Investing in Farmland: 7 Shocking Perks Revealed

“Farmland investments have historically delivered average annual returns of 10-12%, outperforming many traditional asset classes.”

“Over the past 20 years, U.S. farmland values have increased by more than 150%, showcasing strong long-term growth.”

Introduction: The Unique Appeal of Farmland Investment

As we navigate increasingly complex financial markets, the need to diversify our investment portfolios has never been more urgent. Farmland investment stands out as a unique opportunity for investors seeking strong returns, portfolio diversification, and a tangible connection to the essential global food production system. As the world’s population continues its upward trajectory and the demand for food surges, the value of agricultural land as an asset class is being rediscovered by both private and institutional investors.

This article explores the various facets of investing in farmland, including the most shocking perks, associated risks, key avenues for investment, and the role of technology providers like Farmonaut in revolutionizing farm management, decision support, and sustainability.

1. Inflation Hedge: Farmland Investment’s Time-Tested Shield Against Rising Prices

One of the most critical benefits of agricultural land investment is its robust ability to hedge against inflation. Unlike cash or some traditional investments that lose purchasing power during inflationary cycles, farmland as an asset class has consistently demonstrated the capacity to outpace inflation.

- From 1992 to 2020, U.S. farmland provided an average annual return of 11.01%, outperforming many asset classes with a low volatility of 6.9%.

- As food prices rise, so does the value of arable land, creating a powerful buffer for investors against inflation’s erosive effects.

- This makes farmland a preferred long-term choice among those aiming to preserve and grow wealth.

Given the persistence of inflation worldwide and the centrality of food in household spending, investing in farmland offers a practical, time-tested mechanism for wealth protection and growth.

2. Diversification and Portfolio Stability: Diversifying Investment Portfolios with Farmland

In a landscape often dominated by stocks and bonds, diversifying investment portfolios with farmland provides another dimension of financial stability. Unlike traditional assets, farmland investments:

- Exhibit Low Correlation: Farmland is less affected by stock market fluctuations, offering a “safe harbor” during market stress.

- Reduce Overall Portfolio Risk: By allocating part of our capital to farmland, we reduce overall risk and benefit from improved portfolio performance during market volatility.

- Offer Stable Returns: Past decades have shown that farmland investments provide both stability and attractive yields, even when other assets underperform.

For investors seeking to buffer their wealth against shocks and preserve capital, agricultural land as an asset class is an invaluable addition to any portfolio. This diversification quality is especially crucial given the rise in global market uncertainty.

3. Capitalizing on Rising Global Food Demand

Another shocking perk of investing in farmland is its direct correlation with rising global food demand. The world’s population is projected to exceed 9.7 billion by 2050, increasing the demand for food and, consequently, the demand for productive farmland.

- Limited Supply, Growing Demand: The supply of arable land is finite, while food consumption is expected to rise, especially in rapidly urbanizing regions.

- Enhancing Value: Farmland values benefit from this supply-demand equation, often increasing significantly over time.

- Direct Participation: Investors in farmland support the essential food production system, directly influencing food security and agricultural innovation.

By holding assets that are integral to the global food system, we not only enjoy strong returns but also contribute to meeting one of humanity’s most crucial needs.

4. Tax Advantages and Incentives: Unlocking Financial Benefits

A major benefit of agricultural land investment lies in the multiple tax incentives and deductions available to investors. Depending on jurisdiction and structure, these benefits may include:

- Lower Property Assessments: Agricultural land often enjoys favorable property tax rates or exemption programs, reducing ownership costs.

- Mortgage Interest Deductions: Investors can deduct interest payments on farmland loans or mortgages, improving the net yield.

- Conservation Easements: Establishing conservation protections may offer substantial tax deductions, rewarding stewardship and environmental values.

- Depreciation Schedules: Certain improvements or structures on farmland may be depreciated, further lowering taxable income.

When we invest in farmland, these tax advantages can improve overall returns and create an efficient vehicle for building and preserving wealth.

5. Strong and Stable Returns with Low Volatility

Farmland investment is further underscored by its stable returns and low volatility compared to other asset classes. Over several decades, agricultural land has delivered consistent and often superior performance.

