Agricultural Land Mortgages: SBI Loan Guide 2025

“SBI approved over ₹18,000 crore in agricultural land mortgages during 2023–2024, benefiting more than 60,000 Indian farmers.”

Introduction to Agricultural Land Mortgages in India 2025

The agricultural sector continues to serve as a cornerstone in India and other economies where farming employs a significant portion of the population. As we enter 2025, many farmers seek effective credit options to invest in new technologies, enhance productivity, and sustain their income through diverse activities.

Agricultural land mortgages stand out as a vital financial product, providing farmers in India and especially states with a high share of agriculture, like Punjab, Maharashtra, Tamil Nadu, and Rajasthan, with affordable, secured loan options. In this comprehensive overview, we explore the current landscape, process, rates, and best practices for leveraging an agriculture land mortgage loan SBI in 2025—ensuring growth and sustainability in Indian agriculture.

Understanding Agricultural Land Mortgages

What is an Agricultural Land Mortgage?

An agricultural land mortgage is a secured loan where farmers or landowners use their land assets as collateral to obtain credit from banks or financial institutions. By mortgaging land, borrowers access funds at relatively lower interest rates compared to most unsecured loans, which enables higher capital availability for critical seeds, fertilizers, inputs, modern equipment, irrigation facilities, and even improvement measures.

- Type: Secured mortgage with land as collateral

- Purpose: Crop production costs, purchase of equipment, farm development, irrigation setup, value addition

- Borrower: Owner-cultivators, tenant farmers with valid agreements, SHGs/JLGs (self-help or joint liability groups)

- Loan amount: Typically covers 60%–75% of land value

- Government support: Subsidized schemes and interest subventions often integrated

Why are Agricultural Land Mortgages So Popular?

Agricultural land mortgage loans provide flexible tenures aligned with seasonal crop cycles (from 3 up to 15 years), making repayment easier for farmers. The availability of substantial funds helps in both short-term (input costs) and long-term investment (infrastructure, sustainability practices).

Why Are Agricultural Land Mortgages Vital in 2025?

The agriculture sector in 2025 faces new challenges, such as climate change, input cost inflation, fluctuating commodity prices, and the constant need to invest in technology and infrastructure. Institutional credit via agricultural land mortgages helps reduce farmers’ dependence on non-institutional and often exploitative credit avenues, such as moneylenders, by providing reliable, affordable access to capital.

- Improving Farmer Productivity: Access to finance enables adoption of precision agriculture, sustainable techniques, and renewable energy for irrigation and mechanization.

- Enhance Livelihood Security: By unlocking capital, farmers can diversify income, manage risks from crop failure, and invest in ancillary activities.

- Reduce Rural Financial Vulnerability: Lower interest rates and risk-mitigated loans prevent financial traps commonly seen with informal lending.

- Facilitates Rural Growth: Increased flow of funds into agriculture supports rural infrastructure and overall economic activity.

SBI’s Role in Agricultural Credit: 2025 Overview

The State Bank of India (SBI) is the largest public sector bank and a pivotal facilitator for agricultural land mortgages in India. SBI’s agricultural finance division is backed by dedicated Rural and Agri Banking branches, specialized field officers, and seamless digital services.

- Farming Community Focus: Dedicated to supporting farmer needs–from small and marginal to medium and large farm operators.

- Large Lending Portfolio: Handles the majority share of all agri-lending in India, including agriculture land mortgage loan SBI products tailored for diverse regional requirements.

- Government Schemes: Integrates numerous government-backed interest subvention and crop insurance schemes within their loan options.

- Innovation: SBI continues to adopt latest technologies for field verification, digitized documentation, and risk mitigation.

Key Features of SBI Agriculture Land Mortgage Loan (2025)

- Loan Amount: Based on the market value of agricultural land, typically covering 60%–75% of land value. Maximum loan amount varies by location, land quality, and applicant profile.

