conclusion: Protecting the Future of Farming with Drone Insurance and Technology

Integrating drones into agricultural operations unlocks extraordinary capabilities—from rapid damage assessment to smart data collection for crop and soil management. However, these advances also bring fresh risks and liabilities that traditional insurance may not address. As demonstrated by State Farm’s pioneering use and the broader industry trend, comprehensive insurance coverage—including hull, liability, chemical, and data-protection—is essential for today’s farmers and agribusinesses.

Best practices like operator training, regulatory compliance, and integration with advanced precision agriculture technology are not just recommended—they form the foundation for safer, smarter, and more successful farm operations. At Farmonaut, we bridge this gap with seamless, real-time crop monitoring, blockchain-based transparency, and fleet management solutions—giving farms the data-driven edge to thrive in a risk-conscious, tech-enabled era.

Ready to bolster your farm property and drone protection? Learn more and get started:

- Farmonaut Web & Mobile Apps

- Satellite-Based Crop Loan and Insurance Verification

- Fleet & Resource Management

- Carbon Footprint Tracking for Compliance

- Farmonaut API Access

By understanding your insurance options, integrating best safety practices, and leveraging the right technology, you can transform the risks of tomorrow into the resilience—and profitability—of today’s modern farm.