Agricultural Mortgage: 7 Key Benefits for Farmers

“Over 70% of Indian farmers rely on agricultural loans to finance seeds, equipment, and infrastructure improvements annually.”

Introduction: Agricultural Mortgages & Their Growing Importance

In a world where agricultural development is central to economic growth, especially in countries like India and the United States, the significance of tailored agricultural mortgage financing cannot be overstated. Agricultural mortgages are specialized financial instruments orchestrated to address the unique requirements of farmers, ranchers, and agribusinesses. They are instrumental in providing the capital required for land acquisitions, equipment upgrades, infrastructure development, and the overall sustenance of farming operations.

Unlike standard commercial loan systems, these mortgages pledge flexible repayment terms, long-term financing for farmers, and competitive interest rates for agricultural loans. They acknowledge the sector’s seasonal cash flow fluctuations and evolving operational needs. As we explore the 7 key benefits of agricultural mortgages, we’ll connect these advantages to accessible capital, robust infrastructure, and sustainable growth for the entire agricultural ecosystem.

Let’s deep-dive into how these specialized financing options transform the agricultural sector for farmers worldwide, facilitating not just operational stability but also innovation and growth.

Types of Agricultural Mortgages: Serving the Needs of Farmers, Ranchers, and Agribusinesses

The agricultural credit system offers diverse mortgage types, each catering to different purposes and requirements. By understanding these, farmers can make informed choices about the best financing solutions for their unique operational needs.

-

Land Purchase Loans for Farmers:

These loans are the cornerstone for purchasing or expanding farmland. By providing long-term funds (with both fixed and variable rates), they enable farmers to acquire new properties and expand their business. Proper property assessment and a viable down payment are integral to the approval process.

Use Case: Expanding orchards, buying irrigated or dryland farms in rural regions. -

Development Loans:

Tailored for building and improving infrastructure on agricultural land, such as setting up irrigation systems, erecting barns, installing fencing, or upgrading facilities.

Use Case: Constructing modern storage sheds, efficient water systems, or new livestock enclosures. -

Refinancing Loans:

Refinancing farm debts streamlines multiple outstanding loans into a single payment plan. This aids in cash flow management, may result in lower interest rates, and helps farmers better manage their repayment schedules.

Use Case: Consolidation of existing equipment loans, development loans, or seasonal overdrafts.

Each type of agricultural mortgage serves a distinct function, empowering farmers and agribusinesses to expand, modernize, and stabilize their operations.

Key Features of Agricultural Mortgages: Flexible Repayment, Competitive Rates & More

Agricultural mortgage instruments differentiate themselves from conventional commercial loans by integrating specialized features that directly address the evolving needs and cash flow patterns within the agricultural sector:

-

Flexible Farm Loan Repayment Terms:

Given the seasonal nature of farming income, lenders often design repayment schedules that match periods of high cash flow (like harvest season) and allow for deferment during lean months.

This helps to reduce pressure on farmers and decreases risk of default. -

Long-Term Financing for Farmers:

With repayment periods often stretching over 15 to 30 years, long-term agricultural financing allows farmers to spread payments, ensuring manageability and operational continuity. -

Competitive Interest Rates for Agricultural Loans:

These rates reflect the sector’s strategic importance and typically trend more favorably than unsecured or purely commercial loans. Such interest rates lower the overall cost of capital for farmers. -

Collateral-Based Security:

Agricultural mortgages are often secured by land or buildings, decreasing risk for lenders and opening avenues for larger capital access. -

Tax Benefits:

Interest payments on agricultural loans can often be deducted from farm income when calculating taxes, offering farmers tangible annual financial relief.

Farmers leveraging these features can plan better, respond to challenges more effectively, and invest with greater confidence in their capital-intensive farming projects.

“Flexible farm loan repayment terms can reduce default rates by up to 30% compared to traditional fixed-term loans.”

7 Key Benefits of Agricultural Mortgages for Farmers

Let’s examine the direct advantages that agricultural mortgage financing unlocks for farmers, ranchers, and agribusinesses across the rural landscape. Each benefit not only enhances operational capability, but also fosters sector-wide stability, growth, and financial security.

1. Enhanced Access to Agricultural Loans and Capital

With agricultural mortgage instruments, farmers can secure larger sums than most unsecured loans. This increased access to capital enables vital land acquisitions, large-scale equipment purchases, and robust infrastructure development—all crucial for scaling and modernizing farm operations.