- Interest Rates: Competitive and often subsidized as per government policies. Rates may vary from 7.5%–10.5% per annum, based on the loan category, tenure, and schemes.

- Loan Tenure: Flexible tenure extending from 3 years to 15 years for mortgage loans, allowing farmers to align repayments with farm income cycles.

- Purpose: Funds can be used for crop cultivation, purchase of tractors and machinery, irrigation facilities, construction of storage and fencing, land improvement, and even farm-based ancillary activities.

- Documentation: Streamlined process with digital submission, minimum paperwork, and fast field verification for reducing turnaround time.

- Government Schemes: Integration with priority sector lending benefits, interest subvention under PM Kisan, and crop insurance for risk mitigation.

- Repayment: Aligned with seasonal crop cycles, with options for part-prepayment and foreclosure.

- Easy Accessibility: Loans available at over 20,000+ SBI branches nationwide, catering to rural and semi-urban areas, ensuring rural communities can access financial tools as easily as possible.

Comparison Table of SBI Agricultural Land Mortgage Loan Options (2025)

| Loan Scheme Name | Maximum Loan Amount (₹ Lakhs) | Estimated Interest Rate (% p.a.) | Loan Tenure (Years) | Processing Fee (₹) | Prepayment Charges (%) | Eligibility Criteria |

|---|---|---|---|---|---|---|

| SBI Land Mortgage Agri-Term Loan | 150 | 8.25–9.75 (may vary by credit score & scheme) | 3–15 | 0.75% of loan amount, min ₹3,000 | Nil (floating), up to 2% (fixed) | Landowner/farmer, clear land title, income proof |

| SBI Kisan Credit Card (KCC) Mortgage Facility | 50 | 7.5–8.0 | 3–7 | ₹500–2,000 (scheme/region) | Nil | Landowner/cultivator, crop plan, KYC documentation |

| SBI Gold Loan (Agri Linked) | 20 | 8.6–9.5 | 1–3 | 1% of loan, min ₹2,000 | Nil | Jewelry security, basic KYC, proof of agri activity |

| SBI Agriculture Infrastructure Fund Mortgage | 500 | 7.2–8.0 (may be subsidized) | 5–15 | 1% of loan, min ₹10,000 | 0–1% | Landowner, business plan, land valuation, legal check |

SBI Agriculture Land Mortgage Loan Process: Step-by-Step Guide

Step 1: Assessing Eligibility

- Confirm legal land ownership (title deed, mutation records, and possession).

- Ensure allied activities and farming operations are conducted on said land.

Step 2: Application Submission

- Visit nearest SBI branch or use the SBI YONO app for digital/online applications.

- Download and fill the relevant loan application form from SBI’s agriculture finance portal.

Step 3: Documentation

- Submit KYC documents (Aadhaar, PAN, Voter ID), land records (title deed, RTC/7-12 extract), proof of agricultural activity, and income proof if required.

Step 4: Land & Legal Verification

- SBI conducts field verification and legal due diligence to check land ownership, value estimation, and check for encumbrances.

