US Soybeans Futures: 7 Powerful Trends Driving 2025 Prices

Table of Contents

- Introduction

- Market Overview: Understanding US Soybean Futures

- Must-Know Trivia

- 7 Powerful Trends Driving Soybean Futures Prices in 2025

- Trend Impact Overview Table

- Seasonal Trends in Soybean Futures Trading

- Factors Influencing Soybean Futures Prices

- Soybean Trading Strategies for 2025

- Risk Management in Soybean Futures

- Farmonaut: Advanced Technology for the Agricultural Sector

- Video Zone: Learn More About Farmonaut Technology

- Frequently Asked Questions (FAQ)

- Conclusion

- Farmonaut Subscription Plans

“In 2023, US soybean futures saw price swings of over 18% due to global supply chain disruptions.”

Introduction: Why Soybean Futures Prices Matter in 2025

As we navigate through 2025, soybean futures prices stand at the forefront of global agricultural markets, impacting farmers, traders, food manufacturers, bioenergy producers, and governments worldwide. At the Chicago Board of Trade (CBOT), soybean futures are among the most highly traded commodity contracts, offering a standardized means to buy and sell a specific quantity—5,000 bushels per contract—at a predetermined price and date. Quoted in cents per bushel, these contracts empower us with essential tools for hedging, risk management, and speculative trading.

In this comprehensive guide, we will explore the market dynamics of US soybean futures, dissect the key trends for 2025, identify factors influencing soybean prices, and break down actionable soybean trading strategies for market participants. We will also demonstrate how technology—especially Farmonaut’s advanced crop management solutions—can play a crucial role in agricultural decision-making amidst volatile markets.

Market Overview: Understanding US Soybean Futures

The US soybean futures market is robust, highly liquid, and deeply integrated into both domestic and international trade. As of May 23, 2025, soybean futures traded on the CBOT recorded an estimated volume of 200,292 contracts—a slight decrease from the previous day’s 214,525 contracts. Open interest stood at 830,287 contracts, reflecting a high number of outstanding positions and a growing level of market participation.

At their core, CBOT soybean contracts provide market participants with standardized instruments to hedge against price fluctuations, manage risk, facilitate efficient price discovery, and gain exposure to soybean price movements. Each contract specifies:

- Commodity: No. 2 yellow soybeans

- Quantity: 5,000 bushels

- Unit Price: Quoted in cents per bushel

- Traded On: Chicago Board of Trade (CBOT)

- Settlement: Physical delivery (rarely), but most contracts are offset prior to expiration

Soybeans, as a staple agricultural commodity, are central to the global food, livestock, and renewable energy sectors. Given the critical roles of the United States and Brazil—accounting for nearly 70% of world production combined—the US market is especially sensitive to trends in global supply and demand, weather, trade agreements, and energy transitions.

7 Powerful Trends Driving Soybean Futures Prices in 2025

Let us break down the seven most substantial trends that are expected to influence soybean futures prices through 2025. Each of these factors can shape supply, demand, price discovery, risk-management strategies, and overall market sentiment:

- Global Demand Growth: Rising global consumption—notably from China and other Asian countries—continues to push prices upward.

- Weather Patterns and Climate Volatility: Droughts, floods, and temperature fluctuations are having a more profound impact on yields and seasonal price trends.

- US-China Trade Policy Shifts: Recurrent disputes, tariffs, and trade agreements with China shape both export volumes and domestic price discovery.

- Biofuel and Renewable Energy Expansion: Growing demand for soybean oil in renewable diesel industries increases the value of soybean crops and drives investments in new facilities.

- Currency Fluctuations (US Dollar Dynamics): Changes in the strength of the dollar impact the competitiveness of US soybeans in international markets, affecting export flows and prices.

- Government Support and Subsidies: US support programs such as the Market Facilitation Program or crop insurance shape farmers’ planting decisions and overall market supply.

- Technological Advances and Precision Agriculture: The adoption of precision agriculture tools such as satellite crop monitoring (e.g. Farmonaut), AI-driven advisories, and improved supply chain traceability enhances yield forecasting, planning, and risk management.