- Average Annual Returns: Historical data shows average annual returns of 10-12% for farmland. These returns stem from both capital appreciation and rental income.

- Low Volatility: Farmland’s returns are less erratic than those of stocks or real estate, offering a stabilizing effect on overall portfolio performance.

- Intrinsic Value: As land is a finite, necessary resource, its value tends to be resilient even in economic downturns.

These qualities make investing in farmland a prudent strategy for those prioritizing capital preservation and risk-adjusted growth.

6. Tangible Asset and Direct Control

One of the distinguishing features of farmland as an asset class is its tangible nature. Unlike equities or digital securities, agricultural land can be seen, touched, and directly improved.

- Direct Ownership and Lease Opportunities: Investors can buy land outright and lease it to local farmers, generating predictable rental income.

- Control and Improvements: We can make management decisions, adopt sustainable practices, or implement innovative farming techniques to enhance yields and returns.

- Intrinsic Satisfaction: Direct control over a productive, essential resource offers psychological and financial rewards.

These attributes distinguish farmland from many financial assets and make it particularly attractive to investors seeking both security and influence over their portfolio components.

7. Participation in the Essential Global Food System

Perhaps the most compelling benefit is the chance to participate meaningfully in the global food production system. Farmland investors:

- Support Food Security: By investing in productive land, we contribute to a stable, sustainable food supply that underpins economies and societies.

- Promote Agricultural Innovation: Investment capital supports the adoption of advanced farming practices, technologies, and regenerative solutions.

- Align with Environmental Values: Many modern investors seek assets that reflect long-term, sustainable stewardship—a goal that farmland is well-positioned to achieve.

For those aiming to align their portfolios with impact investing and sustainability goals, farmland investments offer a rare bridge between financial returns and ethical, environmental impact.

“Farmland investments have historically delivered average annual returns of 10-12%, outperforming many traditional asset classes.”

Farmland Investment Comparison Table

| Investment Type | Estimated Annual Return (%) | Risk Level | Volatility | Liquidity | Notable Perks |

|---|---|---|---|---|---|

| Farmland | 10-12 | Low-Medium | Low | Low-Medium | Inflation hedge, essential asset, portfolio diversification, stable returns, tax benefits |

| Stocks | 7-10 | Medium-High | High | High | High liquidity, growth potential, broad market exposure |

| Bonds | 2-5 | Low | Low | High | Stable income, low risk, portfolio ballast |

| Real Estate (Residential/Commercial) | 6-9 | Medium | Medium | Medium | Tangible asset, rental income, appreciation potential |

How to Invest in Farmland: Key Avenues and Investment Strategies

Understanding how to invest in farmland is crucial for success. There are various avenues, each with its distinct characteristics, capital requirements, and risk profiles. Let’s explore the main strategies we can utilize for farmland investment:

1. Direct Ownership

- Purchasing Outright: The traditional approach, buying farmland directly allows us to lease it to farmers, cultivate it ourselves, or implement modern management practices.

- Rental Income: Leasing generates steady, often inflation-linked rental payments.

- Substantial Capital Required: Direct ownership may involve significant upfront investments and demands active management or oversight.

2. Real Estate Investment Trusts (REITs)

- Liquid Investment Vehicle: Agricultural-focused REITs—such as Gladstone Land Corporation and Farmland Partners—allow us to own shares in a diversified portfolio of operational farmland.

- Traded on the Stock Market: REITs offer greater liquidity but may be more correlated with market fluctuations.

- Passive Exposure: Ideal for those seeking diversification without direct operational responsibility.

3. Crowdfunding Platforms

- Accessible Entry Points: Online farmland investment platforms such as AcreTrader and FarmTogether allow us to pool resources and invest in high-quality farms.

- Lower Minimums: These platforms reduce capital barriers and democratize access to the agricultural sector.

- Diversification: Investors can easily diversify across geographies and crop types.

Interested in smarter, technology-backed farm management? Explore the Farmonaut Large Scale Farm Management platform for efficient, scalable operations, real-time monitoring, and data-driven decisions.

4. Mutual Funds and ETFs

- Indirect Exposure: These funds invest in agricultural companies or commodities, rather than physical land.