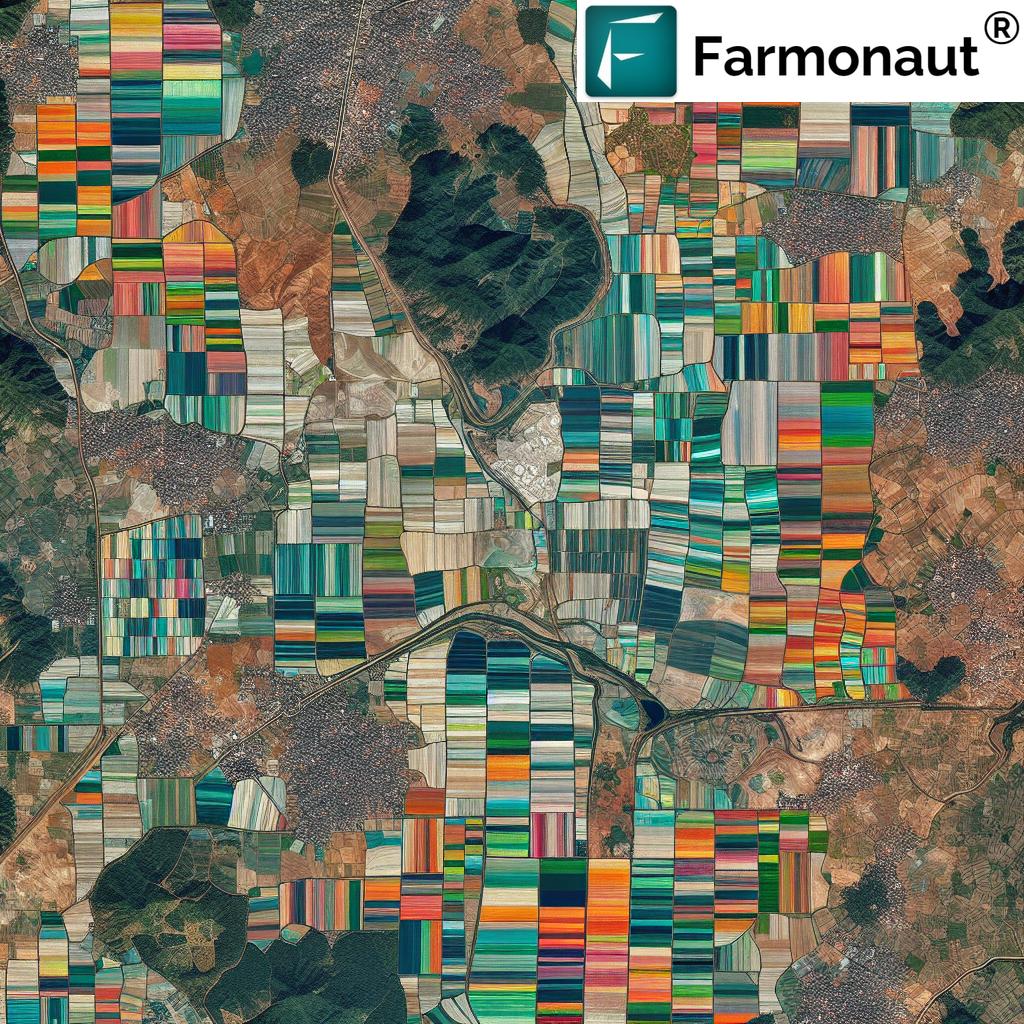

- Physical and satellite-based inspection may be used in 2025 for more transparency and reducing process time (tools like those offered by Farmonaut can make this easier for all stakeholders).

Step 5: Loan Approval and Disbursal

- On satisfactory verification, sanction letter is issued.

- After agreements and mortgage creation, funds are directly credited to borrower’s bank account or as a line of credit for approved uses.

For satellite-enabled crop and land monitoring or data integration in the loan process, financial institutions or farmers can explore Farmonaut’s Satellite API for seamless due diligence and verification. Developer documentation is also available for integration into bank workflows and agritech apps.

Experience real-time, satellite-based field monitoring and modern AI-driven analysis using Farmonaut’s web and mobile applications. Monitor crop health, detect risk areas, and gather actionable data for loan and insurance purposes.

“Agricultural land mortgage loan interest rates in India averaged 8.5% in 2024, with maximum tenure up to 15 years.”

Interest Rates, Repayment, and Charges

Interest rates for agricultural land mortgages in 2025 remain highly competitive due to ongoing government support and widespread institutional competition. Here’s what farmers and stakeholders can expect:

- Standard Interest Range: 7.2%–10.5% p.a., with further reductions available under some government schemes.

- Repayment Options: Structured to align with crop cycles; options for quarterly, half-yearly, or annual EMI based on farm activity cash flow.

- Prepayment Charges: Nil or minimal (mainly only for fixed-rate loans); floating-rate loans usually have zero foreclosure penalty.

