Alfalfa Market Boom: 2024 Trends Rock North America

“In 2024, North America leads the global alfalfa market, accounting for over 35% of total production volume.”

Market Overview: “Queen of Forages” Rising

Alfalfa, often referred to as the “queen of forages,” has become the focal point of a remarkable market surge in 2024. This perennial legume, renowned for its high nutritional value, plays a pivotal role in feeding livestock across the globe. Thanks to its adaptability to diverse climates and resilient soil types, as well as its rich protein content, abundance of essential vitamins, and minerals, alfalfa remains an essential staple in animal diets worldwide.

In recent years, the world has experienced an impressive uptrend in the global alfalfa market. Our industry analysis shows that this robust growth is fueled by an escalating demand for high quality animal feed, remarkable advancements in alfalfa cultivation practices, and continually expanding export opportunities for producers and traders alike. This dynamic shift has placed alfalfa at the center of attention for agricultural developers and livestock industries across key regions—including North America, Europe, Asia-Pacific, and beyond.

As of 2025, the global alfalfa industry is valued at USD 27.14 billion, with forecasts estimating a rise to USD 36.38 billion by 2030. This translates into a powerful CAGR of 6.03% during the forecast period, suggesting plenty of prospects for organic growth and increased market share. These trends will continue to reshape livestock nutrition, feed production, and global agriculture for the foreseeable future.

Regional Alfalfa Market Analysis: Where Growth Is Blossoming

Let’s break down the regional drivers behind this alfalfa market boom and identify where the majority of production, adoption, and innovation are taking place in 2024.

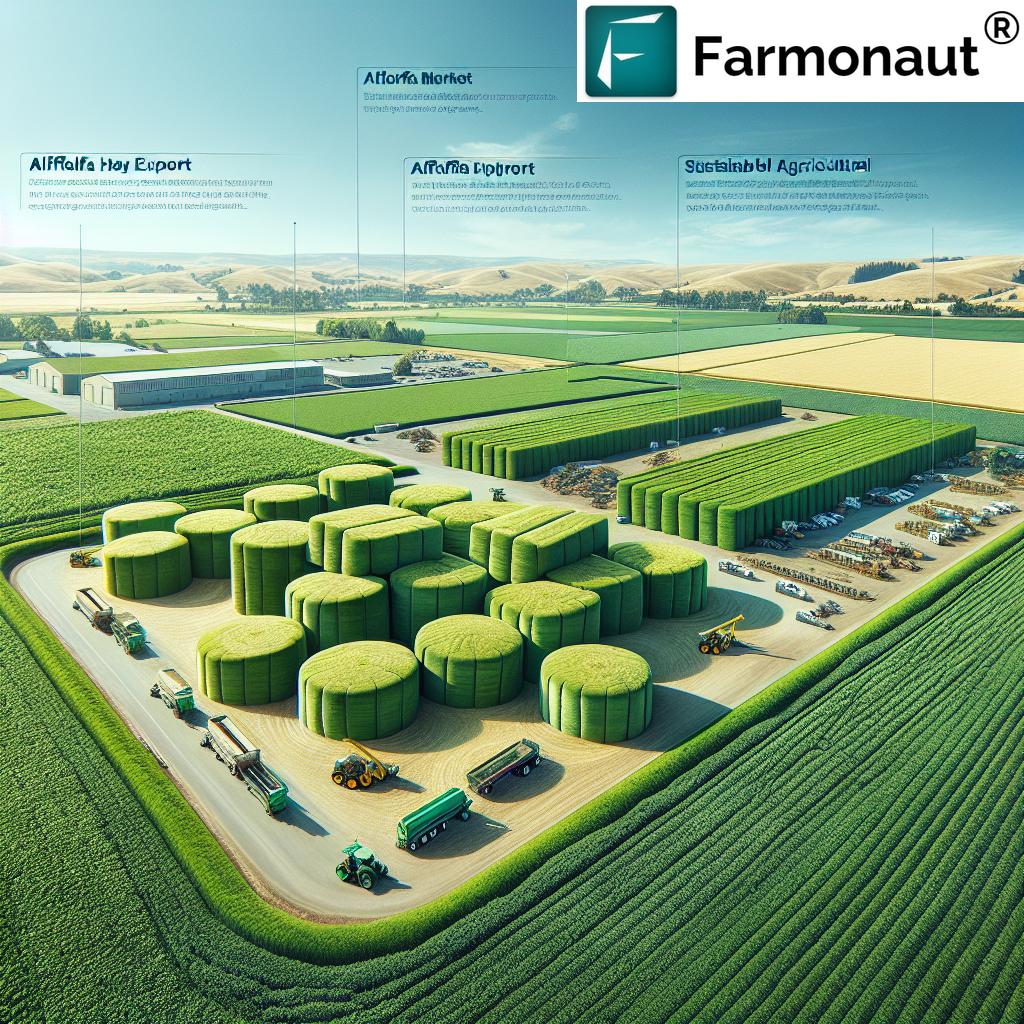

North America: The Powerhouse and Export Leader

North America, and in particular the United States, continues to dominate the global alfalfa industry. Holding over 43% global alfalfa market share in 2024, this region has solidified its reputation as both a major producer and exporter of premium alfalfa hay. In 2023, U.S. farmers produced approximately 70 million metric tons of alfalfa hay—an impressive volume resulting from cutting-edge agricultural practices and technological advancements in seed breeding and cultivation.

