Bloomberg Commodity Futures: 7 Powerful Insights for Traders

“The Bloomberg Commodity Index covers 23 commodities, offering traders exposure to over 90% of the global commodity futures market.”

Table of Contents

- Introduction

- 1. Understanding the Global Commodity Markets & BCOM

- 2. BCOM Composition and Weighting Methodology

- 3. Agricultural Commodities Index: Sector Insights

- 4. BCOM Sector Performance: Risk & Return Analysis

- 5. Commodity Futures Trading Opportunities with BCOM

- 6. Risk Management in Commodity Trading: Regulatory Oversight

- 7. Harnessing Technological Advantages in Agriculture with Farmonaut

- FAQs: Bloomberg Commodity Futures & Trading

- Conclusion

Introduction: Why Bloomberg Commodity Futures Matter

The global commodity markets have an immense impact on our daily lives, shaping the price of food we eat, the fuel we use, and the metals that enable modern technology. For traders, investors, and those seeking exposure to these crucial sectors, understanding the mechanics of diversified commodity futures trading is vital for navigating market risks and identifying growth opportunities. In this comprehensive analysis, we’ll unlock seven powerful insights into Bloomberg Commodity Futures, focusing on the role of the Bloomberg Commodity Index (BCOM) as a benchmark for the agricultural commodities index and a window into broader market dynamics.

We’ll explore how BCOM’s methodology—its unique approach to composition, weighting, and sector inclusion—offers diversified commodity exposure spanning agriculture, energy, industrial metals, precious metals, livestock, and softs. We’ll also analyze trading and investment opportunities enabled by futures, options, and subindexes, and how regulatory oversight maintains the integrity of these markets. For those passionate about agriculture, we’ll highlight how advanced agri-tech like Farmonaut empowers farmers and corporates to harness data, manage resources, and tap into the same market dynamics quantified by BCOM.

Let’s embark on this deep dive into the BCOM, a comprehensive index regarded by market participants worldwide as the gold standard for benchmarking commodity price movements and managing risk.

1. Understanding the Global Commodity Markets & BCOM

The global commodity markets represent a vast and interlinked ecosystem where raw materials—such as wheat, oil, gold, copper, soybeans, coffee, and more—are bought, sold, and traded. These commodities are the building blocks of the world’s economy, forming the bedrock of food production, manufacturing, infrastructure, and energy systems. Prices in these markets are shaped by a complex mix of supply, demand, weather, geopolitical tensions, and economic cycles.

Given the enormous diversity and volatility inherent in individual commodity prices, most institutional and sophisticated retail investors prefer structured benchmarks for managing exposure and measuring performance. This is where the Bloomberg Commodity Index (BCOM) comes in.

Established originally as the Dow Jones-AIG Commodity Index in 1998 and rebranded in 2014, BCOM has become the definitive yardstick for comprehensive commodity investment. It’s referenced widely when gauging sector returns, allocating portfolios, and even constructing new financial products.

2. BCOM Composition and Weighting Methodology: Diversified Commodity Exposure

Perhaps the most striking feature of BCOM is its deliberately diversified composition. Unlike other benchmarks that may concentrate heavily on a single commodity (such as oil or gold), BCOM’s structure is designed to minimize idiosyncratic risk by limiting exposure to any one sector or product.

- Number of Commodities: 23 major commodity futures make up the index, spanning agriculture, energy, industrial metals, precious metals, softs, and livestock.

- Number of Sectors: Six core sectors—energy, grains, industrial metals, precious metals, softs, and livestock—are represented, offering diversified exposure to global production and market liquidity.

BCOM uses an innovative weighting methodology that factors in both economic importance and tradability:

- Liquidity: Two-thirds of each commodity’s weighting depends on the liquidity of its futures market. This means that contracts with higher trading volume—such as WTI crude oil or corn on the Chicago Mercantile Exchange (CME)—get heavier representation.