- Processing Fees: Typically 0.5%–1% of the loan amount; minimum and maximum caps may apply as per scheme.

- Service/Other Fees: Stamp duty (as prescribed by state law), valuation/inspection fee, and legal documentation fee.

Eligibility & Documentation

To qualify for an agriculture land mortgage loan SBI, applicants should meet the following key eligibility and documentation requirements:

- Land Ownership: Clear, marketable title deed for agricultural land.

- Age: Typically 18–65 years (may vary as per scheme).

- Activity: Engaged in agriculture or allied farming activities, proven via income or activity certificate.

- Documentation:

- Proof of identity and address (Aadhaar/PAN/Passport, Voter ID)

- Latest land revenue records (RTC/7-12, mutation)

- Land valuation certificate from a certified valuer

- Crop plan and bank account details

- Other documents may include NOC for encumbrance, legal heir certificate, and photographs

For streamlined digital documentation, using modern technology can help. We at Farmonaut make digital mapping and remote document verification feasible by providing reliable satellite imagery, AI-backed field data, and seamless API integration for real-time field status checks. Explore our large-scale farm management platform to learn more about actionable agri-analytics and documentation support for mortgage and insurance claims.

Risks & Considerations in Agricultural Land Mortgages

While agriculture land mortgage loans SBI offer many opportunities, risk management is critical.

- Risk of Land Forfeiture: Defaulting on the loan can result in loss of land assets, jeopardizing livelihood.

- Market Volatility: Commodity price changes, input cost hikes, and unpredictable weather (like droughts/floods) affect timely repayment.

- Documentation and Verification: Incorrect or disputed land title, or improper legal records, can delay or stop approvals. Always double-check documents with the help of legal advisers or digital verification technologies.

- Over-borrowing: It is important to borrow only what you can repay, based on realistic yield or income projections.

Mitigating risk in 2025 means blending digital field monitoring, responsible borrowing, and active insurance participation. For rapid risk checks and transparency, Farmonaut’s crop loan and insurance services can enable faster approval and risk reduction. Explore these tools for risk and insurance management.

Climate-smart farming is not only a necessity for sustainability but is also being incentivized through green financing and reduced interest rates. For carbon tracking and emission reduction compliance—often critical for modern mortgage schemes—explore Farmonaut Carbon Footprinting for actionable, accurate carbon impact analysis and improved eligibility for green loan products.

Opportunities and Best Practices for Farmers

Leveraging agricultural land mortgages effectively requires awareness, planning, and financial acumen. Here are some actionable strategies:

- Align Borrowings with Value Addition: Invest in activities that increase farm or land value—like modern irrigation systems, renewable energy installations, or on-farm processing.

- Participate in Government Schemes: Take advantage of subsidy-linked loans, interest subvention, and crop insurance (PM Fasal Bima Yojana, PM Kisan, etc.) that are integrated into SBI offerings.

- Plan for Repayment with Cash Flow Cycles: Match your loan tenure and EMI structure to the agricultural production and marketing cycles you manage.

- Practice Transparency: Use technology for documentation, land monitoring, and verification—boosting eligibility for larger, lower-cost credit lines and reducing approval time.

- Invest in Digital Transformation: With Farmonaut’s satellite-AI platform, farmers and FPOs can digitally monitor, analyze, and trace farming operations for improved productivity, transparency, and financial credibility.

Blockchain-based traceability of your crops can add value and trust—often a key factor for specialized credit products or higher loan amounts. Learn more at Farmonaut Traceability.

For large-scale farming businesses seeking to secure logistics and asset-based mortgage backing, exploring Farmonaut Fleet Management can streamline fuel, equipment, and labour costs, ensuring greater profitability and stronger loan eligibility.

If you plan to diversify agri-income using plantation or forestry-based allied activities (such as agroforestry loans), Farmonaut’s plantation and forest advisory platform supports intelligent species selection, monitoring, and sustainable expansion, boosting your appeal to lenders.

