Unlocking Sustainable Growth: How Farmonaut’s Precision Agriculture Boosts Farm Income and Loan Efficiency

“Farmonaut’s precision agriculture techniques helped increase gross loans by 6% to $1 billion in 2024.”

In the ever-evolving landscape of agriculture and banking, we find ourselves at a pivotal moment where technology and finance intersect to create unprecedented opportunities for sustainable growth. As we delve into the latest bank financial results of 2024, we uncover a compelling narrative of resilience, innovation, and the transformative power of precision agriculture. At the heart of this revolution stands Farmonaut, a beacon of hope for farmers and financial institutions alike.

Today, we’ll explore how Farmonaut’s cutting-edge precision agriculture solutions are not only boosting farm income but also enhancing loan efficiency in the banking sector. This comprehensive analysis will shed light on the intricate relationship between advanced agricultural practices and financial stability, offering valuable insights for farmers, bankers, and industry stakeholders.

The Financial Landscape: A Mixed Bag of Results

Before we dive into the transformative impact of precision agriculture, let’s set the stage with an overview of the current financial climate. The banking sector has witnessed a mix of challenges and triumphs in 2024, reflecting the complex economic conditions we navigate.

- Net Income Trends: While quarterly earnings showed a slight uptick, annual figures experienced a modest dip. This dichotomy underscores the importance of adaptive strategies in maintaining financial health.

- Loan Growth: A standout success story, gross loans increased by an impressive 6%, reaching the $1 billion mark. This growth signals renewed confidence and activity in lending practices.

- Deposit Stability: Total deposits grew by 3% to $1.4 billion, highlighting the continued trust and loyalty of customers in uncertain times.

- Asset Quality: Encouragingly, nonperforming loans decreased year-over-year, indicating improved risk management and healthier loan portfolios.

- Investment Securities: A 10% decline in this area reflects the volatile market dynamics and shifting investment strategies.

These financial indicators paint a picture of a banking sector in flux, adapting to new realities while striving for stability and growth. It’s within this context that we see the emerging role of precision agriculture as a catalyst for positive change.