- Production Data: The remaining one-third of weighting is anchored in global production metrics. This ensures the index reflects not just market trading, but real-world economic significance.

This methodology delivers—the BCOM index automatically rebalances each year to reflect changes in market activity and economic trends. The result? A diversified commodity exposure closely aligned with the shifting realities of the global economy.

For more on index methodology and weightings, consult this authoritative resource.

Commodity Sectors Included in BCOM:

- Energy: Crude Oil (WTI & Brent), Natural Gas, Gasoline, Heating Oil, Gasoil

- Grains: Corn, Soybeans, Wheat (Chicago & Kansas HRW), Soybean Meal, Soybean Oil

- Industrial Metals: Aluminum, Copper, Lead, Nickel, Zinc

- Precious Metals: Gold, Silver

- Softs: Coffee, Cotton, Sugar

- Livestock: Live Cattle, Lean Hogs

Why This Matters:

This diversified array of commodities ensures the BCOM index is not swayed by the fortunes of any single product or market. When energy prices are volatile, grains or metals might provide stability. When agricultural markets are driven by seasonal demand or supply shocks (such as droughts or bumper crops), other sectors help balance overall index risk.

3. Agricultural Commodities Index: Sector Insights

Agricultural commodities form the backbone of the BCOM Index, accounting for approximately 30% of the total weighting. Their inclusion is not just a statistical artifact—it’s a reflection of their critical role in global food security, economic activity, and rural livelihoods.

“Agriculture makes up about 30% of the Bloomberg Commodity Index, highlighting its significant role in diversified trading strategies.”

Let’s break down the vital agricultural commodities represented in BCOM, highlighting their importance for market participants, traders, and the agriculture sector:

- Corn: As a staple grain, corn is critical for food production, animal feed, and biofuel supply chains. Weather shocks in the American Midwest, for example, ripple through the global commodity price movements and can influence index performance.

- Soybeans & Soybean Products (Meal, Oil): Soybeans are valued for their protein content and oil, serving as both a mainstay of livestock feed and an essential ingredient in numerous food products. Soybean meal and soybean oil are tracked as distinct subcomponents in BCOM, reflecting their unique market dynamics.

- Wheat: Both Chicago Wheat and Kansas HRW (Hard Red Winter) Wheat play major roles in global food supply, especially for bread. Grains market analysis regularly tracks supply disruptions and harvest outcomes in these segments as bellwethers for agriculture sector performance.

- Sugar: Derived from sugarcane and sugar beets, sugar is integral to the food and beverage industry and is sensitive to both weather and global demand cycles.

- Coffee: One of the world’s most traded softs commodities, coffee is a major export for countries like Brazil and Vietnam and is highly responsive to climate patterns and consumer trends.

- Cotton: Essential to the textile industry, cotton links agriculture with global fashion and manufacturing supply chains.

The Role of Agricultural Commodities in BCOM

- Diversification: Agricultural markets often move independently of energy and metals commodities, acting as “shock absorbers” during oil or metal price crises.

- Risk Profile: Agricultural commodities are subject to distinct risks: weather volatility, pests, trade policies, and shifting government subsidies. Their inclusion in BCOM helps participants spread and manage these risks more effectively.

- Economic Significance: With the world’s population growing and income levels rising, demand for higher-protein diets (soybeans, corn for feed) and luxury goods (coffee, cotton) has never been greater. This structural demand underpins the strategic value of agricultural commodities index exposure.

- Regional Relevance: Specific BCOM agricultural subcomponents (such as “Kansas HRW Wheat” or “Chicago Wheat”) track influential US regions’ production, helping traders and agricultural professionals monitor localized market risks and opportunities.

To leverage these insights for smarter crop planning and risk management, explore Farmonaut’s satellite-powered crop health monitoring and weather-driven AI advisory—get started here.