Trend Impact Overview Table: US Soybean Futures 2025

| Trend Name | Estimated Price Impact (USD/bushel) | Direction of Influence | Confidence Level (%) | Brief Explanation |

|---|---|---|---|---|

| Global Demand Growth | +0.75 | Positive | 85 | Strong consumption from Asia (esp. China) supports higher prices. |

| Weather Patterns | ±0.60 | Volatile | 80 | Droughts/floods during critical periods drive sharp price moves. |

| Trade Policy Changes | ±0.40 | Uncertain | 70 | Tariffs/agreement disruptions with China affect export demand. |

| Biofuel Demand | +0.30 | Positive | 75 | Renewable diesel growth increases demand for soybean oil. |

| Currency Fluctuations | ±0.25 | Volatile | 65 | Stronger dollar hurts, weaker dollar helps US export competitiveness. |

| Government Policies | +0.20 | Positive | 80 | Support programs and subsidies stabilize farmer incomes and output. |

| Precision Ag Technology | +0.10 | Positive | 90 | Better data enables efficient planting, yield prediction, and logistical planning. |

“By 2025, analysts predict US soybean exports could exceed 60 million metric tons, impacting futures market volatility.”

Seasonal Trends in Soybean Futures: How Planting, Weather, and Harvest Move the Market

Seasonal trends in soybean futures are rooted in crop growth cycles and associated market behavior. These periods provide opportunities—and risks—for traders, hedgers, and producers:

- Planting Season (April – June):

- Heightened volatility due to uncertainty in weather, planting progress, and acreage intentions.

- Weather models and satellite imagery (e.g. via Farmonaut) help producers manage planting risk.

- Growing Season (June – August):

- Impact of weather on soybean crops—droughts or excessive rainfall—determines likely yields.

- Reports of crop condition, vegetative indices (NDVI), and soil moisture fluctuations cause price swings.

- Harvest Season (September – November):

- New supply enters the market, often triggering a seasonal price decline due to higher inventory.

- Market watching for quality concerns, late-season weather risks, and actual yields versus forecasts.

- Post-Harvest (December – March):

- If demand is strong, prices can stabilize or rise, especially if signs point to declining global stocks.

- South American crop progress (namely Brazil and Argentina) can reverse post-harvest trends for US contracts.

Understanding seasonal trends in soybean futures is a foundation for effective hedging and speculative trading, as it allows producers and traders to better time their positions and manage exposure during periods of naturally high or low volatility.

Key Factors Influencing Soybean Futures Prices in 2025

By aggregating quantitative market data, expert analysis, and real-world events, we uncover these factors influencing soybean prices and futures price fluctuations:

- Supply and Demand Dynamics

- Production: The US and Brazil account for over 68% of global soybean output (US: 33%, Brazil: 35%).

- Consumption: China is the world’s leading importer, dictating international demand curves.

- Stocks-to-use ratios: Used to gauge whether supply can comfortably meet projected demand; tight ratios usually mean higher prices.

- Weather Conditions

- Adverse weather (droughts, floods, heatwaves) leads to crop damage and potential yield reductions.

- Favorable weather during key growth periods (June – August) can boost production and exert downward price pressure.

- Trade Policies and International Relations

- US-China trade disputes or new agreements have a direct effect on America’s export outlook.

- Tariffs, quotas, or regulatory hurdles can trigger sharp price reactions by affecting the balance between domestic and international supply/demand.

- Currency Fluctuations

- Soybeans are priced in dollars; a strong or weak dollar significantly influences foreign buying power and US export volumes.

- Other exporters—especially Brazil—often benefit when their currency weakens relative to the USD.

- Government Policies and Subsidies

- Programs such as the Market Facilitation Program help stabilize farmer income, allowing for more predictable supply.

- Insurance and subsidy structures may influence farmers’ planting decisions, affecting the supply side of the market.

- Renewable Energy Demand

- Demand for renewable diesel and the subsequent demand for soybean oil have increased considerably.

- New soybean crushing facilities and investments are in response to biofuel policy and energy transition trends.

- Technological Advances

- Adoption of crop health monitoring solutions, AI-based advisories, and blockchain traceability (e.g., using Farmonaut’s traceability platform)

enhances market transparency and reduces operational risk. - Resource management tools enable farmers, cooperatives, and agribusinesses to optimize inputs, improve sustainability, and minimize waste, thereby cushioning supply variability and price shocks.