The top producing states, including California, Idaho, Montana, South Dakota, and Arizona, have collectively helped the U.S. remain the world’s leading supplier. A significant portion of U.S. alfalfa production is exported, with China accounting for 89.9% of China’s total alfalfa imports in 2023, valued at USD 461.7 million.

- U.S. Alfalfa Hay Export: 898,186 metric tons shipped to China in 2023.

- Market Focus: Growing demand for high quality animal feed and increased investment in sustainable production methods.

- Competitive Edge: Advanced seed breeding, hybrid varieties, and precision agriculture technologies.

Clearly, North America is at the forefront of global growth in the alfalfa market, driven by export strategies, scale, and an ongoing shift toward sustainable agriculture.

Asia-Pacific: Fastest Growing Alfalfa Market

In the Asia-Pacific region, the surge in livestock production and the quest for quality animal feed have made it the fastest growing alfalfa market globally. China stands out as the primary importer of alfalfa—sourcing around 1.2 million metric tons in 2024. Remarkably, the United States supplies approximately 90% of China’s imported alfalfa volume, keeping trans-Pacific trade relations strong and stable.

Europe: A Focus on Organic Alfalfa and Sustainability

In Europe, top producing countries such as France, Spain, and Italy remain committed to innovation in alfalfa cultivation practices. France’s output reached 4.5 million tons in 2024, while the entire EU saw an 8% increase in organic alfalfa consumption that same year—reflecting both market demand and consumer preference shifts.

The region is also experiencing significant traction in certified organic alfalfa demand, thanks to heightened regulations and a strong consumer push towards sustainably produced feed.

Other Regions: Emerging Players

- Latin America: Countries such as Argentina are major players in alfalfa seed production and livestock feed, contributing to the global uptick in high protein forage adoption.

- Middle East & Africa: Although smaller in volume, the growing adoption of sustainable irrigation techniques and high-yield seed varieties is transforming alfalfa cultivation prospects in water-scarce environments.

Across all regions, the alfalfa market boom of 2024 is being driven by export growth, demand for high quality products, and a rapid adoption of sustainable and precision farming techniques.

Alfalfa Market Segmentation Insights

To better understand how the alfalfa market is structured and the dynamics influencing its expansion, we must examine market segmentation by product type and livestock usage. These categories reveal preferences, areas of growth, and opportunities for innovation.

By Product Type: Hay Bales Lead the Way

The most popular product in alfalfa trade remains hay bales, which accounted for a commanding 43% alfalfa market share by volume in 2024. Their ease of handling, cost-effectiveness, and suitability for large-scale livestock operations underlie their broad adoption.

Notably, the alfalfa cubes segment is growing at the fastest rate among all forms—driven by convenience, transport efficiency, and longer shelf life. This growth is especially strong in regions with developed equine industries and where feed storage optimization is crucial.

By Livestock: Ruminants and Equines

- Ruminant Segment: Captured 54% market share in 2024, mainly through dairy and beef cattle feed applications.

- Equine Segment: Projected to grow at a robust CAGR of 24.2% over the forecast period, reflecting increased use of alfalfa in horse diets.

As demand in both established livestock sectors (such as dairy and beef) and specialized feeders (particularly horses and camels) keeps rising, product variety and market segmentation will remain vital for future growth.

Technological Advancements in Alfalfa Farming

There have been transformative technological advancements in recent years, reshaping how alfalfa is bred, cultivated, monitored, and integrated into global livestock supply chains. At the forefront of these changes are the adoption of hybrid seed varieties, precision farming tools, and robust agricultural data analytics platforms—all crucial for improving both yield and crop quality.

Alfalfa Seed Breeding Advancements

-

Hybridization:

In the United States, 99% of planted commercial alfalfa seed is now hybridized as of 2022. These genetically improved varieties bring better disease resistance, enhanced drought and cold tolerance, and superior digestibility for livestock. -

Trait Selection and Development:

Ongoing breeding innovation aims to address challenging disease profiles and increase forage nutritional values—ensuring reliable output even amid climate fluctuations.