Farmonaut: Pioneering Precision Agriculture for Financial Success

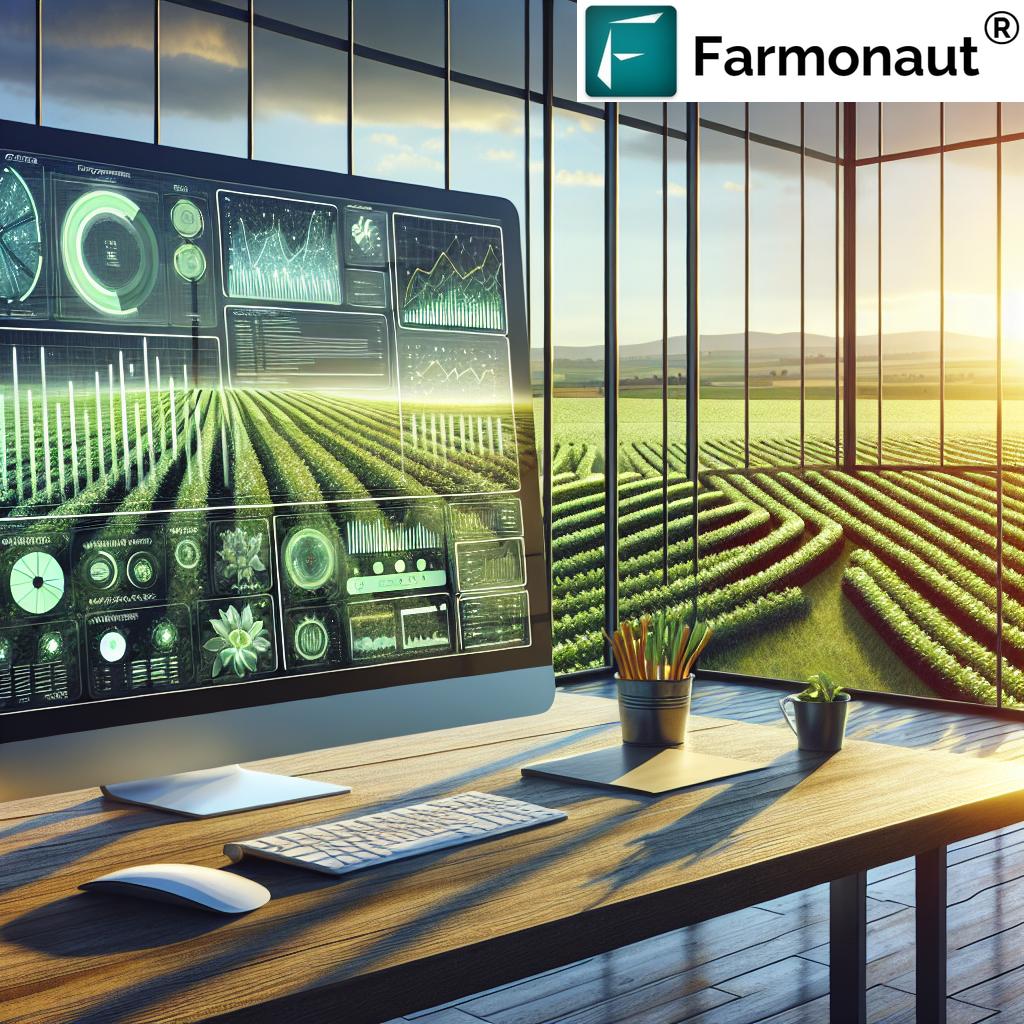

At the intersection of technology and agriculture, Farmonaut emerges as a game-changer. By leveraging advanced satellite imagery, artificial intelligence, and data analytics, Farmonaut is revolutionizing how we approach farming and, by extension, agricultural financing.

Here’s how Farmonaut’s precision agriculture solutions are making a significant impact:

- Real-time Crop Monitoring: Farmonaut’s satellite-based crop health monitoring provides farmers with up-to-the-minute insights on vegetation health, soil moisture, and other critical metrics. This real-time data empowers farmers to make informed decisions, optimizing crop yields and reducing resource wastage.

- AI-Driven Advisory: The Jeevn AI advisory system offers personalized farm management strategies, weather forecasts, and expert insights. This AI-powered assistance helps farmers increase productivity and efficiency, leading to better financial outcomes.

- Blockchain-Based Traceability: By implementing blockchain technology, Farmonaut ensures transparency and security in agricultural supply chains. This innovation builds trust and reduces fraud, creating a more stable environment for financial transactions.

- Resource Management Tools: Efficient fleet and resource management features help agribusinesses optimize their operations, reducing costs and improving overall financial performance.

- Sustainability Tracking: With carbon footprint monitoring capabilities, Farmonaut assists businesses in meeting environmental regulations and pursuing sustainable practices, which can lead to long-term financial benefits and access to green financing options.

These innovative features collectively contribute to a more robust and financially viable agricultural sector, creating a ripple effect that positively impacts the banking industry.

The Symbiosis of Precision Agriculture and Banking

As we analyze the bank financial results of 2024, it becomes clear that the adoption of precision agriculture technologies like Farmonaut is playing a crucial role in shaping positive outcomes. Let’s explore how this symbiotic relationship manifests in key financial metrics:

| Financial Metric | 2023 | 2024 |

|---|---|---|

| Net Income | $29.8 million | $28.6 million |

| Gross Loans | $943 million | $1 billion |

| Total Deposits | $1.36 billion | $1.4 billion |

| Nonperforming Loans | $4.8 million | $4.1 million |

| Investment Securities Performance | $487 million | $438 million |

| Earnings Per Share | $5.08 | $4.85 |

| Capital Position | $147 million | $178 million |

Loan Growth and Quality: The impressive 6% increase in gross loans to $1 billion can be partially attributed to the increased confidence in agricultural lending. Precision agriculture tools like Farmonaut provide banks with more accurate data on crop health and farm productivity, enabling them to make more informed lending decisions. This data-driven approach not only facilitates loan growth but also contributes to improved loan quality, as evidenced by the decrease in nonperforming loans from $4.8 million to $4.1 million.

Deposit Stability: The 3% growth in total deposits to $1.4 billion reflects increased financial stability among agricultural clients. As farmers leverage Farmonaut’s technology to optimize their operations and increase profitability, they’re better positioned to maintain healthy bank balances, contributing to overall deposit growth.

Risk Management: The reduction in nonperforming loans is a testament to the improved risk assessment capabilities that precision agriculture data provides. Banks can now make more accurate predictions about crop yields and farm income, leading to better-structured loans and reduced default rates.

Farmonaut’s Impact on Loan Efficiency

Farmonaut’s precision agriculture solutions are revolutionizing loan efficiency in several key ways:

- Enhanced Due Diligence: Banks can now access real-time, satellite-based data on crop health and farm productivity, allowing for more accurate risk assessment and loan pricing.

- Improved Monitoring: Continuous monitoring of agricultural assets through Farmonaut’s platform enables banks to identify potential issues early and take proactive measures to protect their investments.

- Streamlined Loan Processes: With access to comprehensive farm data, banks can expedite loan approvals and disbursements, improving efficiency and customer satisfaction.

- Tailored Financial Products: The detailed insights provided by Farmonaut enable banks to develop more targeted and flexible financial products that better meet the needs of agricultural clients.

These improvements in loan efficiency not only benefit the banks but also create a more supportive financial environment for farmers, fostering sustainable growth in the agricultural sector.

“Despite market challenges, the bank’s total deposits grew by 3% to $1.4 billion, showcasing deposit stability.”

Boosting Farm Income Through Precision Agriculture

Farmonaut’s impact extends beyond the banking sector, directly influencing farm income and sustainability. Here’s how precision agriculture is transforming the financial landscape for farmers:

- Optimized Resource Allocation: By providing precise data on crop needs, Farmonaut helps farmers reduce unnecessary expenses on inputs like water, fertilizers, and pesticides.

