Agriculture Aircraft Insurance in 2025: Cal Fire, Agri Jobs, and the Benefits of Insurance to Farmers

“By 2025, tech-driven agricultural insurance is projected to reduce farm risk losses by up to 30%.”

Table of Contents

- Introduction: The Evolving Landscape of Agricultural Insurance

- Agriculture Aircraft Insurance: Safeguarding Aerial Farming Operations

- Cal Fire Insurance Cost: Navigating Wildfire Risks in California Agriculture

- Annual Forage Insurance: Protecting Livestock Feed Supply

- Agri Insurance Jobs: Career Opportunities in a Thriving Sector

- Comparative Table: Insurance Technologies, Benefits & Jobs Impact

- Farmonaut: Advancing Agri Insurance with Satellite, AI & Data Analytics

- The Benefits of Insurance to Farmers: Building Resilience through Innovation

- FAQ: Agriculture Aircraft Insurance, Cal Fire, Jobs & Farmer Benefits

- Conclusion: Future-Proofing Agriculture with Comprehensive Insurance

Introduction: The Evolving Landscape of Agricultural Insurance in 2025

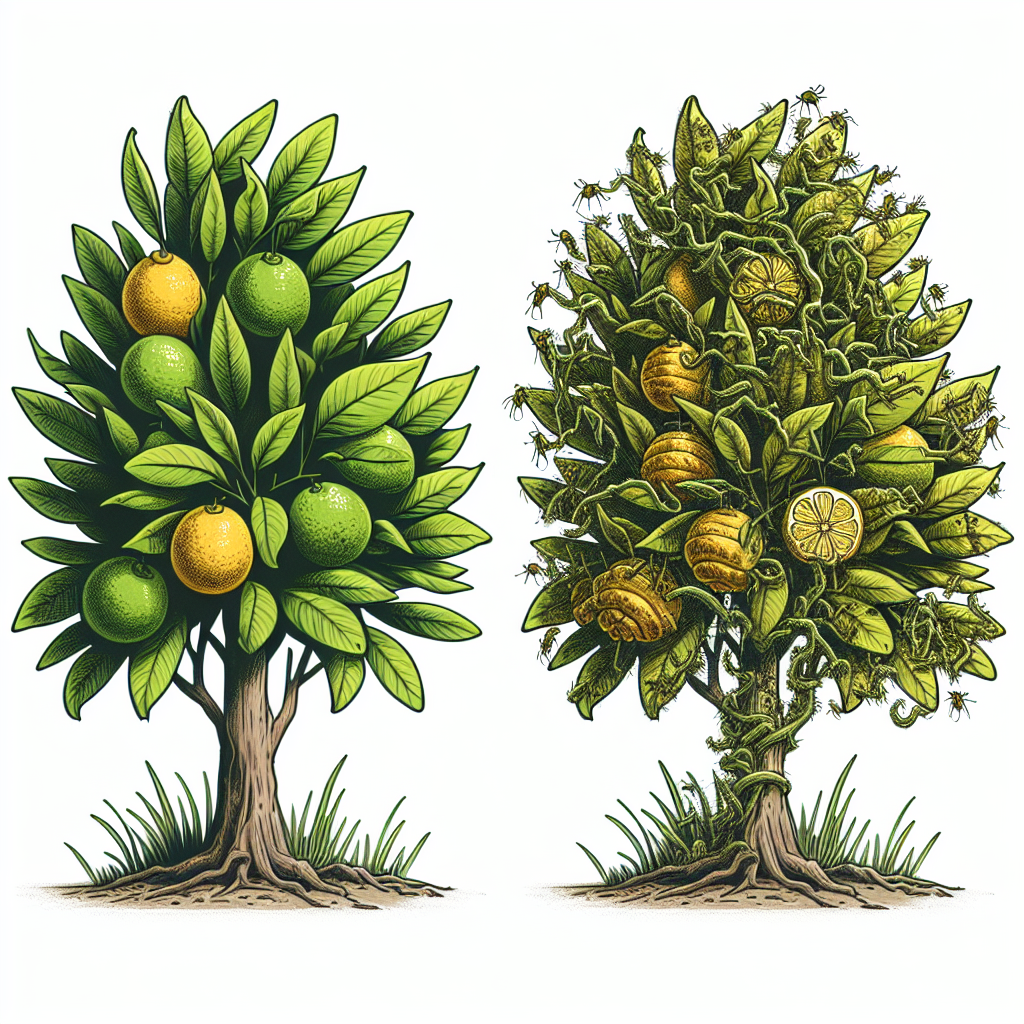

Agriculture in 2025 faces an unprecedented convergence of risks and opportunities as technological innovation collides with the realities of climate change, market volatility, and an increasing need for sustainable practices. In this rapidly developing era, the importance of comprehensive insurance solutions has become paramount for farmers, agribusinesses, and communities dependent on the prosperity of the agri sector.