For example, a farmer aiming to expand acreage or invest in modern irrigation technologies benefits from tailored credit that aligns with sector requirements.

2. Flexible Farm Loan Repayment Terms and Seasonal Payment Schedules

Unlike rigid commercial loans, agricultural mortgage financing provides flexible repayment options to accommodate inconsistent farming income caused by seasonal cycles. By offering periodic and graduated repayments, financial stress is minimized, and the risk of default is slashed.

3. Long-Term Financing for Sustainable Growth

Many agricultural loans extend over 15–30 years, spreading repayments and making investments in land or infrastructure more accessible. This promotes predictable cash flow management and supports multi-phase farm development, from land improvement to equipment procurement.

4. Competitive Interest Rates for Agricultural Loans

Given the strategic importance of food security and rural economies, agricultural mortgage rates tend to be more attractive than unsecured loans. Lower interest rates decrease overall repayment burdens and incentivize responsible investment in farm infrastructure, equipment, and expansion projects.

5. Security for Lenders & Borrowers: Collateralization

Agricultural mortgages are secured by land or buildings—a tangible asset on the farm—providing a lower risk profile for lenders and access to higher loan amounts for borrowers. If a default occurs, the lender may liquidate the secured property, which underpins sector financial stability. For farmers, this means larger loans at better rates.

6. Tax Deductibility & Financial Relief

In many jurisdictions, the interest paid on agricultural mortgages is tax-deductible. This results in direct financial relief and encourages further investment in operations, land purchase or improvements. It effectively optimizes annual tax liabilities for farmers and ranchers.

7. Debt Consolidation & Improved Cash Flow: Refinancing Farm Debts

Refinancing farm debts bundles various underlying loans into a single, manageable payment schedule, reducing administrative burden, and often securing a lower average interest rate. This enhances cash flow predictability and enables farmers to focus on their core operations.

For instance, replacing multiple short-term, high-interest obligations with a single long-term mortgage can result in both cost savings and improved mental health for the farmer’s family.

Agricultural Mortgage Benefits Comparison Table

| Benefit Number/Name | Description | Estimated Impact | Practical Example |

|---|---|---|---|

| 1. Access to Capital | Provides substantial loan amounts for land or equipment purchases | Up to 70% increase in available capital access vs unsecured loans | Enabling purchase of 50 additional acres or a new tractor |

| 2. Flexible Repayment Terms | Adapts to seasonal income cycles, offering deferred payments or annual repayment schemes | Up to 30% reduction in loan defaults | Repayment after post-harvest season, not during sowing |

| 3. Long-Term Financing | Loan terms up to 30 years | Repayment spread over 180–360 months | Smaller monthly/annual payments during lean years |

| 4. Competitive Interest Rates | Interest rates lower than average commercial loans | Average interest savings: 1–2% per annum | Savings of ₹20k–₹40k/year on Rs. 20 lakh loan |

| 5. Security for Lenders & Borrowers | Loans secured by farmland or farm buildings/assets | Increased borrowing limits, ~20% higher than non-secured | Borrower qualifies for higher value machinery loan |

| 6. Tax Benefits | Interest on loans deductible from taxable income | Reduces effective yearly tax bill by ₹10k–₹40k | Greater retained earnings for operational reinvestment |

| 7. Debt Consolidation | Multiple loans merged into one for easier management | Potential drop in interest rates by 0.5–1% and streamlined admin | Monthly admin time reduced by 50% |

Regulatory and Support Systems: Building Trust and Stability in the Agricultural Credit System

The stability and growth of agricultural mortgage financing are underpinned by robust regulatory bodies and supportive financial systems. Let’s highlight the core pillars:

- Farm Credit System (FCS): A vital federal network of borrower-owned banks and associations providing over $373 billion in credit to farmers, ranchers, and rural communities in the US. The FCS consolidates a massive share (~45%) of U.S. farm business debt, channeling affordable capital to boost rural prosperity.

- Federal Agricultural Mortgage Corporation (Farmer Mac): By serving as a secondary market for agricultural real estate and rural housing mortgages, Farmer Mac enhances liquidity and broadens financial access for rural borrowers and institutions.

- Farm Credit Administration (FCA): This independent agency supervises the FCS, ensuring ongoing financial stability, sound lending practices, and effective risk management across the agricultural sector.

Indian Context: In India, cooperative banks, regional rural banks (RRBs), and nationalized commercial banks play similar roles—administering farm credit, infrastructure loans, and refinancing programs for a growing and diverse farming population.