- Flexible and Liquid: ETFs and mutual funds are easily traded but may not capture the full benefits or stability of direct farmland ownership.

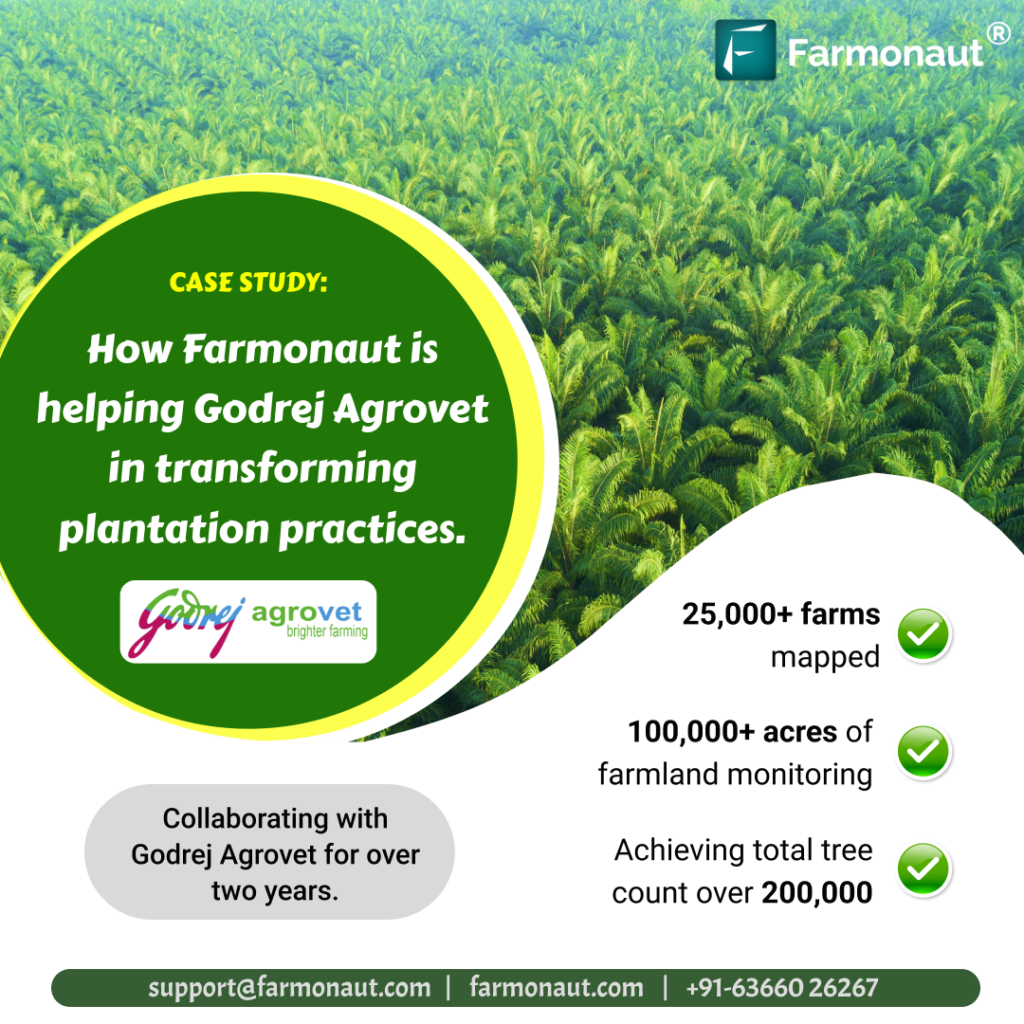

5. Agroforestry and Timberland

- Diversified Land Use: Agroforestry blends agriculture with forestry, providing returns from both timber and food production.

- Sustainable Practices: This approach often incorporates conservation and regeneration, addressing environmental impact.

- Long-Term Growth: Timberland and hybrid models offer attractive, patient capital growth.

- For technology-driven plantation management or crop advisory, explore Farmonaut’s Crop Plantation and Forest Advisory App.

Discover Farmonaut’s Blockchain-Based Product Traceability Solution.