The proliferation of aerial application technologies—ranging from piloted agricultural aircraft to advanced drones—alongside data-driven advancements, have revolutionized farming efficiency. However, these innovations bring new risks and complexities. Whether combating climate change-driven natural disasters in fire-exposed regions like California or safeguarding the forage feed supply for livestock, insurance has evolved from a simple safety net into a dynamic, tech-enabled risk management instrument.

This blog provides a deep dive into agriculture aircraft insurance, addresses the critical issue of Cal Fire insurance cost for wildfire-prone agricultural regions, explores the rich growth in agri insurance jobs, and highlights the transformative benefits of insurance to farmers. Along the way, we’ll examine the power of satellite and AI technology—trailblazers for innovation and resilience in the new agriculture landscape.

Agriculture Aircraft Insurance: Safeguarding Aerial Farming Operations

How Agricultural Aircraft Are Revolutionizing Farming

The use of aerial aircraft in modern agriculture has become a defining feature of 21st-century farming. Agricultural aircraft insurance is no longer optional; it’s an essential foundation for protecting the investments that aerial farming operators make in their equipment and operations.

- Application of fertilizers, pesticides, and seeds: Modern agricultural airplanes and drones efficiently cover vast areas, increasing productivity and yield potential.

- Technological integration: Innovations like GPS guidance, remote sensing, and AI for variable-rate application transform traditional crop management.

However, with these technological advancements, the risks have also evolved. Consider the following factors that raise the stakes for aerial farming operators:

- Low-altitude flying over uneven terrain

- Exposure to changing weather patterns and unpredictable hazards

- Risk of collision, engine failure, pilot injury, and drone malfunction

- Potential for property damage, third-party liability, and crop loss due to misapplication or mechanical faults

Understanding Agriculture Aircraft Insurance Coverage

Comprehensive agriculture aircraft insurance policies are designed to address the unique set of risks associated with aerial operations in farming. Whether it’s a piloted fixed-wing airplane or a high-tech drone, policies in 2025 will increasingly become multidimensional, covering:

- Physical Damage to Aircraft: Including repair or replacement following accidents, weather events, or inability to operate due to damages.

- Liability Coverage: For third-party bodily injury, property damage, and environmental contamination.

- Cargo, Equipment, and Payload: Covering valuable precision farming equipment, sensors, and cargo in case of losses.

- Specialized Drone Insurance: Tailored protection for emerging unmanned aerial vehicles (UAVs) used in agriculture, including software, data breach, and privacy risks.

- Revenue Loss: If an aircraft is grounded, some policies provide business interruption insurance for interrupted spraying or seeding.

The Role of Drones in Shaping Insurance for 2025

The rise of drone-based agricultural applications is reshaping insurance products and risk management frameworks. Tailored insurance now addresses technological risks such as:

- Cybersecurity threats (e.g., data interception during drone communication)

- Drone malfunction affecting crop application accuracy

- Liability for drone collisions and privacy breaches

As regulatory bodies enhance compliance requirements for agri-drones, insurance providers must adapt policies to meet both legal obligations and farmers’ needs.

Looking for robust aerial insurance and verification solutions? Explore Farmonaut’s Crop Loan & Insurance Platform—delivering satellite-verified insights for streamlined claims, risk analysis and reducing insurance fraud in precision agriculture.

Agriculture Aircraft Insurance: Real Impact Example

Example Scenario: A drone fleet operator specializing in aerial crop spraying faces a season with increased windstorms, resulting in a 20% jump in drone downtime and several minor crash incidents. Thanks to specialized coverage for drone technology, losses from equipment damage and lost revenue from uncompleted contracts are significantly minimized.

As precision agriculture continues to drive forward, the need for a comprehensive, tailored insurance solution for both traditional and tech-advanced aerial operations is only becoming more vital.