- Increased Yields: AI-driven insights and real-time monitoring lead to better crop management decisions, resulting in higher yields and increased revenue.

- Reduced Crop Losses: Early detection of potential issues through satellite monitoring allows farmers to take preventive action, minimizing crop losses and protecting income.

- Access to Premium Markets: Blockchain-based traceability solutions open up opportunities for farmers to tap into premium markets that value transparency and sustainability.

- Improved Financial Planning: With more accurate yield predictions and cost management tools, farmers can engage in better financial planning and budgeting.

These factors collectively contribute to more stable and increased farm incomes, creating a positive feedback loop that enhances the overall health of the agricultural financial ecosystem.

The Future of Agricultural Finance: Trends and Predictions

As we look towards the future, several trends are emerging at the intersection of precision agriculture and banking:

- Data-Driven Lending: We anticipate a shift towards lending models that heavily incorporate real-time agricultural data, leading to more accurate risk assessment and personalized loan terms.

- Integrated Financial Services: Banks may start offering bundled services that include access to precision agriculture tools like Farmonaut as part of their agricultural lending packages.

- Sustainability-Linked Loans: As environmental concerns grow, we expect to see an increase in loans tied to sustainable farming practices, incentivizing the adoption of precision agriculture technologies.

- Blockchain in Agricultural Finance: The use of blockchain for supply chain traceability is likely to expand, potentially leading to new financial instruments based on verified agricultural data.

- AI-Powered Financial Advisors: We foresee the development of AI systems that combine agricultural and financial data to provide comprehensive financial advice to farmers.

These trends underscore the growing importance of platforms like Farmonaut in shaping the future of agricultural finance.

Challenges and Opportunities

While the integration of precision agriculture and banking offers numerous benefits, it also presents certain challenges:

- Data Privacy and Security: As more sensitive agricultural and financial data is collected and shared, ensuring robust data protection measures becomes crucial.

- Digital Divide: There’s a risk of creating disparities between farmers who have access to precision agriculture technologies and those who don’t. Efforts must be made to ensure equitable access.

- Regulatory Adaptation: Financial regulations may need to evolve to accommodate new lending models based on precision agriculture data.

- Technology Adoption: Both farmers and banking professionals will need ongoing education and support to fully leverage precision agriculture tools effectively.

However, these challenges also present opportunities for innovation and growth. By addressing these issues proactively, we can create a more inclusive and resilient agricultural finance ecosystem.

Farmonaut: Your Partner in Agricultural Innovation

As we navigate the complexities of modern agriculture and finance, Farmonaut stands ready to support farmers, agribusinesses, and financial institutions with its comprehensive suite of precision agriculture tools. Whether you’re looking to optimize your farm operations, streamline your lending processes, or develop innovative financial products for the agricultural sector, Farmonaut offers the technology and expertise you need.

Explore Farmonaut’s offerings:

- Web Application: Access powerful farm management tools from your browser.

- Android App: Take Farmonaut’s capabilities with you in the field.

- iOS App: Manage your farm efficiently from your Apple device.

- API Access: Integrate Farmonaut’s data into your own systems for enhanced analytics and decision-making.

Earn With Farmonaut: Join Our Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Conclusion: A New Era of Sustainable Growth

As we’ve explored throughout this analysis, the convergence of precision agriculture and banking is ushering in a new era of sustainable growth for the agricultural sector. Farmonaut’s innovative solutions are at the forefront of this transformation, providing the tools and insights needed to boost farm income, enhance loan efficiency, and create a more resilient financial ecosystem.

By embracing these technologies and adapting to the changing landscape, farmers, financial institutions, and agribusinesses can unlock new opportunities for growth and sustainability. As we look to the future, it’s clear that precision agriculture will play an increasingly vital role in shaping the success of both individual farms and the broader agricultural finance sector.

We invite you to join us on this journey towards a more efficient, profitable, and sustainable future for agriculture. Explore Farmonaut’s solutions today and discover how precision agriculture can transform your approach to farming and finance.

Frequently Asked Questions (FAQ)

- How does Farmonaut’s precision agriculture technology improve loan efficiency?

Farmonaut provides real-time, accurate data on crop health and farm productivity, enabling banks to make more informed lending decisions, improve risk assessment, and offer tailored financial products. - Can small-scale farmers benefit from Farmonaut’s solutions?

Yes, Farmonaut offers affordable and accessible precision agriculture tools that can benefit farmers of all scales, helping them optimize resource use and increase productivity. - How does blockchain technology enhance agricultural finance?

Blockchain ensures transparency and traceability in agricultural supply chains, reducing fraud and building trust, which can lead to better financing options and access to premium markets. - What impact does precision agriculture have on environmental sustainability?

Precision agriculture helps reduce resource waste, optimize input use, and monitor carbon footprints, contributing to more sustainable farming practices and potentially opening up green financing opportunities. - How can financial institutions integrate Farmonaut’s data into their lending processes?

Financial institutions can access Farmonaut’s data through its API, allowing them to incorporate real-time agricultural insights into their risk assessment and loan monitoring systems.