- Adoption of crop health monitoring solutions, AI-based advisories, and blockchain traceability (e.g., using Farmonaut’s traceability platform)

Soybean Trading Strategies for 2025: Hedging, Speculation, and Beyond

Navigating volatile soybean futures prices demands robust soybean trading strategies. Among the most widely used are:

-

Hedging with Soybean Futures:

- Producers, exporters, and commercial users lock in future purchase or sale prices to avoid adverse price movements.

- This is particularly vital during high-risk periods, such as pre-harvest or amid global disruptions.

-

Speculative Trading:

- Traders look to profit from directional price movements—going long (buy) expecting gains, or short (sell) anticipating declines.

- Requires in-depth market analysis, macro knowledge, and often technological support for risk assessment.

-

Spread Trading:

- Involves taking positions in different contract months (e.g., buying November and selling July soybeans), seeking to benefit from changing price differentials.

-

Options on Futures:

- Allow traders to buy call or put options, providing the right (not obligation) to transact at a set price before expiration.

- Limits downside risk while maintaining upside potential—ideal for uncertain market periods.

-

Seasonal Trade Timing:

- Recognizing seasonal trends in soybean futures can guide traders to enter or exit positions at optimal times, like entering before the planting season when weather-driven volatility is high.

Risk Management in Soybean Futures: Tools and Best Practices

Efficient risk management is paramount, given the multifaceted influences on soybean price fluctuations:

- Setting Stop-Loss Orders: Automatically limit losses by closing positions at pre-defined price levels.

- Portfolio Diversification: Don’t overexpose to one crop, contract period, or market trend.

- Monitoring Open Interest & Volume: Use ongoing changes in open interest and trading volume as sentiment indicators.

- Leveraging Technology: Utilize platforms like Farmonaut for real-time crop monitoring, weather analytics, and risk alerts (NDVI and soil moisture data).

- Scenario Planning: Develop action plans for major adverse events (trade disruptions, extreme weather, currency shocks).

- Stay Updated: Follow government announcements, USDA reports, and major agricultural news portals to anticipate potential policy or market shocks ahead of time.

Farmonaut: Revolutionizing Precision Agriculture Amid Soybean Market Trends

As the soybean sector faces mounting challenges—volatile weather, shifting international relations, regulatory policies, and technological transformation—embracing agricultural technology becomes integral for producers, traders, and agribusinesses.