Frequently Asked Questions (FAQ) – Agricultural Land Mortgages & SBI Loan Guide 2025

1. What is an agricultural land mortgage loan?

It’s a secured loan where the borrower (farmer/landowner) pledges their agricultural land as collateral to the bank, typically covering up to 75% of its market value.

2. Can tenant farmers or FPOs apply for agricultural land mortgage loans from SBI?

Primarily, legal landowners are eligible. However, some schemes may allow tenant farmers with valid registered agreements or Farmers Producers Organizations (FPOs) to apply, provided clear documentation and agricultural activity proof are available.

3. What is the maximum tenure for an SBI agricultural land mortgage loan in 2025?

The maximum tenure is typically 15 years for standard mortgage loans, though this may vary by scheme type and region.

4. Does SBI require crop insurance or any risk mitigation products for these loans?

Many SBI agricultural loans are linked to mandatory crop insurance under government schemes. This helps mitigate the risk of income shortfall due to natural calamities.

5. How is the value of land determined for mortgage purposes?

Land value is decided using recent sales data, bank-appointed government valuer’s report, and field verification (sometimes supported by satellite imagery).

6. Can I prepay my SBI agricultural land mortgage loan without penalty?

Yes. Most floating-rate agricultural land mortgage loans have zero prepayment charges; fixed-rate loans may have nominal pre-closure fees.

7. What are the main documentation requirements?

You’ll need KYC (identity/address), land title deed, recent land records, income proof, crop plan, and sometimes NOC (if there are joint owners or encumbrances).

8. How does Farmonaut support financial institutions and farmers?

We at Farmonaut provide satellite-based real-time farm monitoring, field verification, AI-driven insights, digital land record traceability, and API tools that speed up due diligence and risk assessment for loan applications.

9. Can new farmers who have inherited agricultural land apply for SBI mortgage loans?

Yes. As long as the legal title and mutation records are updated, inherited land qualifies for mortgage loans.

10. What happens if I default on my agricultural land mortgage loan?

Non-payment could result in recovery proceedings and possible forfeiture of the mortgaged land as per the loan contract, so only borrow responsibly.

How Farmonaut Supports Secure Agricultural Finance

Based on our mission, we at Farmonaut believe that technology-driven transparency, remote field monitoring, and digital documentation are critical to ensuring secure and affordable agricultural land mortgage loans for farmers and financial institutions.

- Satellite Monitoring: Real-time insights into crop health, land use, and risk zones–backed by NDVI, moisture, and yield estimates.

- AI Advisory: The Jeevn AI system offers personalized recommendations for maximizing land value and reducing input costs.

- Blockchain Traceability: Digital verification of land and produce lineage, adding trust for banks and traceability for the supply chain.

- Fleet & Resource Management: Optimize machinery, fuel, and logistics to support large-scale agri operations and mortgage-backed expansions.

- Environmental Impact: Carbon footprinting and compliance tracking to help farmers access “green” loans and meet regulatory requirements.

Our solutions integrate seamlessly with bank and institutional workflows via secure satellite API endpoints and offer developer-friendly access through our API docs.

Try out our app for farm and loan monitoring today:

Conclusion: Empowering India’s Farmers into 2025 and Beyond

As we move through 2025 and beyond, agricultural land mortgages remain a vital financial instrument for empowering India’s rural economy, enabling farmers to invest in productivity-enhancing technology, improve income, and create sustainable growth for future generations. With SBI’s stable loan products, transparent processes, competitive rates, and digital transformation—enabled by innovations such as Farmonaut’s satellite-AI services—India’s agriculture sector is stronger, more secure, and better prepared to deal with challenges and seize emerging opportunities.

For farmers, agribusinesses, and institutions, the time to explore and leverage agricultural land mortgage loans is now—making the most of your land assets for a resilient, self-reliant, and prosperous tomorrow.

Explore more, monitor your fields and assets, and unlock finance opportunities with the latest in satellite-driven agri solutions.