Precision Agriculture and Monitoring Solutions

-

Satellite Imaging & AI Tools:

Farmers are increasingly adopting satellite-based monitoring platforms (such as Farmonaut) to gain insights on crop health, soil moisture, and growth rates in real time. These actionable data streams support smarter irrigation, targeted fertilizer delivery, and early disease detection. -

Irrigation Automation:

The adoption of automated irrigation and water management systems is crucial for optimizing water use, a growing concern in drought-prone regions. -

Resource Management & Sustainability:

By integrating digital tools for carbon footprinting and sustainability analysis, farmers can evaluate their environmental impact and fine-tune inputs for greener, more profitable operations.

These technological breakthroughs are empowering the global alfalfa industry to steadily improve yields, reliability, and product quality.

Sustainable Practices in Alfalfa Cultivation

With the environmental implications of agriculture under increasing scrutiny, sustainable practices are now integral to the alfalfa market and broader livestock industry. In 2024, over 60% of new alfalfa cultivation projects worldwide are influenced by sustainability strategies—a major shift that’s projected to reshape the industry over the next decade.

Producers, driven by both regulation and market opportunity, are pursuing an array of eco-friendly innovations across regions:

-

Rotation Cropping:

Incorporating alfalfa into crop rotation systems enhances soil fertility, reduces dependence on chemical fertilizers, and promotes overall biodiversity—a keystone move for sustainable agriculture. -

Organic Alfalfa Demand:

Particularly prominent in Europe and North America, organic alfalfa is growing in demand by 8% annually in some regions. This shift is attracting both environmentally conscious producers and major feed buyers seeking traceable, chemical-free nutrition for livestock. -

Water Conservation:

Efficient irrigation and the use of drought-resistant seed varieties allow farmers to conserve water—crucial for growing alfalfa in arid zones such as Arizona, California, and the Middle East. -

Reduced Chemical Inputs:

Advancements in pest management, disease control, and weed suppression minimize the need for herbicides and pesticides, improving both yield and environmental outcomes.

Eco-conscious stewardship and sustainability are rapidly becoming essential for alfalfa producers worldwide—with many now leveraging blockchain-based traceability tools (such as those provided by Farmonaut) to document and promote their green credentials throughout the supply chain.

“Sustainable practices now influence 60% of new alfalfa cultivation projects worldwide, reflecting a major industry shift.”

Alfalfa Market Dynamics and Production Forecast 2024

The ongoing expansion of the alfalfa market is driven by a compelling mix of economic, technological, and consumer-led factors. Let’s break down the principal drivers and consider the latest alfalfa production forecast 2024:

Market Drivers: What’s Fueling the Boom?

- Livestock and Cattle Population Growth: The global rise in livestock, especially in emerging markets, is fueling elevated demand for high quality animal feed—with alfalfa at the core.

- Technological Advancements: Improved machinery, genetically enhanced seed varieties, and advanced data monitoring systems (like those offered by Farmonaut) have made cultivation more productive and less resource-intensive.

- Rising Trends in Organic and Non-GMO Products: Shifting consumer preferences toward organic protein and sustainably produced feed is stimulating rapid growth, especially in Europe and North America.

- Supportive Policies: Many governments and agricultural institutions, seeing the environmental and economic benefits, are providing subsidies and incentives for forage crop rotation and sustainable agricultural practices.

- Market Fluctuations: Fluctuations in hay prices and the competitive pricing of alternative forages are impacting the pace of market growth in some regions; overall, however, projections remain bullish through 2030.

Alfalfa Production Forecast 2024 & Export Opportunities

- The alfalfa market is projected to reach USD 36.38 billion by 2030, with a CAGR of 6.03%.

- Alfalfa export volumes, particularly from North America to Asia-Pacific (notably China), continue to rise—ensuring significant opportunities for regional producers and international traders.

- Argentina and Europe are expanding their export footprints, focusing increasingly on premium and organic-certified alfalfa products.

Overall, the market outlook for alfalfa remains robust, with expanding use cases in animal feed, continued adoption of advanced cultivation techniques, and growing demand for sustainable and traceable feed solutions.

Farmonaut: Technology for Modern Alfalfa Farming

Technologies like Farmonaut’s satellite-based farm management system are reshaping the way alfalfa farmers approach precision agriculture. With advanced crop health monitoring, resource management, and blockchain-based traceability, Farmonaut empowers producers to maximize yields while reducing input costs and environmental footprints.

- Crop Monitoring: Farmonaut’s NDVI and soil moisture tracking tools allow farmers to react quickly to changing field conditions—improving yields and crop quality.

- Resource Efficiency: AI-based recommendations help optimize irrigation, fertilization, and pest management.

- Traceability: Blockchain technology enforces transparency across the supply chain, a critical factor as organic alfalfa demand continues to rise.