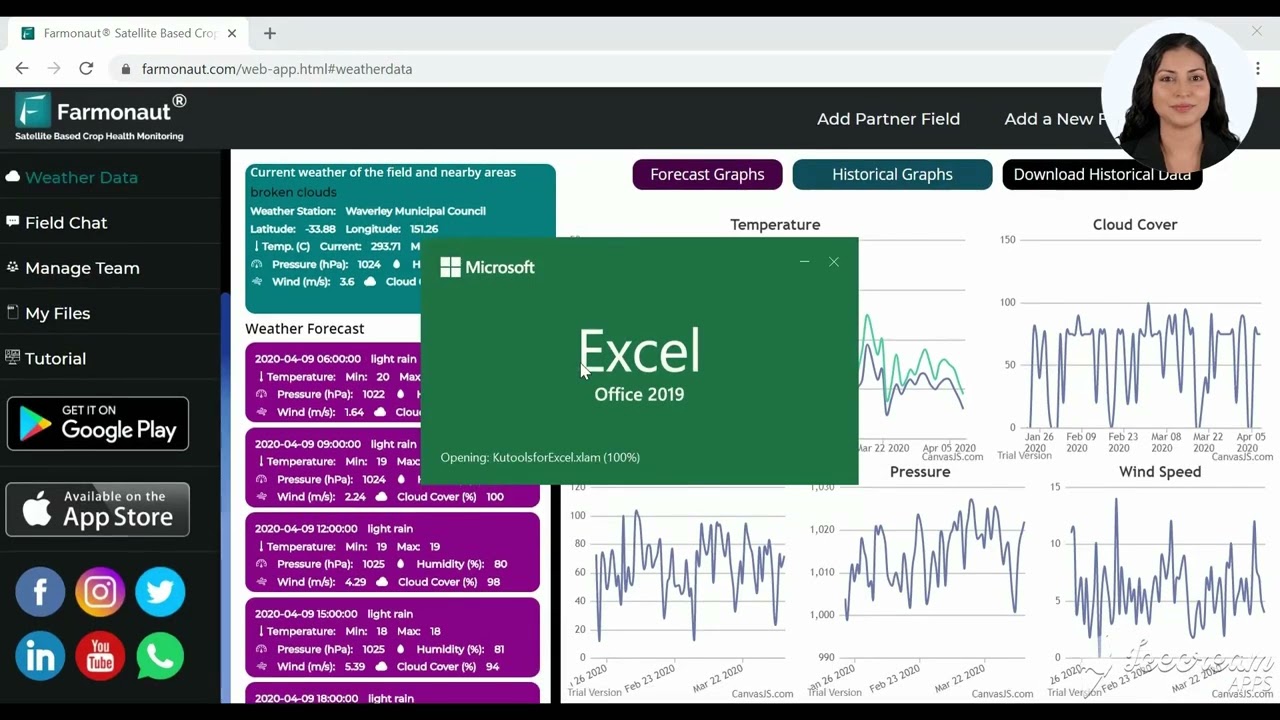

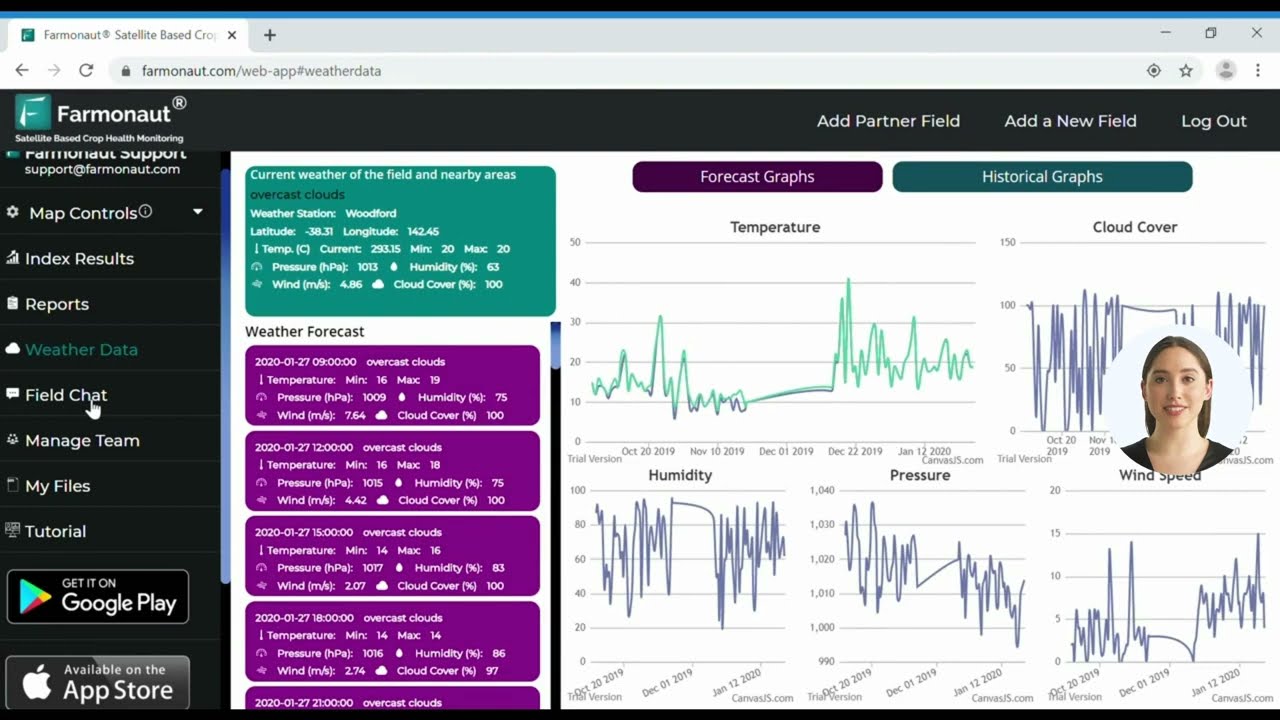

Farmonaut stands out by offering advanced, satellite-based farm management solutions via Android, iOS, web/browser apps, and robust APIs. Our mission: to democratize precision agriculture by providing affordable access to:

- Real-time satellite crop health monitoring:

- Access NDVI, soil moisture, and canopy analytics for smarter farming decisions on irrigation, fertilization, and crop management.