- Sectoral Support: Policies and schemes like the KCC (Kisan Credit Card), NABARD refinancing, and low interest rate initiatives bolster loan access and enhance resilience among rural farmers.

Regulatory oversight protects both farmers and lenders, strengthening the broader agricultural credit system and ensuring sustainable sector growth.

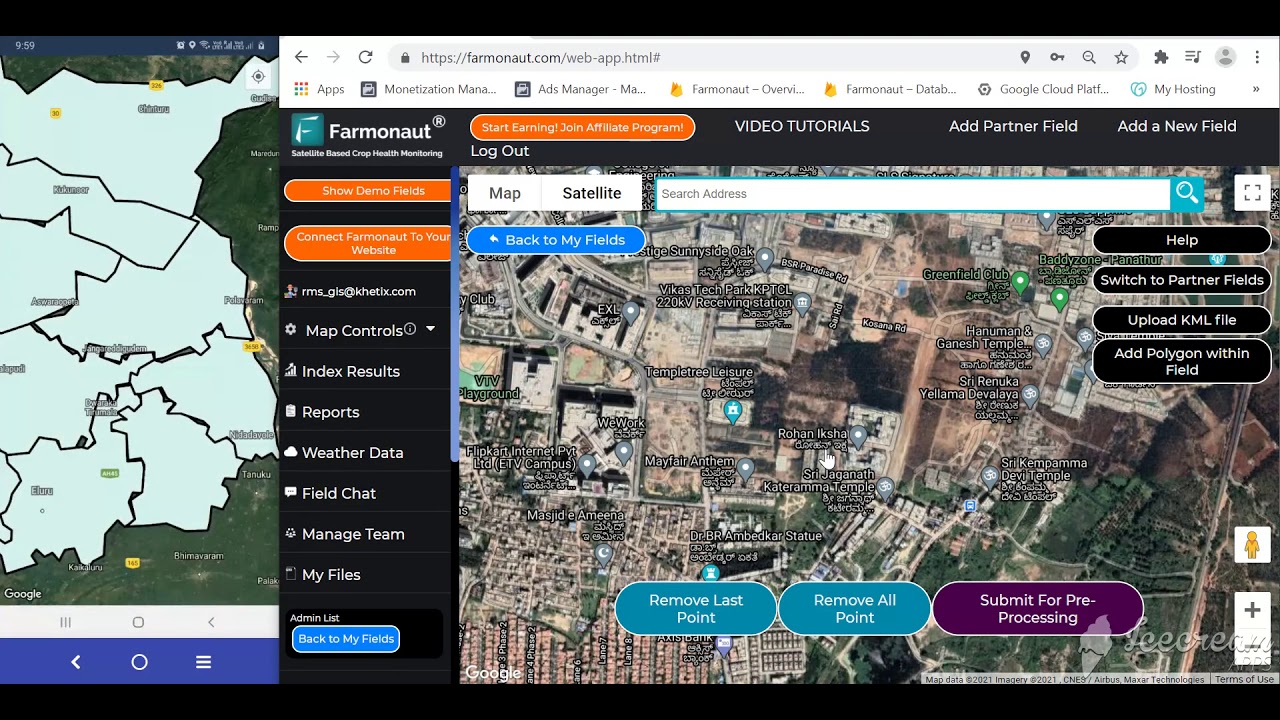

Farmonaut Solutions: Accelerating Digital Agriculture & Financial Inclusion

-

Satellite-Based Crop Loan & Insurance Verification

Farmers benefit from faster, more transparent loan approval and insurance claims using Farmonaut’s satellite-monitoring system. Lenders verify crop health and area in real-time for better risk management. -

Blockchain-Enabled Product Traceability

Brands and consumers gain trust using Farmonaut’s blockchain-based traceability tools. Track every farm product from field to market, fostering food safety and transparency in the agricultural supply chain. -

Carbon Footprinting for Sustainable Farming

Agribusinesses monitor and minimize environmental impact, leveraging Farmonaut’s advanced carbon footprinting platform for compliance and sustainability reporting. -

Large-Scale Farm Management (Agro Admin App)

Monitor plantations, optimize logistics, and improve crop management across thousands of hectares using satellite-based mapping—perfect for cooperatives, processors, and state programs. -

Fleet Management Tools

Reduce operational costs by efficiently managing farm vehicles and machinery—ensure resource optimization and safer logistics. - For seamless integration of our data and services into your existing IT ecosystem, visit our API platform and consult the API Developer Documentation.