- Fleet and Asset Management: Reduce transport and logistics costs using Farmonaut’s fleet management solutions—perfect for large-scale alfalfa producers and exporters.

- Sustainability: Carbon footprinting tools support environmental compliance and build trust with green-minded buyers.

-

Flexible Access: Farmonaut’s system is available on Android, iOS, web, and via API for integration with enterprise solutions or research apps.

See the developer docs here. - Large-Scale Management: Manage vast estates, plantations, or cluster-based farming using Farmonaut’s large-scale farm management system.

- Crop Loan & Insurance Verification: Validate farm area and health for loans/insurance using satellite-based prediction and compliance checks.

Farmonaut is democratizing precision agriculture for all alfalfa market players, delivering smarter, data-driven, and more sustainable farming results across every region.

Alfalfa Market Key Players

Leadership in the alfalfa market comes from a diverse set of global players focused on sustainable production, advanced seed development, and high-quality product delivery. These key industry figures continuously invest in R&D and technological upgrades to ensure competitive market positions and contribute to a resilient global supply chain.

- Alfalfa Monegros SL

- Anderson Hay & Grain Inc.

- Al Dahra ACX Global Inc.

- Standlee Premium Products, LLC

- Bailey Farms

- Cubeit Hay Company

- Green Prairie International

- Haykingdom Inc.

These major market players are actively adopting sustainable agricultural practices, crop rotation, reduced chemical use, and water conservation—responding to global demand for both quality and responsibility in animal feed production.

Regional Alfalfa Market Trends Comparison Table

| Region | Estimated 2024 Market Size (USD Million) | Projected Growth Rate (%) | Major Cultivation Advancements | Leading Sustainable Practices |

|---|---|---|---|---|

| North America | ~11,660 | 5.1 | Hybrid seed varieties, precision agriculture, satellite crop monitoring | Water management, crop rotation, reduced chemical use |

| Europe | ~5,510 | 5.9 | Organic seed breeding advancements, traceability systems | Organic certification, biodiversity promotion |

| Asia-Pacific | ~7,620 | 7.6 | Large-scale irrigation modernization, improved logistics, feed tech | Efficient irrigation, disease control, minimal chemical input |

| Latin America | ~1,890 | 6.5 | Genetic improvement, climate-adaptive farming | Low-water cultivation, eco-fertilizer use |

| Middle East & Africa | ~1,035 | 7.1 | Salt-tolerant seed varieties, intensive water management | Drought resistance, integrated pest/water strategies |

This comparative table reflects key regional market trends in the 2024 alfalfa industry, combining estimated market value, growth rates, and distinct sustainable cultivation strategies shaping the global alfalfa market.

FAQ: Alfalfa Market in 2024

-

Q: Why is alfalfa called the ‘queen of forages’?

A: Alfalfa has earned this title due to its high nutritional value, adaptability to diverse climates and soil types, and its critical role as a protein-rich, mineral-packed feed for livestock worldwide. -

Q: Which region leads the global alfalfa market in 2024?

A: North America, and particularly the United States, leads with around 43% market share and the largest export capacity, driven by high-quality production and advanced farming practices. -

Q: What are the main drivers of alfalfa market growth in 2024?

A: The primary drivers include rising global livestock populations, increased demand for high quality animal feed, advancements in seed breeding, sustainable cultivation, and export expansion. -

Q: How important are sustainable practices in alfalfa farming now?

A: In 2024, sustainable practices influence over 60% of new alfalfa cultivation projects worldwide, prioritizing water conservation, reduced chemical use, and responsible rotation. -

Q: What new technological tools are influencing the alfalfa market?

A: Advanced satellite imagery, AI-based advisory, blockchain-based traceability, and modern hybrid seed genetics are all reshaping how farmers manage and market alfalfa crops. -

Q: How can Farmonaut help alfalfa farmers and industry players?

A: Farmonaut provides satellite-based crop health monitoring, real-time resource management, blockchain-enabled traceability, carbon footprint tracking, fleet management, and accessible analytics via web, mobile, and API platforms—enabling smarter, more sustainable operations.

Still have questions? Try Farmonaut’s app for live insights, or see our documentation and solutions for developers and agribusiness professionals.

Conclusion

The alfalfa market boom in 2024 represents a pivotal era for global agriculture, livestock feed production, and the adoption of sustainable practices worldwide. Led by powerful production hubs in North America, Europe, and Asia-Pacific, and fueled by breakthroughs in seed breeding, cultivation techniques, and traceability technology, alfalfa is reinforcing its status as the backbone of quality livestock nutrition.

At the same time, platforms like Farmonaut empower farmers, agribusinesses, and institutions to implement precision agriculture at scale—maximizing output, minimizing environmental impact, and increasing profitability. As we move toward 2030, sustainable innovation and digital transformation will determine which players dominate the expanding global alfalfa market.