- AI-driven personalized advisory (Jeevn AI):

- Empower farmers with up-to-date weather forecasts, pest alerts, and yield optimizing strategies based on big data analysis.

- Blockchain-based product traceability:

- Enhance supply chain transparency and trace every product’s journey from field to consumer with blockchain technology.

- Fleet and resource management tools:

- Optimize your logistics and machinery usage and save on operational costs with fleet tracking systems.

- Carbon footprinting and sustainability analytics:

- Track, report, and reduce the environmental impact of your agricultural operations via our dedicated carbon monitoring tool.

- Crop area and yield estimation support:

- Simplify verification for loans and reduce fraud in insurance using Farmonaut’s crop loan and insurance advisory.

Farmonaut’s flexible, modular business model serves individual farmers, cooperatives, agribusinesses, and government bodies. Scalable APIs and intuitive apps enable optimized, data-driven decision-making—from planting to post-harvest—across any agricultural sector.

Try Farmonaut’s technologies today for a sustainable, profitable, and resilient agricultural future.

Video Zone: Mastering Weather, Crop Health & Data-Driven Decisions

- How to Download Weather Data: Insights for adapting farm-level risk management to volatile conditions.

- How to Generate Time Lapse: Visualize crop progress and identify stress periods during the growing season.

- Satellite-Based Crop Monitoring: Track real-time health of your soybean fields and make informed input decisions.

- Crop Area Estimation: Optimize financial planning, insurance cover, and productivity assessments.

Frequently Asked Questions (FAQ) About Soybean Futures Prices, Market Trends, and Farmonaut Technology

What is a soybean futures contract on the CBOT?

A soybean futures contract is a standardized agreement traded on the Chicago Board of Trade (CBOT) obligating the buyer to purchase, and the seller to deliver, 5,000 bushels of standardized soybeans at a quoted price (in cents per bushel) at a future date.

How do planting and weather conditions affect soybean futures prices?

The planting season introduces uncertainty, driving price volatility as market participants react to weather forecasts, planting progress, and acreages. Weather during the growing season (drought, flooding) is the single largest factor influencing expected yields and prices.

Why are US-China trade relations so critical?

China is the world’s largest importer of US soybeans. Tariffs, trade disputes, or new agreements can lead to a 20% decline or increase in US soybean exports, directly impacting futures prices and delivering ripple effects throughout the global supply chain.

What tools do traders and producers use to manage price risk?

Key risk-management strategies include futures and options contracts for hedging, spread trading to manage exposure between contract months, and technology solutions like Farmonaut for real-time crop monitoring, weather analytics, and operational planning.

How does renewable energy demand influence soybean markets?

The renewable diesel sector drives higher demand for soybean oil, encouraging investments in new crushing facilities. This boosts demand for US soybeans and supports higher prices.

What makes Farmonaut’s solutions unique for agriculture?

Farmonaut delivers real-time satellite crop health analytics, AI-driven farm advisories, blockchain traceability, fleet/resource management, and environmental monitoring—all via affordable, scalable, and user-friendly platforms for farmers, agribusinesses, and policy-makers.

Conclusion: Navigating Soybean Market Trends and Futures in 2025

Our analysis underscores that soybean futures prices in 2025 will be shaped by global demand growth (especially from China), adverse and favorable weather swings, shifting trade agreements, the rise of renewables, currency volatility, supportive government policies, and the adoption of advanced precision agriculture technologies.

Adopting proactive soybean trading strategies—including hedging, speculation, and timing entry based on seasonal trends in soybean futures—is essential. Staying equipped with actionable satellite data and AI-driven advisories from Farmonaut can offer crucial competitive advantages for farmers, agribusinesses, and market traders.

Whether you are involved in commodity trading, farm management, or supply chain analytics, understanding and responding to these key trends will be pivotal for driving profit, reducing risk, and ensuring the sustainability of your agricultural operations throughout 2025.

Farmonaut Subscription Plans

Explore our affordable subscription plans for robust crop health monitoring, real-time advisories, resource management, and more, all powered by satellite and AI innovation.

- Large Scale Farm Management: Control all your operations, crops, and staff on a single, scalable platform with satellite-backed insights and real-time data.

- Carbon Footprinting: Meet sustainability goals, comply with regulations, and unlock LEED/agri-certifications with live carbon footprint tracking for every field.