Cal Fire Insurance Cost: Navigating Wildfire Risks in California’s Agricultural Regions

The Challenge of Wildfire-Prone Farming

California stands at the forefront of both agricultural innovation and climate-driven wildfire risk. Cal Fire insurance cost now carries new significance in agricultural risk management, not just as a budget item, but as a core piece of operational survival.

Recent years have seen historic wildfires devastate properties, equipment, and crops—causing billions in losses and painstaking recovery for farmers. This has prompted:

- Insurer Reassessment: Insurers are revising premiums and coverage criteria for properties exposed to wildfires.

- Premium Increases: Many farmers face sharply higher insurance costs, sometimes with exclusions for wildfire events or specific property types.

- Policy Exclusions: Difficulties in obtaining comprehensive coverage for older barns, remote infrastructure, and storage facilities in high risk zones.

- Need for Mitigation: Growing pressure to invest in fire-resistant infrastructure and approved mitigation measures to secure insurance at reasonable rates.

Cal Fire Insurance Cost: What’s Impacting Premiums & Coverage in 2025?

- Regional Wildfire Risk Score: Satellite and historical data providing more accurate premium calculations for rural and exposed properties.

- Fire-Resistant Investments: Properties equipped with defensible space, ember-proof construction, and smart irrigation can realize lower costs and better policy terms.

- Bundled Policies: Many insurers encourage combined coverage products (property, equipment, crop, liability) tailored for fire-prone regions.

- Technology Integration: Use of real-time fire alerts, remote sensing, and satellite monitoring to facilitate early warning and claim verification.

Mitigate wildfire risk and manage your agricultural property with Farmonaut’s Carbon Footprinting Solution—essential for compliance and monitoring environmental impact, supporting both insurance eligibility and long-term sustainability.

The Cal Fire insurance cost debate now goes beyond simple pricing: it demands a modernization of how risk is assessed and managed in every corner of California’s agri heartland.

Annual Forage Insurance: Protecting Livestock Feed Supply

Why Forage Insurance Is Critical for Livestock Operations

Livestock producers depend on forage crops—like alfalfa, clover, and native grasses—to provide stable, affordable feed. Volatile weather patterns, extreme heat, flooding, and pest outbreaks threaten pasture productivity every year. This makes annual forage insurance an increasingly vital safety net for both small and large-scale ranchers in 2025.

- Protection Against Weather Risks: Coverage for losses caused by drought, cold, excessive moisture, and weather events that limit hay or grazing yields.

- Safeguarding Economic Stability: Ensuring that producers are not forced to liquidate herds, borrow at unfavorable terms, or pay excessive prices for alternative feed following a crop failure.

- Trigger-Based, Index, and Bundled Products: Increasing use of weather index insurance means that claims can be automatically triggered by satellite-verified rainfall, temperature, or biomass loss, reducing the need for costly on-site inspections.

In 2025, annual forage insurance products are more sophisticated than ever, leveraging real-time data and analytics for fast, objective claim settlements—encouraging sustainable practices and risk diversification.

Annual Forage Insurance: Example

A cattle ranch in the Midwest faces a severe summer drought, reducing expected grass production by 40%. The ranch’s annual forage insurance policy, bolstered by weather-based data, triggers a rapid payout, enabling ranchers to purchase substitute feed and avoid culling their livestock. This single event underscores the benefits of insurance to farmers—it stabilizes rural economies and sustains food production through climate uncertainty.

Enhance pasture monitoring and feed planning with Farmonaut’s Large-Scale Farm Management Platform—AI and satellite-based field analytics for optimizing forage planning, supporting insurance applications, and tracking annual production cycles.

“Agri insurance jobs are expected to grow 15% by 2025, driven by advanced risk management technologies.”

Agri Insurance Jobs: Career Opportunities in a Thriving Sector

How the Insurance Sector Is Creating New Agri Jobs

As the scope of agricultural insurance expands, so does demand for specialized professionals equipped to design, deliver, and manage increasingly complex insurance products. In the landscape of 2025 and beyond, agri insurance jobs are both growing in number and evolving in their required skill sets.

- Insurance Underwriters: Assess and quantify risk related to crops, livestock, aerial operations, and new technology-driven exposures.

- Risk Assessors: Use remote and on-site data, satellite imagery, and predictive analytics to set premium rates and recommend coverage solutions.

- Claims Adjusters: Manage payout processes, leveraging rapid data collection, satellite verification, and AI to streamline claims and reduce fraud.