See API Developer Docs

Farmland Investment Risks and Challenges

No investment is without risk, and farmland is no exception. Before allocating capital, it’s critical to assess the main farmland investment risks:

- Commodity Price Volatility: Returns and land values may be affected by swings in grain, oilseed, or livestock prices—which are influenced by global trade policy, weather, and economic cycles.

- Climate Change Impact: Farmland is increasingly exposed to extreme weather events, such as droughts and floods, which can disrupt crop yields and long-term productivity.

- Regulatory Risks: Agriculture is highly dependent on government support. Policy changes, shifts in subsidies, tariffs, or stricter environmental regulations can impact farm income and land values.

- Operational Risks: Good farm management is essential. Outsized risks are associated with mismanagement, lack of agricultural expertise, pest outbreaks, or poor soil stewardship.

- Liquidity: Unlike stocks or ETFs, farmland may take time to buy or sell; market liquidity can vary greatly by region and economic conditions.

- Management Intensive: Direct ownership requires ongoing oversight, from sourcing tenants to maintaining infrastructure and ensuring regulatory compliance.

Tools such as Farmonaut’s satellite-based monitoring, AI advisory, and blockchain-backed traceability can help mitigate certain risks by providing actionable insights, supporting compliance efforts, and streamlining resource management.

Emerging Trends in Sustainable Farmland Investing

The face of farmland investment is rapidly changing. Staying aware of the latest emerging trends allows us to anticipate opportunities and align portfolios with future demands.

1. Sustainable and Regenerative Agriculture

- Focus on Soil Health & Biodiversity: Investors are increasingly supporting practices that restore soil fertility, increase carbon storage, and boost biodiversity.

-

Carbon Footprinting: Tracking and reducing the carbon footprint of farming operations has become central, driven in part by regulatory and consumer demand.

Want to monitor and reduce your farm’s carbon emissions? Explore Farmonaut’s Carbon Footprinting Service. - Conservation Easements: These offer financial incentives for preserving ecosystem services and open space.

2. Technological Integration and Precision Agriculture

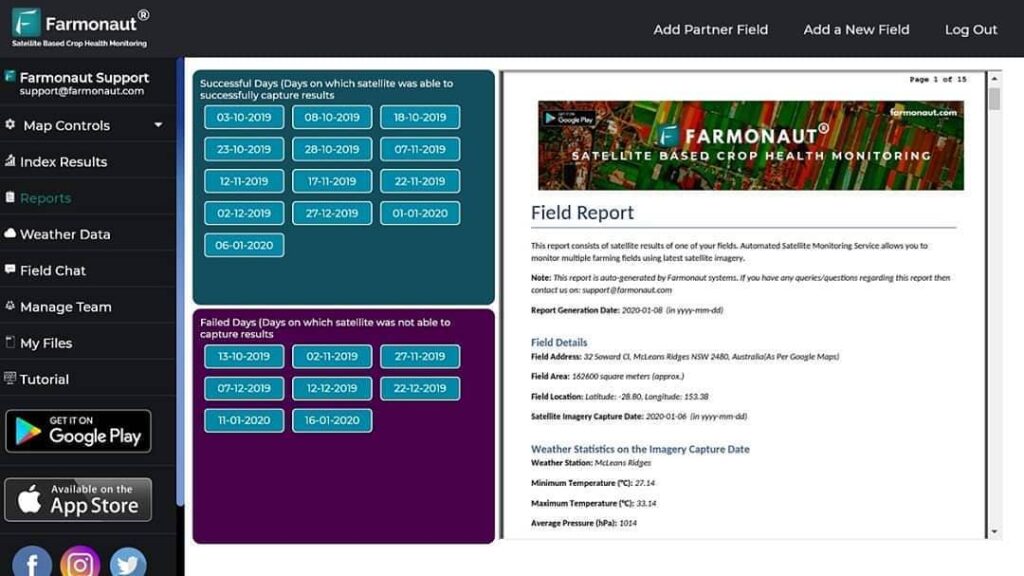

- Satellite Imagery: Adoption of satellite-based crop monitoring provides real-time, parcel-specific insights that profoundly improve farm management, reduce wastage, and enhance yields.