4. BCOM Sector Performance: Risk & Return Analysis

For any trader considering commodity futures trading through BCOM, understanding sector-specific risk and return is essential. The following table summarizes estimated weightings, annual performance, and volatility (risk) profiles by major sector—enabling better diversification and risk management in commodity trading.

| Sector | % Weight in BCOM (Est.) | Notable Commodities | Avg. Annual Return (%) | Estimated Volatility (% Std. Dev.) |

|---|---|---|---|---|

| Agriculture (Grains, Softs, etc.) | ~30% | Corn, Soybeans, Wheat, Sugar, Coffee, Cotton | 4–8% | 16–20% |

| Energy | ~30%-35% | WTI, Brent, Natural Gas, Gasoline, Heating Oil | 7–11% | 23–28% |

| Industrial Metals | ~15%-20% | Aluminum, Copper, Zinc, Lead, Nickel | 4–9% | 18–22% |

| Precious Metals | ~15% | Gold, Silver | 4–8% | 14–18% |

| Livestock | ~2–4% | Live Cattle, Lean Hogs | 3–5% | 12–16% |

Key Takeaway: Diversification across these sectors balances risk and helps offset return volatility, especially during market stress in one segment (such as energy price shocks or agricultural harvest failures).

- Agricultural Commodities: Core for hedging food inflation or capturing weather-driven gains.

- Energy and Metals: Offer liquidity and high economic sensitivity but can amplify portfolio risk during downturns.

5. Commodity Futures Trading Opportunities with BCOM

BCOM serves not just as a performance benchmark but as the foundation for actual trading products on leading exchanges. Here are the main paths for market participants:

- BCOM Futures: Traded on the CME, these contracts give direct access to broad commodity price movements, useful for both speculation and portfolio hedging.

- Subindex Futures: Launched on CME in March 2025, allowing you to target specific commodity sectors such as agricultural commodities, energy, industrial metals, or grains. This is ideal for applying specialized grains market analysis or managing exposure to a particular submarket.

- Options on Futures: Expected for BCOM in September 2024. These products bring even more flexibility—traders can take views on volatility, hedge against downside risk, or structure advanced strategies around expected market shifts.

Each of these products gives traders an entry point into commodity markets in a risk-managed, index-based manner—either broad or sector-specific.

BCOM and Agricultural Market Applications

- Hedging for Food & Feed Producers: If you operate in food processing or animal feed (e.g., corn, soybean meal), futures allow you to lock in input costs and reduce profit uncertainty.

- Speculating on Price Trends: Commodity-focused funds and active traders use BCOM futures/options for exposure to rising (or falling) commodity prices—from coffee and sugar to oil and metals.

- Building a Diversified Portfolio: Because BCOM covers 90% of the global futures market, it is a core building block for portfolio diversification and inflation hedging.

- Agribusiness & Supply Chains: Users can synchronize risk management with carbon footprinting efforts and blockchain-based product traceability enabled by platforms like Farmonaut, letting you both monitor and validate the supply-chain journey of soft commodities.

Looking to Integrate Data into Your Operations?

-

Satellite Data API: Integrate real-time satellite crop health and weather data into your analytics or agri-finance platform using the Farmonaut API.

Review comprehensive API developer documentation here. - Large-scale Farm Management: Overseeing vast acreage? Check out our advanced web and mobile farm management tools for remote monitoring, advisory, compliance, and yield estimation powered by AI and satellite analytics.

6. Risk Management in Commodity Trading: Regulatory Oversight

Commodities markets are dynamic and volatile—factors like climate change, geopolitical disruptions, and shifting supply-demand balances make risk management central to all trading activity. Transparent regulatory oversight ensures markets function fairly and are accessible to both institutional investors and farmers seeking to hedge agriculture sector performance.

-

Commodity Futures Trading Commission (CFTC):

The primary regulator for commodity futures trading in the United States. Learn more here. The CFTC was established in 1974, setting ground rules for market integrity, fraud prevention, and the avoidance of abusive trading practices. - Exchange Standards: Markets like the CME enforce rules around margin, settlement, and reporting to reduce systemic risk.