Affordable Subscription Plans for Modern Farmers

Explore our flexible options for individual farmers, cooperatives, and enterprises below:

Historical and Legislative Foundations of Agricultural Mortgage Systems

Agricultural mortgage financing is the culmination of decades of policy intervention and sectoral reforms. Understanding this historical context reveals the wisdom behind today’s robust systems.

-

Federal Farm Loan Act of 1916 (USA):

Marked a revolution by providing affordable credit through regional farm loan banks, spurring rural prosperity and safeguarding food supply. -

Frazier–Lemke Farm Bankruptcy Act 1934 (USA):

A Depression-era intervention postponing foreclosures and helping farmers survive financial shocks, thereby preserving rural land and infrastructure. -

India’s Banking Sector Reforms (1969, 1991):

Expansion of rural bank branches, priority sector lending (PSL) mandates, and crop insurance schemes. - Present Day: Once established for rescue, farm loans have become engines for development projects, modernization, and sustainable transformation.

How Farmonaut Empowers Farmers in Agricultural Mortgage Financing

At Farmonaut, our vision is to make precision agriculture accessible, affordable, and data-driven—enabling farmers worldwide to better manage their land, optimize resources, and secure favorable loan terms.

- Satellite-Based Crop Health Monitoring: Real-time monitoring helps verify health and yields to support loan and insurance applications, building trust between farmers and lenders.

- AI-Based Advisory: With Jeevn AI, farmers receive tailored recommendations for crop cycles, irrigation, and resource allocation, supporting financial planning and timely loan repayments.

- Blockchain Traceability: Elevate the market value of your produce with verified origin and journey data, making it easier to access new financing or premium buyers.

- Resource and Fleet Management: Lower operational costs and improve cash flow, further enhancing bankability and eligibility for refinancing.

- For Agribusinesses and Governments: Our scalable, API-enabled platform supports large-scale farm management and crop analytics, facilitating sustainable rural credit expansion and infrastructure investments.

Getting Started: Download our mobile app on Android or iOS, or manage your farm via our browser app.

Frequently Asked Questions: Agricultural Mortgage Financing for Farmers

Q1: What makes agricultural mortgage loans different from commercial loans?

Agricultural mortgages are tailored for farming operations, offering seasonal repayment terms, lower interest rates, and longer tenure to fit farm cash flow cycles. They are also often secured by land or agricultural infrastructure.

Q2: How can flexible farm loan repayment terms benefit my operation?

Flexible schedules match your income peaks, enabling payments post-harvest and deferrals in lean periods, reducing the risk of default by up to 30% and supporting better cash flow management.

Q3: Can agricultural mortgages be used for crop insurance or equipment finance?

Absolutely. Many agricultural mortgage packages can be structured for infrastructure development, equipment purchase, or to support farm insurance premium payments.

Q4: How do regulatory bodies ensure the security of agricultural loans for farmers?

Regulatory agencies like the FCA, FCS, and equivalents in other countries oversee lender practices, enforce best standards, and protect both borrower and lender interests—ensuring sector stability.

Q5: How does Farmonaut support the loan and insurance process for farmers?

Through satellite-based crop monitoring, AI-powered analytics, and blockchain traceability, Farmonaut streamlines asset verification, expedites loan approvals, and reduces risk for both farmers and lenders.

Q6: Where can I access Farmonaut’s technology and subscription plans?

Use our browser app, download Android or iOS apps, or check our API platform and API developer docs for seamless integration.

Conclusion: The Road Ahead for Agricultural Mortgage & Financing

Agricultural mortgages are more than just loans—they are powerful enablers of growth, innovation, and resilience for farmers, ranchers, and agribusinesses. By offering capital suited to infrastructure development, land purchase, and modernization projects, these specialized instruments help the sector navigate seasonal income fluctuations and growing market demands.

The long tradition of regulatory stewardship paired with new technology—like Farmonaut’s data-driven solutions—ensures that today’s agricultural financing is efficient, transparent, and accessible. As agricultural challenges and opportunities evolve, leveraging tools like satellite monitoring, AI advisories, and blockchain traceability will be essential for farmers to remain competitive and sustainable in global markets.

We invite all modern farmers, rural entrepreneurs, and agribusiness leaders to explore new models of credit and farm management, taking full advantage of products like Farmonaut’s precision agriculture platform, which embeds data, innovation, and financial confidence at the heart of your operations.