- Data Analysts: Analyze historical and real-time agricultural, weather, and commodity data to inform risk modeling and policy customization.

- Agricultural Economists & Advisors: Develop risk mitigation plans for farmers and agribusinesses.

These roles require a unique blend of:

- Understanding of Agricultural Cycles and management strategies

- Technical literacy with AI and precision technologies

- Communication skills to tailor complex policies to specific regions and farmer profiles

The Growing Demand for Agri Insurance Jobs in 2025

The integration of satellite data analytics, remote sensing, and AI-powered risk modeling is driving double-digit growth in job opportunities in the insurance sector:

- Data-Driven Innovation: Insurers are hiring more analysts and modelers to accurately price emerging risks (drones, new pathogens, climatological extremes).

- Claims Automation: Rapid automated claims processing requires technical operators, software specialists, and fraud investigators.

- Customized Insurance: Demand for customer-facing advisors who can design tailored insurance products for specific crops, livestock, and farming practices grows with market complexity.

Streamline risk assessments and claims validation using Farmonaut’s Fleet Management Solution—remotely track farm machinery or agricultural aircraft for risk reduction, compliance, and insurance benefit.

Integrate satellite-based monitoring into your insurance systems with Farmonaut API (developer docs)—unlock field intelligence and risk scoring for custom insurance offerings.

Comparative Table: Insurance Technologies, Benefits, and Jobs Impact for 2025

| Insurance Solution/Technology | Key Features | Primary Benefits | Relevant Agri Jobs (Est. Growth % 2024-2025) | Impact on Risk Management (Est. Risk Reduction %) |

|---|---|---|---|---|

| Drone-Based Risk Assessments | Automated flyovers, real-time crop health analysis, precision incident detection | Rapid, accurate claims; lower losses; premium reduction; supports microinsurance | Drone Pilots, AI Analysts, Claims Adjusters (+18%) | Up to 24% |

| Satellite AI Monitoring Platforms | NDVI/VI index-based health monitoring, weather and drought prediction, digital twinning | Expands insurability; enables index policies; detects subtle risks early | Satellite Data Analysts, Risk Modelers (+20%) | Up to 30% |

| Real-Time Data Platforms | Farm dashboards, weather interfacing, automated alerts, yield modeling | Informed farming decisions; efficient policy enforcement; reduced fraud risk | IT Support, Data Engineers, Policy Advisors (+15%) | 22% |

| Cal Fire-Specific Insurance Programs | Wildfire propensity scoring, fire mitigation advisory, tailored liability coverage | Lower out-of-pocket costs after fires; speeds claims in disaster events | Risk Assessors, Claims Handlers (+17%) | 18–25% |

Farmonaut: Advancing Agri Insurance with Satellite, AI & Data Analytics

In the modern agricultural insurance sector, technology is no longer an option—it’s a prerequisite for efficiency, accuracy, and resilience. This is where we at Farmonaut harness the power of satellite imagery, AI, and blockchain-based traceability to address evolving insurance challenges across agriculture.

How Farmonaut Empowers Insurers, Businesses & Farmers

- Satellite-Based Agri Monitoring: Our platform uses multispectral satellite images to deliver real-time analytics on fields, supporting insurers in validating claims, assessing drought damage, and monitoring vegetation health for insurance policy structuring.

- Environmental & Resource Tracking: Insurers and financial institutions leverage our data to encourage and verify sustainable practices—such as reduced emissions or improved water use—making coverage more accessible.

- AI-Driven Risk Advisory: The Jeevn AI system offers tailored recommendations, yield forecasts, and risk models to help farmers proactively reduce insurance-related exposure.

- Blockchain Traceability: Enables secure, transparent tracking in agricultural supply chains, supporting insurance fraud prevention and regulatory compliance.

- Scalable App & API Access: Organizations can integrate Farmonaut’s insights via app/web browser or API, and developers find extensive support with developer documentation.

- Loan & Coverage Verification: Financial lenders adopt Farmonaut data for unbiased verification of insured fields—streamlining access to credit and reducing systemic risk.

Strengthen your agri-risk management and minimize supply chain fraud with Farmonaut Product Traceability—leverage blockchain to authenticate product origins and support insurance audits for crops and livestock.

Access Farmonaut’s Suite for Agriculture Risk Management

Apps are designed for seamless, affordable integration of advanced satellite insights into daily farm and insurance operations—empowering precision, sustainability, and risk reduction.