- Contract Standardization: All BCOM-related futures and options are highly standardized, with transparent pricing, deliverable grades, and global access. This encourages high liquidity and limits risk from counterparty failure.

Whether you are a trader, agri-corporate, bank, or even a government-sponsored buyer, understanding the regulatory framework is essential to designing robust risk strategies using commodity index methodology. As BCOM evolves with new contracts and subindexes, so too does the oversight that supports global confidence in its trading systems.

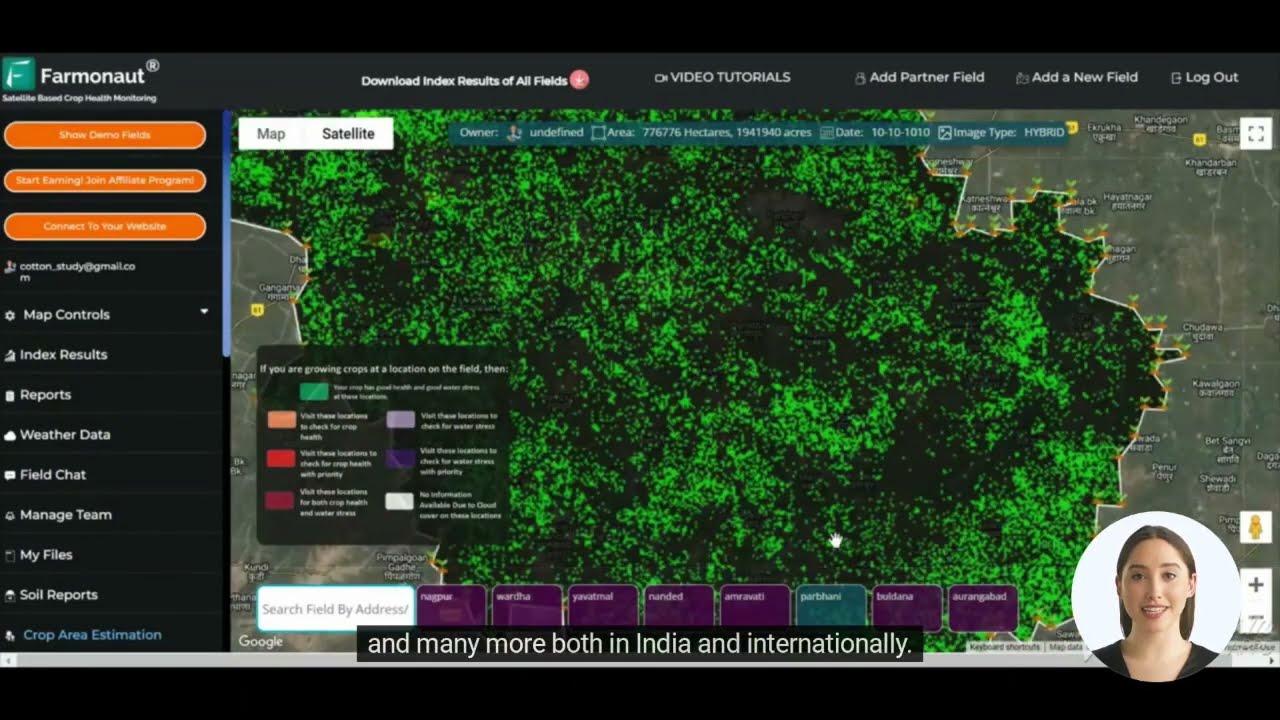

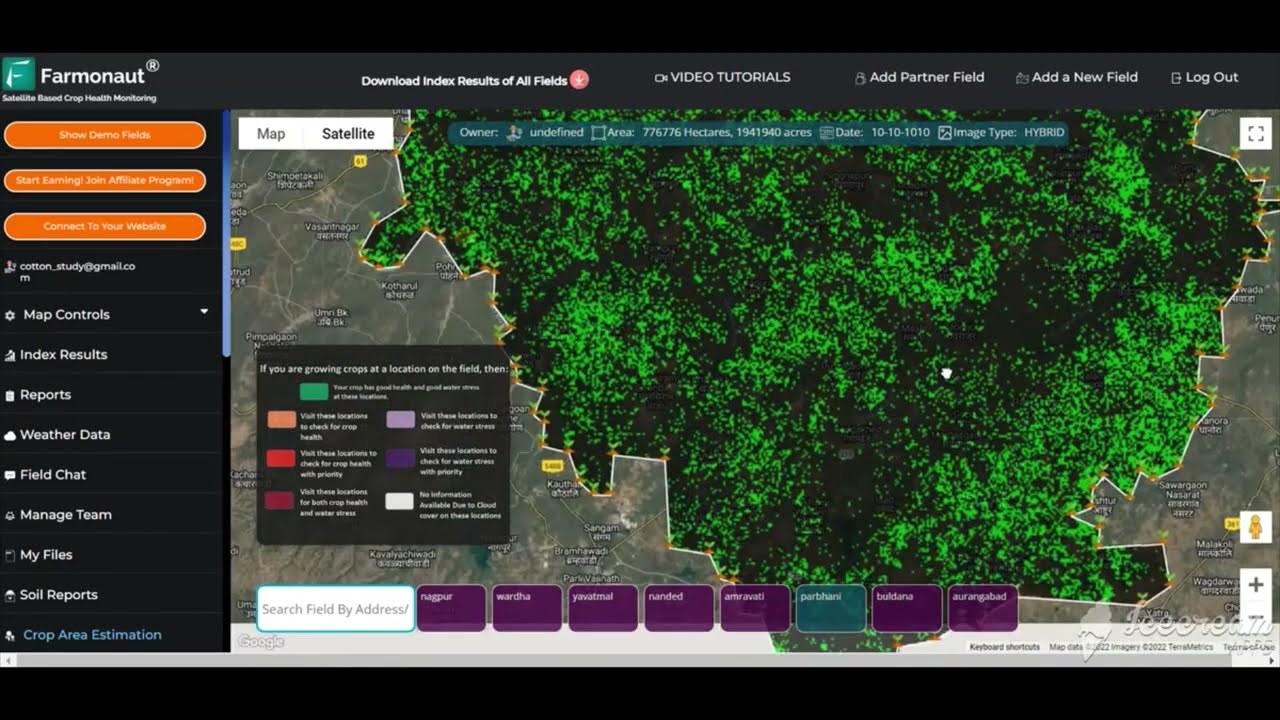

7. Harnessing Technological Advantages in Agriculture with Farmonaut

The complexity of commodity markets—especially in the agricultural sector—demands real-time data, quick decision-making, and smarter resource management. Here’s where Farmonaut delivers a decisive edge for farmers, agribusinesses, governments, and corporates aiming to benefit from the same market trends BCOM tracks at scale.

Precision-Focused Solutions for Modern Agriculture

- Satellite-Based Crop Health Monitoring: Farmonaut’s platforms use multispectral satellite imagery to track crop vigor, NDVI, soil moisture, and pest/disease risks. This empowers proactive management, yield forecasting, and reduction of unplanned losses—directly impacting your exposure to commodity price movements and agricultural sector performance.

- AI-Powered Jeevn Advisory: Jeevn delivers real-time, crop-specific advice based on satellite trends, local weather, and AI-driven modeling—improving input strategy and reducing cost while maximizing field productivity.

- Blockchain-based Traceability: Bring transparency to your supply chain—essential for export, compliance, and premium pricing in global markets. Farmonaut’s traceability module assures end-to-end authenticity for food and cotton.

- Fleet & Resource Management: Optimize movement of grain, wheat, or cotton with precision logistics. Learn about our agribusiness fleet tracking solution for reducing fuel costs and boosting operational efficiency.