- AI and Data Analytics: Tools like AI-based advisory systems (ex: Farmonaut’s Jeevn AI) recommend practices tailored to weather, soil, and crop stages—optimizing inputs and boosting efficiency.

- Traceability and Transparency: Blockchain technologies provide end-to-end transparency, ensuring authentic, secure supply chains—a significant draw for institutional investors and conscious consumers.

3. Institutional Investment Growth

- Long-Term Capital: Pension funds, endowments, and other large investors are allocating a growing share to farmland, attracted by its stable returns and inflation-resistant features.

- Professionalization: The sector is seeing increased professionalism with the growth of specialized farmland managers, REITs, and data-driven service providers.

How Farmonaut Empowers Farmland Investment and Management

Farmonaut offers us a suite of technologies designed for the new age of data-driven, sustainable investment in agricultural land. Here’s how Farmonaut is revolutionizing this space:

- Satellite-Based Crop Health Monitoring: Receive real-time, multispectral imagery and vital indices (NDVI, soil moisture) for actionable decision support and optimal input management.

- AI-Driven Advisory (Jeevn AI): Access farm-specific crop management tips based on weather, satellite, and historical data—all accessible via web, Android, and iOS.

- Blockchain-Based Traceability: Ensure transparency, reduce fraud, and build consumer trust through secure, verifiable farm-to-fork tracking.

- Fleet and Resource Management: Optimize vehicle use, farm logistics, and machinery allocation to reduce operational costs and enhance efficiency.

- Carbon Footprinting: Track, benchmark, and reduce on-farm emissions, meeting both compliance and sustainability goals.

- Accessible Technology: Farmonaut’s subscription-based model is affordable for small farms, large agribusinesses, and government agencies alike, supporting scalability and broad adoption.

Discover more about Farmonaut’s subscriptions and pricing below.

FAQ: Farmland Investment Questions Answered

Q1. What makes farmland a unique asset class for investors?

Farmland is a tangible, essential resource with a finite supply. It delivers stable returns, hedges against inflation, exhibits low volatility, and is often uncorrelated with traditional stocks or bonds, making it an excellent portfolio diversifier.

Q2. How can we mitigate operational risks associated with direct farmland ownership?

Operational risks can be managed by using advanced technology for crop and soil monitoring, employing professional farm managers, selecting reliable tenants, and implementing sustainable practices. Platforms such as Farmonaut provide real-time data and AI-driven advisories to support better management.

Q3. What are the liquidity considerations for farmland investments?

While direct farmland investment is less liquid than stocks or mutual funds, newer avenues such as REITs and crowdfunding platforms offer improved liquidity. It’s crucial to align your liquidity needs with the chosen investment vehicle.

Q4. Can we combine financial returns with sustainability in farmland investing?

Absolutely. Sustainable farmland investing—emphasizing regenerative agriculture, carbon footprint reduction, and ecological stewardship—can deliver strong financial returns while aligning with environmental goals. Traceability, smart resource management, and monitoring tools like those offered by Farmonaut support this dual objective.

Q5. How do we get started with farmland investment and smart farm management?

Begin by selecting your preferred investment avenue (direct ownership, REIT, crowdfunding, ETFs, etc.), conduct thorough due diligence on the land or platform, and utilize technology-driven solutions like Farmonaut for ongoing management and optimization.

Conclusion: Unlocking the Potential of Farmland Investment

As we have explored, farmland investments offer a potent combination of stable returns, diversification, inflation protection, and meaningful participation in the global food system. While there are risks to assess and challenges to overcome, the current landscape—with emerging trends in sustainability, technology, and institutional engagement—makes agricultural land a compelling addition for investors looking to diversify and fortify their portfolios.

By leveraging innovative platforms, advanced data solutions, and evidence-based management practices, we can not only maximize farmland investment returns but also help shape more resilient, transparent, and sustainable agri-food systems worldwide.

Ready to invest, monitor, and harvest the benefits of agricultural land?

Explore Farmonaut’s technology suite to transform your farmland investment journey—from real-time monitoring to smart advisory and blockchain-powered traceability.

Empower your investments. Transform agriculture. Make smarter, data-driven decisions with Farmonaut.