Farmonaut Subscriptions & Pricing

The Benefits of Insurance to Farmers: Building Resilience through Innovation

The range of insurance products available to farmers—from crop, livestock, aerial aircraft, to annual forage insurance—plays a pivotal role in building economic stability, promoting sustainable practices, and empowering rural innovation:

- Income Stabilization: Protects against catastrophic losses from weather, disease, or market volatility.

- Incentive for Technology Adoption: Insurance-linked discounts or plan enhancements reward investment in smart irrigation, precision application, and resilient infrastructure.

- Access to Credit: Lenders require proof of risk mitigation before financing, and insurance is a precondition for agricultural and infrastructure loan approvals.

- Prevention of Community-Level Losses: Protects entire supply chains and local economies by backstopping rural producers in seasonal disasters.

- Lower Premiums through Mitigation: Investment in best practices, fire protection, and environmental monitoring brings credentialed premium reductions while benefiting production.

- Sustainable Practice Promotion: Bundled insurance solutions encourage environmentally restorative measures, such as carbon tracking and reduced chemical use.

- Fostering Innovation and Confidence: Secure in the knowledge of robust coverage, farmers can invest in new practices and technologies for yield improvement and environmental stewardship.

Key Takeaways: Securing a Resilient Future in Agriculture

- Insurance is indispensable in 2025: It’s as much a part of the farm management toolkit as machinery or personnel—enabling resilience, coverage, and innovation.

- Technology will continue to shape insurance products: From drone and satellite-based risk assessments to dynamic, data-driven premium adjustments.

- The benefits of insurance to farmers: Go far beyond disaster recovery—they unlock loans, smooth earnings, and let farmers invest in the future.

FAQ: Agriculture Aircraft Insurance, Cal Fire, Agri Insurance Jobs & Farmer Benefits

What is agriculture aircraft insurance and why is it essential?

Agriculture aircraft insurance is a specialized insurance product for aerial farming operators using aircraft or drones in agriculture. It’s essential because these aircraft face significant risks—low flight, rough terrains, unpredictable weather, and both crop and third-party liabilities. Insurance covers damage, liability, and lost income due to interruptions.

How is Cal Fire insurance cost calculated and how can it be reduced?

Cal Fire insurance cost is determined by regional wildfire risk scores, property resilience (e.g., fireproofing, defensible space), and mitigation investments. Properties in high-risk areas may have higher premiums or policy exclusions. Costs can be reduced by investing in fire-resistant upgrades, mitigation strategies, and leveraging real-time weather and risk data for early response.

What are agri insurance jobs and what skills are in demand for 2025?

Agri insurance jobs include insurance underwriters, risk assessors, claims adjusters, data analysts, and agri economists. In 2025, skills in data analytics, remote sensing, AI modeling, and precision agriculture are especially valued alongside agricultural background and customer advisory skills.

What makes annual forage insurance different from traditional crop insurance?

Annual forage insurance specifically covers forage crops (grasses, legumes, hay) critical for livestock feeding, protecting against losses from weather or pests. It often uses weather index triggers and satellite data for fast payout, unlike traditional crop insurance typically focused on grain or other commodity crops.

How does insurance benefit farmers beyond just financial coverage?

Beyond compensating for losses, insurance enables access to credit, fosters investment in innovation (like precision ag and sustainability), and protects rural economies. It encourages adoption of best practices by linking coverage with risk mitigation and environmental stewardship.

How can satellite and AI enhance agriculture aircraft insurance?

Satellite and AI technologies support risk assessment, claims verification, and early detection of insurable events (fires, pest outbreaks, crop stress), making insurance more accurate, affordable, and responsive in the face of complex modern-ag risks.

Conclusion: Future-Proofing Agriculture with Comprehensive Insurance

The evolving landscape of agricultural insurance demands that farmers, insurers, and all stakeholders stay ahead of both risk and innovation. Agriculture aircraft insurance, modern solutions to Cal Fire insurance cost, dynamic agri insurance jobs, and the growing array of insurance-backed benefits position farming communities for long-term resilience.

By leveraging technology—from satellite and AI monitoring to blockchain traceability—we can address the increasing risks of climate change, market volatility, and natural disasters while enabling sustainable practices and economic opportunity. As we move into 2025 and beyond, insurance remains a cornerstone for securing not only the livelihoods of farmers but the stability of global food systems.

Explore these solutions, embrace innovation, and advance your agricultural operations with confidence.