- Carbon Footprinting: Monitor and minimize the environmental impact of your agricultural operations. Access the Carbon Footprinting product—perfect for ESG reporting and sustainable farming goals.

- Crop Loans & Insurance: Speed up credit and claims using satellite-verified crop stages, empowering better access to financial products designed for the farming community.

Farmonaut’s web, mobile apps, and API offer accessibility for all—from smallholders to agro-corporates—making advanced, data-driven decision-making a reality in the field. Get the Farmonaut app today or integrate our API into your own workflow.

How Farmonaut Empowers Different Stakeholders

- Individual Farmers: Affordable access to NDVI/satellite crop monitoring, maximizing yields, and minimizing risks.

- Agribusinesses: Plantation management, real-time fleet/resource tracking, and farm compliance reporting.

- Governments/NGOs: Region-wide crop health estimation, policy design, and subsidy deployment backed by geospatial data.

- Financial Institutions: Satellite-based farm verification for secure loans, reducing fraud in insurance claim processing.

- Corporate Clients (Textile, Food): Blockchain-verified product journey, premium pricing, and supply chain trust.

Frequently Asked Questions: Bloomberg Commodity Futures & Trading

What is the Bloomberg Commodity Index (BCOM)?

BCOM is a widely recognized, comprehensive index tracking the performance of 23 major global commodity futures, offering diversified exposure across agriculture, energy, metals, and other sectors. It minimizes concentration risk through a unique weighting methodology based on both production and futures market liquidity.

How is commodity weighting determined in BCOM?

The BCOM index uses a combination of futures liquidity (two-thirds of weighting) and global production data (one-third). This approach ensures the index reflects both tradability and economic significance for each commodity.

Why include agricultural commodities like wheat and soybeans in indices?

Agricultural commodities are vital for food security, economic stability, and diversification. Their unique risk profiles, tied to weather and demand cycles, help balance overall portfolio risk and offer targeted trading/investment opportunities.

How can traders invest in Bloomberg Commodity Futures?

Traders can use diversified BCOM futures contracts, sector-specific subindex futures, and, from September 2024, options on BCOM futures—all traded on platforms such as the Chicago Mercantile Exchange (CME).

What role does the CFTC play in commodity futures?

The Commodity Futures Trading Commission (CFTC) regulates U.S. commodity futures markets, ensuring transparency, preventing manipulation, and supporting fair, orderly trading for all participants.

How does technology (like Farmonaut) empower agricultural commodity traders?

Advanced agri-tech solutions, including real-time satellite monitoring, AI advisory, blockchain-based traceability, and resource management (offered by Farmonaut) boost farm productivity, support supply chain transparency, and help traders make informed, risk-managed decisions aligned with global market trends.

How can I access Farmonaut services?

Farmonaut’s crop monitoring, advisory, traceability, and analytics are available via web app, Android/iOS mobile app, and API integration. Visit Farmonaut app to sign up today.

Conclusion: Mastering Diversified Commodity Exposure and Agriculture Sector Performance

The Bloomberg Commodity Index (BCOM) stands out as a critical benchmark for global commodity markets. Its comprehensive, sector-spanning methodology grants market participants the power to manage risk, build diversified commodity portfolios, and track the ever-evolving landscape of food, energy, metals, and soft commodities.

For those focusing on agricultural commodity trading, BCOM’s robust inclusion of grains, oilseeds, coffee, cotton, and sugar enables actionable insights into agriculture sector performance and risk management. Modern technology, typified by platforms like Farmonaut, further empowers stakeholders with advanced satellite and AI tools—making precision agriculture, supply chain transparency, and climate resilience not only achievable but affordable.

As the commodities sector adapts to new economic challenges—ranging from supply chain disruptions to environmental regulation—tools like BCOM and Farmonaut unlock new paths for securing growth, protecting margins, and feeding a growing world.

Ready to harness these insights for your farm, business, or investment strategy? Explore the Farmonaut platform and join the future of data-driven agriculture today!